by Sonam Srivastava, Siddharth Singh Bhaisora

Published On March 31, 2024

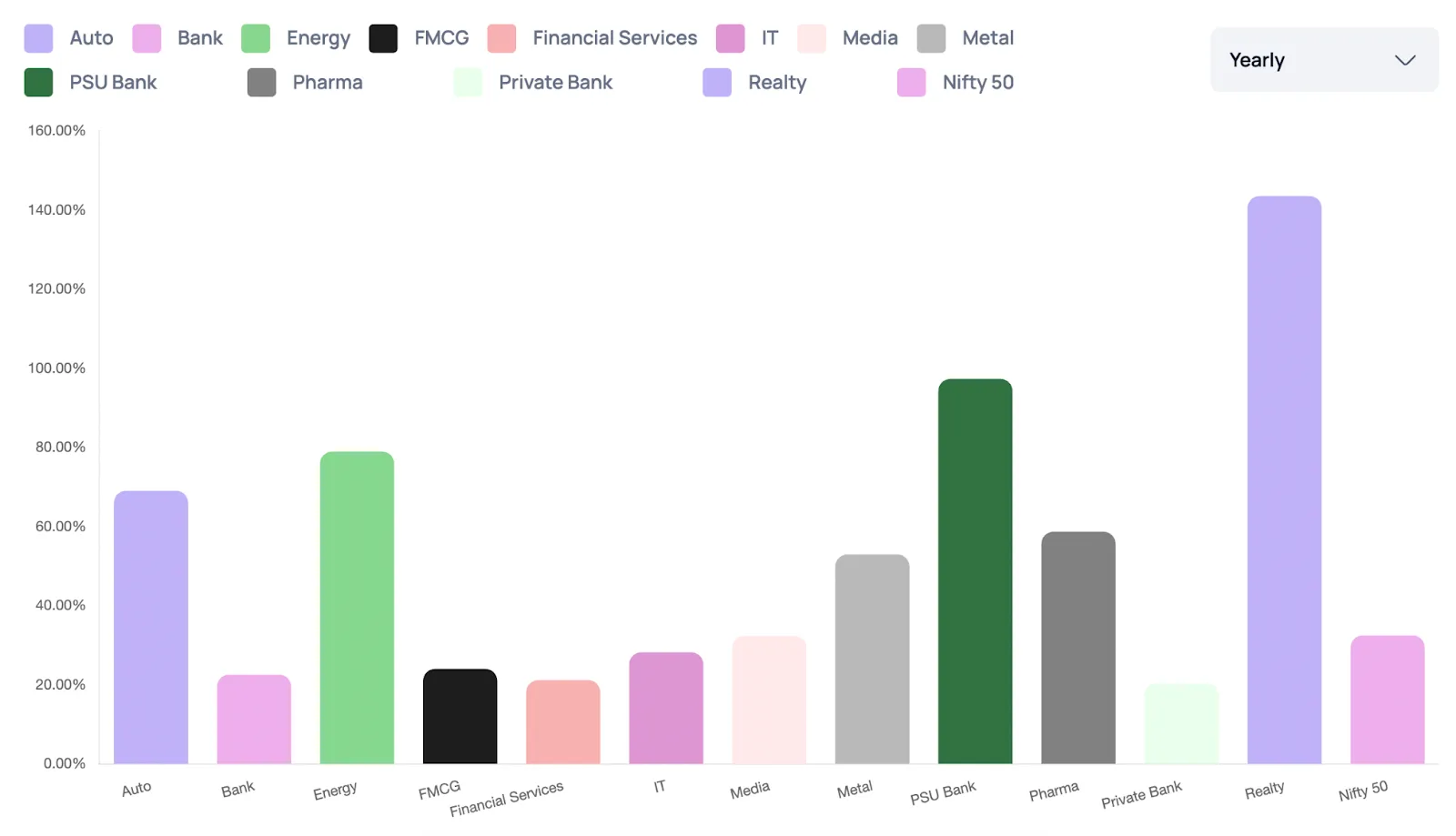

In a year marked by robust economic expansion and stellar corporate earnings, the BSE Mid-Cap and Small-Cap indices have significantly outperformed the benchmark Sensex. The mid-cap index soared by 62.38%, while the small-cap index rose by 59.60%, compared to the Sensex's increase of 24.85%. The rally in mid and small-cap stocks was fueled by impressive quarterly earnings and strong macroeconomic conditions. With the Indian economy on an upswing, these market segments offered lucrative opportunities for investors seeking substantial returns till January 2024. The fiscal year saw the BSE mid-cap, small-cap and large cap indices reaching record highs, demonstrating the vibrant dynamics of the Indian equity market. Despite the remarkable performance, the markets faced a correction in February March, attributed to SEBI’s regulatory scrutiny aimed at tempering speculative investments.

Looking ahead, the future of mid and small-cap stocks remains promising yet challenging. The potential re-election of the current government and India's strong GDP growth forecast could provide a conducive environment for these segments. However, investors must navigate potential risks, including rising interest rates and global uncertainties, with prudence. Let’s look at this in depth in today’s blog

The Indian stock market has witnessed an exceptional rally in the financial year 2023-24, surging nearly 30% and marking multiple record highs. The stock market rally was largely driven by low float stocks along with a combination of improving macroeconomic indicators, declining inflation rates, strong inflows from both foreign and domestic investors - amounting to Rs 1,50,000 crore in FY24, and anticipation of interest rate cuts in FY25. Additionally, the market sentiment has been buoyed by expectations of a third consecutive term for the incumbent government.

Leading the charge, BSE emerged as the standout performer with an astounding 521% increase. Other notable high-flyers include IRFC and Suzlon Energy, with gains of 462% and 444%, respectively. The surge didn't stop there; companies across various sectors from HUDCO to Cochin Shipyard, and from Tata Motors -DVR to Trent, showcased impressive gains, underscoring the widespread momentum across the market.

Nifty500 index saw 120 stocks doubling in value, delivering multibagger returns. The rally extended beyond these leaders, with a significant number of stocks offering returns ranging from 100% to over 300%, indicating a broad-based investor optimism and sectoral growth.

Despite the overall market euphoria, a segment of stocks didn't partake in the bullish trend. In the Nifty500 index 51 stocks were in the negative territory in the year. Rajesh Exports led the pack of underperformers, seeing a sharp decline of over 55%. Other names like UPL, Delta Corp, and One 97 Communications (Paytm) also faced downturns, reflecting the diverse outcomes within the thriving market landscape.

As India strides towards another election, market sentiment in the short term may be influenced by political developments and can be quite volatile - wherein Large Cap Stocks have become the New Safe Haven . We saw the March effect leading to volatile swings in the stock market. However, the long-term outlook remains overwhelmingly positive, buoyed by India's robust economic growth, stable macroeconomic conditions, and strategic sectoral policies. There is potential in infrastructure, manufacturing, and utilities, along with power, defense & transportation driven by favorable government policies and India's strong GDP growth.

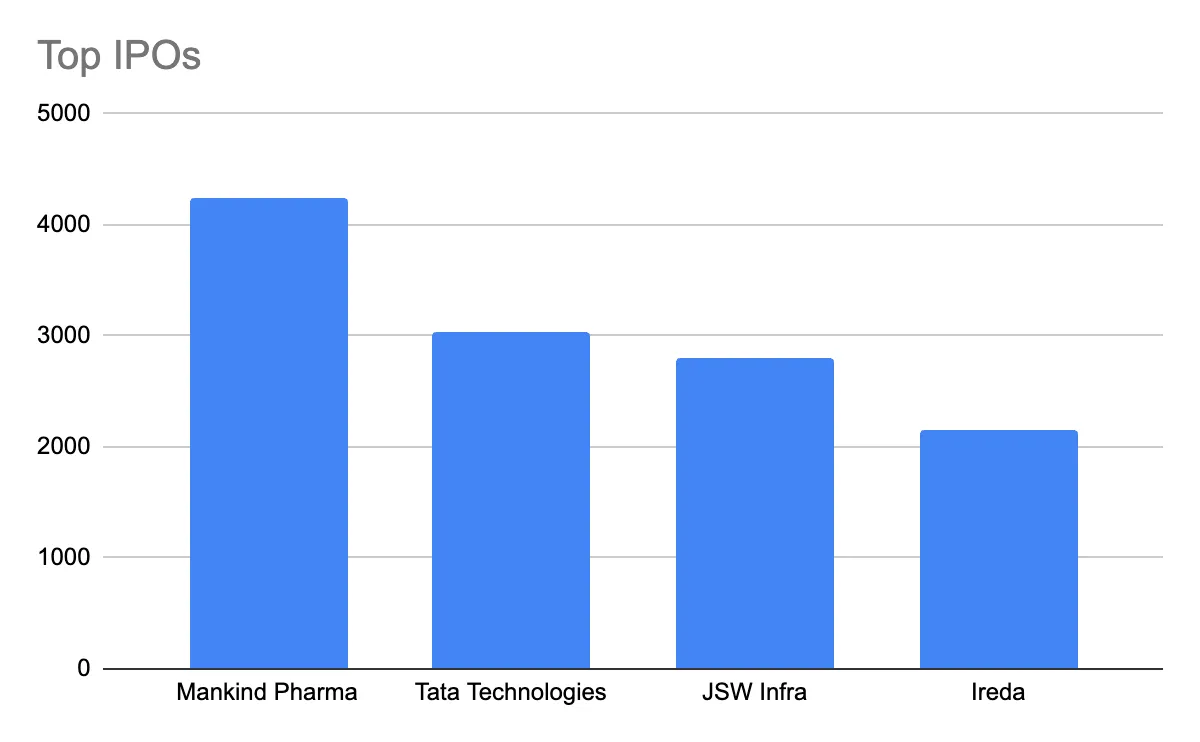

With 75 new issues, the market saw a convergence of eager investors and ambitious companies, setting a new benchmark for the primary market. The increase in IPO activity is largely attributed to the growing domestic investor base, which has shown a voracious appetite for equity investments. This year's standout IPOs, including Tata Technologies, IREDA, JSW Infra, and Cello World, not only met but often exceeded expectations, drawing in substantial subscriptions and achieving notable success on their listing days.

This upswing in IPO engagement facilitated a significant 20% increase in equity fundraising, with 75 companies raising ₹61,915 crore. This marks a considerable leap from the ₹52,116 crore amassed by 37 IPOs in FY23, illustrating the burgeoning confidence in India's equity markets.

The FY24 IPO landscape was characterized by a reduction in the average deal size, yet an increase in investor participation, particularly among retail investors. The surge in retail applications, with Tata Technologies drawing the highest number, showcases the broad-based appeal of IPOs among the general public.

The performance post-listing has been impressive for many, with over 2/3's of the IPOs trading above their issue price, delivering an average return of 65%.

Highlights include IREDA, which outshone its peers with a 400% return, underlining the robust investor interest in sustainable energy financing.

Signature Global and Netweb Technologies also stood out with their remarkable gains, further underscoring the diverse opportunities present within the Indian market.

The much-anticipated Tata Technologies IPO, marking a significant moment for the Tata Group, soared to 106% above its issue price, proving its mettle in the market.

However, the fiscal year wasn't without its disappointments. Some companies struggled post-listing, with HMA Agro Industries and Credo Brands Marketing among the notable underperformers. 2023-24 also witnessed a significant uptick in the number of companies filing offer documents with SEBI, indicating a robust pipeline for future market debuts.

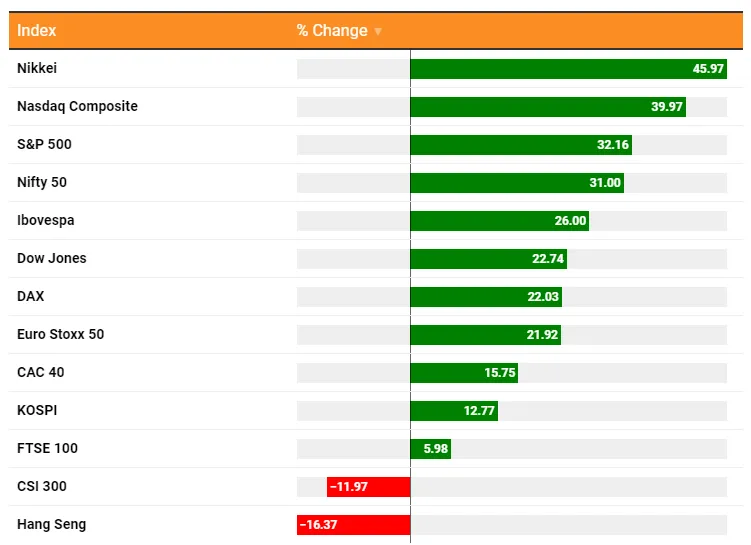

India's headline index carved a niche for itself, outshining prominent global indices such as the Dow Jones Industrial Average, Euro Stoxx 50, FTSE 100, Hang Seng, and KOSPI. Despite this success, India's domestic indices could not eclipse the performance of the Nikkei, Nasdaq Composite, and S&P 500, pointing to a competitive and diverse global market environment. According to Citi Research, India's increased representation in MSCI indices has kept investors' attention riveted, despite concerns over high market valuations dampening some sentiments.

The optimism for India's market is fueled by several factors: a strong growth outlook, a stable macroeconomic backdrop, expectations of policy continuity, and the increasing financialization of savings. These elements contribute to India's appeal, especially in an election year, enticing investors with the prospect of long-term gains. Nonetheless, the high valuation of Indian markets has been a double-edged sword, with some investors remaining cautious, leading to sidelined investments.

On the ground, optimism abounds, with investors keen on seizing opportunities amid positive market signals such as substantial foreign institutional investor (FII) purchases and a general global market rally. Overall there was a strong bullish sentiment dominating Dalal Street, with the Nifty 50 achieving new highs throughout the year - 19,000 in June, 21,000 in December & 22,000 in January. In December, we also saw the market capitalization of listed companies on the National Stock Exchange surpassing the $4 trillion mark, a historic achievement. The enthusiasm was also mirrored in the primary market activities, with companies leveraging the upbeat market mood to raise capital.

The financial year 2024 (FY24) marked a significant turnaround for Foreign Portfolio Investors (FPIs) in the Indian market. After a net outflow of ₹37,632 crore in FY23, FPIs demonstrated renewed confidence in India, injecting a substantial ₹2.04 lakh crore into equities. This influx is the largest since the ₹2.74 lakh crore investment witnessed in FY21, underscoring a rejuvenated interest and optimism in the growth trajectory and investment potential of the Indian economy.

Despite a decade of strong performance, FPI ownership in Indian equities has reached a decadal low, primarily due to recent outflows driven by underperformance and rising US bond yields. However, the substantial inflows in FY24 underscore continued confidence in the Indian market. The increasing participation of retail investors and domestic mutual funds has somewhat offset the reduction in FPI influence, indicating a diversification in market ownership dynamics.

While the Indian market's performance has been strong, high valuations have prompted caution among experts and investors. The current Price-to-Earnings (P/E) ratio and the market capitalization to GDP ratio, which have reached high levels, raise concerns about the sustainability of these valuations, especially in the mid and small-cap segments. Although there is a growing interest in the Indian market from new foreign investors, the consensus is that more favorable valuations may be necessary to sustain large-scale FPI inflows.

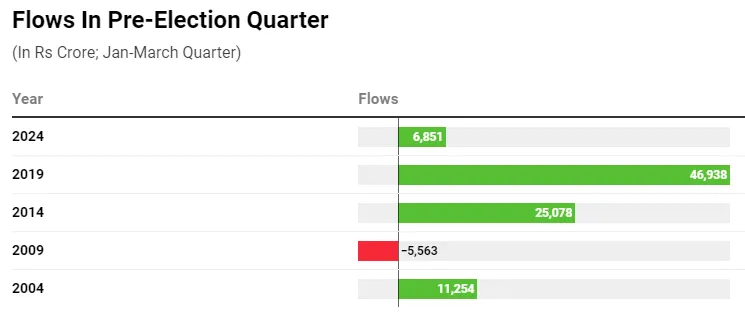

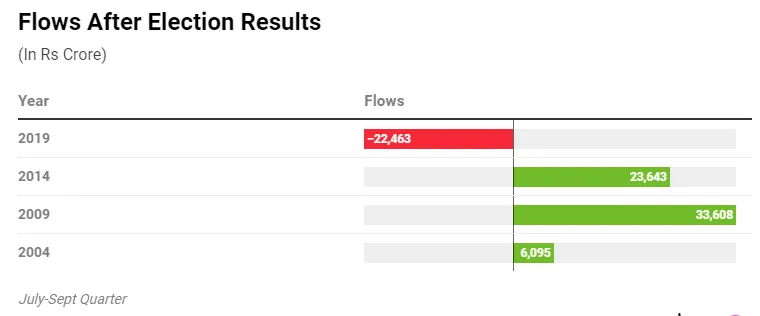

The investment behavior of Foreign Institutional Investors (FIIs) around Indian general election cycles offers intriguing insights into their strategies and market expectations. Historically, FIIs have tended to increase their investments in the Indian market in the quarters leading up to Lok Sabha elections, with 2009 being an exception due to the global financial crisis. In 2024, this trend appears to be continuing, with FIIs injecting Rs 6,851 crore into equities so far, marking a notable shift from earlier in the year.

This year's FPI influx into the primary markets suggests a growing confidence in the Indian economy's prospects and its market's potential for high returns. The current low foreign portfolio investment as a percentage of market capitalisation indicates that FPIs are underinvested, suggesting room for significant future investments.

March 2024 saw a particularly strong surge of Rs 38,098 crore in FPI inflows into Indian equities, reversing earlier selling trends and underscoring a renewed appetite for Indian assets among foreign investors. This resurgence is notable against the backdrop of the general election, aligning with historical patterns of FPI behavior around such periods.

The Indian market's performance in the last 12 months leading up to the general elections, with over a 30% gain, has been buoyed by expectations of political stability and optimism about the onset of a capital expenditure cycle. The anticipation of continued foreign institutional investment, especially favoring large-cap stocks, points to a potential re-rating of these assets post-election, assuming a favorable outcome that reinforces political stability.

However, the post-election quarter historically shows mixed results, with 2019 witnessing an outflow of funds, a deviation from the inflows observed in previous election years. This unpredictability underscores the impact of electoral outcomes on FII investment flows and market dynamics.

As we transition into the financial year 2025 (FY25), the Indian stock market is poised for continued upward momentum, fueled by a confluence of positive factors. Here's a deeper dive into the reasons behind this bullish outlook and the sectors that stand to benefit the most.

Pre-Election Rally: Historical patterns suggest that markets tend to perform well in anticipation of elections. The significant net buying by foreign institutional investors (FIIs) in March, to the tune of Rs 24,000 crore, along with substantial positions carried into April, underscore the positive sentiment. The technical strength is evident, with both the Nifty and Nifty Smallcap indices closing FY24 above their 20-day moving averages.

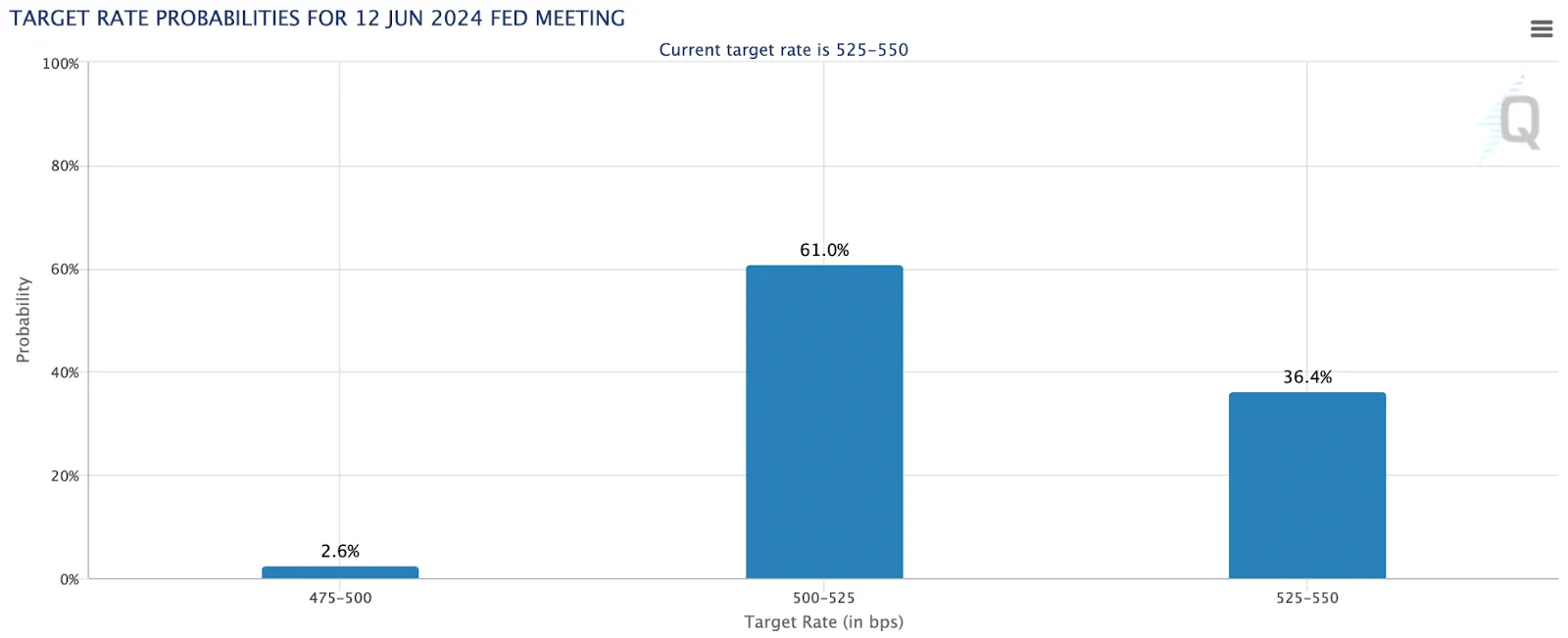

Monetary Policy Easing: The Federal Reserve's indication of potential rate cuts could prompt the Reserve Bank of India (RBI) to follow suit. Such monetary easing would likely increase liquidity in the stock markets, creating a more conducive environment for equity investments.

Inflation Trends: Finance ministry's positive outlook on inflation, with core inflation trending downwards, suggests a broad-based moderation in price pressures. The emphasis on summer sowing to help reduce food prices further aligns with efforts to maintain stable inflation levels.

Inclusion in Bloomberg Index: The anticipated inclusion of Indian bonds in Bloomberg's emerging market index could attract additional foreign investment, estimated between $3-4 billion in FY25. This move will not only enhance the depth of the Indian bond market but also indirectly support equities by improving overall market sentiment.

Upward GDP Revision: Morgan Stanley's revised GDP growth forecast for India, increasing to 6.8% from 6.5%, reflects confidence in the country's economic momentum. The National Statistical Office also did an upward revision of the current fiscal year's GDP growth to 7.6% from 7.3%. India's consistent growth above 8% for three consecutive quarters positions it as a standout performer on the global stage. This adjustment is based on strong industrial and capital expenditure activities, which are key drivers of market growth.

Bloomberg Bond Index Inclusion: The anticipated inclusion of Indian bonds in the Bloomberg bond index from January 2025 is expected to boost foreign inflows, enhancing the depth and stability of India's financial markets.

FPI Inflow: March 2024 saw a particularly strong surge of Rs 38,098 crore in FPI inflows into Indian equities, reversing earlier selling trends and underscoring a renewed appetite for Indian assets among foreign investors. This resurgence is notable against the backdrop of the general election, aligning with historical patterns of FPI behavior around such periods.

The outlook for rate cuts in 2024 is a mixed bag, with central banks around the world carefully balancing inflation control with economic growth. Here's a deeper dive:

Inflation as the Key Driver: After a period of aggressive rate hikes in 2023 to combat inflation, central banks are now monitoring inflation data closely. If inflation falls below target levels (typically around 2-4%), a shift towards rate cuts becomes more likely. Some analysts predict this could happen in mid-2024 for countries like India, where the RBI might consider a modest cut of 0.5-0.75%.

Global Slowdown Pressures: A potential global economic slowdown could also influence rate cuts. Softer economic data and a weaker job market could prompt central banks to ease borrowing costs to stimulate growth. The US Federal Reserve, for example, might adjust its hawkish stance if economic indicators point towards a recession.

Geopolitical Tensions: Unforeseen events like the ongoing conflict in the Middle East can disrupt global supply chains and push up commodity prices, reigniting inflation concerns. This could delay or even derail planned rate cuts as central banks prioritize price stability.

Magnitude of Cuts: Even if rate cuts do materialize in 2024, they are likely to be modest. Central banks will want to maintain a positive real interest rate (interest rate adjusted for inflation) to discourage excessive borrowing and maintain some buffer against inflation surprises.

Looking at specific regions:

US: The Fed is currently projecting rates to be around 4.5% by year-end 2024, down from their peak in 2023. However, this could change depending on inflation and economic data.

India: The RBI is keeping a close eye on inflation, and a rate cut might be considered if CPI falls below 4% in mid-2024. The cut is expected to be in the range of 0.5-1.0%.

Overall, the prospects for rate cuts in 2024 depend heavily on the trajectory of inflation and the global economic climate. While some rate reductions are possible, they will likely be cautious and data-driven.

Capital Goods, Automobiles, and Consumer Services: These sectors have attracted significant interest from FIIs, with capital goods receiving the highest investment at Rs 48,000 crore. The ongoing demand surge, coupled with government initiatives aimed at infrastructure development, suggests a bright outlook for these industries. Find top auto sector stocks .

Healthcare: The Indian healthcare sector is expected to witness significant growth in FY25 due to rising disposable incomes, increasing awareness about healthcare, and growing demand for medical insurance.

Information Technology (IT): The Indian IT sector is a major contributor to the country's GDP and is expected to maintain its growth trajectory in FY25. Factors like digital transformation, increasing cloud adoption, and the growing demand for skilled IT professionals will propel this sector.

Real Estate and Construction: Increased demand for residential properties, especially in tier-2 and tier-3 cities, bodes well for the construction sector, potentially driving further growth and employment. Explore top real estate sector stocks .

Manufacturing and Employment: The revival of non-farm employment and the ascent of the manufacturing sector, fueled by the upscaling of enterprises and the rise of sunrise sectors, are expected to generate quality employment and enhance the economy's capacity to absorb labor.

As we bid adieu to another financial year, it's time to look back at the roller-coaster ride the Indian stock markets and economy have been on. But more importantly, it's time to prepare for what's ahead. 📈🔮

Why Attend?

Here's what you'll gain:

Don't miss this chance to:

Watch the youtube live here on Sunday 31st March, 2024 at 11AM : https://www.youtube.com/watch?v=R4f8j9jDWg4

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios