Why India’s Private Capex Crisis Has Been Falling and Why the Floor May Be Near

by Siddharth Singh Bhaisora5 min read

India’s private capex has been falling for years, even as public investment rises. Understand the key causes, while exploring why signs of stabilisation that suggest the downturn may be bottoming out.

Will India's Fiscal Drag End in 2026 - 2027?

by Siddharth Singh Bhaisora5 min read

Here is a clear breakdown of India’s Budget 2026–27. Understand everything from fiscal deficit targets, revenue and spending mix, borrowing plans, and what it means for key sectors.

Buyback Taxation in India 2026: Budget Changes, Old vs New Rules, Examples & Benefits

by Naman Agarwal5 min read

Budget 2026 Buyback Taxation: Evolution from Company Tax to Capital Gains for Shareholders. Old vs New Rules, Examples, Investor & Company Benefits Explained.

Buyback Taxation in India 2026: Budget Changes, Old vs New Rules, Examples & Benefits

by Naman Agarwal5 min read

Budget 2026 Buyback Taxation: Evolution from Company Tax to Capital Gains for Shareholders. Old vs New Rules, Examples, Investor & Company Benefits Explained.

India’s Private Capex Crisis: Why Investment Has Fallen?

by Siddharth Singh Bhaisora5 min read

India’s Private Capex Crisis: Why Investment Has Fallen?

Is The India–EU FTA Really The Mother of All Deals? How the EU FTA Could Benefit India?

by Siddharth Singh Bhaisora5 min read

Is the India–EU FTA truly beneficial? A detailed breakdown of the India–EU FTA: export winners, import risks, and why EU standards, CBAM and compliance will decide India’s gains.

Can India And IT Sector Win In AI?

by Siddharth Singh Bhaisora5 min read

Indian IT has seen this cycle before: early disruption, then bigger new revenue pools. Here’s how AI shifts from pilots to production, what Q3 FY26 earnings reveal, and where services can win in FY27–FY28.

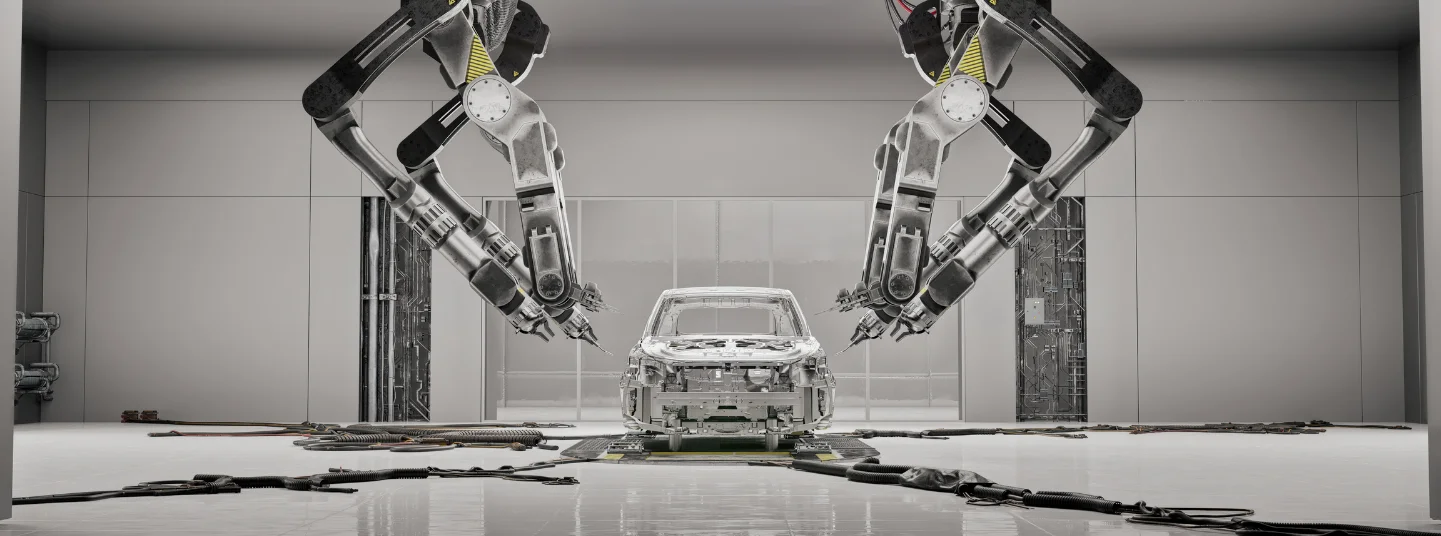

Why The Indian EMS Industry Is Stuck In A Hard Place?

by Siddharth Singh Bhaisora5 min read

India’s electronics output and exports are booming, but EMS firms remain trapped in low margins and high working-capital stress. Here’s why the “assembly-first” model stalls value capture and what it takes to break out.

US Takes Over Venezuela Oil: Impact Globally and on India

by Siddharth Singh Bhaisora5 min read

US detention of Nicolás Maduro could reshape Venezuela’s oil exports via sanctions resets and US investment. For India: low near-term risk, medium-term upside.

Markets Beneath the Surface: A Data-Led Review of 2025 and Outlook for 2026

by Siddhart Agarwal5 min read

Markets Beneath the Surface: A Data-Led Review of 2025 and Outlook for 2026Markets Beneath the Surface: A Data-Led Review of 2025 and Outlook for 2026

Solar PV Manufacturing Policy 2025: How India Is Building a Global Solar Powerhouse

by Naman Agarwal5 min read

India’s 2025 Solar PV Policy: Massive PLI Boost, 125 GW Capacity, Lower Imports, Rising Exports. Is India the Next Global Solar Manufacturing Giant?

New Age of Trade in 2025: Globalisation Rewired & Global Value Chains Bent

by Siddharth Singh Bhaisora5 min read

Tariffs surged in 2025, but trade didn’t collapse. Supply chains rerouted, services led globalization, and connector economies reshaped value chains plus India’s edge.

India's 2025 Inflection Point: Nominal Growth Slows, Easier Money, and a Market Turning Selective

by Siddharth Singh Bhaisora5 min read

India’s nominal GDP has downshifted as consumption leans on debt and capex misses productivity. RBI eases, INR drifts, and large caps regain lead.

Why the Rupee Crossed 90: India’s Balance-of-Payments Story

by Siddharth Singh Bhaisora5 min read

Despite the rupee crossing 90, India’s economy remains strong. This isn’t a crisis but a structural adjustment driven by a wider current account deficit, weaker FDI flows and RBI smoothing operations.

5G Rollout and Its Impact on Telecom Stocks in India

by BB5 min read

How does 5G rollout affect telecom stocks? Learn how faster adoption, capex cycles, and subscriber growth could influence valuations.

Are India’s GDP Numbers Strong Or Uneasy?

by Siddharth Singh Bhaisora5 min read

India’s latest GDP data show rapid real growth but weak nominal momentum, raising questions on data quality and implications for policy, markets and investors.

Indian Real Estate Stock Market Q2FY26

by BB5 min read

Learn how the Indian real estate stock market is expected to perform in Q2FY26 and the trends that could shape sector growth.

India Q2 FY26 GDP Beat: Growth & Consumption Trends

by Naman Agarwal5 min read

India GDP BOOM: Q2 FY26 beats forecasts, consumption surges, nominal GDP trend signals opportunity and hidden risks for investors.

Infrastructure Sector Stock Inflow India 2026

by BB5 min read

Learn how rising inflows into India’s infrastructure sector stock may influence growth, valuations, and investor sentiment in 2026.

Who Is Winning India’s Electric Scooter Race?

by Siddharth Singh Bhaisora5 min read

In five years, EV scooters have hit 8% of India’s 2-wheeler sales. See how Ather, Ola, TVS and Bajaj are battling supply shocks, policy shifts and infra gaps to win.

Indian Wedding Season 2025: When Shaadi Meets Soaring Gold

by Siddharth Singh Bhaisora5 min read

Discover how record gold prices are reshaping the 2025–26 Indian wedding season, from lightweight, design-led bridal jewellery to EMIs and old-gold exchange.

India’s Auto Ancillaries Sector Recovery in 2025

by Naman Agarwal5 min read

India’s auto ancillaries sector enters 2025 with renewed momentum powered by exports, EV demand, and policies pushing the country toward global manufacturing dominance.

The Future of EV (Electric Vehicle) Funds in India

by BB5 min read

Find out the best EV funds in India, key factors to evaluate, and the long-term opportunities in the growing electric vehicle market of India.

NBFC Asset Quality Stress For FY26

by BB5 min read

Learn what’s driving NBFC asset quality stress heading into FY26 and the steps lenders can take to strengthen portfolios.

India’s Renewable Capacity in 2025: Progress Toward the 500 GW Goal

by Naman Agarwal5 min read

Explore how India’s renewable energy capacity is transforming in 2025 with rapid solar and wind growth driving the nation toward cleaner power goals.

India’s Near-Zero Inflation: How We Got Here and What Comes Next

by Siddharth Singh Bhaisora5 min read

India’s CPI inflation has crashed to 0.25% even as growth stays strong. This explainer unpacks food deflation, GST cuts, RBI’s forecast misses, real rates, and the rate-cut dilemma.

Impact of GST on FMCG Sector 2025

by BB5 min read

Find out the impact of GST on the FMCG sector and how changes in pricing, margins, and operations could shape overall growth in 2025.

Upcoming IPOs in 2025: Complete List, Dates & Expected Launches

by Naman Agarwal5 min read

Looking for the upcoming IPOs of 2025? Here’s your quick guide to the biggest upcoming listings and potential market winners to watch.

Indian Metals Sector Deep Dive Amid Global Gold, Copper and Aluminum Upswing

by Naman Agarwal5 min read

The Nifty Metal Index outpaces the Nifty 50 as strong Q2 earnings, policy support and global rallies in gold, copper and aluminum lift India’s metals market in November 2025.

Deregulation, Liquidity, and the Next Leg of India’s Financials Rally

by Siddharth Singh Bhaisora5 min read

From 2024 tightening to 2025 easing, India’s banks and financials enter an early upswing as funding costs fall. Policy easing and deregulation free capital and lift credit.

Is India An Anti-AI Investment Play?

by Siddharth Singh Bhaisora5 min read

Global AI capex is surging while India looks under-indexed to AI and over-indexed to IT and services. See whether India is an anti-AI hedge now or AI winner?

Is India’s Next Decade of Growth Fueled by Necessities Or Affluence?

by Siddharth Singh Bhaisora5 min read

India’s demand is shifting from necessities to aspiration as incomes rise, digital rails scale, mortgages deepen and a young workforce fuels premium consumption.

Should NRIs Consider PMS in India?

by BB5 min read

Curious about PMS for NRIs in India? Learn the benefits, process & tax tips. Wright Research helps NRIs grow wealth smarter in India.

Why Are Gold & Silver Breaking Record Highs And Rallying This Diwali 2025?

by Siddharth Singh Bhaisora5 min read

Gold nears record highs this Dhanteras as silver outpaces gains. Explore what’s driving Gold Rally and Silver Rally in India this Diwali and festive season.

Is India’s Capex Story Coming Back in FY26?

by Siddharth Singh Bhaisora5 min read

India’s FY26 capex: public infra holds high, private spend pivots to power, rail/roads, data centers and semiconductors—what’s real, what’s next.

Mutual Fund Portfolio Health Score: Measure Quality Of Your Portfolio & Investments

by Siddharth Singh Bhaisora5 min read

Understand the Mutual Fund Health Score, a 0–100 gauge that blends returns, risk, costs and consistency to rate fund quality and your overall portfolio health.

What’s the Indian Government Doing to Protect Farmers From Trump’s Bullying?

by Siddharth Singh Bhaisora5 min read

Understand what the Indian government can do to protect farmers from U.S. tariff threats—policy tool

India’s GDP Numbers: The Myth of Prosperity and the Reality of Inequality

by Siddharth Singh Bhaisora5 min read

India’s headline GDP growth looks strong—but who benefits? Explore inequality, jobs, public services, and the metrics that reveal real prosperity.

How Demand In India Is Shaping Up This Festive Season & What To Expect

by Siddharth Singh Bhaisora5 min read

India’s 2025 festive season is bigger, earlier, and digital-first—GST 2.0, easing inflation, and quick commerce drive a rare double-peak; jewellery lags on high gold prices.

Stock Market Investment Strategies

by BB5 min read

Build lasting wealth with investment strategy. Wright Research reveals smart stock market tips for both beginners and experienced investors.

Tax Reforms & Stock Market: Which Sectors Are Likely to Benefit?

by BG5 min read

Tax policy shifts could spark rallies in select sectors. Track the stocks to watch, investor moves, and how reforms may reshape India’s market outlook.

How India's 50% Tariff Storm is Sparking a New Era of Growth and Innovation

by Naman Agarwal5 min read

Find out how India faces 50% tariff shock yet transforms these challenges into opportunities, driving innovation, economic growth, and a resilient New India future.

How India's 50% Tariff Storm is Sparking a New Era of Growth and Innovation

by Naman Agarwal5 min read

Find out how India faces 50% tariff shock yet transforms these challenges into opportunities, driving innovation, economic growth, and a resilient New India future.

Can Indian Macros & GST 2.0 Revive Consumption?

by Naman Agarwal5 min read

India’s equities face a ‘moment of truth’: disinflation, GST 2.0 and capex may boost consumption, but pricey valuations and weak earnings temper optimism.

India & US Trade Deal Delay: What’s at Stake for Indian Exporters?

by BG5 min read

India–US trade deal faces delays, raising concerns for Indian exporters. Learn how tariffs, talks, and market shifts could impact export growth in 2025.

Batteries Arbitrage Exists & Are India’s New Power: Should you add it to your portfolio?

by Siddharth Singh Bhaisora5 min read

Solar driven price swings and new ancillary markets make 1 to 2-hour BESS profitable in India. See returns, drivers, risks, and how retail investors can play.

Why Did Trump Hit India With a 25% Tariff? Real Story Behind the Trade War

by Siddharth Singh Bhaisora5 min read

Why Did Trump Hit India With a 25% Tariff? Real Story Behind the Trade War

RBI Repo Rate Cut: What It Means and How It Impacts You

by BG5 min read

Discover how psychological biases influence investor behavior. Learn to identify, understand, and overcome cognitive traps that can impact financial decision-making.

What Is An OCO Order and How Does It Work?

by BG5 min read

Find out how OCO orders help traders automate decisions and limit losses. A simple guide to understanding One Cancels Other strategies.

Do China’s Macro Surprises Actually Impact Global & Indian Markets?

by Siddharth Singh Bhaisora5 min read

China’s industrial production beats or misses, markets react within minutes. See the channels to India and how to position on data‑release days.

Hammer Candlestick Patterns: What Investors Needs to Know?

by BG5 min read

Hammer candlestick patterns signal potential bullish reversals. Investors use them to time entries, confirm trends, and manage trading risk.

Why Has Indian Data Centre Industry Boomed in 2025?

by Siddharth Singh Bhaisora5 min read

Explore how AI adoption, data‑localization laws, cheap power, and $25 bn investment have turned India into Asia’s fastest‑growing, 4.5 GW data‑centre hub.

Revival of Momentum in the Indian Stock Markets: What factors are pushing markets higher?

by Siddharth Singh Bhaisora5 min read

After a slow start to 2025, Indian equities are roaring back. Rate cuts, breadth and FPI buying push Nifty, Sensex, mid & small caps toward new highs. Learn more!

Will the Israel-Iran Conflict Spark an Oil Shock in India?

by Siddharth Singh Bhaisora5 min read

How the Israel-Iran conflict could trigger oil price spikes, trade disruption, and economic challenges for India. Explore 3 scenarios and sectoral impacts.

What 40 Years of Data Tells Us About Market Crashes, Drawdowns & Recoveries?

by Siddharth Singh Bhaisora5 min read

Large stock drawdowns are common in long-term investing. Learn how long recoveries take, when to worry, and why some crashes lead to major comebacks.

India: The Next Chemicals Manufacturing Hub

by Siddharth Singh Bhaisora5 min read

Explore why India's chemical sector is becoming a global manufacturing leader. Discover insights into specialty chemicals growth, market opportunities, challenges, and investment potential.

Tax Loss Harvesting - What It is & How it Works?

by BG5 min read

Learn the tax loss harvesting meaning, how it works, and how it can reduce your tax liability. A smart strategy to improve your investment returns legally. Read more!

US Is Drowning In Debt: Will It Impact India?

by Siddharth Singh Bhaisora5 min read

The U.S. national debt has exploded to $36 trillion—over 120% of GDP—fueling fears of a global debt spiral. Discover the 4 brutal truths behind the crisis, the fallout from a new tax cut bill, and how this impacts global markets, India’s economy, the rupee, inflation, and your financial future.

India’s Defence Industry Rises: From Importing to Making In India

by Siddharth Singh Bhaisora5 min read

Operation Sindoor marks a turning point in India’s defence strategy—showcasing precision, indigenous tech, and rising global ambition. Explore how India is evolving into a self-reliant defence powerhouse.

Indian Markets Rebound: Sectors to Watch Amid Global Tariff Easing

by BG5 min read

Indian markets rebound as global tariff easing boosts growth. Check out key sectors to watch for emerging opportunities and economic recovery.

What is the Impact of Monsoon On Indian Stock Markets?

by Siddharth Singh Bhaisora5 min read

Explore how the Indian monsoon affects agriculture, rural demand, inflation, and why rainfall trends don’t always align with stock market returns.

The Economic Cost of War: Detailed report of India's War Economy from Kargil to Operation Sindoor

by Naman Agarwal5 min read

A comprehensive analysis of the 2025 India-Pakistan war, including its impact on the Indian stock market, FII/DII trends, defense and supply chain sectors, and the Balochistan insurgency. Includes latest data, charts, and global index comparisons.

The Economic Cost of War: Detailed report of India's War Economy from Kargil to Operation Sindoor

by Naman Agarwal5 min read

A comprehensive analysis of the 2025 India-Pakistan war, including its impact on the Indian stock market, FII/DII trends, defense and supply chain sectors, and the Balochistan insurgency. Includes latest data, charts, and global index comparisons.

Impact on Markets from India & Pakistan Conflicts & War: Kargil, Uri, Operation Sindoor & More

by Siddharth Singh Bhaisora5 min read

Explore how the India Pakistan conflicts & wars historically and including the recent Operation Sindoor, affects markets like Nifty 50 and Sensex, bilateral trade, investor sentiment and more.

Can India Become the World’s Electric Vehicle Hub?

by Siddharth Singh Bhaisora5 min read

Explore India’s evolving EV landscape as Tesla, BYD, Ola Electric, and Ather navigate policy hurdles, IPOs, and market dominance.

How to Select Banking Stocks in the Current Market Cycle — A Quant + Fundamental Playbook

by Sonam Srivastava5 min read

Learn a step-by-step quant + fundamental framework to pick winning Indian banking stocks in 2025, leveraging RBI LCR reforms, asset quality, and margin drivers.

Is Indian IT a Buy in 2025? Tariffs, Valuations & Earnings

by Siddharth Singh Bhaisora5 min read

Trump’s tariff threats, weak earnings, and global uncertainty weigh on India’s IT sector. Outlook cautious for FY26; BFSI stable, other verticals lag. Read to learn more!

How to Read Candlestick Charts for Intraday Trading?

by BG5 min read

Master intraday trading with candlestick chart analysis. Learn key candlestick patterns, improve trade entries, and boost accuracy with real-time price action insights.

Real Impact of Trump’s Reciprocal Tariffs On India & The World: Will India Actually Benefit?

by Siddharth Singh Bhaisora5 min read

President Donald Trump unveils sweeping reciprocal tariffs to address the $1.2 trillion U.S. trade deficit, sparking fears of global stagflation and trade wars. India faces a 26% tariff but emerges relatively well-positioned amid the global supply chain shift away from China.

Can India’s Cricket Fever & IPL Influence the Indian Stock Market?

by Siddharth Singh Bhaisora5 min read

Explore how cricket shapes India’s stock market behavior—from IPL media deals and brand sponsorships to emotional trading after major wins and losses. See real examples of short-term volatility and long-term economic gains.

What is Happening To The Commodity Markets? Why Are Gold & Equities Rising Together?

by Siddharth Singh Bhaisora5 min read

Explore the latest developments in India’s commodities, precious metals, and mining sectors. Discover the impacts of global factors, including China's policies, steel imports, safeguard duties, and gold’s price surge in March 2025.

FIIs Are Selling On The Indian Dream: When Will FIIs Return?

by Siddharth Singh Bhaisora5 min read

FIIs have been net sellers in Indian equities, triggering market corrections. Learn about the reasons behind FII outflows, their impact on mid & small-cap stocks, sector-wise trends, and what lies ahead for Indian markets in 2025.

Economic Fallout of India & US Reciprocal Tariffs: Who Wins, Who Loses?

by Siddharth Singh Bhaisora5 min read

The U.S. has reintroduced tariffs on China, steel, and aluminum, with reciprocal tariffs on India under review. Explore the economic impact on inflation, trade, and key industries like pharmaceuticals, auto components, and semiconductors.

Nifty’s Worst Losing Streak in 29 Years: What’s Next for Indian Markets?

by Siddharth Singh Bhaisora5 min read

Nifty 50 has hit its longest monthly losing streak since 1996, shedding nearly $1 trillion in market value. With foreign outflows rising and investor sentiment at a low, will the bearish trend continue? Read the full analysis here.

Broker In Stock Market: Its Meaning & How It Works ?

by BG5 min read

Learn about stock brokers, their role, types, and how they facilitate trading in the stock market. Understand the difference between stock brokers and sub-brokers, their qualifications, and how to choose the right stock broker for your investment needs.

New US-China Trade War & Its Impact on India

by BG5 min read

Explore how the 2025 U.S.–China trade war is reshaping India's economy, stock markets, and key industries. Learn from past trade wars to anticipate future challenges and opportunities.

India Economy Growth in Focus: RBI Cuts Rates, But Is It Enough?

by Siddharth Singh Bhaisora5 min read

The RBI has cut rates, but is it enough to revive economic momentum? Get expert analysis on the latest monetary policy, inflation trends, Indian economy's growth outlook and capital flows.

Understanding the Smallcap Dip, Our Strategy & Dissecting Union Budget 2025

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the reasons behind the recent smallcap stock dip, our investment strategy, and key takeaways from Union Budget 2025. Learn how tax reforms, fiscal policies, and economic growth plans will impact markets and investors, why smallcaps crashed and how we are handling it.

The Kumbh Mela Coincidence : Decoding Market Patterns

by Naman Agarwal5 min read

Explore the effect of Mahakumbh 2025 on Stock Market and Different Sectors , which is estimated to create an economic impact of Rs 2-3 Lakh Crores.

Why Are Mid and Small-Cap Stocks Crashing in 2025?

by Sonam Srivastava5 min read

Discover why mid and small-cap stocks are underperforming in 2025, with the Nifty Midcap 150 down 7% and the Nifty Smallcap 250 down 9%. Learn about overvaluation, RBI's policies, global pressures, and FII outflows driving this downturn.

What to Expect from Donald Trump in 2025: Impacts on Markets and India

by Siddharth Singh Bhaisora5 min read

Explore the market volatility, trade dynamics, and sectoral impacts expected under Donald Trump's second term. Learn how his policies could reshape India's IT, defense, and export sectors while influencing global trade and emerging market investments.

Earnings Season Predictions: High Growth Stocks to Watch in Q3FY25

by Sonam Srivastava5 min read

Explore key sectoral trends in Q3FY25, including consumer durables, healthcare, agrochemicals, fintech, and premium discretionary. Discover growth drivers, challenges, and investment opportunities amid India’s stable 6% GDP growth and cooling inflation.

5-Year High Breakouts: 4 Stocks Reach Multi-Year Peaks

by BG5 min read

Discover the significance of 5-year high breakouts in the Indian stock market, their impact on investor confidence, and risks to consider. Explore analysis of 4 Indian stocks that recently hit multi-year peaks, signaling potential for strong growth.

Indian Stock Markets 2024 Wrapped: Key Themes The Market Went Through

by Siddharth Singh Bhaisora5 min read

Explore the key themes shaping Indian stock markets in 2024, from interest rate cuts and diversification strategies to election-year impacts, sector rotations, and capex revival. A comprehensive recap with investment insights for a promising 2025.

India’s Capex Story - Will Government & Private Sector Increase Spending in Second Half of FY25?

by Siddharth Singh Bhaisora5 min read

India's capex has grown five-fold over the last decade, fueling infrastructure and economic development. While FY25 began with a slowdown due to elections and fiscal constraints, robust government initiatives, private sector participation signal a strong recovery in 2nd half.

What Is The December Effect On Indian Stock Market? Looking At Nifty Indices

by Siddharth Singh Bhaisora5 min read

Explore the December effect in Indian stock markets, with historical Nifty performance trends, sectoral strengths, and insights into key factors driving returns. Learn how investors can strategically navigate December's opportunities and risks for better gains.

What Are Adani's Bribery Charges? Is Adani Too Big To Fail?

by Siddharth Singh Bhaisora5 min read

Explore the implications of US bribery charges against the Adani Group, including bribery charge allegations, wider global fallout, and is Adani Group too big to fail. Read now!

Analyzing India’s Booming $130 Billion Wedding Industry | Wright Videos

by Siddharth Singh Bhaisora5 min read

Explore the Indian wedding industry's rapid growth, worth $130 billion, with insights into luxury spending, destination trends, and investment opportunities. Learn why this evergreen sector is set to thrive in 2024 and beyond.

Why Is The Indian Stock Market Correcting? Analysing Reasons Behind The Recent Crash

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the causes behind India's recent stock market correction, sectoral impacts, global and domestic challenges, and strategic investment approaches to navigate volatility.

Trump 2.0: What Does Post Re-Election Look Like For Asian & Indian Stock Markets?

by Siddharth Singh Bhaisora5 min read

Explore how Donald Trump’s re-election impacts global markets and India, with insights on U.S. equities, tariffs, Indian sectors, and currency trends. Discover the opportunities for Indian sectors, potential risks from high valuations, tariffs, and geopolitical shifts.

Understanding the Rise of Luxury Consumption From Affluent India

by Siddharth Singh Bhaisora5 min read

Explore how India’s luxury market is growing at a remarkable pace. Discover the rising growth of affluent India, expanding investments by brands like Dior, Louis Vuitton, and Balenciaga. Learn about shift towards Luxury sector & sectors to benefit from this shift toward premiumisation.

Impact of Trump vs. Harris Presidency on Indian Economy, Sectors & Stock Markets

by Siddharth Singh Bhaisora5 min read

Explore how the 2024 US presidential election could affect global stocks, currencies, and US and Indian stock markets. Key insights on the dollar, gold, inflation hedges, and Indian sectoral impacts under potential Harris vs. Trump presidencies.

Cyclicals vs Defensive Stocks: Historical Outperformance & Major Sector Rotations in India and US

by Siddharth Singh Bhaisora5 min read

Explore why investors in India and the US are pivoting towards defensive stocks amidst global market uncertainty and policy risks. Learn how cyclical stocks have outperformed in certain periods and how sector rotation is changing in 2024.

China's Stimulus Sparks Rally, But Is It Sustainable? And What Does This Mean for Indian Stocks?

by Siddharth Singh Bhaisora5 min read

China's stock market rallied after major multiple stimulus measures. But uncertainty looms over china's economy, labor growth, corporate earnings and long-term sustainability. So, how will this impact Indian stock markets, Indian investors & Indian economy?

SEBI F&O Report: Individual Traders in F&Os Incur Rs 1.8 Lakh Crore Loss Over 3 Years

by Siddharth Singh Bhaisora5 min read

A SEBI study shows significant losses for individual F&O traders, totaling ₹1.8 lakh crore over 3 years. While institutional traders profited from algorithmic trading, retail investors struggled. SEBI proposes stricter regulations to curb speculative trading and protect small investors.

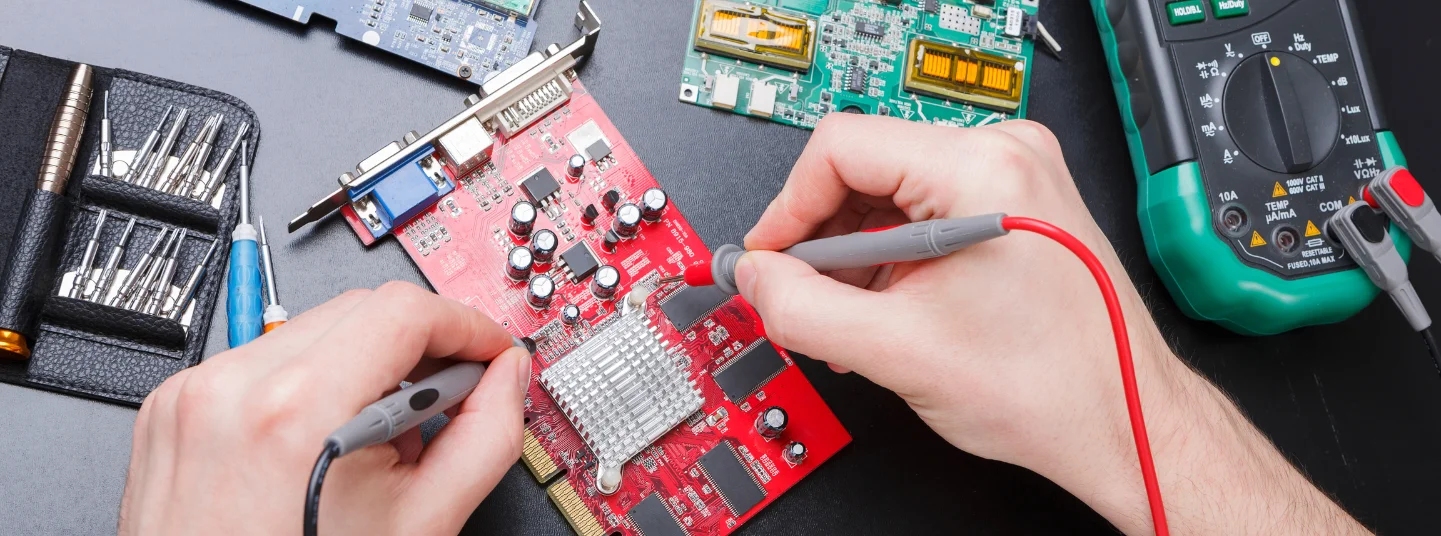

The Growth of India's Semiconductor Industry to $110 Billion By 2030

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore India's rapid growth in the semiconductor industry, driven by government initiatives and international collaborations. Learn about strategic U.S.-India partnerships, rising semiconductor investments, and the future of semiconductor manufacturing in India.

Indian Consumption Theme Is Rising: India’s Growing Middle Class & Shift Toward Premium Consumption

by Siddharth Singh Bhaisora5 min read

Explore India's booming consumption story driven by rising incomes, urbanization, and premiumization. Discover the key sectors poised for growth based on the consumption theme in 2024, including FMCG, retail, travel, and luxury goods, as India becomes one of the top consumer markets globally.

Best 10 Fundamentally Strong Penny Stocks in India

by BG5 min read

Explore the world of fundamentally strong penny stocks in India and discover the top picks for 2024. Learn how to identify high-potential penny stocks that could deliver multibagger returns while understanding the risks and benefits of investing in this exciting segment.

Impact of Interest Rate Cutting Cycle on Stock Markets: Analysis of Expansions & Recessions

by Siddharth Singh Bhaisora5 min read

Explore how the US Fed's interest rate cuts influence stock, cash and bond performance over 95 years historical trends. We explore how impact of interest rate cuts varies during recessionary & expansionary periods for the economy. Finally, see how interest rate cuts will impact Indian stock markets.

Quarter 1 FY25 Earnings Review: Slow Growth Amid Mixed Sectoral Performance

by Siddharth Singh Bhaisora5 min read

Explore the mixed financial performance of Q1 FY25, with 6% sales growth and 4% profit rise in NSE500 companies. Delve into the earnings for different sectors, impact of easing WPI inflation, favorable monsoon, and sector-specific trends on India's economy & share markets.

Evolution of the Indian Stock Markets: A Historical Overview from 19th Century to 2024

by Siddharth Singh Bhaisora5 min read

Explore evolution of the Indian stock market from its 19th-century origins to modern milestones like BSE's $5 trillion market cap and the rise of retail investors. Discover key events that shaped India's financial markets and future growth prospects.

What is the Japanese Yen Carry Trade? Impact on India & Global Markets

by Siddharth Singh Bhaisora5 min read

The unwinding of the Yen carry trade is causing global market volatility, affecting US tech stocks, Indian midcaps, and emerging markets. Explore what is the Japanese Yen Carry trade, impact of yen carry trade on stock markets historically & in 2024.

7 Sectors to Benefit the Most Under Modi 3.0

by Alina Khan5 min read

Discover which sectors will benefit from the Modi 3.0 budget and BJP's economic policies. Explore how infrastructure, defense, technology, and more are poised for growth under Modi's third term. Learn how these sectors could drive India's economic future.

Black Monday - What Happened to Stock Markets on 5th August?

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Indian markets faced volatility as global cues triggered a risk-off sentiment. The Yen carry trade unwind, US recession fears, and geopolitical tensions in the Middle East and Bangladesh are influencing market movements. Investors weigh strategies amid rising uncertainty.

Union Budget 2024 Impact on Stock Market

by Siddharth Singh Bhaisora5 min read

Explore the Union Budget 2024's emphasis on employment, skilling, MSMEs, and infrastructure development. Discover Union Budget 2024's sectoral impacts and investment opportunities in agriculture, space economy, manufacturing, telecom, and more.

How Does The Budget Impact Your Equity Investing Strategy? Capital Gain Changes & Sector Analysis

by Siddharth Singh Bhaisora5 min read

Explore the 2024 capital gains tax changes made in the Budget 2024, impact of STCG & LTCG on different asset classes and investor strategies. Find how the budget affects key sectors like power, infrastructure, EV, textiles, financials and more!

Budget 2024: Indian Economy Growth With Government Interventions

by Siddharth Singh Bhaisora5 min read

Explore the Union Budget 2024 as Finance Minister addresses India's economic growth challenges. Key highlights of the Budget 2024 include measures to boost consumption, private investments, and job creation while managing fiscal deficit reduction.

Indian Defence Stocks Are Rallying: Growth, Valuations, and Bubble?

by Sonam Srivastava5 min read

Discover why are Indian defence stocks rallying, and the key factors that are driving the Indian defense sector's growth. Driven by record-high defence production and strong defense sector government initiatives understand the growth opportunities in the defence sector.

Are New Age Tech Companies Recovering? Detailed Analysis of New Age Stocks

by Madhav Agarwal, Siddharth Singh Bhaisora5 min read

Explore the evolving landscape of New Age Tech Stocks in India. And see why new age stocks are rallying. See our detailed analysis of new age stocks focusing on key drivers, issues and positive developments.

Investing in India's Renewable Energy: Top Stocks to Invest in the Green Energy Sector!

by Sonam Srivastava5 min read

Explore India's renewable energy sector, learn about leading renewable sources - solar, wind, and hydropower - and the trends driving this sector. Discover opportunities and risks in the renewable energy sector, and India's future potential in achieving ambitious energy goals.

China's Economy Recovers, Stock Market Rallies - What Does it Mean for Indian Investors?

by Siddharth Singh Bhaisora5 min read

China's stock market shows signs of recovery, but the property sector remains a major challenge. The global economy faces headwinds, while India emerges as a potential beneficiary of the "China Plus One" strategy. Understand the impact on China's stock market recovery for Indian investors.

Top 5 Growing Sectors to Invest in India 2024

by Alina Khan5 min read

Discover the fastest growing sectors in India for 2024 and capitalize on investment opportunities. Learn about the healthcare, renewable energy, IT, real estate, and FMCG sectors, all poised for significant growth due to supportive government policies and market trends.

Lok Sabha Election 2024 - 5 Smart Investment Strategies

by Alina Khan5 min read

Explore how the Lok Sabha Election 2024 may impact the Indian stock market. Learn about historical trends, current market observations, and smart investment strategies to navigate election-driven volatility. Discover the sectors poised for growth and how to balance risks.

Key Insights from Q4 FY24 Earnings for Indian Stock Markets & Sectors

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Get a comprehensive breakdown of India's Q4 FY24 earnings season. Explore sector-by-sector performance, key trends & takeaways for investors. Strong growth in domestic cyclicals vs muted performance in defensives. Includes Nifty 50 & Nifty Next 50 analysis.

Best Large Cap Stocks to Buy Today

by Alina Khan5 min read

Dive into a comprehensive guide covering the top large-cap stocks in India for 2024. Discover why these stocks, including industry giants like Reliance Industries, Infosys, and TCS, are favored for stability and growth. Understand large-cap stocks' role in investment portfolios. Read Now!

Earnings Expectation For Sectors In Indian Stock Markets For Quarter 4 FY24

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Anticipated slowdown in earnings momentum across sectors for FY24. Nifty earnings projected to grow 5% YoY in Q4FY24. Explore key insights, sector specific outlooks, and growth forecasts for banking, IT, pharma, real estate, automobile, chemicals, insurance & more.

FY24 Stock Market Recap & Outlook For India In FY25

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

The Indian stock market witnessed a stellar year with the Sensex surging nearly 30%. Mid & small-caps outperformed, while IPOs boomed. Get the complete review of Indian stocks markets, including top performers, election impact, and sectors to watch for in FY25.

What led to stock market rallies in 2024? Relationship Between Low-Float Stocks & Returns

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Indian stocks have surged, with smaller companies and those with low share liquidity leading the rally. These low-float stocks have fueled the rally so far, but are high valuations sustainable? We analyze recent gains, corrections, and a long-term outlook for Indian equities.

Decoding the March Effect: Why Stocks Can Be Volatile in March

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Worried about volatile stocks in March? Learn about the "March effect" and how factors like budget announcements & tax deadlines impact Indian markets. Discover why this seasonal trend occurs in March.

Understanding SEBI's Advisory on Small Cap & Large Cap Mutual Fund Inflows

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

SEBI's directives on small & mid-cap funds raise questions for investors. Understand the impact, industry response, and what it means for your portfolio. Read more!

Investing in Multibagger Stocks in India: A Guide for 2024

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Discover the secrets of multibagger stocks in India! Learn key characteristics, analysis strategies, and potential risks to find high-growth investments that multiply your returns. This guide also looks at examples of multibagger stocks such as Varun Beverages, Jindal Stainless, Tata motors & others

Top Sectors to Invest in After the Interim Budget

by Sonam Srivastava5 min read

Exploring Investment Opportunities: Top Sectors Post-Interim Budget 2024

How Lakshadweep Transformed from a Pristine Paradise to an Investor's Playground?

by Alina Khan5 min read

Lakshadweep is emerging as a top investment destination in India. Explore opportunities in sustainable tourism, renewable energy, and more while considering the challenges of development.

10 Promising Stocks to Buy Today for Long-Term Growth

by Alina Khan5 min read

Learn about the essential criteria for selecting robust investments and strategies for your long-term portfolio.

What To Expect From India's Interim Budget for 2024?

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the expectations for India's interim budget FY25, set for presentation on February 1, with insights on fiscal consolidation, defense and railways sector boosts, and strategies to address India's consumption challenges. Read more!

Q3 Earnings - How Are Indian Companies Performing? What To Expect From Different Sectors

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore our concise overview of Q3 FY24 corporate earnings across key Indian sectors. Discover insights into IT, Telecom, FMCG, Banking, NBFC, and Pharma industries, highlighting trends in sales, EBITDA, PBT growth, and sector-specific challenges and opportunities.

India to Become 3rd Largest Economy by 2030: Implications for the Stock Market

by Alina Khan5 min read

Explore the impact of India's projected growth to become the world's third-largest economy by 2030 on the stock market.

India's Inclusion in JPMorgan's Bond Index: A Game Changer for Its Markets

by Alina Khan5 min read

Discover how India's inclusion in JPMorgan's global bond market index in 2024 represents a pivotal shift, set to attract US$ 20-30 billion in inflows, reduce borrowing costs, and enhance economic stability.

Interest Rate Cut Expectations In 2024 For India, US & the World: Impact On Stock Markets

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the anticipated interest rate cuts in 2024 and their impact on global and Indian stock markets, economies, and businesses. Understand the reasons behind these cuts, including easing inflation and changing macroeconomic policies.

Risks of Investing in Portfolio Management Services (PMS): A Comprehensive Analysis

by Alina Khan5 min read

Explore the risks associated with Portfolio Management Services in this comprehensive guide. Learn about market risk, underperformance, fees, liquidity, and more, to make informed decisions and manage your PMS investments effectively.

Unlocking Investment Success: Key Metrics for Evaluating the Performance of a PMS Portfolio

by Alina Khan5 min read

Uncover the essential metrics to evaluate your Portfolio Management Services (PMS) portfolio. Learn the importance of performance evaluation in PMS and outlines key indicators like absolute and relative returns, risk-adjusted returns, and more for effective investment analysis.

Understanding Portfolio Rebalancing in PMS: A Crucial Strategy for Wealth Management

by Alina Khan5 min read

Explore the significance of portfolio rebalancing in Portfolio Management Services (PMS), a critical tool for maintaining risk profiles and optimizing returns. Understand the rebalancing process, its importance for PMS investors, and considerations for effective strategy implementation.

How to Open a PMS Account as an Investor in India?

by Alina Khan5 min read

Learn how to open a Portfolio Management Services (PMS) account in India with this comprehensive guide. Covering the basics, regulatory requirements, account setup, and necessary documentation, this article helps investors embark on their tailored investment journey with PMS.

Understanding the Tax Treatment for Portfolio Management Services (PMS) in India

by Alina Khan5 min read

This article provides an in-depth look at the tax treatment of Portfolio Management Services in India, contrasting it with mutual funds. Understand key differences in ownership, fees, and minimum investment, and explore how PMS taxation works for informed investment decisions.

Who Should Invest in Portfolio Management Services (PMS)?

by Alina Khan5 min read

Discover how Portfolio Management Services can be tailored to different life stages, from young investors to pre-retirees. This guide delves into the suitability of PMS at various ages, focusing on investment strategies, risk management, and goal alignment for wealth creation and preservation.

Difference Between Discretionary PMS, Non-Discretionary PMS, and Advisory PMS in India

by Alina Khan5 min read

Explore the key differences between Discretionary, Non-Discretionary, and Advisory Portfolio Management Services in India. This article helps investors understand each type's unique features and decide which PMS aligns best with their investment goals and strategy.

Value Stocks vs Growth Stocks: Which is Better?

by Alina Khan5 min read

Explore the difference between Value & Growth stocks – understand performance, risks, & dividends. Gain insights to make informed investment decisions.

Where Does the Money Go When Stock Prices Drop?

by Alina Khan5 min read

Discover the impact of stock price drops on portfolios, investor behavior, and market corrections. Learn risk management and wher does the money go from wright blogs

What is Broad Market Index? What are Some Broad Market Funds?

by Alina Khan5 min read

Explore Broad Market Index Funds – their advantages, considerations, & future trends. Make informed investment decisions with expert insights. Start investing wisely.

2023 Recap: Indian Stock Market Performance, Indian Economy & Wright Portfolios Performance in 2023

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the 2023 trends in global and Indian stock markets, including S&P 500's comeback, tech sector's surge, the banking crisis, inflation rates, and key investment themes like AI and defense stocks. How did Indian stock markets perform in 2023? What were the key investment themes of 2023?

Is the Santa Claus Rally Real? Randomness or Seasonal Trends for Global & Indian Stock Markets

by Siddharth Singh Bhaisora5 min read

Uncover the truth behind the Santa Claus rally in global stock markets and its potential influence on India's Nifty 50 during the year-end season. We analyse Santa Claus rally's historical performance in the US and its significance for investors in Indian markets.

Path to Wealth Creation: Timeline To Initiate a PMS Account in India

by Alina Khan5 min read

Understand the process and timeline for initiating a PMS account in India. The essential stages from selecting a provider, offering insights for high-net-worth individuals on their journey to professional wealth management.

Understanding the PMS Process: Fund Pooling and Fund Accounting

by Alina Khan5 min read

Discover the significance of fund pooling and fund accounting in Portfolio Management Services (PMS). Explore how these critical components enhance investment diversification, professional management, and financial transparency for high-net-worth individuals in PMS.

Are Foreign Investors Bullish On India? Will Foreign Portfolio Investor Invest In India Growth Story

by Siddharth Singh Bhaisora5 min read

Understand why foreign portfolio investors are bullish on Indian stock markets. Examine Foreign Investors' investing activity, look at inflows & outflows across different sectors. Learn why India is outperforming China & other emerging market countries & what foreign investors are investing in.

Complete Guide to the Indian Telecom Sector and Top Telecom Stocks in India

by Alina Khan5 min read

Examine significant growth of 5G technology globally and its impact on India's telecom sector in 2023 & 2024. Substantial increase in mobile subscriptions, along with Union Budget 2023 enhanced the telecom infrastructure. This has boosted Indian Telecom Sector. Find top telecom stocks in India today

Benefits of Long-Term Investment in Stocks

by Alina Khan5 min read

Explore the advantages of long-term stock investments in India's dynamic economy. Benefits of a long-term approach, including wealth building, tax advantages, and risk mitigation. Maximizing your wealth with long-term stock investments in India.

Greatest ODI Cricket Team Ever? Investing Lessons From India’s Cricket Dominance

by Siddharth Singh Bhaisora5 min read

Explore the Indian Cricket Team's historic ODI World Cup run and discover valuable investing lessons. From cricket strategies to stock markets, find insights for success.

Best SIP to Invest In Now for Maximum Returns: A Strategic Guide for Indian Investors

by Alina Khan5 min read

Discover the best SIP strategies for the Indian market in this detailed guide. Learn about SIP advantages, choosing the right SIPs, and building a diversified portfolio for long-term wealth creation.

What is a Blue-Chip Stock? Characteristics and Qualities of Top-Performing Large-Cap Companies

by Alina Khan5 min read

Dive into the world of blue-chip stocks in India with this comprehensive guide. Learn about their defining characteristics, financial stability, and how blue chip stocks offer a reliable path for investors seeking long-term growth and stability in the stock market.

Complete Guide On Investing In Metal Sector Stocks In India

by Alina Khan5 min read

Explore the surge in metal stocks in India – from current trends & driving factors to the impact on the economy. Discover insights & tips for investing in this sector.

How to Invest in Gold? Guide for Investors

by Siddharth Singh Bhaisora5 min read

Explore the intricacies of investing in gold, from bullion and coins to ETFs and sovereign bonds. Get a detailed guide for investors looking to invest in gold. If you are seeking wealth preservation and growth through gold investments, addressing types of gold investments & strategies in India.

Navigating the Challenge: How to Deal with Loss-Making SIPs

by Alina Khan5 min read

Learn to manage underperforming & loss-making Systematic Investment Plans (SIPs) in mutual funds. We emphasize the importance of understanding market fluctuations, long-term investment, diversifying portfolios, regularly reviewing fund performance, aligning with investment. Read now!

When To Exit from Small Cap Investment

by Alina Khan5 min read

Dive into the world of small-cap funds, where timing and strategy play critical roles. Explore the nuances of small-cap investments, their potential for high returns, risk considerations, and effective entry and exit strategies. When To Exit from Your Small Cap Investment? Read Now.

How to Trade in Gold in 6 Simple Steps

by Alina Khan5 min read

Unravel the complexities of gold trading in six simple steps. Learn essential aspects of gold trading, including its economic impact, supply-demand dynamics, and strategic approaches. Whether you're a novice or an experienced investor, discover the step-by-step process to navigate.

Is Buying Gold a Good Investment - 10 Reasons to Invest

by Alina Khan5 min read

Discover ten compelling reasons to invest in gold, including its hedging capabilities against inflation and market volatility. Get insights into gold's role as a tangible, liquid asset, with advantages for portfolio diversification and economic resilience. Align gold investment with your investment.

Should You Add Gold To Your Portfolio This Diwali?

by Siddharth Singh Bhaisora5 min read

Should you invest in gold or equities? Compare returns, analyze historical trends, & get insights into making the right investment choice for a prosperous Diwali season.

Advantages And Benefits of Mutual Funds in India

by Alina Khan5 min read

Get a concise overview of the benefits of investing in mutual funds in India, covering key aspects like diversification, professional management, affordability, and tax efficiency. It emphasizes mutual funds' role in wealth creation, offering options for investor profiles with SIPs etc.

Best Defence Stocks to Buy in India Today

by Alina Khan5 min read

Invest in Indian Defence Stocks: Discover key defence stocks in India's strategic sector, focusing on companies in aerospace, electronics, and land systems. Learn about the sector's growth, driven by government support and technological innovation. Why are defence stocks are appealing?

Top Small Finance Bank Stocks in India Today

by Alina Khan5 min read

Navigate the World of Small Finance Banks in India: Uncover the transformative role of small finance banks in India's banking landscape, focusing on their mission to promote financial inclusion in underserved areas. Explore top small finance bank stocks and the factors driving their success.

Top 10 Metal Stocks to Buy in India Today

by Alina Khan5 min read

Discover the Top 10 Metal Stocks in India: Unveil a list of leading metal stocks in India today, delving into key aspects and growth drivers in the industry. Find Top Metal Companies Now!

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

by Sonam Srivastava5 min read

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

Impact Of Elections on Indian Stock Markets

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the historical impact of elections on Indian stock markets from 1989 to 2019. Discover market insights, sectoral analysis, and investing factors through wright blogs.

Best PSU Bank Stocks to Buy in 2023

by Alina Khan5 min read

Explore the resilient world of PSU bank stocks in India for 2023. Navigate through our comprehensive guide to discover top picks like SBI and PNB, delving deep into their performance, financial health, and investment potential. Find Top PSU Bank Stocks Today!

How To Make Financial Planning This Dussehra For Early Retirement?

by Sonam Srivastava5 min read

Harness the spirit of Dussehra to embark on a financial journey towards early retirement. Discover steps to achieve financial freedom and enjoy a life free from monetary constraints. Read now!

Buying Stocks in October, November & December? Seasonal Patterns in Global & Indian Stock Markets

by Siddharth Singh Bhaisora5 min read

Find seasonal patterns in global and Indian stock markets. Understand January effect in the US to the Diwali effect in India to October effect globally, understand the monthly trends, their historical context, and implications for traders & investors. Learn about buying stocks in October, November.

9 Investment Lessons To Learn From Navratri

by Sonam Srivastava5 min read

Get the 9 Investment Lessons To Learn From This Navratri. Explore 9 crucial investment lessons derived from each day of the celebration, guiding you towards prudent money management, wealth creation, and a secure financial future. Read now!

Impact of War on Stock Markets: Israel-Palestine War & Impact on Indian Stock Markets

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

What is the Impact of War on Stock Markets? What will be the impact of Israel Palestine War? Will Indian Stock Markets be impacted from Israel Palestine War? We deep dive into wars across countries and history, attempting to decode what happens, what factors impact stock markets and much more!

Comprehensive Q2 Indian Stock Market Analysis: Earnings, Market Valuation, Volatility, Trends & More

by Sonam Srivastava5 min read

Explore Q2 earnings, market valuations, monetary policies, key sectoral trends, inflation and navigate through India's economic landscapes, market volatility, and future investment potentials. We look at where the Indian Stock Market & Economy are today, and what are the key themes playing out.

Equity Funds vs Debt Funds: Making Informed Investment Decisions

by Alina Khan5 min read

Explore the world of mutual funds with a focus on Equity and Debt Funds in India. Learn the distinctions, merits, and considerations for each, and delve into strategic investing insights for different financial goals and risk appetites, with a lens on effective portfolio diversification.

Will market volatility continue? Where to invest in volatile times?

by Sonam Srivastava5 min read

Explore the factors driving global market volatility, from macroeconomic shifts to sector-specific trends. Dive into the Indian stock scenario, understand the long-term market outlook, and discover strategies to invest wisely in these uncertain times.

Complete Guide to Indian Railway Sector and Top Railway Stocks in India 2024

by Alina Khan, Siddharth Singh Bhaisora5 min read

Understand the Indian Railways Sector in depth in this Sectoral Analysis by Wright Research. Dive into the key highlights, major developments like electrification, station upgrades, and top reasons to invest in Indian Railway Stocks in 2024. Explore top railway stocks in India. Read Now!

Inflation in India 2023 - Causes, Impact & What to Expect for Indian Stock Market & Investors

by Siddharth Singh Bhaisora5 min read

How is India’s inflation in 2023 doing - what is the effect on food and fuel prices, and the government's strategies for stabilisation. Understand Why India’s inflation has increased, where it is expected to go and how this will impact the Indian Stock Markets and you as Investors. Read now!

Inflation in India 2023 - Causes, Impact & What to Expect for Indian Stock Market & Investors

by Siddharth Singh Bhaisora5 min read

How is India’s inflation in 2023 doing - what is the effect on food and fuel prices, and the government's strategies for stabilisation. Understand Why India’s inflation has increased, where it is expected to go and how this will impact the Indian Stock Markets and you as Investors. Read now!

Top New Age Stocks 2023: Delhivery, Zomato, PayTM, Easemytrip & Nykaa

by Siddharth Singh Bhaisora, Siddhart Agarwal5 min read

Uncover key financial trends, strategies, and stock performance of top new age companies in India for 2023. Dive into 5 New Age Companies - Paytm's mixed financials, Zomato's profitability, Delhivery's resilience, EaseMyTrip's market dynamics, and Nykaa's growth prospects. Analysis of new age stocks

Top New Age Stocks 2023: Delhivery, Zomato, PayTM, Easemytrip & Nykaa

by Siddharth Singh Bhaisora, Siddhart Agarwal5 min read

Uncover key financial trends, strategies, and stock performance of top new age companies in India for 2023. Dive into 5 New Age Companies - Paytm's mixed financials, Zomato's profitability, Delhivery's resilience, EaseMyTrip's market dynamics, and Nykaa's growth prospects. Analysis of new age stocks

Complete Guide to India's Renewable and Green Energy Sector: Top Green Energy Stocks

by Siddharth Singh Bhaisora5 min read

Explore an in-depth analysis of India’s renewable energy, green energy, green hydrogen and electric vehicle sectors, examining government initiatives, investment needs, and challenges. Find top performing green energy and renewable energy stocks in india for 2023.

Complete Guide to India's Renewable and Green Energy Sector: Top Green Energy Stocks

by Siddharth Singh Bhaisora5 min read

Explore an in-depth analysis of India’s renewable energy, green energy, green hydrogen and electric vehicle sectors, examining government initiatives, investment needs, and challenges. Find top performing green energy and renewable energy stocks in india for 2023.

Investing in India's New Age Sectors: A Public Stock Market Perspective for 2023

by Sonam Srivastava5 min read

Investing in India's New Age Sectors: A Public Stock Market Perspective for 2023

Small step for ISRO, Giant leap for India - Top Performing Space Sector Stocks of 2024

by Siddharth Singh Bhaisora5 min read

Explore how India's ISRO made history with the successful Chandrayaan-3 mission. India's cost-effective approach is shaking up the global space sector. Find the top space sector stocks in India for 2024, bolstered by the successful Chandrayaan-3 launch. Click to read now!

What is the ASM and GSM List and How Does It Affect Stock Investors?

by Siddharth Singh Bhaisora5 min read

Learn about the Additional Surveillance Measure (ASM) and Graded Surveillance Measure (GSM) in the Indian stock market, implemented by SEBI to monitor and regulate securities. Discover the selection criteria, trading restrictions, liquidity, price volatility, etc associated with ASM/GSM lists.

Why we are bullish on the India Growth Story?

by Siddharth Singh Bhaisora5 min read

Learn why Wright Research is bullish on the India Growth Story! With insights into investments, technology, demographic dividends, education, and more, discover how India's robust growth story is leading the nation towards a potential $10 trillion economy by the end of the decade.

Why we are bullish on the India Growth Story?

by Siddharth Singh Bhaisora5 min read

Learn why Wright Research is bullish on the India Growth Story! With insights into investments, technology, demographic dividends, education, and more, discover how India's robust growth story is leading the nation towards a potential $10 trillion economy by the end of the decade.

The Indian Stock Market's Regulatory Bodies: RBI, SEBI, BSE, NSE & More

by Alina Khan5 min read

Explore the comprehensive guide to the regulatory bodies governing the Indian stock market. From RBI and SEBI to NSE and BSE, delve into their roles, responsibilities, and the significance in maintaining market integrity, investor protection, and fostering economic growth. Read now!

RBI's Rate Pause, Inflation and Why Tomatoes are making Farmers Crorepatis

by Siddharth Singh Bhaisora5 min read

Explore the latest developments in India's monetary policy, including the RBI's decision to hold the repo rate and the introduction of a 10% ICRR. Delve into the complexities of rising food prices, especially tomatoes, and understand how these dynamics affect inflation, farmers' profits, & economy.

What is socially responsible investment (SRI)? How to build a SRI portfolio?

by Siddharth Singh Bhaisora5 min read

Socially Responsible Investing (SRI), once considered a niche strategy, is now at the forefront of modern investment practices. Explore SRI, a powerful way to align financial decisions with ethical beliefs.

Emerging Market Stocks: A New Era of Growth & Opportunities

by Sonam Srivastava5 min read

Explore the shift from bonds to stocks in emerging markets like India and China, driven by the various factors such as US credit rating downgrade by Fitch, growth opportunities, economic resilience, and investment strategies reflecting global changes. Read more about the rise of India and China.

Emerging Market Stocks: A New Era of Growth & Opportunities

by Sonam Srivastava5 min read

Explore the shift from bonds to stocks in emerging markets like India and China, driven by the various factors such as US credit rating downgrade by Fitch, growth opportunities, economic resilience, and investment strategies reflecting global changes. Read more about the rise of India and China.

How the US Credit Rating Downgrade Affects India?

by Siddharth Singh Bhaisora5 min read

Unravel the ripple effects of the US credit rating downgrade from AAA to AA+ by Fitch Ratings on global markets, especially its impact on India. We discuss the reasoning behind the downgrade, its influence on the US, European, and Asian markets, why India is an interesting investing opportunity.

New-Age Stocks: A Winding Road to Profitability and Investor Confidence

by Wright Research5 min read

New-Age Stocks: A Winding Road to Profitability and Investor Confidence

New-Age Stocks: A Winding Road to Profitability and Investor Confidence

by Wright Research5 min read

New-Age Stocks: A Winding Road to Profitability and Investor Confidence

Impact of Global Recession on Indian IT sector

by Sonam Srivastava5 min read

The Indian IT sector is a significant contributor to the global economy, generating billions of dollars annually. However, just like any other industry, it is affected by global economic downturns.

India vs Emerging Markets

by Sonam Srivastava5 min read

India has left behind the emerging market by a wide margin over the past few years in terms of stock market growth rate. But are we also over-valued?

Atmanirbhar Bharat: A Profitable Investing Theme in the New India

by Sonam Srivastava5 min read