The financial landscape of Q1FY24 presents a mixed bag of results. While revenues have shown a slowing trend, the silver lining has been the rescue provided by margins. This post delves deep into the earnings review of Q1FY24, highlighting the key takeaways and sectoral trends.

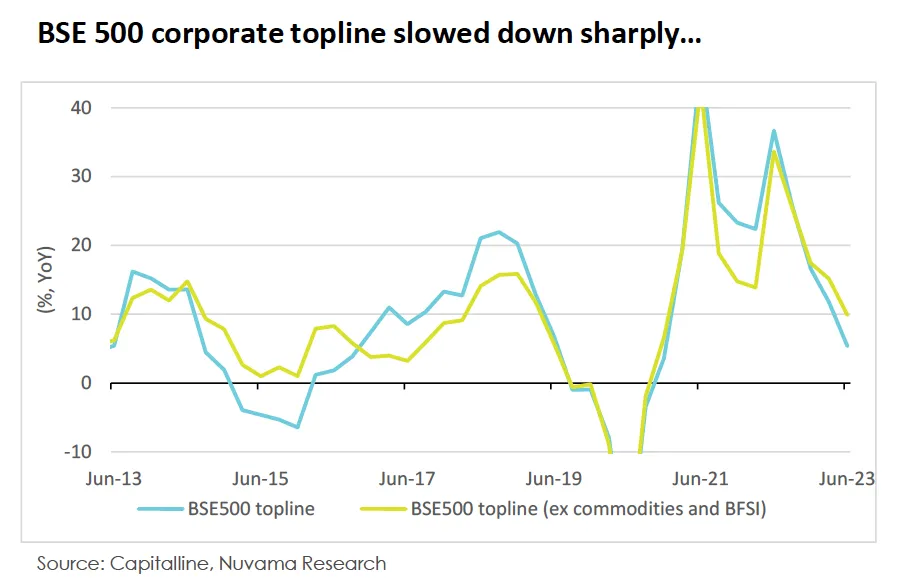

The aggregate Profit After Tax (PAT) has witnessed a commendable rise, swelling by 49% YoY. However, this growth comes with its set of challenges. The topline, which indicates the gross sales or revenues of a company, has been experiencing a slowdown. This deceleration is especially pronounced in sectors with a global orientation, such as IT and chemicals.

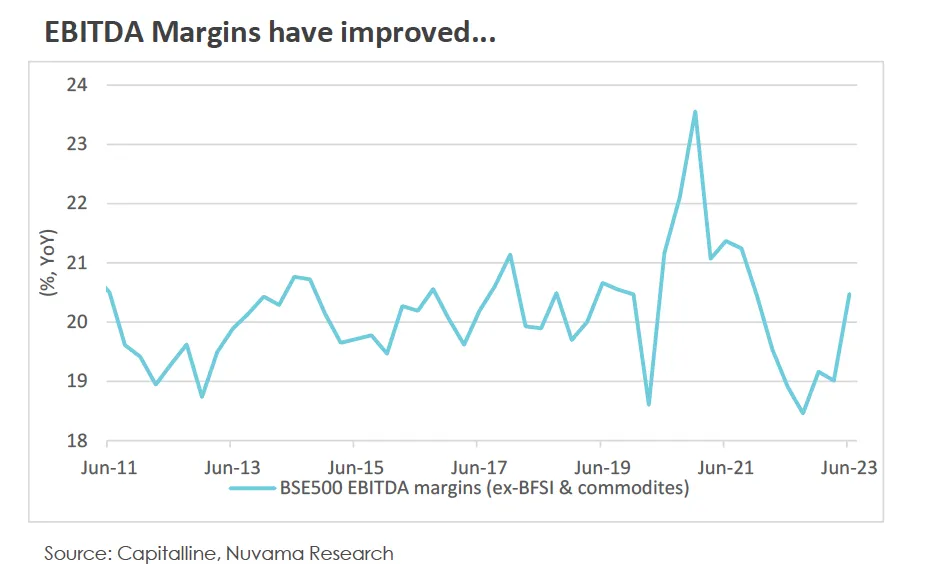

Despite the topline slowdown, companies have managed to maintain their profitability, thanks to improved margins. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins have seen a positive trend. This essentially means that while sales might be slowing, companies are managing to keep their operational profits intact. This boost in EBITDA, despite a topline slowdown, is a testament to the resilience and adaptability of businesses.

Margins across the board have seen an increase. However, there's a looming cloud over demand, especially for discretionary companies and certain service providers. The post-COVID surge seems to be fading, and it remains to be seen how businesses adapt to this changing landscape.

For Domestic Consumption, the Auto (Domestic) sector has shown a robust 17% growth in revenue, a significant 98% surge in EBITDA, and a 94% increase in PAT. The Telecom sector has been a standout with a massive 149% growth in revenue, a 27% increase in EBITDA, and a 52% surge in PAT. The FMCG sector has also performed well with a 13% rise in revenue, a 47% growth in EBITDA, and an 89% increase in PAT.

IT companies have delivered results that can be termed as weak, especially with disappointing growth metrics. The chemical sector too has shown signs of weakness. On the brighter side, the pharmaceutical sector has been robust, particularly in terms of margins.

The Auto (Export) sector has experienced a slight decline in revenue growth by 3%, but has shown resilience with a 38% growth in EBITDA and a 61% surge in PAT. The Chemicals sector has been a star performer with a 20% rise in revenue, a whopping 207% increase in EBITDA, and a 211% growth in PAT. In contrast, the IT sector has faced headwinds with an 11% drop in revenue, a 27% decline in EBITDA, and a 42% decrease in PAT. The Pharmaceuticals sector has remained stable with an 11% growth across revenue, EBITDA, and PAT.

Oil Marketing Companies (OMCs) have staged a strong recovery. However, metal companies continue to face challenges, with most seeing a slight increase in debt to manage their working capital requirements.

In the Commodity Sector, the Oil Marketing Companies (OMCs) have shown a decline in their revenue growth by 7% YoY, both in actual and estimated figures. However, they've managed to boost their EBITDA by 30% and their PAT by 45%. The Energy sector, excluding OMCs, has seen a decline in revenue growth by 8%. Metals & Mining, another significant player in the commodity sector, has faced challenges with a 9% decline in revenue, a 12% drop in EBITDA, and a 22% decrease in PAT.

The banking sector, which had a golden run in FY23, might be seeing the end of its profitable phase. While credit growth remains strong, Net Interest Margins (NIMs) have contracted.

In the BFSI sector, Private Banks have shown a 17% growth in revenue and a 19% increase in EBITDA, but have faced challenges with a 71% decline in PAT. PSU Banks have remained stable with minor growth across revenue, EBITDA, and PAT. NBFCs have shown a 17% growth in revenue, a 34% surge in EBITDA, and a 30% increase in PAT.

In the realm of Domestic Investment, the Power sector has shown a promising 17% growth in revenue. Engineering & Capital Goods have seen a 24% surge in revenue, an 18% increase in EBITDA, and a 14% growth in PAT. The Cement sector has remained relatively flat in revenue but has managed to boost its EBITDA by 13% and PAT by 6%. The Construction and Real Estate sector has been a strong performer with a 26% rise in revenue, a 26% growth in EBITDA, and a 37% surge in PAT.

The topline slowdown is a concern that can't be ignored. A significant number of companies are now reporting a contraction in their topline. This trend is worrisome, especially when compared to pre-COVID peaks. If this continues, it could potentially impact margins and the overall profit outlook.

Real estate sales and industrial companies' order books have shown strength. The real estate sector, in particular, has seen a growth of 13% in Q1FY24, continuing the post-COVID momentum. However, with weakening exports and consumption, there are concerns about the sustainability of this growth.

Different sectors have shown varying sensitivities to topline and margins. While some sectors are more sensitive to topline, indicating that their profitability is closely tied to their sales, others derive their valuations more from their margins. Understanding this dynamic is crucial for investors and stakeholders to make informed decisions.

The Q1FY24 earnings landscape offers both challenges and opportunities. While the topline slowdown is a concern, improved margins provide some solace. As businesses navigate this mixed scenario, adaptability and resilience will be the keys to sustained growth.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios