by Siddharth Singh Bhaisora

Published On Aug. 31, 2023

Countries globally are transitioning towards reducing carbon emissions. Fossil fuels still dominate the energy mix, but there is significant movement that is being seen in green energy, renewable energy and green hydrogen.

Global renewable energy production doubled in the last decade, but contribution to primary energy consumption has only increased from 9% to 13% during the same period

Energy demand has increased by 14% with carbon and other emission intensive sources driving this demand - consequently there is a 5% increase in energy emissions

Fossil fuels dominate the energy consumption mix globally, with 82% of primary energy consumption coming from fossil fuels

In this article we will focus on India’s green energy and renewable energy space, this will extend to the green hydrogen and electric vehicles sector as well. We will understand the background, the regulatory measures taken by the Indian government to boost the space, can India achieve net-zero emissions by 2050 and finally we will explore the top green energy and renewable energy stocks.

While India is currently the 3rd largest energy consuming country in the world, on a per capita basis India’s greenhouse gas emissions are well below the global average. With consistent GDP growth of around 6-7%, India’s energy demand requirements have increased which means energy security is of paramount importance. We are also the 4th largest in terms of installed renewable energy capacity (including hydro, wind energy, solar power etc.). Additionally, we are also one of the fastest growing markets for electric vehicles (EV). Here is a quick overview of where things stand for India’s green energy, electric vehicle sector & renewable energy sectors -

Currently, coal contributes 44% to energy consumption, followed by petroleum at 24%, and natural gas at 6%

Energy security is at risk since 85% of oil needs and 50% of natural gas is imported

India's non-fossil fuel capacity has increased phenomenally by 396% in 8.5 years

Renewable energy additions in India grew by 9.83% in 2022, the highest year-on-year growth

Investments in solar energy are set to eclipse investments in oil production in India

Solar energy capacity has increased 24.4 times in the past 9 years, reaching 67.07 GW in July 2023

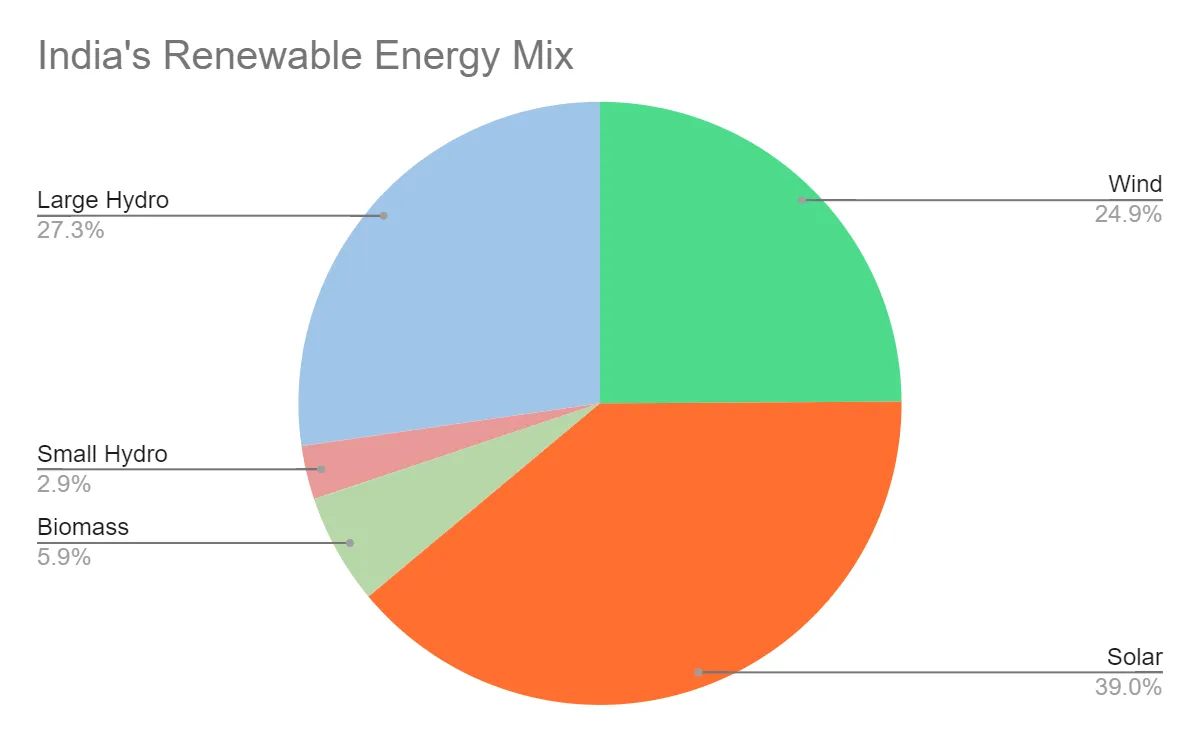

As of July 2023, India’s installed renewable energy capacity is 179 GW

Notably, India's geographical advantages for solar and wind energy are significant, with abundant sunlight & clear skies for nearly 300+ days, strong wind belts in north west and southern India, along with its uninterrupted coastlines stretching over 7,600km.

90% of 2.3 Million EVs are the 2-wheeler or 3-wheeler variants

More than 50% of 3 wheeler registrations in India in 2022 were EVs

Much of the growth has come from the $1.3 Billion investment plan for electric vehicles from the government to provide discounts, subsidies, increase awareness

EV sales in the first 6 months of 2023 exceeded 700,000 electric vehicles.

105,299 2-wheeler EVs sold in May, 46003 sold in June and 54,176 in July - the decline could be linked to reduction of subsidy benefit under FAME for 2

India has several ambitious goals regarding the green energy and renewable energy space. This includes reducing carbon intensity by less than 45% by the end of the decade, achieving 50% cumulative electric power from renewables by 2030, and net-zero carbon emissions by 2070.

Here are a few goals and commitments from the Indian Government

50 GW annual bidding trajectory from FY2024 to FY2028 aims to meet the government's ambitious target of 500 GW of non-fossil fuel-based capacity by 2030, a key goal under the Panchamrit initiative

National Electricity Plan is targeting 277.2 GW peak electricity demand in 2026-27 and 366.4 GW in 2031-32, with 57.4% non-fossil-based capacity by 2026-27 and potentially 68.4% by 2031-32

59 solar parks of 40 GW are approved

30 GW of offshore wind energy is being aimed for by 2030

Production of Green Hydrogen is aimed at 5 Million tonnes by 2030

Achieve 30% electrification of total mobility by 2030

Approximately, $266 billion needs to be invested between 2020 to 2030 to support India’s transition towards EVs. 2-wheeler EVs will constitute 10-12% of new vehicle sales by FY2025, 3-wheeler EVs at 14-16% and electric buses at 11-13%. The investment opportunity for India achieving its net-zero emissions by 2070 is estimated to be upwards of $12.7 trillion.

In order to achieve its ambitious renewable energy goals, India has rolled out several government initiatives that offer incentives for renewable energy production. India has permitted up to 100% Foreign Direct Investment (FDI) in renewable energy generation and distribution projects under the automatic route, subject to provisions of The Electricity Act 2003. Even in the latest union budget 2023, the government highlighted several priorities with Green Energy growth being part of the SAPTARISHI (7 priorities) -

$2.4 billion National Hydrogen Mission to produce 5 Million tonnes of green hydrogen by 2030

$36 million additional funding for hydrogen production

Support for 4 GWh of Battery Energy Storage Systems

Framework development for Pumped Storage Projects

$1.02 billion for ISTS infrastructure to support 13 GW of renewable energy from Ladakh

The following government policies are essential in bridging the gap between current energy supply and demand while also contributing to the nation's net-zero emissions goals -

RBI guidelines mandates banks to allocate 40% of their adjusted net bank credit to the 7 priority sectors, which includes agriculture, MSMEs, export credit, education, housing, social infrastructure, and renewable energy.

Ministry of New and Renewable Energy (MNRE) has initiated schemes like the Jawaharlal Nehru National Solar Mission, aimed to deploy 20 GW of grid-connected solar power by 2022.

Perform-Achieve-Trade (PAT) scheme sets an energy efficiency improvement target for industries, thereby reducing their reliance on fossil fuels.

Significant interest in utilizing green hydrogen as a clean fuel alternative. Subsequently, the National Hydrogen Mission was announced in 2021, aiming to generate hydrogen from green power sources.

Subsidies are being provided through the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) schemes encouraging the adoption of electric and hybrid vehicles, setting up battery charging stations etc. by providing incentives on purchases - earmarking ₹10k crore as incentives to customers. However, this is set to end by March next year.

Production-Linked Incentive (PLI) Scheme for High Efficiency Solar PV Modules to enhance India's manufacturing and exports under the Aatmanirbhar Bharat initiative. The second phase, launched in September 2022, aims to establish 65 GW annual manufacturing capacity.

PLI scheme for the Auto and Auto Component sectors, along with the PLI scheme for manufacturing of Advanced Chemistry Cells (ACC), aims to boost local production - earmarked around ₹26k crore for the promoting EV within the automotive industry

MNRE and US’s Department of Energy have jointly launched the US-India Renewable Energy Technology Action Platform (RETAP) to accelerate the development and deployment of emerging renewable technologies focusing on green hydrogen, wind energy, etc. first. The collaboration blueprint includes themes like R&D, technology piloting, skill development, policy planning, and investment programs.

For its energy security, India is focusing on diversifying energy supplies to enhance resilience and reduce carbon emissions for energy security. It will achieve this by expanding its exploration & production capabilities, tapping into new and alternative energy sources such as green hydrogen , green energy, off-shore wind energy etc. The government is also focusing on transitioning the economy towards a net-zero emission economy with less reliance on fossil fuels and more reliance on renewables, green hydrogen, EVs, carbon capture etc.

New Energy Outlook: India by BloombergNEF has conducted a detailed analysis to understand how India can achieve net-zero emissions by 2050. Here is a summary of the analysis -

Optimal strategy for India involves maximizing the deployment of solar and wind energy, supplemented by nuclear power, energy storage, and carbon capture and storage (CCS) for thermal power plants

Wind and solar power capacity needs to increase to 2,998 GW by 2050 which equates to about 80% contribution to electricity supply

Grid flexibility is essential for incorporating the variability of wind and solar energy (this means energy is produced erratically and can be unpredictable as its dependent on weather/ sun), e.g. battery storage solutions, pumped hydro-storage, parker gas plants to improve grid stability

Investment levels must rise to an annual average of $438 billion, constituting approximately 5% of India's expected GDP by then

An additional $870 billion would be needed for CCS to offset emissions from remaining fossil fuel use

$3.9 trillion is allocated for the deployment of electric vehicles. Falling battery costs are likely to accelerate the adoption of electric vehicles and contribute to local manufacturing

Industrial CO2 emissions are expected to rise and overtake power sector emissions by the 2040s. To address this, green hydrogen and CCS technologies are expected to be critical. India's industrial emissions are anticipated to peak in 2031, beginning to decline in the mid-2030s due to the adoption of these technologies.

Green hydrogen demand is projected to increase tenfold by 2050, especially in the steel industry, through the use of hydrogen-fired direct-reduction furnaces

While strides are being made, there are several challenges in integrating renewable energy into India's energy security plan. One of the key obstacles is the high initial capital cost required for setting up renewable energy infrastructure. This is often compounded by regulatory hurdles and land acquisition issues.

For renewable energy projects a focus on timely tender completion, risk mitigation during project execution, and fortification of the domestic solar supply chain are imperative

Grid stability and intermittency risks continue to exist unless they can be modernized robust cost-effective energy storage solutions are deployed

Grid infrastructure in India needs to be modernised to handle the intermittent nature of renewable energy

India's domestic solar module manufacturing capacity has grown to approximately 20-25 GW, the supply chain still heavily relies on Chinese imports, particularly for solar cells and wafers

Inox Wind is an India-based integrated wind energy solutions provider - providing a full suite from manufacturing wind turbine generators to doing EPC, operations & maintenance, wind farm development and more.

Strong order book of 1,327MW and has turned EBITDA positive in Q1 FY24.

Promoters have infused capital to the tune of Rs.500cr to repay Inox’s debt and strengthen the balance sheet

Pans to become net debt-free soon and projected Free Cash Flow of ₹600-1000 crore starting from FY25

Management expects a surge in demand due to stabilized power tariffs and has expressed commitment towards innovation and sustainable solutions.

However, do note back in June 2023 there were reports of non-compliance issues reported against Inox machines for not completing various simulation tests.

Over a 1 month horizon, Inox’s performance has been choppy giving negative 2% returns however the past month was also when the promoters had infused capital into the company for debt repayment. Over a 6 month horizon the stock delivered 92% returns and 68% over a 1 year period. On a longer term horizon, the stock has given a decent CAGR of 15.84%.

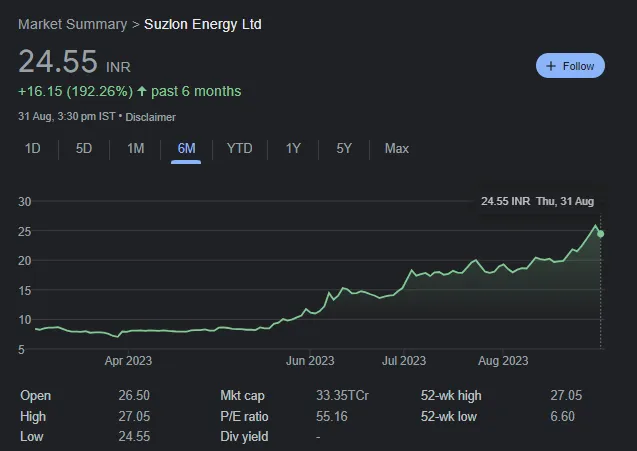

Suzlon Energy is a renewable energy solutions provider that designs, manufactures, installs and services wind turbines. It is one of the largest wind turbine manufacturers in India and operates in 17 countries across different continents.

Market share of 33% in the domestic market.

Significant operational wind power capacity at 20GW globally.

Debt restructuring and rights issue have reduced leverage to merely 1x debt/EBITDA, from 10x in FY22.

Healthy existing order book at 1.6 GW, which bodes well for the next two years

95.8% YoY decline in net profit in the June quarter, though partly attributed to exceptional items.

2% YoY fall in revenue in the June quarter.

Caution: Suzlon has been on the verge of defaulting at several instances historically. Back in 2013 banks restructured loans, they sold few core assets, brought on new equity partners and survived the crisis. Again in 2019 the firm defaulted on principal and interest payments on account of FX losses, lower volumes etc. And in 2021, Suzlon’s US unit filed for bankruptcy

In the last 1 month, the stock has given 27.20% returns and on a 6 month horizon this increases to a mouth-watering 192%. On a 1 year horizon, the stock has delivered 203% returns and on a 5 year horizon it has given a CAGR of 30.57%.

Suzlon Energy due to high leverage, regulatory challenges and reduction in demands saw its value drop. Given the last few years have been shaky for the stock, we need to wait and see how sustainable are the earnings of this green energy stock.

Adani Green Energy is a pureplay green energy and renewable energy stock. It is part of the larger Adani Group.

Expanded its operational renewable energy capacity by 43% to 8,316 MW and total usable capacity to 20,000 MW in the June quarter, making it the largest renewable energy company in India.

Added 1,750 MW of solar-wind hybrid capacity, 212 MW of solar capacity, and 554 MW wind power plants in the first quarter of FY24.

Target to achieve 45 GW of renewable energy capacity by 2030.

Energy sales increased by 70% from a year ago to 6,023 million units in the June quarter.

Net profit increased by 51% year-on-year to ₹323 crore in the June quarter.

Revenue from operations increased by 33% to ₹2,176 crore in the June quarter.

EBITDA margin expanded to 95.6% in the June quarter from 58% a year ago

Hybrid energy sale has increased by whopping 1,546% to 2,206 MW in the June quarter of FY24 due to 1,750 MW capacity addition in Rajasthan and 380 bps improvement in capacity utilization (CUF)

The elephant in the room with Adani Group companies - the Hindenberg report. Adani Group has been on a deleveraging mode ever since the Hindenberg report was put out. The group's net debt-to-EBITDA ratio (leverage ratio) in 2013 was 7.6 times, which was lowered to 3.2 times by March 2022. But, later this rose to around 4.1 again during FY23, as per a Mint report. The group, which has a total debt of around Rs. 2.27 trillion, aims to bring it down to 3.1 times by the end of FY2024. And is something we need to pay a close attention to.

In this list we look at top hybrid green energy stocks that have a mixed energy portfolio of fossil fuels and green energy.

Unlike many utility companies that are slow to transition away from fossil fuels, Tata Power has been aggressively increasing its renewable energy portfolio.

Their long-term goal is to achieve net-zero carbon emissions by 2045.

Tata power’s thermal portfolio growth saw 2.3% CAGR from March 2015 to March 2023, while the renewable portfolio growth saw a 18.4% CAGR.

Their total renewable energy capacity of 7,815 MW of which 4,132 MW is operational comprising 3,139 MW in solar and 993 MW in wind, balance is under implementation.

It is also a solar EPC company with order book close to Rs.100 Billion, 100,000 installed solar pumps, solar rooftops across 275 districts and is active in off-grid solar segment.

Tata Power has setup a 4GW solar module manufacturing capacity.

Looking at the stock’s performance, Tata Power has generated a return of 20.36% over the past 6 months. On a 1 year horizon the company has performed at a relatively poor 3.79%, however over a 5 year horizon has generated a CAGR of 26.82%.

The short term performance of the stock has been on a downward trajectory, however the longer term view could be more bullish. In its latest financials, Q1FY24 it saw an increase in its consolidated revenue from operations by 5% on year and total income increased to ₹15,484.71 crore. The net profit has increased for the 15th straight quarter with EBITDA growing by 43% to Rs.3,005cr.

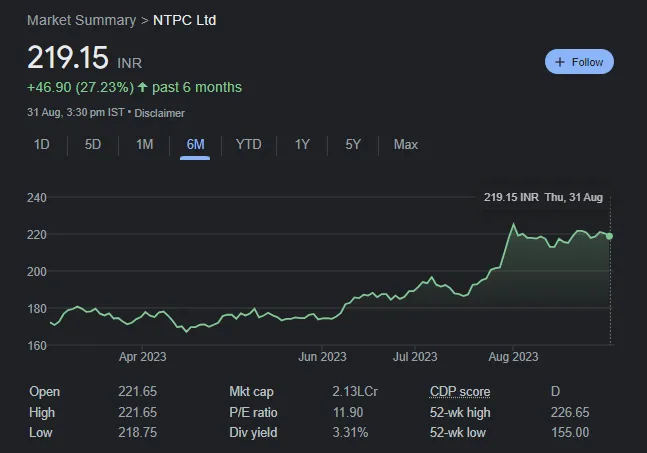

NTPC is India's largest power generation company and a 100% government owned entity. The green energy and renewable energy arm of NTPC resides with its fully owned subsidiary NTPC Renewable Energy Limited, which is yet to go for an IPO. In that sense, this stock isn’t a pureplay green energy stock as NTPC has non-renewable energy arms as well. Let’s look at the renewable energy piece of the company -

3.3GW of installed operational renewable energy capacity and 20GW of pipeline capacity

It plans to set up 16 GW of renewable energy capacity in the next 3 years of which 12GW will be mounted solar, 1GW of floating solar, 3-4 GW of wind.

It plans to implement 60GW of renewable energy capacity by 2032 and plans to be a major player in the green hydrogen energy and energy storage technology space

Over a 1 month horizon NTPC has performed negatively, giving -2.66% returns, but over a 6 month window it has given 27.23% returns and 36.37% over a 1 year horizon. On a longer term horizon of 5 years, the stock has given only 9.21% which is mediocre.

It reported a 23% rise in consolidated net profit at ₹4,907 crore for Q1FY24. Revenue from operations was marginally lower at ₹43,075.09 crore. Operating margins improved from 17.67% a year ago to 20.72% in Q1FY24.

JSW Energy is a significant player in India's power generation sector and a subsidiary of the JSW Group. It has a mixed energy portfolio with 6.6GW of cumulative power generation capacity of which 3.2GW is in thermal energy, 1.4GW in Wind energy, 1.4 GW in Hydropower and 657MW in Solar energy - balance is in under-construction.

Despite a decrease in net profit and revenue, the company's EBITDA saw an 18% YoY growth, largely due to refinancing delays and one-time recoveries in the previous year affecting comparisons. EBITDA could have been higher by Rs 110 crore, which the company expects to recover in future quarters.

Factors like unseasonal rains led to flat power demand in April and May, but there was a rebound in June and July.

Plans to expand its renewable assets to 6,000-7,000 MW

By 2025, JSW Energy aims to commission a 1GW solar module manufacturing factory and a green hydrogen production unit capable of producing 3,800 tonnes per annum, and a battery energy storage system

The stock has given 18.4% over 1 month and given nearly 50% over 6 months. However on a 1 year horizon, the stock hasn’t given any returns. On a 5 year horizon the stock has delivered a CAGR of 41.73%.

While the company is open to expanding its thermal business, its primary focus is on renewables. It has a robust balance sheet with a net debt-to-equity ratio of 1.2x and net debt-to-EBITDA ratio of 4.7x. Cash reserves stood at Rs 2,572 crore as of June 2023. JSW Energy is optimistic about its future performance, focusing predominantly on renewable energy projects and maintaining financial stability.

There is an increasing trend of large corporates that have decades of experience in oil and gas exploration, production, distribution etc that are now looking to enter or are already entering the booming green energy space. So let’s look at the top new entrant green energy stocks -

Reliance Industries has decades of experience in gas exploration and production capabilities. It is now looking to foray into green and renewable energy, and like most things Ambani does - this could be a big move.

By 2026, it plans to set up a gigafactory for producing battery chemicals, cells, and packs manufacturing.

Commercialization of its sodium-ion battery technology, with plans to industrialize production at the megawatt level by 2025. And plans to fully-integrated, end-to-end solar photovoltaics (PV) manufacturing ecosystem.

It has committed capital of ₹750 billion (~$9 billion) for a new energy manufacturing ecosystem. It is aiming to install 100 GW of clean energy by 2030

Envisions India becoming first country to produce green hydrogen at less than $1 per kg within the next decade.

Renewable energy consumption across RIL's operations increased by 115% YoY during FY23.

The challenge here remains the execution and scalability of its ambitious renewable projects.

Reliance industries being a conglomerate with its hand in multiple pies has performed erratically over the last few years and has given a decent 13.72% over 5 years.

Indian Oil Corporation is India’s top oil firm. The company is taking significant steps to drive India’s energy transition.

It has earmarked $30 billion for environmental sustainability measures, R&D aimed at reducing carbon emissions, expanding into solar and wind energy sectors and achieving zero operational emissions by 2046.

In terms of green energy and renewable energy capacity, it currently has 239 MW.

Collaborations with NTPC will increase renewable energy capacity by around 2.8 GW.

IOCL plans to add green energy of 3GW by 2025, 35GW by 2030 and 200GW by 2050.

IOCL is adding solar panels to its retail outlets, setting up 4,700 charging stations for EVs and collaborating with Phinergy for advanced battery systems.

2 refineries out of 11 are on track to produce green hydrogen.

All of these initiatives will help IOCL aim to meet 12% of India's energy needs by 2030.

Looking at the stock’s performance, IOCL has generated a return of 15.66% over the past 6 months. One a 1 year horizon the company has performed at a relatively decent 25.09%, however over a 5 year horizon the stock has suffered from global oil market fluctuations and has generated negative -2.74%. While IOCL is making major moves and inroads into the green energy space, we need to be watchful of its fossil fuel portfolio and the subsequent shocks from global fluctuations.

For FY23, at an aggregate level IOCL has witnessed the highest ever throughput at its refineries, surpassing 72.4 million tonnes, up from 67.67 million tonnes in the previous year. It recorded a 14% increase in fuel sales, with its petroleum products market share rising from 40.8% to 42.9%. It also invested a record amount of Rs 35,205 crores in capital expenditure.

Despite formidable challenges such as high initial capital costs and grid instability, India has made remarkable strides in renewable energy, green energy and electric vehicle adoption. Government policies have been robust, but the magnitude of investment required for transitioning to net-zero emissions economy is substantial. Whether India can achieve net-zero emissions by 2050, or even later by 2070, remains an open question. However, the commitment towards a greener, more sustainable future is evident. It will take a monumental effort on the part of the government, private sector, technological innovation, and public awareness to catalyze India's journey towards becoming a global leader in renewable energy and electric vehicles.

Explore the Wright New India Smallcase and the Wright Innovation Smallcase.

Also Read:

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Full disclosures here.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios