Japan's Bond Market Crash: What Just Happened and Why It Matters for Global Markets

by Naman Agarwal5 min read

Japan bond crash: Global market spillover, emerging markets under pressure.

The Real Story of Zerodha’s Volume Crash and F&O’s New Reality

by Naman Agarwal5 min read

Explore Zerodha’s 2025 volume plunge and India’s F&O crash—regulatory impact, retail trader losses, and reshaping markets.

Investing in India 2025 : Equities vs. Real Estate

by Naman Agarwal5 min read

India’s investment landscape in 2025 is evolving rapidly, with both equities and real estate presenting unique opportunities. Choosing the right path depends on balancing growth potential with stability in a changing economic environment.

Jio-BlackRock: Big Tech Meets Big Finance

by Naman Agarwal5 min read

Discover how the Jio-BlackRock partnership is redefining financial services in India with cutting-edge technology, affordable investing, and a powerful digital ecosystem targeting mutual funds, broking, and wealth advisory.

NSE Unlisted Shares: Financials, Valuation & IPO Outlook

by Naman Agarwal5 min read

NSE unlisted shares are dominating India’s private markets with skyrocketing valuations and strong IPO buzz. In this 2025 deep dive, we break down the financials, grey market trends, risks, and return potential everything you need to know before investing in India’s most valuable u

The Economic Cost of War: Detailed report of India's War Economy from Kargil to Operation Sindoor

by Naman Agarwal5 min read

A comprehensive analysis of the 2025 India-Pakistan war, including its impact on the Indian stock market, FII/DII trends, defense and supply chain sectors, and the Balochistan insurgency. Includes latest data, charts, and global index comparisons.

Real Impact of Trump’s Reciprocal Tariffs On India & The World: Will India Actually Benefit?

by Siddharth Singh Bhaisora5 min read

President Donald Trump unveils sweeping reciprocal tariffs to address the $1.2 trillion U.S. trade deficit, sparking fears of global stagflation and trade wars. India faces a 26% tariff but emerges relatively well-positioned amid the global supply chain shift away from China.

Why Is The Indian Stock Market Correcting? Analysing Reasons Behind The Recent Crash

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore the causes behind India's recent stock market correction, sectoral impacts, global and domestic challenges, and strategic investment approaches to navigate volatility.

What is Upper Circuit in Share Market: Buying and Selling Guide

by Siddharth Singh Bhaisora5 min read

Understand the upper circuit in share market and master the buying and selling process. A comprehensive guide to navigating market fluctuations for upper circuit stocks. Read more.

Are Foreign Investors Bullish On India? Will Foreign Portfolio Investor Invest In India Growth Story

by Siddharth Singh Bhaisora5 min read

Understand why foreign portfolio investors are bullish on Indian stock markets. Examine Foreign Investors' investing activity, look at inflows & outflows across different sectors. Learn why India is outperforming China & other emerging market countries & what foreign investors are investing in.

Comprehensive Q2 Indian Stock Market Analysis: Earnings, Market Valuation, Volatility, Trends & More

by Sonam Srivastava5 min read

Explore Q2 earnings, market valuations, monetary policies, key sectoral trends, inflation and navigate through India's economic landscapes, market volatility, and future investment potentials. We look at where the Indian Stock Market & Economy are today, and what are the key themes playing out.

Will market volatility continue? Where to invest in volatile times?

by Sonam Srivastava5 min read

Explore the factors driving global market volatility, from macroeconomic shifts to sector-specific trends. Dive into the Indian stock scenario, understand the long-term market outlook, and discover strategies to invest wisely in these uncertain times.

Why we are bullish on the India Growth Story?

by Siddharth Singh Bhaisora5 min read

Learn why Wright Research is bullish on the India Growth Story! With insights into investments, technology, demographic dividends, education, and more, discover how India's robust growth story is leading the nation towards a potential $10 trillion economy by the end of the decade.

How the US Credit Rating Downgrade Affects India?

by Siddharth Singh Bhaisora5 min read

Unravel the ripple effects of the US credit rating downgrade from AAA to AA+ by Fitch Ratings on global markets, especially its impact on India. We discuss the reasoning behind the downgrade, its influence on the US, European, and Asian markets, why India is an interesting investing opportunity.

Best Small Cap Stocks 2023: Top Investment Picks

by Siddharth Singh Bhaisora5 min read

Explore top small cap stocks for 2023. Unlock potential investment picks for potential growth and maximize returns in the stock market. Read more.

What is Lower Circuit in Share Market: Buying and Selling Guide

by Siddharth Singh Bhaisora5 min read

Understand the lower circuit in share market and master the buying and selling process. A comprehensive guide to navigating market fluctuations. Read more.

Bye 2022. You wont be missed!

by Sonam Srivastava5 min read

We had big hopes for you 2022, but needless to say, you turned out to be one of the craziest years for investors. Here’s looking back at 2022 - obviously with memes!

This week in investing memes

by Sonam Srivastava5 min read

Let’s unwrap the market with some charts and some high-quality memes!

Inflation and Fear of Recession in the US and Impact on India

by Sonam Srivastava5 min read

The US Fed has vowed to suppress growth to control inflation and keep raising interest rates until inflation reaches 2%. This is an evolving situation that can impact India.

Which sectors are gaining from the atmanirbhar initiatives?

by Sonam Srivastava5 min read

Stocks benefiting from the critical policies have a long way to go. In this post, we will drill down into the sectors and industries covered under these schemes, which will be crucial to spot these winners.

Sectors where Mutual Funds are buying in 2022

by Wright Content Team5 min read

Did you know that tracking the stocks that are being bought by large institutions like Mutual Funds can be a very profitable investing strategy?

Why are FIIs buying into the Indian market?

by Sonam Srivastava5 min read

After months of constant selling from October 2021 to June 2022, foreign institutional investors (FII), are back in love with Indian markets and, to date, have purchased shares worth $ 5 billion.

Is festive season the time to bet on consumption?

by Sonam Srivastava5 min read

Consumer confidence is an economic indicator that measures the degree of optimism regarding a country's economy. Consumer confidence has been picking up in recent weeks.

Rising Interest Rates make Banks Attractive

by Sonam Srivastava5 min read

The banking sector should be at the centre of investor focus right now. Not only is the rising interest rate environment favourable for the banks, but several catalysts make banking extremely attractive

Evaluating Sectoral Performance

by Siddhart Agarwal5 min read

Most sectors in the Indian economy have struggled in the last six months of the bear market, and in these challenging times, the outlook for the sectors changes quickly. In this post, we evaluate the sectoral performance and the outlook.

Sector Rotation Strategy & Business Cycles

by Siddhart Agarwal5 min read

Maximize Returns with Sector Rotation Strategy. Identify stock market sector rotation opportunities in different business cycle phases. Explore Wright Research now.

We don't talk about bear markets, no, no, no

by Sonam Srivastava5 min read

The crash has unnerved everyone! Are we in a bear market? What happens next? How to manage risk? Lets find out

Inflation & It's Impact

by Sonam Srivastava5 min read

The markets have been routed over the past month after the central banks raised rates.Why are these central banks hiking rates and destroying our portfolios? The answer is INFLATION. In this post, we will look at inflation and try to predict the way. So gear up!

Can we Invest in Atmanirbhar 🇮🇳 theme?

by Sonam Srivastava5 min read

Even with the recent volatility in the Indian market, the stocks that have stayed resilient are the atmanirbhar India stocks. The term ‘AtmaNirbhar’ has evolved from a buzzword to a solid profitable strategy.

Key Investor Questions

by Sonam Srivastava5 min read

In the past few months and recent weeks there have been too many announcements to absorb. Furthermore, the global macro factors are also adding to investor ambiguity. So it makes sense to answer a few of the burning investor questions.

Falling Rural Demand vs Rising Agri Commodities

by Sonam Srivastava5 min read

The rural economy that was just recovering from supply shock during the pandemic has been hit afresh by the commodity inflation fueled by the Ukraine-Russia crisis. Can the momentum in agri-commodity prices revive it?

Decoding the Fund Flow

by Siddhart Agarwal5 min read

FIIs have sold equities worth $19.82 billion since October 1 last year. In 2008, FIIs sold $15 billion of shares during GFC. Yet, more surprisingly, the DIIs have kept the index stable. Why is this happening?

The Wild Commodity Price Rise

by Siddhart Agarwal5 min read

There has been a massive upsurge in crude, natural gas, metals, and agro commodities after the beginning of Ukraine's invasion by Russia. Let's explore the pressures and opportunities from the crisis.

The markets have been tough. Let’s dig in...

by Sonam Srivastava5 min read

Is the market volatility making you jittery? 🥶 Let's keep our long-term investor hats on 🎩 and try to understand the economics of war, the impact on India, and portfolio guidance. Let's dive in.. 🏊

Serving Consistent Market Returns

by Sonam Srivastava5 min read

At Wright Research, we believe that the market does not remain the same all the time. And as the market itself shifts its behavior, allocations within our portfolios also need to turn. This is why we like to follow a multi-factor approach in our stock selection and asset allocation.

Market Overview - Key Investor Questions

by Sonam Srivastava5 min read

As volatility kicks in to the market with rising inflation in the US and rising Crude prices, we answer some key investor queries

Budget 2022 - Pivot your Portfolio the Wright way!

by Sonam Srivastava5 min read

This is a Capex boosting budget which is prudent in other expenditures as the FM looks to contain the fiscal spending while enhancing growth. Understand how to pivot your portfolio as the market turns green.

What to expect in the run-up to the Budget?

by Sonam Srivastava5 min read

The 2022 Budget will be looked at from two critical angles. First, the expectation of a boost to economic growth through capital expenditure, and second, the ability to contain fiscal deficit in the increasingly uncertain global economy

Sector Deep Dive: Infrastructure

by Siddhart Agarwal5 min read

The Indian economy relies heavily on the infrastructure industry. This sector is critical to India's overall growth, and the government has placed a high priority on enacting regulations that would assure the country's building of world-class infrastructure promptly

New Year, Key Investor Queries

by Moneycontrol5 min read

Market can scale new highs if the Budget delivers on growth: Sonam Srivastava of Wright Research

Happy New Year: Markets in Review

by Sonam Srivastava5 min read

As the year ends and we look back, we can declare that 2021 was one of the good ones! Check out our review and projections for next year.

How to value high growth companies?

by Siddhart Agarwal5 min read

Find out how high-growth companies are valued Uncover investment gems with expert insights Dive in now to navigate the complex world of high-growth companies valuations.

The Growing Craze of IPOs in India

by Siddhart Agarwal5 min read

72 Initial Public Offerings (IPOs) were launched in India between January and September, raising a total of $330.66 billion. In addition, 33 IPOs are planned for this year, including Nykaa, Mobikwik, Paytm, and the well-known LIC.

This Diwali, add sparkle to your portfolio with Wright Research.

by Siddhart Agarwal5 min read

With Diwali approaching, now is the time for investors to assess their investment portfolio and add some luster to it with some exciting investing themes.

Markets at a Discount

by Sonam Srivastava5 min read

The markets rising rapidly over the last month took a nosedive last week, with small and mid-caps losing more than 5% as Nifty crashed 2%.

Markets at 60k!

by Sonam Srivastava5 min read

In this month's markets & macros review, we celebrate Sensex hitting 60k!

SIP Investment Guide: What is SIP, How to Start, Benefits, & Is It Worth It

by Siddhart Agarwal5 min read

Discover the benefits of Systematic Investment Plan (SIP) and how it works. Start investing early with SIP to achieve your financial goals. Learn more now.

Market Pulse - Deep Dive

by Sonam Srivastava5 min read

There's uncertainty in the equity markets and churn happening from cyclical to defensive sectors. Investor nerves are frayed!

The Burning Investor Questions

by Siddhart Agarwal5 min read

Is the market overvalued? Are we nearing price correction? Is this the right time to double down on investments? What about the FED tapering and rate hikes?

Bond Yields, Commodities, Inflation & Equity Markets

by Sonam Srivastava5 min read

In the last couple of weeks we have heard these terms - bond yields, commodity price rise, inflation while watching the equity markets countless times. Let's try to understand where we stand now.

Rebalancing your portfolio post-budget: the data-driven way!

by Sonam Srivastava5 min read

In this blog, Sonam talks about how tactical planning and execution driven by data can curate an Ideal Portfolio in the ‘post-budget’ period. Here, she focuses on how data plays an important role and how the new budget can teach us to plan accordingly for the future.

Rebalancing Updates: December 2020

by Sonam Srivastava5 min read

Last month was a good month for the Wright portfolios. Our tilt towards smallcap stocks and financial stocks worked in our favour.

Trading US Elections with Data Science

by Sonam Srivastava5 min read

US Elections are the one of most important events for the markets. There is a lot of fear in the market on the ongoing trend in the equity markets getting broken after elections

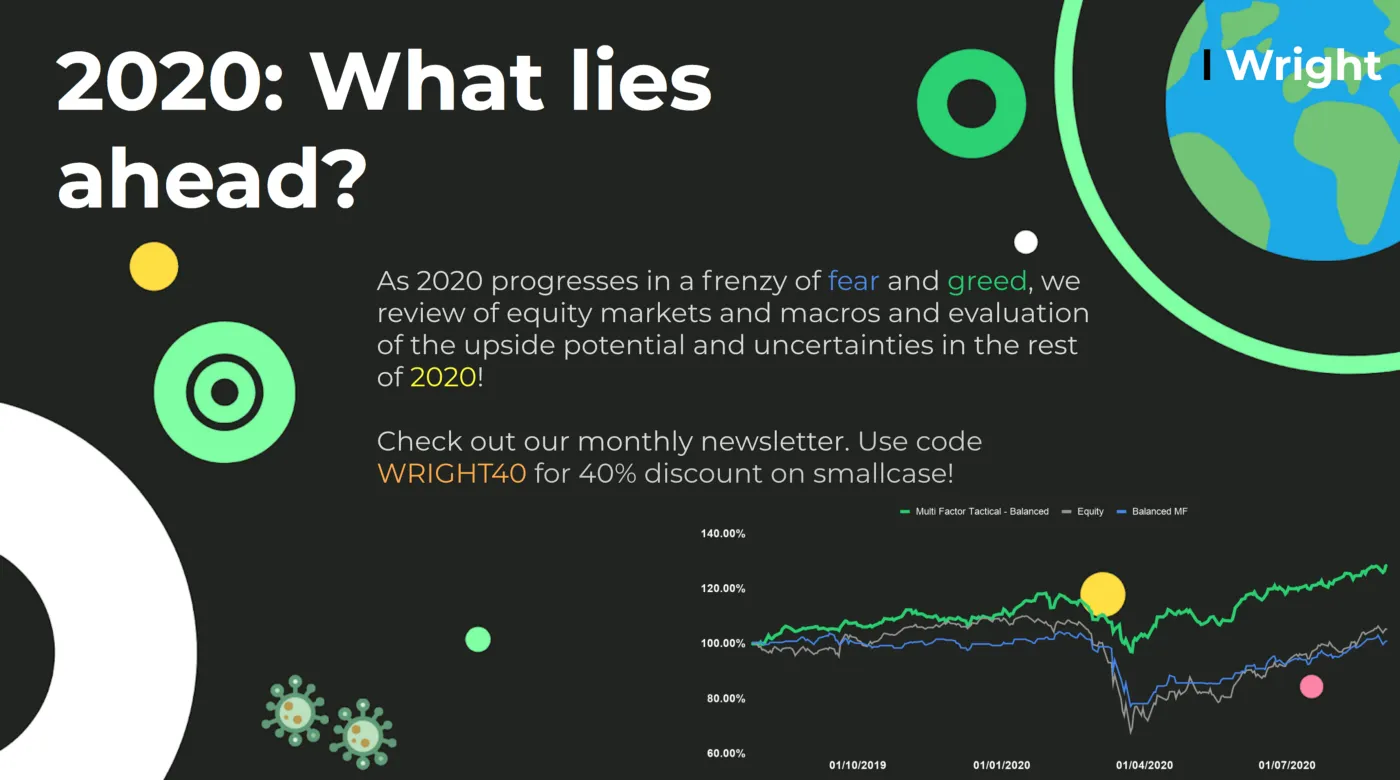

2020: What lies ahead?

by Sonam Srivastava5 min read

As 2020 progresses in a frenzy of fear and greed, we review of equity markets and macros and evaluation of the upside potential and uncertainties in the rest of 2020!

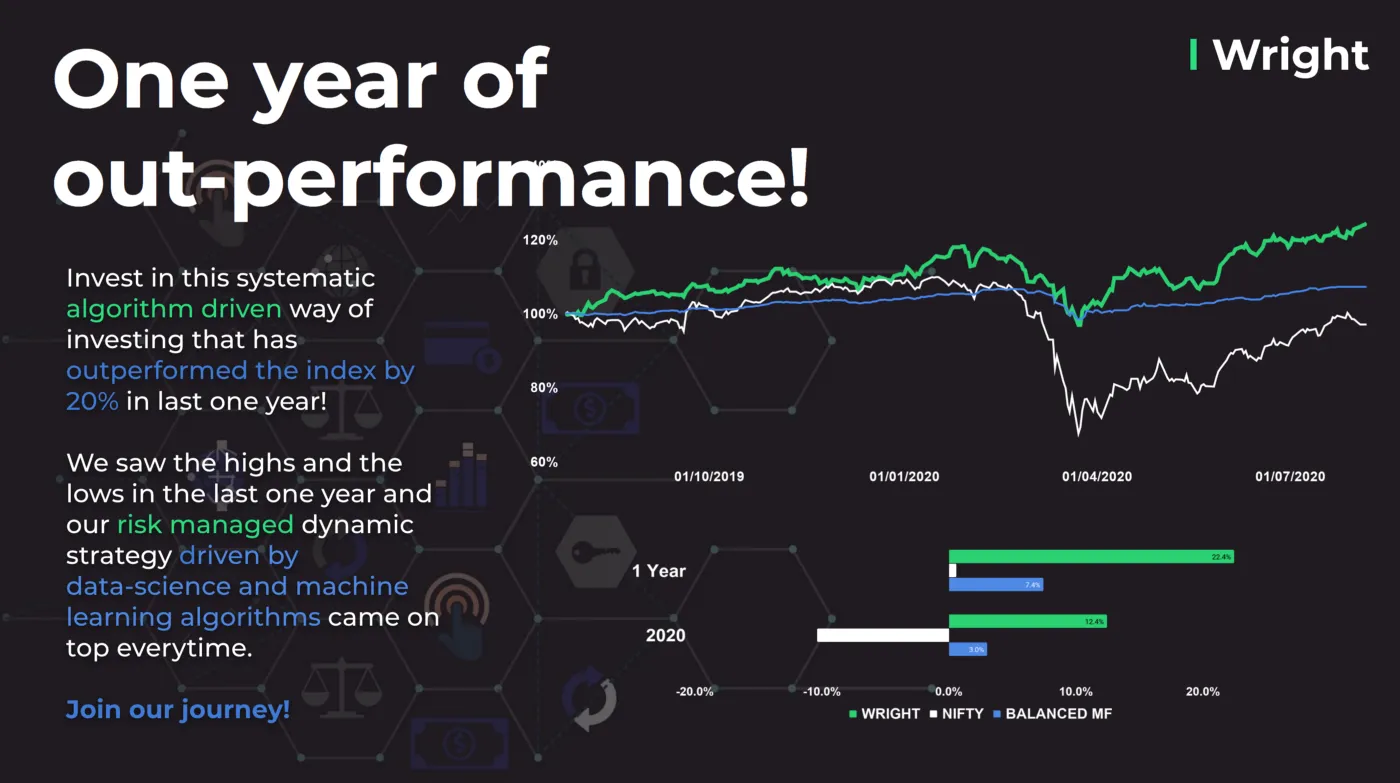

One Year of Outperformance

by Sonam Srivastava5 min read

Last week, Wright completed one year of offering our flagship portfolios to investors via smallcase! This first year of our journey has been the most incredible

Wright Views: August 2020

by Sonam Srivastava5 min read

Monthly newsletter for August commenting on the markets, economy, equity factors & our portfolio

Economic Impact of India-China trade war

by Sonam Srivastava5 min read

Let us understand the economic implications of India-Chine trade war on your portfolio.

Macro Regime Prediction Model

by Jasmeet Singh5 min read

In this post we use macro economic variables to model stock market risk and returns

Covid – 19: Impact, Recovery & Investment Strategies

by Sonam Srivastava5 min read

Once again, India and the world are in the face of a crisis like no other.

Performance Update: Nine months and a market crash!

by Team Wright5 min read

We completed 9 months of live performance and survived a market crash!

Three month performance update

by Team Wright5 min read