by Sonam Srivastava

Published On May 20, 2019

Here, I try to provide a snapshot macroeconomic perspective on the Indian economy driven by data but not necessarily usingdata science.

Let’s look at some broad themes.

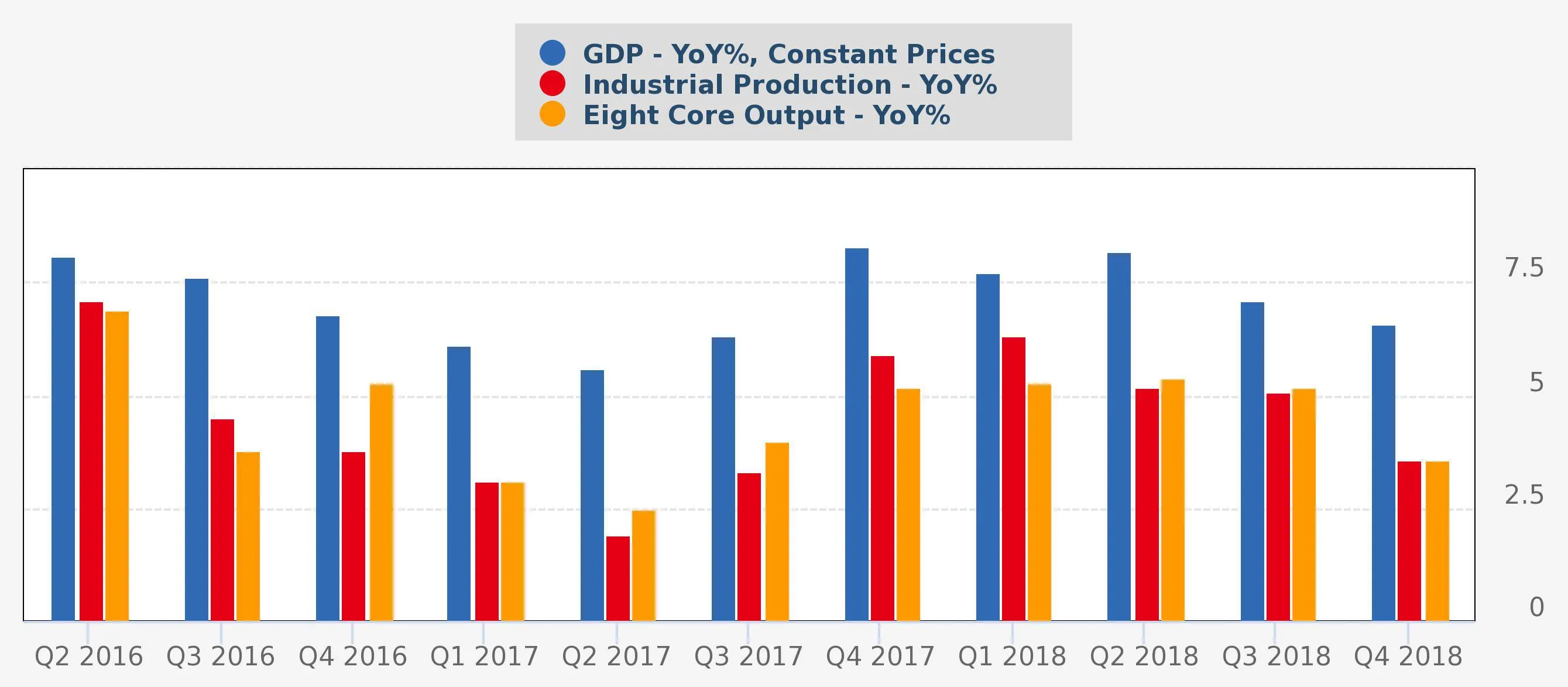

India’s Gross Domestic Product (GDP) growth was reported at a six-quarter low of 6.6% year-on-year (YoY) during Q4 2018. This slump was on account of lower growth in agriculture, manufacturing, services as well as a slowdown in both private consumption and the government consumption spending. The GDP growth projections for 2018–19 have also been revised lower to 7% YoY from an earlier estimate of 7.2% YoY by the Central Statistical Office.

The industrial production growth slowed down to a 21-month low of -0.1% year-on-year in March 2019, much lower than the 5.3% YoY growth witnessed last year.

The slump in GDP and Industry growth indicates that the economy is losing steam.

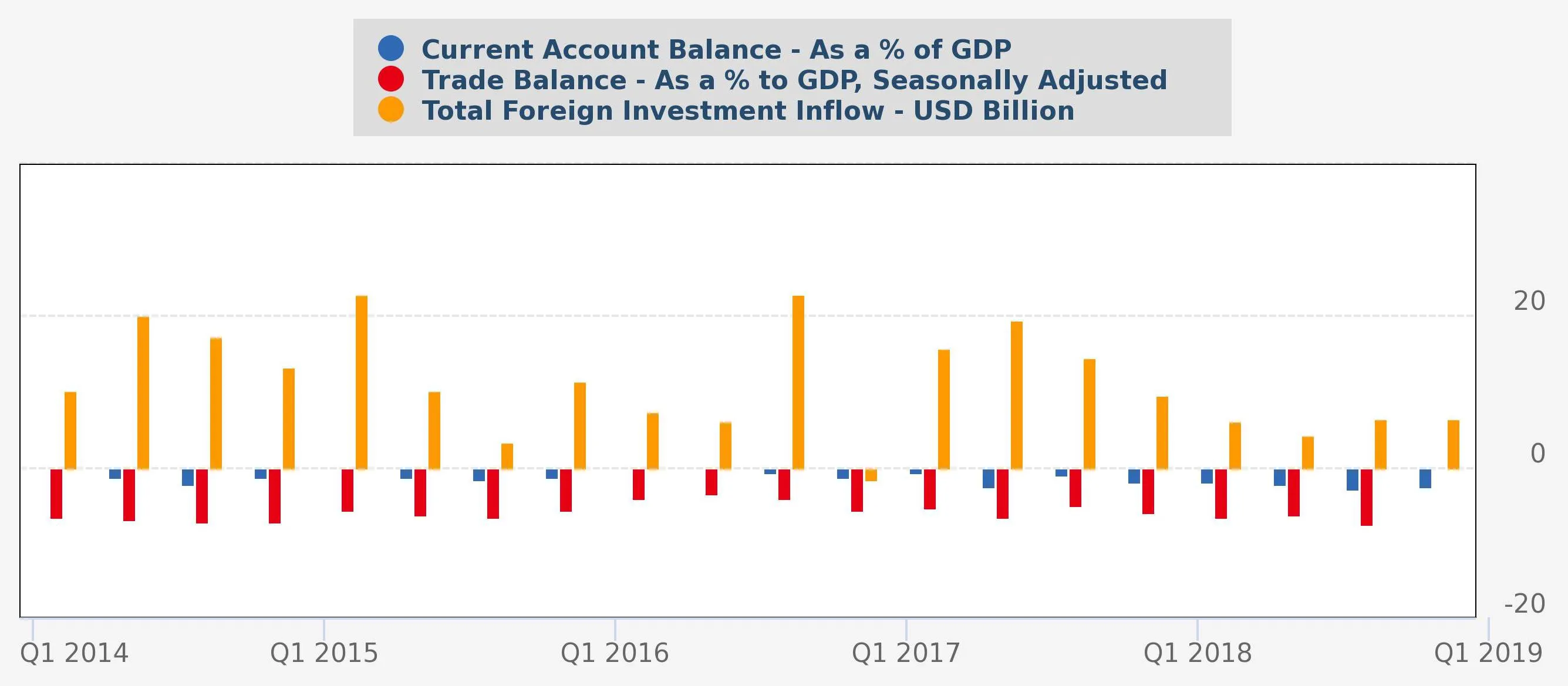

India’s current account deficit worsened to USD 16.9 billion (2.5% of GDP) during Q4 2018 from a level of USD 13.7 billion (2.1% of GDP) a year ago. The widening of CAD was on account of higher imports which resulted in a widening trade deficit.

India’s trade deficit widened to a five-month high of USD 15.3 billion in April 2019 from USD 10.89 billion in the previous month. The significant expansion in the trade balance was due to a four-month low growth in exports and five-month high growth in imports in April led by Oil and Gold.

India’s external debt witnessed a decline to USD 510.4 billion by end-Sep’18 recording a decrease of USD 19.3 billion over the level at end-Mar’18.

India witnessed a surge in its total foreign investment inflows to USD 12.3 billion in March 2019, a highest since October 2010.

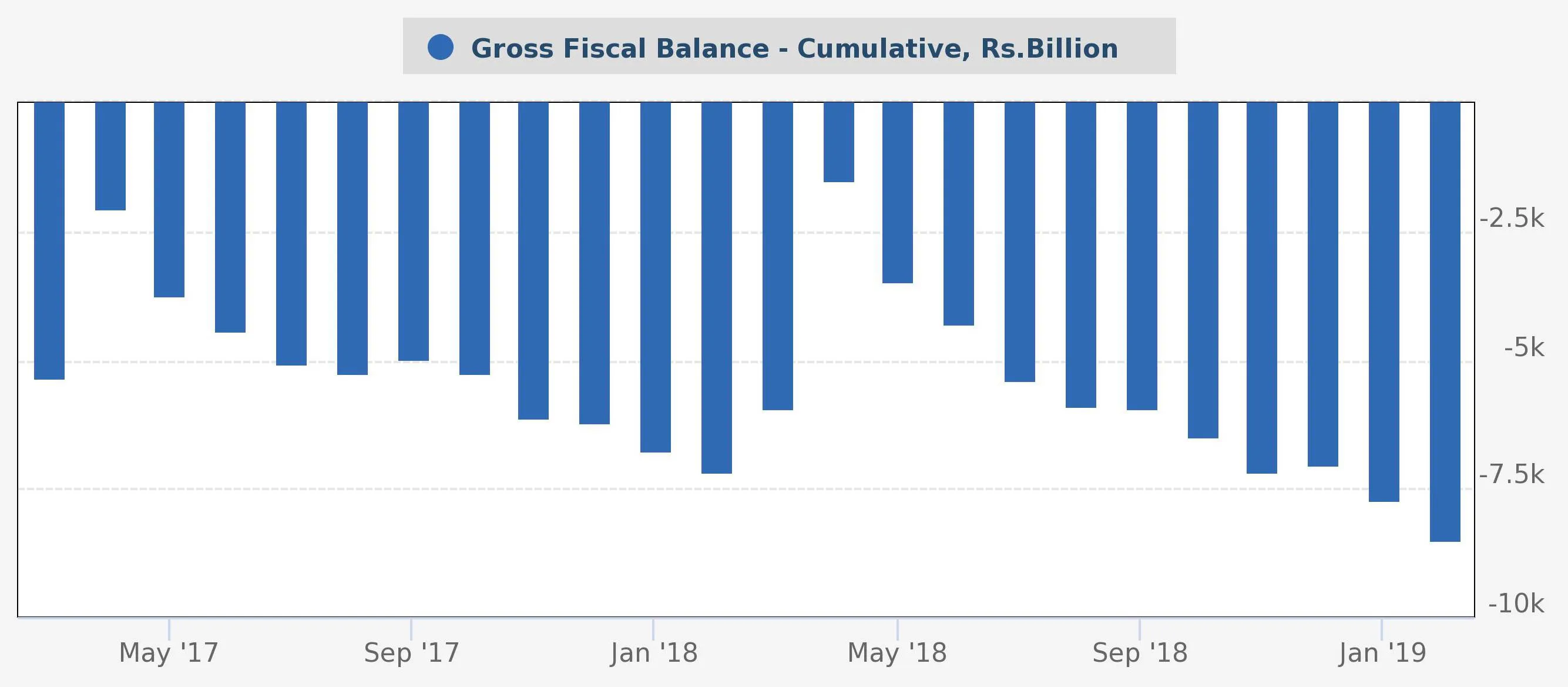

Centre’s gross fiscal deficit reached 136.3% of its revised budgeted estimate (BE) of Rs. 6.2 trillion, during April-February. This is equivalent to Rs. 8.5 trillion (4.5% of GDP). The amount of fiscal deficit is the highest in the last decade. With just one month left in the fiscal year, the picture remains clear that the pressure for the government to meet the fiscal deficit target of 3.4% of GDP for 2018–19 continues to mount.

If the government misses the target, inflationary consequences are likely in the near-term.

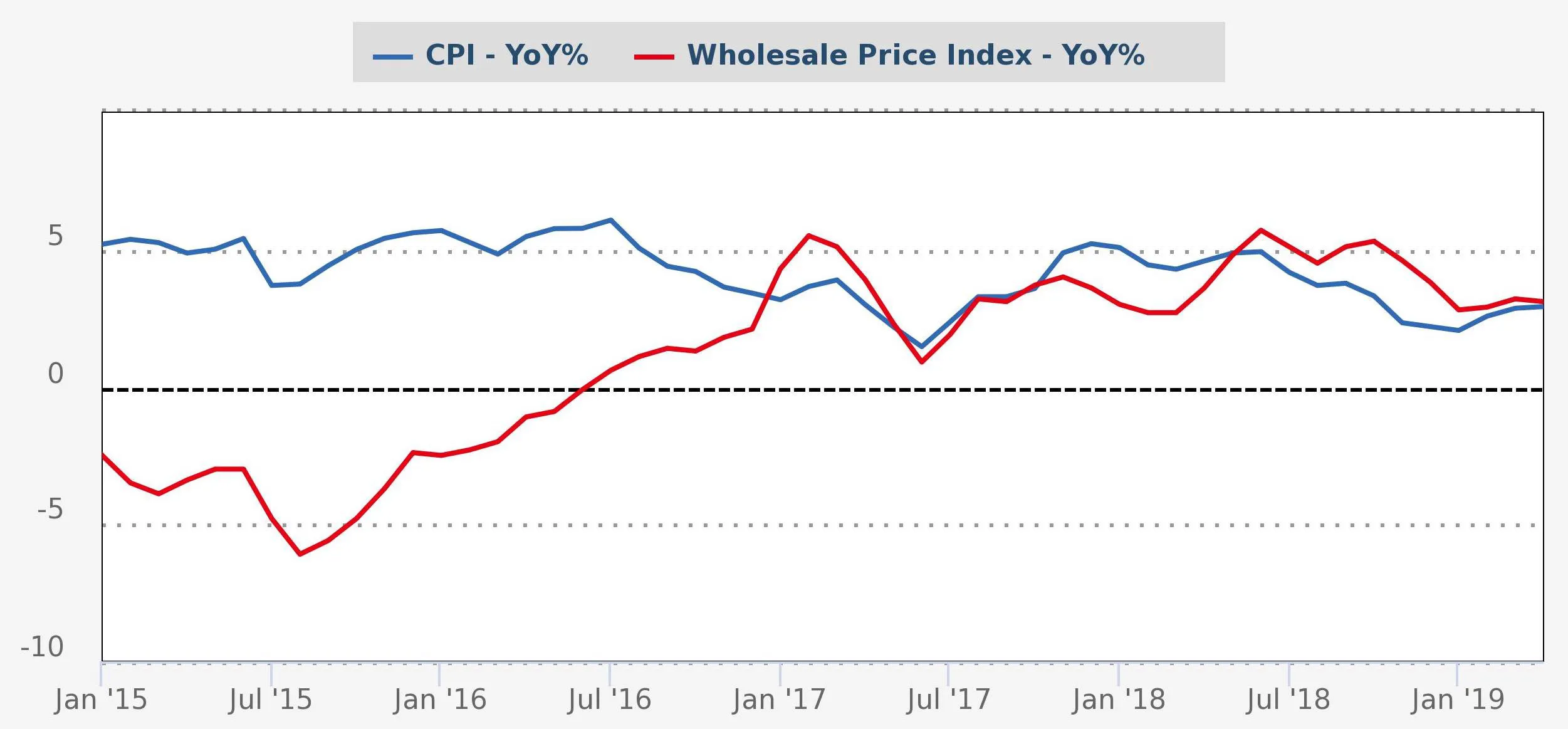

India’s Consumer Price Index (CPI) inflation rose to 6-month high of 2.92% year-on-year (YoY) in April 2019 from 2.86% in March 2019 on account of the 9-month high rise in food prices and 4-month high pickup in fuel prices.

The Wholesale Price Index inflation eased to 3.1% YoY in April 2019 compared to 3.18% in March 2019, primarily on account of cheaper fuel and manufactured items.

Housing prices grew by 5.7% year on year (YoY) in Q2 FY19. The real estate sector, which got impacted by the subsequent implementation of demonetization and GST, has been facing a multi-year demand slowdown.

Monsoons and Crude Prices would decide the direction of retail inflation in the next period.

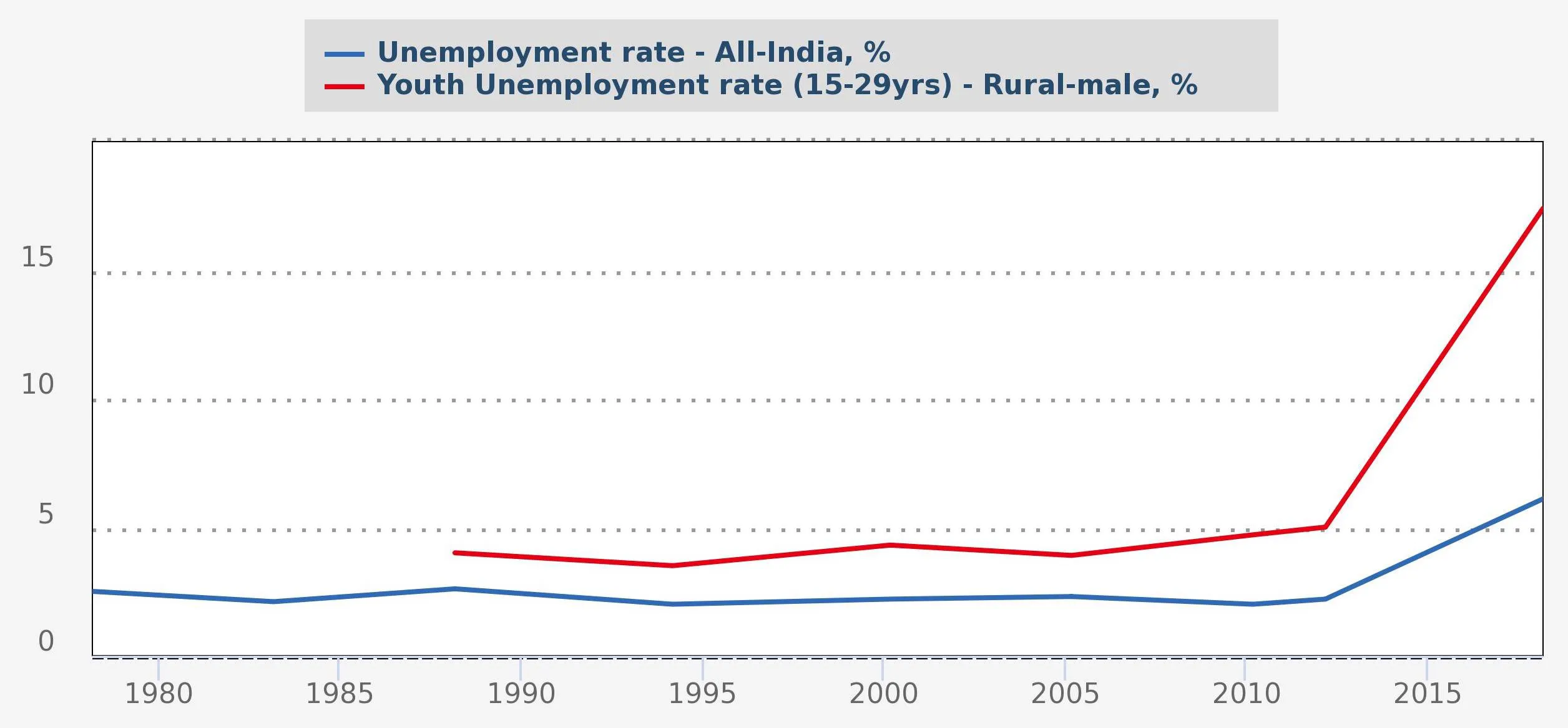

Business Standardpublished a leaked scoop about the country’s unemployment rate having reached a 45-year high of 6.1% in 2017–18.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart