by Siddharth Singh Bhaisora, Siddhart Agarwal

Published On Sept. 7, 2023

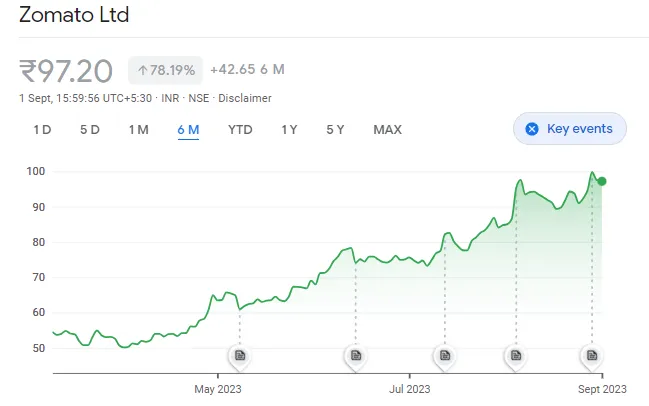

Foreign portfolio investors (FPIs) have significantly increased their stake in new-age Indian companies, such as Paytm, Zomato, PB Fintech, and Delhivery. Recent data shows FPI holding in Zomato jumped from 9.85% to 33.33% in just one year. Stakes in other firms increased in the range of 10-16% in the last quarter. The primary driving force behind this increased interest is to focus on growing revenue and profitability as opposed to the earlier burning cash to acquire users' philosophy.

Many of these new age companies went public in 2021 with all time high valuations. Since then the market has corrected and most of these companies are trading at prices much lower than their IPO price, however we are seeing an uptrend in some of these new-age companies that have shown strong focus on improving profitability, cutting unnecessary expenses and focusing on optimising their marketing/ promotional expenses. As a result, shares of Rate gain Travel surged over 75% in the last year, and stocks like Zomato, PolicyBazaar, and Paytm saw increases ranging from 20-40%.

With China’s growth slowing, high debt laden economy and real estate tumbling, foreign investors are increasingly looking at the India growth story and the long-term growth prospects of such new-age companies that have a significant opportunity to tap into and could show strong growth in the next 3-5 years horizon. Does this mean that investors should also be looking at new-age Indian companies again? Let’s deep dive into our top 5 new-age companies where we see growth opportunities in 2023.

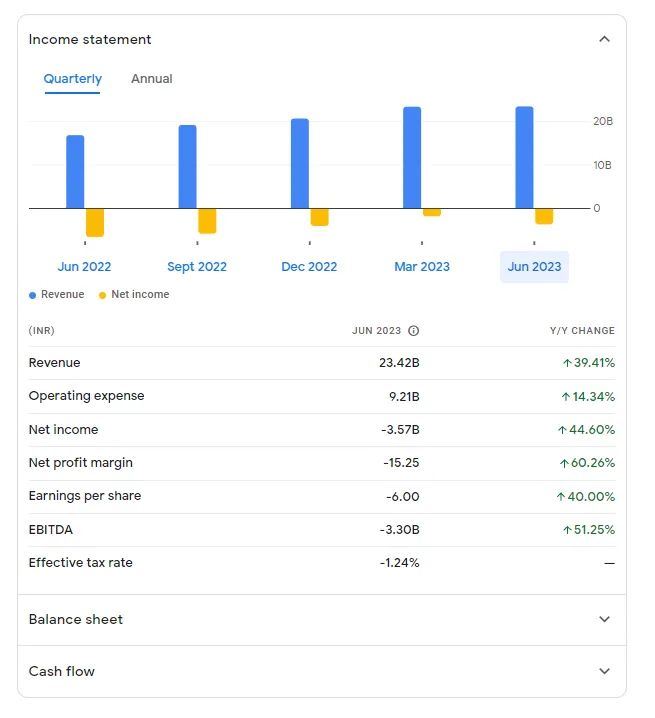

Paytm’s financial results for the first quarter, signaled mixed fortunes. Despite a 44.6% year-over-year (YoY) reduction in its net loss, the figure more than doubled sequentially. The company reported an INR 358.4 Cr loss, even as its operating revenue showed a 39% YoY increase to INR 2,342 Cr. It has also announced an additional 1.7 million employee stock options - which could continue to push the bottom line.

Paytm’s momentum in high margin lending and Soundbox business to remain good for at least next 3-4 quarters

High margin lending: Intend to disrupt the small mobile credit market in the country via its digital loan collection on the app - according to Sharma “a loan of as small as a few hundred rupees can be disbursed and collected at very minuscule cost”. Loan disbursements increased 137% in July and August with 88 Lakh loans disbursed, a 47% y-o-y growth

Soundbox: Offline payment devices used by merchants reached 87 lakhs in August - increasing by 42 Lakhs devices y-o-y

Strong UPI growth: NPCI reported 10 billion UPI transactions crossed in August and as of 30th August UPI transactions were at 10.24 billion, increasing from 9.96 billion in July and 9.33 billion in June

Adding another layer of complexity, Antfin, a significant investor in Paytm, sold a 3.6% stake in the company, equivalent to 2.27 Cr shares, for over INR 2,037 Cr. Prior to this sale, as of June 2023 Antfin held 23.79% stake in Paytm. This follows a recent off-market transaction where Antfin transferred 10.3% of Paytm to founder Vijay Shekhar Sharma’s Resilient Asset Management. Sharma will acquire voting and ownership rights, while Antfin retains economic rights via non-convertible debentures - no cash changed hands.

This change in shareholding is a good sign since it removes potential stock supply concerns from Antfin selling it in the broader market. It reduces risk of a strategic investor coming in and taking a large position in the company. Antfin is also a chinese company/ shareholder - ceasing to be the largest shareholder is also viewed positively in the geopolitical climate. The Reserve Bank of India had previously declined Paytm Payments Services Ltd's license application, giving time for compliance with foreign direct investment guidelines.

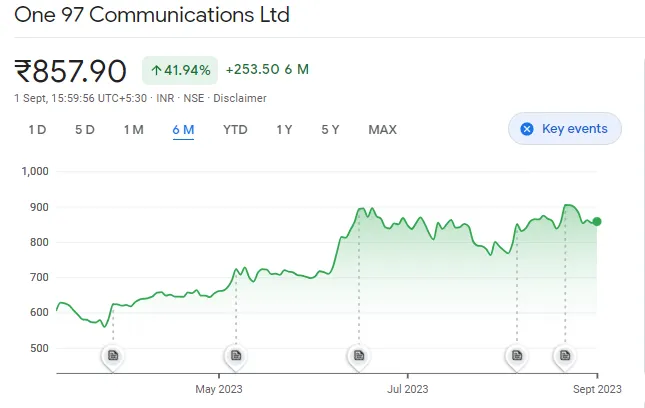

Paytm shares have had a sideways movement for much of August but on the whole it has been up 10.54% in the month, with the stock ended at INR 857 as of Friday. On a 6month basis it is up 42% and on YTD basis it is up 62%. It performed well in July as well, but from its IPO price it is down around 45%. Despite this, experts remain optimistic. Stock appears to be range bound, but is bullish. We can see resistance at 875 and support around 800. If the stock sustains above 880, then there could be an upward trend from there.

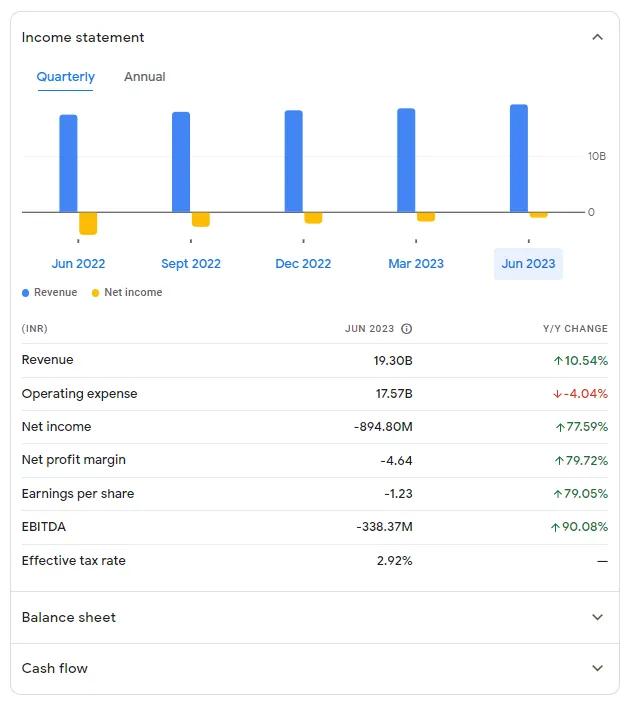

Online travel service provider, EaseMyTrip, reported a 21.46% year-on-year decline in consolidated net profit to Rs 26 crore for Q1 FY24, down from Rs 33.13 crore in the same period last year. Interestingly, the dip in profit occurred despite a 41.6% YoY rise in operating revenue, which stood at Rs 124.05 crore compared to Rs 87.58 crore a year ago.

Total expenses for the firm surged to Rs 91.56 crore, nearly doubling the expense of Rs 47 crore from Q1 last year. The increase is largely attributed to higher advertising, payment gateway charges, and employee costs as operations scaled. EaseMyTrip also cited deep discounts offered during its 15th anniversary celebrations in early June as a reason for the profit decline.

Management is upbeat and optimistic about the company’s growth on the back of “revenge travel” and “pent up demand” from Covid.

Company’s gross booking revenue rose by 43% YoY, outpacing the 19% growth reported by the DGCA. This indicates that EaseMyTrip is gaining market share, suggesting a strong position amid sector-wide growth.

Sold 32.1 lakh air tickets (after accounting for cancellations), a notable year-on-year growth of 43.3%

Total hotel nights sold in the quarter reached 1.6 lakh, a significant increase compared to the 0.7 lakh recorded in the same quarter last year

Hotel business is expected to reach a breakeven point or turn profitable in Q2. Hotel business showed 123% y-o-y growth

Cricket World Cup is expected to bolster the travel and hospitality sector in India significantly. Prices for flights and accommodations are skyrocketing, particularly in cities hosting matches. It also presents an opportunity for EaseMyTrip's international platforms, serving markets like the UK and the Middle East, to see increased booking volumes from non-resident Indians wishing to attend the event.

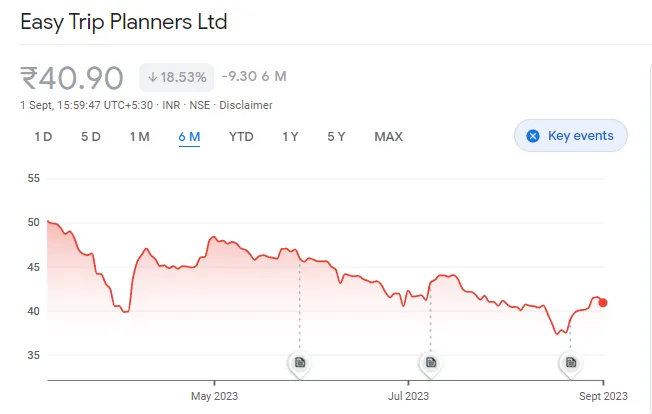

Easemytrip shares have had a sideways movement for much of August showing marginal 0.5% increase in the month, with the stock ended at INR 40.90 as of Friday. Most of the new age stocks have performed well and bounced back this year compared to the sharp drops in 2022. On a 6 month basis it is down 18.5% and on YTD basis it is down 23.7%. It showed sideways performance in July as well, but from its IPO price it is down around 21%. If stock can break the resistance at 42, it could rally upwards to around 46-48 in the short term.

Delhivery, logistics unicorn, is showing signs of steady financial health by significantly reducing its net losses in Q1 FY24. Here are the key financials -

Revenue increased by 11% YoY to INR 1,929.8 Cr.

Express parcel and part truckload segments show strong growth - revenue growths of 14% and 34% on a year-on-year basis respectively

Adjusted EBITDA loss declined by 89% YoY to INR 25 Cr with the margin improving from -12.5% to -1.3%

Total expenses reduced by 3.4% YoY to INR 2,129.7 Cr. Freight, handling, and servicing costs fell from from Rs.1,452.6 Cr in Q1 FY23 to Rs.1,438 Cr in Q1 FY24.

Net loss reduced by 78% YoY to INR 89.5 Cr and by 44% QoQ

Secured critical contracts in Q1 from big players like Havells, TATA Motors, and MamaEarth - should positively impact the earnings in subsequent quarters.

Launched a digital shipping platform for MSEs and larger D2C e-commerce brands in India to optimize processes and reducing costs. It offers various shipping services, including post-purchase communication, analytics, international shipping, and more.

Future enhancements include integration with marketplaces, a mobile app, shipping credits, and an AI-powered return-to-origin predictor.

Carlyle Group, exited its stake in Delhivery through block deals to Goldman, BNP - Carlyle made about 2.7X returns on their investment.

\

\

Delhivery shares has performed decently in August showing 8.87% increase in the month, with the stock ended at INR 437.05 as of Friday. On a 6 month basis it is up 28.24% and on YTD basis it is up 31.68%. From its IPO price it is still down around 19.3%. Analysts expect the stock to do well with Morgan Stanley downgrading it from overweight to equal-weight and raising the target price to 460. The stock could perform well and hit Rs.500 to 550 in the short term.

Zomato achieved profitability in Q1 FY23 - outperforming expectations and plans to remain profitable. Let’s look at how it did this -

Revenue surged 70% YoY, totaling INR 2,416 crore compared to Rs. 1,414cr last year

Operational improvements in Zomato’s food delivery business - margins increased to 13.6%

Consolidated adjusted EBITDA was at Rs 12 crore - drastically improving from a loss of Rs 152 crore in the same quarter last year

Consolidated net profit was Rs 2 crore compared to a net loss of Rs 186 crore a year ago

Tax credit of Rs 17 crore and other income helped boost the bottom line.

Food delivery business’ gross order value increased from Rs. 6,425cr last year to 7,318cr in Q1FY24.

Zomato Gold has positively impacted frequency of orders and contributes 30%+ to GoV

Blinkit, fast commerce business, turns contribution positive. Management expects positive adjusted EBITA breakout in the next 4 quarters

Hyperpure, which supplies restaurants, saw a 126% YoY revenue growth to Rs. 617cr in Q1FY24.

Management expects 40%+ year-on-year topline growth in the next few years.

August saw Zomato tinkering with its monetization strategies. It increased platform fee from INR 2 to INR 3 for users in Tier-II cities.

AI Chatbot launched to help users find food items

Lock-in period ended following Zomato’s acquisition of Blinkit - with significant investors offloading shares such as SoftBank which owned 3.35% stake in Zomato - it sold 10 crore shares worth ₹940 crore on August 29 - Softbank will likely exit completely. Tiger Global Management also liquidated its entire 1.44% stake in Zomato for ₹1,123.85 crore.

Introduction of the platform fee of Rs.2 would directly add to Zomato’s contribution margin, EBITDA and profit. It has also increased platform fee from INR 2 to INR 3 for some users in Tier-II cities. The fee will increase the contribution margin and help them achieve their targeted margin of 8% from its Q1 FY24 margin of 6.4%. The feature is expected to be rolled out across the board in due course.

Zomato has performed well in August - the stock increased by 14.29% in the month, and ended at INR 97.20 as of Friday. On a 6 month basis it is up 78.19% and on YTD basis it is up 61.19%. From its IPO price it is still down around 22.86%, but it has largely been on an upward trend from last year. Zomato shares have shown volatility and have hit Rs.100 at multiple times during the last week which appears to be the resistance. If it crosses the 100 level, the breakout could push the stock upwards of 110. From a support perspective, close below 96 could push the stock down to 88.

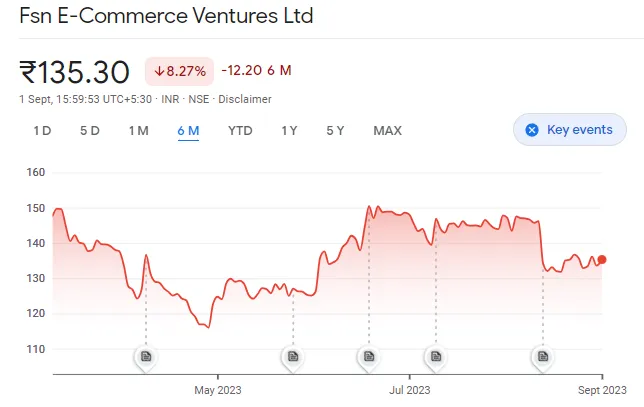

Nykaa, the beauty and fashion e-commerce giant, posted a Q1 FY24 net profit of INR 5.4 Cr, an 8.2% YoY increase. Revenue and GMV also saw strong growth, largely attributed to the Beauty and Personal Care (BPC) vertical. While the fashion segment showed signs of recovery, operating expenses rose. Recent top-level exits raised questions, but the company dismissed concerns over talent erosion. Here are the financials -

GMV increased by 24% YoY to INR 2,667.8 Cr in Q1 FY24 and Revenue was up 23% to INR 1,421.8 Cr

Gross Merchandise Value (GMV): INR 2,667.8 Cr, up 24% YoY.

EBITDA grew 60% YoY and 4% QoQ to INR 73.5 Cr.

Total expenses rose to INR 1,418.8 Cr, up 23.5% YoY, with traded goods purchase as a major contributor.

Net Profit was INR 5.4 Cr, up 8.2% YoY and a 138% sequential increase from Q4 FY23.

Management expects the business to remain profitable, targeting 40%+ YoY topline growth, especially given strong July trends - with focus on scaling high-margin categories like women’s wear, bags and scaling up inhouse brands

Fashion vertical's contribution to GMV contracted to 24.5% in Q1 FY24 from 27%.

Other vertical's (NykaaMan and SuperStore) GMV surged 92% YoY to INR 16.33cr, contributing 6.1% of consolidated GMV in Q1 FY24.

Nykaa's BPC vertical drove growth with GMV rising 24% YoY to INR 1,850 Cr.

Management optimistic about growth Customer retention meant business from existing customers contributed significantly to Nykaa's growth

However there have been multiple C-suite exits chief marketing officer, SuperStore CEO, and chief business officer and more. CEO Falguni Nayar finds no significant erosion of talent attributing recent exits to upgrading its talent pool. Reliance Retail’s fashion vertical Tira may show tough competition to Nykaa’s core beauty business.

Most of the new age stocks have performed well and bounced back this year compared to the sharp drops in 2022. However, Nykaa has been under pressure this entire year and last year as well. For the month of August the stock fell by 8% ending at INR 135.30 as of Friday. On a 6 month basis it has move sideways and is down around 8% and on YTD basis it is down further at 12.79%. From its IPO price it is down around 65.58%. Nykaa appears to be a volatile stock - it could touch around 170 with the bottom side being around 120 to 125. Most analysts expect the stock to do well, given its strong brand affinity, the go-to BPC platform, its push for high margin products and its highest margin inhouse products, along with the fashion segment improving contribution towards revenue and adding to the bottom line. Obvious risks include ONDC diluting competitive power and the need to expand its fashion consumer base quickly.

New age companies in India are gaining substantial attention from investors due to their innovative approaches and growth potential. These new age companies, such as Paytm, Zomato, PB Fintech, and Delhivery, are revolutionizing their respective industries with technology-driven solutions. The surge in foreign portfolio investments in new age companies in India reflects confidence in their long-term growth prospects. As new age companies in India continue to evolve, they focus on improving profitability and optimizing operations. For investors, tracking the performance and strategies of new age companies in India can provide valuable insights into emerging opportunities in the market.

Here’s a quick video on the topic - How New Age Stocks are Performing? Zomato, Paytm, Delhivery, Nykaa & more!

Want to understand the New Age Sector better? Read our article on New-Age Stocks: A Winding Road to Profitability and Investor Confidence

Explore the Wright New India Smallcase and the Wright Innovation Smallcase .

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Full disclosures here .

Explore these interesting articles to understand investing in different financial products & assets in detail:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios