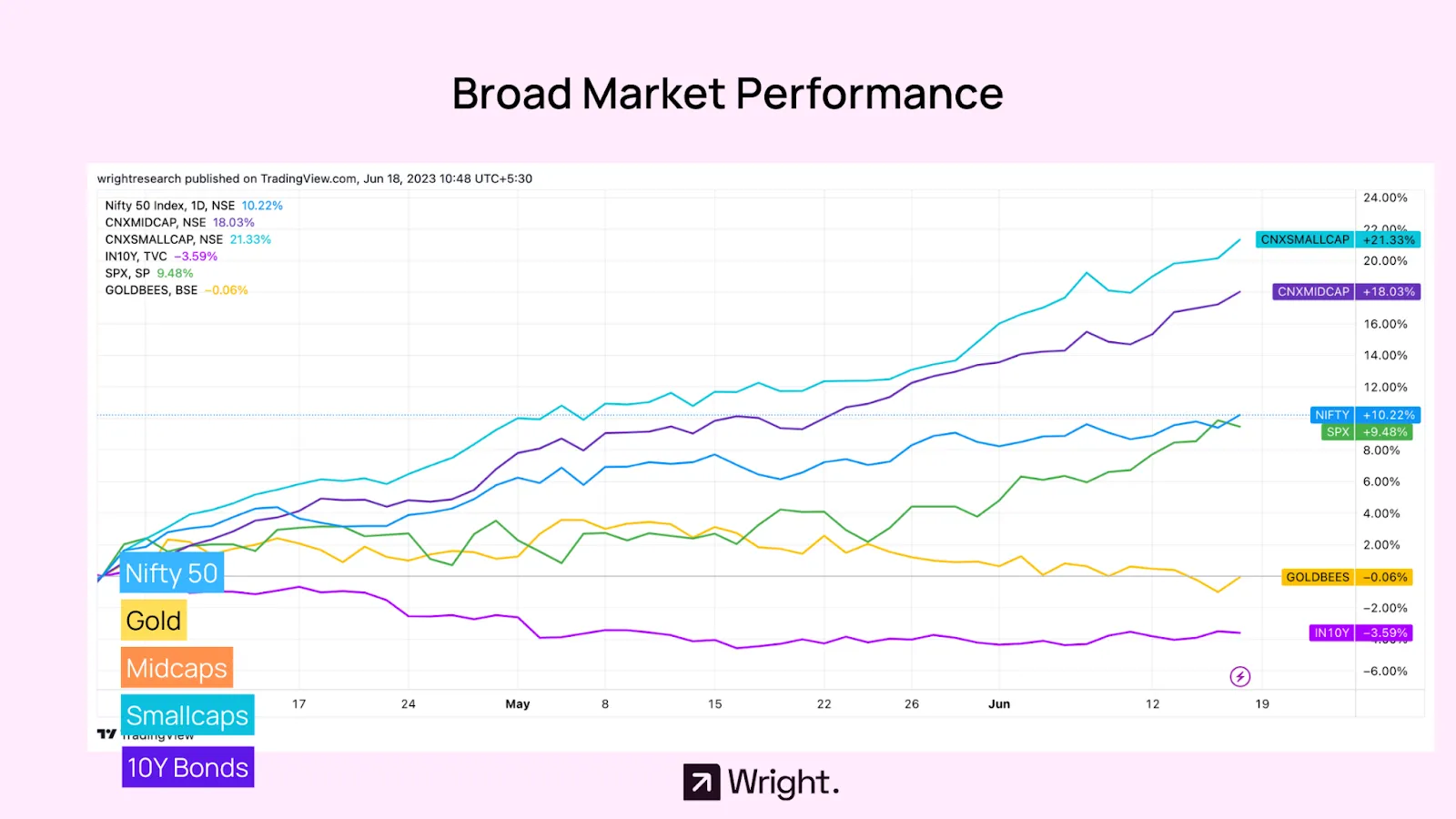

India's stock market is showing positive trends with key indices like NIFTY 50 and BSE Sensex rising more than 7% in this quarter due to strong domestic growth and substantial FPI investment. Lowered inflation rates and robust GDP growth are attributed to the Reserve Bank of India's efforts. The market is bullish on sectors such as auto, realty, and consumer goods. India is emerging as an alternative to China for big corporations. Future considerations include the impact of the high US interest rates and the Indian monsoon. However, we remain optimistic and suggest investing in quality businesses. The market anticipates continuous foreign institutional investment, strong corporate earnings, and a steady macroeconomic environment.

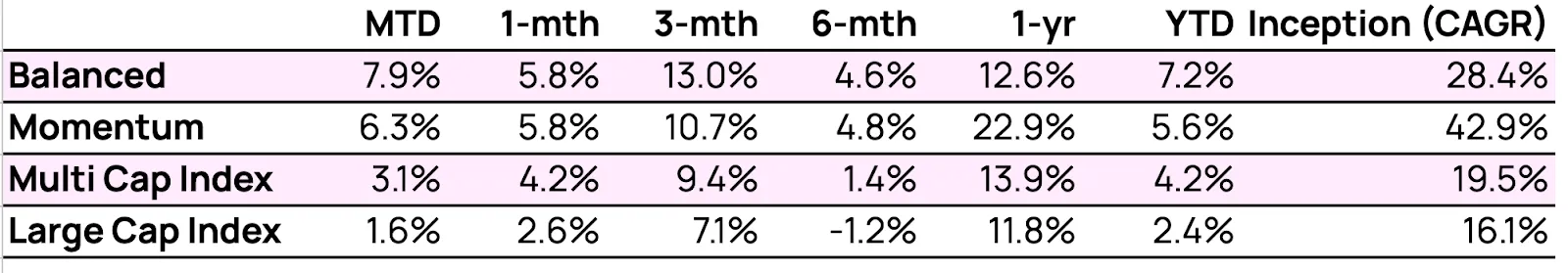

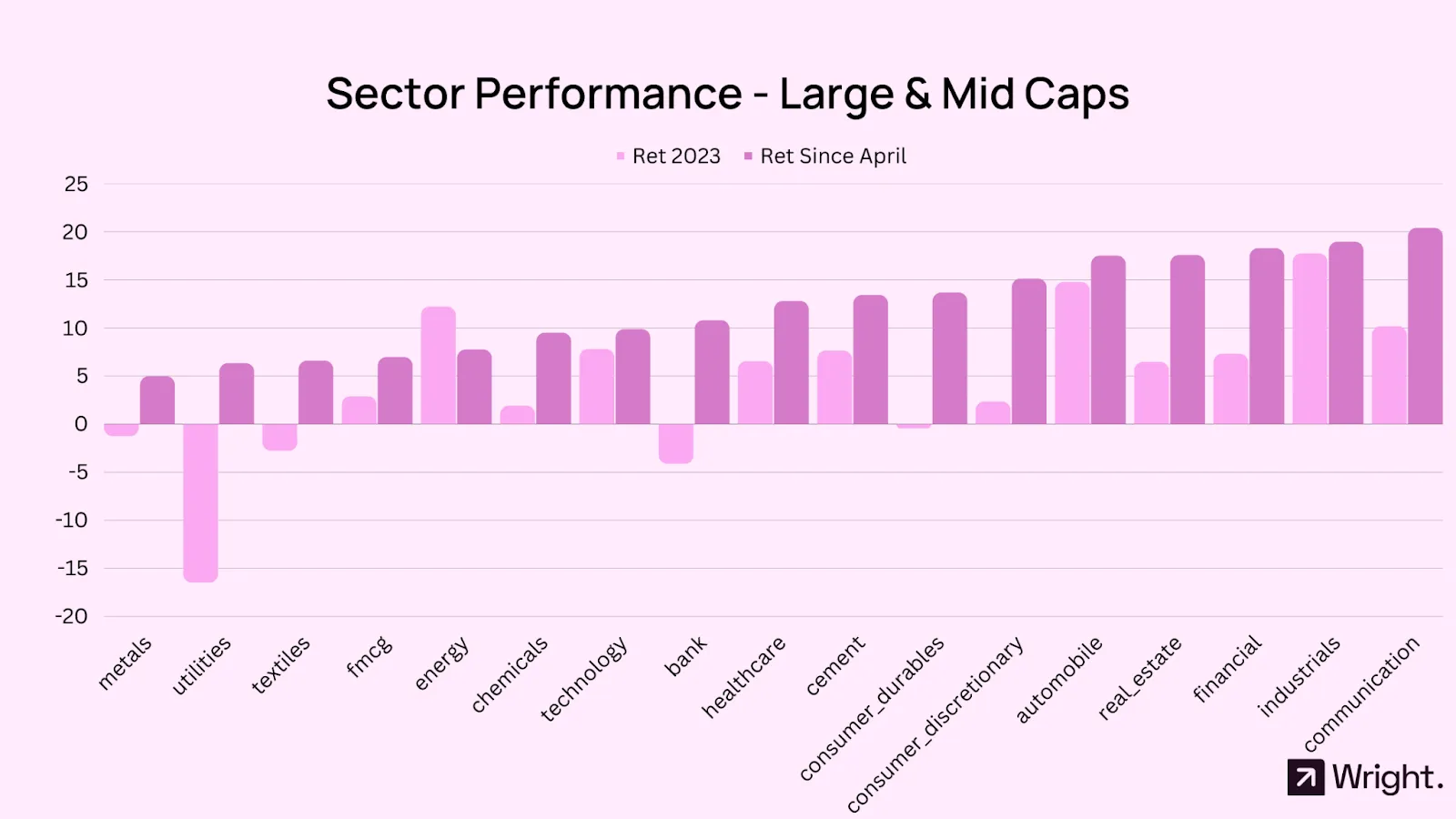

The Wright Research portfolios are giving a stellar performance this quarter. In terms of MTD, 1-month, and 3-month performance, Balanced and Momentum portfolios have outperformed Multi Cap and Large Cap indices. Balanced showed 7.9% (MTD), 5.8% (1-month), and 13% (3-month) returns, and Momentum exhibited 6.3% (MTD), 5.8% (1-month), and 10.7% (3-month) returns. These figures surpass Multi Cap and Large Cap returns, indicating stronger performance from Balanced and Momentum strategies.

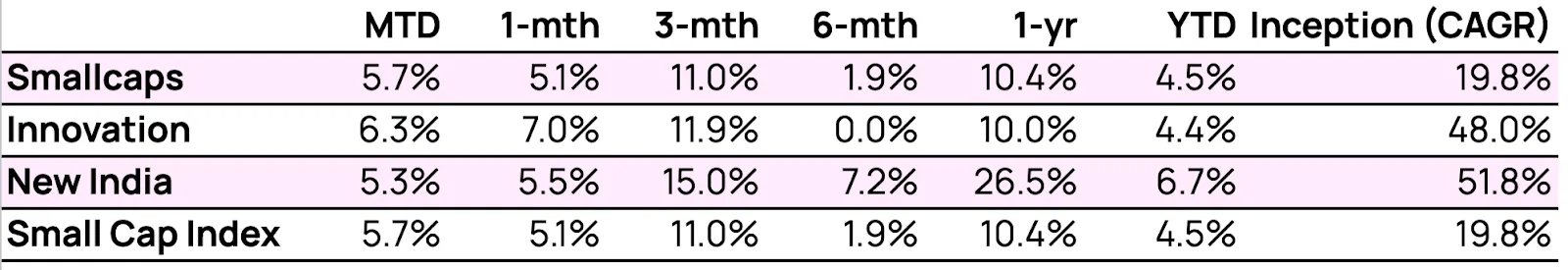

In the MTD, 1-month, and 3-month periods, the Innovation and New India portfolios have shown superior returns compared to Smallcaps and Small Cap Index. The Innovation portfolio returned 6.3% (MTD), 7.0% (1-month), and 11.9% (3-month), while New India showed 5.3% (MTD), 5.5% (1-month), and a remarkable 15.0% (3-month). In contrast, Smallcaps and Small Cap Index yielded identical returns of 5.7% (MTD), 5.1% (1-month), and 11.0% (3-month).

India's economy in 2023 shows positive signs despite some global challenges. GDP growth is robust at 6.1% in Q4 and FY23 growth is predicted to be 7.2%. Unemployment is significantly lower and inflation is well-controlled, with the consumer price index slipping to an 18-month low of 4.70% in April 2023. Foreign portfolio investors (FPIs) have shown confidence, investing INR 37,316 cr in Indian equities in May, the highest investment by FPIs in the last six months. Future considerations include the impact of the high US interest rates, Indian monsoon and rise in commodity prices due to the recovery in China.

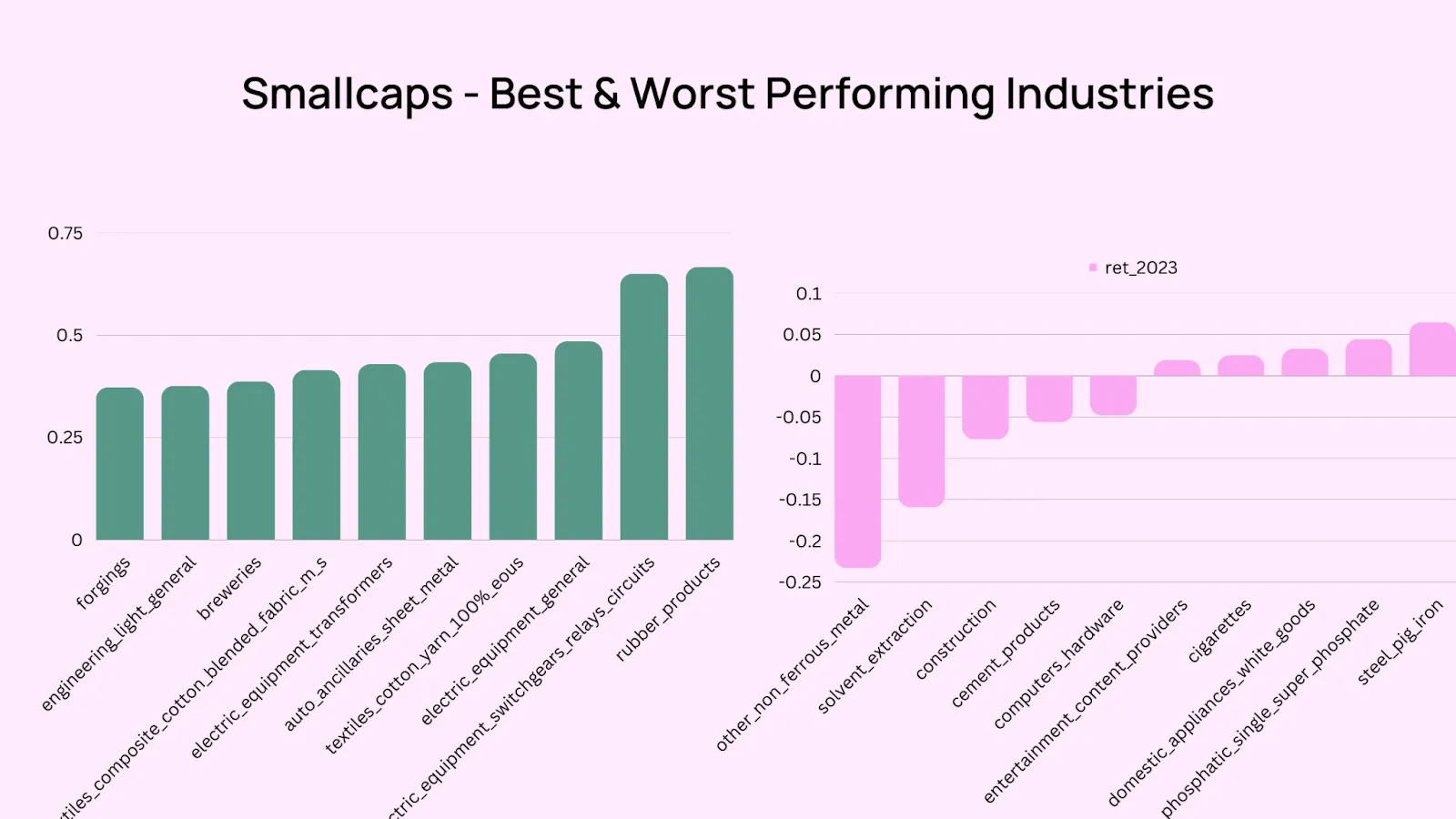

The BSE MidCap and SmallCap indices have experienced significant gains of over 20 percent each since March 28, indicating a technical bull market. Factors such as a pause in the rate hike cycle, improved macroeconomic conditions, and continued foreign investor inflows have been driving this rally. Stable interest costs particularly benefit mid- and small-cap companies, which struggle more to access capital compared to larger firms. With expectations of a prolonged pause by the RBI, declining commodity costs, and improved operating margins, sentiment for these stocks is expected to improve further. Analysts believe that the recent rally will continue and gain momentum over the next two years, presenting promising investment opportunities in mid- and small-cap companies.

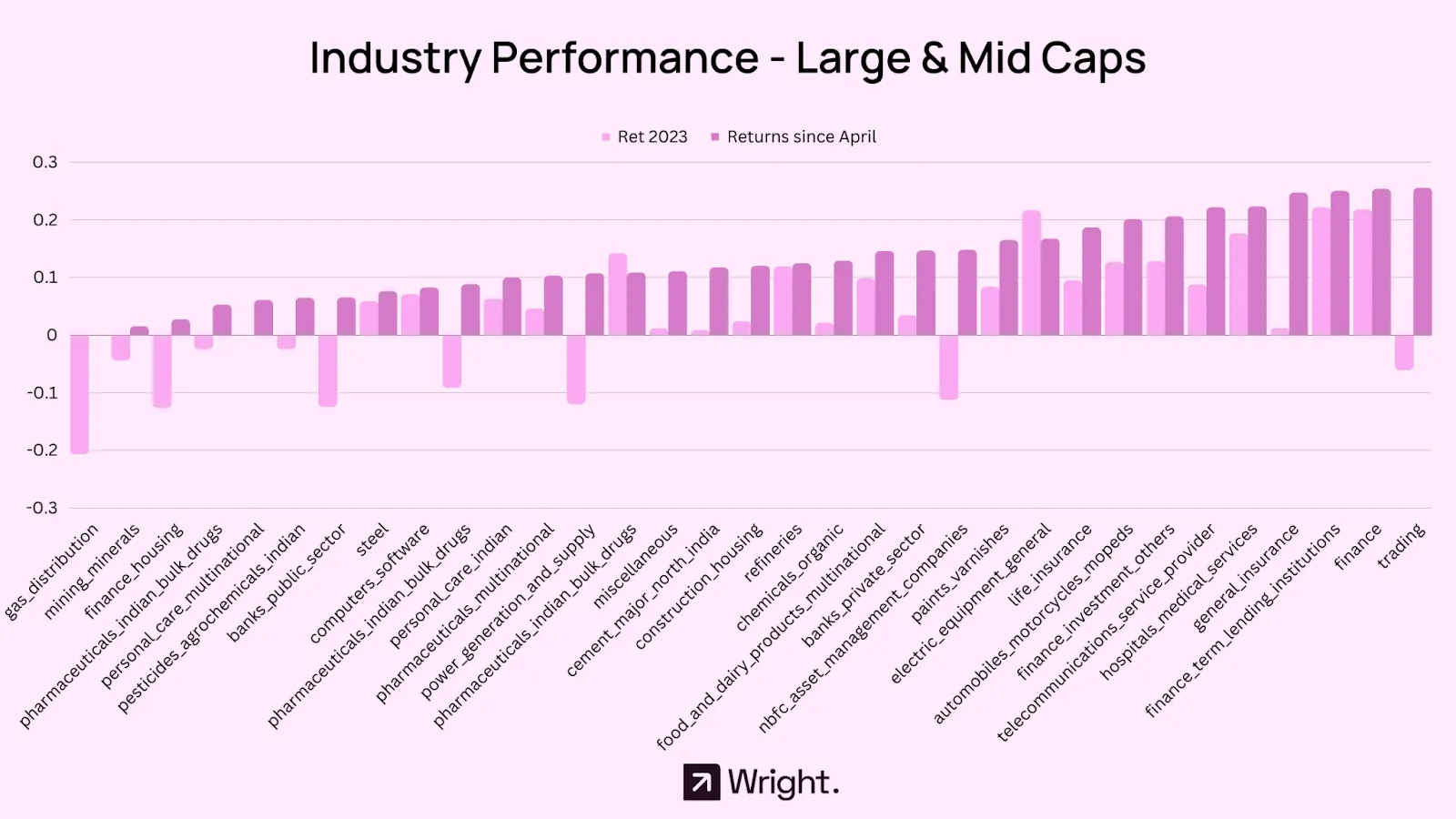

The returns vary across sectors, with some sectors experiencing positive growth and others facing challenges. Here is a summary of the performance:

1. Metals: The sector has shown a modest gain of 4.92% since April, likely influenced by global commodity price fluctuations and changes in demand.

2. Utilities: With a 6.33% increase since April, the sector has seen moderate growth.

3. Textiles: Despite a decline earlier in the year, the textiles sector has recovered slightly, gaining 6.54% since April.

4. FMCG: The Fast-Moving Consumer Goods sector has experienced a steady rise of 6.94% since April, possibly driven by positive performance in consumer durable goods.

5. Energy: The energy sector has seen notable growth of 7.74% since April, potentially linked to volatility in global crude oil prices.

6. Chemicals: This sector has recorded a gain of 9.48% since April

7. Technology: With a significant increase of 9.85% since April, the technology sector has likely benefited from investments by major corporations and the overall growth of the sector.

8. Banking: The banking sector has rebounded strongly, with a rise of 10.76% since April, likely influenced by positive market sentiment and the pause in rate hikes by the Reserve Bank of India (RBI).

9. Healthcare: Despite a decline earlier in the year, the healthcare sector has seen substantial growth of 12.76% since April.

10. Cement: The cement sector has performed well, showing a gain of 13.39% since April, likely driven by a broader recovery in the construction sector.

Overall, the Indian stock market has displayed a mix of sectoral performance, with some sectors recovering from previous downturns and others maintaining their positive momentum. Factors such as market sentiment, global trends, and specific industry dynamics can contribute to the performance of each sector.

Since April 2023, the performance of various industries in the Indian stock market has shown a mix of positive and negative returns. Some industries have experienced significant growth, while others have faced challenges. Industries that have shown positive returns since April include personal care multinational, pesticides agrochemicals Indian, banks public sector, steel, power generation and supply, cement major north India, construction housing, refineries, food and dairy products multinational, banks private sector, paints varnishes, electric equipment general, hospitals medical services, general insurance, finance term lending institutions, finance, and trading. These industries have demonstrated growth ranging from 0.058% to 0.539%. However, there are also industries that have faced negative returns since April, such as gas distribution, finance housing, computers software, and telecommunications service provider. Despite the mixed performance, several industries have displayed resilience and positive growth potential during this period.

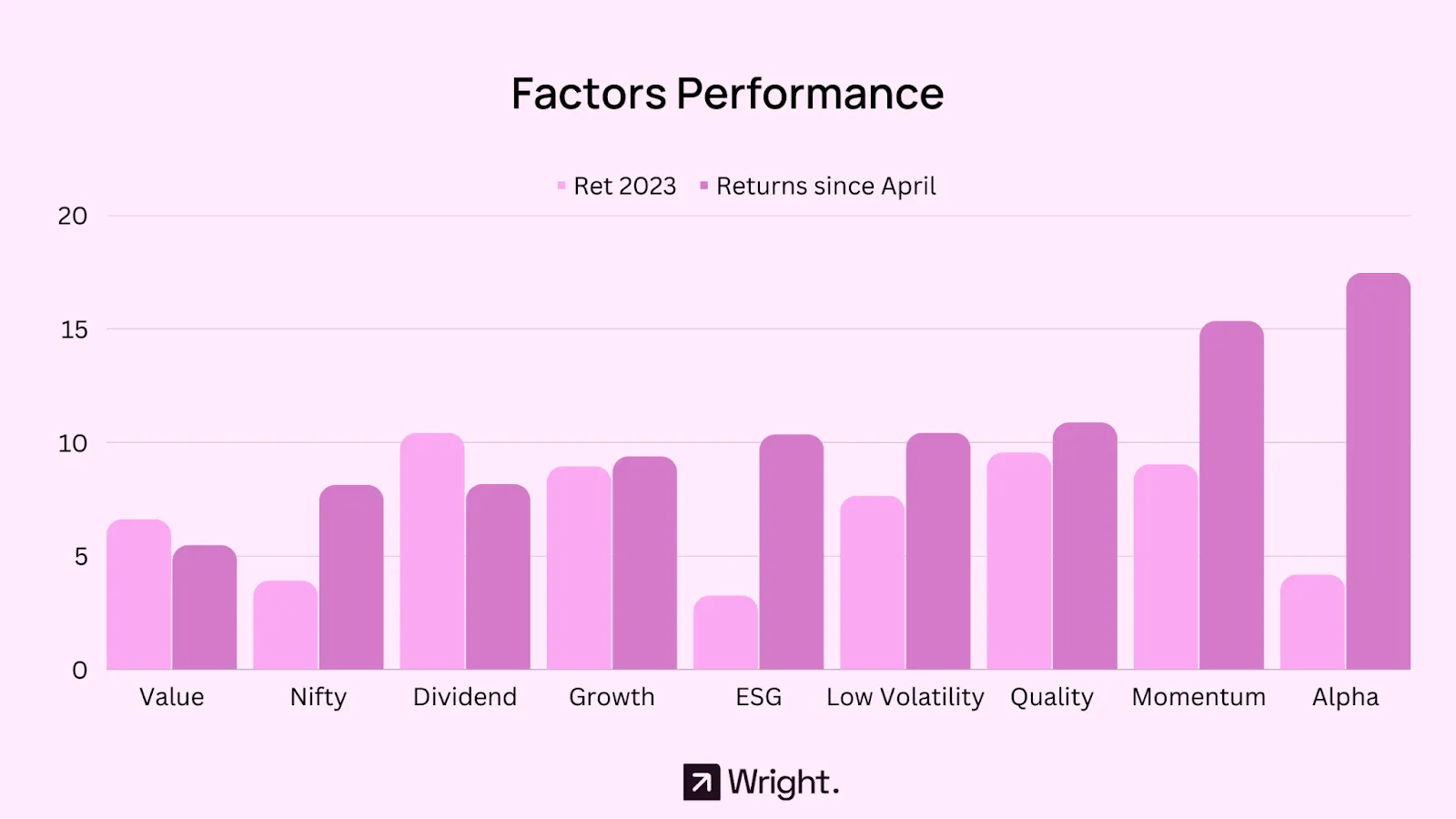

Since April, the performance of various factors in the market has shown a mixed trend. Factors like Growth, Momentum , Alpha, and Quality have exhibited strong performance, with returns ranging from 9.37% to 17.46%. On the other hand, factors like ESG and Dividend have displayed more moderate growth, with returns of -1.08% and 8.14% respectively. Factors such as Value and Nifty have shown steady growth with returns of 5.47% and 8.11% respectively. The performance of the Low Volatility factor has been consistent, with returns of 10.41%. Overall, the factors demonstrate diverse performance, indicating the varying investor preferences and market conditions.

In conclusion, the Indian stock market has been showing positive trends in recent months, driven by strong domestic growth, substantial foreign portfolio investments, and favorable macroeconomic conditions. Sectors like auto, realty, and consumer goods have been performing well, and India is emerging as an attractive alternative to China for major corporations. The Wright Research portfolios have delivered impressive performance, with Balanced and Momentum strategies outperforming other indices. The macroeconomic outlook remains optimistic, with expectations of continued foreign institutional investments, strong corporate earnings, and a stable macroeconomic environment. While challenges such as high US interest rates and the impact of the Indian monsoon need to be considered, the overall sentiment is positive. The rally in mid-cap and small-cap indices, along with the performance of various sectors and factors, indicates promising investment opportunities in the Indian market. It is recommended to focus on quality businesses and keep a close eye on market dynamics and global trends to make informed investment decisions.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios