The Indian banking sector, a significant driver of the nation's economy, has experienced considerable growth and transformation in recent years, thanks to digitalization, regulatory reforms, and evolving consumer behaviors.

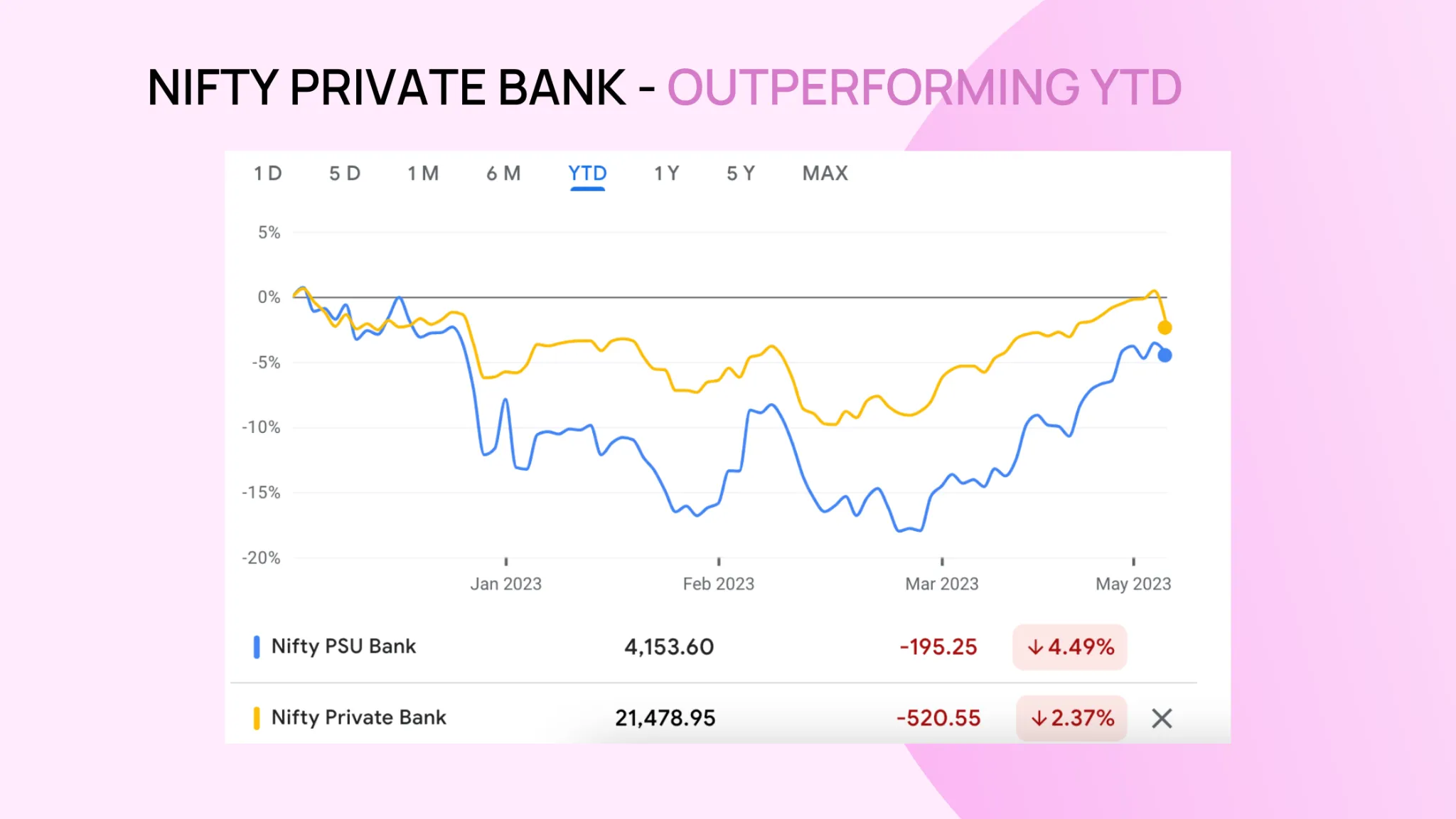

Last year, public sector banks (PSBs) emerged as the winners, but this year, private banks are taking the lead. Are you contemplating investing in Indian banks?

This article will discuss whether it's the right time to invest, the private vs. public bank debate, the current status of HDFC Bank, top banking picks, and the key opportunities and challenges in the sector.

It appears to be a good time to invest in the banking sector, as it currently stands out in terms of earnings and growth potential. Several factors contribute to this assessment:

Favorable Price-to-Earnings (P/E) Multiple: The banking sector is not very expensive on a P/E multiple basis, making it an attractive investment opportunity.

Strong Earnings Growth: The growth of corporate India for the quarter ended March 2023 is expected to be driven by banks. This is a result of the due diligence in terms of fresh assets and non-performing assets management that banks have undertaken over the last 4-5 years.

Sustained Net Interest Margins (NIMs): Although there were views that the March quarter numbers would be the peak for NIMs, the current situation suggests that the banks' NIMs might be sustainable moving forward.

Potential for Improved Credit Demand: If interest rates do not increase or start to decline, the possibility of credit demand may improve, benefiting both banks and other financial institutions in the lending space.

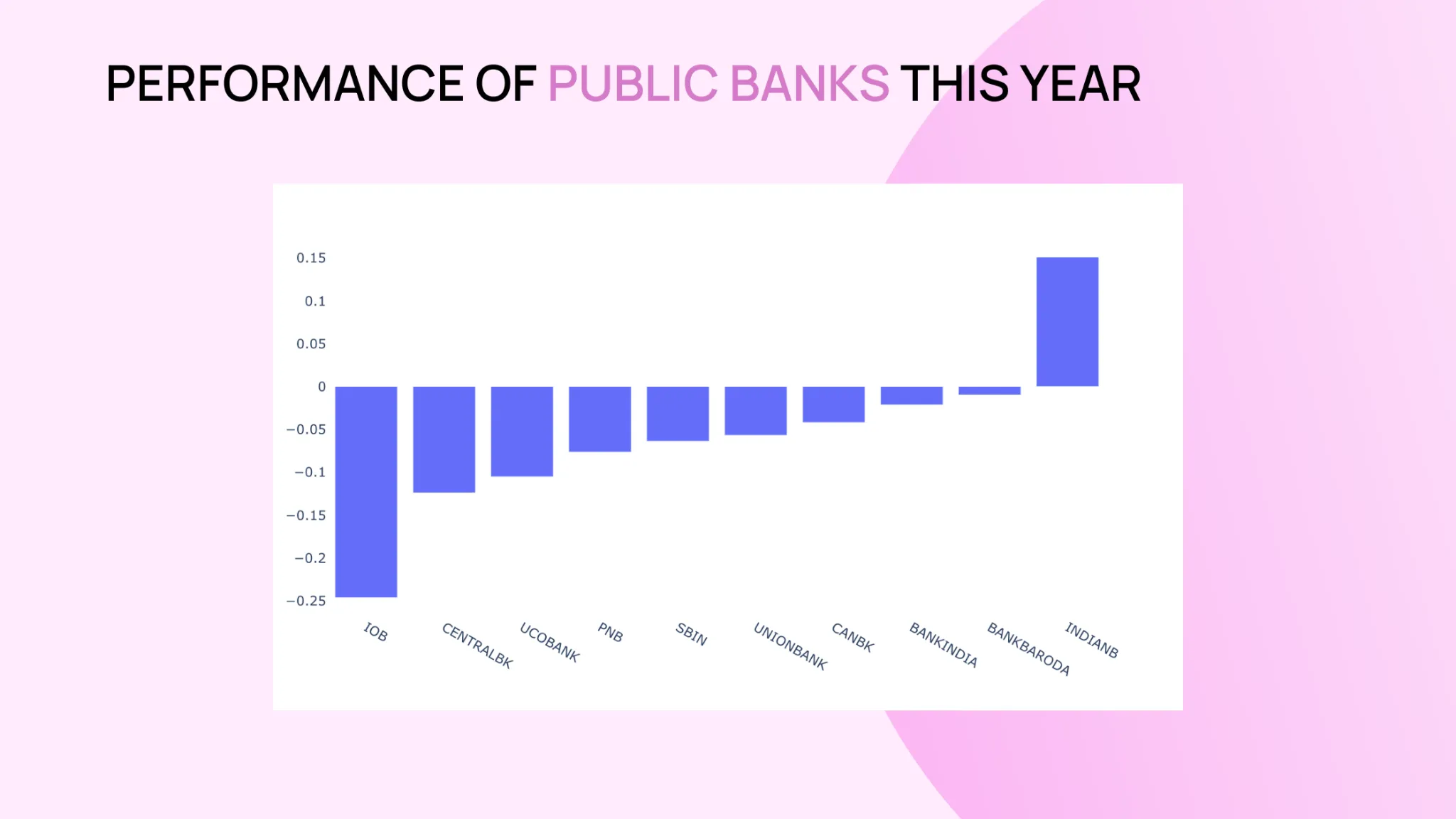

Improved Performance of Public Sector Banks: Several public sector banks have shown improved results in the last 6-8 quarters, with spreads net of credit cost being quite decent. Some of them have great brands and are comparable to private sector banks in terms of maintaining their CASA ratio.

Choosing between private and public banks depends on various factors such as risk tolerance, investment objectives, and the banks' performance. Private banks have traditionally outperformed public banks due to efficient management and customer-oriented services. However, public banks, backed by government guarantees, offer stability during economic downturns.

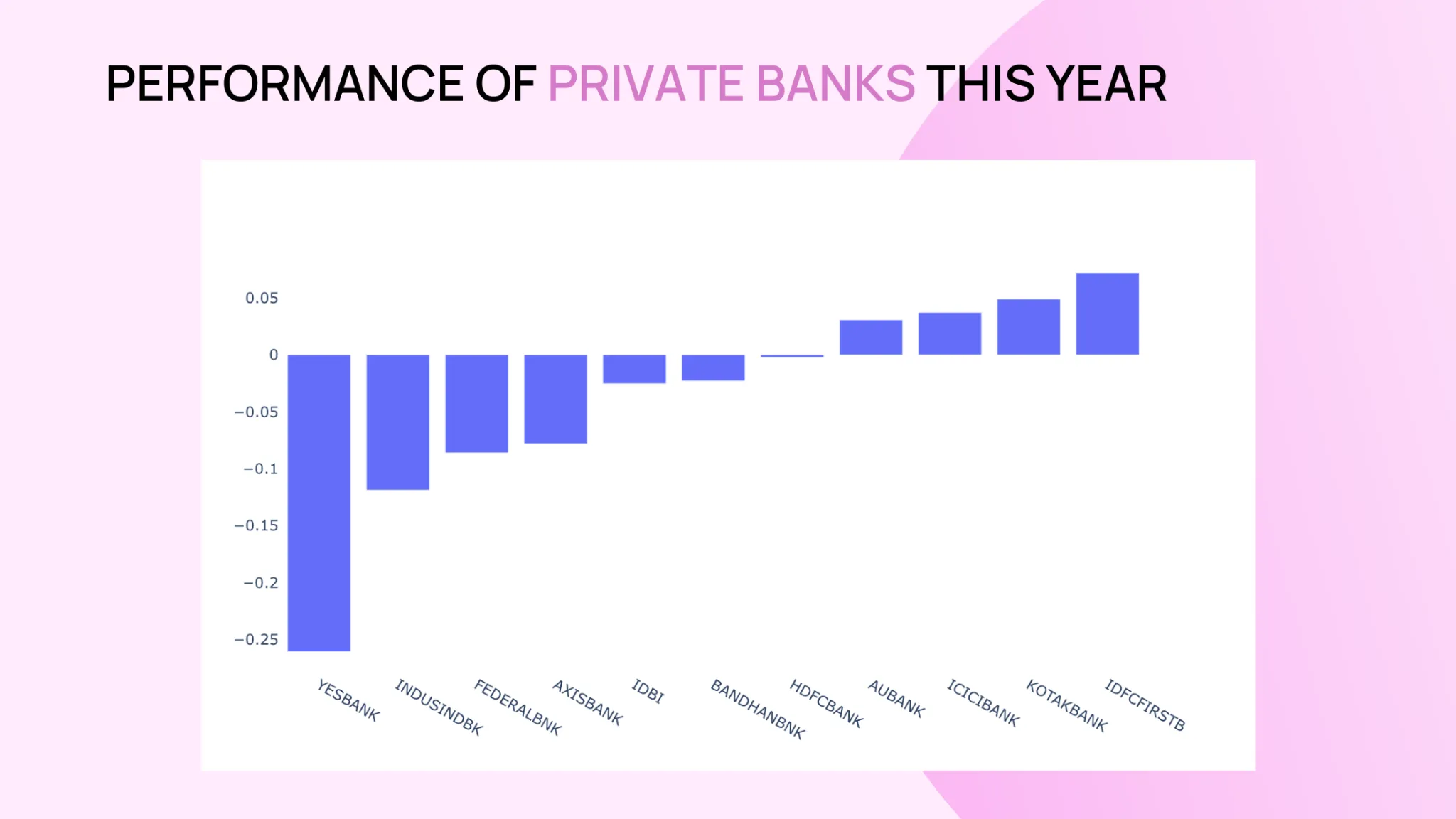

In the current scenario, private banks are the preferred choice due to their stronger growth prospects, better margins, higher credit quality, and effective use of technology. Top picks in this space include Kotak Mahindra Bank, HDFC Bank, and ICICI Bank. Remember to consult a financial advisor before making any investments and consider your investment goals and risk tolerance.

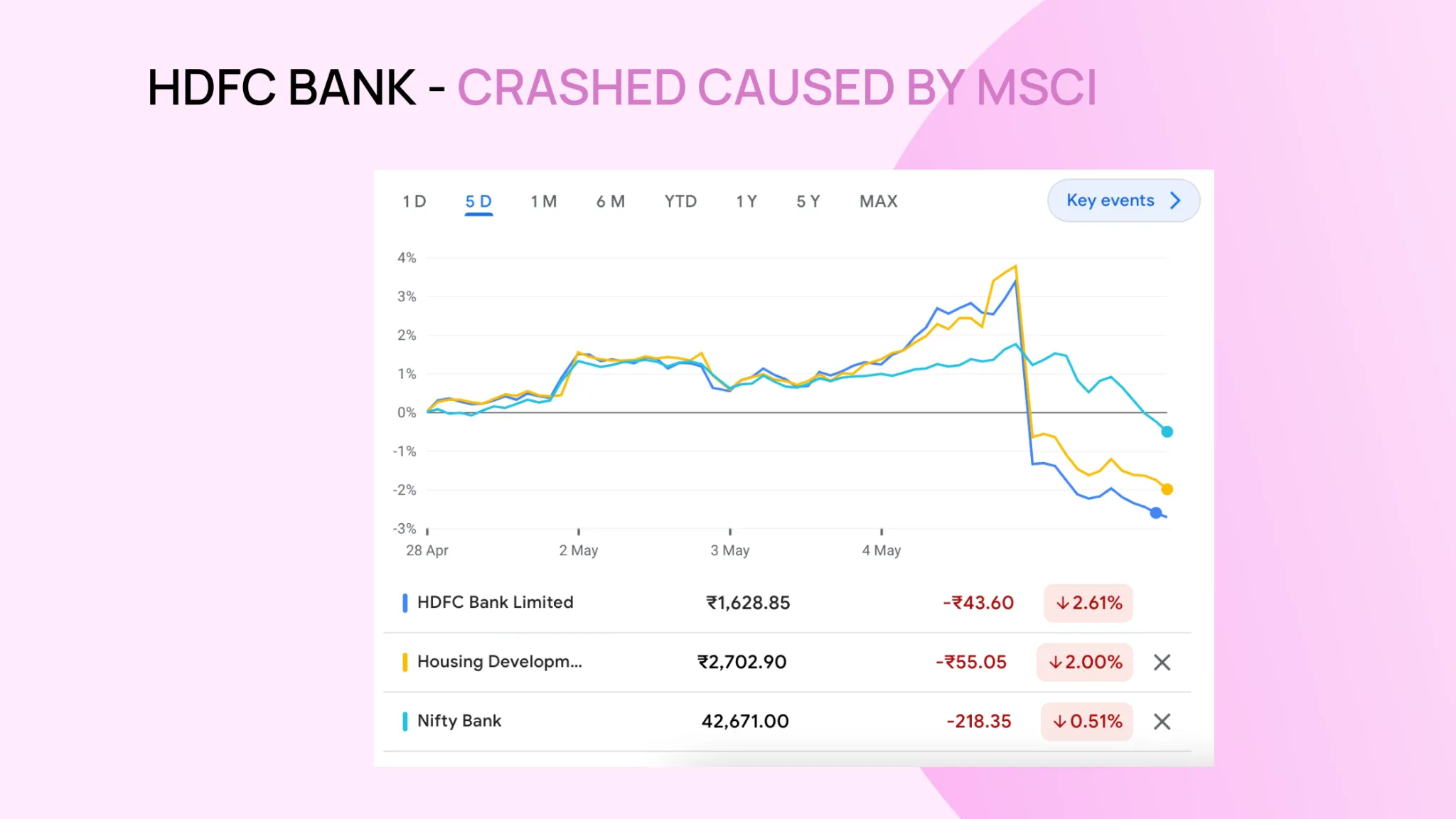

The recent MSCI notice has significantly impacted HDFC Bank, causing a decline in its share price. Contrary to earlier expectations that the merged HDFC and HDFC Bank entity would command double the current weight in MSCI, the index provider has adjusted the factor to 0.5x, resulting in a similar weight. This change could lead to an outflow of around $150-200 million, as opposed to the previously anticipated $3 billion inflow.

Despite HDFC Bank's recent decline, IDFC First Bank, ICICI Bank, and Kotak Mahindra Bank continue to lead the private banking sector in terms of performance. On the other hand, public sector banks have lagged this year but have shown a strong recovery in recent months.

Investing in the Indian banking sector also comes with its challenges, including managing Non-Performing Assets (NPAs), ensuring cybersecurity, navigating complex regulations, and staying competitive in the face of fintech companies, payment banks, and small finance banks. Other challenges include financial inclusion, human resource management, and growing unsecured loans.

Despite these challenges, the Indian banking sector holds promising opportunities for investors, thanks to its innovative and adaptive nature. As the economy shows signs of recovery and the banking sector evolves, it is essential for investors to stay informed and make strategic investment decisions. By carefully assessing the performance, risks, and growth potential of banks, investors can tap into the lucrative prospects of this sector.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart