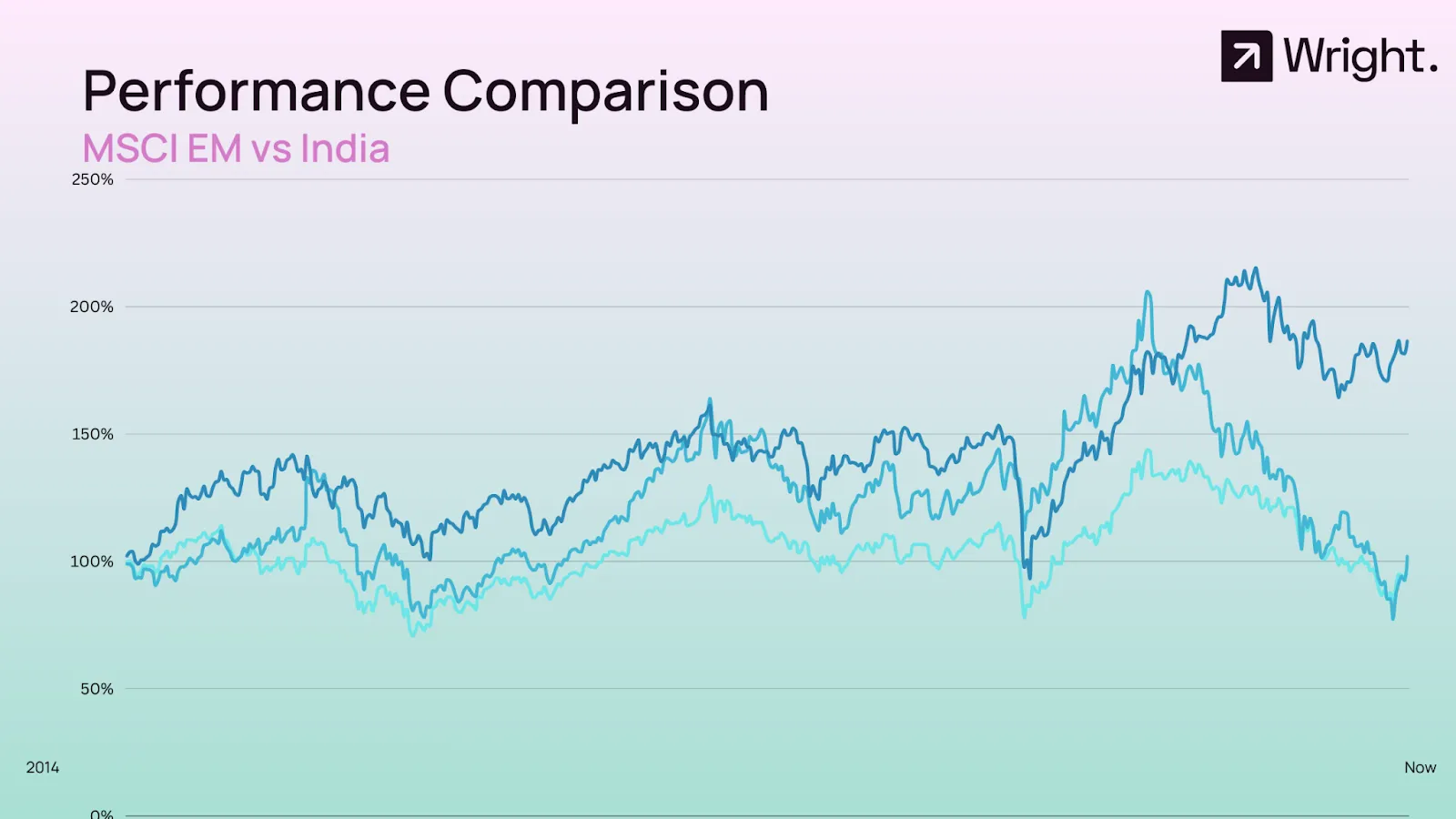

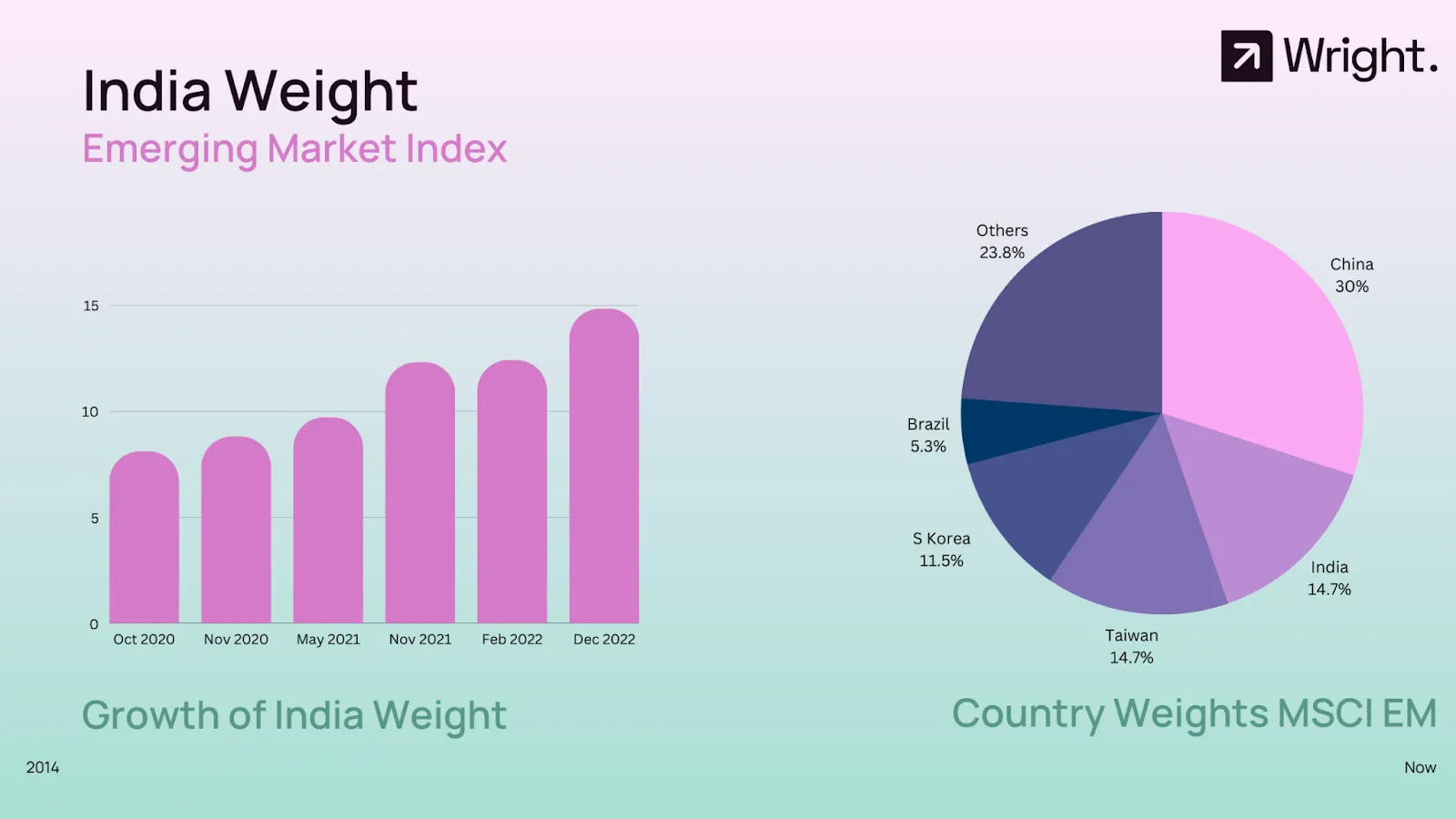

India has left behind the emerging market by a wide margin over the past few years in terms of stock market growth rate. The Indian market weight in the emerging market basket has almost doubled from 8.1% in October 2020 to 14.8% now. India remains the most bought emerging market with the highest projected GDP growth rate but recently we have been hearing a lot of murmurs about India’s valuation being too pricey compared to the emerging markets. Let’s dissect this.

Indian market has indeed grown at much higher pace than the emerging market basket. While the emerging markets on the whole have corrected 20% this year, India still remains almost flat.

India’s weight has steadily grown from 8% 2 years back to 14.8% now. We now have reached the second spot in the EM index surpassing Taiwan. This trajectory is fascinating, and speaks volumes about the strength of the Indian markets and it’s projections.

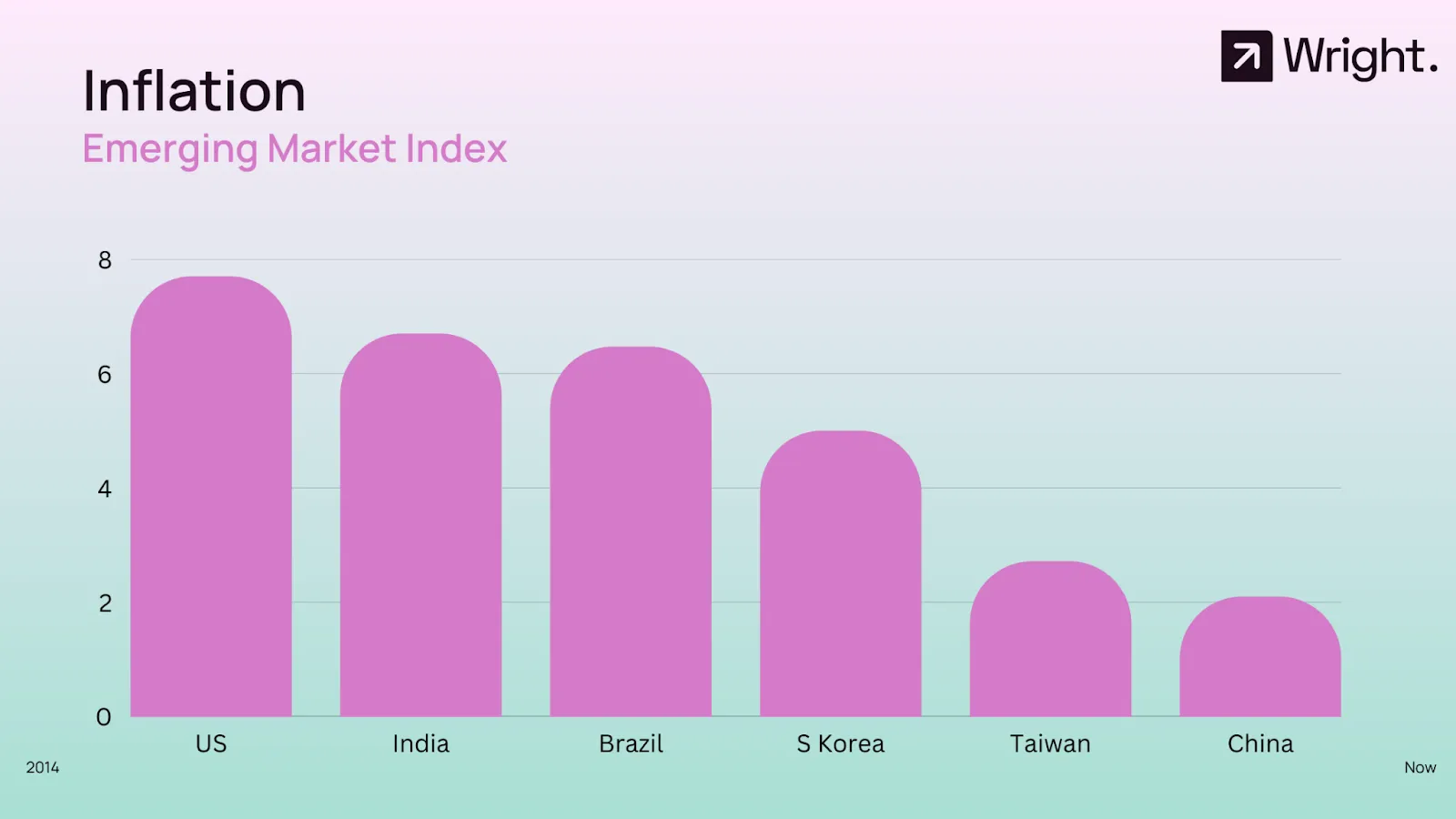

While the biggest struggle that the world is facing right now is inflation, the Indian Inflation remains quite close to our target rate of 6%. Other emerging markets have a much lower inflation rate which is understandable as many of them are commodity producing nations. The biggest eye sore in terms of inflation still remains the US market.

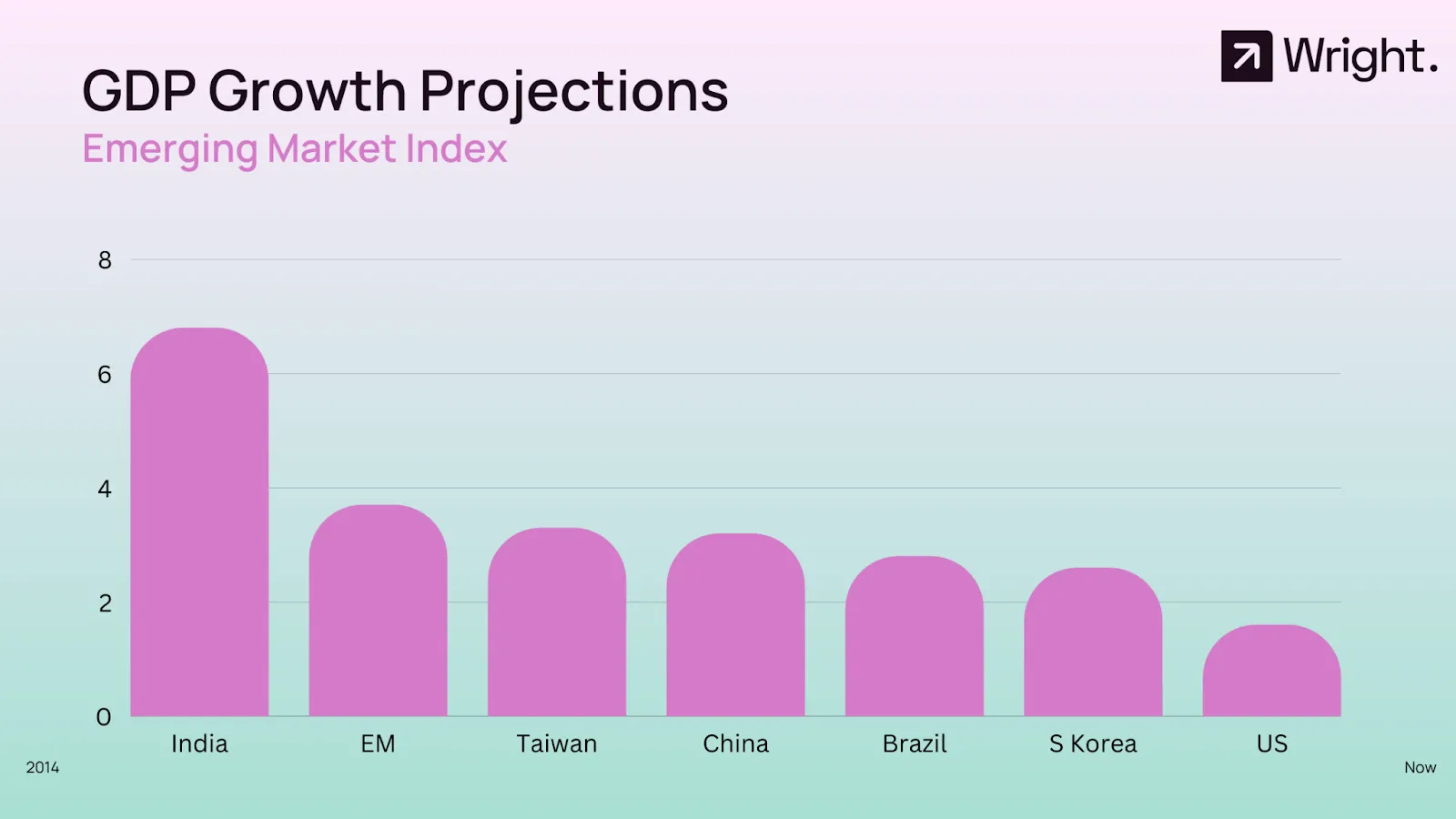

The International Monetary Fund (IMF) on Tuesday lowered India's gross domestic product (GDP) growth projection for 2022-23 to 6.8% from the earlier 7.4%, citing the impact of a slowing global economy, stubborn inflation, rising interest rates and the war in Ukraine. But still India remains the fastest growing EM nation and this projection can explain the equity premium.

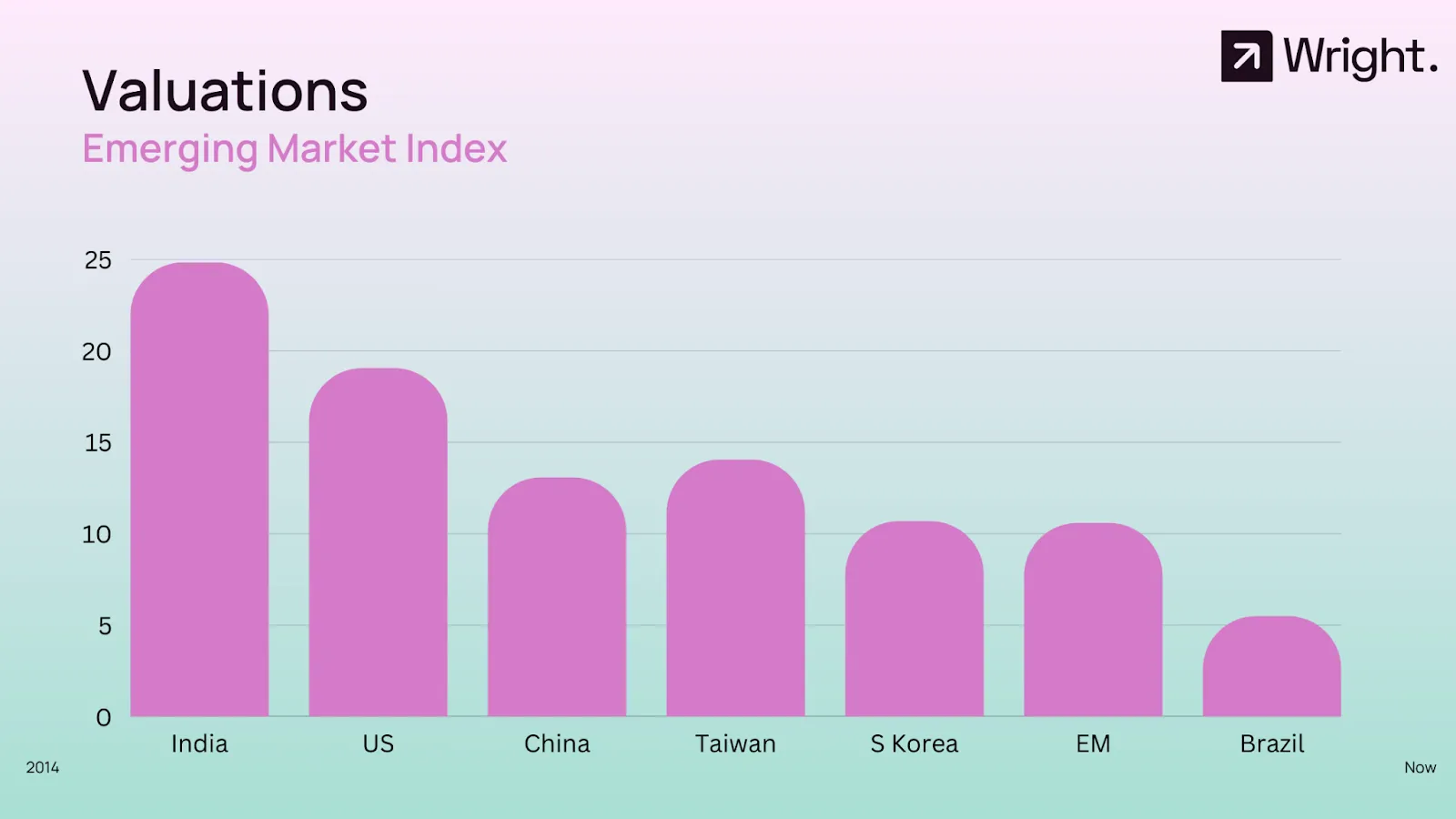

Valuations are the biggest worry for India in comparison with the world. Driven by rally in Indian stocks over the past one year, the valuation of the MSCI India Index, in price/earnings terms, is trading at a 134% premium to the MSCI Emerging Market (EM) index, which is above the historical average of 62%.

There are various reasons due to which Indiais commanding a premium in valuation:

India is very different from many of the EM nations like Brazil or Russia or South Africa. While Indian companies represent a set of diverse businesses which are high quality and high ROE, the other EMs are predominantly commodity driven.

India is quite ahead of many emerging markets in terms of ownership, governance and transparency

On the other hand we have seen the Indian market miss in terms of earnings by 4% last quarter and in such scenarios valuation can become a concern.

While we are quite sure about the strength of the Indian market and can justify its over-valuation, we are also sure that the valuation comparison is something that we shall hear a lot in the coming days.

But as the market cycle shifts from a highly inflationary environment to a low inflation one, the emerging markets might start shining soon and India being the second largest country in the Index will make bring in cheer to our markets.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios