Why India’s Private Capex Crisis Has Been Falling and Why the Floor May Be Near

by Siddharth Singh Bhaisora5 min read

India’s private capex has been falling for years, even as public investment rises. Understand the key causes, while exploring why signs of stabilisation that suggest the downturn may be bottoming out.

Will India's Fiscal Drag End in 2026 - 2027?

by Siddharth Singh Bhaisora5 min read

Here is a clear breakdown of India’s Budget 2026–27. Understand everything from fiscal deficit targets, revenue and spending mix, borrowing plans, and what it means for key sectors.

India’s Private Capex Crisis: Why Investment Has Fallen?

by Siddharth Singh Bhaisora5 min read

India’s Private Capex Crisis: Why Investment Has Fallen?

Is The India–EU FTA Really The Mother of All Deals? How the EU FTA Could Benefit India?

by Siddharth Singh Bhaisora5 min read

Is the India–EU FTA truly beneficial? A detailed breakdown of the India–EU FTA: export winners, import risks, and why EU standards, CBAM and compliance will decide India’s gains.

Japan's Bond Market Crash: What Just Happened and Why It Matters for Global Markets

by Naman Agarwal5 min read

Japan bond crash: Global market spillover, emerging markets under pressure.

Understanding Commodity Super Cycle: What It Means for Investors in 2026 ?

by Naman Agarwal5 min read

A dive into the commodity super cycle, its drivers, historical patterns, and what the next phase could mean for global markets and long term investors.

US Takes Over Venezuela Oil: Impact Globally and on India

by Siddharth Singh Bhaisora5 min read

US detention of Nicolás Maduro could reshape Venezuela’s oil exports via sanctions resets and US investment. For India: low near-term risk, medium-term upside.

New Age of Trade in 2025: Globalisation Rewired & Global Value Chains Bent

by Siddharth Singh Bhaisora5 min read

Tariffs surged in 2025, but trade didn’t collapse. Supply chains rerouted, services led globalization, and connector economies reshaped value chains plus India’s edge.

India's 2025 Inflection Point: Nominal Growth Slows, Easier Money, and a Market Turning Selective

by Siddharth Singh Bhaisora5 min read

India’s nominal GDP has downshifted as consumption leans on debt and capex misses productivity. RBI eases, INR drifts, and large caps regain lead.

Why the Rupee Crossed 90: India’s Balance-of-Payments Story

by Siddharth Singh Bhaisora5 min read

Despite the rupee crossing 90, India’s economy remains strong. This isn’t a crisis but a structural adjustment driven by a wider current account deficit, weaker FDI flows and RBI smoothing operations.

India's Energy & Commodities Outlook: Crude, LNG, Chemicals & Tariff Impacts

by Naman agarwal5 min read

Learn how Crude, LNG and Chemicals Prices Plus New Tariffs Could Reshape Profits, Costs and Opportunities Across Indian Sectors

Are India’s GDP Numbers Strong Or Uneasy?

by Siddharth Singh Bhaisora5 min read

India’s latest GDP data show rapid real growth but weak nominal momentum, raising questions on data quality and implications for policy, markets and investors.

India’s Near-Zero Inflation: How We Got Here and What Comes Next

by Siddharth Singh Bhaisora5 min read

India’s CPI inflation has crashed to 0.25% even as growth stays strong. This explainer unpacks food deflation, GST cuts, RBI’s forecast misses, real rates, and the rate-cut dilemma.

Is India’s Next Decade of Growth Fueled by Necessities Or Affluence?

by Siddharth Singh Bhaisora5 min read

India’s demand is shifting from necessities to aspiration as incomes rise, digital rails scale, mortgages deepen and a young workforce fuels premium consumption.

Does GST Need Reform Beyond Just Reduction In Rates & Slabs?

by Siddharth Singh Bhaisora5 min read

Beyond slab cuts, GST needs fixes to ITC delays, compliance pain, inverted duty structures, and disputes—with a roadmap that helps MSMEs and protects revenue.

What’s the Indian Government Doing to Protect Farmers From Trump’s Bullying?

by Siddharth Singh Bhaisora5 min read

Understand what the Indian government can do to protect farmers from U.S. tariff threats—policy tool

India’s GDP Numbers: The Myth of Prosperity and the Reality of Inequality

by Siddharth Singh Bhaisora5 min read

India’s headline GDP growth looks strong—but who benefits? Explore inequality, jobs, public services, and the metrics that reveal real prosperity.

What The US Fed Rate Cuts Means For Inflation, Labor & Stock Markets?

by Siddharth Singh Bhaisora5 min read

The Fed eases 25 bps amid sticky inflation and cooling jobs, signaling caution on stagflation while keeping balance-sheet runoff. How the Fed Weighs Inflation vs Unemployment?

Can Indian Macros & GST 2.0 Revive Consumption?

by Naman Agarwal5 min read

India’s equities face a ‘moment of truth’: disinflation, GST 2.0 and capex may boost consumption, but pricey valuations and weak earnings temper optimism.

Corporate Panic: Nvidia, AMD Give US 15% of China Chip Sales in Historic Deal

by Naman Agarwal5 min read

Discover how Nvidia and AMD’s historic deal with the Trump administration, involving a 15% revenue share from Chinese chip sales, is reshaping global trade, triggering corporate panic, and setting a dangerous precedent in the tech industry.

Why Did SEBI Ban Jane Street from Indian Markets?

by Naman Agarwal, Siddharth Bhaisora5 min read

Understand why SEBI banned Jane Street from Indian Derivative Markets and what are it's implications on Indian equity & derivative markets.

Hedging in Stock Market: Meaning, Benefits & Strategies

by BG5 min read

Discover what hedging in the stock market means and its benefits, and explore common hedging strategies with real-world examples to reduce investment risk.

Rising COVID-19 Cases in India : New Wave or Just Noise?

by Naman Agarwal5 min read

India is once again facing an uptick in COVID-19 cases, raising concerns across public health systems and financial markets. The stock market is showing resilience but is the situation calm or just a calm before the storm ?

The Economic Cost of War: Detailed report of India's War Economy from Kargil to Operation Sindoor

by Naman Agarwal5 min read

A comprehensive analysis of the 2025 India-Pakistan war, including its impact on the Indian stock market, FII/DII trends, defense and supply chain sectors, and the Balochistan insurgency. Includes latest data, charts, and global index comparisons.

The Kumbh Mela Coincidence : Decoding Market Patterns

by Naman Agarwal5 min read

Explore the effect of Mahakumbh 2025 on Stock Market and Different Sectors , which is estimated to create an economic impact of Rs 2-3 Lakh Crores.

Navigating the Future of Indian Equities Post-2024 Elections: Opportunities and Challenges

by Sonam Srivastava5 min read

Navigating the Future of Indian Equities Post-2024 Elections: Opportunities and Challenges

Elections 2024 and Their Impact on the Stock Markets

by Sonam Srivastava5 min read

Elections 2024 and Their Impact on the Market and Other Major Economic Indicators

The PSU Rally: Why are they Soaring and Should You Invest?

by Sonam Srivastava5 min read

Public Sector Undertaking Stocks Boom: Should You Join the Herd or Stay Alert?

Top Sectors to Invest in After the Interim Budget

by Sonam Srivastava5 min read

Exploring Investment Opportunities: Top Sectors Post-Interim Budget 2024

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

by Sonam Srivastava5 min read

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

Festive Season Forecasts a Bright Spark for India's Economic Revival

by Sonam Srivastava5 min read

Explore the economic impact of India's festive season, from surges in consumer spending to sectors thriving during festivals. Get insights on top investment picks.

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

by Sonam Srivastava5 min read

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

Why we are bullish on the India Growth Story?

by Siddharth Singh Bhaisora5 min read

Learn why Wright Research is bullish on the India Growth Story! With insights into investments, technology, demographic dividends, education, and more, discover how India's robust growth story is leading the nation towards a potential $10 trillion economy by the end of the decade.

Nifty @ All Time High, Adani stocks, Debt Ceiling - A Guide in Memes

by Sonam Srivastava5 min read

Nifty @ All Time High, Resurgence in Adani stocks, Debt Ceiling - A Guide in Memes

Emerging Trends in the Market Q1 FY24

by Sonam Srivastava5 min read

Emerging Trends in the Market Q1 FY24

Decoding the market craziness with data

by Sonam Srivastava5 min read

Decoding the market craziness with data

Impact of Global Recession on Indian IT sector

by Sonam Srivastava5 min read

The Indian IT sector is a significant contributor to the global economy, generating billions of dollars annually. However, just like any other industry, it is affected by global economic downturns.

Bye 2022. You wont be missed!

by Sonam Srivastava5 min read

We had big hopes for you 2022, but needless to say, you turned out to be one of the craziest years for investors. Here’s looking back at 2022 - obviously with memes!

Emerging Investment Themes for 2023

by Sonam Srivastava5 min read

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

Overvaluation, Rate Hikes and What Looks Attractive?

by Sonam Srivastava5 min read

Our market has been the most robust over the last year and is at a much higher valuation multiple than many emerging markets. Is this a concern during global recessionary fears.

Markets @ All-Time High | Factors to Watch

by Sonam Srivastava5 min read

Ever since the inflation numbers have eased and the US FED has hinted at a slower rate hike, the market euphoria has returned. Nifty is almost touching the all-time high of 18600, and we have seen the FIIs return to India!

No Gyan, Only Data

by Sonam Srivastava5 min read

Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

Investor Questions Answered - Diwali Edition

by Sonam Srivastava5 min read

Diwali is a season that brings in luck! Where should we invest this Diwali and what to look out for in the next year? Find out…

Earnings - Do they even matter?

by Sonam Srivastava5 min read

Earnings release is a huge event every quarter. Let's analyse if that actually matters...

Sectors that benefit from Rising Dollar

by Sonam Srivastava5 min read

The dollar has had a drastic rise above all other major global currencies and companies that export to US stand to gain.

Inflation and Fear of Recession in the US and Impact on India

by Sonam Srivastava5 min read

The US Fed has vowed to suppress growth to control inflation and keep raising interest rates until inflation reaches 2%. This is an evolving situation that can impact India.

Which sectors are gaining from the atmanirbhar initiatives?

by Sonam Srivastava5 min read

Stocks benefiting from the critical policies have a long way to go. In this post, we will drill down into the sectors and industries covered under these schemes, which will be crucial to spot these winners.

Why are FIIs buying into the Indian market?

by Sonam Srivastava5 min read

After months of constant selling from October 2021 to June 2022, foreign institutional investors (FII), are back in love with Indian markets and, to date, have purchased shares worth $ 5 billion.

Is festive season the time to bet on consumption?

by Sonam Srivastava5 min read

Consumer confidence is an economic indicator that measures the degree of optimism regarding a country's economy. Consumer confidence has been picking up in recent weeks.

All about bear markets. How to navigate one?

by Sonam Srivastava5 min read

Let’s no longer play around with it and call a spade a spade. We are in a bear market! Spoiled by bull markets most of our lives, many have no idea what bear markets are, how long they last, and what to do with our money when in one. In this post, we will enlighten you all about them.

Sector Rotation Strategy & Business Cycles

by Siddhart Agarwal5 min read

Maximize Returns with Sector Rotation Strategy. Identify stock market sector rotation opportunities in different business cycle phases. Explore Wright Research now.

We don't talk about bear markets, no, no, no

by Sonam Srivastava5 min read

The crash has unnerved everyone! Are we in a bear market? What happens next? How to manage risk? Lets find out

Inflation & It's Impact

by Sonam Srivastava5 min read

The markets have been routed over the past month after the central banks raised rates.Why are these central banks hiking rates and destroying our portfolios? The answer is INFLATION. In this post, we will look at inflation and try to predict the way. So gear up!

Can we Invest in Atmanirbhar 🇮🇳 theme?

by Sonam Srivastava5 min read

Even with the recent volatility in the Indian market, the stocks that have stayed resilient are the atmanirbhar India stocks. The term ‘AtmaNirbhar’ has evolved from a buzzword to a solid profitable strategy.

Key Investor Questions

by Sonam Srivastava5 min read

In the past few months and recent weeks there have been too many announcements to absorb. Furthermore, the global macro factors are also adding to investor ambiguity. So it makes sense to answer a few of the burning investor questions.

Falling Rural Demand vs Rising Agri Commodities

by Sonam Srivastava5 min read

The rural economy that was just recovering from supply shock during the pandemic has been hit afresh by the commodity inflation fueled by the Ukraine-Russia crisis. Can the momentum in agri-commodity prices revive it?

Decoding the Fund Flow

by Siddhart Agarwal5 min read

FIIs have sold equities worth $19.82 billion since October 1 last year. In 2008, FIIs sold $15 billion of shares during GFC. Yet, more surprisingly, the DIIs have kept the index stable. Why is this happening?

The Wild Commodity Price Rise

by Siddhart Agarwal5 min read

There has been a massive upsurge in crude, natural gas, metals, and agro commodities after the beginning of Ukraine's invasion by Russia. Let's explore the pressures and opportunities from the crisis.

The markets have been tough. Let’s dig in...

by Sonam Srivastava5 min read

Is the market volatility making you jittery? 🥶 Let's keep our long-term investor hats on 🎩 and try to understand the economics of war, the impact on India, and portfolio guidance. Let's dive in.. 🏊

Serving Consistent Market Returns

by Sonam Srivastava5 min read

At Wright Research, we believe that the market does not remain the same all the time. And as the market itself shifts its behavior, allocations within our portfolios also need to turn. This is why we like to follow a multi-factor approach in our stock selection and asset allocation.

What to expect in the run-up to the Budget?

by Sonam Srivastava5 min read

The 2022 Budget will be looked at from two critical angles. First, the expectation of a boost to economic growth through capital expenditure, and second, the ability to contain fiscal deficit in the increasingly uncertain global economy

India Inc Q2FY22 Earnings Snapshot

by Siddhart Agarwal5 min read

The cumulative net earnings of 42 Nifty50 businesses that have released their results so far increased by 19.2% YOY to Rs 1.12 trillion in Q2FY22. The consistent earning growth is indeed a new high.

The Growing Craze of IPOs in India

by Siddhart Agarwal5 min read

72 Initial Public Offerings (IPOs) were launched in India between January and September, raising a total of $330.66 billion. In addition, 33 IPOs are planned for this year, including Nykaa, Mobikwik, Paytm, and the well-known LIC.

This Diwali, add sparkle to your portfolio with Wright Research.

by Siddhart Agarwal5 min read

With Diwali approaching, now is the time for investors to assess their investment portfolio and add some luster to it with some exciting investing themes.

Markets at a Discount

by Sonam Srivastava5 min read

The markets rising rapidly over the last month took a nosedive last week, with small and mid-caps losing more than 5% as Nifty crashed 2%.

Regime Modeling

by Sonam Srivastava5 min read

One of the underlying principles of our investment philosophy is that the markets do not always stay the same.

Markets at 60k!

by Sonam Srivastava5 min read

In this month's markets & macros review, we celebrate Sensex hitting 60k!

Market Pulse - Deep Dive

by Sonam Srivastava5 min read

There's uncertainty in the equity markets and churn happening from cyclical to defensive sectors. Investor nerves are frayed!

The Burning Investor Questions

by Siddhart Agarwal5 min read

Is the market overvalued? Are we nearing price correction? Is this the right time to double down on investments? What about the FED tapering and rate hikes?

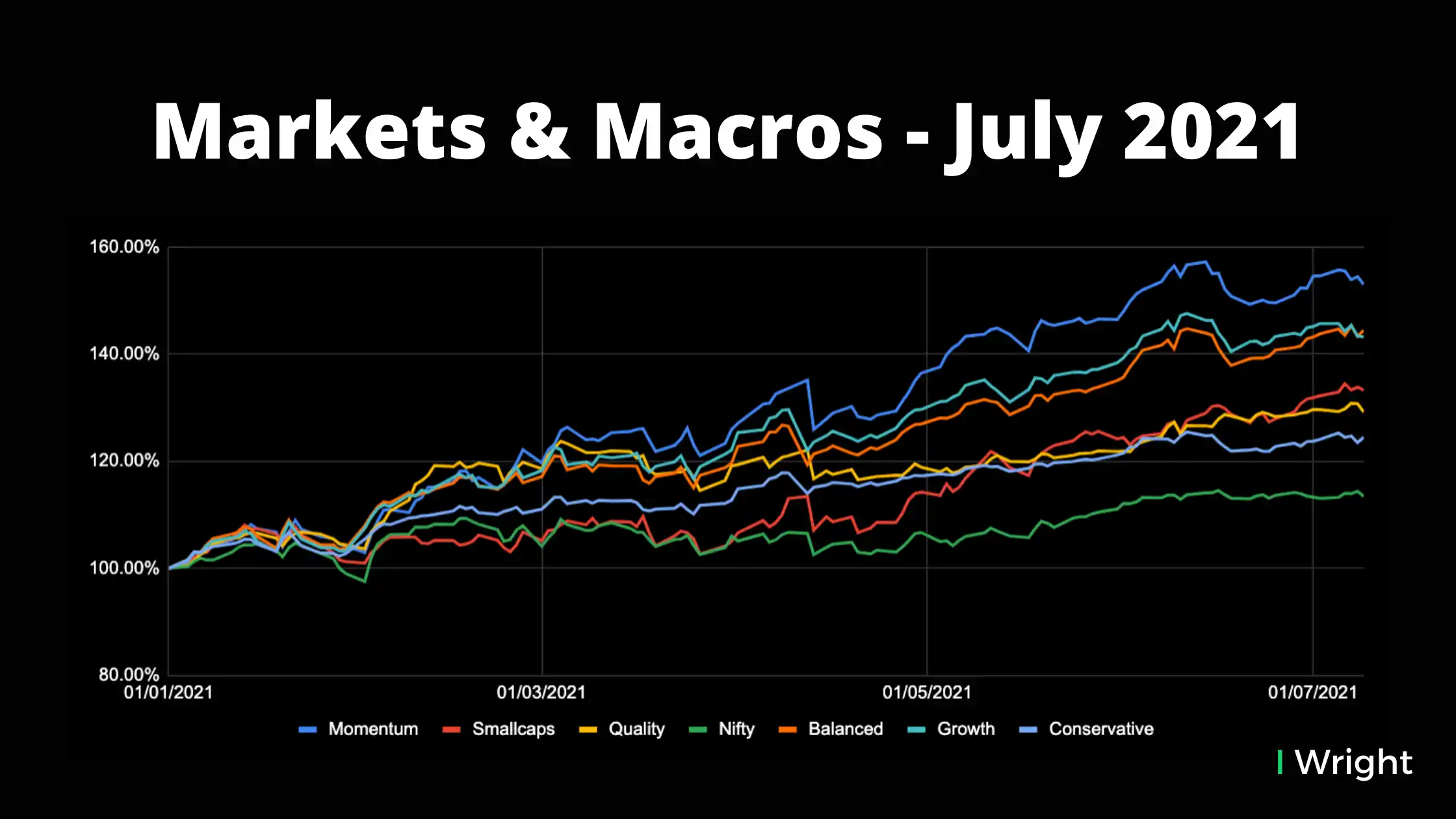

Markets & Macros - July 2021

by Sonam Srivastava5 min read

Once a month, it makes sense for us to take a pause and look at the markets & macros to make sense of all the noise. Here we look at markets, our performance and hits & misses

Riding the Tide of The Covid-19 Second Wave

by Sonam Srivastava5 min read

As the world is fighting the second wave of Covid19. How does this translate to conditions of the Indian Financial Markets?

Sector Rotation with Augment Capital

by Sonam Srivastava5 min read

Sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle

Wright Views: Post Elections 2020

by Sonam Srivastava5 min read

Monthly portfolio update and views on the US election results

Trading US Elections with Data Science

by Sonam Srivastava5 min read

US Elections are the one of most important events for the markets. There is a lot of fear in the market on the ongoing trend in the equity markets getting broken after elections

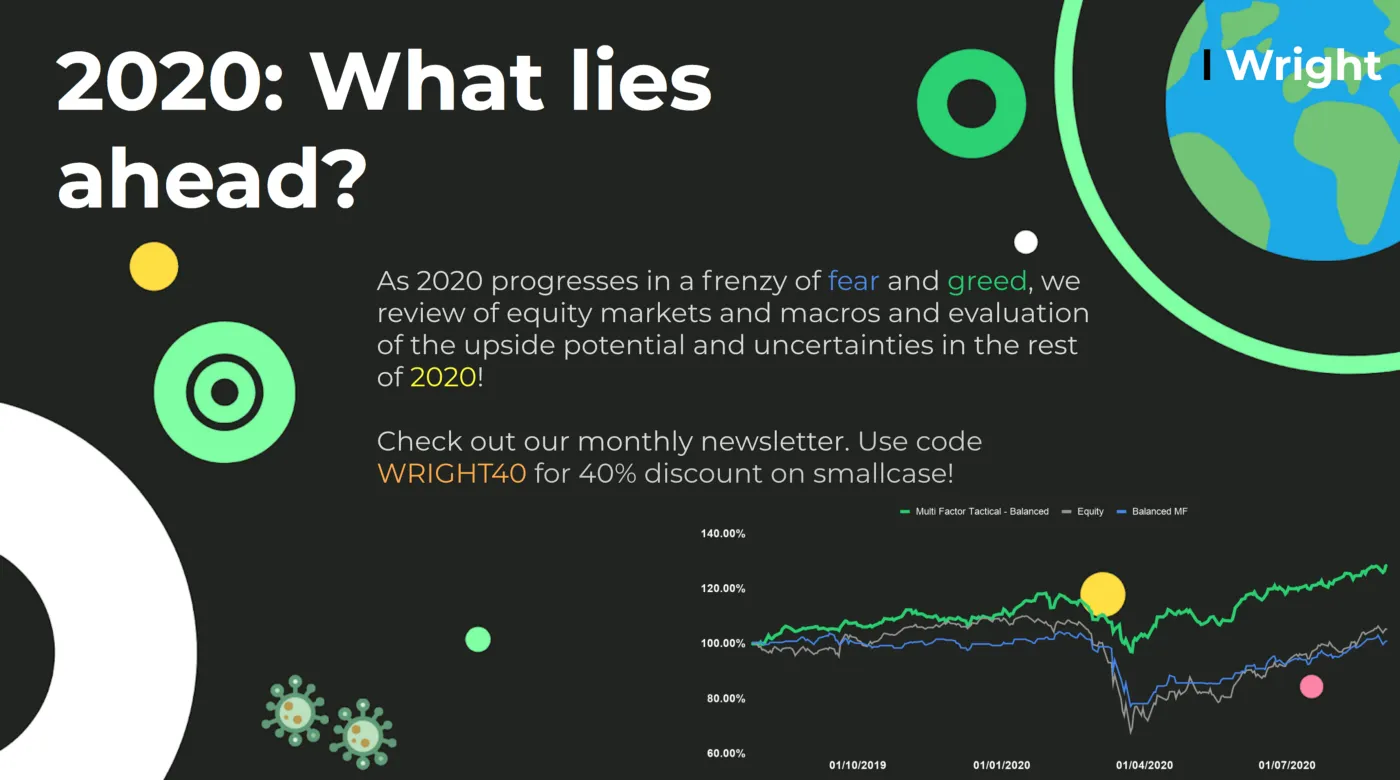

2020: What lies ahead?

by Sonam Srivastava5 min read

As 2020 progresses in a frenzy of fear and greed, we review of equity markets and macros and evaluation of the upside potential and uncertainties in the rest of 2020!

Economic Impact of India-China trade war

by Sonam Srivastava5 min read

Let us understand the economic implications of India-Chine trade war on your portfolio.

Macro Regime Prediction Model

by Jasmeet Singh5 min read

In this post we use macro economic variables to model stock market risk and returns

Covid – 19: Impact, Recovery & Investment Strategies

by Sonam Srivastava5 min read

Once again, India and the world are in the face of a crisis like no other.

Macroeconomic perspective on the Indian Economy

by Sonam Srivastava5 min read