by Siddharth Singh Bhaisora

Published On Oct. 15, 2023

Today’s blog is all about Alpha!

Financial theory assumes that we humans act rationally and use all publicly available information to make judicious investment decisions. As such, all available information is promptly and accurately reflected in asset prices, which means delivering consistent alpha - excess return above the market benchmark returns - is an ostensibly insurmountable task. Basically according to the Efficient Market Hypothesis (EMH), outperforming the market means that you have a unique informational or forecasting advantage. And this could be true since information in today’s day and age is commoditized and has given a level playing field across managers be it large or small. However, irrational exuberance and pessimism, particularly during volatile market conditions along with herd mentality, market’s euphoria etc. contradict these fundamental assumptions.

Of course uncertainty or risk in the market is important to understand when talking about Alpha. If you are investing, you need to be comfortable with the constant presence of uncertainty - uncertainty of risk, of unpredictable events etc. And relying on forecasts when looking to generate Alpha can be tricky. John Kenneth Galbraith, a famous economist, summarises the point succinctly:

"There are two types of forecasters – those that don’t know and those that don’t know they don’t know. The [latter] are the dangerous ones, the people who think they know what the future will behold."

As investors, the question you need to ask is whether there are investment managers that can capture this risk adjusted excess return - or alpha - (net-of-fees)? Can we find alpha with active managers? What about when we are in competitive markets, does alpha exist? And if we invest in alpha, what happens over time - does it continue to exist and persist?

Here’s a simplistic analysis to understand what we are talking about - if the stock market gave 10% return, and there are companies in that stock market that gave greater than 10% return, then alpha exists. The only thing is whether investment managers are able to pick the right companies, at the right and put them in their portfolios or if they are doing it based on luck, skill or risk. Let’s look at the first part here and tackle the next part in the following paragraph.

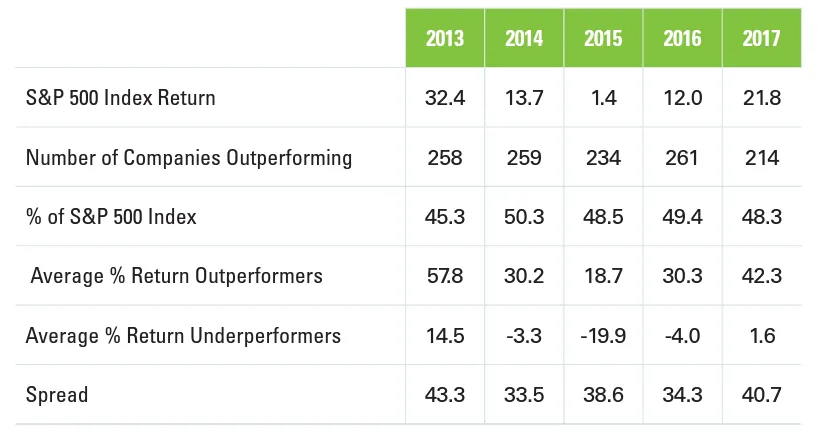

Here’s a graph that shows the return of S&P 500 companies between 2013 to 2017. In almost all cases, we can see the presence of alpha. In 2017, S&P 500 gave 21.8%, while 214 companies outperformed it, giving 42.3% on average. Similarly in 2013 the index gave 32.4% return, while 258 companies outperformed it giving 57.8% return on average.

Alpha exists over both short and long-term periods across various market sectors. The only challenge remains, identifying and selecting the winners from the losers. Despite alpha’s evidence, are investment managers able to find it?

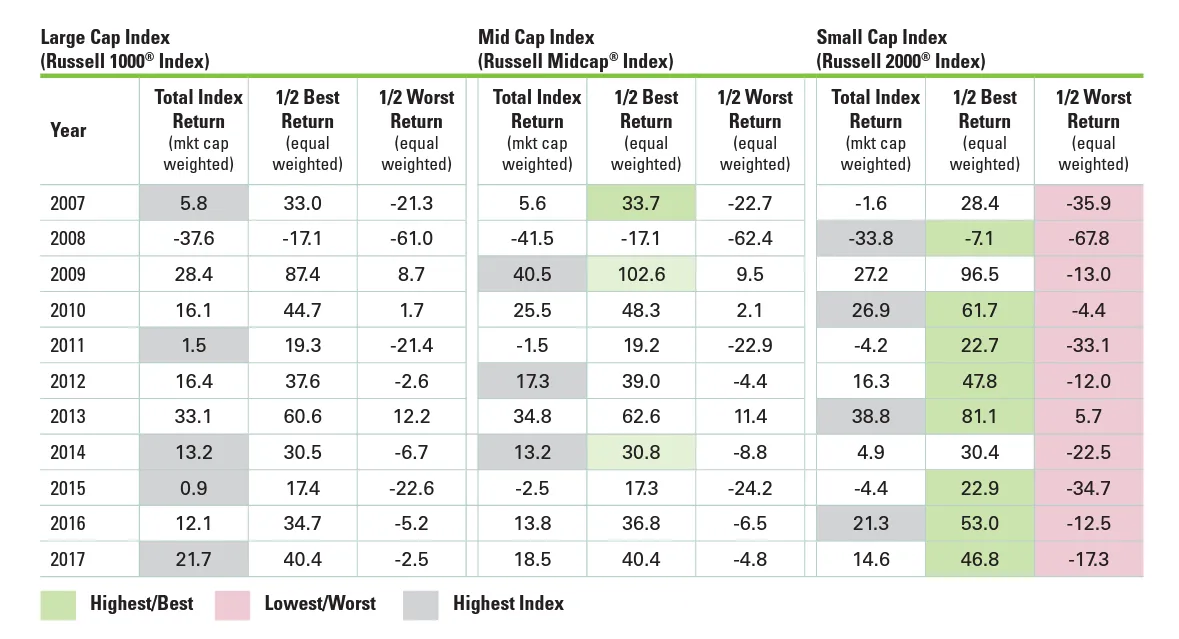

The figure below shows an equal weighted portfolio of best performing stocks and worst performing stocks and compares them across sectors. Comparative data of indices like Russell 1000®, Russell Midcap®, and Russell 2000® showed that alpha potential was evident through notable spreads between the best and worst-performing stocks. Alpha is more pronounced in small and mid-cap segments.

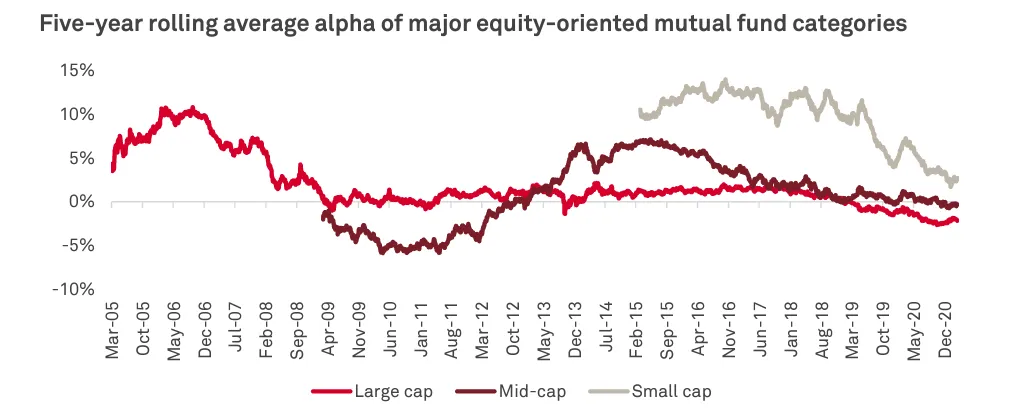

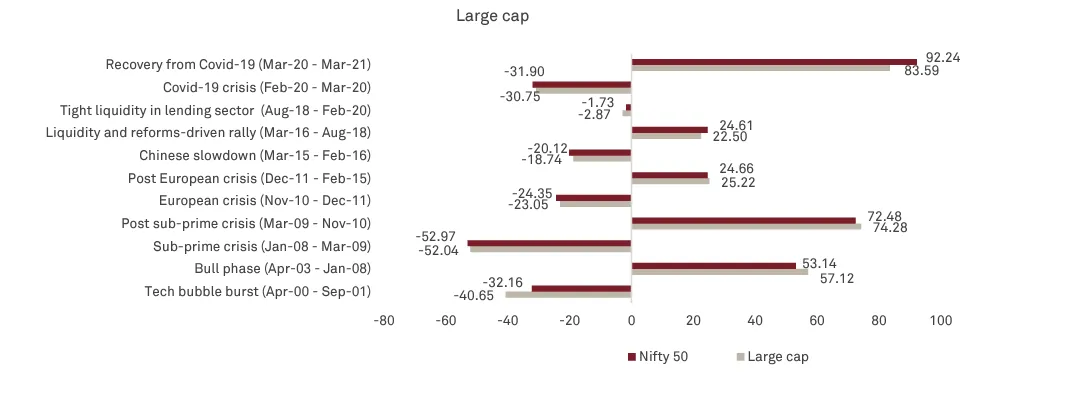

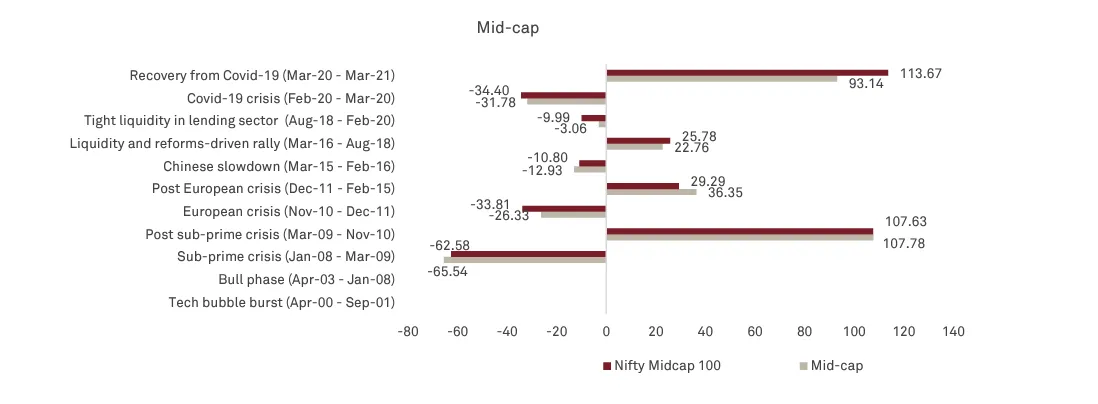

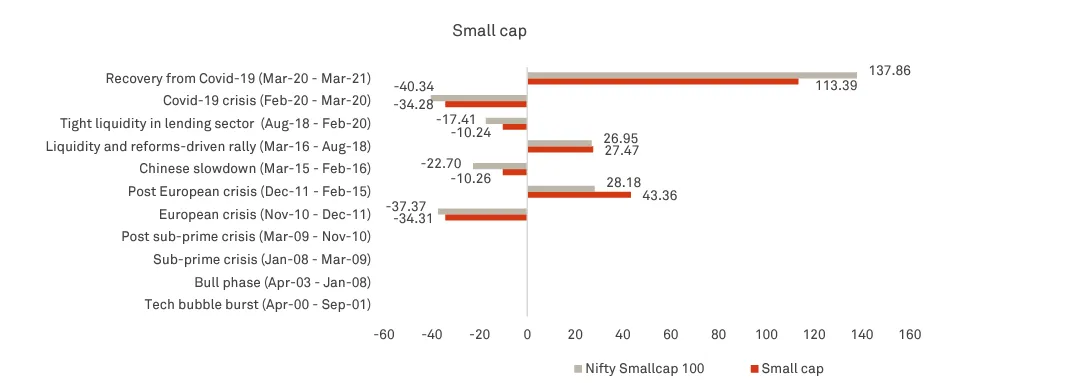

Are we selectively choosing these markets or this data? No. And this isn’t the case just for US stock markets, but we will see similar trends across developed and developing markets. Let’s look at the performance of actively managed mutual funds across large caps, mid caps and small caps in India. Here’s a study that was conducted by CRISIL where they looked at the 5 year rolling period average alpha generation over a 15 year period.

We can see underperformance across large cap, mid cap and small caps , albeit varying across the 3. Large-cap funds showcase the most pronounced underperformance relative to benchmarks. About 90% of large-cap schemes generated negative alpha in the five-year rolling period analysis while, performance for mid caps in the initial years showed underperformed, generated alpha in between, and reverting to underperformance up to 2020.

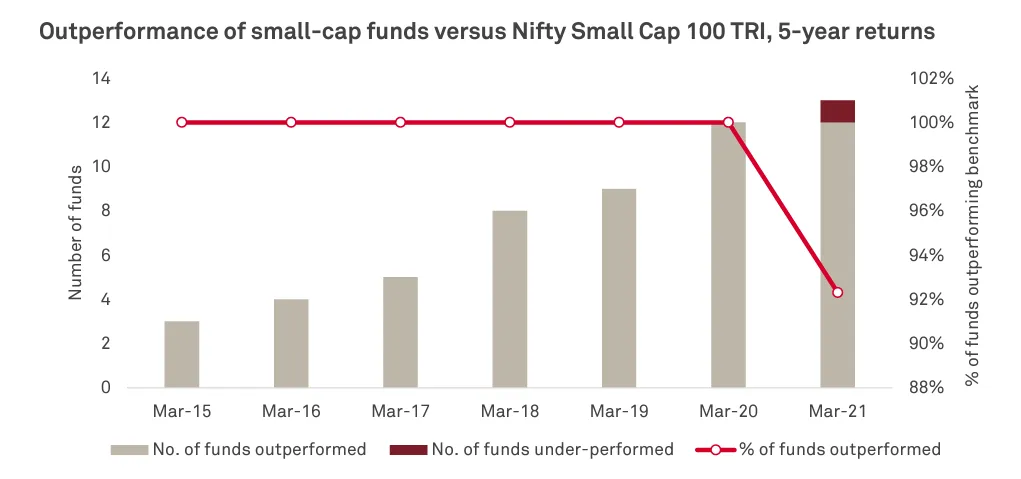

Small-cap funds generally outperformed their benchmarks, with a minimal proportion producing negative alpha up to March 2021.

It also depends on where we are in the market cycle - bull or bear markets. During bull phases, actively managed funds tend to lag behind benchmarks, while during bear phases they show enhanced performance. For instance, large-cap funds outperformed the benchmark in 3 out of 5 bull phases, and generated alpha in 4/6 bear phases.

Mid-cap funds gave negative alpha relative to benchmarks in 2/4 bull phases but outperformed in 3/5 bear phases.

Successful identification of alpha needs a strategic approach to differentiate between potential winners and losers in the market. And small-cap funds have consistently generated alpha in all 4 bear phases and delivered positive alpha in 2/3 bull phases.

Interested in learning more about small caps, explore our Complete guide to Invest in Smallcap Stocks & in Wright Smallcaps Portfolio and Understanding Concentrated Portfolios - Alpha Prime

Stock markets are noisy - we are bombarded with data. Data is everywhere - what is important is how we convert data or information towards something that is actionable or knowledgeable for us as investors to implement. To understand this better we need to first see if performance is related to luck, risk or skill.

The average manager tends not to outperform the benchmark, indicating challenges in distinguishing between winning and losing investments amidst market uncertainties. Let’s look at some research that has been conducted in this space -

Fama and French (2010) found negligible alpha net of expenses, even in top-performing U.S. equity mutual funds, but they did find alpha before expenses in highest performers.

Cremers and Petajisto (2009) defined "active share" as deviation degree of fund’s holdings from its benchmark index. They found high active-share funds outperformed low active-share ones.

Amihud and Goyenko (2013) introduced "selectivity" as a fund return variation portion not explained by the Fama & French and others. Identified high selectivity as a predictor of fund performance, being more stringent and practical than active share, and without needing a benchmark or specific trading strategy for meaningful outcomes.

Let’s try to look at researchers found for the top-performing 2.5% of funds to distinguish luck from skill.

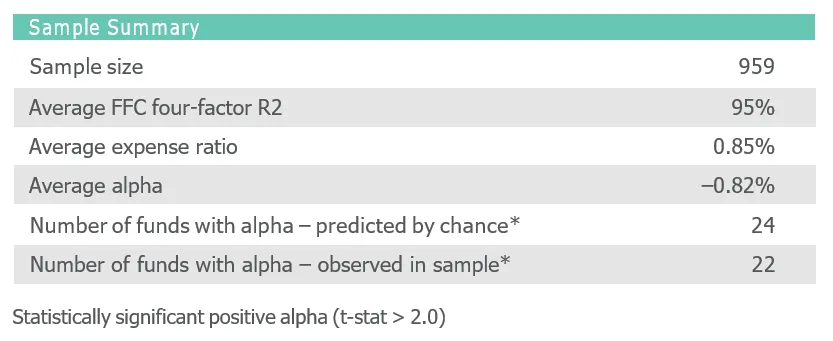

Average Alpha: On average, the funds did not deliver alpha (a measure of performance on a risk-adjusted basis). The average alpha was -0.82%, which is almost the same as the average expense ratio of 0.85%. This means that the underperformance of the funds can be fully explained by their expenses.

Top-Performing Managers: The study aimed to distinguish between top-performing managers who achieved their results due to skill (true alpha) versus those who got lucky. To do this, they looked at the top 2.5% of the sample. They expected some funds to be top performers just by chance. If more than 24 out of the 959 funds produced statistically significant positive alpha, it would be evidence of manager skill. However, they found only 22 such funds. On the other hand, 119 funds produced statistically significant negative alpha, mainly because of fees.

Top-performing funds may exhibit non-random alphas, indicating true alpha before expenses as explained in the next section.

What about selection from the investment manager that comes from their unique investment process?

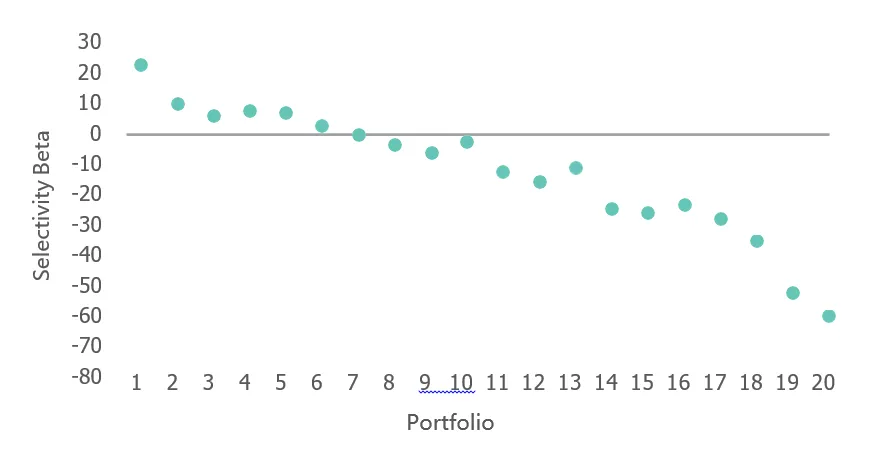

Selectivity, derived from a manager’s unique investment process, might be linked to non-random alpha.

A weak but statistically significant relationship was found between alpha t-stat and selectivity across the full sample hinting at ability of top performing managers to generate alpha.

Funds were sorted into 20 equal-weighted portfolios based on alpha t-stat, then tested for alpha sensitivity to selectivity. Among six positive-alpha portfolios, Portfolio 1’s fund alphas were most sensitive to selectivity, suggesting performance screening using alpha t-stats and selectivity might distinguish true skillful alphas from lucky one

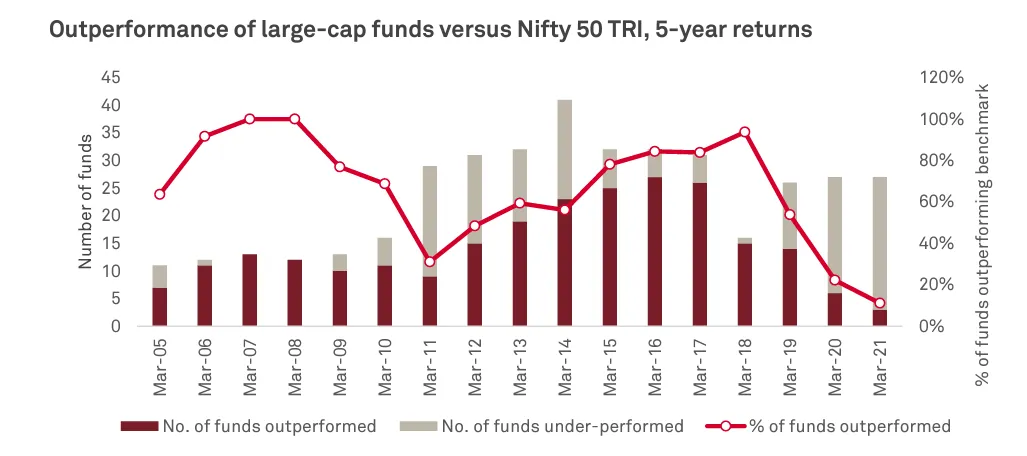

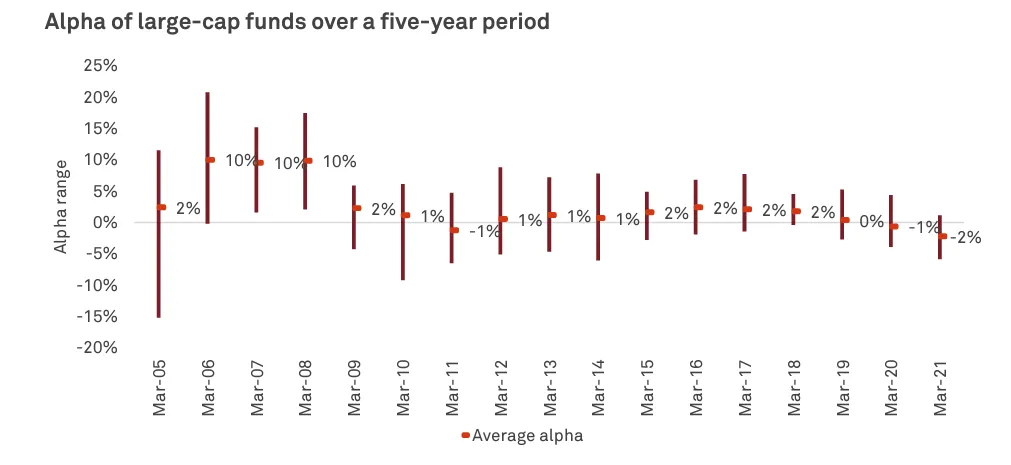

Another study conducted by CRISIL looked at actively managed equity funds in India from March 2005 to March 2021. It considered their daily rolling alpha over 5 year horizons. There is pronounced deviation in the range of top and bottom performers across all mutual fund categories, which means selecting the right fund is important for investors to earn alpha for their mutual fund investments. Here we can see alpha for large cap funds over a 5 year period - we can see the range of alpha has reduced over time for large cap funds.

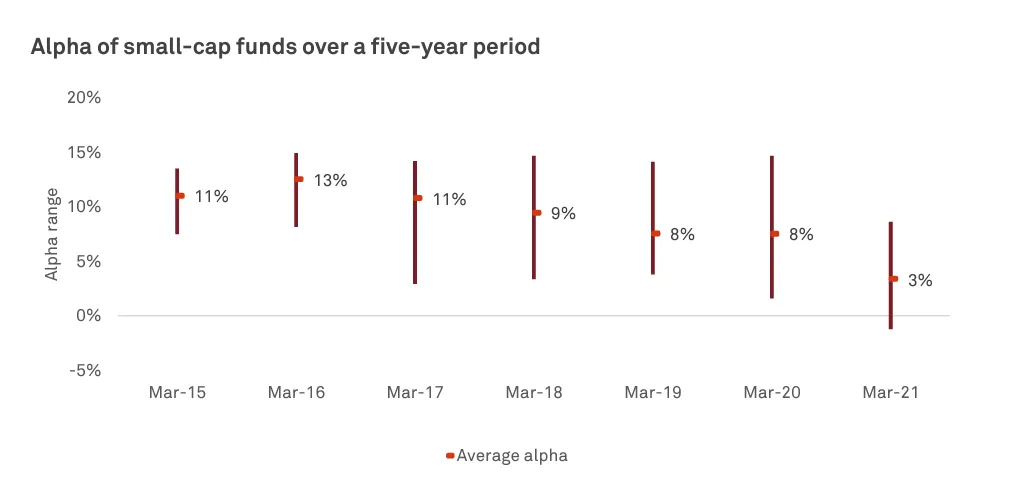

Midcaps have shown performance between large and small caps . The alpha range has also decreased over time. On the other hand, most small-cap funds registered positive returns against benchmarks (except in the most recent five-year period) and the range for alpha has increased initially and remains stable.

Disparities in returns among best and worst performers within the category signal the risk of suboptimal alpha if fund selection falters. This means that investors that do not select the right fund manager or the fund scheme, may not get funds that outperform and generate the alpha that we all seek.

Disparities in returns among best and worst performers within the category signal the risk of suboptimal alpha if fund selection falters. This means that investors that do not select the right fund manager or the fund scheme, may not get funds that outperform and generate the alpha that we all seek.

Interested in learning more about small caps, explore our Complete guide to Invest in Smallcap Stocks & in Wright Smallcaps Portfolio and Understanding Concentrated Portfolios - Alpha Prime

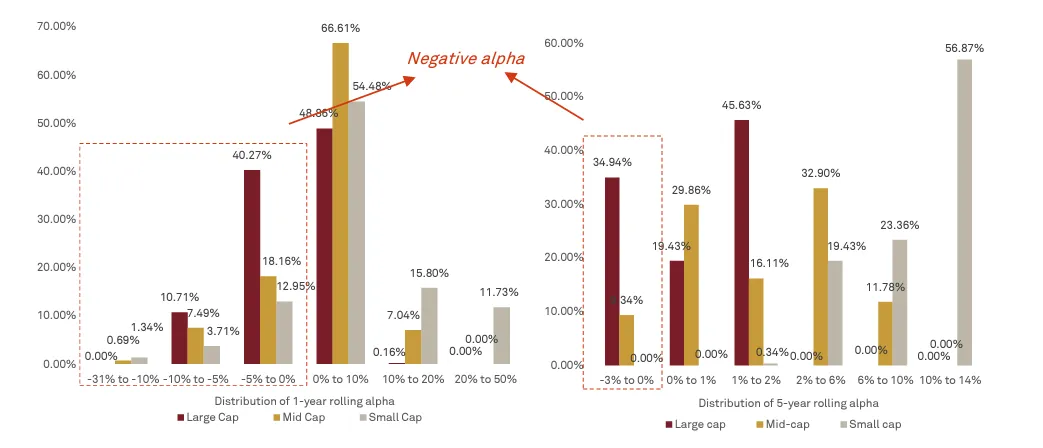

When we are investing in equity markets, durations and horizons become important. And yes Alpha generation is also impacted depending on the investment horizons. A study conducted by CRISIL looked at actively managed equity funds from April 2010 to March 2021. It considered their daily rolling alpha for different market caps - analysing it over 1 year and 5 year horizons.

We can see longer investment horizons give more positive alpha generation opportunities for equity funds, and range of negative alpha also decreases

Magnitude of average underperformance also diminishes as the investment horizon increases. The analysis showed underperformance of 31% for the 1 y ear horizon to 3% for 5 year horizon.

Small-cap funds, notably, showcased persistent positive alpha across instances during elongated investment horizons.

Interested in learning how great investors generate alpha, explore Learnings from Warren Buffett, Peter Lynch & Michael Burry and Alpha Prime: Unveiling Our New Concentrated Momentum, High-Risk Investment Portfolio

Alright, so what does all of this research about alphas tell us? Well alpha, particularly among top performers, is influenced by manager skill or selectivity, though not universally. But alpha cuts both ways. And poor selectivity was a primary factor among the worst-performing portfolios with negative alphas. Alpha generation is possible over longer durations of time with specific sectors such as small caps doing better than large caps. There is a nuanced role of selectivity in determining genuine alpha, and much like perfecting any skill, alpha is seen across markets and geographies. As investors we need to be concerned with 3 things for seeking alpha:

Selecting the right investment manager or fund manager

Investment manager’s selectivity of assets

Investment horizon

Alpha is abundantly present, but it is also elusive and hidden when we look at the alpha that is realised by the average fund manager. Why are fund managers not able to beat the market?

Information is available freely which can lead to information overload. Managers need to distinguish between information that is pertinent and that which is redundant.

Forecast modelling to determine what tomorrow or day after or 1 week later looks like for financial markets is complex, extremely difficult and unpredictable.

Unpredictability of macroeconomic events, geopolitical movements, anticipating market events, investor behavior etc. can overwhelm predictions.

Simplifying investment analysis to concentrate on fundamental characteristics that align with historical outperformance often gets overlooked when we have so much data, analysis and intricate analytical models.

Deep focus on a company’s finer details may distract investment managers from looking at a broader, holistic analysis that considers investing factors that often can determine performance and alpha generation such as momentum , value, quality factors etc.

Confirmation Bias: Investment managers may prioritize information or analysis that corroborates pre-existing beliefs or investment theses.

Narrative Bias: Investment managers want to lend credibility to predefined narrative that has a detailed and cohesive investment story. This may come at the expense of objective and probabilistic thinking.

You have managed to avoid all the pitfalls and have found the right alpha strategy - life’s great. Not so quick. Alpha can decay and disappear. This phenomenon, known as Alpha decay, sees gradual diminishing of a strategy’s ability to generate above-benchmark returns and the strategy loses all of its prediction ability. Naturally this poses a tangible risk to systematic investing and trading approaches.

1. Alpha Strategy is Copied: The alpha strategy gives returns as expected, but over time as more people become aware of the strategy, as its popularity gains, it loses its unique edge as other participants leverage similar tactics. You can think of this as akin to the disappearance of any arbitrage opportunity as people dissect and analyze it.

2. Higher capital = higher cost: Certain strategies focus on less liquid stocks such as small caps or micro caps where investing further may result in higher transaction costs, lower average volume or there could be lack of tradeable shares. When we allocate more capital to such strategies, it could lead to lower returns and alpha decay.

3. Changing market regime : If there is a sudden change in the prevalent market conditions it could lead to a shift in the market regime. Any alpha strategies that were performing strongly in the initial market regime, may not perform when the fundamental characteristics of the market have shifted leading us into a new market regime. For example, momentum strategies do well in bullish markets, but if the market shifts into a bearish market or interest rates rise, such strategies may not continue to perform well, and could result in alpha decay.

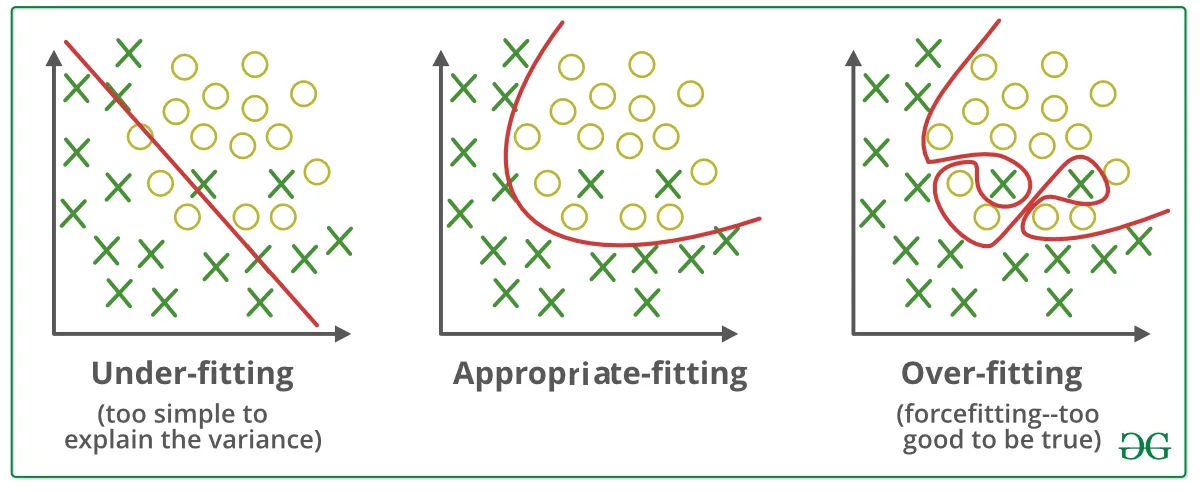

Overfitting a model or a strategy that is excessively tailored to historical data, could be seen as alpha decay when we implement it. The reason alpha decay isn’t overfitting is that unlike genuine alpha decay, underperformance here is not a function of deteriorating market edge or changing market regimes , but rather since it was an overfitting strategy it was never truly robust to begin with. T

To distinguish between alpha decay and overfitting, investment managers can look at out-of-sample testing. The strategy is validated using data not utilized in its construction.

Alpha decay is inevitable and cannot be avoided. Investment strategies will go through alpha decay over time. Changes in the market conditions, likelihood of people copying the strategy can potentially dampen alpha generation. It is imperative to continuously monitor and evaluate the strategy and conduct thorough statistical evaluations of its performance. Don’t worry if your alpha is disappearing - read on to find out how to generate alpha consistently.

At Wright Research we have several alpha strategies such as Alpha Prime and Momentum where we are consistently beating the benchmark and generating alpha for our users. Our focus is on the investing process, analytical research, quality, efficacy of the quant models used and proprietary AI models & deep machine learning to give us an edge in this world of abundant commoditized information. We use all of this to make sense of what has happened in the market historically, the many thousands of ways that the market could move tomorrow, day after, 1 week later, 1 month later etc. We deploy probability and statistical models along with our proprietary AI models to understand the likelihood of specific market events occurring and how to identify pockets to generate alpha.

Still interested in investing on your own? Well the easier way is to invest in Alpha Prime and Momentum . For those that want to find alpha consistently from the market, here are a few things to consider:

Adopt a Probabilistic Approach: Moving away from binary or deterministic forecasting towards a probabilistic approach that accommodates a spectrum of potential outcomes.

Sensitivity Analysis: Engaging in sensitivity analysis to discern how susceptible investment thesis is to variations in underlying assumptions.

Deploy statistical models, AI tools and deep machine learning to identify the many possibilities that can exist across different scenarios and assumptions

As an individual investor, prioritize a small subset of critical factors (quality, value, momentum) as primary determinants in the investment analysis.

Employ automated tools to consistently evaluate basic factors so as to remove any bias from the process and to focus only on the data-driven, systematic analysis of the investment opportunities

P.S. at Wright Research, we analyze over 300 factors to build our investment portfolios

Make sure to look at contrarian views rigorously to ensure your behavioural and cognitive biases are in check

As an individual investor, you can maintain a decision journal that archives investment decisions, rationales, and expected outcomes to help you learn from your successes and your failures.

Conduct regular portfolio reviews and systematic rebalancing to ensure the portfolio doesn’t stray too far from its strategic allocation due to the differential performances of underlying investments

During the portfolio review, also analyse if the alpha generation potential is disappearing and find ways to continuously improve and optimise the portfolio to give you the alpha that you want

At Wright Research, we continuously monitor and review our portfolios to ensure alpha decay is at a minimum by rigorously testing thousands of market scenarios and events. This enables us to provide sharp, laser-focused portfolios that have the potential to generate alpha returns

While alpha decay is inevitable it also shows the transient nature of any competitive edge, or better yet any investment edge. You need to have a dynamic, research-intensive, data-driven, unbiased and adaptive approach to systematic investment strategy development and management. This perpetual cycle of creating, deploying, monitoring, and eventually decommissioning strategies means that as individual investors if you are seeking alpha you will need to learn and commit to understand quantitative investing like we do at Wright Research. Quant researchers and quantitative investors can quickly identify reduction in alpha returns, and can quickly determine how to adapt the strategy and polish it to give investors the alpha that they seek.

This Navratri explore and visit the Alpha Prime Smallcase !

Read the full article on Wright Research All About Alpha: Is Your Investment Generating Alpha?

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Read our article to understand 9 Investment Lessons To Learn From Navratri & Building a High-Risk, High-Return Portfolio: A Step-by-Step Guide

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios