by Siddharth Singh Bhaisora

Published On Aug. 24, 2023

ISRO's Chandrayaan-3 mission successfully delivered a lander called Vikram and a rover named Pragyan to the Moon's south pole. ISRO and India deserve all the glory, accolades and this marks a critical juncture in our space exploration endeavors. We became the 4th nation to safely land a robotic explorer on the Moon and the first to achieve a landing near the Moon's largely unexplored south pole, a location that holds untold scientific potential. With its relatively low-cost approach to space missions and increasing technical capabilities, India is poised to become a major player in the space sector.

Landing on the Moon is fraught with challenges. This accomplishment is especially significant given that it is a second attempt. The Chandrayaan-2 mission failed in 2019 due to issues in its flight software, making this redemption all the more poignant. More recently, Russia’s space agency, Roscosmos, had launched the Luna 25 lander on a mission to beat India and be the first to Moon’s south pole. However, an ill-fated orbital maneuver led to the probe's crash, serving as a reminder of the complexity involved in lunar expeditions. Chandrayaan-3 is a spectacular feat because -

Soviet Union's first 11 attempts to land a spacecraft on the moon were mostly failures

10 lunar landing attempts since 2013, only three had succeeded with the 4th being Chandrayaan-3. Countries involved in these modern attempts include China, India, Israel, Japan, and Russia

Of the 113 lunar missions over the last 70 years, 63 are successful, 42 failed and 8 achieved partial success

Resurgence of interest in space exploration has, in part, been inspired by industry leaders like Elon Musk, Jeff Bezos, Richard Branson and others. Musk’s SpaceX has achieved remarkable milestones in a very short span of time. With its ambitious Starship project, aimed at launching satellites and ferrying NASA astronauts to the Moon under a $3 billion contract, SpaceX is setting new benchmarks for what is achievable. India, too, seems to be drawing inspiration from such visionaries, accelerating its own space endeavors at an unprecedented pace.

As nations like Russia fail in similar endeavors, India's success marks an important milestone not only for the Indian Space Research Organization (ISRO) but also for the future of global space exploration and also for boosting the Make in India (Atmanirbhar Bharat) theme .

It's hard to overlook the budgetary efficiencies demonstrated by ISRO. The mission was expected to cost around ₹6.1 billion (US$ 74 million) - the mission was delayed by about 2 years, so latest budget numbers could be higher. Let’s look at the budget of a few films and infrastructure projects for comparison -

Adipurush was made for ₹700 crore - 12% more than the cost of Chandrayaan-3

Christopher Nolan’s 2014 blockbuster movie 'Interstellar' cost $165 million to make - 2x the budget of Chandrayaan-3

Mission Impossible starring Tom Cruise cost nearly ₹2,400 crore to produce - 4x the cost

29.6 km long Dwarka expressway is being built at a cost of ₹9,000 crores - 14.5x the cost

Here’s a quick comparison of the budgets and programs of other lunar and space missions.

NASA’s Commercial Lunar Payload Services (CLPS) program has a maximum budget of $2.6 billion over 10 years. 14 companies are competing for mission contracts, each typically worth upwards of $70 million

NASA’s annual budget for 2023 stands at $25.4 billion compared to ISRO’s modest $1.6 billion

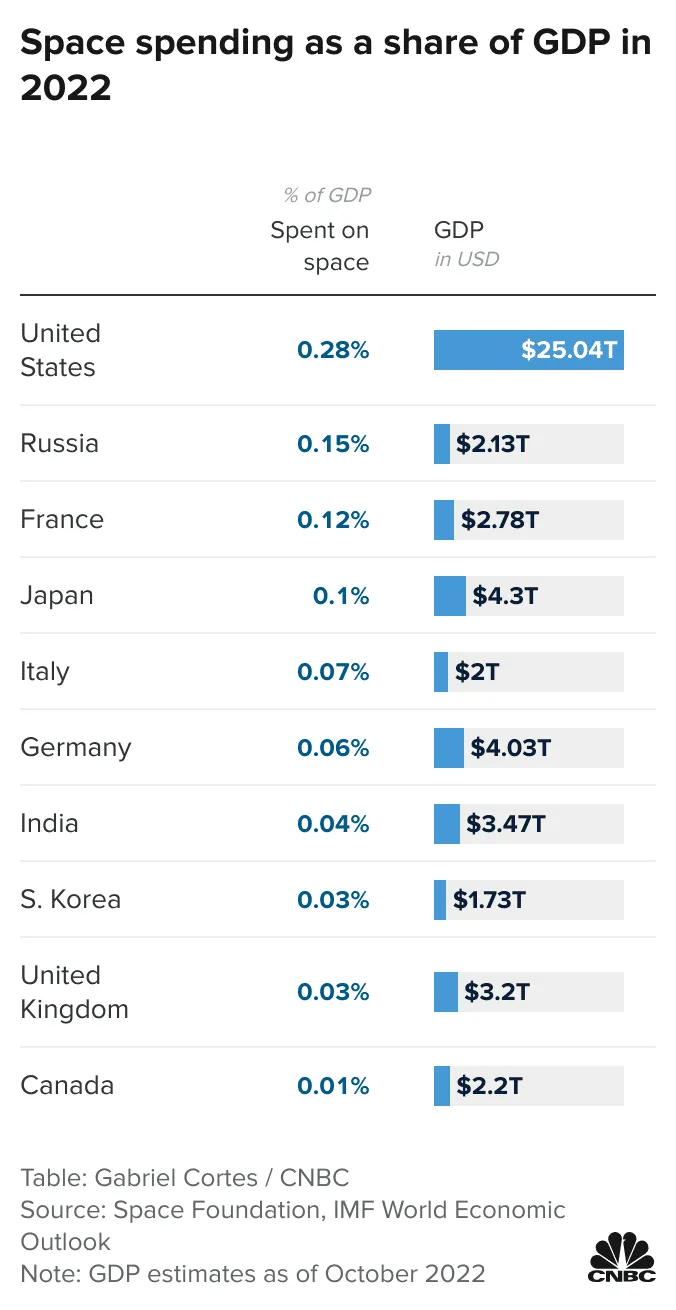

In terms of GDP allocation, the U.S. spends 0.28% of its GDP on space activities, far ahead of India's 0.04%, yet ISRO manages to make strides with its cost-effective approach.

NASA's Artemis moon program, which plans to return astronauts to the moon preparing humans for missions on Mars, is projected to cost about $93 billion through 2025

Russia’s Luna 25, which crashed a few days back, cost Rs. 1,600 crores

Surprisingly, Chandrayaan-3 was cheaper than even its predecessor Chandrayaan-2 which cost Rs. 978 crore.

Here’s the GDP allocation towards space activities by countries -

Former ISRO Chairman Dr. K. Sivan explained that the cost-effectiveness comes from strict vigilance at every stage of spacecraft development, multiple uses of PSLVs, and priority given to producing critical components domestically. Additionally, ISRO benefits from a skilled workforce that, despite being world-class, earns less than their international counterparts.

However it is important to note that launching manned missions such as Artemis Moon program will naturally be more expensive. NASA officials also point out the difference in the scale of budgets is a reflection of the "different level of capability" that the U.S. agency offers.

India currently contributes 2-3% to the global space economy. India's ability to operate at a fraction of the cost could make it an attractive partner for international collaborations. If India can continue to pull off cost-effective space missions, it might find itself in a favorable position in the global space economy. By positioning itself as a cost-effective satellite launcher, spin-off technologies and services that have commercial applications, and even going beyond to creating new space technology, India could contribute 8-10% to the global space economy over the next 10 years, creating opportunities for public and private investment.

One of the most compelling aspects of India’s space program, as highlighted above, is its cost-effectiveness. This frugality is part of a broader trend in India, which produces critical components domestically and employs a highly skilled workforce at relatively lower costs.

