Investing in the top performing sectors for the next stage of the economic cycle

Strategy

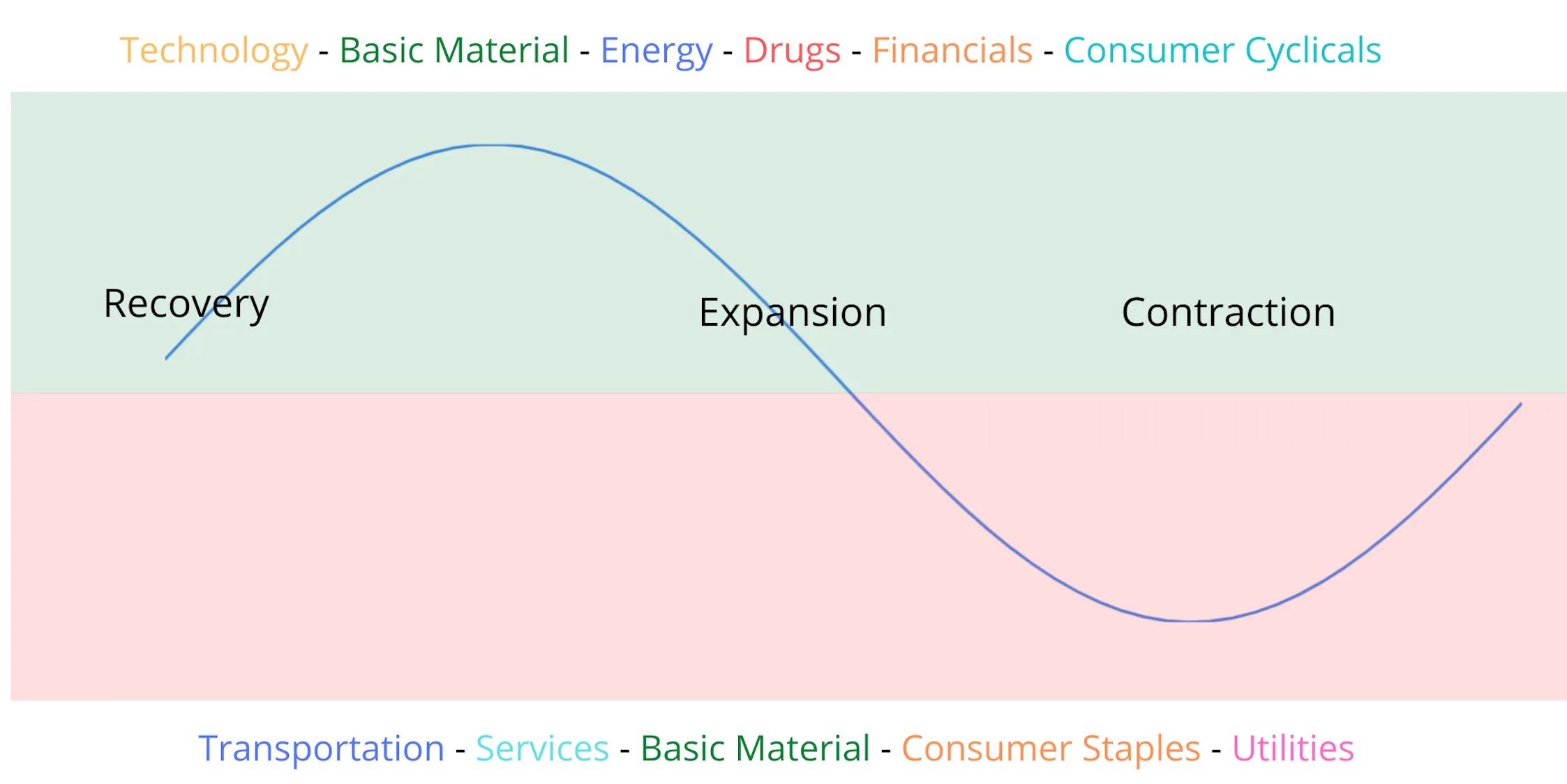

Sector rotation is an investment strategy where one moves money invested in stocks from one industry to another as we anticipate the next stage of the economic cycle.

The economy moves in reasonably predictable cycles and there is a specific set of sectors that dominate a given market cycle. While cyclical stocks do well when the economy is growing, the defensive stocks outperform in riskier markets.

With the sector rotation strategy we aim to take advantage of the cyclical nature of sector outperformance and allocate to most suitable sector for the given phase of the business cycle.

Benefits

Approach

Business Cycles & Sectors

The economy moves in reasonably predictable cycles and there is a specific set of sectors that dominate a given market cycle. While cyclical stocks do well when the economy is growing, the defensive stocks outperform in riskier markets.

We select sectors based on valuation, dividend yield & trend based filters. We do an equal weight allocation to stocks in the selected sectors.

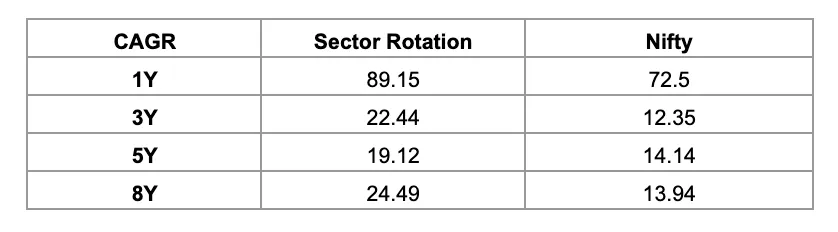

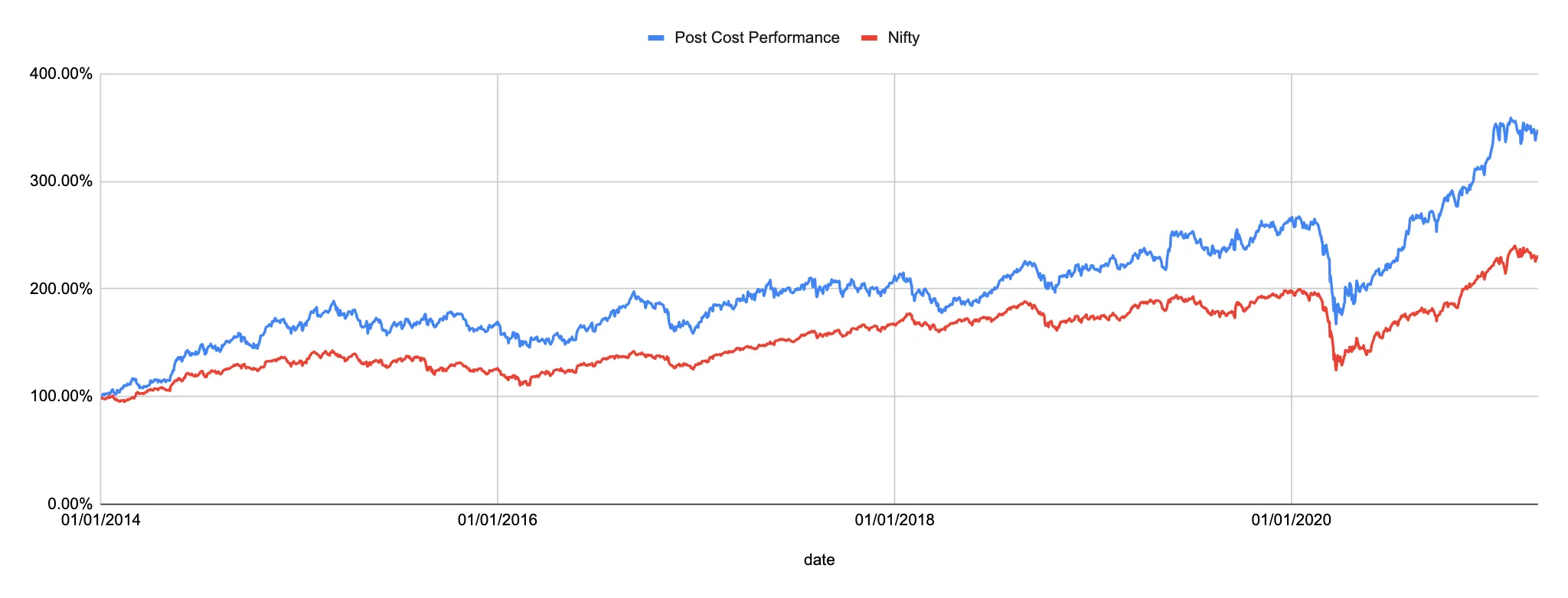

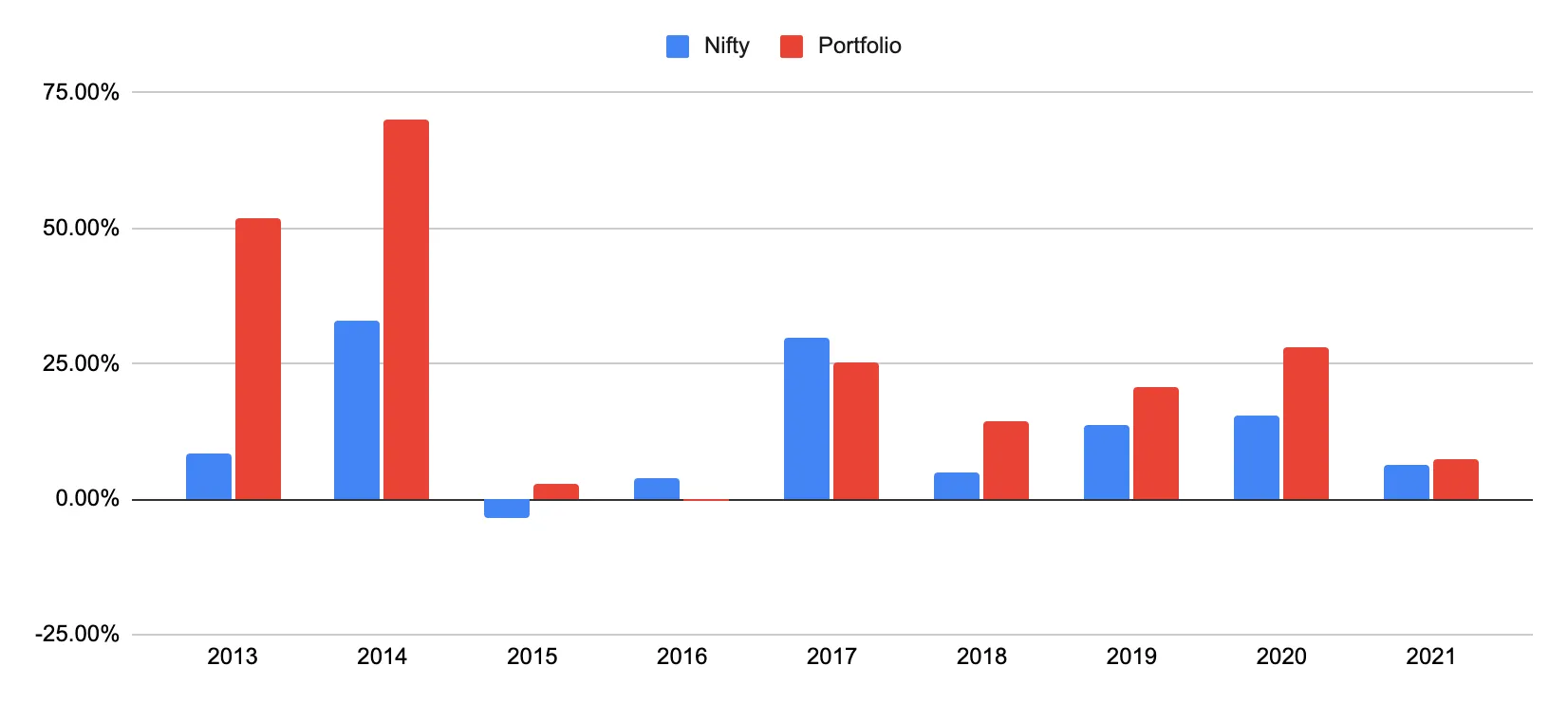

Performance

Cumulative Historical Performance

Annual Risk-Adjusted Returns

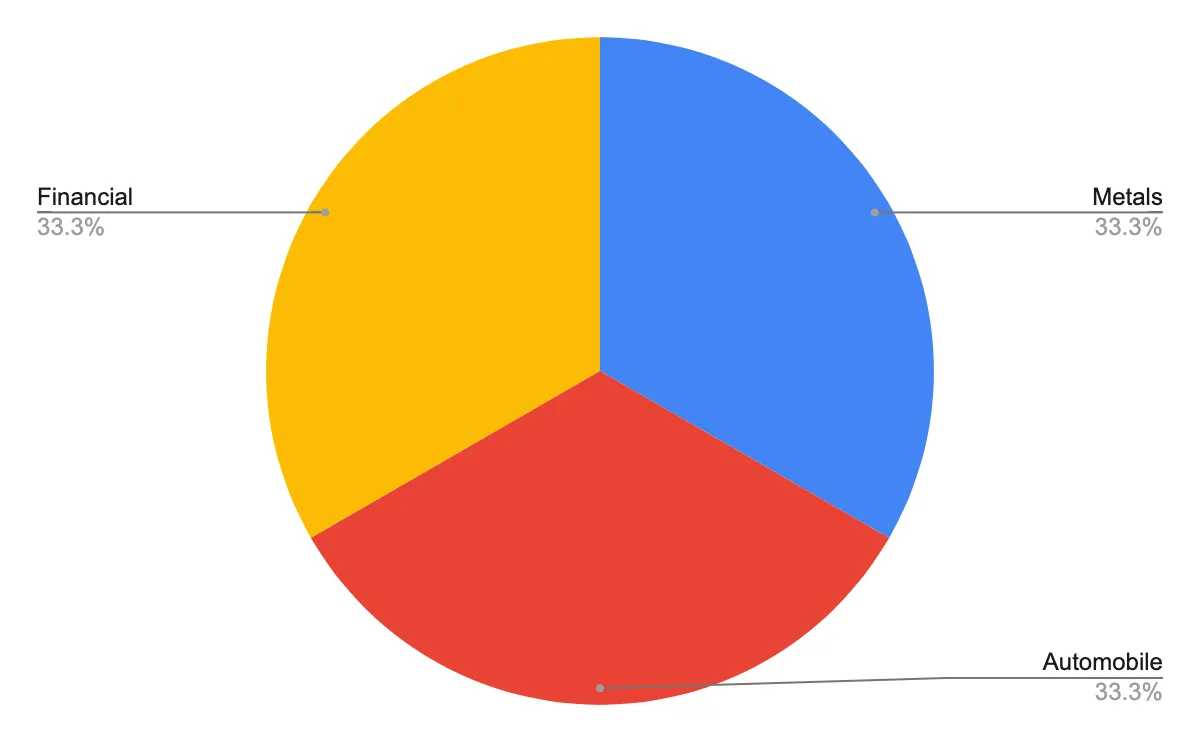

Current Sector Allocation

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart