- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

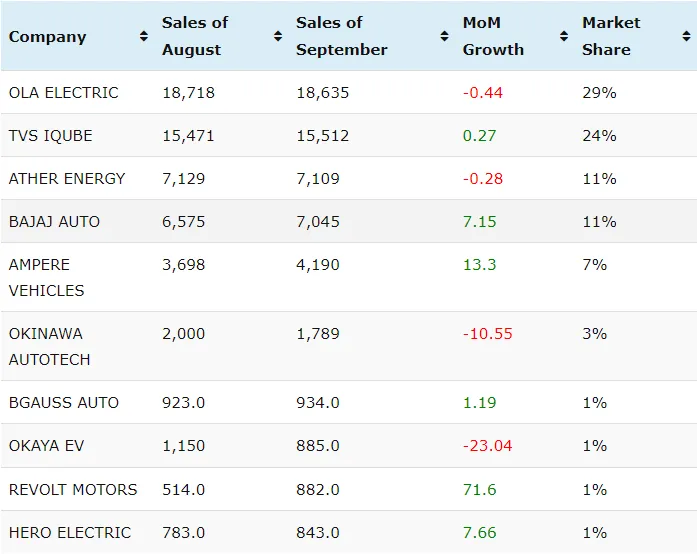

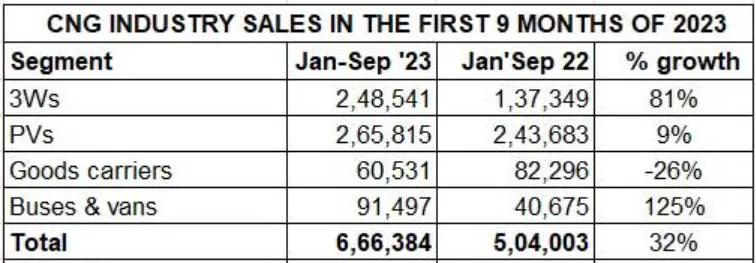

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In