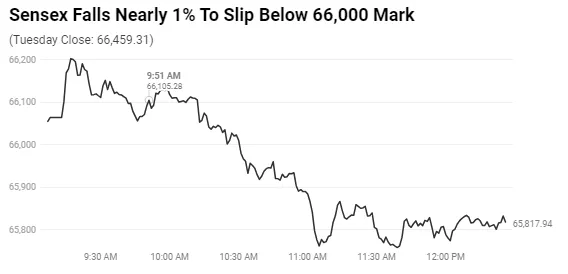

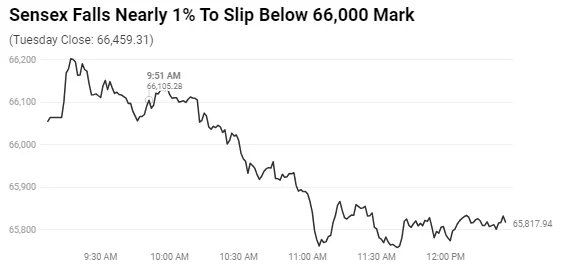

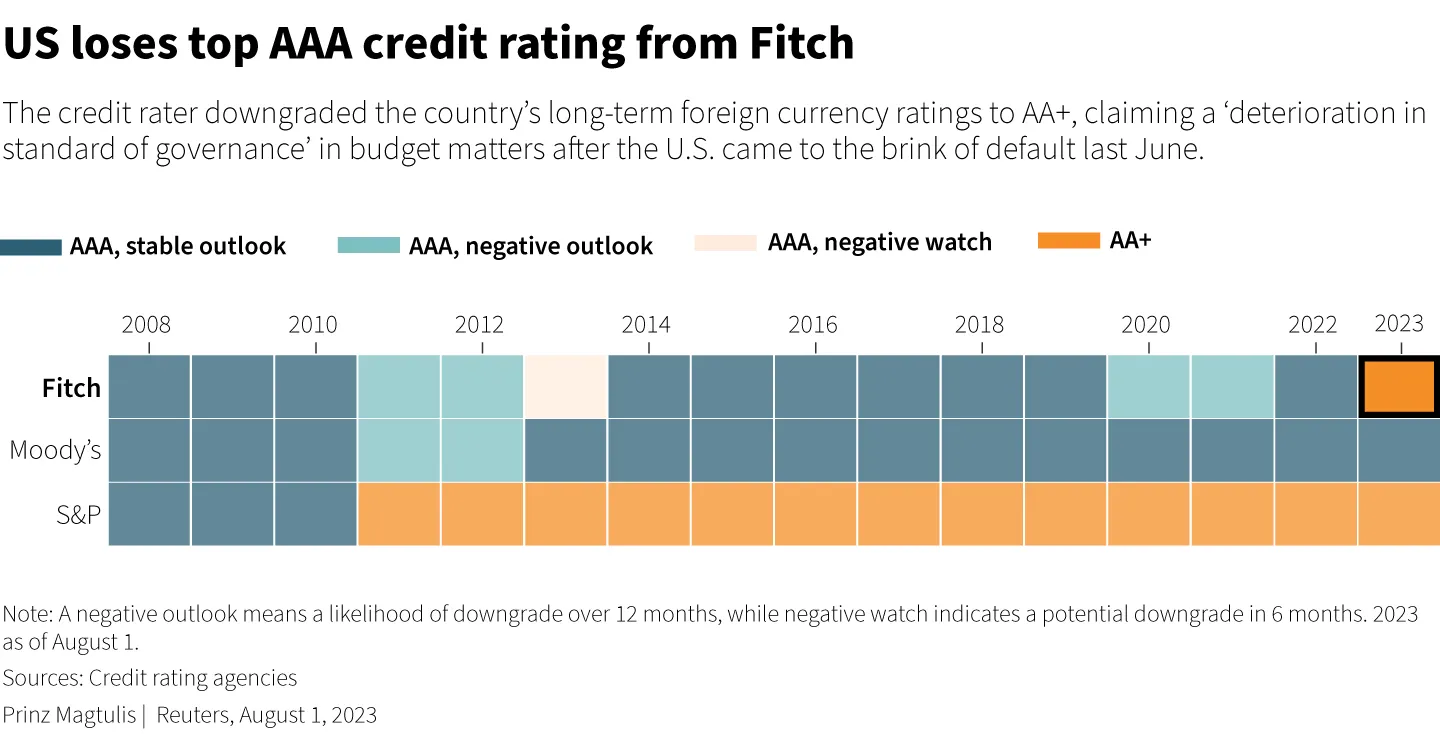

On August 2nd, as a knee-jerk reaction to the US sneezing, the Indian market caught a cold. The Sensex saw a 1,000-point correction. However, analysts and fund managers remain confident in India’s resilience and ability to absorb the impact. The ripple effect was caused by a decline in the US credit rating from AAA to AA+, a move previously seen over a decade ago by S&P Global Ratings. Fitch Ratings was the bearer of this news, citing tax cuts and new spending initiatives that have swelled the US budget deficits as one of the key reasons. Add to this a number of economic shocks and largely unaddressed rising entitlement costs, and we have a clearer picture of the factors leading to this downgrade.

In simple terms, a credit rating downgrade means a lower grade on one's financial scorecard. Governments and companies are given ratings that show their likelihood of paying back their debts. A downgrade, then, indicates a worsening financial situation and an increased risk when lending money.

Credit rating agencies like Moody's, Fitch, and Standard and Poor's evaluate the creditworthiness and risk of default associated with governments and companies. Fitch's 'AAA' rating signifies the best creditworthiness and 'AA+' is considered high-quality. The recent downgrade of the US rating to 'AA+' with a 'stable' outlook implies the US's creditworthiness remains strong, albeit slightly diminished.

Taking a deeper dive into the downgrade, the six key drivers highlighted by Fitch give us a comprehensive understanding of the reasons for the US rating drop.

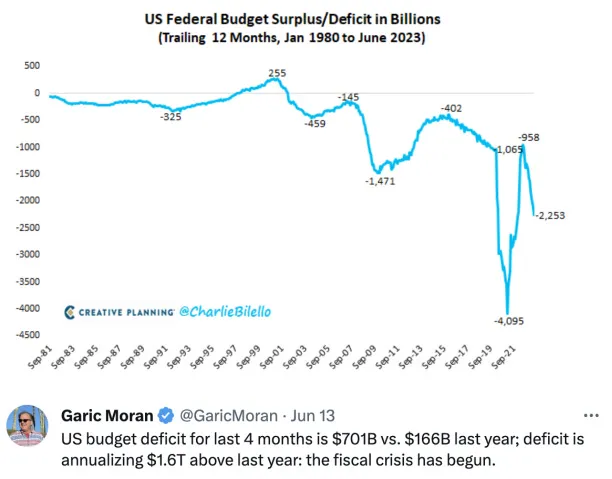

Fitch expressed concern over a steady decline in governance standards over the last two decades, including fiscal and debt matters. The rating agency noted that repeated political standoffs and eleventh-hour resolutions around the debt limit have negatively affected confidence in fiscal management. Adding to this, Fitch observed that the US lacks a medium-term fiscal framework, which most of its peers have, leading to a complex budgeting process. These factors, combined with various economic shocks and tax cuts, have contributed to consecutive debt increases over the past decade. Moreover, there's been only limited progress in addressing rising social security and Medicare costs due to an ageing population.

Fitch anticipates the general government (GG) deficit to increase from 3.7% of GDP in 2022 to 6.3% in 2023, a significant jump attributed to weaker federal revenues, new spending initiatives, and a larger interest burden. It's expected that the GG deficit will reach 6.9% of GDP by 2025 due to slow GDP growth, a heightened interest burden, and wider local government deficits.

Fitch highlighted that although lower deficits and high nominal GDP growth reduced the debt-to-GDP ratio from its pandemic peak of 122.3% in 2020, it is still significantly higher than the pre-pandemic level of 100.1% in 2019. Fitch anticipates that the GG debt-to-GDP ratio will increase over the forecast period, reaching 118.4% by 2025. This puts the US at over two-and-a-half times the 'AAA' median of 39.3% and the 'AA' median of 44.7%.

Medium-term fiscal challenges like rising debt stock, higher interest rates, and increasing healthcare costs remain largely unaddressed. Fitch underscored that these challenges will increase the interest service burden over the next decade, and an ageing population and rising healthcare costs will elevate spending on the elderly in the absence of fiscal policy reforms.

Fitch projections indicate that tighter credit conditions, diminishing business investment, and a slowdown in consumption will push the US economy into a mild recession by the end of 2023. The agency predicts that US annual real GDP growth will slow to 1.2% this year from 2.1% in 2022, with an overall growth of just 0.5% in 2024.

Fitch anticipates a further hike in the Federal Funds Rate by September, as the resilience of the economy and the labor market complicate the Federal Reserve's goal of bringing inflation towards its 2% target. With the key price index remaining high, it's unlikely that we'll see cuts in the Federal Funds Rate until March 2024. Simultaneously, the Federal Reserve continues to reduce its holdings of mortgage-backed securities and US Treasuries, further tightening financial conditions.

The downgrade of the US credit rating and these key driving factors have significant implications for the global market, and it's crucial to understand the potential impact on economies like India's.

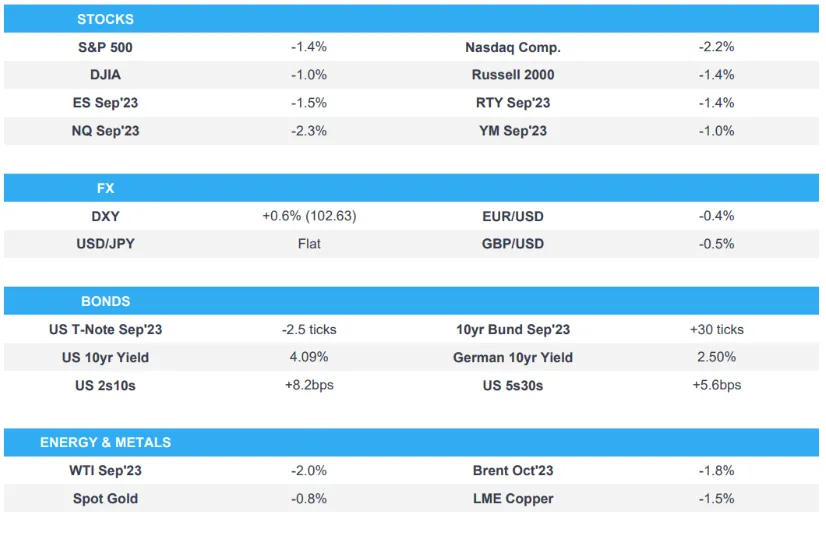

The downgrade caused a sell-off in the US equity markets, reminiscent of a similar downgrade by S&P in 2011. The tremors spread to Asian markets upon their opening and European stocks also followed the trend. This sell-off occurred because a rating downgrade undermines confidence in a nation's economy and its government. While this may not directly impact company revenues, it influences investor sentiment and affects the cost of capital for companies, impacting their balance sheets. The immediate drop in equities across markets was a reflex reaction.

On August 2nd, Wall Street wrapped up lower, with the S&P 500 and Nasdaq Composite down for a second consecutive day as investors capitalized on five months of gains following Fitch's rating cut. The S&P 500 recorded its largest daily percentage drop since April 25, with major indexes falling.

However, multiple major brokerages suggested that the downgrade was unlikely to cause a sustained drag on U.S. financial markets. They noted the economy was stronger than when S&P cut its rating in 2011. The Fitch downgrade seemed to offer a chance for investors to pause and reassess.

Despite the sell-off, the ADP National Employment report indicated a resilient labor market, which could protect the economy from a recession. Corporate America has remained strong, with around two-thirds of the S&P 500 having already reported, 79.9% have posted earnings above analysts' expectations.

European equities plummeted on August 2nd, following the US credit rating downgrade. The pan-European STOXX 600 index fell 1.4%. The FTSE 100 in Britain and DAX in Germany both shed 1.4%, and France's CAC 40 declined by 1.3%.

Asian markets also dropped on August 2nd, with Hong Kong's Hang Seng index slipping 2.5% and China's Shanghai Composite losing 0.9%. Japan's Nikkei 225 tumbled by 2.3%, while Australia's S&P/ASX 200 index closed 1.3% lower. New Zealand's S&P/NZX 50 index ended slightly down at 0.2%.

India's Dalal Street suffered significant losses on August 2nd, with both major domestic equity benchmark indices ending with sharp cuts. Broad-based selling was witnessed with midcap and smallcap indices also falling over a percent each. All sectoral indices closed in the red, with banks, auto, and metals falling the most.

Historically, in 2011, when S&P took similar action, Indian equities, already on a downturn, entered bear market territory, losing about 18% in the following 4-5 months. However, the situation is different this time. The Nifty and other indices are either at their all-time high or close to it.

The Indian market is likely to remain resilient as earnings momentum , especially in midcaps and smallcaps , have been robust. Investors can also find solace in the fact that the buying dip has continued as opportunistic traders jumped to grab stocks at lower levels. This gives confidence that the crisis in the US may not have much negative impact in India.

Although the downgrade reflects the US's expected fiscal deterioration, it is not expected to drastically influence inflows into emerging markets. This is primarily due to the market having already factored in the possibility of a downgrade, as hinted at by Fitch back in May.

Over the past few months, India has proven to be an appealing destination for inflows amongst emerging markets. With a relatively better inflation trajectory and successful monetary policy management compared to its global counterparts, India stands out as a resilient player. Ongoing trend to India's effective monetary policy and favorable inflation forecast models predict further easing of inflation.

Recently, Morgan Stanley has upgraded India to 'overweight', which signifies a growing optimism towards the Indian economy. The reasons cited for this upgrade include sustained superior dollar EPS growth against emerging markets and a promising demographic profile that supports equity inflows.

According to Morgan Stanley, India's economy is experiencing a surge in foreign direct investment, with the country leveraging multipolar world dynamics to its advantage. India's economic indicators continue to show resilience, with the country on track to achieve a forecasted 6.2% GDP growth.

In contrast, Morgan Stanley has downgraded China to 'equal-weight' due to concerns over growth and valuation. This move underlines the comparative advantage that India currently holds in the global market scenario.

In less than a decade, India has seen numerous significant changes that have had a profound impact on its economic landscape. These include supply-side policy reforms, changes in real estate regulations, digitization of social transfers, new bankruptcy laws, and the introduction of a flexible inflation targeting focus on Foreign Direct Investment (FDI).

These reforms, coupled with the declining intensity of oil to GDP and the shifting of the current account funding to more stable FDI flows, have greatly diminished India's correlation with external factors such as oil, the U.S. Fed's fund rate, and U.S. growth cycles.

India's future growth potential is seen in a positive light, with government incentives for the corporate sector and a transition in India's income pyramid expected to boost economic growth. The introduction of lower tax rates and production-linked incentives to promote investments in targeted sectors are likely to further support this growth.

In addition, the systematic investment plans introduced by domestic households is creating a reliable domestic source of risk capital. However, risks do exist, including potential surprises in inflation and monetary policies, and disruptions from artificial intelligence to India's service exports and the labour force. These factors will continue to be closely monitored in the coming years.

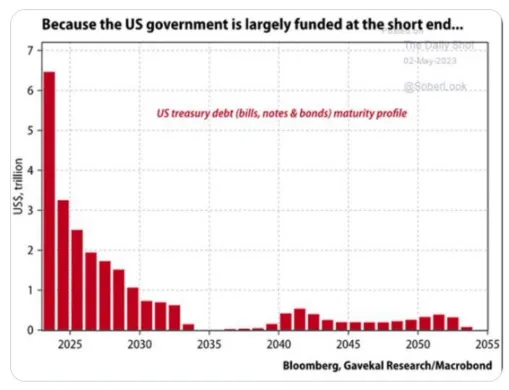

The immediate implication of the downgrade by Fitch is an increased risk perception for US bonds and treasury bills. Ideally, this would necessitate the US to offer higher interest rates on its bonds to attract investors. Nonetheless, it's crucial to note that US bonds continue to be regarded as some of the safest globally.

The rating downgrade means Fitch now sees more risk in US bonds and treasury bills. Subsequently, the US should ideally offer higher interest on its bonds to compensate for the risks. Although it's important to remember that US bonds are still perceived as the safest globally. The bond market and sovereign credit default swap (CDS) market, used as a hedge against government defaults, have already factored in the rising risks flagged by Fitch.

Notably, the downgrade in US credit rating is seen as an incentive for global investors to start thinking about diversification. It suggests that while the US market remains significant, there's a need to invest in international markets, particularly emerging markets, and more specifically, India. This development is anticipated to influence investors to avoid relying too heavily on the US market.

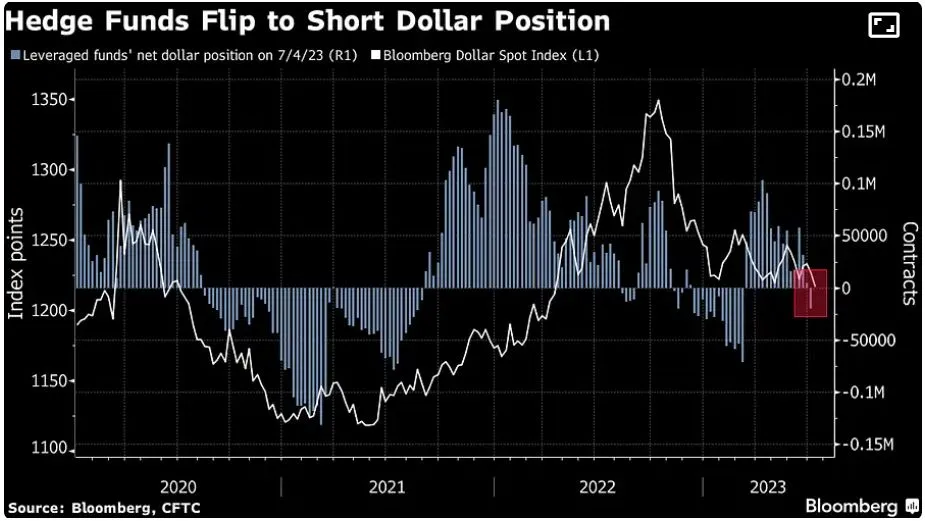

Despite the US dollar traditionally being considered a refuge during global financial disturbances, it has lost ground against other currencies. The drop in the US dollar index suggests a growing strength of alternative currencies like the Euro. This observation reinforces the necessity for investors to consider diversifying their currency portfolios, including into emerging market currencies, some of which have performed well against the US dollar.

Investors are being encouraged to shift their portfolios towards a) more diversification into emerging markets, and b) a transition from fixed income to equities. This shift reflects the need to take advantage of the growth opportunities and potentially superior returns that these markets and asset types offer.

Rupee depreciation is a common factor considered by foreign investors investing in India. However, the fact that many Indian companies earn in strong foreign currencies like the US dollar or Euro can offset the problems posed by a weakening rupee. For equity investors, the improved margins from earning in strong currencies and incurring costs in a weaker currency can be a benefit.

Moreover, as India's growth story becomes more widely recognized and the rupee becomes more internationalized, a change in attitudes towards the rupee is expected. This shift could prompt a revisit of the assumption of constant rupee depreciation by institutional investors.

While the Chinese market has damaged foreign investor confidence in the past, a resurgence in confidence from local investors could gradually attract global interest. However, a significant surge in foreign investment is not expected in the short term.

Efforts by the Indian government to encourage investment are gaining traction, with more global companies like Apple and Tesla looking to India for their manufacturing needs. This trend of increasing foreign inflows is projected to continue.

Although India is viewed as a fast-growing country, the relative smallness of its market compared to markets like China is a concern for large institutional investors. The privatization of state-owned enterprises is seen as a potential strategy to increase the size of the Indian market and attract more significant investment.

While investors are generally positive about factors such as India's population growth, technological advancement, and potential for economic growth, there are concerns about currency devaluation and the weakness of the Indian rupee. This concern extends beyond India and represents a global apprehension for investors.

The downgrade of the US credit rating from AAA to AA+ by Fitch Ratings has stirred a wave of response in global markets, but it may well prove to be a catalyst for diversification, especially towards emerging markets like India. As one of the fastest-growing economies in the world, India continues to exhibit resilience and appears to be well-positioned to absorb this shock wave. This scenario does not undermine the strength of the US economy but rather underscores the need for diversified portfolios to hedge against concentrated risks and embrace the upside potentials elsewhere.

In the short term there might be turbulence, but in the medium to longer term the unfolding dynamics signal a recalibration of the global investment climate, prompting an accelerated shift toward diversified and balanced portfolios. India's strong fundamentals, backed by a thriving demographic and sustained reform agenda, lend it a compelling growth narrative. So, while global markets will continue to monitor the US's fiscal situation closely, the story also turns our attention towards the promising canvas of opportunities in emerging markets. For investors, the key takeaway should be that, in an interconnected world economy, no market should be overlooked, and portfolio diversification should remain a cornerstone strategy for risk mitigation and wealth generation.

To learn more about our thoughts on the recent market movements, wright anniversary, alpha prime, momentum investing and more, ask us questions on our Live AMA with Sonam Srivastava and Rakesh Rathod from Smallcase on Sunday, 6th August at 11AM. Don't forget to click the bell icon to be notified. See you there!

Submit your questions for the Live AMA here.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart