Investing in India 2025 : Equities vs. Real Estate

by Naman Agarwal5 min read

India’s investment landscape in 2025 is evolving rapidly, with both equities and real estate presenting unique opportunities. Choosing the right path depends on balancing growth potential with stability in a changing economic environment.

Turning Caution into Confidence – June 2025 Macro & Strategy Update

by Sonam Srivastava5 min read

Wright Research's June 2025 macro update — from RBI’s bold rate cuts to earnings upgrades and strategy refinements. Learn how we're evolving to capture alpha with confidence amid shifting market winds.

Risk Management Strategies in Financial Management: Assessing, Mitigating, and Hedging Risks

by Alina Khan5 min read

"Delve into effective risk management strategies for financial markets in India. This article explores key approaches for managing market, credit, operational, and liquidity risks, offering insights for businesses and investors on navigating uncertainties.

Find Out What Portfolio Risk Is & How to Reduce It

by Alina Khan5 min read

Explore the intricate dynamics of portfolio risk, the various types, and the art of risk management. From asset allocation to diversification, learn how to calculate and mitigate potential financial loss. Discover tools, examples, and strategies to navigate the investment landscape, balance returns.

Portfolio Allocation for Tackling Market Turbulence

by Wright Research5 min read

Portfolio Allocation for Tackling Market Turbulence

Overvaluation, Rate Hikes and What Looks Attractive?

by Sonam Srivastava5 min read

Our market has been the most robust over the last year and is at a much higher valuation multiple than many emerging markets. Is this a concern during global recessionary fears.

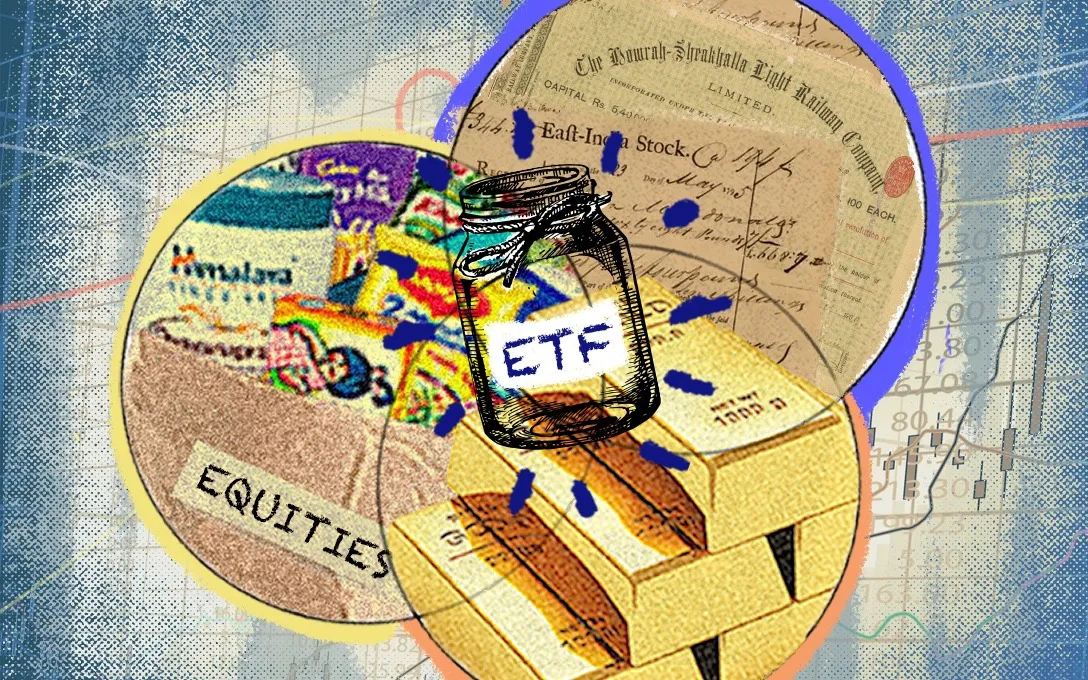

Multi Factor Investing: Strategies, Benefits, & Best Multi-Factor ETFs

by Sonam Srivastava5 min read

Find out how multifactor investing can help you to enhance your portfolio by exploring strategies, benefits and the top multi-factor exchange traded funds in India.

Serving Consistent Market Returns

by Sonam Srivastava5 min read

At Wright Research, we believe that the market does not remain the same all the time. And as the market itself shifts its behavior, allocations within our portfolios also need to turn. This is why we like to follow a multi-factor approach in our stock selection and asset allocation.

10 Investing Resolutions for 2022

by Sonam Srivastava5 min read

It’s that time of the year when everyone’s making resolutions! So why not resolve to be a better investor next year?

Risk Management at Wright Research

by Sonam Srivastava5 min read

Learn how to manage risk effectively. Our comprehensive guide covers key strategies and insights to navigate the complex world of financial risk.

Asset Allocation To Protect and Grow Your Investments

by Wright Content Team5 min read

One of the biggest problems new investors face is placing all their eggs into one basket or stock, hoping to get rich quickly. What often happens is that new investors “blow up” their portfolio and st

Macro Regime Prediction Model

by Jasmeet Singh5 min read

In this post we use macro economic variables to model stock market risk and returns

Investing for Women

by Sonam Srivastava5 min read

Women typically have a different approach to life as well as investing than men. The traditional gender roles have attached the role of caretakers to women and have made women low-risk takers compared to their male counterparts.

Portfolio Optimization Methods

by Sonam Srivastava5 min read

Unlock Portfolio Optimization: Methods, Risk Parity equation, Examples. Discover best techniques at Wright Research for optimizing your investment portfolio.

Three month performance update

by Team Wright5 min read

We have completed 3 months since we started our multi asset tactical portfolios!

Regime Shift Models — A Fascinating Use Case of Time Series Modeling

by Sonam Srivastava5 min read

Delve into the world of regime shift models and gain a comprehensive understanding of what they are and how they function. Explore regime shift now.

Dynamic Asset Allocation with Wright Research

by Team Wright5 min read

The Multi Asset Tactical smallcase by Wright Research invests in the best assets by combining stocks selected via Smart Beta factors with Bond & Gold ETFs

All you need to know about the Multi Factor Tactical portfolio

by Sonam Srivastava5 min read