BRICS Summit: Prime Minister Narendra Modi celebrated the mission's success at a BRICS summit, subtly highlighting India's growing influence on the global stage

Russia's Decline: Roscosmos has been struggling with a series of unsuccessful missions and underfunding. It is also reliant on outdated space technology. Finally, also consider the ongoing sanctions and economic issues for Russia

Collaboration with Major Space Powers:India's strategically aligning itself with other major space-faring nations benefiting from their experience to exponentially jump the learning curve. Here are a few knowledge sharing collaborations India is taking part in -

With new draft policies aimed at deregulating the space industry and encouraging private participation, India is creating a fertile ground for cutting-edge space technologies strengthening the Atmanirbhar Bharat (Make in India) vision . There are around 140 startups focusing on the space sector in India.

Investment in Startups: Pixxel, a startup building earth observation satellites, received a $36 million investment from Google

Commercial Satellite Launches: India’s homegrown rockets are now launching satellites on commercial terms for companies like OneWeb and countries like Singapore, demonstrating a maturing private space sector

Draft policies focus on space communication, navigation and remote sensing

Chandrayaan-3 mission paves the way for future economic activities in space. We are already seeing rocket power focused startups springing up and we can continue to expect a surge in companies seeking to leverage India’s technological capabilities to generate economic output in space.

Moon Mining and Mars Missions: The mission’s success also opens the door to more ambitious projects like lunar colonies and mining operations, areas ripe for public-private partnerships and foreign direct investments

Human Spaceflight: The next frontier for ISRO is human spaceflight, where India lags behind. Work has begun on the Gaganyaan mission which will take people into orbit. This is yet another avenue for investments

India’s openness to collaborate on space missions: As the U.S. and Europe make plans for long-term lunar activities, India has already begun strategically positioning itself to collaborate and advance its space technology

India opened the Space Sector for private companies in 2024. The global market is sized at around $447 billion with India contributing just 2-3% to the global market. Since the successful launch of the Chandrayaan-3 and in anticipation of the moon landing, stocks of 13 firms across sectors ranging from aerospace to software which contributed to the space mission increased in value, adding more than $2.5 billion in market value.

Investing in ISRO related stocks in India has gained popularity as the country's space agency, ISRO, continues to achieve significant milestones in space exploration and satellite launches. ISRO related stocks in India include companies involved in satellite manufacturing, launch services, and ground support equipment. These companies benefit from ISRO's increasing number of missions and collaborations with international space agencies. By investing in ISRO related stocks in India, investors can capitalize on the growth potential of the space industry, which is expected to expand rapidly in the coming years. Keeping an eye on ISRO related stocks in India can provide exposure to a high-growth sector driven by technological advancements and government support. Here are the top space sector stocks orISRO related stocks that performed well before and during the launch of Chandrayaan-3:

AVANTEL: Avantel has carved a niche in creating radio components and distinctive products including Satellite Communications, HF Communications, Electronic Warfare, and Radar systems. It is creating SCA-compliant Software Defined Radios, High Power HF systems, Air Defence Radars, and Small Satellites. It supplies strategic solutions to the Indian Defence Services (& associated entities), Boeing, DRDO, L&T, Bharat Electronics, National Institute of Ocean and Technology, and ISRO. Avantel is up 8% today (24-08-2023), having given 396% over the past 1 year and 1634% over the last 5 years.

In the space sector, the fastest growing segment that is expected to see significant private participation is the satellite launch service. Avantel is a microcap and has a market cap of just Rs. 20.5 Billion. And it has been especially active in the fast-growing satellite launch services and small software defense radios segment. Avantel’s capabilities and in-house R&D facilities are even certified by the Government of India, Department of Scientific and Industrial Research. Given its established track record and robust balance sheet, Avantel stands well-positioned to capitalize on opportunities in the aerospace and defense sectors and makes it one of the top space sector stocks to watch in 2023.

L&T: L&T has been a significant player in India's growth having spread itself across segments - from semiconductors, infrastructure, green hydrogen, 5G telcom, to space endeavors. Having contributed to multiple missions like Chandrayaan-1 and 2, Gaganyaan, and Mangalyaan, the conglomerate has supplied critical components such as middle segments and nozzle bucket flanges, flight umbilical plates etc. for the Chandrayaan-3 mission. It was fully involved in the Chandrayaan-3 moon landing mission - working on everything from manufacturing of subsystems to mission tracking. L&T has grown by 42% in the last 1 year and 100% over the last 5 years.

In 2022, HAL and L&T’s joint venture also won a Rs.8.6 Billion order to build 5 end-to-end polar satellite launch vehicle rockets. It is also supposedly in talks with Blue Origin (Jeff Bezos owned) to supply orbital launch capabilities. This established its credentials in multiple technological arenas, making it one of the top space sector stocks to watch in 2023.

CENTUM: Centum Electronics manufactures and provides subsystems, microelectronics and system integration services. It was a critical electronics industrial provider for ISRO having provided over 200 mission critical modules and systems for the moon landing mission. Centum Electronics is up 9% today (24-08-2023). Over the last 1 year it has given 306% return and 384% over the past 5 years.

LINDEINDIA: A 75 year old company, Linde India, manufactures and distributes industrial gases such as oxygen, hydrogen, nitrogen, argon etc. It also distributes electrodes, welding equipment, liquid oxygen explosives etc. The stock surged by over 17% in the last 5 days, giving 74% over 1 year and 1,315% over the past 5 years. Notably, yesterday Linde India also secured a letter of acceptance from IOCL (Indian Old Corporation Ltd.) for setting up an Air Separation Unit in Panipat.

HAL: Hindustan Aeronautics Limited (HAL) is an Indian Government owned defence and aerospace company which designs, develops, manufactures and supplies helicopters, avionics, communication equipment, aircrafts and more for military and civil markets. HAL and L&T’s joint venture also won an order to build 5 end-to-end polar satellite launch vehicle rockets. HAL saw a year-high increase, rising 3.5% yesterday (23-08-2023). HAL gave a return of 80% in the last 1 year and 345% over the last 5 years.

HAL has inaugurated a facility that manufactures end-to-end rocket engines for ISRO, boosting India’s self-reliance capability for manufacturing high-thrust rocket engines.

MIDHANI: Mishra Dhatu Nigam specializes in high-strength steel, titanium alloys, superalloys, and special-purpose metals essential for rockets and satellites. It played a pivotal role for India's 3-stage heavy lift launch vehicles used in lunar missions - developing and providing key cobalt, nickel, titanium alloys among other special steel components. Mishra Dhatu Nigam has given 4% in the last 5 days. On a 1 year horizon, the stock has given 109.75% return and generated 167% return over 5 years.

The space segment alone accounts for 30% of the company's order books, with aero accounting for 10%. It continues to get queries and export orders. The primary challenge is in execution which can be seen with a few delays for space technology sector related projects.

DATAPATTNS: Data Patterns is unlike the large defence giants in the market. The company offers an array of services across defense and aerospace platforms. Starting out by supplying small satellites, Data Patterns has made considerable progress in the space sector. It's not just involved in making small satellites, but has provided cable harness health checkout and other systems to ISRO's Gaganyaan mission. Data Patterns increased by 6.5% over the last 5 days. It has given 170% return in a 1 year horizon and 216% return over 21 months.

Complete vertical integration across defense and areospace electronics solutions, along with proven in-house design competencies, development capabilities and healthy order inflows provides strong long term revenue growth and visibility.

WALCHANNAG: Walchandnagar Industries offers comprehensive EPC (engineering, procurement and construction) solutions and has been a vital contributor to India's defense and aerospace sector. Involved in multiple missile programs (qualified for 4 programs in 2023 and has qualified for a total of 10 under DRDO) and key ISRO projects like Gaganyaan, Walchandnagar Industries has demonstrated its versatility and capability in aerospace and defense technologies. With regards to the Chandrayaan-3 moon landing mission, Walchandnagar Industries manufactured and proof pressure tested 4 of the 6 booster motors which were critical to the first stage of the mission. Notably, Walchandnagar Industries has manufactured and been involved in all 48 launches starting from the first launch of PSLV-D1 in 1993.

While, the stock has grown by nearly 80% in the last 1 year over a 5 year horizon the stock has given negative returns of upto 30%. It is a smallcap company and while it has performed well this year, its a stock that investors should keep a close eye on and analyse further.

BHEL: Bharat Heavy Electrics (BHEL) is a central public sector undertaking which is India's largest government-owned power generation equipment manufacturer. For the Chandrayaan-3 mission, BHEL’s Welding Research Institute (WRI) was lauded by ISRO’s Liquid Propulsion System Centre (LPSC) for its expertise in producing bi-metallic adaptors. These adaptors were part of the cryogenic stage in the LVM-3M4 flight for Chandrayaan-3. Besides, BHEL was also responsible for the mission's batteries and the supply of Titanium tanks, playing a multifaceted role in the mission.

Over the last 5 days the stock has risen by 7.5%. It has performed significantly over a 1 year horizon, delivering 87% returns. On a longer horizon of 5 years, the stock has given only 33.56%.

PARAS: In 2020, the Department of Space (DoS) and NewSpace India Limited (NSIL) inked an MoU to transfer commercializable ISRO-developed technologies to public and private sectors. Paras Defence and Space Technologies has been instrumental in this endeavor, making significant strides in the space sector. It has given 13.7% return over the last 5 days. While the last 1 year has been turbulent for the stock having grown only 21%, since its listing 22 months ago, the stock has grown 56%, but is yet to touch its post IPO listing all time high of Rs. 1,198.

Based on the Q1 FY23 results, while it’s Q1 margin decreased due to higher employee costs as a result of investing in manpower, which they expect to drive future growth. The company’s annual profit margin forecast remains unchanged at 30-40%. Their current order book value exceeds Rs 650 crore, with potential opportunities surging above Rs 2,000 crore. The drone business is expected to generate Rs 100 crore revenue by FY25. Today it comprises less than 5% of the total order book. Finally, while the company's current focus is on domestic ventures, exports might emerge as a natural progression in the coming years.

2023 marks a watershed moment for India's burgeoning space industry, a sector once dominated by government entities. With India's historic Chandrayaan-3 mission providing a significant tailwind, the stocks of various companies, ranging from traditional aerospace firms like L&T and HAL to emerging players like Avantel and Data Patterns, have witnessed remarkable uptrends, largely because of their specialized focus in niche categories within the space sector. Similarly, established conglomerates like L&T have solidified their standing by contributing to multiple space missions, including the Chandrayaan-3.

However, it's essential to approach such currently trending and top space sector stocks with a balanced perspective. As noted, for many of the larger companies, their involvement in space missions, while sentimentally positive, still represents a relatively small part of their overall revenue streams. Companies like Larsen & Toubro, HAL, and BEML may see short-term stock upside due to the successful mission, but it would be premature to expect mass production of Chandrayaans affecting their long-term valuation significantly. Small cap and microcap companies such as Walchandnagar or Avantel, respectively, have seen strong growth over the last 1 year, but they also pose much high risk. Another category we will discuss at a later point would be the unlisted companies and the startups in the space technology sector - there is immense potential for disruption with companies that are willing to take a chance.

What is undoubtedly clear, though, is that the Indian space sector has hit a critical mass of both technological capability and market interest. It is not just Indian missions that may benefit; other countries may also look to utilize India's burgeoning space expertise. This broadening scope of opportunity makes the space sector an exciting space to watch.

Explore the Wright New India Smallcase.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Full disclosures here.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios