by Sonam Srivastava

Published On Dec. 18, 2022

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

While the volatile phase in the market is still not over, we are getting increasingly confident about a few themes becoming immensely strong.

Capex - private investment remains strong in India despite global volatility, The government is incentivizing domestic manufacturing and defence indigenization and private sector is seeing capex in energy transformation, emerging tech and warehousing.

Budget - with the budget coming in the beginning of 2023, the sectors that the government is looking to focus on like - manufacturing, defence, sustainability, railways, public sector banks are already seeing fresh investments

Banking Sector Improvements - Asset quality, corporate loan portfolios and earnings have improved for public sector banks. PSB's strong performance will be supported by higher margins, continued credit growth and improved trade debt over the next few years.

Here are themes where we are seeing a trend form:

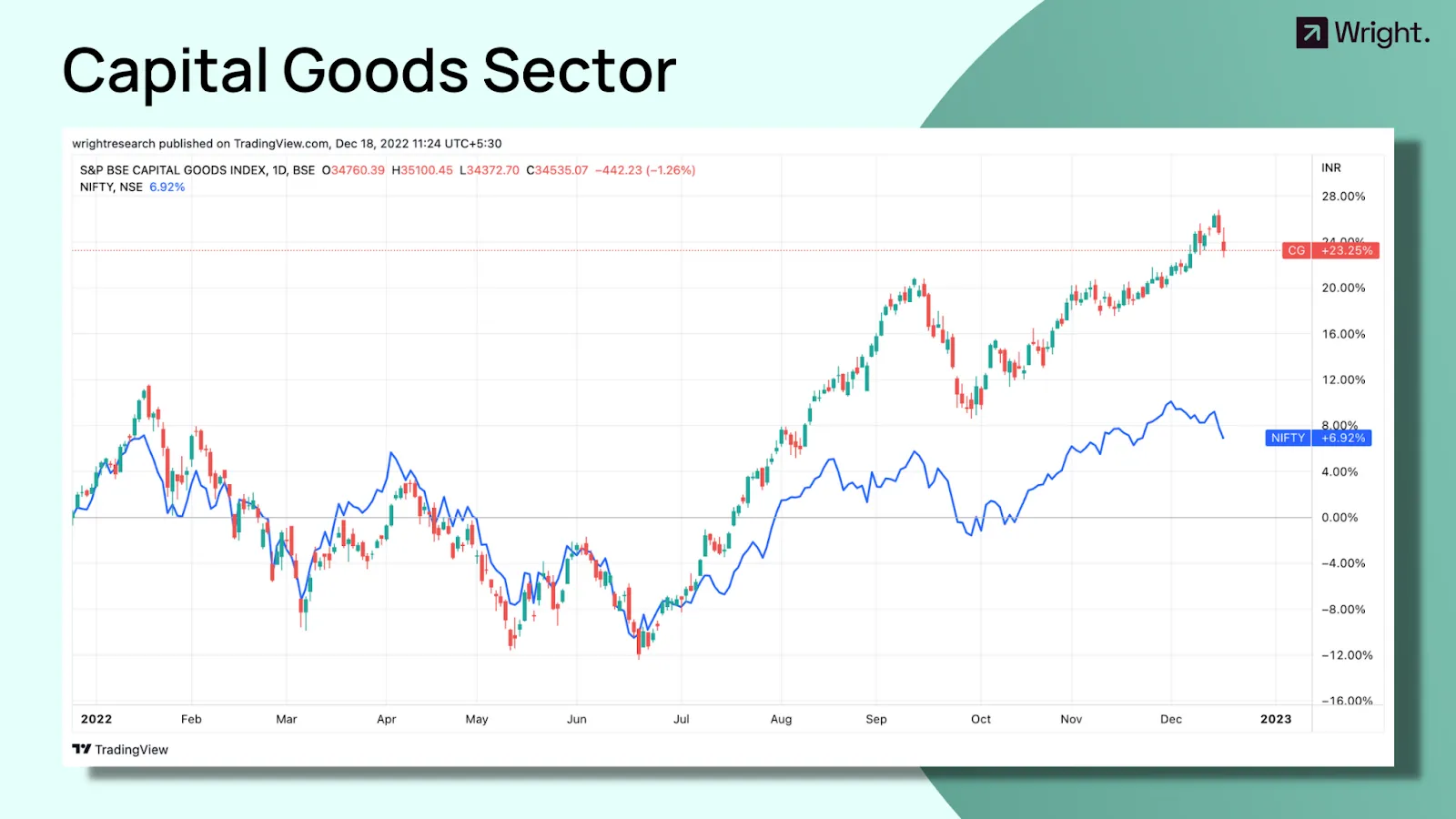

Industrial stocks have far outperformed benchmark Sensex as a resurgence in the investment cycle has led to a surge in new orders for industrial companies. Since the June low, the Industrial Goods Index has risen 38%, outpacing the Sensex recovery by 22%.

The sector saw revenue growth of 18% year-over-year. Profit margins remained strong despite higher input costs. Net income increased 23% year-over-year and 38% sequentially. The recent corrections in steel, base metals and other commodity prices will benefit all companies in terms of margins in the coming quarters.

India's private investment pipeline remains strong, driven by energy transition-related investment plans, participation in PLI programs, and emerging tech areas such as data centers (due to 5G transition) and automated warehouses (due to e-commerce growth)

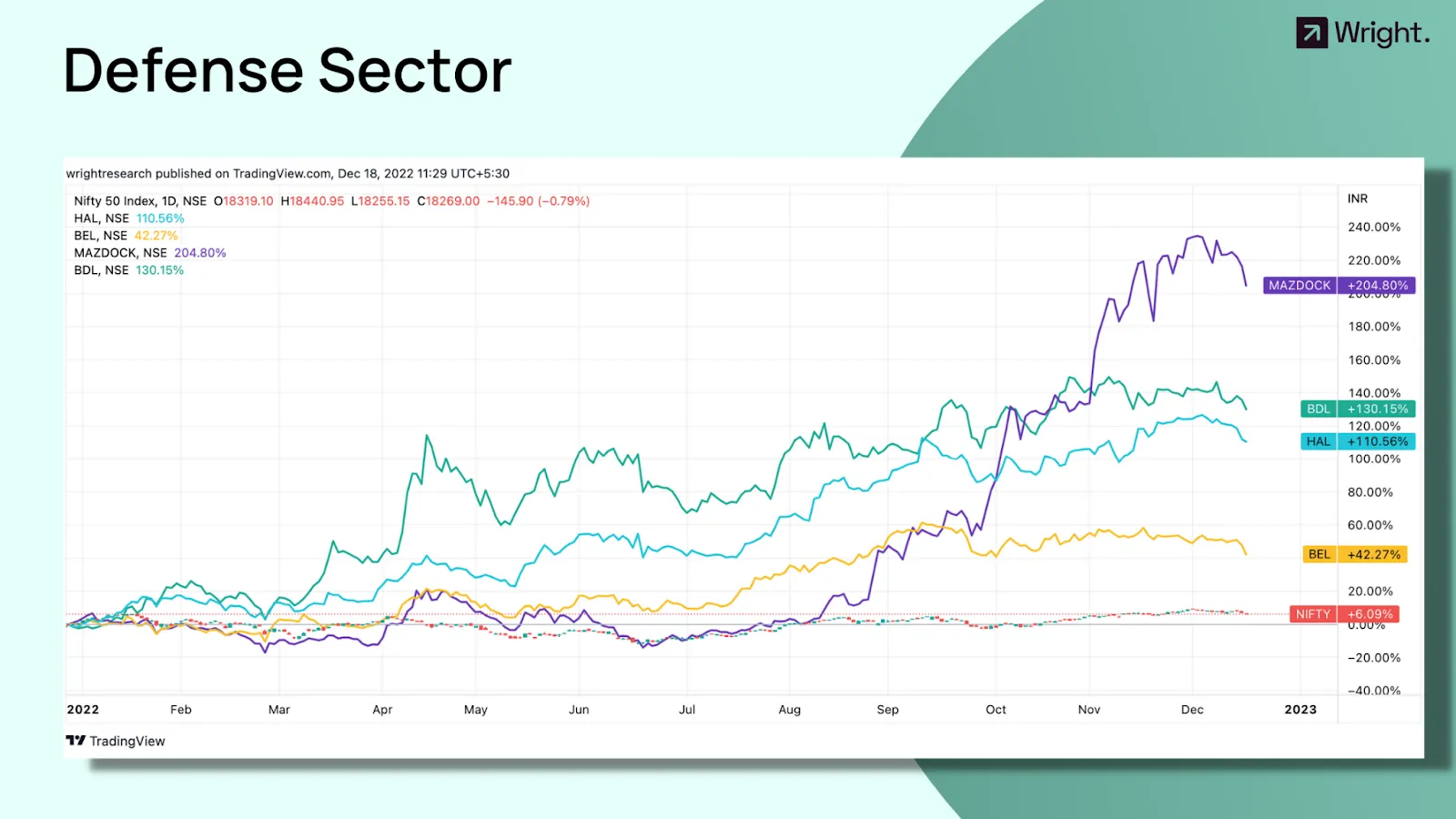

With the localization of the defense sector comes great opportunities for manufacturers in this sector. India is on track to meet its $5 billion defense export target as the government focuses on boosting its supply overseas.

Many foreign defense OEMs are now dependent on China and Russia, giving Indian manufacturers a great opportunity to expand their exports, led by the China Plus 1 strategy.

Healthy order books and government localization efforts make defense stocks an attractive time. Expectations that the government might announce more localization measures are also spurring purchases of defense stocks.

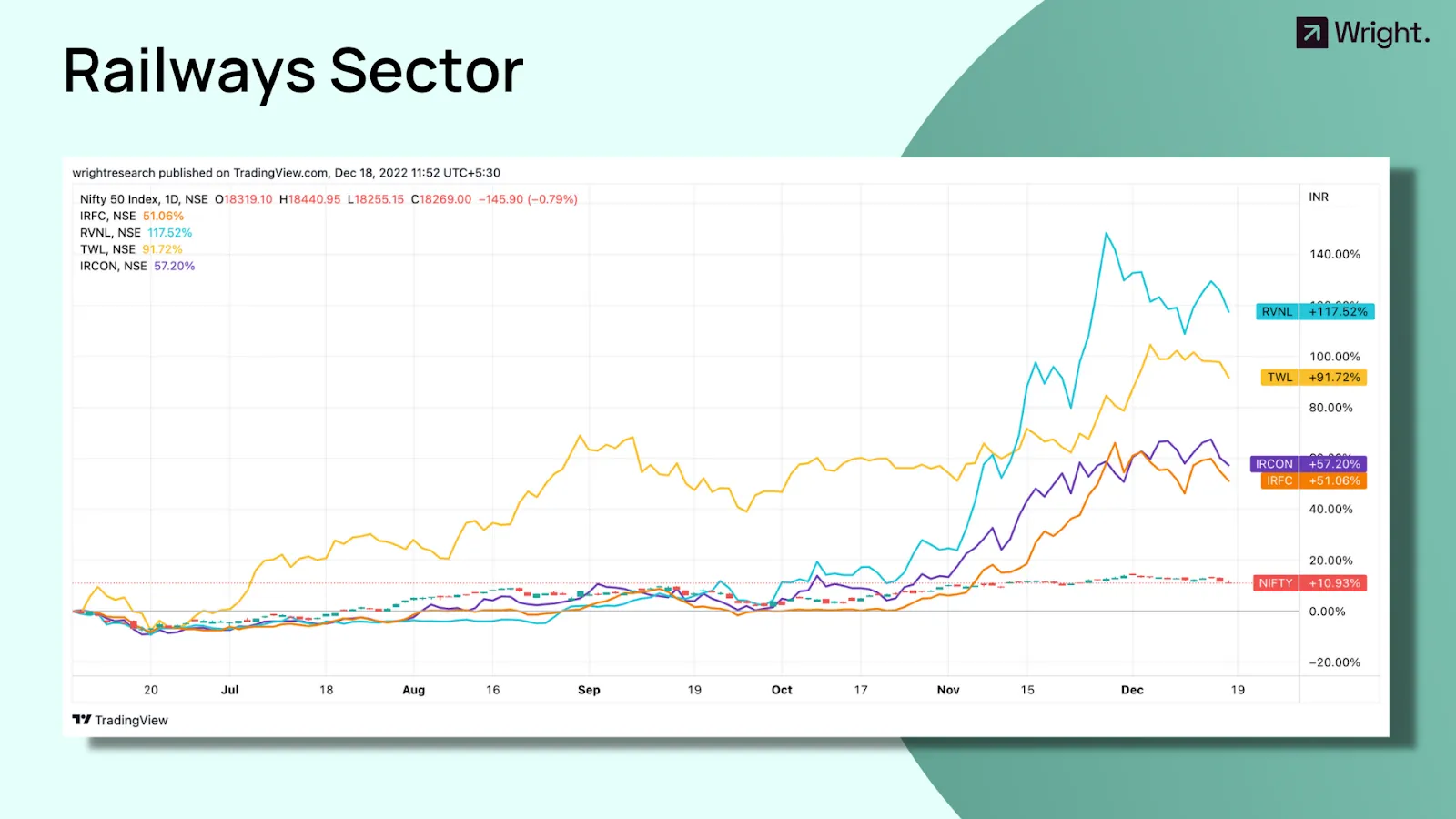

Recently, there were reports that the central government could sell up to 10% stake in four other companies, including RailTel and RVNL. This has increased investor confidence in the railway company. The government is also planning to increase the number of trains. In addition, there is enthusiasm among investors as the government focuses on the road and rail product mix.

The government is expected to make several important announcements on Indian Railways in the upcoming budget. Around 300-400 Vande Bharat trains are expected to be unveiled in the 2023-2024 budget. The government is also working to modernize the railways. So far this year, 400 such trains have been announced. According to media reports, production of around 100 of these trains should also be completed by him by the 2023/24 financial year.

A large portion of the government's total investment was also spent on railroads last quarter. Governments are investing heavily. In the July-September quarter, rail investment was up 80% year-on-year.

PSU Bank is going through a cycle of good loan growth, good NII growth, good NIM and balance sheet cleanup, giving investors confidence. PSU's banking stocks have outperformed their private sector peers as asset quality, corporate loan portfolios and earnings have improved. PSB's strong performance will be supported by higher margins, continued credit growth and improved trade debt over the next few years. Credit growth is sustainable and credit costs for these banks will remain low.

The PSB sector in India has been on the road to normalization for the past few years and Q2 came together to deliver her highest RoA in eight years. PSB loan/PPOP growth was about the same as commercial banks. The most encouraging factor is the widespread improvement in asset quality indicators.

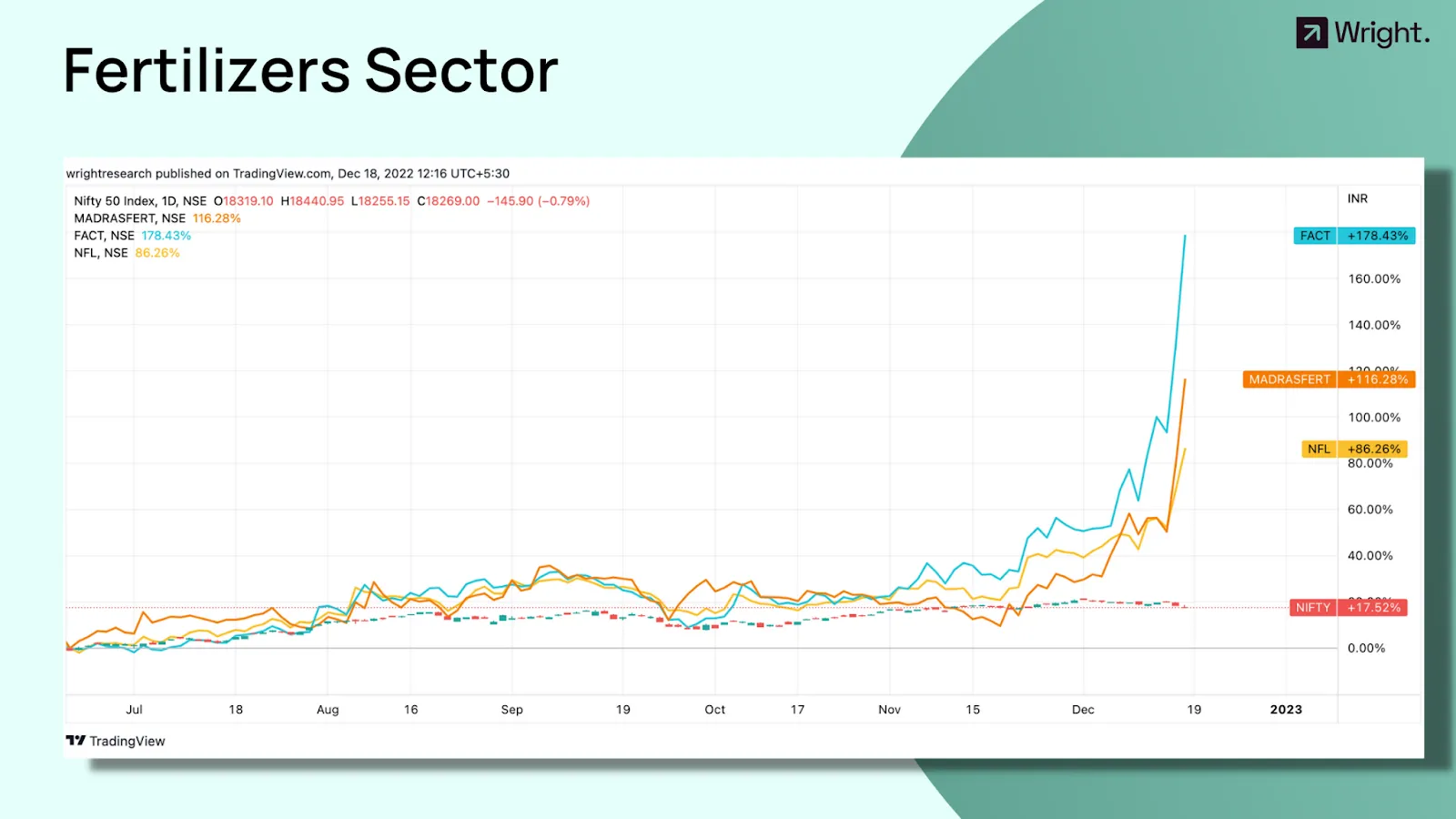

According to media reports, Russia will impose an export tariff of 23.5% on all types of fertilizer, with a "marginal price" set at $450 per ton. According to local Russian media, the obligation will come into force on January 1, 2023. After the news, Indian fertilizer stocks saw a significant price increase.

Market prices for RCF, MFL, FACT and NFL have increased 38-60% in BSE in the past month. In contrast, the S&P BSE Sensex he rose less than 1% over this period. Most of Russia's fertilizer exports are consumed mainly in the European region. But this will obviously affect India as well. Import costs are expected to increase by $70/ton. At the same time, the recent government announcement to cut fertilizer subsidies for the second half of 2023 will not be changed by the government. has already completed its 23rd fiscal year. Subsidies are therefore likely to remain high into next year (FY24).

We might see a new regime in 2023, with low inflation, rising commodities, the resurgence of the manufacturing and cyclical businesses and high-interest rates. Other themes apart from the ones mentioned above have started signs of emergence.

What are the themes that you are betting on? Let us know by filling in this short form

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios