by Sonam Srivastava

Published On Nov. 19, 2022

No one factor works well all the time! So it makes sense to have multiple factors in the same portfolio.

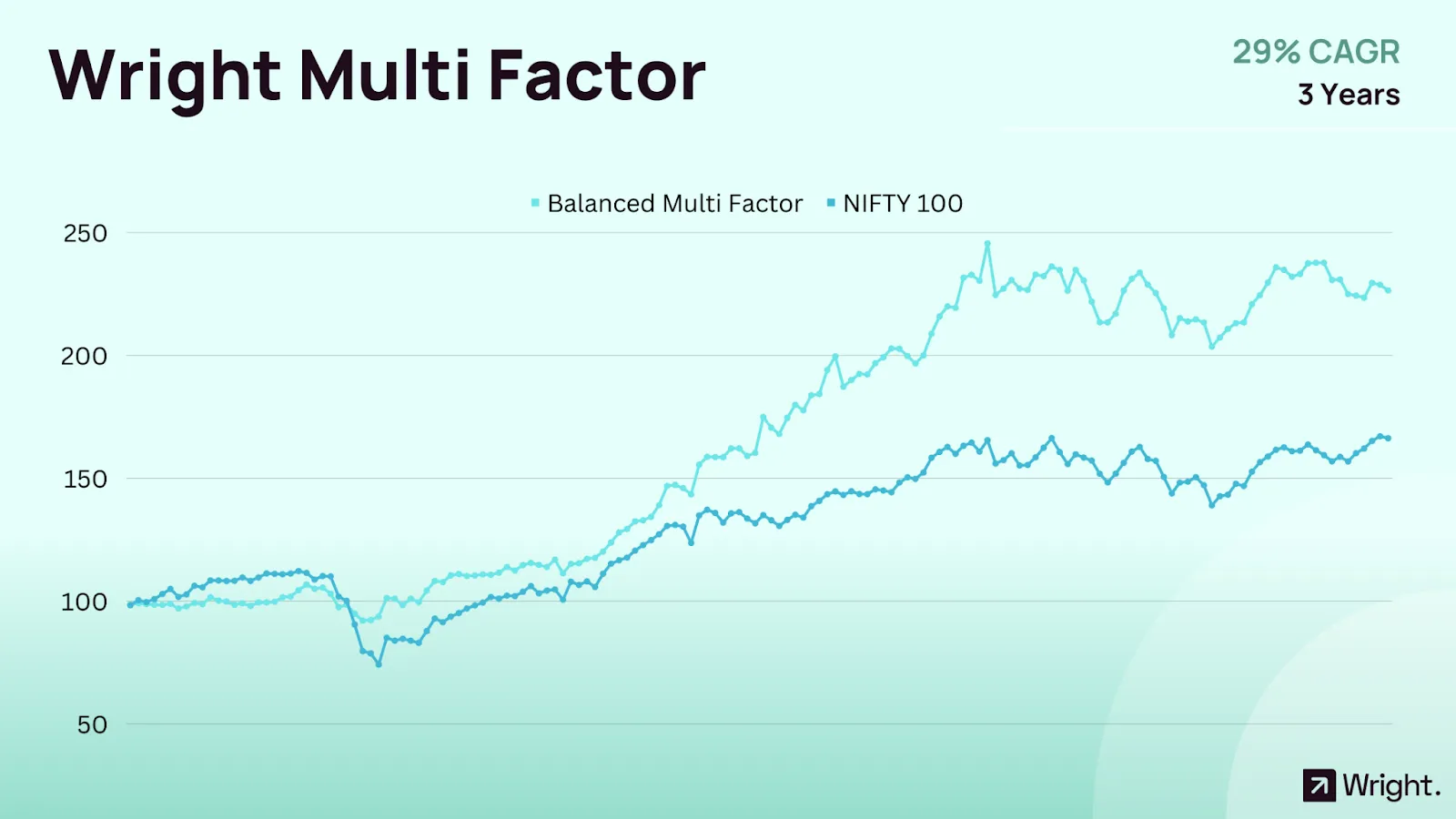

Wright Research’s Multi-Factor portfolios were the first portfolios we started with three years ago, and they have had a fantastic run. In this post, we want to cover the salient points of the multi-factor approach.

“Factors” and Factor Investing are getting increasingly popular in the Indian market. A “Factor” is a differentiating characteristic of a stock that delivers excess returns. These factors are deep-rooted rationales for outperformance that have lasted over decades.

While “factor investing” usually requires a lot of data and numbers, factors are very intuitive to understand for a regular investor.

Factor investing strategies are typically created as a basket of stocks. However, as quantitative methods are used in making these strategies, the baskets are very well diversified and, more often than not, carry a risk less than the Nifty index!

Multi-Factor Investing is an investment strategy that goes beyond traditional single-factor approaches to consider a combination of factors that may influence a stock's performance. Factors refer to specific characteristics or attributes of a stock that have historically demonstrated a relationship with its returns. By combining multiple factors in a systematic manner, this investment approach aims to enhance portfolio diversification, reduce risk, and potentially deliver improved risk-adjusted returns.

In Multi-Factor Investing, the factors considered may include, but are not limited to:

Value Factor: Companies with attractive valuation metrics, such as low price-to-earnings (P/E) ratios or low price-to-book value (P/B) ratios.

Quality Factor: Companies with strong financial health, profitability, and consistent earnings growth.

Momentum Factor: Companies whose stock prices have exhibited positive trends and outperformance in recent periods.

Size Factor: Companies with smaller market capitalizations that historically have shown the potential for higher returns.

Low Volatility Factor: Companies with lower levels of price volatility, which may indicate a more stable performance.

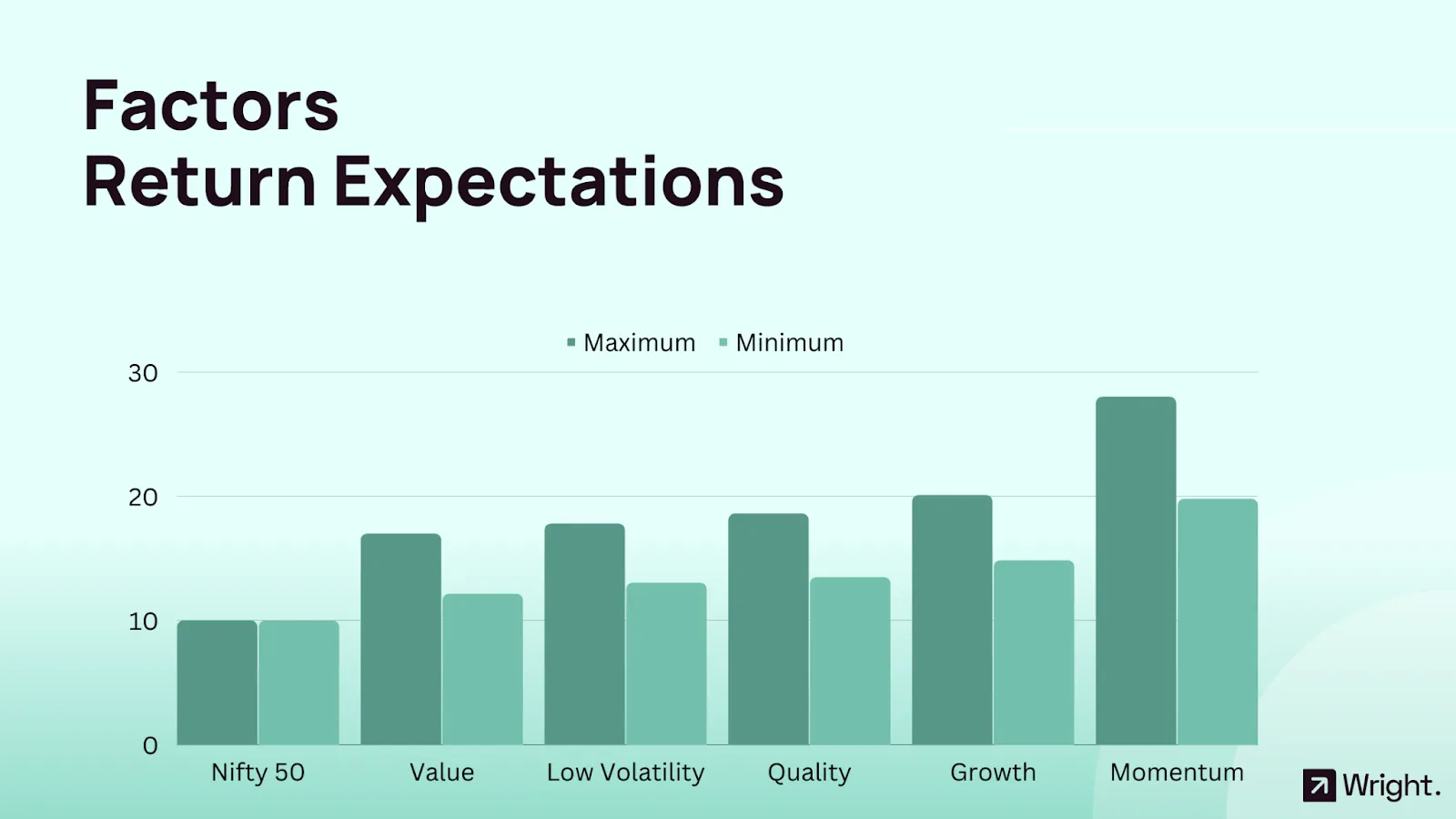

Factor strategies can be a gamechanger for long-term performance. While the Nifty 50 Index has given around 10% CAGR since 2010, most factor strategies have a much higher return. There is no one set definition of a factor or its methodology, but based on different interpretations, a range can be set for the factor returns based on data from 2010. Because India has been a growth market in the last decade with significant bull markets, the best performing factor in India has been Momentum or Trend Following. Momentum is followed closely by Growth and Quality factors. The Low Volatility factor gives good performance at extremely low risk, while Value also outperforms in the long term.

As the definition of factors can differ for different people, we have given a range of factor CAGRs here. The NIfty Factor Index returns fall within this range.

The Multi-Factor Investing strategy offers several potential benefits to investors:

Enhanced Diversification: By considering multiple factors, the strategy aims to diversify risks associated with individual factors, leading to a more balanced and resilient portfolio.

Reduced Concentration Risk: Investing in a single factor can expose investors to specific risks, while Multi-Factor Investing helps mitigate concentration in any one area.

Potential for Improved Risk-Adjusted Returns: The combination of factors seeks to enhance returns while managing overall portfolio risk, potentially leading to improved risk-adjusted performance.

Adaptability to Market Conditions: Different factors may perform better under varying market conditions, and Multi-Factor Investing allows the portfolio to adapt to changing market dynamics.

Long-Term Focus: The strategy's systematic approach is often based on rigorous research and historical performance, promoting a long-term investment perspective.

Now again, no one factor is the single solution. For example, in a bull market like 2021, Momentum has given astronomical returns while quality and value strategies have drastically underperformed in comparison. But as the correction started in Q4 202, Momentum has lagged while Value and Low Volatility have done much better.

You need at least ten factors to explain significant variance in market returns. Unfortunately, a single factor can only be a satellite portfolio because it only works in specific market regimes.

To use the power of factors, a much more innovative approach is multi-factor investing, which simply means a portfolio that combines multiple factors. When you combine various factors, you get an added advantage from diversification because the factors do not move together. By definition, the factors are chosen such that the correlation between any two factors is less than 50%. Hence, if one factor goes down in a multi-factor portfolio, the other factor would support the portfolio. Thus a multi-factor portfolio would give you an exceptional performance due to the constituent factors, but the risks would become drastically lower.

There are many ways of combining factors and several interpretations. Some people just choose their preferred factors and give them equal or set weights to do tactical allocation to factors. This means that depending on the market conditions, they shift their allocation to factors. For example, in a trending market like 2021, we allocate more to momentum, but as the volatility creeps in, we shift to more quality and value allocation. We even include some bonds and gold ETFs along with the factors to allocate to in times of extreme volatility.

Value Factor Investing is an investment strategy that focuses on identifying and investing in undervalued stocks that are trading at prices lower than their intrinsic or perceived worth. This approach seeks to capitalize on the potential for these undervalued stocks to experience price appreciation over time as the market recognizes their true value.

The Value Factor is based on the fundamental principle that the market may occasionally misprice certain stocks, leading them to trade at discounts relative to their intrinsic value. Such undervaluation can occur due to various reasons, including temporary market sentiments, unfavorable macroeconomic conditions, or lack of attention from investors.

Value investors, who adhere to this approach, believe that these underpriced stocks have the potential to rebound as their true value becomes evident. They seek to identify these hidden gems and invest in them with the expectation of long-term capital appreciation.

Value Factor Investing is a strategy that seeks out undervalued companies based on specific financial metrics. These metrics might include price-to-earnings (P/E) ratios, price-to-book value (P/B) ratios, dividend yield, and cash flow. Here's how you can integrate Value Factor Investing into your portfolio:

Understand Your Risk Tolerance: Value investing often requires patience as it might take time for the market to recognize a stock's intrinsic value. Ensure you're comfortable with potentially waiting for a return on your investment.

Research and Analysis: Carefully analyze a company's financial statements and understand its business model before investing. Look for companies trading below their intrinsic value based on financial metrics.

Diversification: Don't put all your eggs in one basket. Even though you might have a high conviction about a particular stock, diversify your portfolio across multiple value stocks to manage risk.

Long-Term Perspective: Value investing typically requires a long-term investment horizon. Be prepared to hold your investments for several years.

Quality Factor Investing is an investment strategy that focuses on selecting stocks of companies with strong financial health, consistent earnings growth, and high profitability. This approach seeks to identify and invest in companies that demonstrate resilience and have a history of delivering robust performance, even in challenging market conditions.

The Quality Factor is based on the belief that companies with solid fundamentals and a track record of stable financial performance are likely to outperform their peers over the long term. Quality investors prioritize companies with strong competitive advantages, efficient operations, and sustainable business models.

By focusing on high-quality companies, investors aim to reduce risk and enhance the potential for consistent returns, making Quality Factor Investing an attractive strategy for those seeking stability and growth in their portfolios.

Quality Factor Investing focuses on companies with robust financial health, consistent earnings growth, and high profitability. Here's how to integrate this strategy into your portfolio:

Assess Company Fundamentals: Look at financial ratios such as return on equity (ROE), return on assets (ROA), debt-to-equity ratio, and profit margins. High-quality companies typically have high ROE and ROA, low debt, and strong profit margins.

Stable Earnings: Look for companies with stable and predictable earnings growth. Companies with fluctuating or unpredictable earnings may not meet the quality criterion.

Competitive Advantage: High-quality companies often have a sustainable competitive advantage, such as a strong brand, superior technology, or a dominant market position.

Diversification: Invest in a diverse array of high-quality stocks to spread the risk and potential for steady returns.

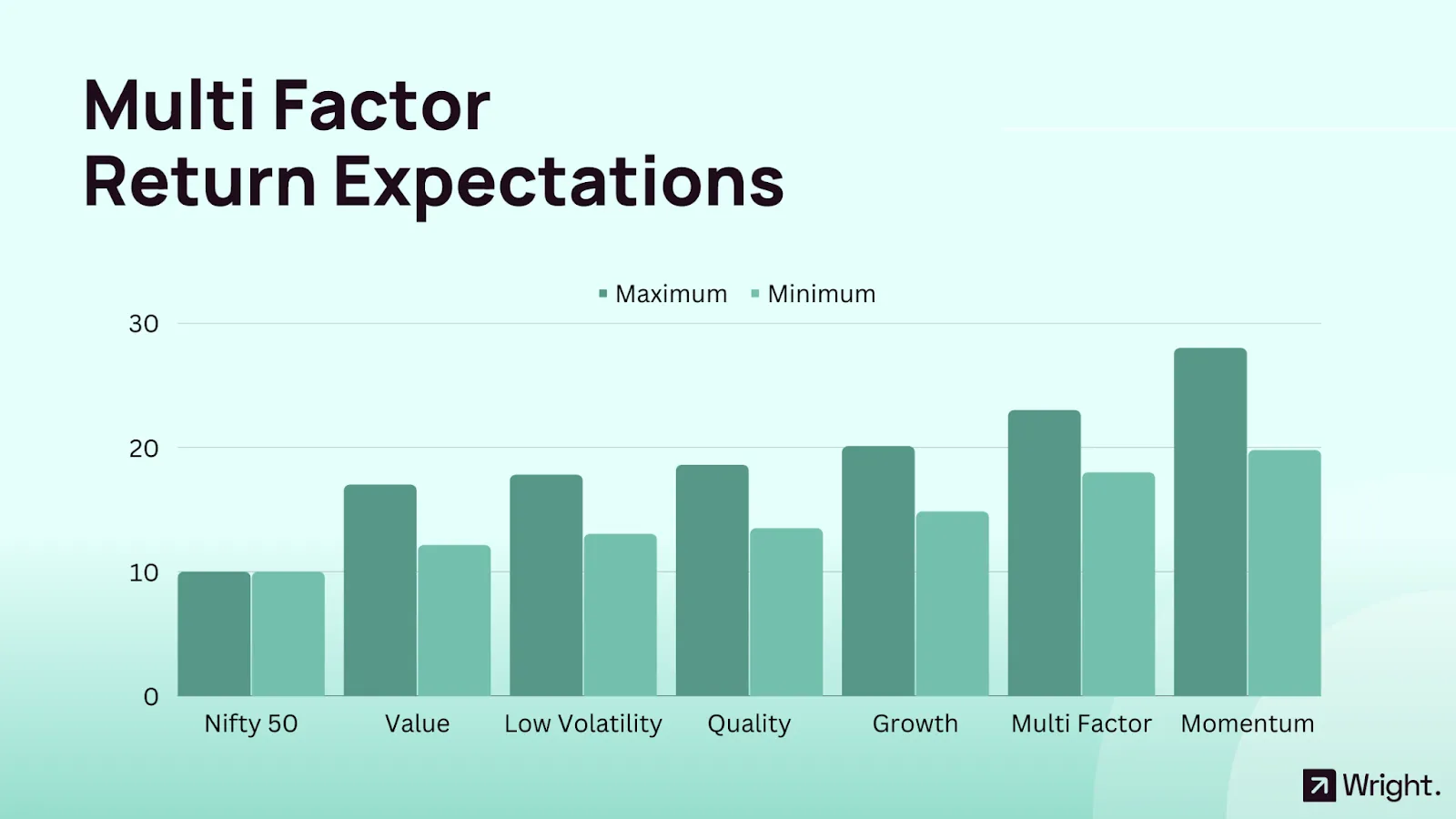

Let's look at the stats to understand the utility of multi-factor strategies. This is quite open for interpretation and highly subjective, but a multifactor approach can give you more than 20% CAGR based on an analysis of more than ten years of data wherein the multi-factor approach mentioned here is dynamic where factor weights vary based on market conditions and while the multi-factor strategy might lag a momentum strategy in terms of returns, the multi-factor approach has a much lower risk and excellent risk-adjusted return, making it ideal to become the core of someone’s portfolio.

Understand the Factors: The first step in implementing a multi-factor investing strategy is to understand the factors you wish to incorporate. These could include value, quality, momentum, size, and low volatility, among others.

Factor Analysis: Carry out a comprehensive analysis to ascertain which factors are most likely to drive excess returns based on historical data and future economic outlook.

Factor Weighting: Decide how you will weight each factor in your portfolio. This could be equal weighting, or based on the strength of each factor.

Portfolio Construction: Once you've selected your factors and assigned them weights, construct your portfolio by picking stocks that score highly based on your factor analysis.

Regular Review: The relevance of factors can change with market conditions. Regularly review your portfolio to ensure it remains aligned with your investment objectives.

Remember, multi-factor investing is not a guarantee of high returns. It's a strategy that aims to manage risk and improve the potential for outperformance. Always consider your personal investment goals, risk tolerance, and time horizon before implementing this approach.

With 30% CAGR in 3 years and at a risk much lower than the index, we have done true to our potential.

The bottom line is that factor investing is not only a fascinating area of research if you are a math and investing nerd, but they are also a fantastic way to generate a better-than-market return at a very conservative risk. These strategies depend on numbers- whether technical or fundamental- and your results will depend on the quality of your data.

The performance depends on the portfolio creator, but simple tools like diversification, risk targeting, and dynamic deallocation can make these strategies extremely safe. While some factors like momentum are excellent ways to take advantage of the bull market, a multi-factor approach can be a perfect way to compound your way to 10X in 10 years at a risk which is much better than the market.

Looking to invest in the infamous Multi-Factor portfolio?

Check it out on our website: https://www.wrightresearch.in/portfolio/balanced/

Looking to invest via smallcase:https://wrightresearch.smallcase.com/smallcase/WRTMO_0003

Why should I consider multi-factor investing?

You should consider multi-factor investing because it offers a more diversified approach to portfolio construction by combining multiple factors (such as value, growth, momentum, etc.), potentially enhancing returns and managing risk.

What is an example of a multi-factor model?

An example of a multi-factor model is a portfolio strategy that combines Value, Quality, Momentum, Size, and Low Volatility factors. This model seeks to identify companies that are undervalued (Value), have a consistent track record of profitability (Quality), are experiencing positive price trends (Momentum), have smaller market capitalizations (Size), and show lower levels of price volatility (Low Volatility). Combining these factors allows the model to achieve a balanced portfolio that can potentially outperform under different market conditions.

What is a good range factor, and why is it important in multi-factor investing?

A good range factor in multi-factor investing refers to selecting factors that have low correlation with each other. It is important because low correlation among factors can lead to improved diversification benefits, reducing the impact of individual factor fluctuations on the overall portfolio.

How can I incorporate multi-factor investing into my investment approach in India?

To incorporate multi-factor investing in India, start by understanding the different factors like value, growth, momentum, size, and low volatility. Then, identify which factors align best with your investment goals and risk tolerance. Consider using tools and resources provided by research firms like Wright Research to help you in your decision-making process. Also, make use of ETFs or mutual funds that focus on multi-factor investing to diversify your portfolio effectively. Remember, it's important to regularly review and rebalance your portfolio based on changing market conditions and investment objectives.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios