In today's rapidly evolving financial landscape, markets across the globe are experiencing heightened volatility. The aftershocks of the COVID-19 pandemic, coupled with geopolitical tensions, inflationary pressures, and supply chain disruptions, have created an atmosphere of uncertainty. Investors, both seasoned and new, are treading cautiously, trying to decipher the market's next move.

The Indian stock market, for instance, after reaching its peak in July, has witnessed significant fluctuations, reflecting the broader global trend. Such volatility, while unnerving, also presents unique investment opportunities. As we delve deeper into this topic, we aim to provide a comprehensive understanding of the current scenario, the macroeconomic factors at play, and insights into making informed investment decisions in these turbulent times. Whether you're looking to safeguard your investments or capitalize on market movements, understanding the root causes and potential trajectories of this volatility is crucial.

The macroeconomic landscape plays a pivotal role in shaping the volatility and direction of financial markets. Let's break down the current macro scenario to better understand the forces at play:

Rising valuations, rather than earnings growth seems to be a theme for developed economies, along with certain challenges for emerging markets like China. Rising interest rates, a strong dollar, inflation, geopolitical worries are just some of the global events at play.

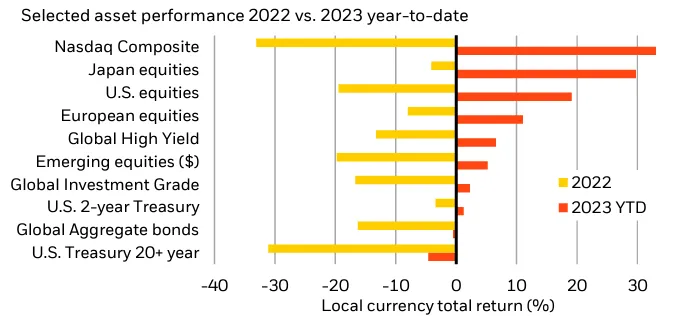

The equity selloff of 2022 has mostly been reversed in 2023, but not necessarily the case for long term bonds.

Factors such as persistent inflation pressures, an increase in government debt, and volatility in the macro and geopolitical arenas are expected to drive bond yields higher which questions the relative attractiveness of broad equity allocations

While the S&P 500 has risen by over 16% this year, this growth is driven primarily by a few firms. In comparison, the equal-weighted S&P 500 has grown only about 4%.

There's a notable stagnation in U.S. earnings.

China's property sector continues to affect the market negatively.

The market isn't showing extreme negative trends; instead, it's adjusting sideways, suggesting an underlying strength and potential for further positive movement. Valuations aren’t comfortable, but are not exorbitantly high

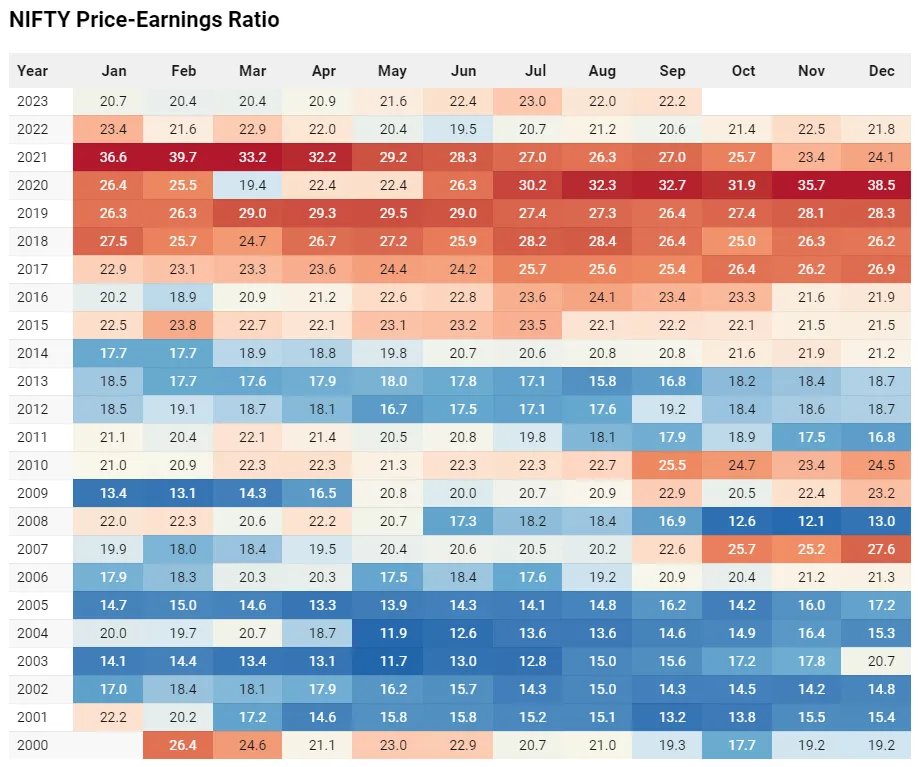

PE of Nifty is slightly below +1 standard deviation to the historical average PE (considering a 15-17 year span).

Comparing India's 10-year bond yield & Nifty's 12-month forward earnings, the current difference between these yields is around 1.6%age points, which is less than a 2% discount to the bond yield. Historically, when this discount has exceeded 2%, it has been considered an extreme valuation.

There is still some room for the market to move before reaching an extreme valuation. However, if there are quick rallies in the market without earnings catching up, this could push valuations into extreme territory. Especially if the market starts to price future expectations from assumptions of short-term improvements or festive demand into the value of the stock and it turns out that these aren’t met.

Many economies, including the US and parts of Europe, are witnessing rising inflation. Factors such as supply chain disruptions, increased demand post-lockdowns, and expansive monetary policies have contributed to this inflationary pressure. Central banks worldwide are closely monitoring these trends, and some have already begun tightening monetary policies in response.

With inflation on the rise, there's growing speculation about potential interest rate hikes by major central banks. The US Federal Reserve, for instance, has hinted at potential rate increases, which could have ripple effects on global markets, especially emerging economies.

Read our detailed analysis on Inflation in India 2023 - Causes, Impact & What to Expect for Indian Stock Market & Investors

The flow of foreign investments, especially into emerging markets like India, plays a significant role in market dynamics. Recent shifts in FPIs, driven by global interest rate scenarios and risk appetites, have impacted market valuations and liquidity.

The strength of the US dollar, coupled with the performance of other major currencies, impacts global trade, debt servicing for emerging economies, and commodity prices. Recent fluctuations in currency values have added another layer of complexity to the macroeconomic picture.

Inflation fell in August from highs of July (Read our detailed analysis on Inflation in India 2023 - Causes, Impact & What to Expect for Indian Stock Market & Investors )

GDP growth for private consumption over a four-year period has been only 3.5%. The data points towards challenges in boosting consumption growth in the economy

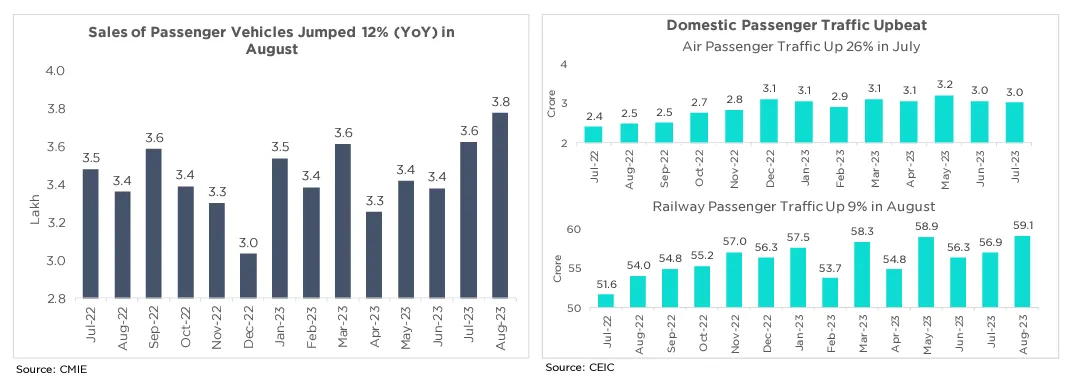

Urban demand is doing well with improvements in PVs, retail credit growth, domestic passenger traffic numbers.

Weak global cues, economic health concerns, inflation worries, high rates, slowing global economy, risks of an expanded slowdown, and foreign institutional investors (FIIs) selling due to a weaker rupee are factors affecting sentiment.

Read our detailed viewpoint on Why we are bullish on the India Growth Story?

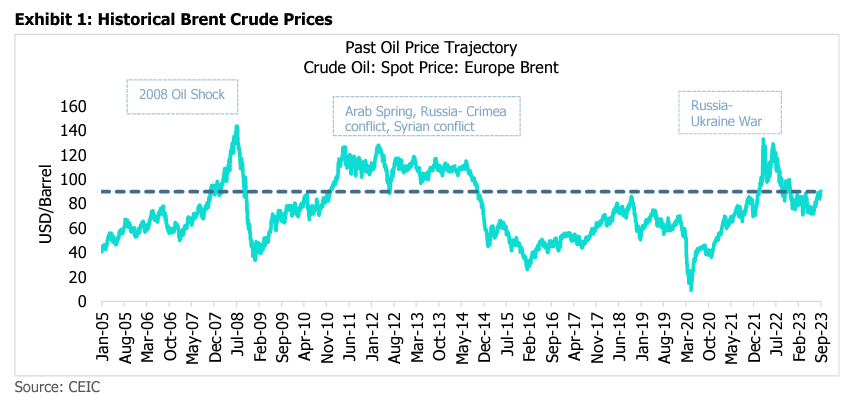

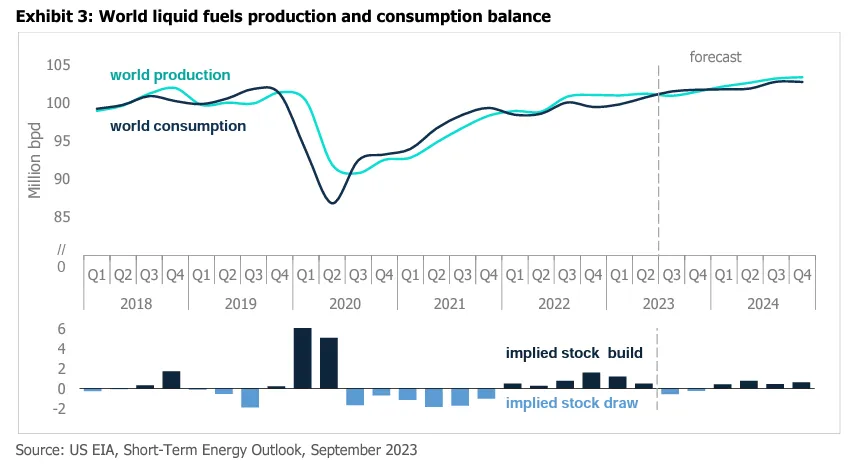

Crude oil situation also demands attention. A surge in crude prices, driven mainly by controlled supply from OPEC Nations rather than dwindling supply. The 2005-2006 cut by OPEC, which led to skyrocketing prices later on, is reminiscent of the current scenario.

US: From a longer-term perspective, the tepid growth of U.S production amid strong oil prices is concerning. Incremental oil demand, which averages between one to one and a half million barrels per day during a standard growth year, might be hard to meet if the U.S doesn't ramp up its production. With older oil fields naturally declining and investments in new fields being hindered by global ESG (Environmental, Social, and Governance) priorities, the supply might tighten further.

China: China were to release its vast inventory, it could potentially influence crude prices, but it's not transparent about these inventories, so it's an unpredictable element.

Saudi Arabia: Aware of global economic fragility, Saudi Arabia reviews their production on a monthly basis and could adjust their production cuts keeping in mind the broader market volatility and economic impact.

Natural declines in old oil fields must be offset by new production. However, attracting investments for upstream oil projects has become more challenging due to ESG concerns

Hope lies in moving towards alternative energy sources in the long run, though this isn't a transition expected to happen overnight.

When we zoom out from the daily ebbs and flows of the stock market and take a broader perspective, a clearer picture often emerges. The long-term view is essential for investors to understand the underlying trends and potential trajectories of the market, irrespective of short-term volatilities. Here's a deeper look into the long-term outlook:

Historical Resilience: Historically, markets have shown a remarkable ability to recover from downturns. Whether it was the financial crisis of 2008 or the dot-com bubble burst of the early 2000s, markets have always rebounded over time, often reaching new heights.

Emerging Markets Growth: Countries like India, China, Brazil, and several African nations are poised for significant economic expansion in the coming decades. As their middle classes grow and urbanization continues, these markets present vast opportunities for investors.

Technological Advancements: The next few decades will likely witness unprecedented technological innovations. From AI and machine learning to renewable energy solutions and biotechnologies, these sectors promise growth and can drive market advancements.

Demographic Shifts: Aging populations in developed countries and young, burgeoning populations in developing nations will reshape global economic dynamics. This shift will influence sectors like healthcare, real estate, finance, and consumer goods in various ways.

Sustainability and ESG: There's a growing emphasis on Environmental, Social, and Governance (ESG) factors in investment decisions. Companies focusing on sustainability and responsible governance are likely to attract more investments, indicating a shift in market priorities.

Globalization vs. Localization: While the past few decades saw rapid globalization, recent trends suggest a potential shift towards more localized economies, influenced by geopolitical tensions and the desire for self-reliance. This dynamic will create new investment avenues and challenges.

Infrastructure and Development: Many countries, both developed and developing, are focusing on massive infrastructure projects, from transportation networks to digital infrastructure. These initiatives will spur economic growth and offer long-term investment opportunities.

Financial System Evolution: With the rise of digital currencies, decentralized finance (DeFi), and fintech innovations, the very foundations of the global financial system are evolving. While this brings in volatility in the short term, the long-term prospects of a more inclusive and efficient financial system are promising.

In essence, the long-term view suggests a world of opportunities for investors. While challenges and uncertainties will always be part and parcel of the investment landscape, a well-researched, diversified, and patient approach can harness the growth potential the future holds.

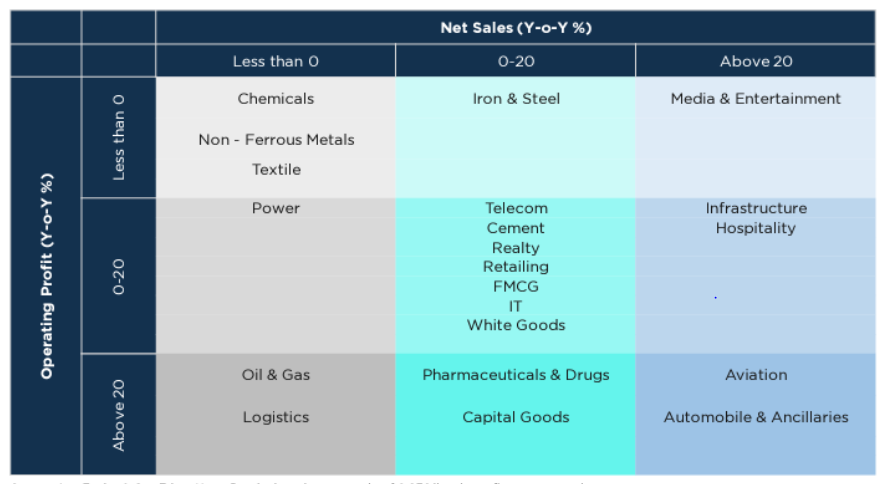

Here’s a quick summary of net sales for Q1 FY24 across different sectors

In sectors such as defense, railways , and power which have seen strong participation, the market is split between profit booking and future growth.

Profit booking: Even if these sectors experience growth in earnings, volume, and revenue, stock price returns might be subdued. This is because the high valuations have already priced in the anticipated growth for the next few years. High valuations = lower chances of earning returns.

Future growth: Another school of thought finds these high valuation sectors could show strong growth opportunities in the longer horizon given robust fundamentals, strong order books, and continued government push. Take into account, upcoming elections in 2024, and government spending in these sectors is unlikely to dip.

Consumption-driven companies seem overvalued despite a weakened consumption backdrop evident from the past three quarters.

While there are concerns globally about consumption due to inflationary pressures, India's consumption story is still strong, thanks to its demographic dividend.

Brands that cater to the aspirational middle class could find greater traction.

An upswing in auto stocks was witnessed due to improved profitability from 3Q of FY23. This was mainly due to a reduction in commodity prices.

However, the scenario has evolved. With rising oil prices (though stagnant diesel and petrol prices) and the depreciation of the rupee, raw material prices are inching upwards.

If there isn't a volume surge and if profitability metrics such as EBITDA margins start to feel the pressure, the market's reaction might be severe.

The current market sentiment appears to be pricing in a lot of positive developments. If these do not materialize, corrections might be in order. If the festive season does not stimulate sufficient demand, the sector might experience substantial correction.

Despite IT stocks' correction from their 2021 highs, it might not be as attractive due to their elevated valuations over an extended period and due to exposure of external market shocks

Look at stocks that are more India-focused as a hedge against such potential external shocks.

With increasing digitization and India being a hub for IT services, companies with a diversified client base and innovative solutions might continue to do well.

In the past 2-3 years, India's banking and financial sector saw significant growth, contributing 30-35% to indices.

With stable macro indicators and the push towards more financial inclusion, this sector could continue its rally.

We've already seen the likes of private sector banks scaling new highs.

PSU stocks have rallied recently and their business fundamentals have improved - with companies benefiting from B2G contracts.

Among the subsets within the PSU bucket, railways, defense, and capital goods are favored for the next few years. The defense budget is unlikely to be reduced, making defense stocks appealing.

Railways are also promising due to increased budgets and a supply challenge, which is considered a good problem as capacities are enhancing.

As India pushes for more infrastructural developments, the capital goods and infra sectors could see significant benefits.

Companies with solid order books and sound financial health would be the ones to watch out for.

Given the global health crisis we've just navigated through, there's an increased emphasis on healthcare infrastructure and pharmaceutical R&D.

Companies investing in research and those with a diversified portfolio of medicines might stand out.

There's a recent focus on specialty chemicals, particularly the bromine and fluorine chains. Bromine has potential because of its use in fire retardants and the movement towards bromine derivatives for pharmaceutical and agro industries.

" Make in India " and "China plus one" themes are emphasized in specialty chemicals.

In the face of market volatility, making informed investment decisions becomes paramount. While turbulent times can be nerve-wracking, they also present unique opportunities for savvy investors. Here's a guide on where to channel your investments during volatile periods:

Diversification is Key: One of the primary strategies to mitigate risk is diversification. By spreading your investments across various asset classes, sectors, and geographies, you can cushion your portfolio against significant downturns in any one area.

Defensive Stocks: These are stocks from sectors that remain relatively stable during economic downturns, such as utilities, healthcare, and consumer staples. People will always need electricity, medical care, and food, regardless of economic conditions.

Dividend Stocks: Companies that consistently pay dividends can offer a steady stream of income. Even if the stock price drops, the dividend can provide a return on investment.

Emerging Markets: While they can be riskier, emerging markets offer growth potential. As developed markets might face stagnation, countries with burgeoning middle classes and rapid industrialization can present investment opportunities.

Technology and Innovation: Sectors like AI, space tech , biotechnology, new age tech startups , renewable energy , and e-commerce are driving the future. Investing in innovative companies or sectors can offer substantial returns, though it's essential to be aware of the associated risks.

Bonds and Fixed Income: Consider allocating a portion of your portfolio to government or corporate bonds. They can act as a stabilizing force, providing regular interest income and returning the principal upon maturity.

Gold and Precious Metals: Historically, gold has been viewed as a safe-haven asset during turbulent times. Its value often moves inversely to stock markets, making it a good diversification tool.

Cash Reserves: Keeping a portion of your portfolio in cash or cash-equivalents allows you to capitalize on investment opportunities as they arise. It also provides liquidity and safety.

Volatility, while often viewed with apprehension, is an inherent aspect of financial markets. It tests the mettle of both novice and seasoned investors, challenging their strategies, patience, and long-term vision. However, as history has shown, markets have an innate ability to recover and present opportunities even in the most tumultuous times.

The current market scenario underscores the importance of being adaptable and well-informed. While short-term fluctuations can be unnerving, they should not deter investors from their long-term financial objectives. Instead, these moments should be seen as a chance to reassess, realign, and perhaps even capitalize on the shifting landscape.

It's also crucial to remember that no single investment strategy fits all. Individual financial goals, risk tolerance, and investment horizons vary, and so should the approach to navigating volatile markets. Diversification remains a cornerstone principle, but its application might differ based on individual circumstances.

In these uncertain times, collaboration and consultation with financial experts can provide invaluable insights. Their experience and knowledge can offer a broader perspective, helping investors see beyond the immediate turbulence.

In the end, the journey through volatile markets is as much about mindset as it is about strategy. Embracing change, staying informed, and maintaining a clear vision of one's financial goals will not only help navigate the stormy waters but also emerge stronger and more resilient on the other side. As the adage goes, "It's not about timing the market, but time in the market." Embrace the volatility, stay the course, and let time work its compounding magic.

Explore the Wright Balanced Multifactor Smallcase & Wright New India Smallcase.

Read the full article on Wright Research Will market volatility continue? Where to invest in volatile times?

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios