by Siddharth Singh Bhaisora

Published On July 9, 2023

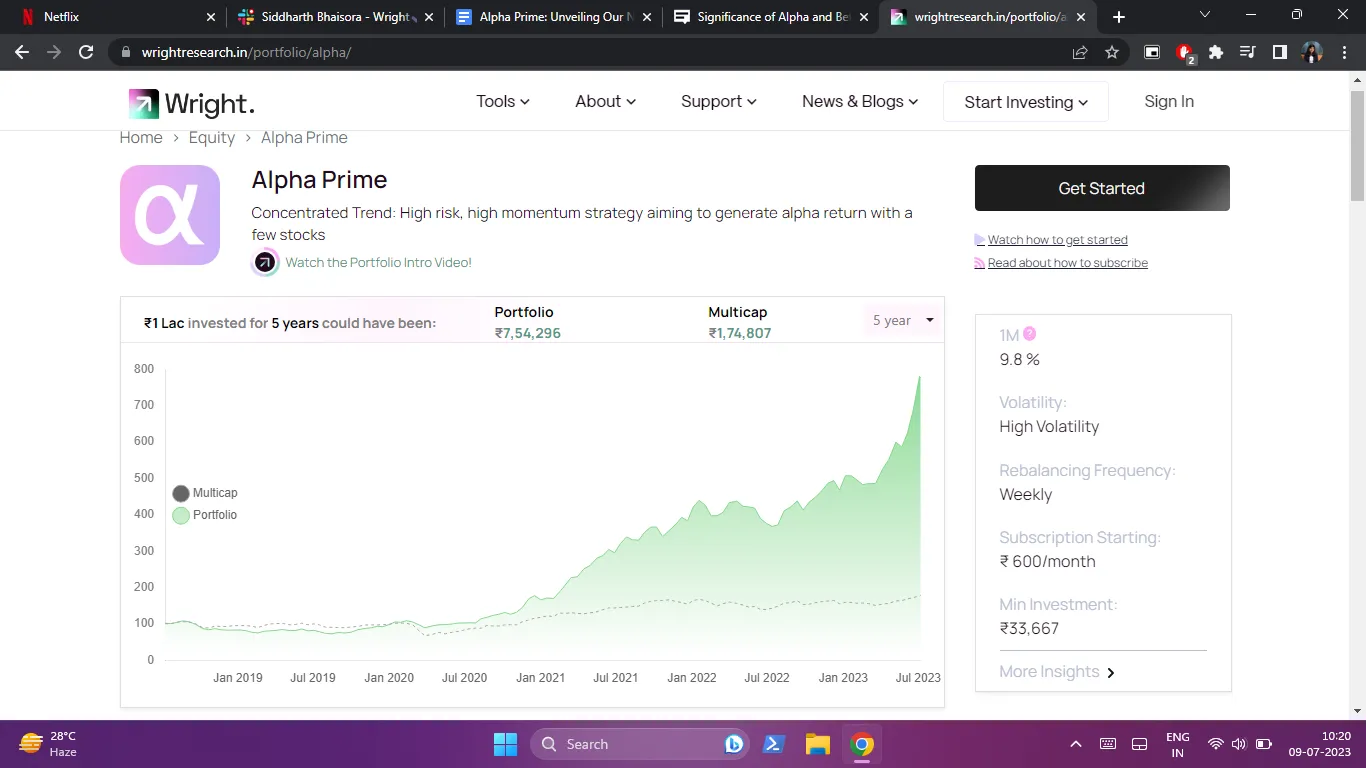

We are thrilled to introduce our latest portfolio - Alpha Prime. This strategy is designed to leverage the power of concentrated momentum investment and generate high alpha returns, offering substantial value for our investors.

Key Highlights:

Concentrated portfolio provides potential for concentrated returns

More actively managed with frequent bi-weekly rebalancing

Wider universe, including high quality smallcap stocks

Aggressive strategy with high return potential along with high risk

All of this at an affordable price

Let’s understand Alpha and its relationship with momentum investing first, before we explore what is Alpha Prime , why we launched it, what is the investment philosophy for it, the performance of the portfolio and who it is designed for. Here's a Youtube Video talking about the Alpha Prime Portfolio -

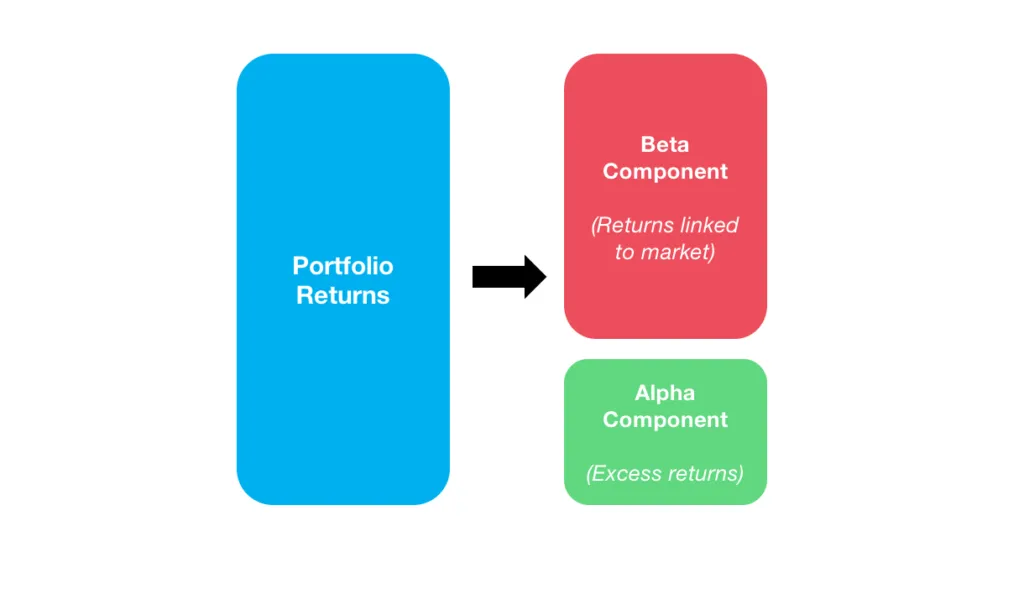

In the realm of investing, 'Alpha' is a term that signifies a strategy's ability to outperform the market, giving it a distinct 'edge.' Alpha measures the active return on an investment, or in other words, its performance relative to a benchmark market index. If we are talking about generating 'Alpha', we are essentially discussing the potential to surpass market averages.

For investment managers, alpha is indeed a powerful metric that helps gauge how well they are doing in their decision-making process compared to the overall market. As active managers, their primary aim is to generate returns that surpass the market average. So, an alpha provides an objective, quantifiable measure of their performance. It allows them to validate their strategies, justify their management fees, and demonstrate their skill and expertise to existing and prospective clients.

For investors, alpha is a measurable way to determine an active manager's success or the value that a portfolio manager adds or subtracts from a fund's return. In a marketplace where passive, index fund investing is increasingly becoming popular, an investment manager's alpha can indicate whether the costs of active management are worthwhile.

Consider alpha as an indication of a manager's skill in picking outperforming stocks or timing the market effectively. A positive alpha indicates the manager has outperformed the market. For example, an alpha of 1.0 suggests an outperformance of 1%. This can be a strong selling point for investors seeking returns above what the market offers.

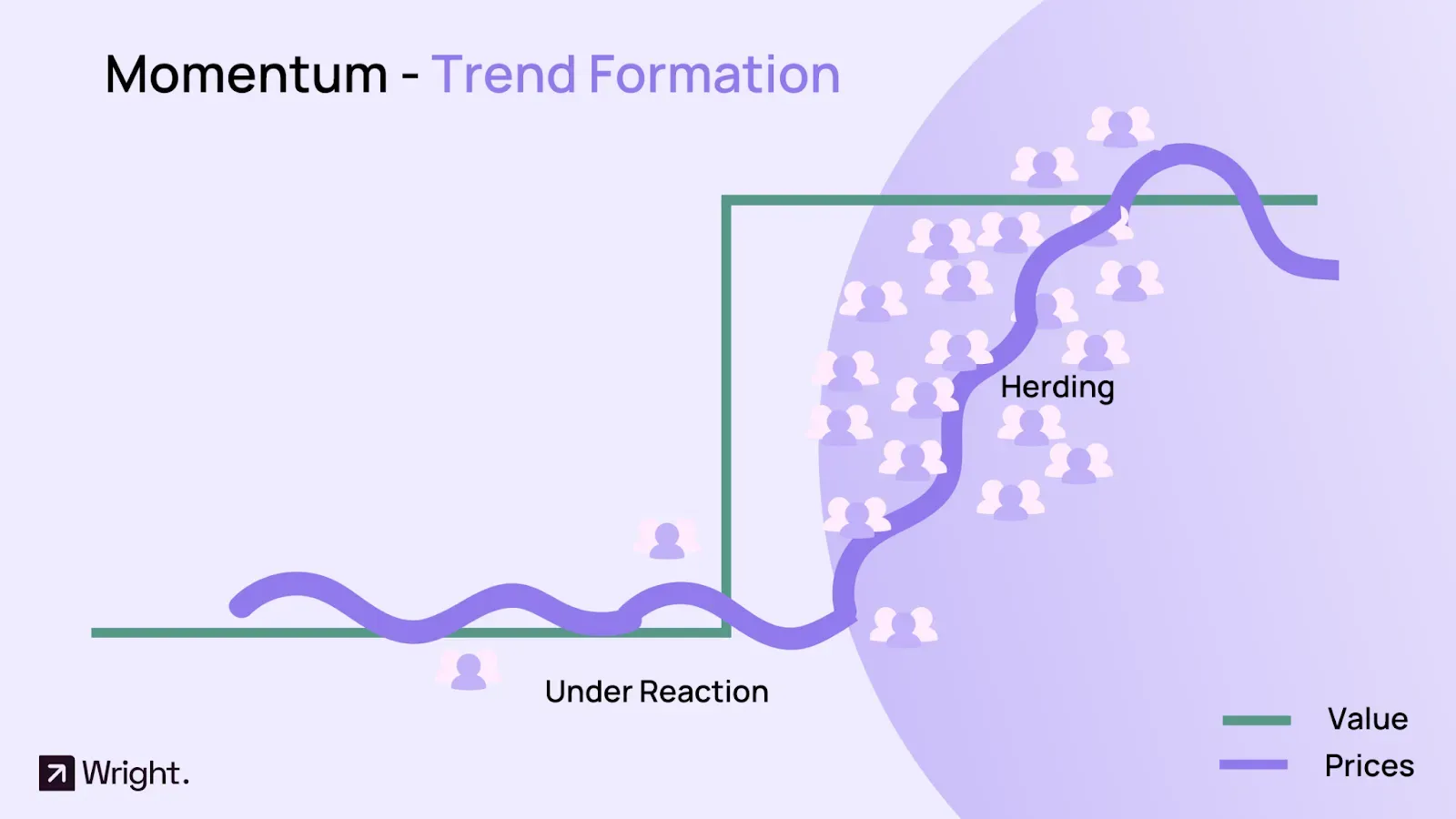

Momentum investing is a strategy that involves capitalizing on current market trends by purchasing 'hot' stocks, those that have shown an upward trend recently, with an expectation that the trend will continue. Momentum investors ride the wave of these high-performing stocks for as long as possible, attempting to sell before the trend reverses. In essence, momentum investing is akin to hopping on a high-speed investment train with the goal of getting off before it loses steam.

Typically, conventional wisdom suggests the key to profitable trading lies in buying low and selling high. Momentum investing , however, proposes a different approach – buy high and sell even higher. Now, that's quite a paradigm shift, isn't it? This practice of capitalizing on the current market trends to make investments is what sets momentum investing apart. The basic strategy involves investing in companies that are escalating in value, then selling them after they peak and start to decline.

Interested in learning more about momentum investing, check out our indepth article What is Momentum Investing? A Comprehensive Guide to Understanding Momentum Investing !

While alpha is a measure of performance against a benchmark, momentum investing is a strategy employed to achieve high alpha. Successful momentum investors, by correctly identifying and investing in 'hot' stocks, aim to exploit existing market trends to generate returns that exceed those of the benchmark index.

By doing so, they can generate a positive alpha, indicating their investment strategy's success in beating the market. Thus, in a way, alpha can be considered a measure of a momentum investor's skill – their capability to pick the right stocks at the right time and then sell before the trend reverses.

Creating alpha in a portfolio requires unique insights, meticulous research, and rigorous analysis. When it comes to momentum investing , alpha generation can be highly dependent on timing, identifying trends, and choosing the right high-momentum stocks. Here’s a look at the essential ingredients of the secret sauce for alpha generation in momentum investing:

Identifying Trends: The core idea behind momentum investing is that stocks that have performed well in the recent past will continue to perform well. Thus, a crucial step is identifying these upward trends early.

Timing: Buying high-momentum stocks at the right time and selling them before their momentum declines is vital. Effective timing can dramatically increase returns and contribute to alpha generation.

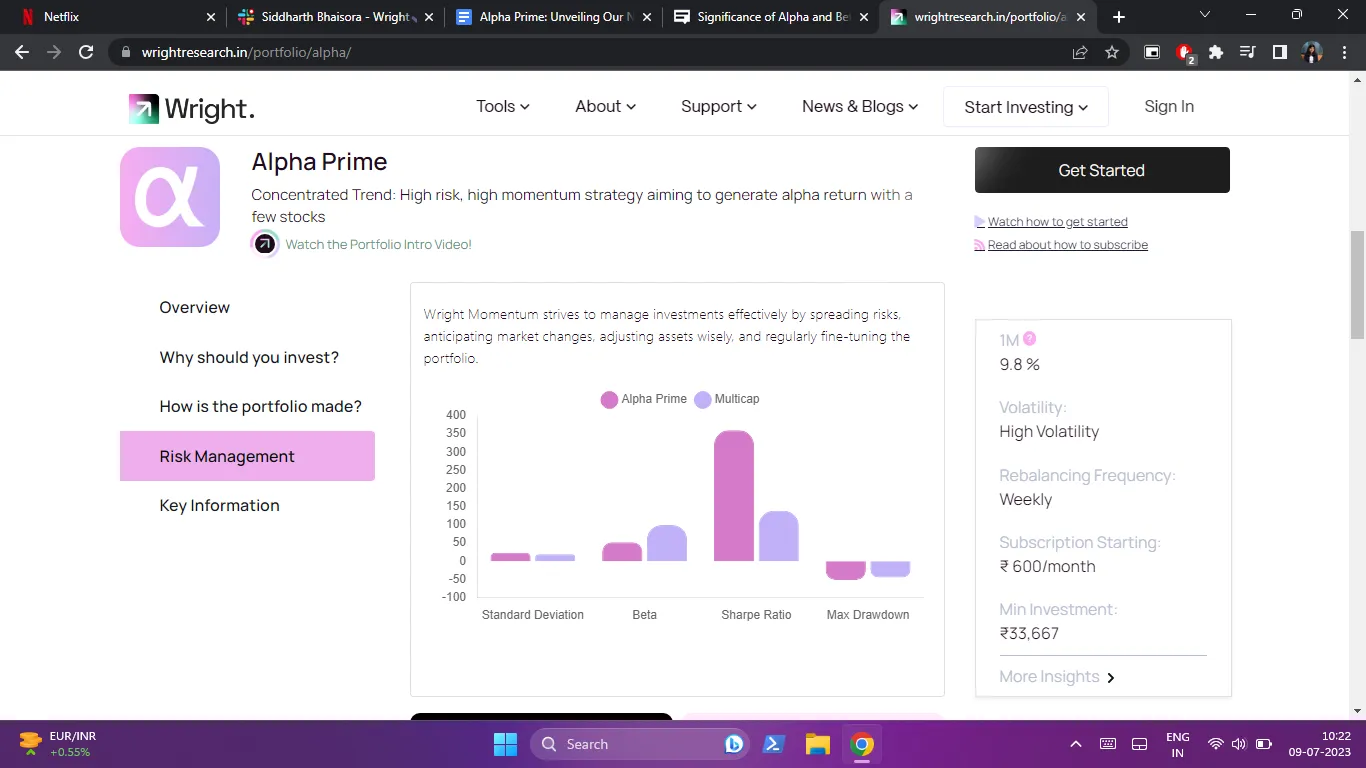

Risk Management: While the potential for high returns can be tempting, momentum investing also comes with substantial risk. Effective risk management strategies, like setting stop-loss orders or diversifying within the momentum stocks, can help manage this risk.

Regular Monitoring and Review: As market conditions change, so do stock trends. Regular monitoring and timely rebalancing of the portfolio can help maintain high performance and alpha generation.

Understanding Market Psychology: The stock market isn't just about numbers and trends; it's also about people and their behavior. Understanding market psychology can provide insights into potential market movements, giving an edge in alpha generation.

Wright Research stands committed to research-backed, data-driven quantitative investment strategies. We believe in strategically choosing the right asset mix tailored to your risk profile across different market conditions.

One principle that underlines our philosophy is that markets are inherently dynamic. Abrupt shifts in financial markets, often triggered by changes in macroeconomic variables, policies, or regulations, require an investment strategy that is equally adaptive. We use predictive machine learning models and AI technology, combining fast-moving macroeconomic variables and technical indicators over the index, to predict future market events. This highly accurate predictive model enables us to adapt our participation in various strategies dynamically.As market dynamics evolve, it's vital to adjust our strategies proactively. Alpha Prime is our response to these changing dynamics. It is an aggressive momentum investing strategy, focusing on 10 specially chosen stocks that demonstrate strong earnings momentum and trending opportunities. The goal of Alpha Prime is threefold:

To establish a portfolio for the bull market capable of taking concentrated risks and generating high returns.

To create a strategy suited for high-risk investors who aim to take full advantage of market trends aggressively.

To combine robust risk management with alpha and high trend investing to protect capital.

Our investment strategy is centered around a concentrated momentum approach, which allows us to home in on a select collection of high-potential stocks that display strong momentum. While diversification is typically celebrated as a fundamental investment principle, allowing risk to be spread across a variety of assets, it can also potentially limit the opportunity for exceptional returns. This is precisely where the allure of concentrated portfolios enters the picture.

Concentrated portfolios, such as Alpha Prime , due to their inherently focused nature, carry a heightened potential to generate outstanding returns. By selecting a few high-potential stocks, each chosen stock has a significant influence over the portfolio's overall performance. If these handpicked stocks flourish, the rewards can be substantial, despite the inherent risks due to the intentional reduction of diversification.

The potential to generate alpha in our Alpha Prime strategy comes from a blend of expert portfolio design, experienced investment management, sophisticated quantitative models, and the use of AI technology for advanced market forecasting. We consciously forego certain diversification benefits to unlock higher potential returns for our investors. The following components form the core of our investment universe:

High Momentum Stock Focus: We focus on high-quality, high momentum stocks that are more likely to generate higher returns.

Selection Process: We select 10 standout stocks from the top 500 companies based on a comprehensive evaluation of the company's fundamentals, industry position, and growth potential.

Use of AI Technology: AI and machine learning algorithms help us identify market trends, anticipate market shifts, and adjust our portfolio strategy.

Risk Optimization: We balance the potential for high returns with the associated risks, using sophisticated risk management strategies and techniques.

Diversification: Even though our portfolio is concentrated, we practice diversification among our chosen 10 stocks to spread the risk - Portfolio remains well-rounded and not overly reliant on any single stock or sector.

Systematic De-Allocation: In high-risk market scenarios, we systematically de-allocate our investments to mitigate risk exposure.

This concentrated momentum strategy represents a calculated risk, choosing the extraordinary performance potential of a few stocks rather than seeking the safety of average performance spread across a broad array of assets. Thus, while this approach can lead to higher returns, it is important to bear in mind that it also inherently carries increased risk. Yet, if our selection performs strongly, the benefits of this concentrated approach can significantly outweigh the risks involved.

Although Alpha Prime is a new initiative, we are excited about its potential, backed by comprehensive research and analysis.

Alpha Prime has only been live for less than a month where the return has been 9.53%. As per the backtests the portfolio has a long term (10 year) CAGR of 35%+.

Talking about the risk as well, Alpha Prime has a higher risk than the benchmark but a much higher risk adjusted return.

But we have to understand that backtest results do not represent real data.

Alpha Prime is designed for investors who are comfortable taking on higher risk levels in exchange for the potential for higher returns. It is especially suited for those seeking exponential growth and comfortable with the higher churn associated with a high-momentum strategy.

This is an aggressive strategy, with a high portfolio churn requiring bi-weekly rebalancing. Equity strategies such as these are high risk. Such portfolio strategies will see drawdowns depending on market conditions. Investments in the stock market should be considered for the long term, as short-term market fluctuations are normal and expected. The value of your investment can go up and down over time, and it's possible to experience losses. You have to make sure that the high risk nature of this portfolio suits you before you invest.

Investing in the stock market is a journey, and with Alpha Prime , we aim to make that journey more rewarding for those who are not averse to taking risks. This portfolio is an embodiment of our continuous efforts to design innovative investment solutions that cater to diverse investor needs. We invite you to join us on this exciting new voyage of Alpha Prime, where we strive to outperform the market and offer significant risk-adjusted returns.

Stay tuned for more updates on Alpha Prime as we continue to monitor its performance and share key insights with our investment community. Always remember, at the heart of successful investing lies understanding your risk tolerance and investing in line with it.

Explore the Wright Alpha Prime Portfolio and Wright Alpha Prime Smallcase .

Interested in learning more about momentum investing, check out our indepth article What is Momentum Investing? A Comprehensive Guide to Understanding Momentum Investing!

LIVE WEBINAR + Q&A with Sonam Srivastava & Smallcase on Unleashing the Power of Momentum: Factors to Consider before Investing in Small Cap

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios