Earnings being released at the beginning of the quarter is a big event in the market. People start getting excited about stocks that might post good numbers, and pessimistic about sectors that might underperform. The commentary that the management provides in an earnings event is also extremely interesting. If the management puts out a good plan for growth for the company in the next quarter again people get excited and if the projections are bad, we get discouraged.

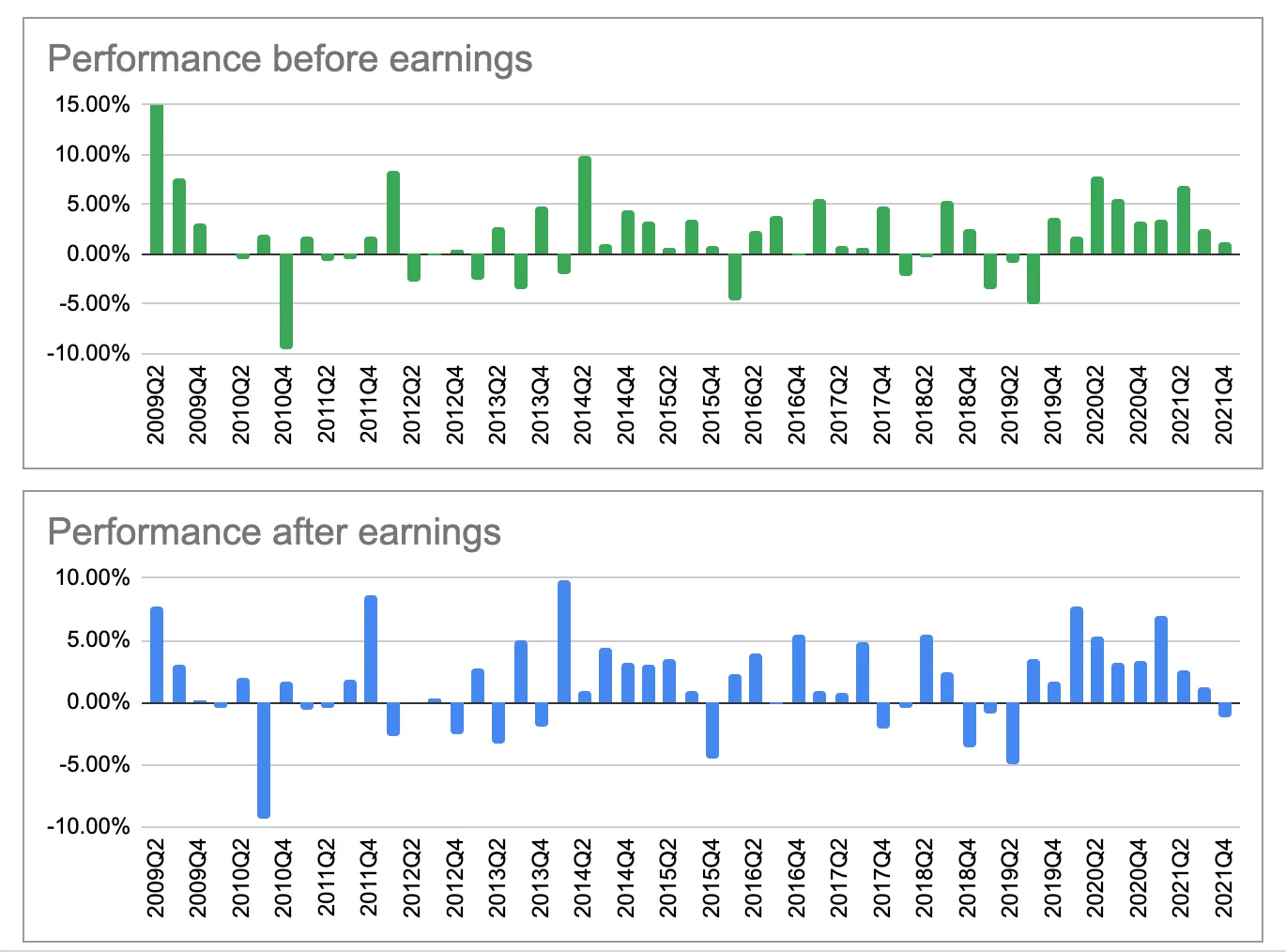

We analyzed the price patterns in Nifty 500 stocks around earnings. We wanted to see if investing in a stock a few weeks or a few after the earnings can be profitable in any scenario.

We checked the performance of the market in three ways:

Performance of all stocks 3 weeks before and after earnings.

We saw that performance of stocks after earnings were somewhat correlated to the earning growth, but not before the earnings.

Performance of stocks with positive earning growth 3 weeks before and after earnings.

We saw that the correlation of stocks after earnings gets stronger. This means stocks that give strong earnings give good performance post-results.

Performance of stocks with negative earnings growth 3 weeks before and after earnings

We saw that the correlation of stocks that have given bad earnings is uncorrelated to the earning growth numbers.

| AllStocks | Positive Earning | Negative Earning | |

| Correlation of growth and pre-earning returns | -0.50% | -0.44% | -1.48% |

| Correlation of growth and post-earning returns | 0.31% | 0.60% | -0.24% |

Note here that the results shown here are based on internal, non-peer-reviewed research.

With these interesting results, we can say that the earnings number does have a correlation with the stock’s performance after the earnings release especially if the earning growth is positive but this correlation is not very strong. Stocks that give negative earnings have a much lower correlation to results.

Obviously correlation is not causation. On the other hand, factors that might be more important are:

expectations in the market before earnings

broader market trends and volatility

management guidance.

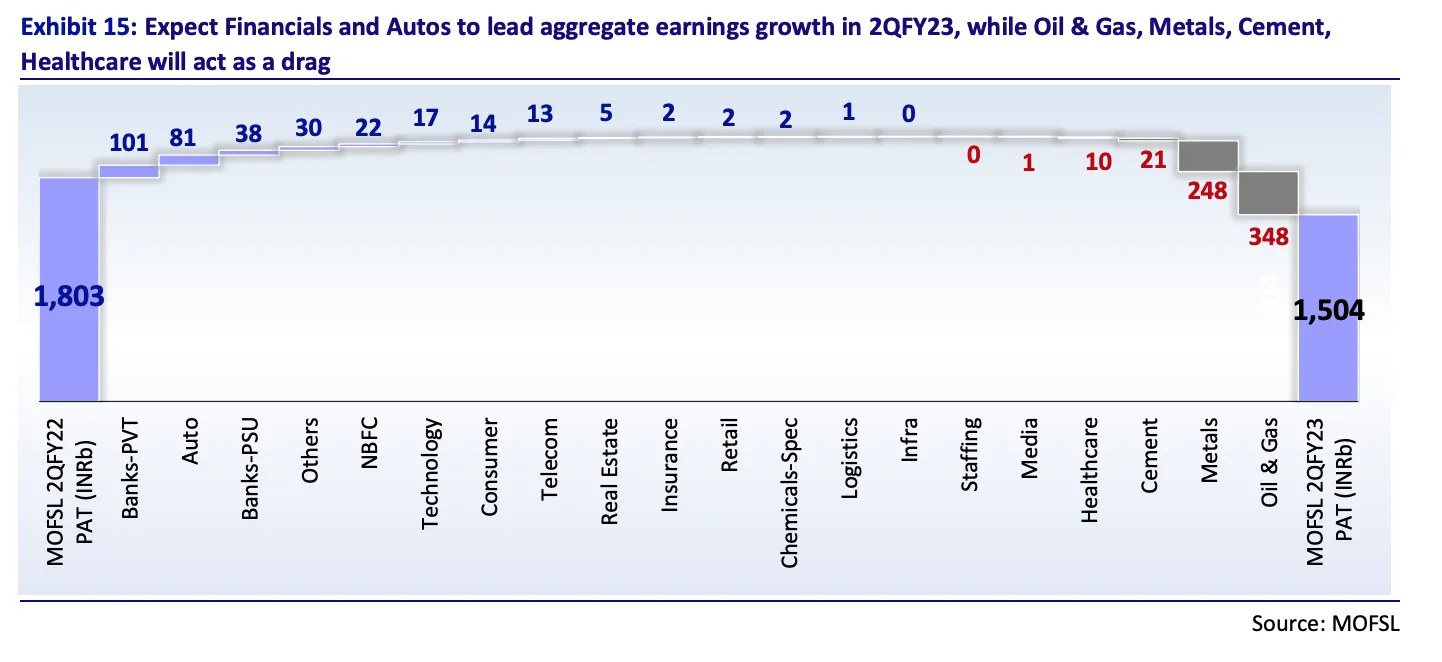

Nifty earnings are expected to remain flat YoY in 2QFY23.

Banking & Financial Services and Autos are expected to post amazing numbers.

The aggregate performance is adversely impacted by a sharp drag from global commodities. Metals and O&G will drag the overall earnings performance.

Apart from Metals & O&G, the earnings will be dragged by Cement and Healthcare.

Sectors focused on domestic consumption/investments are likely to outperform the sectors dependent on global demand/cyclical/commodities.

Many see this quarter as a bottom for declining margins and declining earnings growth.

Financials & Autos are expected to lead the earnings growth while Oil & Gas, Metals, Cement and Healthcare will drag.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart