by Sonam Srivastava

Published On Dec. 11, 2022

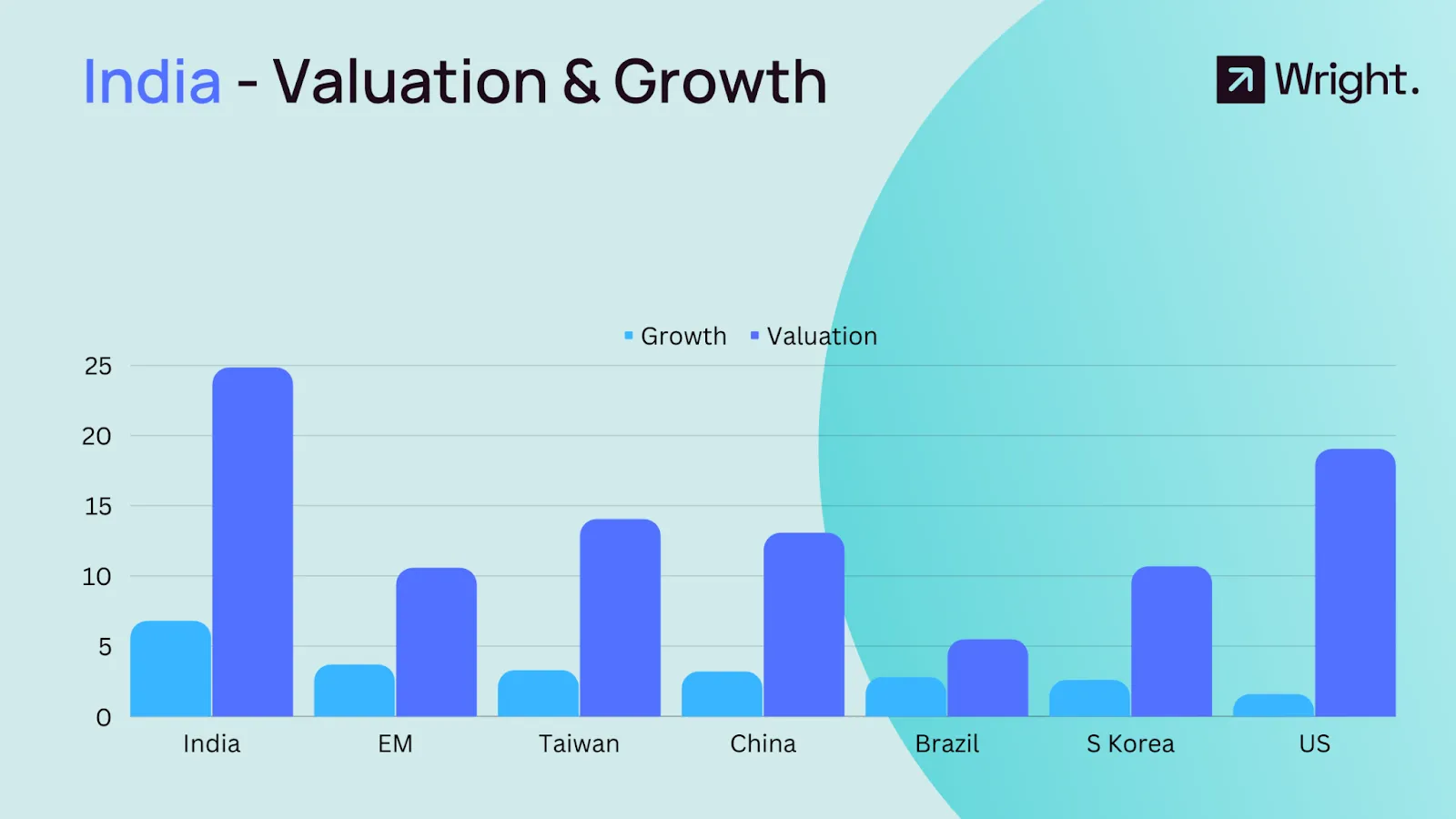

Our market has been the most robust over the last year and is at a much higher valuation multiple than many emerging markets. For example, the valuation ratio for the Nifty is running at a 134% premium. But we are not in the overheated zone if you look at the PE ratio compared to historical values. The US Fed has been very aggressive in its fight against inflation by hiking interest rates. However, they would compromise on growth in the economy for inflation. As the inflation in the US has cooled slightly but is still nowhere near the target rates, the rate hikes continue and be a concern for growth.

While India still has the highest projections globally in terms of growth which justifies the high valuation we demand. The Nifty deserves to command a high multiple for several reasons - India becoming an alternate manufacturing destination for the world, India leading in the public digital and financial infrastructure space, domestic focus on job-creation and ease of doing business. The RBI inflict expects India's growth to be 7% next year, and the world bank looks at 6.9% growth.

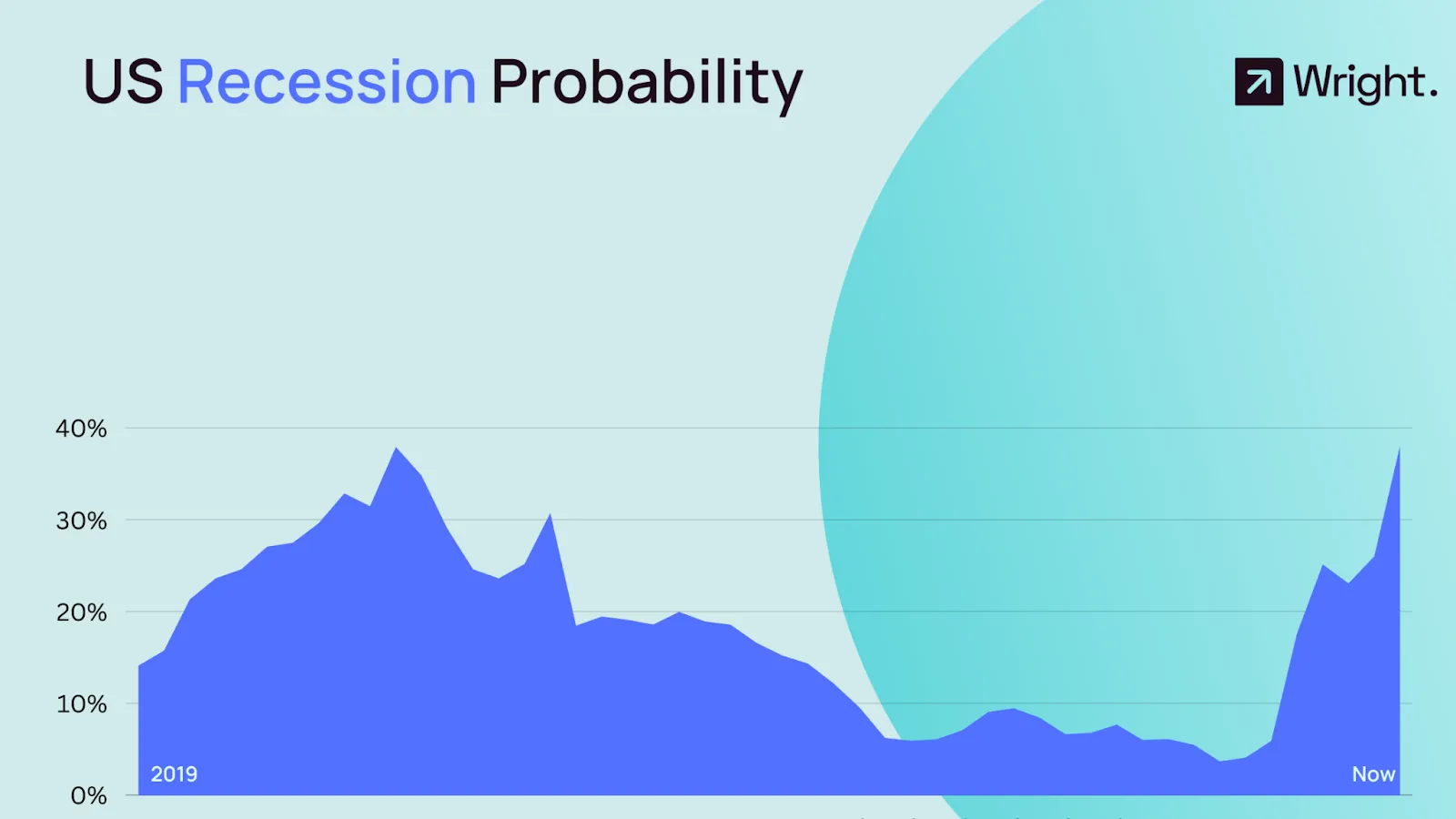

Elon Musk recently came out with a stark warning against a US recession next year if the FED keeps hiking rates, and he’s not alone. Economists worldwide have started warning against the fear of a Global recession.

The recession probability index published by the US Fed that looks at the spread between 3-year and 10-year treasury yields shows a heightened Recession fear.

Other economists who use several other statistical models and prediction techniques based on economic data to forecast recession are also seeing warning signs. The heightened inflation, rate hikes that are decelerating growth, and the strength of the US dollar are some of the culprits.

The growth concerns are not priced into the market prices, but the rupee tells another story. The valuation multiples that the Nifty is at are not the numbers that hint at a likely escalation but, in fact, hint at solid growth. The impact of slowing growth has already been felt in India, so in the scenario of slowing growth, many might call the robustness of prices in India a little overheated.

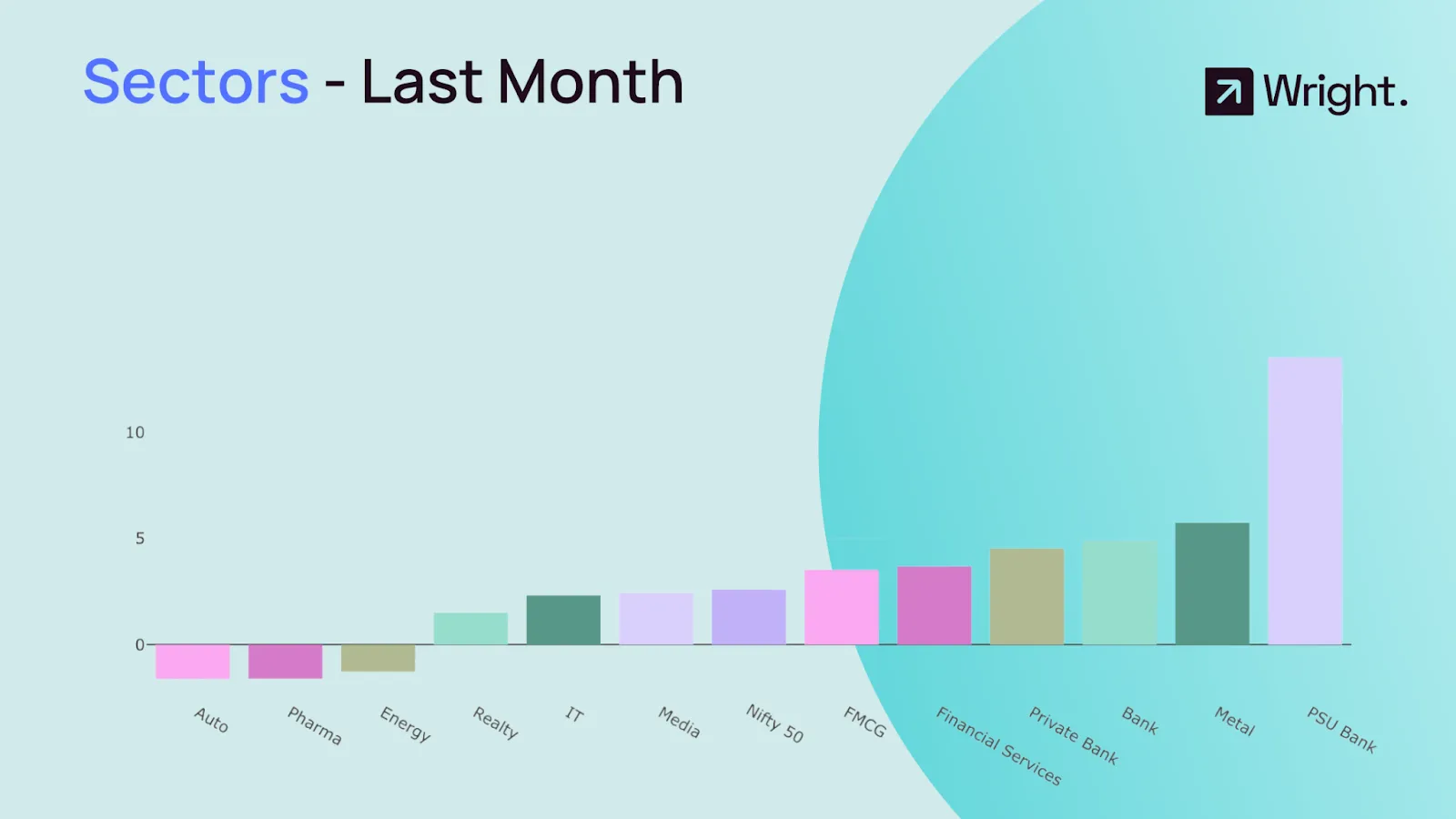

The Indian economy coming out of the pandemic will remain resilient. As inflation eases, many sectors will remain buoyant, especially domestic consumption, travel, and hospitality. Banks have come up strong with rising credit growth and much more robust balance sheets, and they will flourish in a rising interest rate environment. In a growing economy, we import more, but the exports will suffer as global growth slows down, and this will cause concerns. In a worldwide recessionary environment, sectors whose earnings are linked more to the global market, like Pharma and IT, will be impacted and see downgrades.

Banks are an excellent pick for an earnings upgrade in a rising interest rate environment even though the Bank Nifty is, in fact, the most heated sectoral index at the current junction. This is because domestic consumption will continue to be robust even if global growth slows down, and in a lower inflationary environment, the margins will expand and could see upgrades. In addition, domestic capital goods and manufacturing are still seeing upgrades as the Capex cycle remains robust, and they continue to benefit from PLI schemes. We could see good numbers there as well.

Debt has increasingly started looking attractive as interest rates have risen. The long-duration rates might have little demand as the rates will not be this high for too long, but the short to medium-duration debt is quite attractive. As a result, we are seeing a lot of buzz all around about debt products, which is a direct function of the attractiveness of the debt market in a rising interest rate environment.

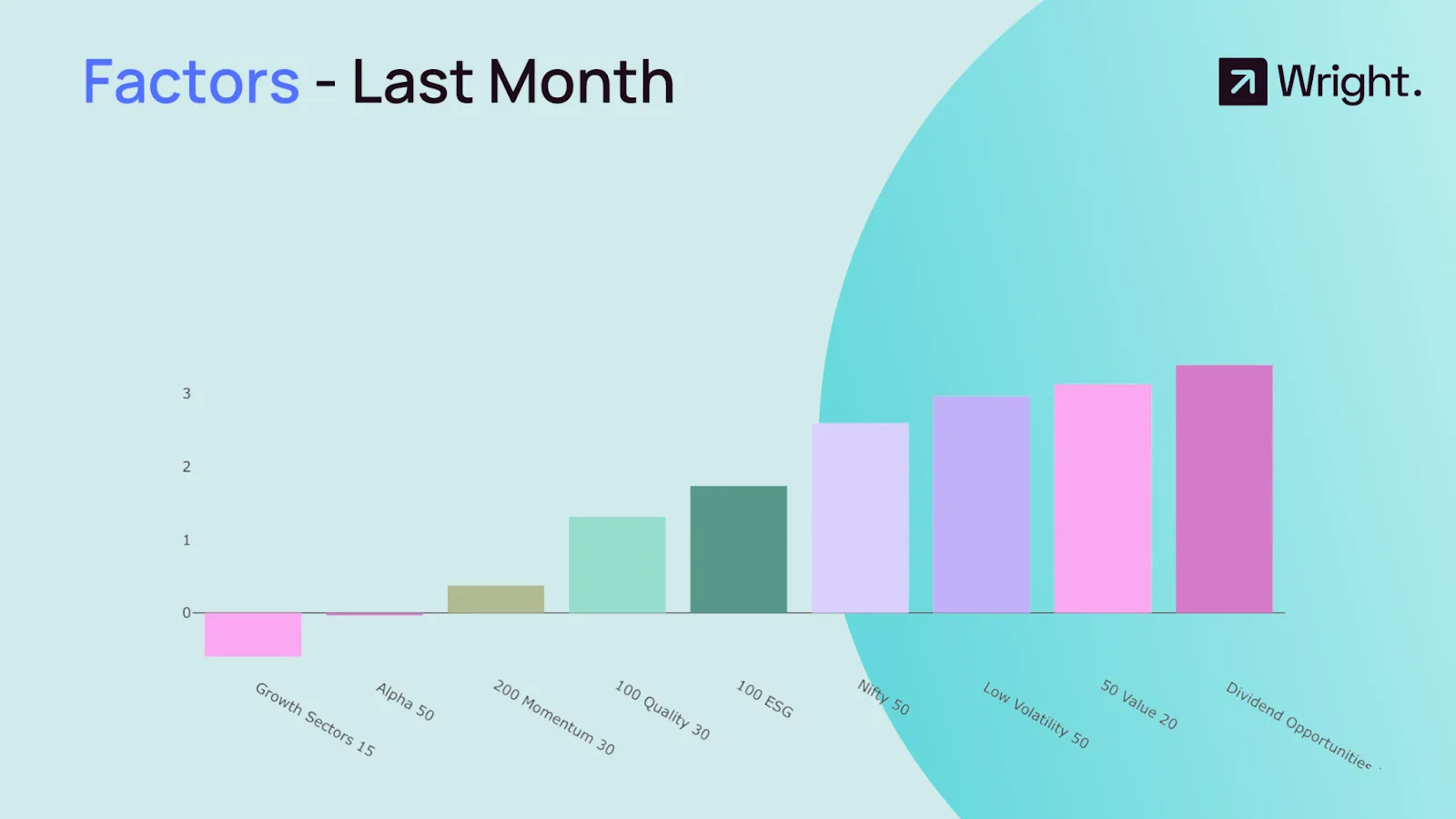

The high-flying factors of last years have been lagging over the past few months. This might be the time to bet on value stocks and high-quality bets, along with some bond allocation.

Check out our multi-factor tactical strategy that has a philosophy to shine in bad and good times based on tactical allocation and can be a safe core portfolio.

Invest in our Balanced Multi-Factor Tactical portfolio to take advantage of the multi-factor philosophy:

Balanced 🎯 Multi Factor smallcase by Wright Research

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios