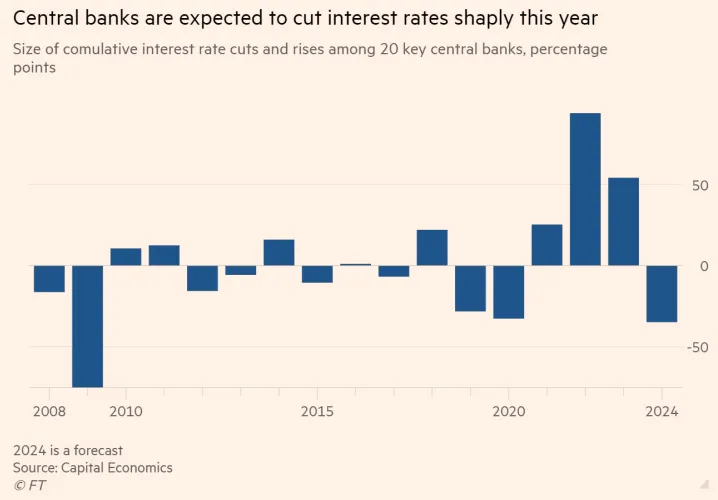

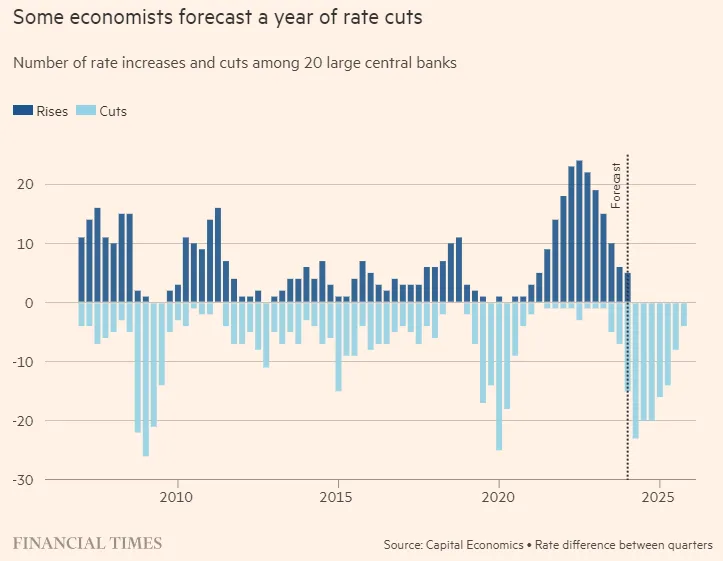

Interest rate cuts and its impact on stocks markets will be a key theme for 2024. Macroeconomic policy measures are seeing a significant shift towards interest rate reductions by central banks. Some economists are expecting a cumulative drop of around 35 percentage points for large central banks - marking the steepest decline since 2009. This could also be the highest number of rate decreases over the last 15 years.

Central banks are responding to deflating inflation rates and reversing supply chain challenges. Energy costs, a primary inflation driver in the recent past, have started to stabilize. Moreover, the aggressive monetary policies previously enacted are now dampening economic momentum, leading to softer wage and rent growth. Let us understand how interest rates have changed so far across developed and emerging markets, along with expectations how much interest rates will be cut in 2024. We also deep dive into the impact of rate cuts on the Indian economy, stock markets & businesses.

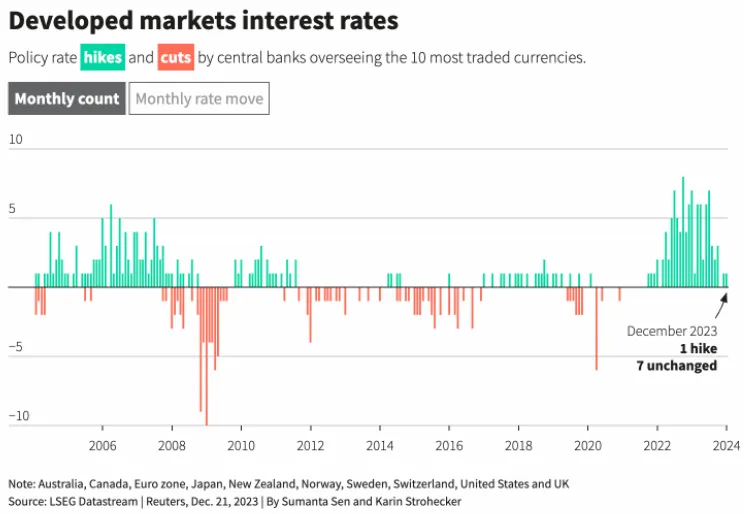

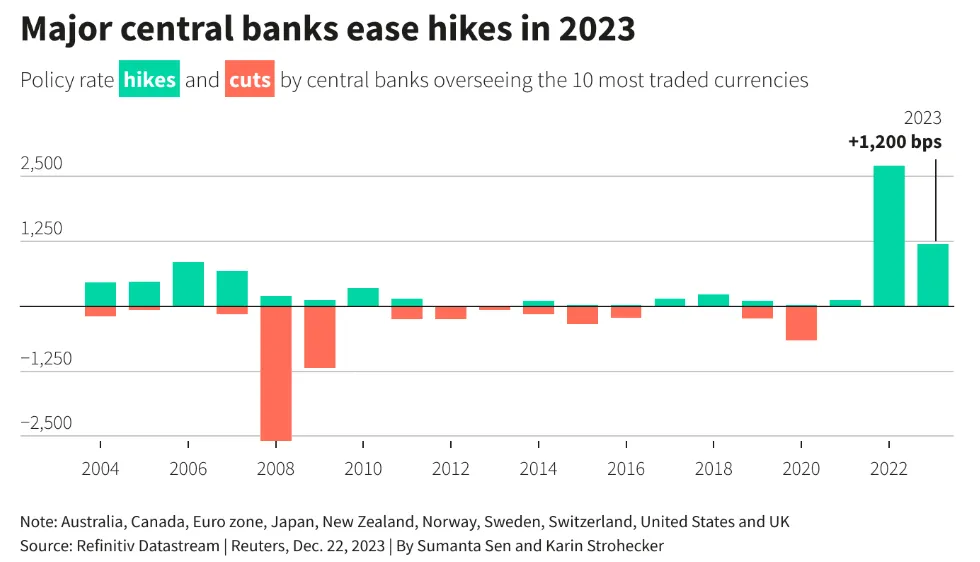

Comparing the year-to-date figures, G10 central banks have increased rates by a total of +1,200 basis points over 38 increments. This is significantly less than half of the +2,700 basis points increase seen in 2022, which included 54 rate adjustments.

In the developed markets, there was a single rate hike by Norway while seven other central banks from the group managing the 10 most traded currencies opted to maintain their rates. This decision signals a tentative stance among these economies, possibly due to the U.S. Federal Reserve's unexpected dovish pivot, which has set the stage for potential rate cuts in the future.

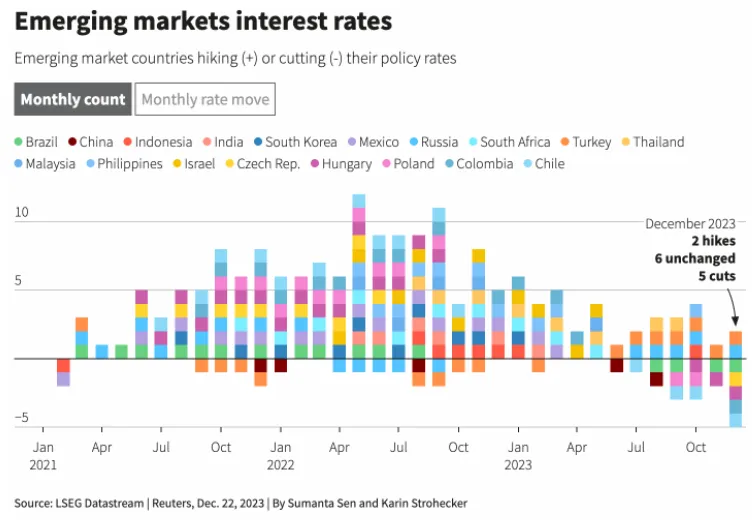

Emerging markets, on the other hand, showed a more pronounced trend towards easing. Overall, 2023’s tightening in emerging markets amounted to 5,075 basis points, a deceleration compared to the 7,425 basis points in rate hikes throughout 2022. US Fed's dovish turn may have signalled central banks in emerging markets to maneuver and ease their monetary policies. And this deceleration is indicative of a global shift in monetary policy as economies adapt to evolving financial conditions.

Central banks of Czech Republic, Brazil, Hungary, Colombia, and Chile were among those that reduced their interest rates, making it the highest number of rate cuts in the past 3 years for this group. 13 central banks in these markets held their rate-setting meetings in December, with a total annual count of rate cuts reaching 945 basis points through 18 moves. This is a significant change from the previous year's 1,765 basis points of rate cuts across 11 moves. Despite this easing trend, some emerging economies such as Russia and Turkey continued to hike rates due to ongoing inflation pressures and currency challenges, cumulatively tightening by 350 basis points.

In December 2023, 8 out of 10 central banks of the world's most traded currencies saw rate setting meetings, with only Norway raising rates by 25 basis points. Other central banks, including the European Central Bank (ECB), as well as those in Britain, Japan, Australia, Canada, and Switzerland, held their rates steady, mirroring the U.S. Federal Reserve's stance. India also followed suit and maintained its rates steady.

What changed in December, was the Fed's unexpected shift towards a more dovish position. This surprised stock markets, leading to speculation that rate reductions could occur sooner and be more rapid than initially thought. This naturally led to a significant boost for global and Indian stock markets. Despite this, European policy makers and others have not aligned with these market expectations, indicating a potential misalignment regarding the timing of policy changes.

The US Fed has attempted to curb any unnecessary & excess rate cut expectations. But economists are highlighting that a slowing global economy, diminishing inflationary pressures, and a downturn in the labor market may necessitate rate cuts from major central banks across the world. If central banks attempted to maintain the current rate levels, this may inadvertently tighten economic conditions. And it looks like central banks around the world are generally in agreement that further tightening may not be required, implying that rate cuts are on the horizon for 2024.

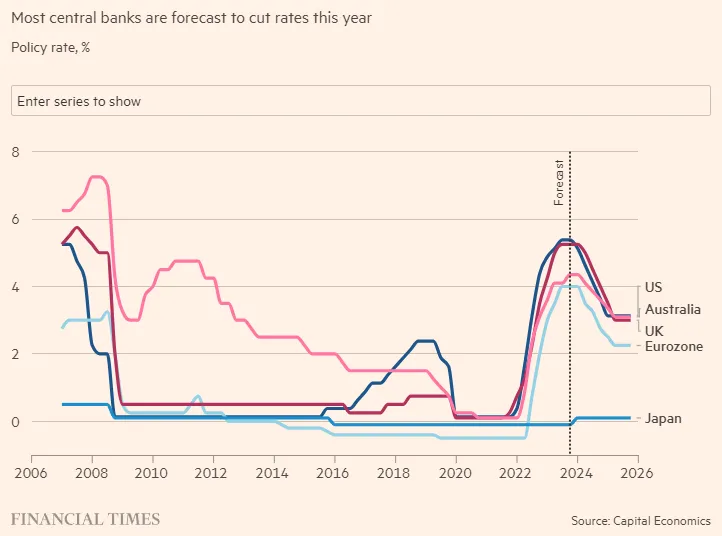

The consensus among analysts suggests that the cycle of interest rate cuts is set to continue beyond this year. Leading forecasters project further reductions in 2025 for major economies like the US, the UK, the eurozone, and Canada. The rationale behind this continued easing trend is attributed to the current high and restrictive interest rates, indicating that the normalisation of monetary policy may be a gradual process. Some economists feel that interest rates across various countries and forecasts that, with the exception of China, rates at the end of this year will be higher compared to the end of 2021. This trend is expected to persist into the following year for most of these countries.

Expectation isn't that interest rates will fall below the neutral threshold. Instead, the anticipated rate cuts are seen as a move towards normalizing monetary policy rather than introducing new economic stimuli. This suggests a cautious approach to ensure that the policy rates are brought back to levels that neither restrain nor overly stimulate economic growth.

Markets are predicting a halt or decrease in rates at the upcoming sessions of 19 central banks, except for Turkey. Additionally, expectations are set for over 400 basis points in rate cuts by the year's end across key financial institutions like the Federal Reserve, the European Central Bank, and the Bank of England.

The US experienced an unexpected rise in inflation to 3.4% in December, exceeding consensus of 3.2%. This inflation uptick has shifted the anticipated timeline for Federal Reserve rate cuts to a later date in 2024 & in 2025. Some economists feel that while this inflation data may not significantly alter the projected rate cuts for the year, the strong inflation figures, particularly the December PCE, could restrain the Fed from adopting an excessively dovish tone before the January FOMC meeting. And the earlier interest rate forecasts may persist for other countries even with this news about higher US inflation figures.

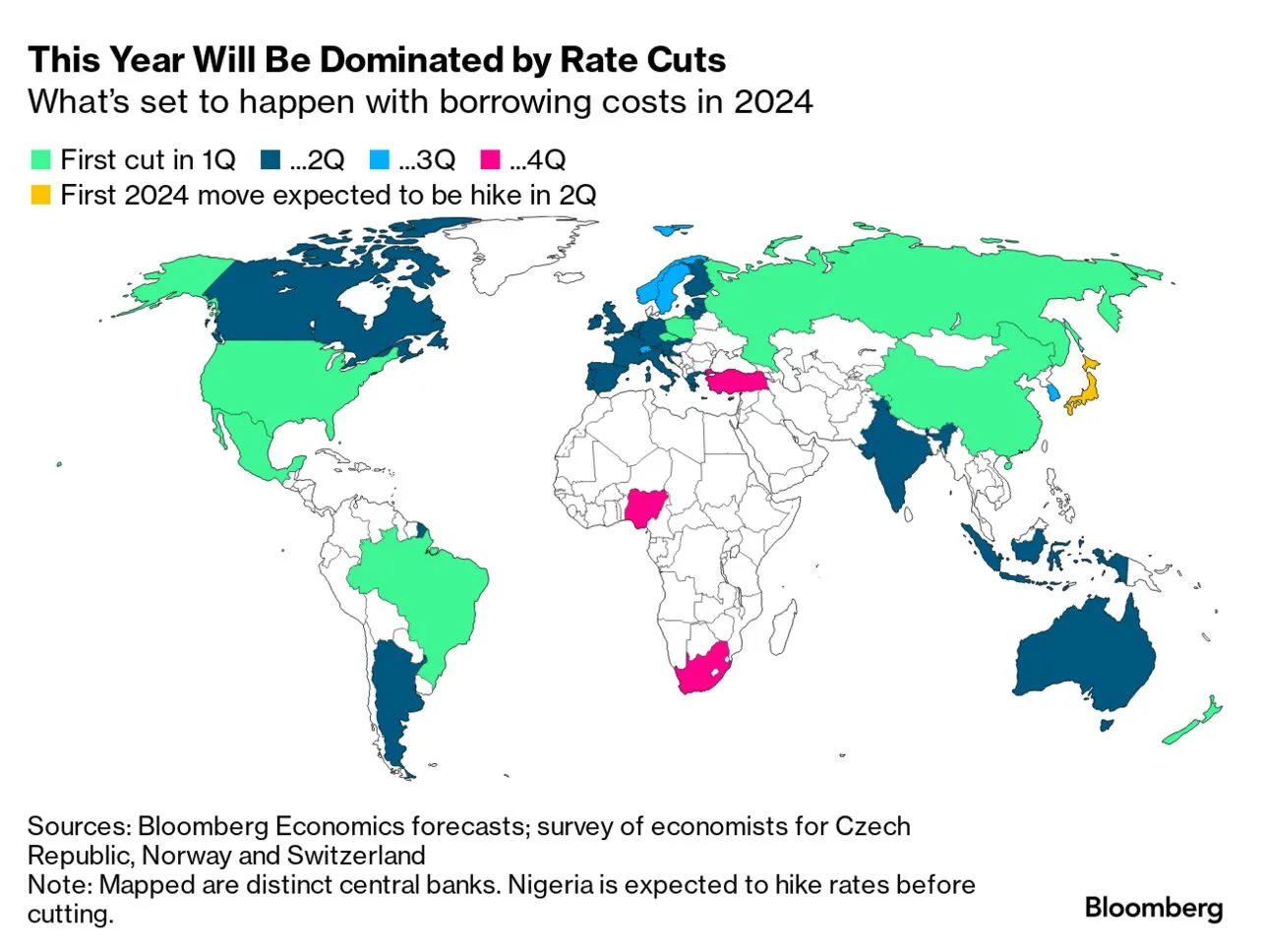

Despite the general trend toward reduced borrowing costs, emerging markets embarked on their tightening cycles earlier and concluded them earlier than developed economies. They are also slated for some of the most substantial cuts in the current year. Forecasts suggest significant rate reductions in countries like Hungary, Chile, and Colombia, with rates expected to drop by 50% from their recent highs by year's end.

Peru has already made its fourth policy rate cut, bringing it down to 6.5%, with UBS predicting a further reduction to 4.75% by year's end. Brazil is also on a downward trajectory, having reduced its Selic rate from 13.75% to 11.75%, with projections indicating a possible descent to 9.5% by the end of the year, as per Capital Economics. UBS offers an even more aggressive forecast, suggesting a potential fall to 8% by the end of 2024 and 7.50% by the following year.

Here are the market’s expectations comparing the current interest rates against the forecasts for the end of 2024. We also share some key insights and market pricing from each central bank.

Central Bank | Current Rate | Forecast for End of 2024 | Key Insights and Market Pricing |

US Federal Reserve | 5.5% | 4.25% | - End of hiking cycle. Rate cut expected in March 2024. - Market expects five quarter-point cuts in 2024. - Focus on inflation progress. |

European Central Bank | 4% | 3.25% | - No immediate rate cuts expected. - First cut possibly in June 2024. - Inflation concerns still present. |

Bank of Japan | -0.1% | 0% | - End of negative rate expected. - First rate hike since 2007 potentially in April 2024. |

Bank of England | 5.25% | 4% | - Markets expect rate cuts starting June 2024. - Inflation forecasts are likely to be lowered. |

Bank of Canada | 5% | 4% | - Rate cuts expected in the second quarter of 2024. - Focus on the impact of high rates on households. |

People’s Bank of China | 2.5% | 2.2% | - Modest rate cuts expected to support the economy. - Focus on the property market slump and consumer confidence. |

Reserve Bank of India | 6.5% | 5.5% | - Rate cuts expected after the Fed moves. - Inflation and growth concerns are key factors. |

Central Bank of Brazil | 11.75% | 9% | - Continued rate cuts expected through mid-2024. - Focus on inflation within tolerance range. |

Bank of Russia | 16% | 12% | - Key rate has peaked; cautious easing expected. - Inflation remains a significant concern. |

South African Reserve Bank | 8.25% | 8% | - Rate cuts expected in the Q4 of 2024. - Inflationary risks and political factors |

Market analysts are closely monitoring the Reserve Bank of India's (RBI) potential move towards lowering interest rates. However, current indicators, specifically the domestic derivatives market, suggest that such a shift is unlikely within the next 6 to 8 months due to RBI's ongoing efforts to firmly control consumer inflation.

One key metric, the overnight index swaps (OIS), which is vital for hedging interest rate risks, indicates no anticipated rate cuts until Q2 of FY25. As of now, the 2 year OIS stands at 6.55%, hinting at possible rate reductions in a timeframe spanning six to nine months. Market experts predict that the RBI might initiate rate cuts around August or October 2024. Recent data from the Clearing Corporation of India revealed that the one-year OIS rate closed at 6.86%, and the two-year rate at 6.56%. These rates, particularly in one and two-year contracts, are significant market indicators. Generally, OIS rates are about 25 basis points above the expected benchmark interest rates for a given period. The current OIS rates, even when global factors like US government bond yields are considered, show market skepticism about a reduction in the RBI's repo rate until the central bank approaches its 4% inflation target.

Some economists are expecting the RBI to modify its stance in Q1FY25 and commence rate cutting in Q2 of 2024, aligning with global rate cycles. This view is supported by the RBI's Monetary Policy Committee projections, which anticipate consumer price index inflation at 4% in Q3 and 4.7% in Q4 of the next financial year. RBI has stressed the need for sustained inflation control at 4% before considering policy relaxation. With Indian elections coming up in a few months along with a potential easing in India’s interest rate cycle, this could have a significant impact on Indian stock market movements.

The Indian market is gearing up for a potential interest rate easing cycle in 2024, a move that is increasingly viewed as likely.

Inflation Trends: The CPI inflation is projected to average around 5.4% in the fiscal year 2023-24, according to RBI. These projections, while slightly above the RBI's target of 4%, show a trend towards easing inflation.

Economic Growth: India's GDP is robust, but could benefit from lower interest rates. This could provide the necessary stimulus for sustained growth.

Global Economic Environment: Internationally, there's an anticipation of an interest rate easing cycle starting between March and May in major economies like the USA and Eurozone. China has already begun easing its rates with expectations of a rate cut on 15th to aid its economy.

The rate cut is anticipated to be moderate, in the range of 50-75 basis points (0.50-0.75%). The Monetary Policy Committee (MPC) aims to maintain a real positive interest rate, considering CPI inflation and the repo rate. With the current repo rate at 6.5%, and an inflation rate of around 5%, the real positive rate stands at 1.5%. The MPC would likely prefer a buffer to guard against unexpected inflation spikes. There are expectations from economists & the market that pegging the rate cut to be nearly 100 basis points (1.00%).

US rate cuts could lead to a more abundant supply of dollars from FPIs & foreign investors , potentially softening the dollar and strengthening the Indian rupee. This shift would have several beneficial effects for India:

Reduced Import Costs: India, which imports over 80% of its oil, could see a decrease in its import bill due to a stronger rupee. This reduction is crucial as oil constitutes a major portion of India's total imports.

Current Account and Fiscal Deficit: A strong rupee could alleviate the current account deficit and indirectly influence the fiscal deficit by reducing the cost of imports.

Inflation Control: Lower imported fuel costs can help keep inflation in check, as they contribute significantly to overall transportation and goods costs.

Furthermore, a global easing in monetary policy led by the US Fed could influence the RBI to consider rate cuts, especially if inflation aligns closer to the 4% target. This could stimulate domestic demand and contribute to economic growth.

Read this article to learn more about Stock Market Predictions For 2024 .

Lower interest rates in the US & other developed markets across the world can lead to increased foreign investment in Indian markets , benefiting Indian businesses. This influx of capital could result in higher investment and boost overall business activity.

Startups and Investment: Indian startups, which have faced a funding crunch, might see a revival in investments, especially from American investors. The expected rate cuts by the US Fed could end the funding winter for Indian startups.

Exports and Imports: A stronger rupee, while reducing import costs, could also impact Indian exporters by lowering their revenue in rupee terms. However, businesses reliant on imports, like those dealing in raw materials or subsidiary goods, would benefit. Additionally, foreign travel and education loans might become more affordable.

Read this article to learn more about Why we are bullish on the India Growth Story?

The US Federal Reserve's decision to lower interest rates could lead to a significant influx of foreign investment in Indian markets. As the interest rate differential between the US and India widens, India becomes a more attractive destination for foreign investors. This is particularly relevant for foreign institutional investors , who had previously retreated from Indian markets due to the US Fed's rate hikes. A revival in foreign investment could trigger a strong rally in the Indian stock market as we saw in December when markets picked up from the Santa Claus rally . Expectations of an end to the tightening cycle and possible rate cuts in 2024 are set to positively influence global indices, including India's.

Predicting market reactions is challenging, but long-term trends indicate that the average spread between the RBI repo rate and the 10-year benchmark government bond yield is around 1%. Currently, the spread is approximately 70 basis points, below the long-term average. With a potential 50 basis point rate cut, the 10-year yield might adjust to around 7%, and if the repo rate is reduced to 5.75%, the yield could settle near 6.75%. The 10-year government bond yield is often referenced due to the absence of a widely-followed bond yield index.

Bond markets typically react ahead of the policy rate easing cycle, incorporating expectations. This response usually occurs in the initial phase of the easing cycle and towards its conclusion, the market begins to position for its end. Therefore, palpable movements in yields are expected next year, especially if inflation aligns with projections or the RBI shifts its stance.

Read this article to learn more about Stock Market Predictions For 2024 .

Existing market pricing paradoxically reduces the urgency for actual rate cuts, as financing conditions in the US and Eurozone have eased since early December, inadvertently fulfilling the role of supporting growth while also increasing inflation risks. Additionally, the stability observed in the US economy and the lack of worsening conditions in the Eurozone diminish the need for emergency rate cuts, requiring a severe economic downturn to prompt action, which is not currently projected. Inflation narrative is equally complex, with 2023 marked by disinflation and 2024 poised to determine whether the trend continues towards disinflation, shifts towards deflation, or sees a resurgence in inflation, influenced by factors like wage pressures, fiscal policies, and potential supply chain disruptions like the Suez Canal.

Central bankers are wary of repeating past mistakes, specifically avoiding the precedent set by Arthur Burns in the 1970s, who is often criticized for prematurely cutting rates and inadvertently fueling a second wave of inflation. This caution reflects a desire to be certain of an inflation downtrend before acting, leading them to lag behind market expectations. This scenario underscores a critical aspect often overlooked: central bankers, in their decision-making, are only human, balancing data with the lessons of history and the unpredictability of future developments. So, what do you think will happen to interest rate cuts in 2024?

Read this article to understand Impact of Interest Rate Cutting Cycle on Stock Markets: Analysis of Expansions & Recessions

Join the Wright PMS Team with Sonam Srivastava ,Founder of Wright Research & Siddhart Agarwal to look at the 5 Month PMS Performance Update. The team will cover the following topics:

💰 Wright PMS portfolios 5 Month live performance in the stock markets

💰 Stock Market's highs & lows - what is going on in Indian & global stock markets?

💰 What to expect in 2024? How will your investment portfolio change in 2024?

💰 Best practices for managing & maintaining a strong portfolio in the current market

As always, Sonam & Wright PMS team will answer all your questions live and clarify any doubts you may have about Wright PMS, Smallcase, Performance of our portfolios, Market Update & more. We will give you a full overview of all our PMS portfolios, how are they have performed since launch, what to expect going forward, and much more! ⚡

If you are interested in PMS, this 1 hour session will equip you with the knowledge and insights to navigate the investing landscape and leverage the potential of your investments.

📈 5 Month PMS Update⚡ Sonam Srivastava , Siddhart Agarwal 🗓️ Start Date: 14th January🕚 Timing: 11:00AM

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Other interesting articles to explore:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios