by Siddharth Singh Bhaisora

Published On July 1, 2023

The current rally in the Indian stock market has been characterized by an impressive resurgence of smaller companies. As of 17th July 2023, the BSE Small-cap Index has grown by approximately 29%, soaring from 26159 points on 28th March 2023 to 33,986.98 points. This resurgence demonstrates the investor confidence in the growth potential of small-cap stocks, spurred by their robust earnings performance and the overall optimism in the market.

Conversely, the BSE Large-cap Index has grown at a slower pace, posting a growth of approximately 16% over the same period. Large-cap stocks, typically seen as relatively stable investments, may be experiencing less dramatic growth due to the investors' shift towards higher-return potential small-cap stocks.

What are Small Cap stocks? In the diverse landscape of the Indian stock market, the Securities and Exchange Board of India (SEBI) categorizes firms with a market capitalisation below Rs. 5,000 Crore as Small Cap companies. Surprisingly, such companies, making up over 95% of all Indian firms, demonstrate the dynamism of our economic structure. Often ranking beyond the 251st position in terms of market capitalisation, these companies tend to excel in the early phases of economic revival. Their publicly traded shares, known as small-cap stocks, could be the potential key to growth. If you are considering incorporating small cap stocks into your investment strategy, it is beneficial to understand their nature, factors to consider when selecting smallcaps and associated risk factors.

Small cap stocks are a category of stock investments that consist of stocks from smaller companies. They possess distinct characteristics that set them apart from large cap and mid cap stocks. Investing in smaller companies offers several advantages such as -

Small-cap firms usually harbour significant growth prospects. Large cap companies have already experienced substantial growth and may have limited room for further appreciation in share prices. Conversely, smaller companies have the potential for significant growth and price appreciation in the years ahead. Investing in small cap stocks allows individuals to seize opportunities early on with emerging companies. By purchasing and holding shares of smaller companies, investors can benefit from potential future growth and value appreciation. If the company succeeds, it may eventually transition from small cap to large cap status.

Market inefficiencies may offer high-quality smallcap stocks at more affordable prices. While large cap companies can provide stable returns and potentially offer income through dividends, small caps historically outperform larger companies in terms of average annual returns. Smaller companies tend to be more agile than their larger counterparts, allowing them to adapt quickly to market cycles, introduce new products or services, or undergo internal restructuring as needed. These factors contribute to the potential for small cap stocks to deliver better performance within their specific market segment compared to larger competitors.

Institutional investors, such as banks, hedge funds, and real estate investment trusts, often overlook small cap stocks due to their size. Additionally, regulatory restrictions restrict these investors from heavily investing in small caps. This creates an opportunity for individual investors to enter the market and potentially witness the growth of small companies over time.

You don't need to tune into a finance TV show or a Youtube video to hear about the next big 'guaranteed' method promising to make you a millionaire overnight. Instead, focus on fundamentally strong businesses with a diversified product range, profitable operations, and a robust market position. Such companies are most likely to be a worthy investment. The rest 10% of your decision-making process should focus on some specific metrics to determine if it's the best stock for your investment.

Here are the 9 essential metrics that will help you understand the company, its operations, and the underlying business better:

Institutional Activity: Massive share transactions by institutions like pension funds, mutual funds, hedge funds, insurance companies, and corporations can result in significant price fluctuations. Aim for companies where institutional ownership is less than 40% of the shares.

Analyst Coverage: The number of analysts tracking a stock can indicate future share volatility. It's prudent to avoid companies with more than 10 or fewer than 2 analysts following them.

Price-Earnings Ratio (P/E): The P/E ratio, a popular financial metric, determines whether a company's shares are overvalued or undervalued. If the P/E exceeds 35, the shares might be too pricey, especially for beginner investors.

Cash Flow: A positive Total Cash Flow From Operating Activities figure or a trend in that direction over a year is preferable.

Debt/Equity: This ratio signifies the business's debt for each dollar of ownership. Examine if the company's debt level has been escalating too quickly over the years.

High Operating Margin: A consistently increasing operating profit margin indicates the profitability of the business and can be a promising investment opportunity.

Rising Sales and Profits: Small-cap companies heavily rely on their sales due to limited cash reserves. Look for companies whose sales and net income are growing at double-digit rates.

Quality of Management: Corporate governance and quality of management are critical. Conduct a thorough background check of the company’s promoters and management before investing.

Insider trading activity: High levels of insider selling could be a red flag, while insider buying could suggest that the company's leaders believe the stock is undervalued.

Armed with these key metrics, you'll be well-prepared to make informed decisions about small-cap stocks. Remember, "Knowledge is power!" Embark on your investing journey, and let your portfolio do the talking! To learn more read our article on 9 Essential Elements for Evaluating Small Cap Stocks .

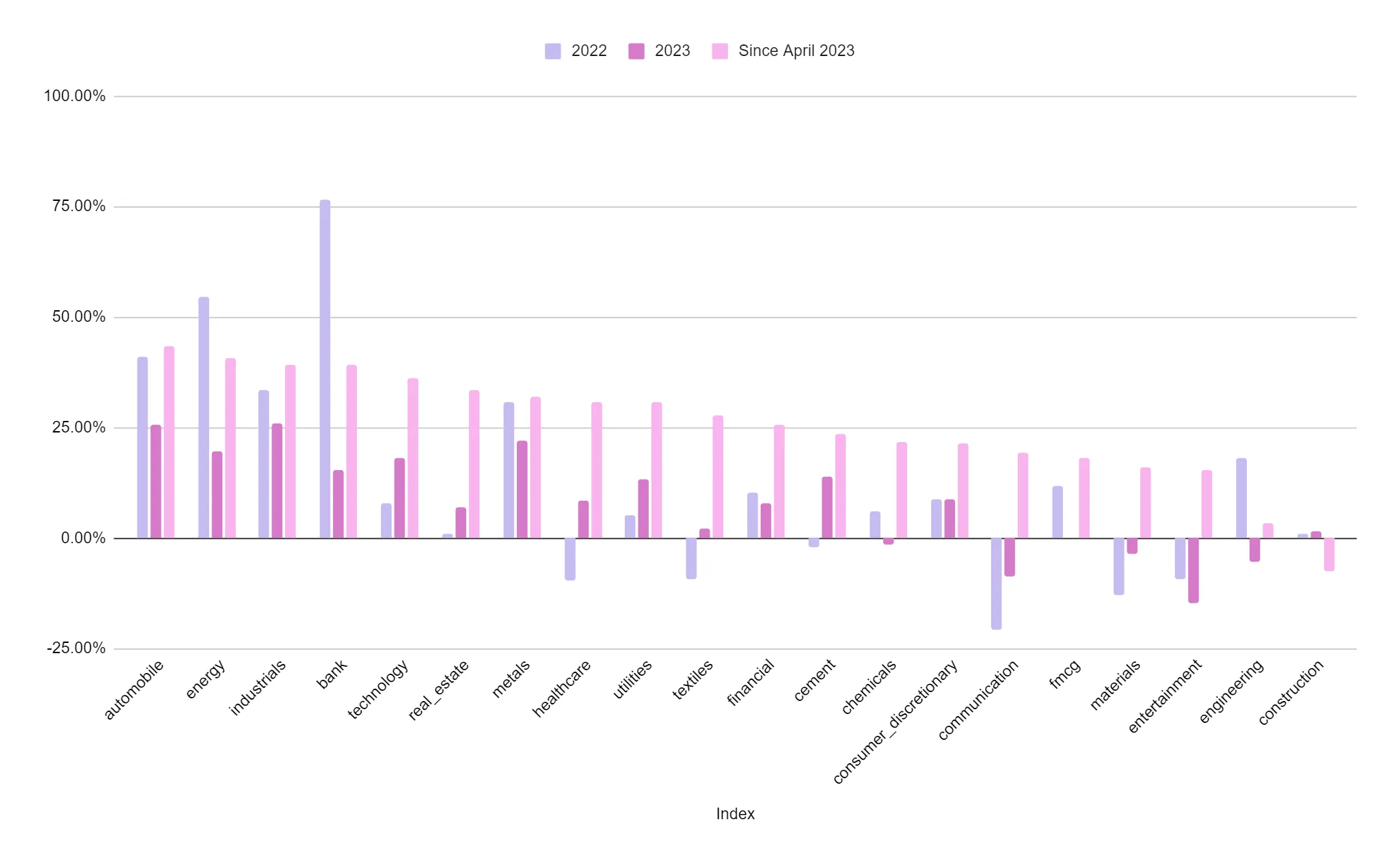

Sector-wise, the automobile sector has emerged as a standout performer, with a year-to-date growth of 25.72% in 2023 and a whopping growth of 43.44% since April 2023. The robust growth reflects the sector's recovery from the pandemic-induced slump, buoyed by increased demand for personal mobility.

The energy sector is another strong performer with a year-to-date growth of 19.62% and a significant 40.73% surge since April 2023. The sector's performance can be tied to global energy transition trends and the continued demand for conventional energy sources.

However, not all sectors have fared well. The construction sector has seen a decline of 7.37% since April 2023, indicating struggles in recovery possibly due to lingering impacts of the pandemic and supply chain disruptions.

The engineering sector has also lagged with a meager growth of 3.39% since April 2023. The sector might be grappling with challenges such as labor shortages and increased costs of raw materials.

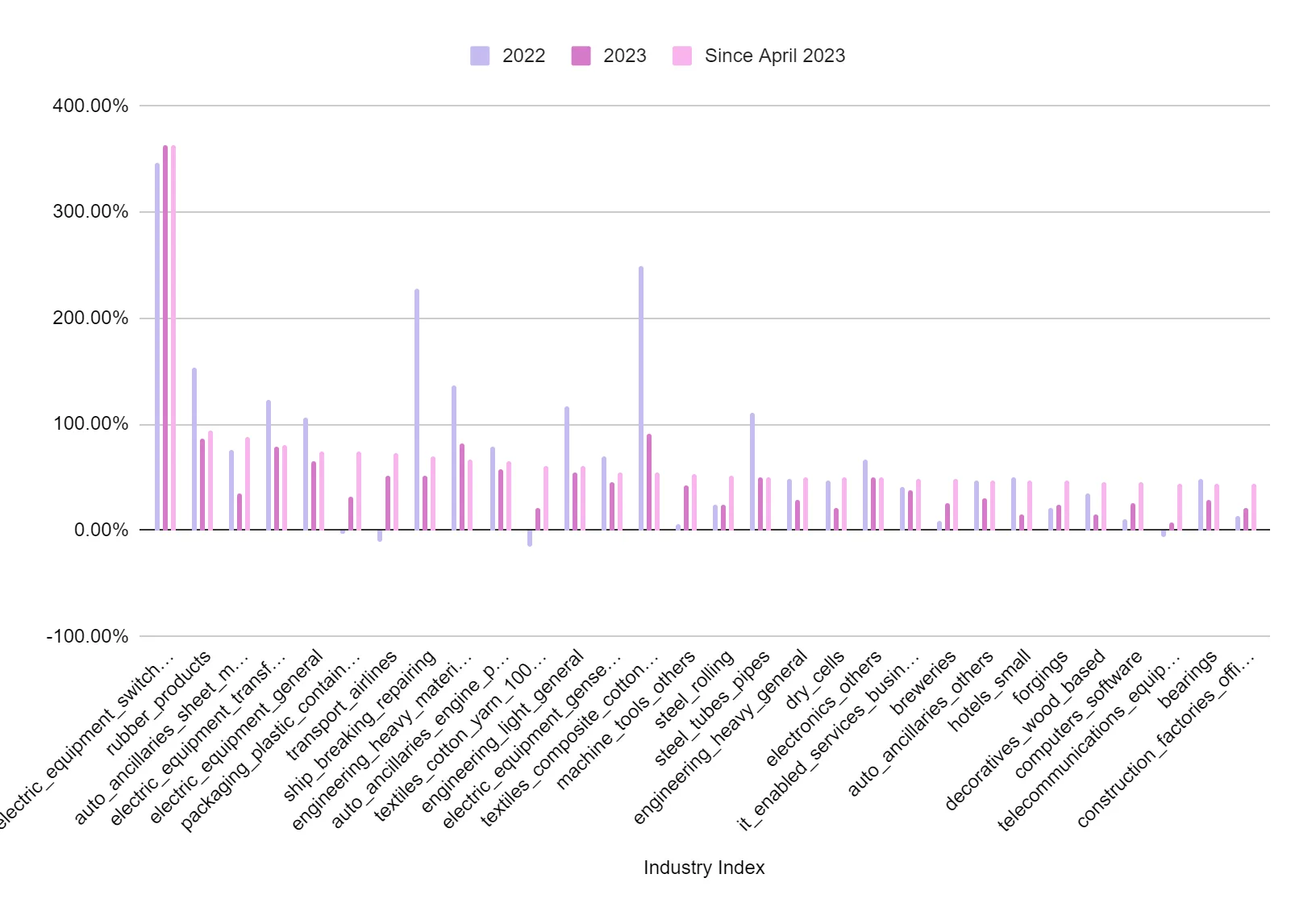

At the industry level, the electric equipment, switchgears, and relays circuits industry has seen astonishing growth. With an impressive 363.07% increase since April 2023, this industry's performance is a testament to the growing demand for electrical infrastructure in the era of digital transformation and clean energy.

The rubber products industry follows suit with a strong performance, boasting a 94.59% increase since April 2023. The growth in this industry could be tied to the increased demand for rubber products in the recovering automotive sector.

However, not all industries have managed to post positive growth. For instance, the textiles weaving industry, with a growth of just 34.56% since April 2023 despite a -7.42% performance in 2023, indicates continued challenges in this sector, potentially due to the rise in raw material prices and slow recovery of global demand.

The construction factories offices commercial industry also lags behind with a growth of 43.51% since April 2023. The performance suggests that the sector is still dealing with the aftermath of the pandemic, including labor shortages and supply chain issues.

Investors seeking high-growth potential often look towards the best small cap stocks for 2023, given their ability to outperform larger counterparts in favorable market conditions. The best small cap stocks for 2023 are anticipated to benefit from the robust economic recovery and increasing investor confidence. Companies with strong fundamentals, innovative business models, and competitive market positions are likely to stand out. Analysts recommend focusing on sectors such as technology, healthcare, and renewable energy, where the best small cap stocks for 2023 are expected to drive significant growth.

Among the best small cap stocks for 2023, those with a solid track record of financial performance and sustainable growth strategies are particularly attractive. Investors should conduct thorough research, considering factors such as earnings growth, market trends, and management quality to identify the best small cap stocks for 2023.

A leading global manufacturer of camshafts, a key component in vehicles. They provide innovative solutions to a diverse range of clients in the automotive industry. The growth trend has been distinctly positive for this company, rising from 81.42% in 2022 to 161.50% in 2023, and further accelerating to 176.32% since April 2023. Volume is quite high which signifies active trading and liquidity. This impressive progression points to the company's strong performance in the rally.

India's premier defence shipbuilding company under the Ministry of Defence. Mazagon Dock constructs and repairs warships and submarines for the Indian Navy. The company experienced a high growth of 541.97% in 2022. However, the returns reduced to 117.27% in 2023, but the company managed to boost it back up to 160.52% in April 2023, capitalizing on the small-cap rally. High trading volume shows liquidity and investor confidence.

FACT is a leading fertilizer and chemical manufacturing company in India. They primarily produce ammonia, sulphuric acid, ammonium phosphate, and complex fertilizers. After an impressive surge in stock price by 269.55% in 2022, it slowed down significantly in 2023 to 31.50%. However, with the small-cap rally in April 2023, returns have rebounded to 138.33%.

Best small cap stocks for 2023 #4:Jindal SAW Ltd. (JINDALSAW)

A part of the O.P Jindal Group, Jindal SAW Ltd is a leading global manufacturer and supplier of iron and steel pipe products, and related services predominantly across India, Europe, and the USA. It exhibited high returns for both 2022 (256.80%) and 2023 (233.25%).

Best small cap stocks for 2023 #5:Aurionpro Solutions Ltd. (AURIONPRO)

A technology company that offers solutions in digital innovation, enterprise security, and banking solutions. It helps enterprises to be more efficient, secure, and improve customer engagement. Stock returns have been consistently strong with returns of 143.42% in 2022 and 109.74% in 2023, further increasing to 133.50% since April 2023, thus benefiting from the small-cap rally. With low market cap and low volume indicating low volatility, this stock may have been under the radar.

Best small cap stocks for 2023 #6:Force Motors Ltd. (FORCEMOT)

Force Motors is an Indian automotive manufacturer, known for their multi-utility vehicles, light commercial vehicles, tractors, and engines. This stock has displayed consistent growth, providing stock growth of 121.16% in 2022 to 98.35% in 2023. Since April 2023, the stock returns are 132.99%.

Best small cap stocks for 2023 #7:Suzlon Energy Ltd. (SUZLON)

One of the leading renewable energy solutions providers in the world, specializing in offering total solutions in Wind Power Generation with over two decades of operational track record. Despite a decrease in returns from 78.43% in 2022 to 71.70% in 2023, Suzlon has been able to turn the tide with post-April 2023 returns of 130.38%.

Best small cap stocks for 2023 #8:JBM Auto Ltd. (JBMA)

JBM Auto is part of the JBM Group, a leading global auto parts manufacturer. They primarily produce sheet metal components, assemblies and sub-assemblies, and automotive systems. The company maintained strong growth from 2022 to 2023 with returns of 228.15% and 187.59% respectively. Since April 2023, it has recorded returns of 129.89%.

Best small cap stocks for 2023 #9:Shriram Pistons & Rings Ltd. (SHRIPISTON)

A part of the Shriram Group, Shriram Pistons & Rings Ltd is a leading provider of high-quality pistons, engine components, and rings. They serve both the automotive and non-automotive sectors, boasting superior products and solutions that cater to a wide array of requirements. The company's stock has been steadily increasing year by year, returns increased from 37.02% in 2022 to 86.37% in 2023, and further soaring to 121.80% since April 2023.

Best small cap stocks for 2023 #10: Genus Power Infrastructures Ltd. (GENUSPOWER)

An integral part of the Kailash Group, Genus Power Infrastructures Limited is an advanced metering solutions provider. They design and manufacture smart meters and also offer cost-effective and energy-efficient solutions. Stock showed strong growth in 2022 (170.97%) and continued to perform well in 2023 (119.91%).

The top small cap stocks to invest in India can vary over time, as stock market conditions and performances change. It's important to conduct thorough research and stay updated on the current market trends. Here’s a list of top performing smallcap stocks that have done well this year (as of 17th July 2023):

VST Industries: VST Industries Ltd. is a conglomerate company based in Hyderabad. It is primarily involved in the manufacturing and distribution of cigarettes. Giving 16.10% return over the last 6 months and 9.91% on a year-to-date basis.

Bajaj Consumer Care: Bajaj Consumer Care Limited is an FMCG company specializing in the manufacturing of hair oils and personal care products, including the well-known brand Nomarks. Giving 13.66% return over the last 6 months and 16.47% on a year-to-date basis.

Maharashtra Seamless: Maharashtra Seamless is a prominent steel company operating in the casino gaming, hospitality, and online skill gaming segments. The company has experienced consistent sales and profit growth over the past five years, with a notable increase in promoters' stake, indicating confidence in the business's future prospects. However, it is exposed to the cyclicality of the oil and gas industry and fluctuations in input prices. Giving 42.45% return over the last 6 months and 45.78% on a year-to-date basis.

Arman Financial Services: Arman Financial Services is a mid-sized non-banking financial company (NBFC) that focuses on serving the financing needs of rural and semi-urban retail markets. With a strong presence in multiple states and a conservative approach to high-yielding assets, the company has demonstrated sustainable returns on assets (ROA). However, the company is susceptible to any downturn in the microfinance industry and has a concentrated geographical presence. Giving 52.59% return over the last 6 months and 52.72% on a year-to-date basis.

Mold-Tek Packaging: A leading player in rigid packaging, serving industries such as paints, lubricants, food, and FMCG. Mold-Tek Packaging is well-positioned to expand its market share and target new growth opportunities in the packaging industry. However, the company faces risks related to its high dependency on one key customer and regulatory concerns regarding the use of plastic-based products and raw material price volatility. Giving 6.30% return over the last 6 months and 9.38% on a year-to-date basis.

Here is a list of the top smallcap picks by investment managers & money managers across portfolio management schemes, mutual funds, AIF & ULIPs for the month of May 2023. These selections reflect the preferences of market participants for promising small-cap stocks during that period.

| Smallcap stock | MF | PMS | ULIP | AIF | Total # of Funds |

Equitas SFB | 9 | 10 | 13 | 1 | 33 |

Birla Corporation | 4 | 2 | 10 | 0 | 16 |

Sanofi India | 6 | 2 | 7 | 0 | 15 |

Affle India | 3 | 0 | 11 | 0 | 14 |

V I P Industries | 0 | 2 | 12 | 0 | 14 |

Indiamart Intermesh | 12 | 1 | 0 | 0 | 13 |

Birlasoft | 9 | 2 | 1 | 0 | 12 |

Can Fin Homes | 4 | 5 | 3 | 0 | 12 |

PVR Inox | 5 | 3 | 3 | 0 | 11 |

Exide Industries | 7 | 3 | 0 | 1 | 11 |

In May, Indian mutual funds and portfolio management scheme (PMS) managers identified Equitas Small Finance Bank, Birla Corporation, and Sanofi India as their top new small-cap picks for 2023. Equitas SFB garnered attention from 9 mutual funds, 10 PMS, 13 unit-linked insurance plans, and one alternative investment fund. Birla Corporation was picked by 4 mutual funds, 2 PMS and 10 ULIPs, while Sanofi India was picked by 6 mutual funds, 2 PMS and 7 ULIPs. Additional small-cap picks included Indiamart Intermesh, Affle India, VIP Industries, Birlasoft, Can Fin Homes, PVR, Inox, and Exide Industries.

Historically, small-cap stocks have shown a consistent trend of higher returns compared to large-cap stocks due to several factors:

Market Risk (Beta): Small-cap stocks typically exhibit higher market risk or beta. They are often less established, have unstable financials, and seldom pay dividends, leading to increased market risks.

Liquidity Risk: Small-cap stocks have a higher liquidity risk due to a narrower investor base, making them less liquid assets.

Information Risk: The lack of coverage or 'information risk' can deter some investors as small-cap stocks are often less covered by analysts and financial reporters.

The aforementioned risks lead to the potential for higher returns, aligning with the risk-return tradeoff principle. Essentially, the greater the risk, the greater the potential return, and small-cap stocks certainly carry their fair share of risk. However, these incremental returns may compound to significant differences over a long period.

Despite these risks, the less followed nature of small-cap stocks can also present opportunities. With fewer analysts tracking them, these companies may have undervalued aspects that the market hasn't fully recognised yet, leading to potential profit opportunities for perceptive investors.

As such, while investing in small-cap stocks does present unique challenges and risks, the potential for higher returns compared to large-cap stocks has been a compelling historical trend. As always, a well-diversified portfolio and careful consideration of individual financial circumstances and risk tolerance are key elements of successful long-term investing. Read this article to learn more about the Risks & rewards of investing in Smallcaps

Investing in small-cap stocks can provide excellent long-term investment opportunities. For investors looking for exposure to small-cap stocks, index funds are often a viable and straightforward option. These funds offer diversification and typically come with relatively low costs. Alternatively, investors can consider actively managed small-cap mutual or exchange-traded funds. A common strategy employed by investors is to buy a basket of small, young firms in a rapidly growing industry, then reinvest in the firms that emerge as winners as the industry matures.

Small-cap investments do carry a certain level of risk, and many end up losing money or going out of business. However, those that succeed can offer significant returns. Just as a cricketer doesn't need to hit a boundary on every ball to have a high batting average, investing in small-cap stocks doesn't require every pick to be a winner in order to generate a winning long-term return. Even if some investments fail, those that succeed can provide substantial returns and boost the overall performance.

Explore our small-caps portfolio. To learn more about small caps read our article, Complete Guide to Invest in Small cap stocks and in Wright Smallcaps Portfolio.

Be sure to check out the next article in this series: The Small Cap Rally - Is it Time For a Correction?

Explore the Wright Alpha Prime Portfolio.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Full disclosures here.

1. What are the best small-cap stocks to buy now?

The best small cap stocks to buy now can vary over time, as stock market conditions and performances change. It's important to conduct thorough research and stay updated on the current market trends.

2. Will small-cap stocks do well in 2023?

Predicting the performance of small-cap stocks or any specific segment of the market for a particular year, such as 2023, is challenging and uncertain. Small-cap stocks can be more volatile and have the potential for higher returns, but they also carry increased risk. Their performance will depend on various factors, including economic conditions, market trends, company fundamentals, and investor sentiment. After major corrections in the stock market, fundamentally strong smallcaps should do well in 2023.Major fears revolve around fed rate hikes and inflationary pressures globally, which could dampen the performance of smallcap stocks in 2023.

3. What are the top Small Cap Stocks to Invest in 2023

Based on their recent performance, these small-cap stocks have shown positive returns over the last six months and year-to-date basis, indicating their potential for doing well in 2023. VST Industries, Bajaj Consumer Care, PSP Projects, Maharashtra Seamless, Arman Financial Services, and Mold-Tek Packaging have delivered attractive returns, showcasing their resilience and growth prospects. These companies operate in various sectors, including gaming, manufacturing, construction, financial services, and packaging, presenting diversification and exposure to different market segments. While there are certain associated risks, such as industry cyclicality and market volatility, their strong financials, competitive positions, and growth strategies position them favorably for continued success in the coming year.

4. How do small-cap stocks differ from large-cap and mid-cap stocks?

Small-cap stocks differ from large-cap and mid-cap stocks in terms of market capitalization. Small-cap stocks typically have a lower market capitalization, representing smaller companies, which can offer greater growth potential but also higher risk compared to large-cap and mid-cap stocks.

5. What factors should I consider when selecting small-cap stocks for investment?

When selecting small-cap stocks for investment, several factors should be considered. First, analyze the company's fundamentals, including its financial performance, revenue growth, profitability, and balance sheet strength. Second, assess the growth prospects of the industry in which the company operates and evaluate its competitive position within the market. Third, examine the quality and experience of the management team, as their decisions and strategies can significantly impact the company's success. Finally, consider the valuation of the stock and ensure it aligns with the company's growth potential and the overall market conditions.

6. What are the potential risks associated with investing in small-cap stocks?

Investing in small-cap stocks carries certain risks that investors should be aware of. One potential risk is higher volatility compared to larger companies, as small-cap stocks are more susceptible to market fluctuations and investor sentiment. Liquidity can also be a concern, as smaller companies may have lower trading volumes, leading to wider bid-ask spreads and potential difficulty in buying or selling shares. Additionally, small-cap stocks may have limited analyst coverage, making it important for investors to conduct their own research and due diligence. Lastly, there is a possibility of higher business and financial risks associated with smaller companies, such as limited access to capital, competitive challenges, and potential market disruptions.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios