by Sonam Srivastava

Published On Sept. 14, 2023

In the dynamic world of investing, market corrections are an inherent part of the journey. To the uninitiated, these corrections can seem daunting, like a storm cloud looming over a sunny investment horizon. However, for the seasoned investor or the educated novice, they are but temporary disturbances in an otherwise growth-oriented trajectory.

A market correction is typically defined as a decline of 10% or more from a recent high in any security or market index. They are often a result of various factors, be it macroeconomic indicators, geopolitical tensions, monetary policies, or sometimes, market speculations. At its core, a correction is a market's natural way of "resetting" itself, much like a computer that occasionally needs to reboot.

For smallcap investors , these corrections can be more pronounced. Given the volatile nature of small-cap stocks, which can be significantly influenced by market sentiment, the movements can be steeper and more rapid. But it's crucial to remember that volatility also means opportunity, and with the right perspective and strategy, these moments can be navigated judiciously.

As we delve deeper into the anatomy of market corrections and discuss our approach to them, it's imperative for investors to remember that these periods, while challenging, are also transient. They have come and gone in the past, and will do so in the future. Our role, as your trusted investment advisors, is to guide you through these times, ensuring that decisions made are in line with long-term objectives and not just fleeting market sentiments.

Smallcap stocks , often regarded as the "daring young adventurers" of the investment universe, present a unique set of challenges and opportunities. Their name is derived from their market capitalization, which is relatively smaller compared to mid-cap and large-cap stocks. However, what they might lack in size, they often make up for in potential growth and volatility.

Many of the new favorite mid-and-small-cap stocks have delivered significant returns in the past six months, especially in 'investment' sectors such as capital goods, defense, EMS, railways, real estate, and renewables.

The Nifty Smallcap Index has seen an increase of 23% over the past three months and 35% over the past six months. In comparison, the Nifty Midcap index has risen by 20% and 32% over the same periods, respectively.

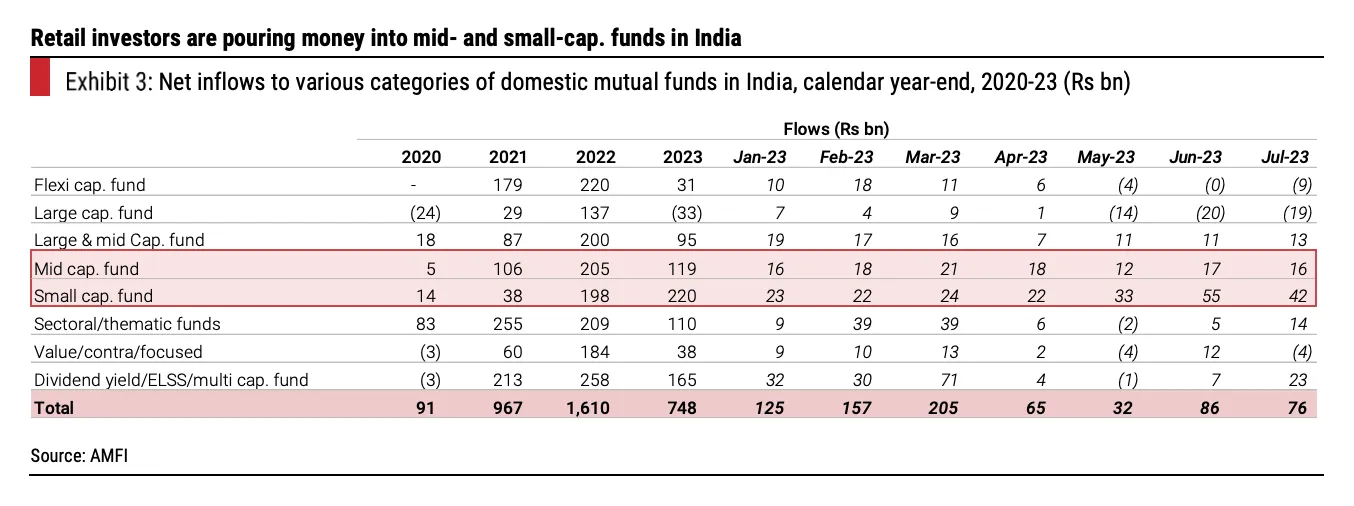

Mid-cap and small-cap funds of domestic equity mutual funds have witnessed inflows of Rs 215 billion, while large-cap and flex-cap funds have seen outflows of Rs 60 billion in the past four months.

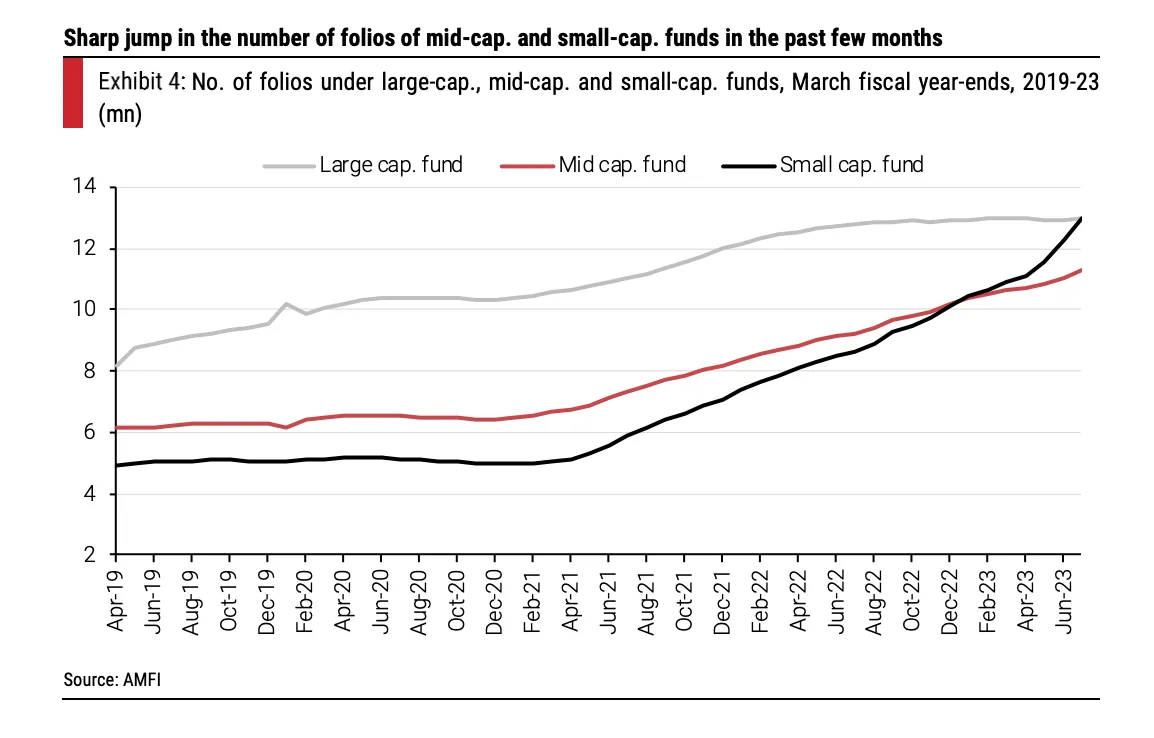

There has been an addition of 6.4 million new folios in mid-cap and small-cap equity mutual funds over the past 12 months, marking a 34% increase.

There has been a significant increase in stock prices of several mid-cap and small-cap stocks.

The primary driver of this smallcap rally appears to be the irrational exuberance among investors, with high return expectations being influenced by the high returns of the past few months.

The strong performance of the mid-cap and small-cap indices has possibly elevated return expectations among retail investors

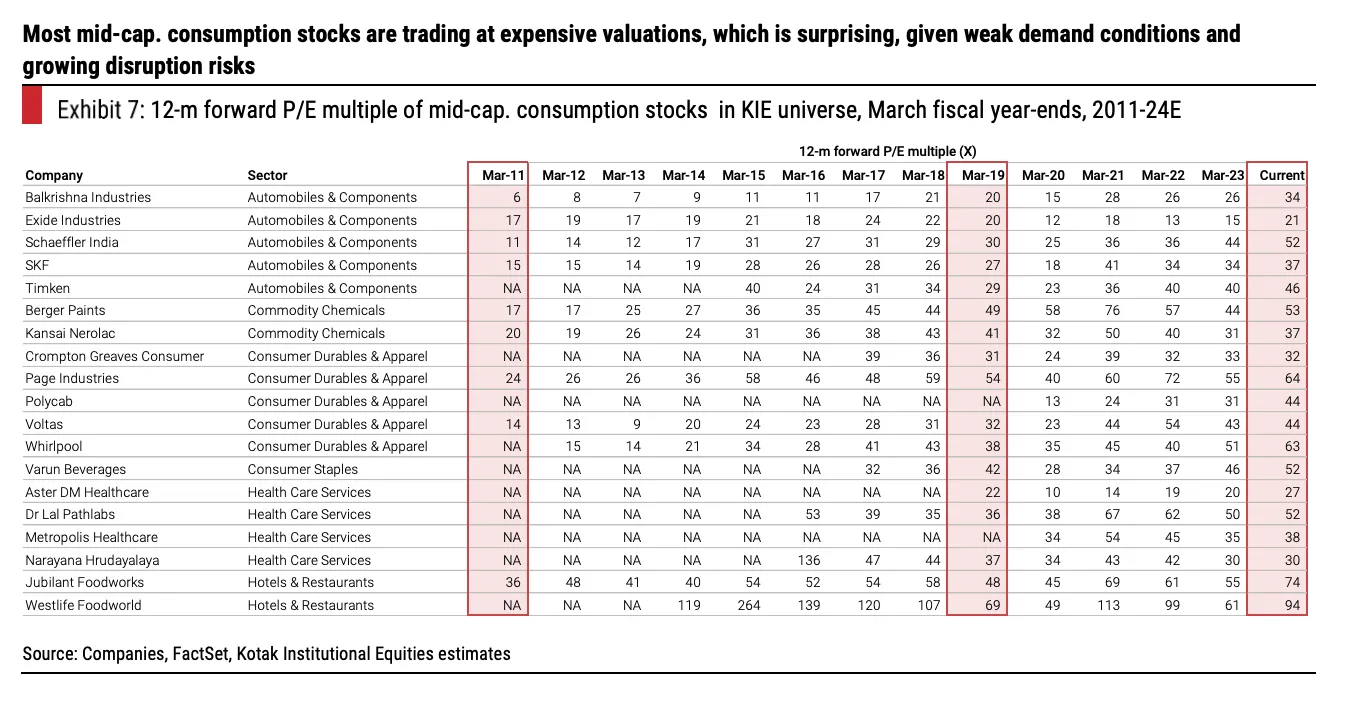

Traditional favorite mid-cap stocks of institutional investors in the broader ‘consumption’ sector have lagged in the ongoing mid-cap rally due to weak consumption demand.

However, many of the new favorite mid-and-small-cap stocks of institutional and retail investors are in the broader ‘investment’ sector (capital goods, defense, EMS, railways, real estate, renewables). These stocks have delivered significant returns in recent months.

Smallcaps are generally more volatile than their large-cap counterparts. This means their price movements, both upwards and downwards, tend to be more exaggerated.

Here's a breakdown of what typically happens to smallcaps during and after market corrections:

Higher Volatility: Smallcaps usually experience steeper declines than large-caps during market corrections. This is due to their inherent risk, lower liquidity, and the fact that they're often the first to be sold off as investors seek to reduce exposure to more volatile assets.

Reduced Liquidity: In a downturn, there might be fewer buyers for smallcaps, making it harder for investors to sell without affecting the stock price. This reduced liquidity can exacerbate price declines.

Earnings Vulnerability: Smallcaps might not have the financial strength or diversification that large-cap companies possess. Therefore, any economic downturn can impact their earnings more severely, further pressuring their stock prices.

Reduced Access to Capital: During corrections or recessions, capital markets can tighten, making it challenging for smaller companies to raise funds. This can be problematic for those that rely on external financing.

Potential for Higher Returns: Historically, after a market downturn, smallcaps have shown the potential to rebound aggressively. Their lower base can allow for a larger percentage increase, offering substantial returns for those who can endure the volatility.

Re-evaluation and Strategy Shift: Post-correction, many smallcap companies re-evaluate their business models, streamline operations, and cut unnecessary costs, making them more efficient and potentially more profitable in the long run.

Investor Sentiment: As the market starts recovering and sentiment improves, investors may begin searching for higher growth opportunities, often leading them back to smallcaps. This renewed interest can provide a boost to smallcap stocks.

In the world of investments, market corrections, though unsettling, are not unusual. It is essential for investors to understand the forces driving these corrections to respond adeptly and make informed decisions. Below, we dive into the various factors currently influencing the market sentiment:

Over-Optimism: The bullish run witnessed by several small-cap stocks, in some cases, exceeded their fundamental valuations. Such optimism can be driven by factors such as increased retail participation, speculation, or perceived future growth. When reality begins to set in, and investors reassess the actual worth of these companies, a correction can ensue.

Reduced Purchasing Power: Rising inflation can erode the purchasing power of consumers, leading to decreased spending. This can impact the revenue of companies, especially those in consumer-driven sectors.

Monetary Policy Repercussions: Central banks may resort to tightening monetary policies to combat rising inflation. This could mean higher interest rates, which can increase borrowing costs for companies and reduce disposable income for consumers. Both scenarios can depress stock prices.

Decreased Global Demand: The specter of a global recession can decrease demand for goods and services worldwide. Export-driven economies can witness a decline in overseas sales, impacting company earnings and, by extension, stock prices.

Capital Flight: In anticipation of a global recession, investors might look for safe-haven assets or pull out of riskier assets, including equities in emerging markets, causing a sell-off and market correction.

Impact on Import-Dependent Economies: For countries dependent on oil imports, rising crude prices can inflate import bills, leading to trade imbalances and putting pressure on national currencies.

Increased Operational Costs: Sectors like aviation, logistics, and manufacturing can see a spike in their operational costs due to higher fuel prices. This can squeeze profit margins, leading to bearish sentiments in these sectors.

Consumer Spending: Higher crude prices can result in increased prices at the pump for consumers, leading to reduced disposable income and decreased spending in other areas.

Favorable:

Energy: With crude prices on the rise, energy stocks, especially those involved in oil and gas exploration, refining, and distribution, stand to gain.

Metals: With concerns arising from China (which is a significant global player in metals), there could be potential opportunities in the metal sector, especially if supply constraints arise.

Avoid:

Stocks and sectors with inflated valuations and those most impacted by inflation, such as consumer discretionary.

Favorable:

FMCG: Leveraging the upcoming festive season, expect a surge in domestic consumption, which bodes well for the Fast-Moving Consumer Goods sector.

PSU Banks: Often seen as more resilient during volatile periods, Public Sector Undertaking banks could offer a more stable investment avenue.

IT: As global businesses continue their digital transformation journeys and outsource more, Indian IT companies stand to benefit.

Pharma: Given the ongoing global health situation, pharmaceuticals remain a promising sector.

Chemicals: With global supply chain disruptions and a shift in manufacturing base, the Indian chemical sector can see substantial growth.

Cement: Infrastructural and housing growth continues to spur demand in this sector.

Favorable:

Defensive sectors like Pharma and IT which can potentially offer services and products that are in demand irrespective of economic downturns.

Avoid:

Overvalued companies and those in sectors vulnerable to a global slowdown.

Favorable:

Given the prevailing high valuations in some sectors, diversifying into undervalued or reasonably valued sectors like PSU Banks and Cement might be a prudent move.

Avoid:

Companies and sectors that are trading at peak valuations and do not have the earnings or growth metrics to justify those valuations.

Financial downturns are as much a test of emotional fortitude as they are of investment strategy. As the markets swing, it's not just our portfolios that fluctuate, but our heartbeats too. Delving deep into the emotional rollercoaster that corrections tend to bring, it's crucial to understand the psychological play at hand, prevent knee-jerk reactions, and resist the allure of market-timing.

Emotional Investment: Stock market investments are not merely numbers on a screen; they often carry the weight of our hopes, dreams, and aspirations. This personal attachment can amplify emotional reactions to market movements.

Herd Mentality: Watching others panic-sell can create an infectious environment of fear. The natural instinct to 'follow the crowd' can sometimes lead investors astray, making them act against their best interests.

Overconfidence: Periods of bullish markets can give investors a false sense of invincibility, making corrections seem like unwarranted blips that challenge this belief.

Historical Perspective: Corrections are a natural part of market cycles. Historically, every major dip was followed by a recovery. Understanding this can help maintain perspective and prevent hasty decisions.

Long-term Vision: If your investment strategy was designed for the long term, short-term market movements, even sharp ones, shouldn't dictate major changes to your approach.

Stay Informed, Not Overwhelmed: While it's essential to stay updated with market news, avoid drowning in the noise. Distinguish between factual updates and opinion-driven commentary.

Predicting the Unpredictable: Market movements are influenced by a myriad of factors, many of which are unpredictable. Trying to time the market based on predictions can be a perilous endeavor.

Missed Opportunities: Waiting for the 'perfect' moment to buy or sell can mean missing out on potential opportunities. Studies have shown that missing just a few of the market's best days can significantly impact overall returns.

Consistent Strategy: Rather than trying to time the market, a consistent investment strategy – such as dollar-cost averaging, where regular investments are made irrespective of market conditions – can yield better results in the long run.

Market corrections, while inherently challenging, can serve as prime moments for investors to re-evaluate and refine their strategies. Rather than approaching these downturns with apprehension, adopting certain time-tested techniques can ensure that your investments remain resilient. Below are some key strategies that have proven their mettle during market corrections:

Consistent Investments: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, irrespective of market conditions. This method allows investors to buy more shares when prices are low and fewer when prices are high.

Mitigating Timing Risks: By spreading investments over time, you reduce the risk associated with trying to time the market or investing a large amount just before a downturn.

Emotional Balance: Consistent, scheduled investments can also alleviate the stress of deciding when to invest, providing emotional equilibrium amidst market volatility.

Spread the Risk: Diversification involves spreading investments across various asset classes or sectors to reduce exposure to any single risk. This strategy can limit potential losses during corrections since not all asset classes move in tandem.

Regular Check-ins: It's essential to review your portfolio periodically to ensure it aligns with your risk tolerance and investment goals. Market movements can alter asset allocations, so rebalancing helps maintain your desired portfolio structure.

Tactical Moves: While the core of your portfolio should remain stable, strategic shifts in allocations based on market conditions or valuations can sometimes be beneficial. However, these should be made judiciously and not as knee-jerk reactions.

Historical Context: Remember that markets have historically recovered from corrections. The key is patience. A long-term perspective can provide solace during the tumultuous phases and keep investors from making impulsive decisions.

Future Goals: Reaffirm your investment objectives. Whether you're saving for retirement, a home, or your child's education, keeping these goals at the forefront can provide clarity and deter deviations from the path.

Resist the Short-Term Noise: Markets are inundated with news, predictions, and analyses. While staying informed is crucial, it's equally important to discern between momentary disturbances and genuine shifts in fundamentals.

Market corrections, characterized by sharp declines and heightened uncertainty, can evoke fear and apprehension among many investors. However, for those with a discerning eye and a long-term horizon, these downturns can present valuable opportunities. Here’s how:

Bargain Hunting: Market corrections often result in an across-the-board decline in stock prices, including those of fundamentally solid companies. This provides an opportunity for investors to purchase top-tier stocks at reduced prices – akin to a sale in the stock market.

Historical Perspective: Historically, many blue-chip companies have seen their stock prices rebound after market corrections. Investors who capitalized on these temporary price dips have often been rewarded with attractive long-term returns.

Enhanced Dividend Yields: Buying a dividend-paying stock at a reduced price can increase its yield, given that dividend yield moves inversely to its price. This could offer better income prospects for yield-seeking investors.

Inherent Volatility: Small-cap stocks, given their relatively lower market capitalization, tend to be more volatile than their large-cap counterparts. This means that during corrections, the decline in small-cap stocks can be steeper. However, the upside during recovery phases can also be significant.

Research and Analysis: Downturns provide a chance to sift through the small-cap segment and identify companies with strong fundamentals, innovative products, efficient management, and sustainable business models. These companies are more likely to weather economic downturns and possibly emerge stronger.

Potential for Higher Returns: Historically, certain small-cap stocks have outperformed the broader market post-corrections. While they come with higher risks, the potential for substantial returns can be greater for those willing to undertake thorough research and bear the volatility.

Sectoral Opportunities: Corrections can also shine a light on specific sectors that have been unduly punished despite having a positive long-term outlook. Investors can delve into these sectors to find both large and small-cap gems.

In the ever-fluctuating world of finance, risk management is a cornerstone of our investment approach at Wright Research. With a view to safeguard our clients' investments and capitalize on market opportunities, we employ a multi-faceted strategy that taps into advanced technology, diversification methods, and astute market insights. Here's a deeper dive into our risk management tools:

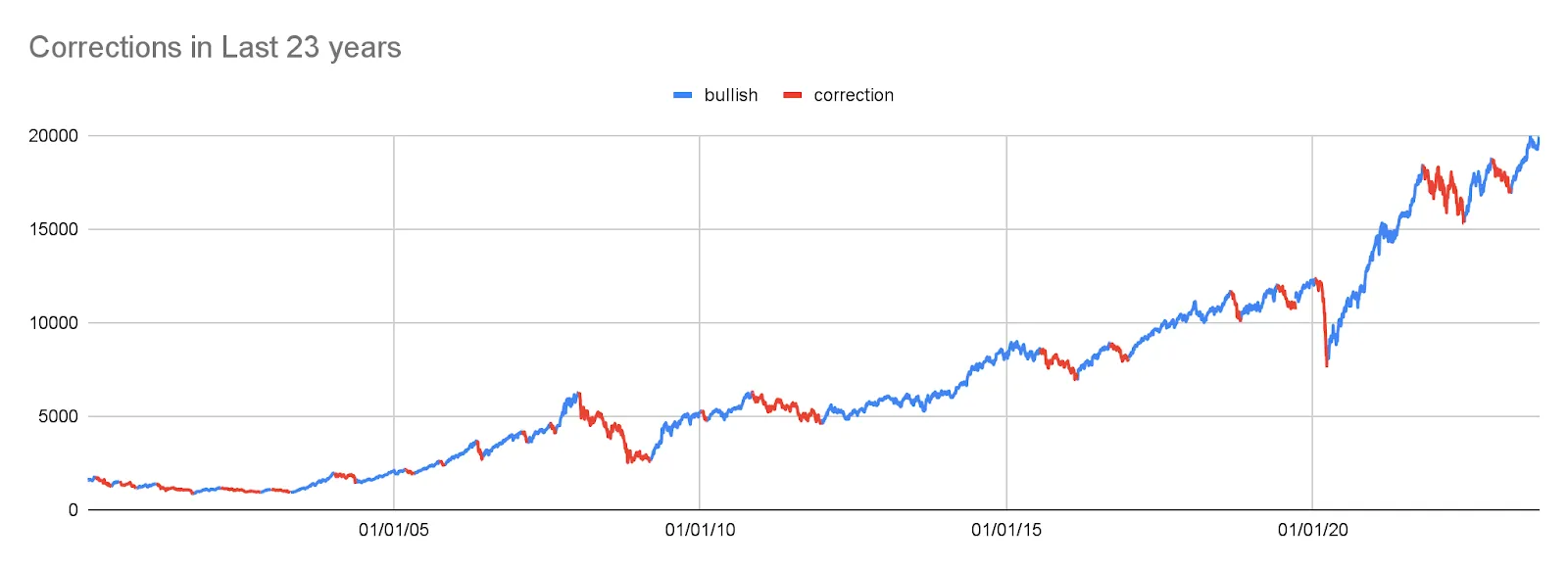

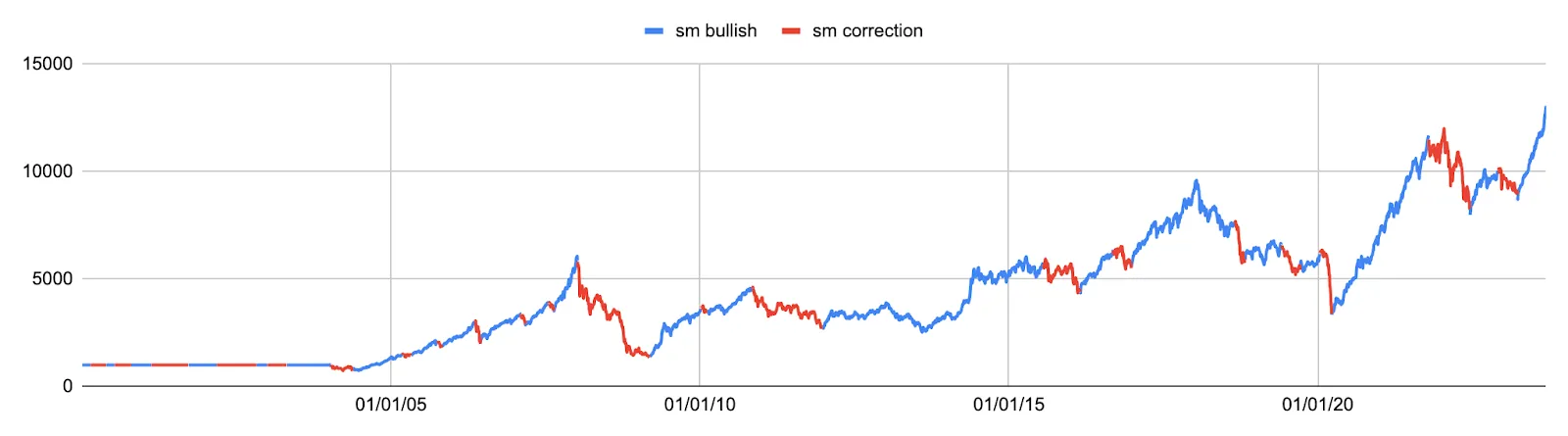

At the heart of Wright Research's strategy is our cutting-edge regime modeling technique, which leans heavily on Artificial Intelligence.

Predictive Analysis: Our model is designed to forecast the upcoming month's market trajectory. Is the market sentiment leaning bullish, indicating growth? Or is it bearing a bearish tint, suggesting a potential downturn? Our AI-powered tools analyze vast amounts of data to make these predictions, helping us to position our investments proactively.

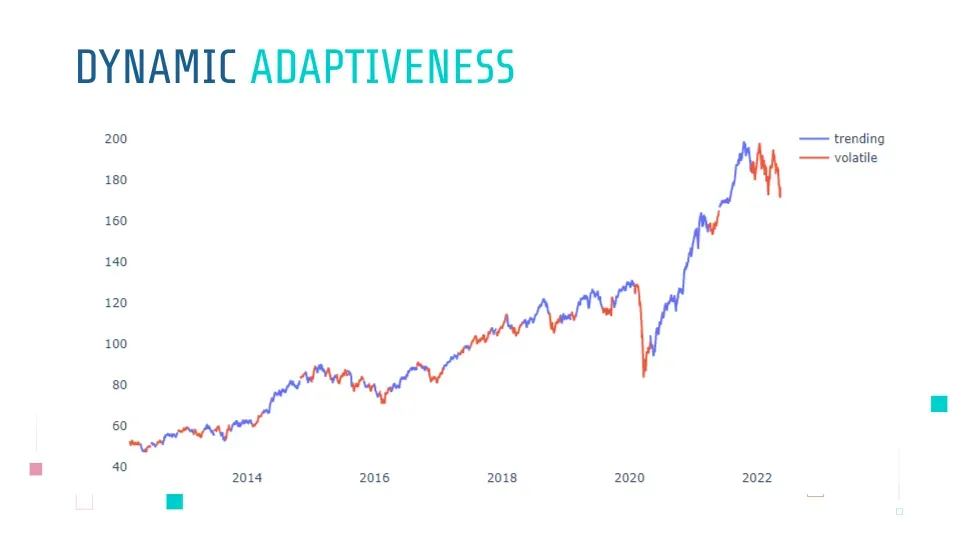

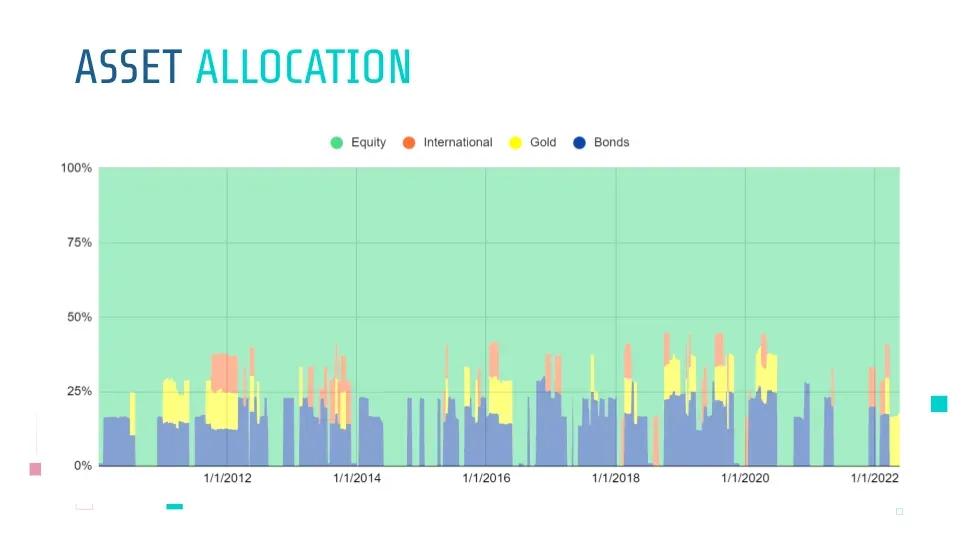

Diversification isn't just a buzzword for us; it's a tried-and-tested strategy that forms a significant part of our risk management approach.

Adaptive Allocation: Recognizing that different assets have varying risk profiles, we dynamically adjust our asset allocation in response to market volatility. This means we may reduce exposure to high-risk assets during tumultuous times and pivot towards more stable ones.

Safe Havens: During particularly uncertain market phases, we might increase our allocation to traditionally safer assets like bonds and gold ETFs. These assets often offer stability and can act as a hedge against unpredictable market movements.

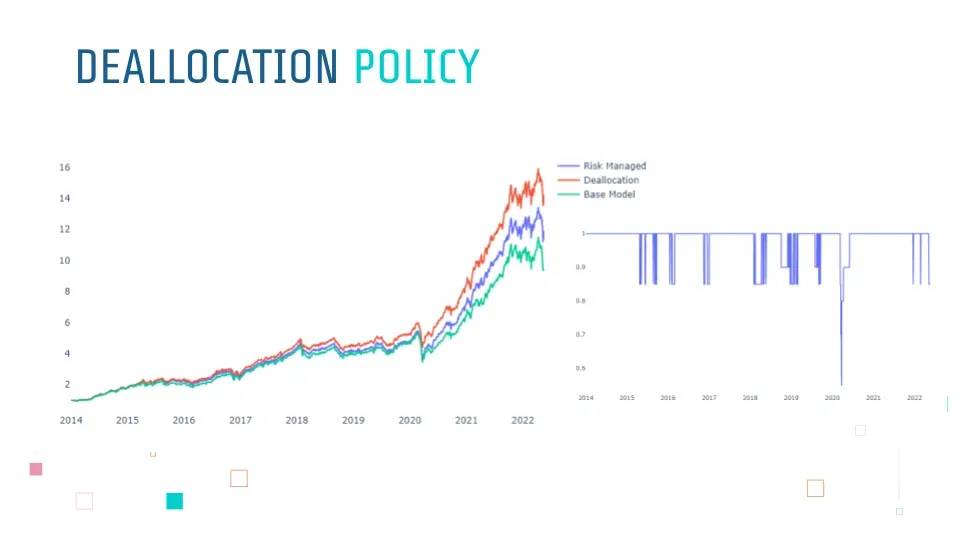

While being invested in the market is crucial, there are times when a defensive stance is the best offense.

Switching to Liquidity: Our policy allows for a shift to cash or cash-equivalents in extreme market conditions. This isn't a retreat, but a strategic move, ensuring that we have liquidity on hand and are positioned to take advantage of opportunities when the market stabilizes or presents buying opportunities.

Long-Term Performance: Experience has shown us that this deallocation strategy, employed judiciously, can help mitigate deep losses and position the portfolio for stronger long-term performance.

Market corrections, while daunting, are natural occurrences in the investment world. Historically, small-caps experience higher volatility during these phases, but they also offer robust rebound potential post-correction. The current market sentiment reflects concerns from high small-cap valuations, rising inflation, global recession fears, and increasing crude prices. However, strategically, there are sectors and assets that investors might find favorable, like energy, metals, FMCG, and pharma. Investors should be wary of their emotional responses during downturns, focusing on the long-term perspective and avoiding the pitfalls of market-timing. Tactics like dollar-cost averaging and diversification can provide stability during turbulent times. Moreover, corrections can offer astute investors opportunities to buy quality assets at reduced prices, especially in the small-cap segment. Lastly, at Wright Research, the fusion of AI-driven predictive analysis, dynamic asset allocation, and strategic deallocation formulates a robust risk management strategy. While the landscape may change, staying informed, strategic, and emotionally balanced are keys to navigating market corrections.

Read the full article on Wright Research Deciphering SmallCaps: Understanding Valuation Amidst Market Corrections.

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more! Watch the full video on Are Indian Stock Markets Correcting? Is the Smallcap Rally Over? 👇🏻

Want to learn more about Smallcaps, read our detailed article on Complete guide to Invest in Smallcap Stocks & in Wright Smallcaps Portfolio and Smallcaps learnings from Great Investors: Warren Buffett, Peter Lynch & Michael Burry !

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios