by Sonam Srivastava

Published On Oct. 8, 2023

This is going to be a packed article. There is a lot happening in the market and we will try to give you a flavor of all the different topics and themes at play.

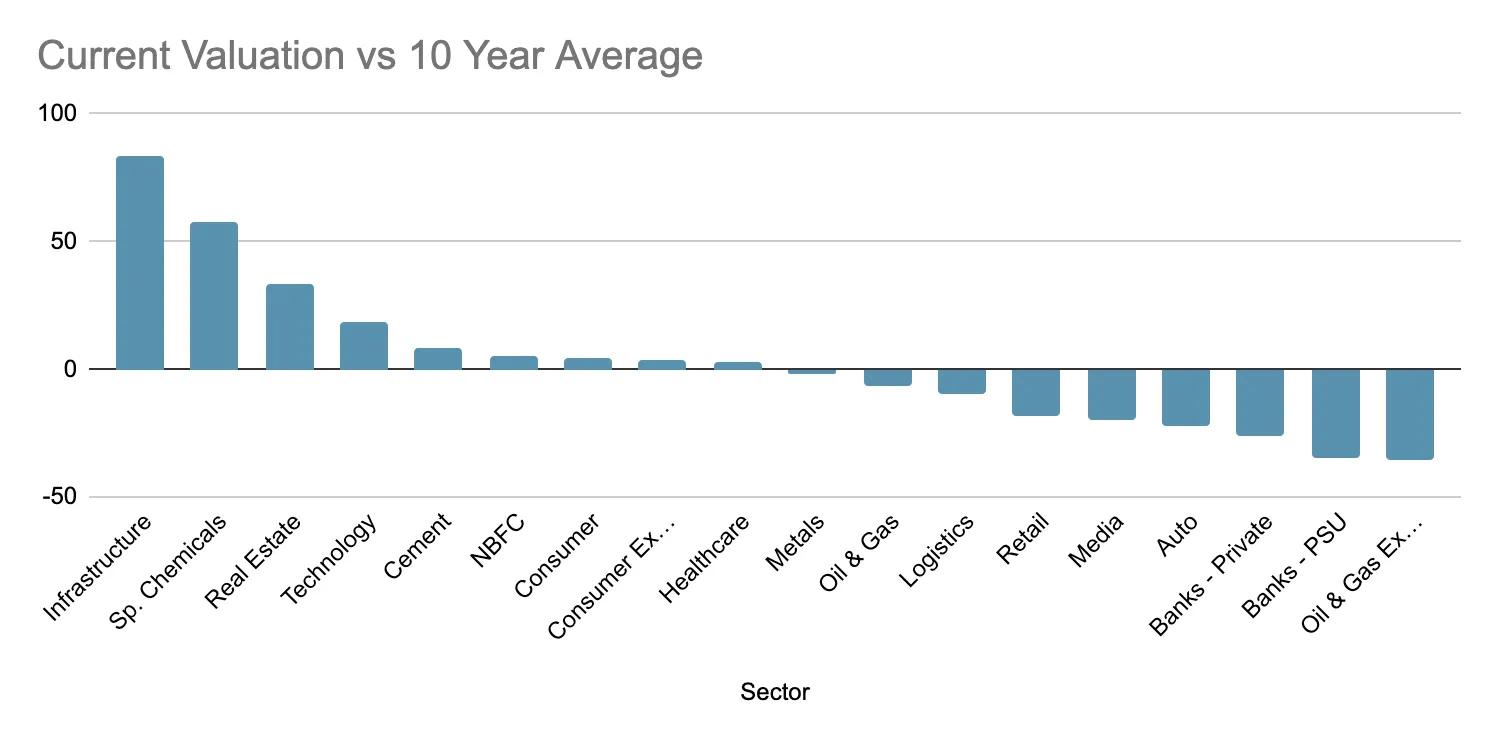

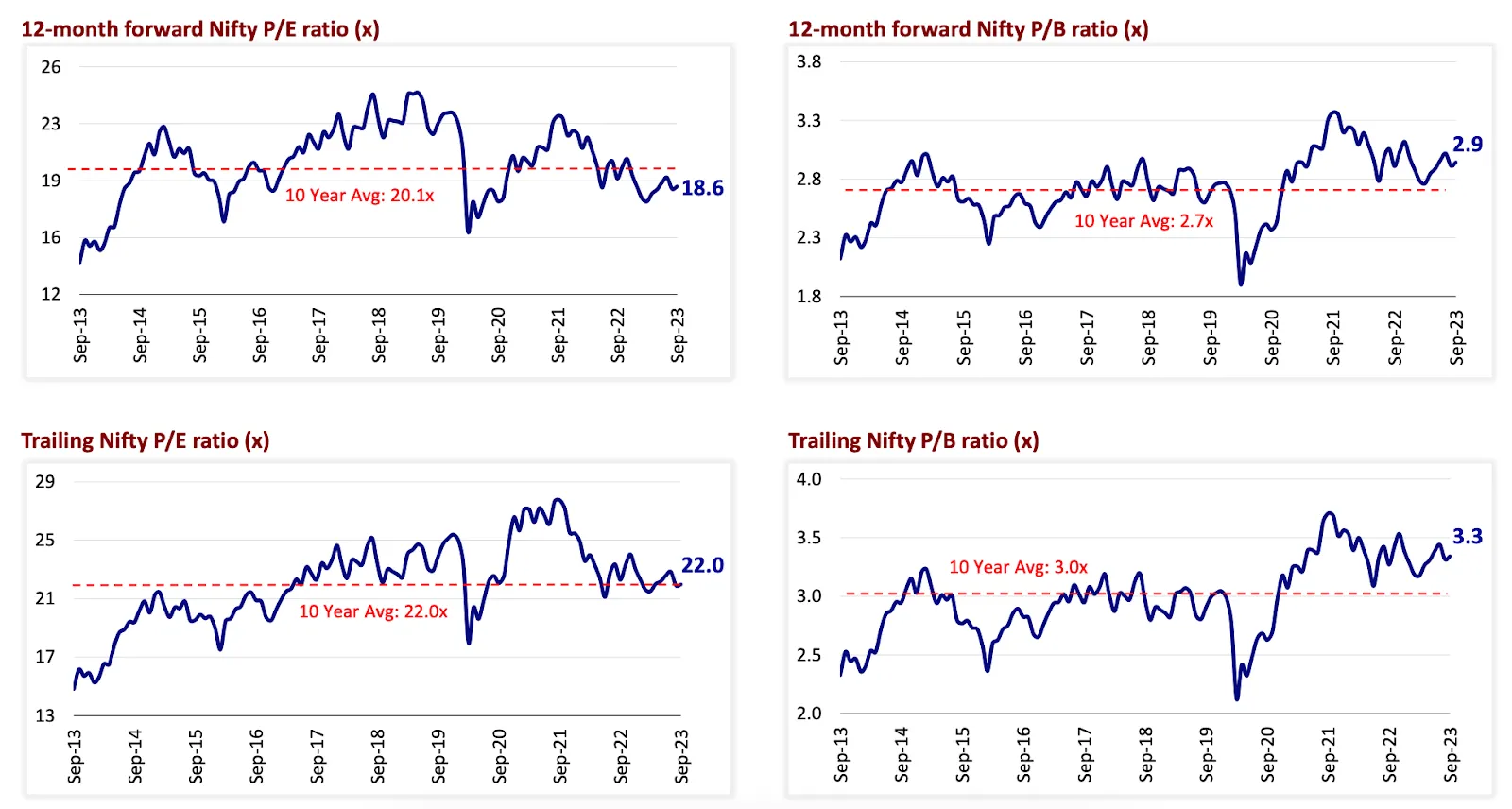

The valuation landscape of the Indian stock market is currently presenting a diverse picture. Several leading companies within the Nifty are trading at significant premiums or discounts to their historical averages. For instance, prominent firms in sectors like chemicals, pharmaceuticals, and energy are trading at substantial premiums, indicating strong investor confidence and growth expectations. Conversely, companies in sectors such as oil and gas, energy, and metals are trading at noticeable discounts, suggesting potential undervaluation or sectoral challenges.

Interestingly, about half of the Nifty constituents are trading below their historical average, hinting at potential investment opportunities in these blue-chip stocks. However, the market also showcases evident volatility , with some sectors like metals hovering around their long-term average valuations.

Furthermore, when comparing the Indian market to other emerging markets, the Price-to-Earnings (PE) ratio for Indian stocks is at a significant premium. This could be indicative of the market's perception of India having better growth prospects, leading to higher valuations.

The Indian stock market has been experiencing heightened market volatility in recent times. This volatility can be attributed to a myriad of factors, both domestic and global. On the domestic front, economic indicators, policy decisions, and sector-specific developments play a pivotal role in influencing market movements. For instance, announcements related to fiscal policies, interest rates, and regulatory changes can lead to swift market reactions.

Globally, geopolitical tensions, trade disputes, and central bank policies in major economies have a cascading effect on emerging markets, including India. Additionally, the ongoing pandemic and its economic repercussions have introduced an element of uncertainty, further fueling market volatility.

It's also worth noting that the rapid influx of retail investors, driven by increased accessibility through digital platforms, has brought a new dynamic to the market. Their investment patterns, often influenced by short-term trends and sentiments, can lead to sharp swings.

The upcoming Q2 earnings season is anticipated to be a mixed bag for the Indian market similar to Q1 FY24 earnings. The capital goods sector is expected to benefit from the government's renewed focus on infrastructure spending and the revival of private capex. Metals are likely to ride the wave of strong demand, especially from emerging markets like China. The pharmaceutical sector is set to capitalize on the increasing exports of generic drugs and a surge in demand.

However, the banking sector might witness moderated growth. The challenges posed by the global economic slowdown and supply chain disruptions could lead to both revenue and margin disappointments for some sectors. The auto sector, in particular, may not present very attractive numbers due to these disruptions.

The Oil and Gas sector is anticipated to witness a robust performance in Q2, driven by a sharp turnaround in Oil Marketing Companies (OMCs). The recovery in Gross Refining Margins (GRM), gains in crude and product inventory, and enhanced marketing margins on auto fuel retailing are expected to be the key growth drivers. Additionally, companies like RIL are projected to benefit from various segments, including Oil-to-Chemical (O2C) and Exploration and Production (E&P).

The Capital Goods sector is poised for a steady performance in Q2. Companies under our coverage are expected to showcase moderate growth, driven by the execution of a robust order book. The anticipated topline growth stands at 11.8% YoY. EBITDA margin is projected to improve by 140bps YoY, attributed to easing Raw Material (RM) costs, reduced freight costs, and enhanced supply chain dynamics. Key players like Triveni Turbine are expected to register strong growth (+33% YoY) due to improved execution following robust order inflows. Solar Industries is projected to achieve a topline growth of 9% YoY, with key factors being realizations, Ammonium Nitrate (AN) price volatility, and the scaling up of the Defence segments, including Oil-to-Chemical (O2C) and Exploration and Production (E&P).

The IT sector is anticipated to maintain its growth trajectory in Q2, driven by the increasing demand for digital transformation services. While the sector might face challenges due to global economic slowdowns and supply chain disruptions, the overall outlook remains positive. Companies are expected to benefit from a diversified client base, innovative service offerings, and strategic acquisitions. Margin expansion, driven by operational efficiencies and cost optimization, will be a key factor boosting profitability.

The banking sector is set to witness steady growth in Q2. Systemic loan growth is expected to remain robust, driven by traction in the Retail and SME segments. Private banks are projected to report healthy earnings, supported by business growth and benign credit costs. However, challenges may arise from margin compression and elevated operational expenses. Public Sector Banks (PSBs) are likely to see a resurgence in earnings, aided by controlled credit costs and improved asset quality. The focus will be on monitoring deposit traction, technology-related spending, and fee income traction.

The pharmaceutical sector is projected to see a revenue growth of around 13% YoY, primarily driven by the US market. Key product launches, including drugs like Revlimid, and favorable currency movements are expected to boost growth. However, domestic growth might be tepid due to softer offtake in Acute therapies. Margins are likely to improve YoY, benefiting from a better product mix, price hikes in branded markets, and diminishing US pricing pressure.

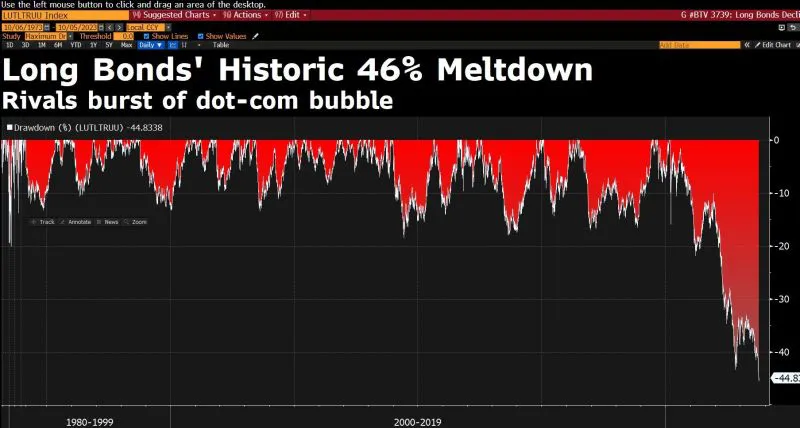

Bond yields, often seen as the pulse of the global economy, can have profound implications for investors, governments, and consumers. A spike in bond yields, especially when unexpected, can reshape financial landscapes and economic outlooks. The recent surge in bond yields has captured the attention of market watchers, prompting questions about its causes and consequences.

Several factors converged to drive the bond yield spike:

Several factors converged to drive the bond yield spike:

Implications for Global Markets: The bond yield spike has multifaceted repercussions:

For India, a spike in global bond yields, especially U.S. Treasuries, can have mixed outcomes. A stronger U.S. dollar might exert pressure on the Indian rupee. However, if the yield spike reflects global economic optimism, it could bode well for Indian exports and sectors linked to global growth.

The Reserve Bank of India (RBI), in its recent monetary policy announcement, has once again underscored its commitment to ensuring macroeconomic stability amidst prevailing challenges.

The RBI has decided to maintain the status quo, keeping the repo rate unchanged at 6.5%. This marks the fifth consecutive time the central bank has held the rate steady, signaling its cautious approach in the face of inflationary pressures.

Governor Shaktikanta Das highlighted the challenges posed by inflation in India 2023. While there's an expectation of significant easing of inflation in September, concerns persist for the October-December 2023 period, especially regarding food inflation. The CPI inflation forecast for 2023-24 remains unchanged at 5.4%.

The banking sector and related financial markets are likely to experience short-term volatility in response to these announcements. However, the broader market might interpret the RBI's stance as a sign of confidence in the economy's resilience.

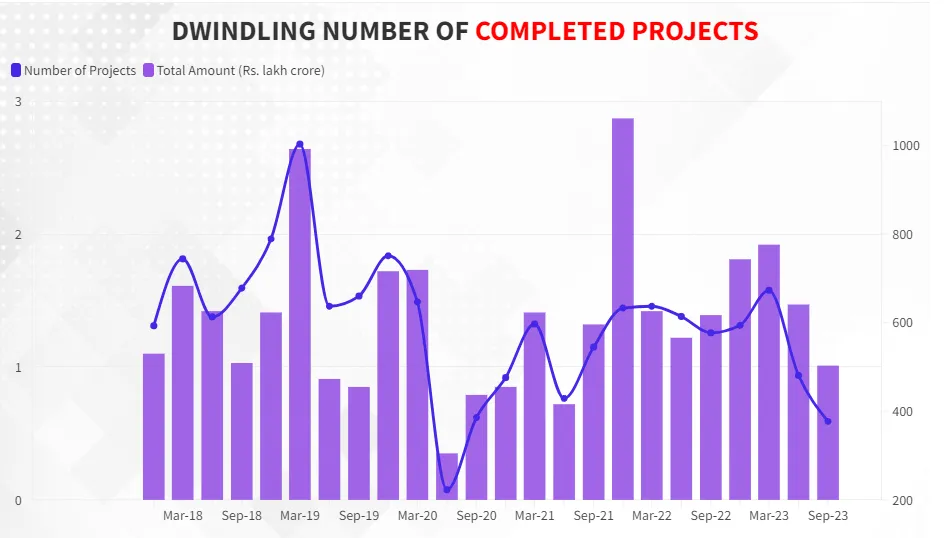

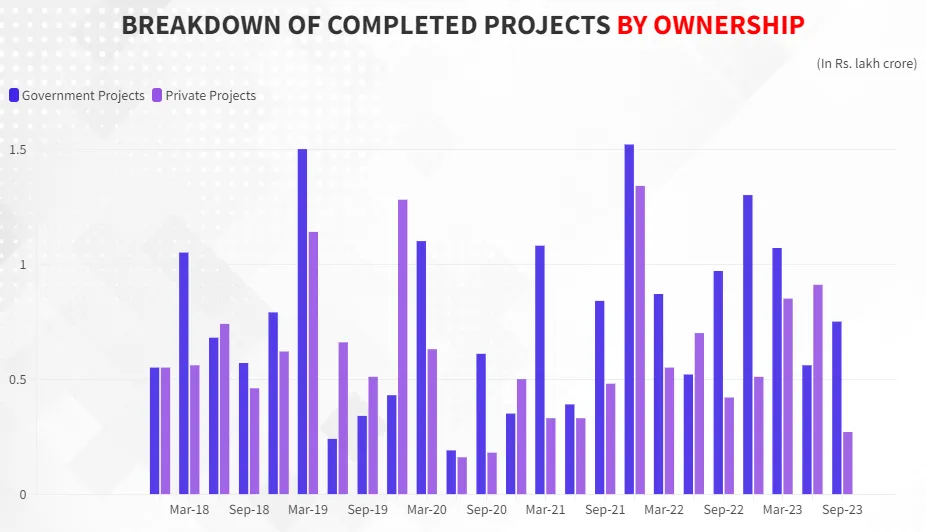

In the first half of FY24, government capex surged, seeing a 48% YoY increase from April to August 2023. However, the CMIE indicates that this did not significantly impact total investments. Completed projects in the quarter ending June 2023 numbered 481, worth about Rs 1.5 lakh crore. The following quarter saw completion of 377 projects, valued around Rs 1 lakh crore. Typically, about 600 projects are concluded each quarter in non-pandemic years, but 2023 trends toward 500.

If the current pace persists, by fiscal year-end, Rs 6–6.5 lakh crore projects might be completed i.e. no growth relative to last 2 years. In the April-June quarter, under 1% of anticipated total projects were realized as new capacities. The July–September quarter is estimated at a mere 0.67%.

Additionally, new investment announcements have diminished. While 1,295 new projects were declared in FY23’s last quarter, Q1 FY24 saw a plunge to 414, further reducing to 404 in Q2. Project completions along with a drop in new investment proposals could indicate the investing climate is reducing in India.

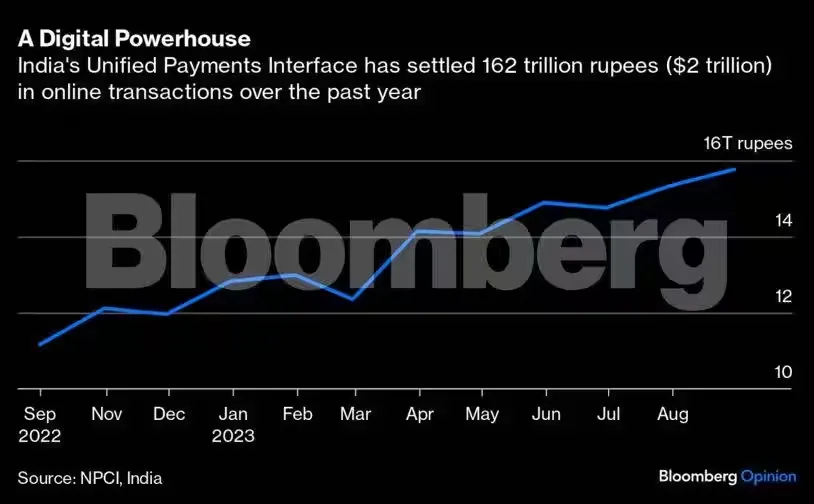

We are all familiar with UPI nowadays. We crossed over 10 billion cashless transactions in August alone. UPI Interface itself is free. India's payment revenue last year was $64 billion. Simultaneously, credit card usage and innovations, like pre-approved credit lines, have expanded. This instant-payment protocol, UPI, has been taken globally and is collecting additional revenue through fees and currency-exchange commissions. For banks, which witnessed a 38% revenue growth last year partly due to digital transactions, the digital payment system represents a lucrative opportunity given its widespread adoption and robust transaction volumes.

Digital commerce is up. Credit card usage has expanded. 1/5th of India’s 620 billion transactions in 2022/23 were settled digitally. This is expected to increase to 765 billion transactions with 2/3rds being digitally settled by 2027.

India is in the early stages of building out a 5G network, with around 3.3 lakh base transceiver stations established. Reliance Jio and Bharti Airtel have rolled out 5G on their networks, while Vodafone Idea Ltd. has been lagging behind.

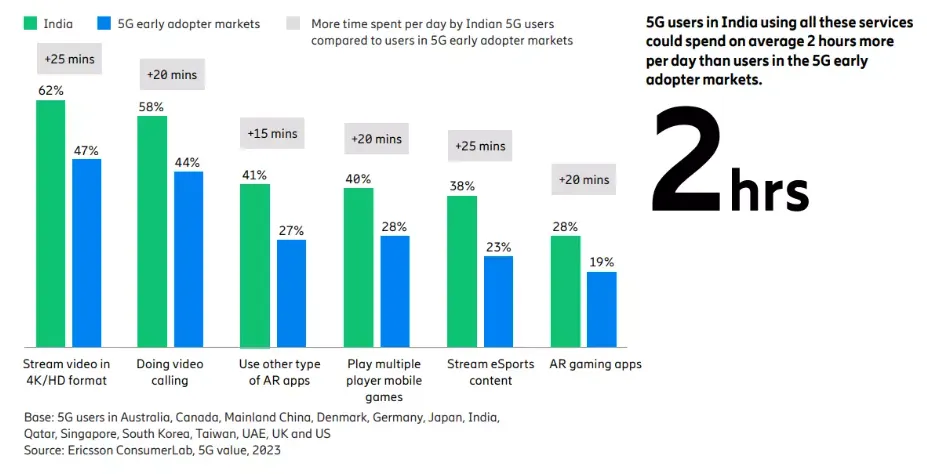

Indian users engage significantly more in 5G-enabled activities like enhanced video streaming, video calling, mobile gaming, and AR services.

31 million users in India plan to purchase 5G smartphones in the upcoming year, as per Ericsson Consumer Lab Report increasing total 5G users to 100 million.

On average, Indians spend 2 hours+ per week on such apps than 5G users in early adopter markets like the USA, South Korea, and China.

30% increase in overall satisfaction when transitioning from 4G to 5G, largely attributed to higher download speeds.

Around 58% of Indian users reportedly end the month with more than 30 GB of unused data.

Approximately 15% of consumers expressed a readiness to pay a premium (up to 14%) for 5G plans bundled with applications, including video on demand, gaming, and music.

Network APIs offer telecom operators the potential to provide enhanced network experiences that customers might pay extra for, fostering an environment where developers can access 5G capabilities to deliver premium experiences. Differentiation in packages and services, like temporary 5G boosts and optimized mobile gaming packages, opens new models for monetization. To monetize 5G, some telcos in Asian markets are offering quality of service led offerings, such as better uplink speed or downlink, along with optimized mobile gaming.

Growth happens in leaps and bounds. Apple took 38 years to reach a $1 trillion market cap, doubled it in the next 2 years and took another 2 years to add another $1 trillion to its market cap. Once the foundation is set, the next phase of growth can happen exponentially. When we look at the Indian market, it took us a while to get to $3.5 Trillion economy. We are just scratching the surface. Our household debt as a percentage of GDP is just 14% compared to China’s 64%, USA’s 65%, Japan’s 68% and UK’s 88% - given where our GDP is, there is enough growth expectation.

New to credit set of population is also picking up. Government spending in infrastructure is happening at a fast pace, and with elections around the corner - do you think it will slow down? Our digital payment systems outpace most payment mechanisms in developed economies. 5G is spreading across the country and opening up avenues. We are now the 4th largest economy in the world. We could become the 3rd largest by 2027. And just like Apple, the economy could double in less than a decade. So are you bullish on India ?

Amid rising inflation risks and prolonged higher interest rate expectations, value stocks are gaining attention. Historically, these stocks, which trade at prices lower than their intrinsic value, have shown resilience during inflationary times , especially those in sectors like financials and energy. As interest rates rise, growth stocks, reliant on future earnings, might face challenges due to the increased discounting cost of those earnings. In contrast, value stocks, rooted in current earnings, could be less impacted. Particularly, banks within the value category might benefit from wider net interest margins in a higher rate environment. While the macroeconomic scenario seems to tilt in favor of value stocks, it's essential to factor in individual company fundamentals and broader market dynamics when making investment decisions.

Read the full article on Wright Research Comprehensive Q2 Indian Stock Market Analysis: Earnings, Market Valuation, Volatility, Trends & More

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Read our article to understand What is a Micro Cap Stock? Which are the Best Micro Cap Stocks in India in 2023

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart