- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In

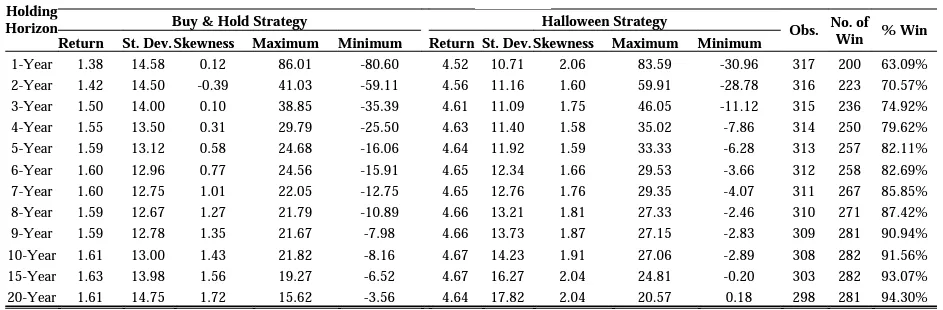

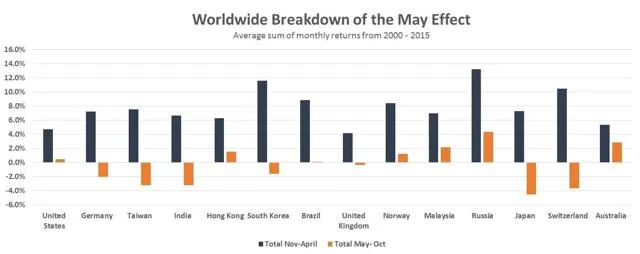

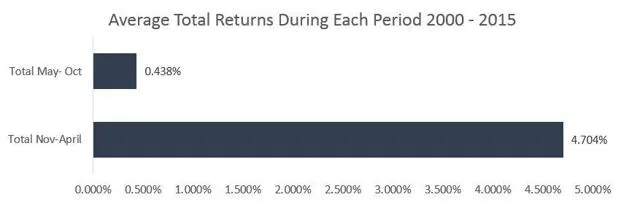

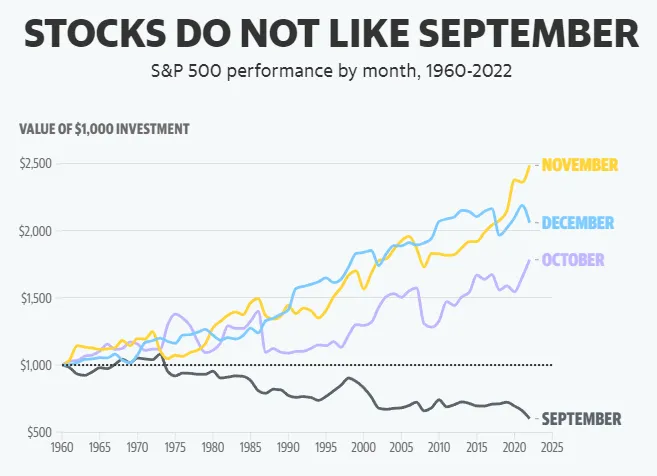

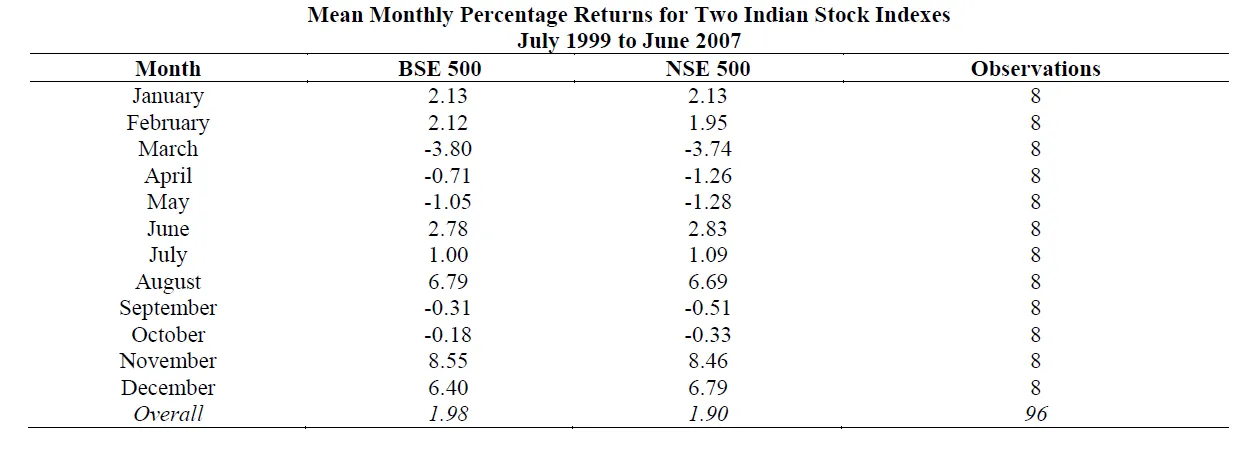

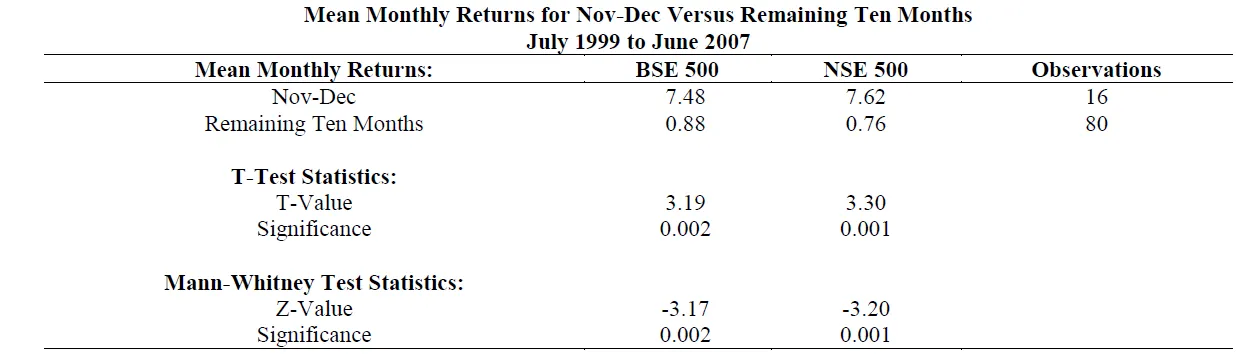

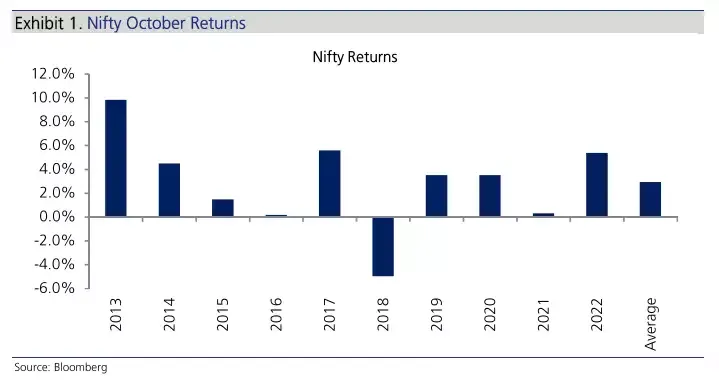

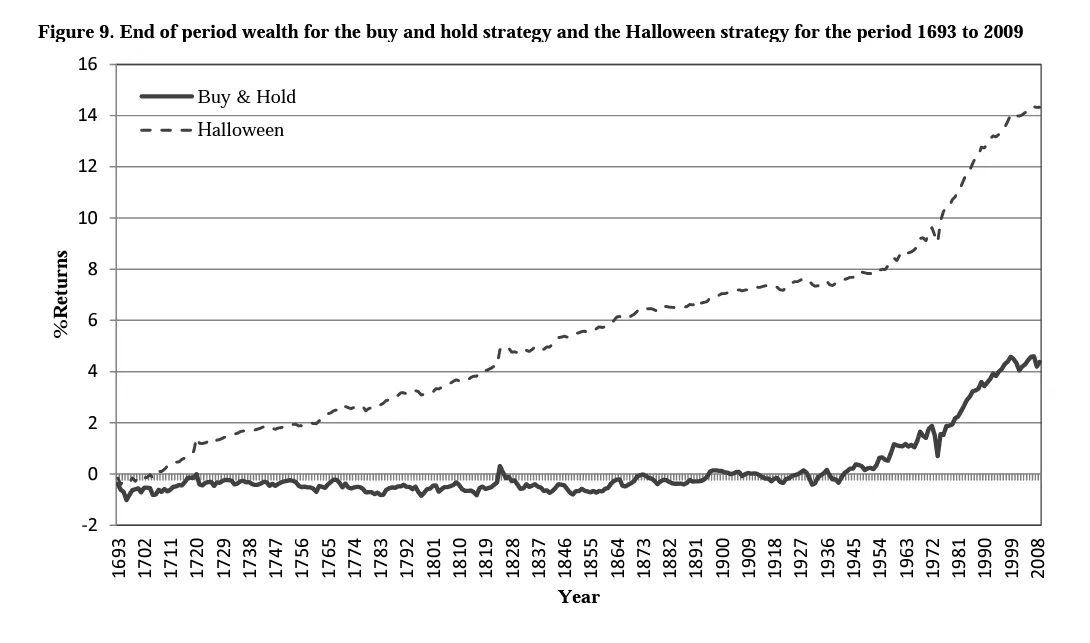

Higher Average Returns for October Effect

Higher Average Returns for October Effect