Portfolio Management Services (PMS) are specialized investment services offering portfolio

advisory services to high-net-worth individuals and institutions seeking tailored investment

strategies. PMS involves professional management of a client's portfolio of stocks, mutual

funds, ETFs, fixed income products, cash, and other assets based on specific investment

objectives. PMS provides clients with a dedicated portfolio manager who designs and manages

the portfolio, aiming for higher returns customized to the risk tolerance and financial

goals of the individual. Unlike mutual funds, PMS advisory services offer direct ownership

of securities, and the minimum investment size is generally higher, ensuring exclusivity and

personalized attention to the investor's needs.

...

Types of Portfolio Management Services

Portfolio Management Services are generally classified into 3 types: Discretionary,

Non-Discretionary, and Advisory. Each type caters to different levels of investor

involvement and preference in decision-making.

|

Type of PMS

|

Discretionary PMS

|

Non-Discretionary PMS

|

Advisory PMS

|

|

Pros

|

Expert management with minimal investor

effort

|

Investor retains control; professional

advice

|

Full control and personalized

advice

|

|

Cons

|

Limited direct control over individual

investments

|

Time-consuming for the investor

|

High demand on investor's time and

decision-making

|

|

Ideal for investors who

|

Lack the time or expertise to manage

their investments actively or prefer a hands-off approach.

|

Like active involvement and

decision-making, but still want expert guidance.

|

Have the expertise and time to manage

their investments but appreciate professional input.

|

|

Buy/Sell recommendations are made by the

|

Portfolio manager

|

Portfolio manager

|

Portfolio manager

|

|

Investor consent is required for execution?

|

No

|

Yes

|

Yes

|

|

Transaction is executed by

|

Portfolio manager

|

Portfolio manager

|

Investor

|

1. Discretionary PMS:

In a discretionary PMS, the portfolio manager has complete authority to make investment

decisions on the client's behalf. The investor entrusts experienced managers with the

authority to handle investment decisions based on the client's goals and risk tolerance.

The focus is on leveraging market opportunities promptly, without the need for client

intervention in each decision.

2. Non-Discretionary PMS:

In a non-discretionary PMS, the portfolio manager plays an advisory role, proposing

investment strategies and specific trades. However, the execution of these

recommendations requires the client's approval. The manager executes the trades but does

not decide independently. This service appeals to investors who prefer a degree of

personal involvement in their investment choices.

3. Advisory PMS:

PMS Advisory services involves providing advice to clients who retain full control over

their investment decisions. The portfolio manager offers guidance and recommendations,

but the execution of these suggestions is entirely up to the investor.

Investors looking to engage in portfolio advisory services of a PMS should consider these

varied offerings, each with its distinct approach to managing portfolio risk, employing

active or passive strategies, and the degree of discretionary authority granted to

portfolio managers. Understanding these options enables investors to align their

investment strategies with their financial objectives, risk tolerance, and preferred

level of involvement.

Benefits of Investing in a PMS

Investing in a PMS can offer several benefits. Let’s look at them:

Customized Investing:

Portfolio advisory services of a PMS provide a personalized investment experience.

Portfolios can be customized to align with specific investor goals, risk profiles, and

investment horizons, unlike mutual funds which are structured for mass consumption.

Expert Active Portfolio Management:

PMS accounts are actively managed by a team of seasoned professionals. This active

portfolio analysis and management can potentially lead to better returns, especially in

markets where opportunities are rapidly changing.

Transparency & Visibility:

Investors in a PMS have visibility into the specific securities in their portfolio along

with all the transactions that occur. You get real-time access to your portfolio’s

performance, which gives you a complete understanding of where your money is invested.

Tax Efficiency:

PMS can be more tax-efficient compared to mutual funds. Since the investor owns

individual securities, they can make strategic decisions about when to sell and realize

capital gains or losses, which can be used to manage tax liabilities effectively.

How does PMS work?

Here is a step by step guide on how the portfolio advisory services of a PMS work:

1. PMS Account Setup and Investor Agreement

When an investor decides to undertake portfolio advisory services of a PMS, the first

step involves setting up an investment account. The investor needs to complete necessary

KYC (Know Your Customer) formalities and sign a discretionary or non-discretionary

management agreement based on their choice. This agreement specifies the terms of

management, including fees, the scope of authority granted to the portfolio manager, and

other essential service details.

2. Minimum Investment

PMS typically requires a substantial minimum investment of Rs. 50 Lakhs, which can be

quite high compared to other investment products. This threshold ensures that the

service is tailored to high-net-worth individuals looking for personalized investment

strategies.

3. Fund Deployment

Once the account is set up, the portfolio manager or management team assesses the

investor’s financial goals, risk tolerance, and investment horizon. Based on this

assessment, they advise the client on how their fund’s can be deployed or the client can

choose specific strategies offered by the PMS to invest into based on their allocation

preference. This could include a mix of stocks, mutual funds, gold, ETFs, fixed-income

securities, and other investment vehicles, depending on the investor's preference and

risk profile.

4. Active Portfolio Management

In Discretionary PMS, the portfolio manager actively manages the investor’s portfolio by

making buy/sell decisions without needing prior approval from the investor. In

Non-Discretionary and Advisory PMS, the manager suggests investment ideas, but the final

decision and execution lie with the investor. The active portfolio analysis and

management approach allows for timely decision-making aimed at capitalizing on market

opportunities.

5. Reporting and Communication

Major PMS funds will provide detailed and regular reports to the investor - along with a

dashboard where the investor can track the live performance, see current stock

positions, allocations, get detailed reports on performance data, financial statements,

and a comprehensive analysis of the portfolio’s holdings. Additionally, portfolio

managers maintain an open line of communication with clients to discuss potential

adjustments and understand any changes in the investor's financial outlook. Specific

fund managers will also advise the client on when to increase their investment amounts.

6. Fee Structure

PMS fees can be structured in various ways but typically include a management fee based

on the assets under management (AUM), a performance fee contingent on achieving certain

benchmarks or a hurdle rate, or a combination of both. This fee structure may align the

interests of the portfolio manager with those of the investor, as a part of the

manager’s compensation is directly related to the performance of the portfolio.

Regardless of the fee structure, PMS funds are not allowed to differentiate between

investors that have chosen the same strategy but different fee structures.

7. Regulatory Oversight

PMS is heavily regulated by Securities and Exchange Board of India (SEBI) to ensure

transparency, fairness, and accountability in management practices. This regulation

includes mandatory disclosures about investment strategies, risk factors, and periodic

auditing on a monthly, quarterly and annual basis.

Fees Structure of Portfolio Management Services

The fees structure of Portfolio Management Services (PMS) is a crucial aspect that

investors must understand before committing their capital. It directly impacts the net

returns from the PMS portfolio and is integral to portfolio risk management. Here’s a

detailed breakdown incorporating essential keywords:

1. Management Fees: This is a fundamental component of PMS charges, representing

the cost paid to the portfolio manager for their expertise in managing the PMS

portfolio. It's typically calculated as a percentage of assets under management (AUM)

and can vary based on the PMS provider and the service level chosen. Management fees

cover the strategic allocation of assets, constant monitoring of the investment

landscape, and the execution of trades to align with the portfolio's objectives.

2. Performance-Based PMS charges: Many PMS services include a performance fee

component, aligning the portfolio manager’s interests with the client's investment

success. PMS charges are contingent on the portfolio's performance exceeding a

predefined benchmark or hurdle rate. The structure incentivizes portfolio managers to

achieve higher returns, but investors should understand the benchmarks used and the

calculation methodology.

3. Entry and Exit Loads: Some PMS providers may levy an entry load when investors

initiate their investment or an exit load when withdrawing funds from the PMS portfolio.

These charges are meant to cover the operational costs associated with onboarding a new

client or the administrative expenses of liquidating positions.

4. Custodian and Brokerage Fees: Separate from the management and performance

fees, PMS in investment also incurs custodian charges for holding securities and

brokerage fees for executing transactions. These are usually direct pass-through costs

and vary based on the custodian and brokerage services used.

5. Other Operational Expenses: Depending on the PMS agreement, investors might

also bear additional costs related to auditing, legal fees, and other operational

expenses associated with maintaining the PMS portfolio. These should be detailed in the

PMS agreement for transparency.

Understanding the fee structure of portfolio analysis and management is essential for

investors to gauge the true cost of investment and its impact on expected returns. A

well-structured fee arrangement ensures alignment between the investor and the portfolio

manager, with a clear focus on optimizing returns while effectively managing portfolio

risk. Investors are advised to thoroughly review and discuss the fee structure with

their PMS provider to ensure clarity and alignment with their investment objectives.

Comparing Portfolio Management Services to Mutual Funds and ETFs

Active Portfolio Management Services (PMS), mutual funds, and Exchange-Traded Funds

(ETFs) are popular investment avenues, each with unique features catering to different

investor needs. Here’s a comparative overview to understand how they differentiate:

|

Feature

|

Portfolio Management Services (PMS)

|

Mutual Funds

|

ETFs

|

|

Customization

|

High customization based on individual

client needs, allowing for a personalized PMS portfolio.

|

Standardized portfolios with no

individual customization.

|

Standardized portfolios similar to mutual

funds, but trade like stocks.

|

|

Investment Minimum

|

Generally higher minimum investment,

making it suitable for high-net-worth individuals.

|

Lower minimum investment, accessible to a

wide range of investors.

|

Varies, but generally low, similar to the

purchase of a single stock.

|

|

Management Style

|

Can be actively or passively managed,

with discretionary or non-discretionary options.

|

Mostly actively managed, though index

funds offer a passive approach.

|

Typically passively managed, tracking a

specific index.

|

|

Fees and Charges

|

Potentially higher PMS charges due to

personalized service and active portfolio management.

Performance-based fees might apply.

|

Fees vary, with actively managed funds

generally charging higher fees than passive funds.

|

Lower fee structure compared to mutual

funds, owing to their passive management style.

|

|

Liquidity

|

Liquidity can vary, often subject to

terms and conditions defined in the PMS agreement.

|

High liquidity, with shares redeemable at

the end of each trading day at the current NAV.

|

High liquidity, traded throughout the

trading day at market prices.

|

|

Portfolio Risk Management

|

Direct oversight by portfolio managers

allows for dynamic risk management strategies tailored to individual

client profiles and market conditions.

|

Risk is managed at the fund level based

on the fund’s stated objectives, with less individual

tailoring.

|

Risk management is tied to the index or

sector the ETF tracks, with limited individual customization.

|

|

Transparency

|

High level of transparency with detailed

reporting on holdings, transactions, and performance.

|

Holdings are disclosed periodically, with

less frequent transaction reporting.

|

High transparency with holdings

reflective of the tracked index and visible market pricing.

|

|

Regulation

|

Heavily regulated with specific

guidelines for operations, reporting, and disclosures.

|

Regulated by financial authorities with

stringent compliance for operations and disclosures.

|

Regulated similar to mutual funds with

additional stock exchange listing requirements.

|

|

Investment Constraints

|

Constrained by the investment strategy

and approach that has been agreed. Faster to react & can easily

change asset mix, allocations

The most personalized investment strategy,

allowing rapid reaction to market changes and flexible asset

allocation,

|

Bound by stricter regulatory frameworks

and their stated investment objectives, which restricts quick

pivoting in strategy.

Slow to respond to changes, cannot easily

change asset mix/ allocation due to 1,000s of crore invested.

|

Constrained by the need to track a

specific index or asset group, limiting active management

opportunities.

Do not frequently change their asset mix

due to their nature of tracking indices.

|

Key Takeaways:

- Active Portfolio Management Services (PMS) offer a high degree of customization and

personalization, making them suitable for investors with specific investment goals

and higher capital. They provide direct portfolio risk management with a potential

for higher PMS charges.

- Mutual Funds present a convenient option for diversified investment with

professional management. They are ideal for investors looking for accessibility and

simplicity, with varying fee structures based on fund management styles.

- ETFs stand out for their liquidity and lower cost structure, appealing to investors

who prefer a passive investment strategy that tracks specific indexes or sectors.

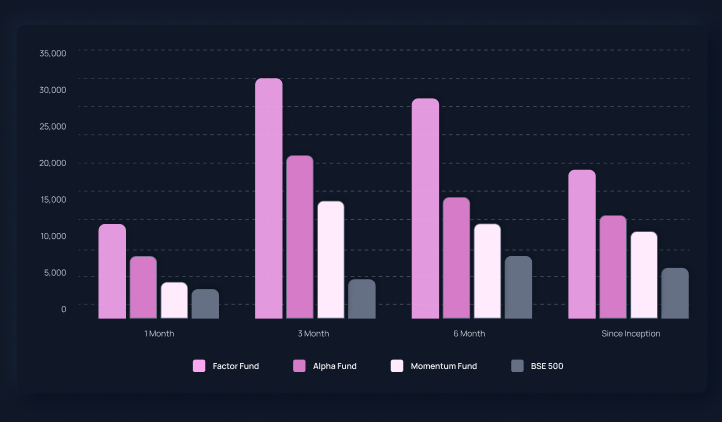

Analysis of performance between PMS and Mutual Funds

- Investing INR 2.5 crores in the top 5 PMSs in April 2014 would have been

substantially more profitable than investing in the top 5 MFs, yielding an

additional INR 8.75 crores over 10 years.

- This indicates a stronger performance and possibly higher returns associated with

the selected PMSs compared to the mutual funds during this period.

- This shows the advantages of PMS such as personalized portfolio analysis management,

direct ownership of securities, and potentially better adaptation to market changes,

all of which can lead to higher returns under the right circumstances.

- However, it is also essential to consider the risk factors and management fees

associated with PMS, which could be higher compared to MFs.

When considering PMS in investment, it’s essential to weigh these aspects against

individual financial objectives, risk tolerance, and investment horizon. Each investment

vehicle offers distinct advantages and limitations, guiding investors towards the most

suitable option for their portfolio.

Why Choose Active Portfolio Management Services Among Other Financial

Services?

Active Portfolio Management Services (PMS) stand out as a premier choice for discerning

investors looking to optimize their investment strategies. Here are compelling reasons

to choose PMS among various financial services:

1. Tailored Investment Solutions: PMS services excel in offering bespoke

investment strategies tailored to the specific needs and goals of individual investors.

This personalized approach ensures that the PMS portfolio aligns perfectly with the

investor's financial objectives, risk tolerance, and investment horizon.

2. Expert Portfolio Management: PMS provides access to seasoned investment

professionals who bring their extensive market knowledge and expertise to manage your

investments actively. This expert oversight is invaluable in navigating complex market

conditions and identifying potential opportunities, setting PMS apart from more generic

investment solutions.

3. Enhanced Portfolio Risk Management: A hallmark of PMS in investment is the

sophisticated portfolio risk management strategies employed. Portfolio managers

continuously monitor and adjust the portfolio to mitigate risks and capitalize on market

opportunities, ensuring a dynamic approach to safeguarding and growing your investments.

4. Direct Ownership: Unlike mutual funds where investors own units of a fund, PMS

clients have direct ownership of individual securities in their portfolio. This direct

ownership provides greater transparency and control over the investment choices made on

their behalf.

5. Active Investment Strategies: PMS services often employ active investment

strategies that aim to outperform the market, providing potential for higher returns.

Through active management, portfolio managers can quickly adapt to changing market

dynamics, an advantage during volatile market conditions.

6. Comprehensive Reporting: Investors in PMS enjoy detailed and transparent

reporting on their portfolios. These reports offer insights into the performance,

transactions, and strategic decisions made, ensuring investors are well-informed about

their investments' status and progress.

7. Exclusivity and Privilege: PMS caters primarily to high-net-worth individuals,

offering a level of exclusivity and personalized service that is not typically available

with other investment options. This exclusivity extends to customized communication,

direct access to portfolio managers, and involvement in strategic investment decisions.

Choosing PMS services signifies a commitment to an investment strategy that values

personalized service, expert portfolio analysis management, and robust risk management.

For those prioritizing these aspects in their investment journey, PMS offers a

compelling solution that distinguishes itself from other financial services.

Are data driven, quant focused PMS better than traditional PMS?

Traditional PMS strategies are typically characterized by their reliance on fundamental

analysis, personal judgment, and discretionary decision-making. Quant PMS in investment

has the advantage of human intuition and years of experience, which can be particularly

valuable in interpreting qualitative factors and during market anomalies that models

might not predict accurately.

Quant-focused PMS, like Wright Gold PMS, offers several distinct advantages:

1. Systematic and Analytical Approach For Objective Decision-Making:

Quant-focused PMS like Wright Gold PMS utilize a systematic, data-driven approach that

leverages large, objective data sets. These sets enhance stock analysis and enable the

running of complex quant strategies across thousands of simulations. This approach

allows models to learn and adapt, selecting the optimal strategy based on current market

conditions.

By integrating AI and quantitative analysis, these services minimize human biases,

offering a more systematic strategy that enhances consistency and reliability in

investment outcomes. The use of AI and quantitative methods allows for identifying

patterns and correlations that might escape traditional analyses, enabling more accurate

forecasts and smarter investment decisions.

2. Dynamic and Active Rebalancing:

In response to demands for more resilient investment strategies, quant-focused PMS offers

active and dynamic rebalancing on an as needed basis to capitalize on market

opportunities and reduce risk exposures efficiently. Unlike traditional PMS, which might

follow a rigid rebalancing schedule, quant PMS rebalances portfolios as market

conditions change, ensuring investments are always aligned with the latest market

dynamics.

3. Predictive Analytics and Empirical Data:

Quantitative PMS utilizes predictive analytics to anticipate future market conditions,

adjusting risk exposures accordingly. This proactive approach is supported by empirical

data and advanced research, which continually refine proprietary algorithms and models.

For example, analyzing unstructured data from social media to gauge market sentiment can

provide insights that are not typically available through traditional methods.

Quant models & AI systems can quickly analyze vast amounts of data, allowing for

swift adaptation to market changes, which is crucial in volatile environments.

4. Advanced Risk Management With Superior Risk-Adjusted Returns:

Automated tools and sophisticated models facilitate proactive risk assessment and

management, adapting allocations based on perceived market risks and opportunities.

Traditional investment strategies often lag in adapting to rapid market changes, and are

susceptible to inherent behavioral biases, leading to panic buying or selling. These

approaches can result in suboptimal risk-adjusted returns. In contrast, quant PMS uses

advanced AI tools to analyze vast datasets, detect potential risks, and adjust

portfolios preemptively, thus potentially offering superior risk-adjusted returns.

Quant PMS often provide back-tested results that demonstrate potential future

performance, giving investors a data-backed expectation of return on investments.

Complex and sophisticated quant models analyse thousands of data points across thousands

of scenarios to improve the model’s understanding of how risk-return can be

optimized further.

Let’s also look at the challenges of quantitative PMS vs traditional PMS

1. Complexity and Accessibility:

The complexity of quantitative models might be a barrier for some investors, particularly

those who are not familiar with advanced statistical concepts and computer models.

2. Dependence on Historical Data:

While quant models are powerful, they largely depend on historical data, which might not

always predict future events accurately, especially in black swan scenarios where past

data may not provide relevant insights.

This is where PMS funds are able to build predictive models that can accurately predict

how risk & return in the market will shift over the next week, month or more.

Wright Gold PMS’s Approach to Portfolio Rebalancing

Wright Gold PMS employs a strategically agile approach to portfolio rebalancing,

characterized by monthly adjustments to ensure that portfolios remain optimally aligned

with prevailing market conditions. Annually, this results in approximately 250% churn in

the portfolio, reflecting a highly responsive strategy to the dynamics of the financial

markets. Adjustments to factor weightings are not arbitrary but are instead driven by a

sophisticated mix of market dynamics, predictions derived from AI technologies, and

thorough quantitative analyses.

The rebalancing strategy at Wright Research is intricately linked to its regime shift

models. These models are crucial for determining when the portfolio should shift towards

less volatile factors, such as bonds or gold ETFs, especially in bearish markets or when

market risk escalates. Conversely, in bullish markets or when conditions are favorable,

the strategy increases allocations towards high-performing equity factors. This

proactive and dynamic approach ensures that portfolios are not only responsive but also

preemptively aligned with anticipated market shifts.

Introduction video.

Introduction video.