The steep recovery in the equity markets after the COVID-19 crash is showing signs of consolidation. Equity markets across the world have made a V-shaped recovery and hit new highs fuelled by positive news of stimulus packages from all major central banks and news of reopening & economic recovery.

In this blog we look back at this recovery period and what lies ahead. Where will the equity markets recovering from a frenzy of fear & greed land up? We look at valuations, earning growth & clues from equity factor performance to ascertain this.

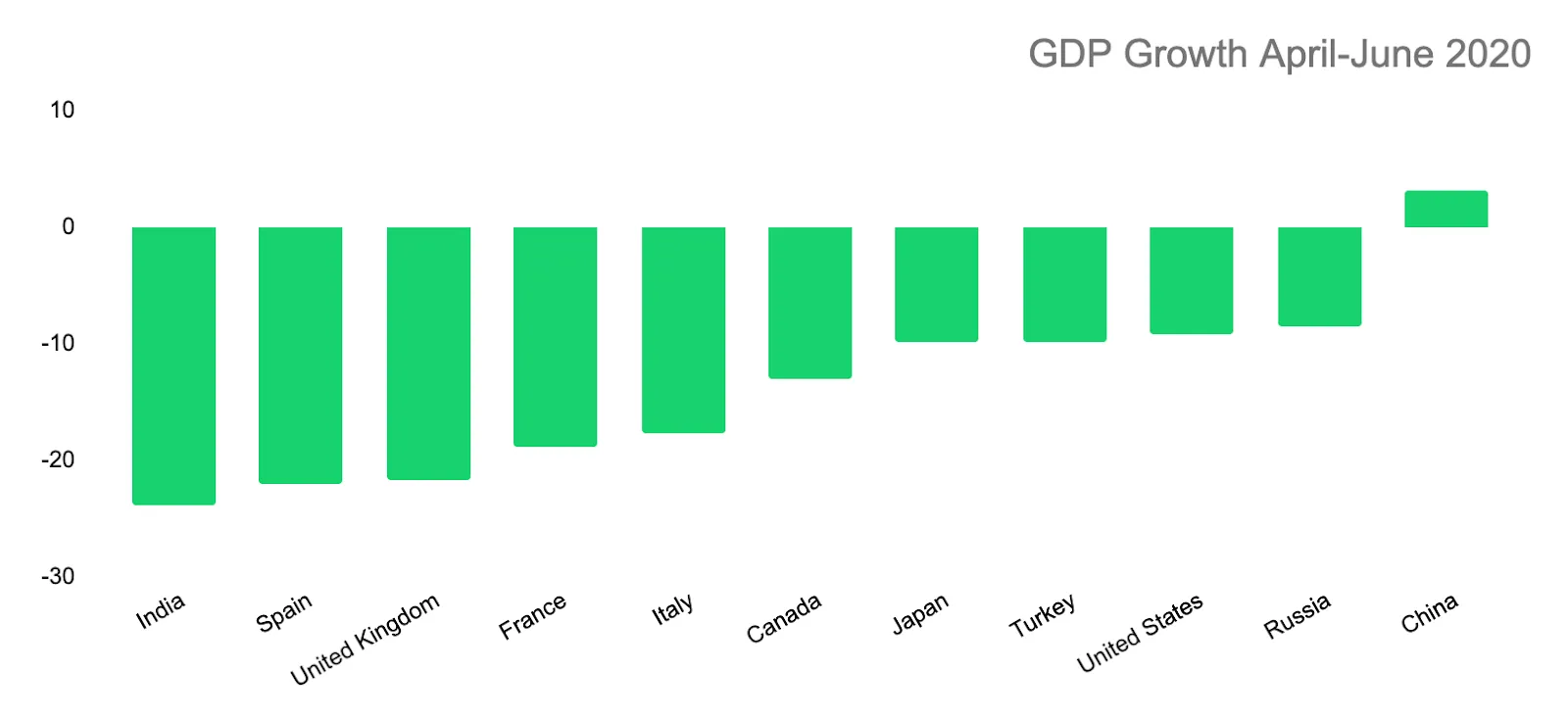

We all saw the chart for GDP fall across the world in April-June quarter 2020, where we saw India’s GDP falling by -23.9% ! This is highly disappointed and not a surprise given the nation wide lockdown.

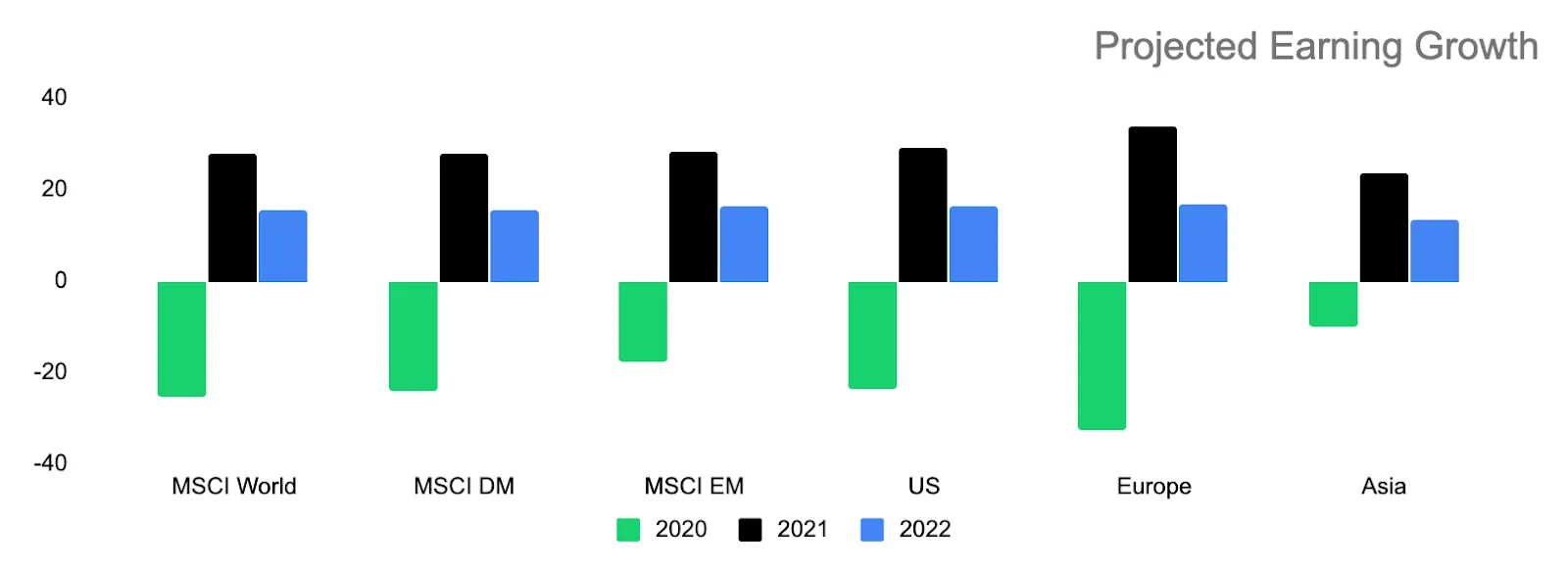

But according to experts the massive fall in real GDP and earning growth in 2020 will be met by a rapid growth in earnings in 2021 and 2022 as the world recovers from COVID-19. According to Bloomberg projections, all major economies in the world will have better than average growth in 2021 and reach normal growth rate by 2022.

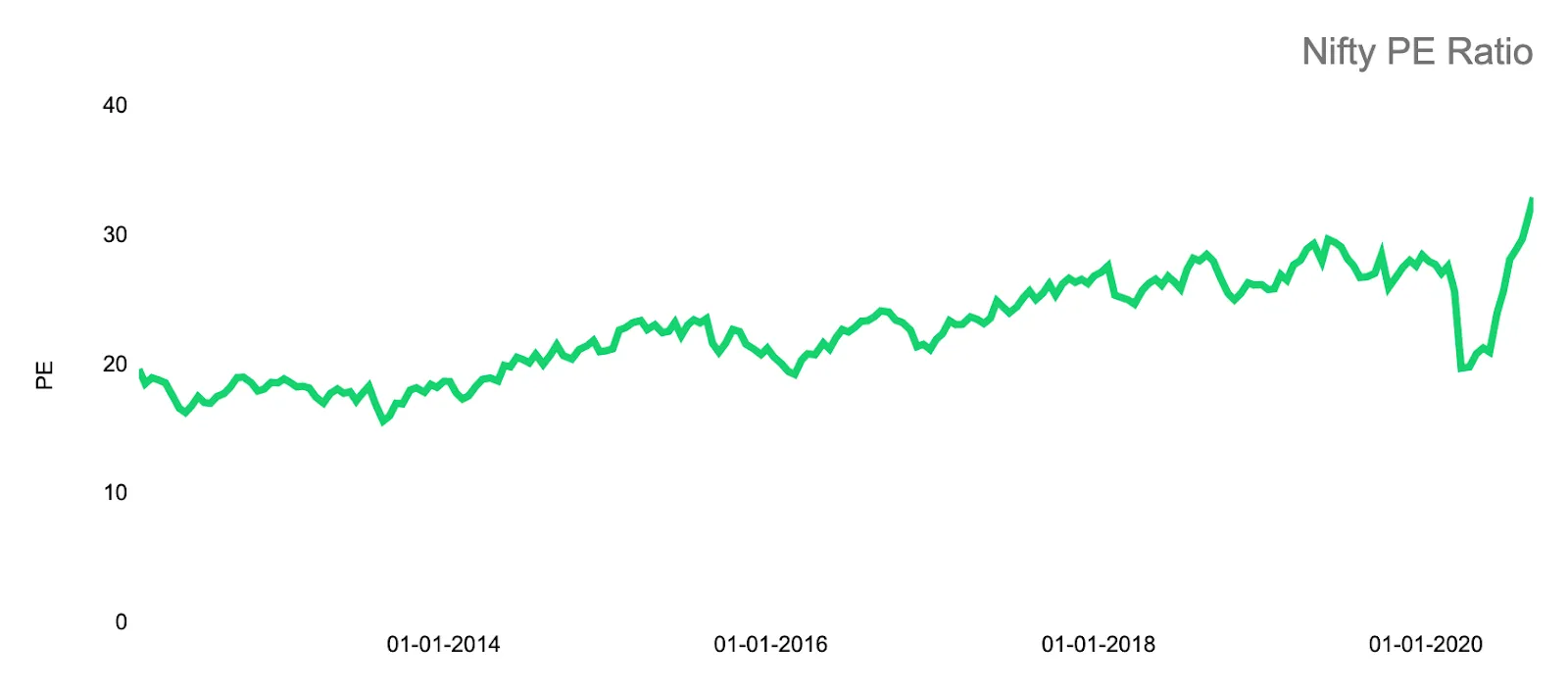

With the recovery rally, equity markets have reached a peak in valuation in terms of price to earning multiples, this is mostly because of the massive fall in earnings along with the sharp recovery. The Valuations are cheap looking at the US FED stance of keeping interest rates low and encouraging inflation in equity prices.

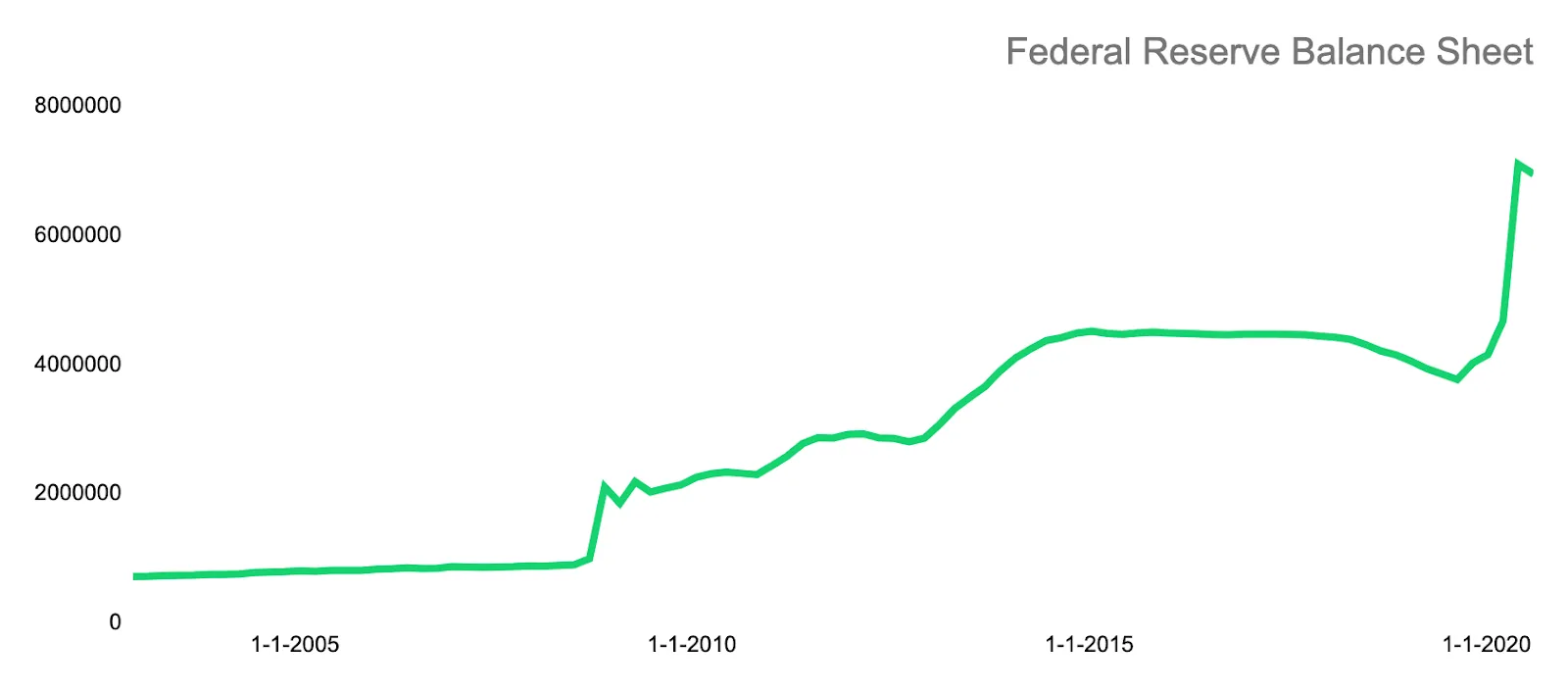

The PE ratios are also expected to be even more inflated in the future as the FED total assets have increased to unprecedented levels and this would pump in a lot of liquidity in the markets and will keep valuations on the higher side in the near future.

Given the high earning potential, favourable policy and lower interest rates —we see equities to be attractive in the future with select stocks and sectors picking up pace.

While the macro cues present an upside, there are various other factors that might change the course. The potential uncertainty factors are:

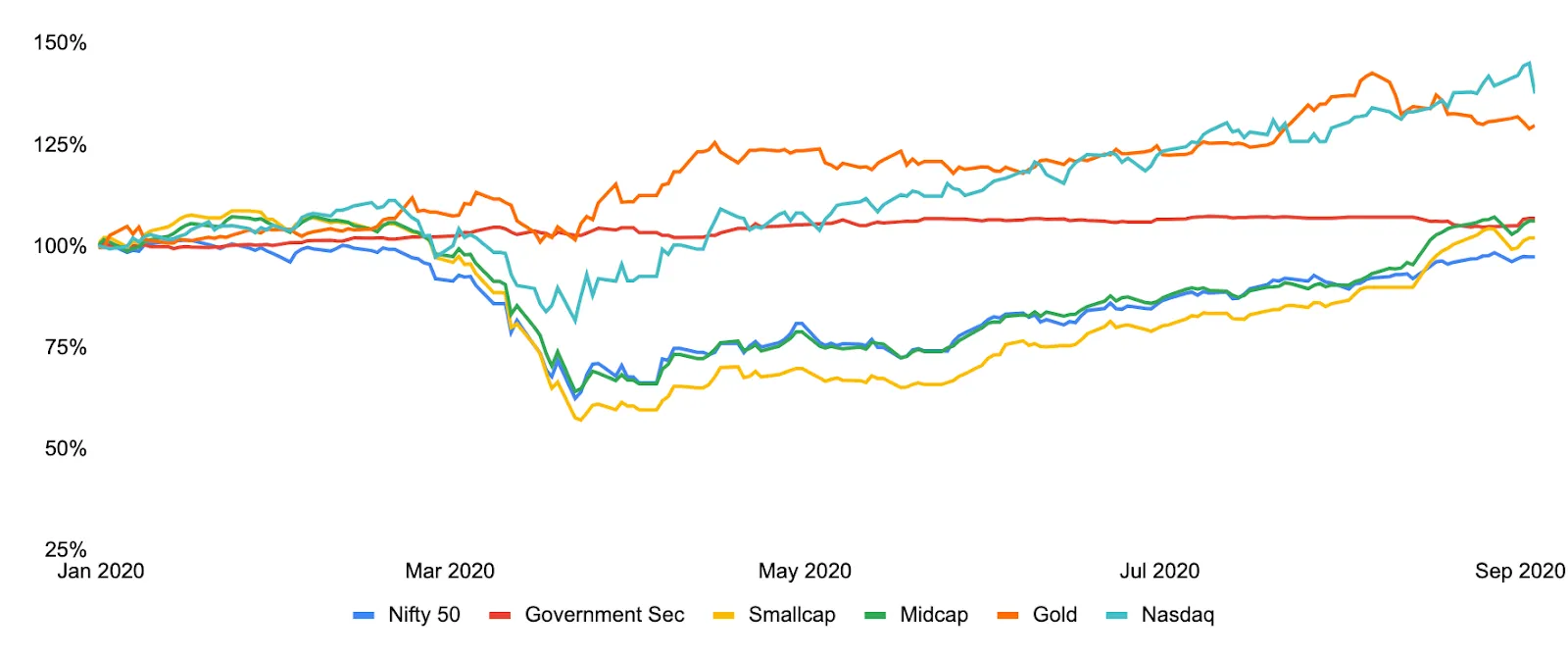

In broad level markets, US markets have outperformed India, led by the rally in Tech. Gold has had a bad last month — breaking its rally. Indian equity indices have also struggled around a support level reached last month.

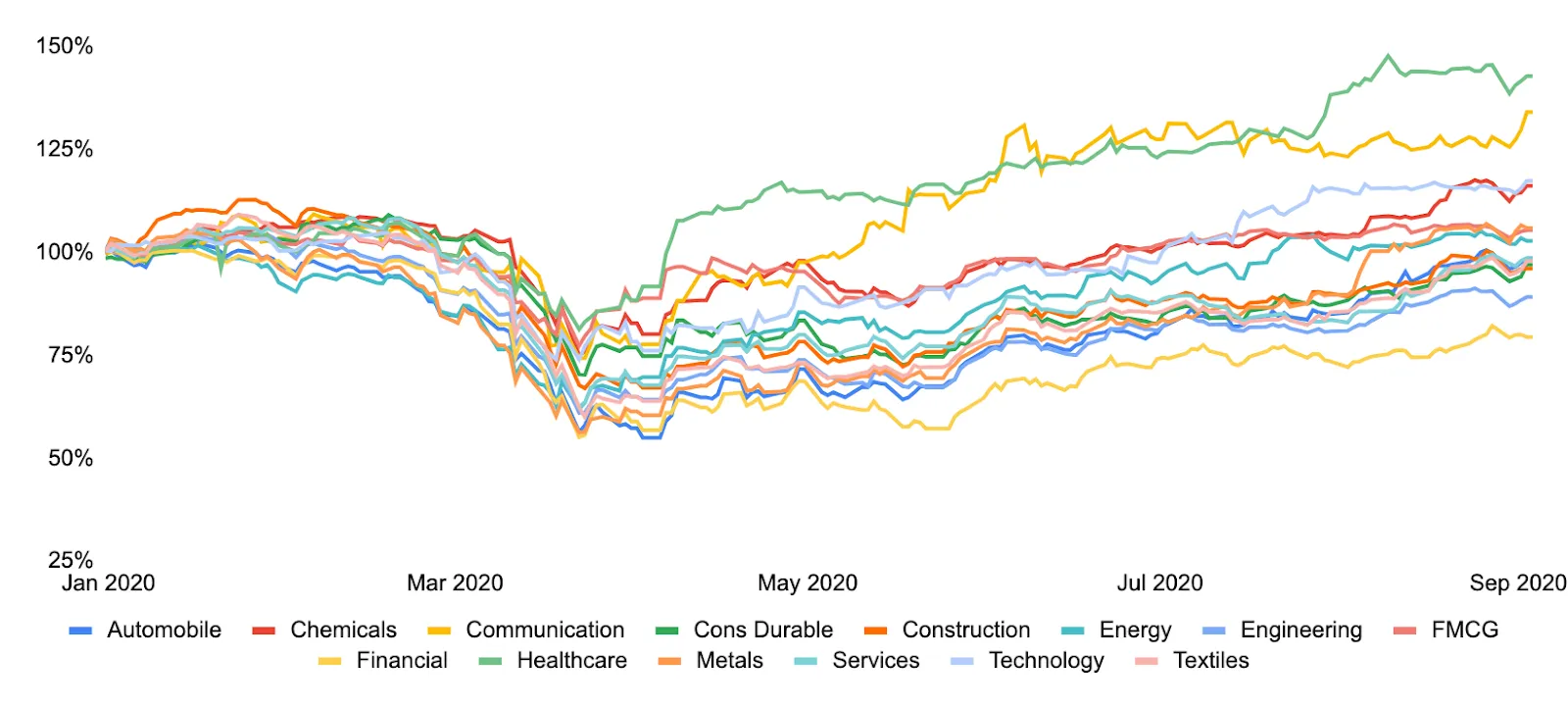

Pharma sector is still at the top in terms of 2020 YTD performance, Technology & Automobile sectors have made a comeback in the recent rally and sectors like banks have also started signs of recovery.

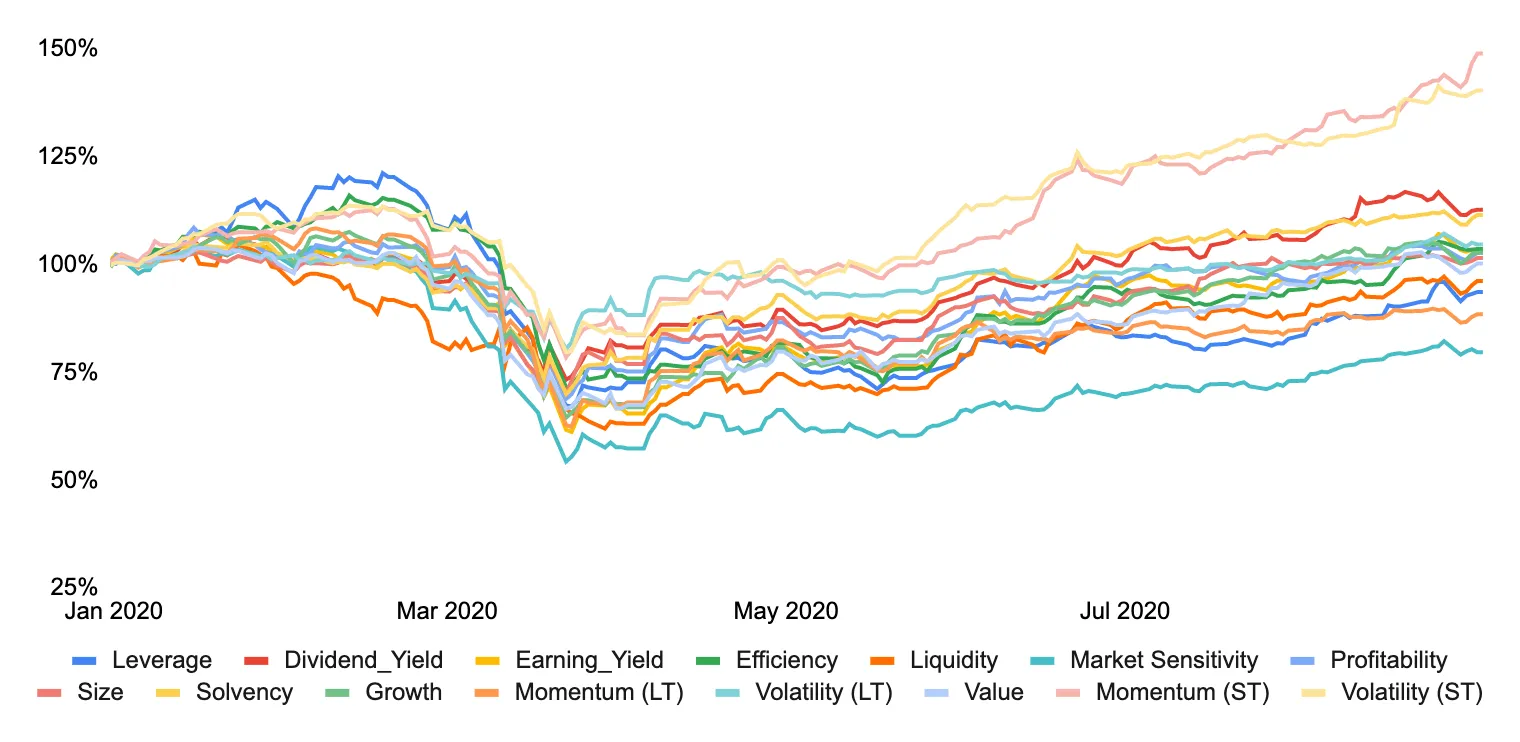

Among equity factors we see that short term momentum and volatility are faring strong. Growth stocks are doing better that value.

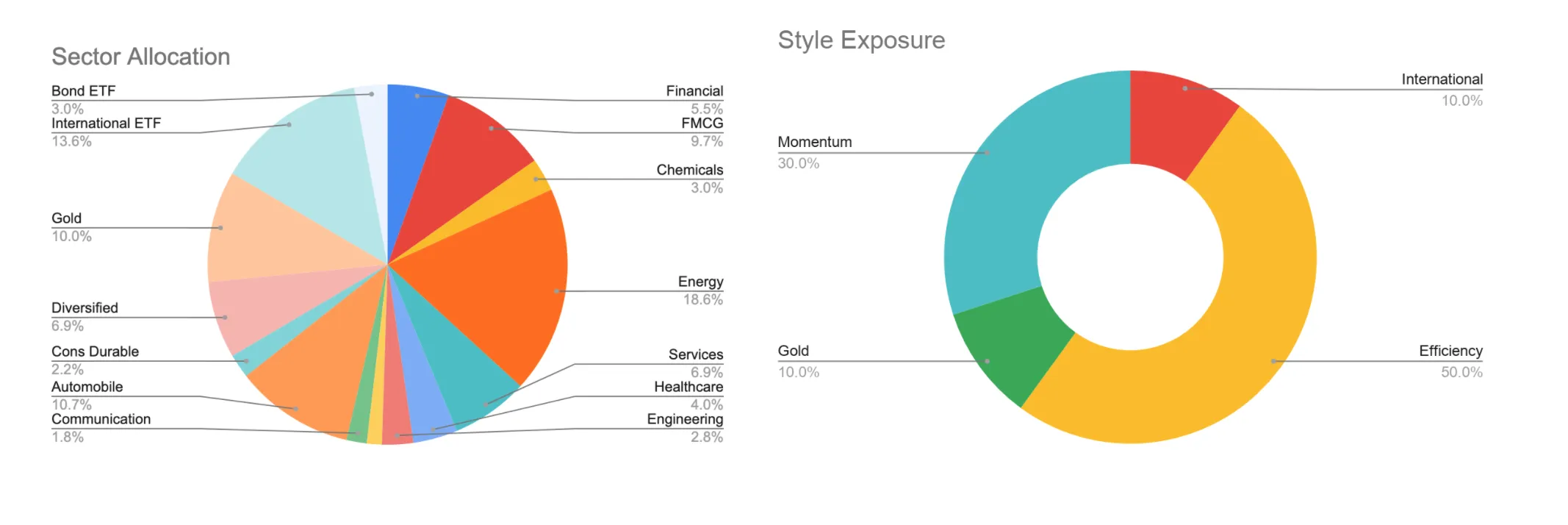

Our portfolio allocations are biased towards high short term momentum & high efficiency stocks in the larger universe that includes smallcaps. We are reducing Gold in our portfolios with high quality equity exposure.

We are adding TATAPOWER, TATAMOTORS and removing CROMPTON, PERSISTENT & SYNGENE

Here’s how sector and style allocations look like:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart