Is The India–EU FTA Really The Mother of All Deals? How the EU FTA Could Benefit India?

by Siddharth Singh Bhaisora5 min read

Is the India–EU FTA truly beneficial? A detailed breakdown of the India–EU FTA: export winners, import risks, and why EU standards, CBAM and compliance will decide India’s gains.

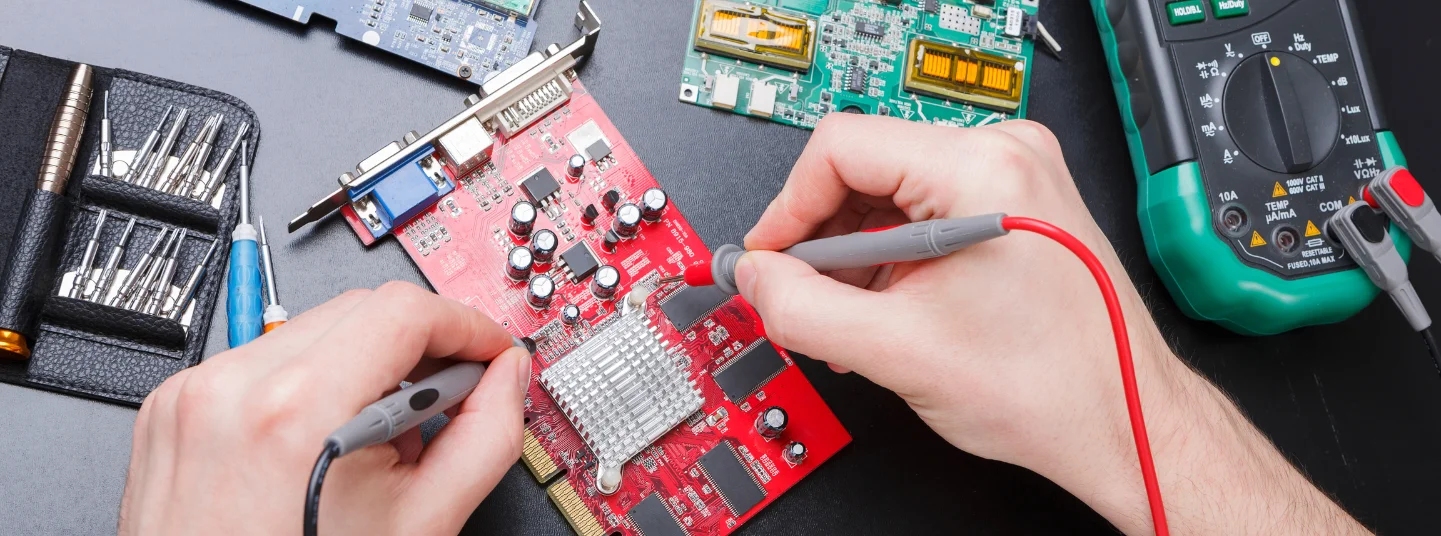

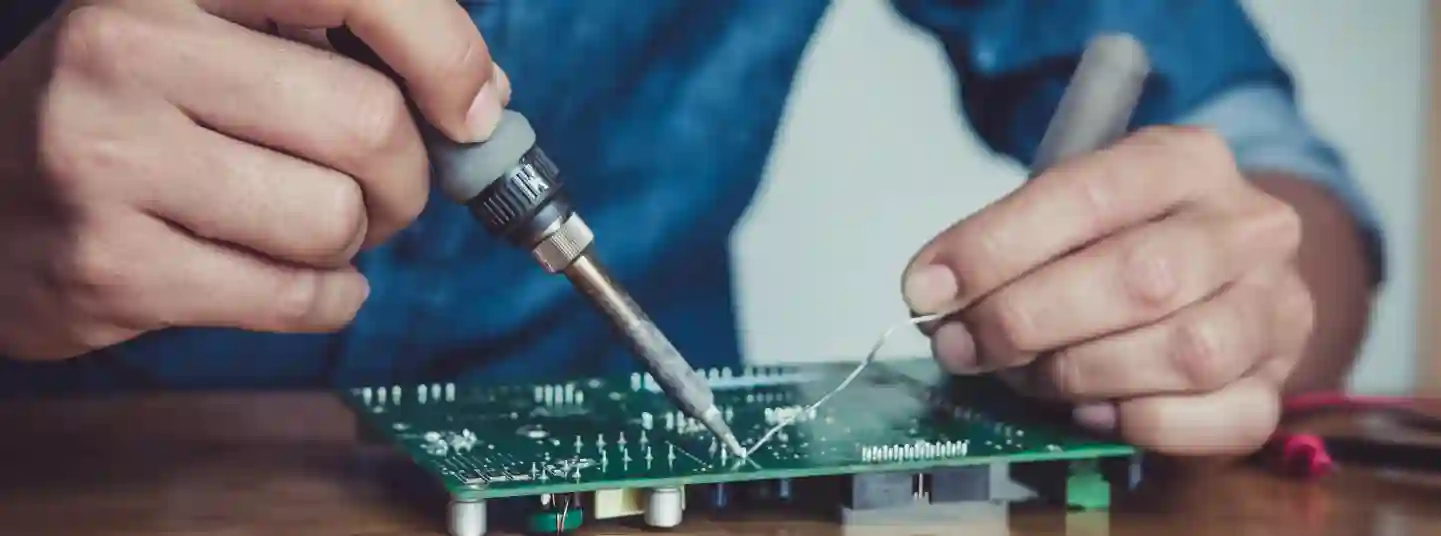

Why The Indian EMS Industry Is Stuck In A Hard Place?

by Siddharth Singh Bhaisora5 min read

India’s electronics output and exports are booming, but EMS firms remain trapped in low margins and high working-capital stress. Here’s why the “assembly-first” model stalls value capture and what it takes to break out.

Mexico Tariffs Impact on Indian Exports in 2026

by Naman Agarwal5 min read

Mexico Tariffs 2026: How New Trade Barriers Could Reshape Indian Exports, Supply Chains, Sectoral Winners, Losers, and Global Competitiveness

Infrastructure Sector Stock Inflow India 2026

by BB5 min read

Learn how rising inflows into India’s infrastructure sector stock may influence growth, valuations, and investor sentiment in 2026.

Semiconductor Manufacturing Investment Opportunity in India

by BB5 min read

Find out how semiconductor manufacturing is shaping India’s next growth wave and the sectors benefiting most from this opportunity.

Indian Wedding Season 2025: When Shaadi Meets Soaring Gold

by Siddharth Singh Bhaisora5 min read

Discover how record gold prices are reshaping the 2025–26 Indian wedding season, from lightweight, design-led bridal jewellery to EMIs and old-gold exchange.

Life Insurance Revival 2025: Impact of GST Waiver on Sector Growth

by Naman Agarwal5 min read

GST waiver triggers a strong comeback in India’s life insurance industry .Explore rising demand, improved affordability, and the major growth drivers reshaping the sector.

Indian Metals Sector Deep Dive Amid Global Gold, Copper and Aluminum Upswing

by Naman Agarwal5 min read

The Nifty Metal Index outpaces the Nifty 50 as strong Q2 earnings, policy support and global rallies in gold, copper and aluminum lift India’s metals market in November 2025.

India: The Next Chemicals Manufacturing Hub

by Siddharth Singh Bhaisora5 min read

Explore why India's chemical sector is becoming a global manufacturing leader. Discover insights into specialty chemicals growth, market opportunities, challenges, and investment potential.

Indian Markets Rebound: Sectors to Watch Amid Global Tariff Easing

by BG5 min read

Indian markets rebound as global tariff easing boosts growth. Check out key sectors to watch for emerging opportunities and economic recovery.

Analyzing India’s Booming $130 Billion Wedding Industry | Wright Videos

by Siddharth Singh Bhaisora5 min read

Explore the Indian wedding industry's rapid growth, worth $130 billion, with insights into luxury spending, destination trends, and investment opportunities. Learn why this evergreen sector is set to thrive in 2024 and beyond.

Understanding the Rise of Luxury Consumption From Affluent India

by Siddharth Singh Bhaisora5 min read

Explore how India’s luxury market is growing at a remarkable pace. Discover the rising growth of affluent India, expanding investments by brands like Dior, Louis Vuitton, and Balenciaga. Learn about shift towards Luxury sector & sectors to benefit from this shift toward premiumisation.

Cyclicals vs Defensive Stocks: Historical Outperformance & Major Sector Rotations in India and US

by Siddharth Singh Bhaisora5 min read

Explore why investors in India and the US are pivoting towards defensive stocks amidst global market uncertainty and policy risks. Learn how cyclical stocks have outperformed in certain periods and how sector rotation is changing in 2024.

The Growth of India's Semiconductor Industry to $110 Billion By 2030

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Explore India's rapid growth in the semiconductor industry, driven by government initiatives and international collaborations. Learn about strategic U.S.-India partnerships, rising semiconductor investments, and the future of semiconductor manufacturing in India.

Top 7 Hotel Stocks in India in 2024

by BG5 min read

Discover the best hotel stocks in India for 2024, as the hospitality industry thrives with rising tourism and increasing disposable incomes. Learn about key hotel players, market trends, and growth opportunities in the booming Indian hotel industry.

Best 8 Travel and Tourism Stocks in India 2024

by BG5 min read

Discover the best tourism stocks in India for 2024 as the travel and tourism sector experiences a robust resurgence. Learn about top tourism companies, tourism market trends, and investment opportunities in the tourism industry.

5 Best Liquor Stocks in India for 2024

by BG5 min read

Explore the top 5 liquor stocks in India to invest in for 2024. Learn about the growth potential of India's thriving alcohol industry, key market players, and factors driving the success of top liquor stocks in India.

Best Ethanol Stocks to Buy in India 2024

by Madhav Agarwal5 min read

Discover the top 10 ethanol stocks in India for 2024. Learn about the growth potential of the ethanol industry driven by government policies, renewable energy focus and investment opportunities in the best ethanol stocks in India.

The Rise of Indian Electronics Manufacturing Industry | Wright Videos

by Sonam Srivastava5 min read

Explore the rapid growth of India's electronics manufacturing sector, now valued at $101 billion in FY23. Discover key production areas, government initiatives, and investment opportunities in the EMS industry.

Top 5 Growing Sectors to Invest in India 2024

by Alina Khan5 min read

Discover the fastest growing sectors in India for 2024 and capitalize on investment opportunities. Learn about the healthcare, renewable energy, IT, real estate, and FMCG sectors, all poised for significant growth due to supportive government policies and market trends.

Earnings Expectation For Sectors In Indian Stock Markets For Quarter 4 FY24

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Anticipated slowdown in earnings momentum across sectors for FY24. Nifty earnings projected to grow 5% YoY in Q4FY24. Explore key insights, sector specific outlooks, and growth forecasts for banking, IT, pharma, real estate, automobile, chemicals, insurance & more.

The PSU Rally: Why are they Soaring and Should You Invest?

by Sonam Srivastava5 min read

Public Sector Undertaking Stocks Boom: Should You Join the Herd or Stay Alert?

Complete Guide to the Indian Telecom Sector and Top Telecom Stocks in India

by Alina Khan5 min read

Examine significant growth of 5G technology globally and its impact on India's telecom sector in 2023 & 2024. Substantial increase in mobile subscriptions, along with Union Budget 2023 enhanced the telecom infrastructure. This has boosted Indian Telecom Sector. Find top telecom stocks in India today

Complete Guide On Investing In Metal Sector Stocks In India

by Alina Khan5 min read

Explore the surge in metal stocks in India – from current trends & driving factors to the impact on the economy. Discover insights & tips for investing in this sector.

Top Small Finance Bank Stocks in India Today

by Alina Khan5 min read

Navigate the World of Small Finance Banks in India: Uncover the transformative role of small finance banks in India's banking landscape, focusing on their mission to promote financial inclusion in underserved areas. Explore top small finance bank stocks and the factors driving their success.

Best PSU Bank Stocks to Buy in 2023

by Alina Khan5 min read

Explore the resilient world of PSU bank stocks in India for 2023. Navigate through our comprehensive guide to discover top picks like SBI and PNB, delving deep into their performance, financial health, and investment potential. Find Top PSU Bank Stocks Today!

Investing in India's New Age Sectors: A Public Stock Market Perspective for 2023

by Sonam Srivastava5 min read

Investing in India's New Age Sectors: A Public Stock Market Perspective for 2023

Small step for ISRO, Giant leap for India - Top Performing Space Sector Stocks of 2024

by Siddharth Singh Bhaisora5 min read

Explore how India's ISRO made history with the successful Chandrayaan-3 mission. India's cost-effective approach is shaking up the global space sector. Find the top space sector stocks in India for 2024, bolstered by the successful Chandrayaan-3 launch. Click to read now!

Q1FY24 Earnings Analysis: Margins expand while Revenue Contracts

by Sonam Srivastava5 min read

Q1FY24 Earnings Analysis: Margins expand while Revenue Contracts

Top Auto Stocks in India 2023: Best Automobile Stocks

by Siddharth Singh Bhaisora5 min read

Revving Up: Indian Automobile Sector Hits the Accelerator in FY23

Indian Banking Sector: A Promising Investment Opportunity

by Sonam Srivastava5 min read

Indian Banking Sector: A Promising Investment Opportunity

Q4 Earnings Outlook: Sector Expectations and Challenges Ahead

by Siddharth Singh Bhaisora5 min read

Q4 Earnings Outlook: Sector Expectations and Challenges Ahead

This week in investing memes

by Sonam Srivastava5 min read

Let’s unwrap the market with some charts and some high-quality memes!

Earnings - Do they even matter?

by Sonam Srivastava5 min read

Earnings release is a huge event every quarter. Let's analyse if that actually matters...

Sectors where Mutual Funds are buying in 2022

by Wright Content Team5 min read

Did you know that tracking the stocks that are being bought by large institutions like Mutual Funds can be a very profitable investing strategy?

Why are FIIs buying into the Indian market?

by Sonam Srivastava5 min read

After months of constant selling from October 2021 to June 2022, foreign institutional investors (FII), are back in love with Indian markets and, to date, have purchased shares worth $ 5 billion.

Is festive season the time to bet on consumption?

by Sonam Srivastava5 min read

Consumer confidence is an economic indicator that measures the degree of optimism regarding a country's economy. Consumer confidence has been picking up in recent weeks.

Rising Interest Rates make Banks Attractive

by Sonam Srivastava5 min read

The banking sector should be at the centre of investor focus right now. Not only is the rising interest rate environment favourable for the banks, but several catalysts make banking extremely attractive

Evaluating Sectoral Performance

by Siddhart Agarwal5 min read

Most sectors in the Indian economy have struggled in the last six months of the bear market, and in these challenging times, the outlook for the sectors changes quickly. In this post, we evaluate the sectoral performance and the outlook.

Sector Rotation Strategy & Business Cycles

by Siddhart Agarwal5 min read

Maximize Returns with Sector Rotation Strategy. Identify stock market sector rotation opportunities in different business cycle phases. Explore Wright Research now.

We don't talk about bear markets, no, no, no

by Sonam Srivastava5 min read

The crash has unnerved everyone! Are we in a bear market? What happens next? How to manage risk? Lets find out

Market Overview - Key Investor Questions

by Sonam Srivastava5 min read

As volatility kicks in to the market with rising inflation in the US and rising Crude prices, we answer some key investor queries

Budget 2022 - Pivot your Portfolio the Wright way!

by Sonam Srivastava5 min read

This is a Capex boosting budget which is prudent in other expenditures as the FM looks to contain the fiscal spending while enhancing growth. Understand how to pivot your portfolio as the market turns green.

Sector Deep Dive: Infrastructure

by Siddhart Agarwal5 min read

The Indian economy relies heavily on the infrastructure industry. This sector is critical to India's overall growth, and the government has placed a high priority on enacting regulations that would assure the country's building of world-class infrastructure promptly

Market Pulse - Deep Dive

by Sonam Srivastava5 min read

There's uncertainty in the equity markets and churn happening from cyclical to defensive sectors. Investor nerves are frayed!

Sector Rotation with Augment Capital

by Sonam Srivastava5 min read

Sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle

Rebalancing your portfolio post-budget: the data-driven way!

by Sonam Srivastava5 min read