by Sonam Srivastava

Published On April 30, 2020

Factor models have become an important cog in the financial wheel, enabling investors to quantify risk and predict returns of securities. A factor model essentially identifies various drivers - fundamental, technical, macroeconomic, or alternative, and uses them to formulate a clear picture of a security's behavior.

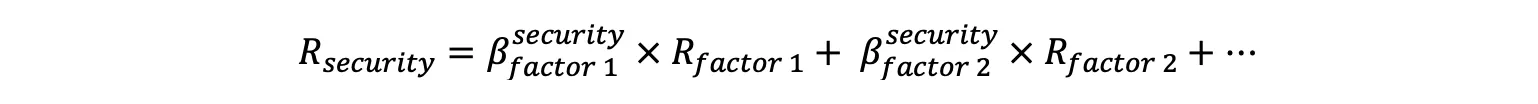

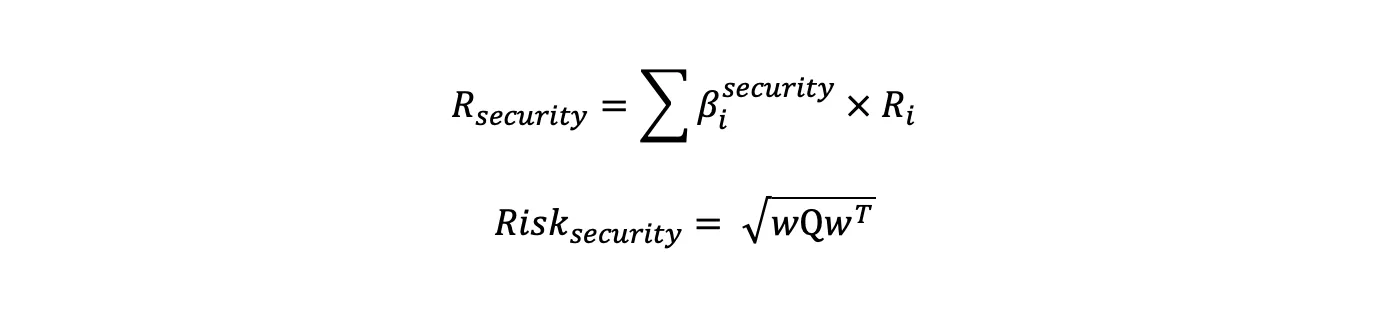

The relationship of these factors to the security's returns is not chaotic but linear. The returns of a security are essentially an amalgamation of various factor returns, each contributing proportionately to the final outcome based on the security's specific exposure to these factors. Factor models are financial models that usefactors— that can be technical, fundamental, macroeconomic or alternate to define a security’s risk and returns.

These models arelinear,as they define the securities returns to be a linear combination of factor returns weighted by the securities factor exposures.

Factor exposures function as the ties that bind securities to their respective factors. The level of exposure a security has to a particular factor can illuminate the extent to which that factor influences the security's risk and returns.

Factor models, also known as factor-based models, are statistical models used in finance and investing to explain and predict the returns of securities or portfolios. These models attempt to capture the systematic factors or underlying sources of risk that drive asset returns.

In a factor model, the returns of a security or portfolio are expressed as a linear combination of one or more factors. These factors represent broad characteristics of the market or economy that influence asset prices. Common factors used in factor models include macroeconomic variables, industry performance, interest rates, volatility, and other market indicators.

The basic idea behind factor models is that the returns of securities or portfolios can be explained by the exposure to these underlying factors. By identifying and quantifying the factor exposures, investors can better understand and manage the risk and return of their investments.

Read our article on What is Factor Investing?

Factor investing strategies involve selecting and weighting securities based on their exposure to specific factors that are expected to drive their returns. While there are numerous factors that can be considered, some commonly used factors in factor investing strategies include:

Value: The value factor focuses on investing in securities that are considered undervalued relative to their fundamental measures such as price-to-earnings ratio, price-to-book ratio, or dividend yield. This factor aims to capture the potential for price reversion or mean reversion.

Size: The size factor looks at investing in smaller companies that tend to outperform larger companies over the long term. This factor is based on the belief that smaller companies have more room for growth and can provide higher returns.

Momentum: The momentum factor involves investing in securities that have exhibited strong recent price performance. This factor assumes that assets with positive price trends will continue to perform well in the near term.

Quality: The quality factor focuses on investing in companies with strong financial health, stable earnings, and low levels of debt. This factor aims to capture companies with resilient business models and sustainable competitive advantages.

Low Volatility: The low volatility factor emphasizes investing in securities with lower volatility or risk compared to the broader market. This factor assumes that low-volatility stocks can provide better risk-adjusted returns over time.

Dividend Yield: The dividend yield factor focuses on investing in securities with high dividend yields. This factor aims to capture income generation from dividends and potentially benefit from the stability and cash flow characteristics of dividend-paying stocks.

Growth: The growth factor involves investing in companies with strong earnings growth potential and high revenue growth rates. This factor aims to capture companies that exhibit strong growth prospects and may outperform in growth-oriented market conditions.

It's important to note that factor investing strategies can differ based on the specific factors considered, weighting methodologies, and investment horizons. Additionally, new factors can emerge over time as research and market dynamics evolve.

Here’s a detailed article on What are the different types of Investing Factors?

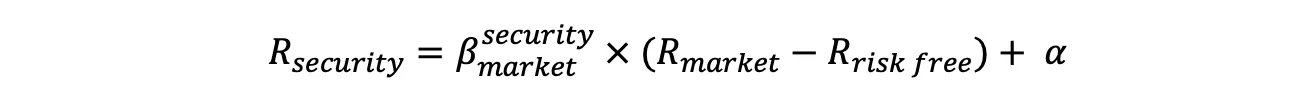

The conversation about factor models begins with the Capital Asset Pricing Model (CAPM) , a crucial pillar of the Modern Portfolio Theory. The CAPM is a single-factor model that characterizes a security's risk as a product of its exposure to the market, captured through the concept of market Beta.

The CAPM, describes security’s risk as a function of it’s market exposure or market Beta

In the context of factor models, market Beta emerges as a metric to quantify systematic risk. Statistically, Beta is the slope of the line resulting from regressing the stock returns against the market returns. It's like a translator that tells us how a security's returns tend to move relative to the broader market's returns.

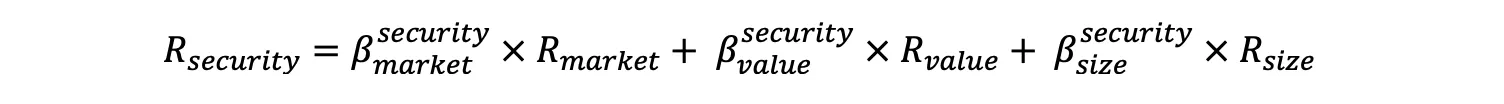

The simplicity and efficacy of CAPM have undoubtedly been attractive, but its reliance on a single factor prompted the need for a more comprehensive model. Thus, the Fama-French 3-factor model was born. Pioneered by Eugene Fama and Kenneth French in their landmark 1993 paper, this model incorporated two more factors - the size and value of firms - alongside market sensitivity, increasing the model's predictive power substantially. Their research demonstrated that these three factors could explain 90% of the equity's risk.

In the following years, the model expanded to include additional factors such as momentum, identified by Jagadeesh and Titman in 1993, low volatility (2006), and quality (2013). The evolution of factor models underlines the continuous quest in finance to improve risk-return predictions.

The most popular model in factor literature is the Fama-French 3-factor model. In their seminal paper published in the 1993 Fama & French demonstrate that 90% of an equity’s risk can be described based on the 3 factors —market sensitivity, value and size.

Later, momentum as a factor was added to the equation by Jagdeesh Titman in 1993,low volatility in 2006 and quality in 2013.

The foundational concept of factor investing is that these characteristics or factors offer returns above the market because they are either 1) compensation for bearing risk or 2) they exploit behavioral biases. The Efficient Market Hypothesis asserts that it is impossible to beat the market because the stock market efficiency causes existing share prices to always incorporate and reflect all relevant information. However, over the years, researchers have found consistent anomalies in this hypothesis that suggest that certain risk factors tend to outperform the market consistently.

One of the most recognized and earliest examples of factor investing is the Capital Asset Pricing Model (CAPM) where the market beta was identified as a source of expected return. Later, Fama and French's three-factor model expanded the concept by adding size and book-to-market value as additional factors. Today, the commonly acknowledged factors that have shown to drive a significant amount of the variation in stock returns include size, value, momentum, quality, and volatility.

In practice, factor investing can be implemented in a few ways:

Single-factor approach: Investors take a bet on one factor that they believe will outperform in the future. This can be through factor ETFs, factor mutual funds, or creating a custom portfolio of stocks that exhibit a high degree of the chosen factor. For instance, an investor might choose to focus on the value factor, investing primarily in stocks that appear undervalued based on financial fundamentals like P/E ratios, believing these stocks will eventually converge to their intrinsic value. Investors often execute this strategy through factor ETFs, mutual funds or robo-advisors that focus on a specific factor, such as momentum strategies.

Multi-factor approach: To increase diversification and limit underperformance if one factor underperforms, investors can use a multi-factor approach where they invest in a combination of different factor exposures. By combining multiple factors, investors hope to smooth out the returns, as factors often outperform in different market conditions. For example, an investor might construct a portfolio that includes exposure to both value and momentum factors, with the rationale that the negative correlation between these two factors can lead to risk reduction. A real-world example of a multi-factor strategy is the Balanced Multifactor portfolio which includes value, momentum, quality, and low volatility factors.

Factor rotation: This strategy is similar to sector rotation but with factors. It involves shifting exposure among different factors based on an investor's prediction of how various factors will perform under specific market conditions. For example, during the recovery phase of the economic cycle, an investor might overweight the portfolio towards the momentum factor, with the expectation that stocks with high momentum will continue to perform well as the economy improves. Balanced Multifactor portfolio follows a factor rotation strategy.

Risk factor approach: This strategy uses factors as tools for understanding the sources of risk in a portfolio to aid in asset allocation decisions. The aim here is to achieve a well-diversified portfolio across different risk sources rather than to tilt the portfolio towards specific factors. For example, an investor might use the value, size, and momentum factors to evaluate the risk characteristics of a portfolio and then adjust the asset allocation based on the portfolio's factor exposures to mitigate risk.

However, while factor investing offers the potential for improved portfolio performance and risk management, it also carries potential pitfalls and risks. Identifying and timing factors is complex and requires a deep understanding of market dynamics and economic conditions.

Factors can also underperform the market for extended periods. It is also possible that factors identified in historical data may not persist in the future. While historical data may suggest certain factors have outperformed, it does not guarantee future performance. Therefore, a strong understanding of factor investing, a disciplined approach, and a long-term perspective are crucial when implementing a factor-based investing strategy.

Factor investing offers several potential benefits and also comes with certain challenges. Here are the key benefits and challenges of factor investing:

Enhanced Risk-Adjusted Returns: Factor investing aims to capture risk premia associated with specific factors. By targeting factors that have historically demonstrated outperformance, factor investing has the potential to enhance risk-adjusted returns compared to traditional market-cap-weighted approaches.

Diversification: Factor investing allows investors to diversify their portfolios beyond traditional asset class diversification. By selecting factors with low correlation to each other, factor investing can provide additional diversification benefits and potentially reduce portfolio risk.

Increased Transparency: Factor investing strategies are typically rules-based and transparent. The use of specific factors and their explicit weighting methodologies provide investors with clarity on how the portfolio is constructed, enabling better understanding and evaluation of the investment strategy.

Potential for Persistent Returns: Certain factors, such as value, momentum, or quality, have exhibited persistent performance over long periods. By systematically targeting these factors, factor investing strategies aim to capture the long-term benefits associated with these persistent return patterns.

Flexibility and Customization: Factor investing allows for flexibility and customization based on investor preferences. Investors can choose specific factors that align with their investment objectives and risk tolerance. They can also blend different factors or combine factor strategies with other investment approaches.

Factor Volatility and Cyclicality: Factors can experience periods of underperformance or exhibit cyclical behavior, leading to potential challenges in timing factor rotations or dealing with factor-specific risks. Factors that have performed well historically may not continue to do so in the future.

Data Mining and Model Overfitting: The process of identifying and selecting factors involves analyzing historical data. There is a risk of data mining and model overfitting, where factors may appear statistically significant in historical analysis but fail to deliver similar performance in the future.

Factor Crowding: Popular factors can become crowded as more investors adopt factor-based strategies. Increased demand for securities with exposure to certain factors can impact their expected returns and reduce the effectiveness of factor investing.

Implementation and Costs: Implementing factor investing strategies may require regular rebalancing, which can lead to transaction costs and potential tax implications. Additionally, accessing certain factors may require specialized investment vehicles or higher fees associated with factor-focused funds or ETFs.

Manager Skill and Selection: Successfully implementing factor investing strategies requires expertise in factor analysis, portfolio construction, and risk management. Investors need to carefully select skilled managers or employ robust factor allocation methodologies to achieve desired outcomes.

Factor investing is not a guarantee of superior returns and comes with its own set of risks. It is important for investors to conduct thorough research, understand the limitations and risks associated with factors, and carefully evaluate their suitability and potential impact on their investment objectives before implementing factor-based strategies. Check out our article to understand the Nuances of Factor Investing: A Balancing Act of Risks and Rewards .

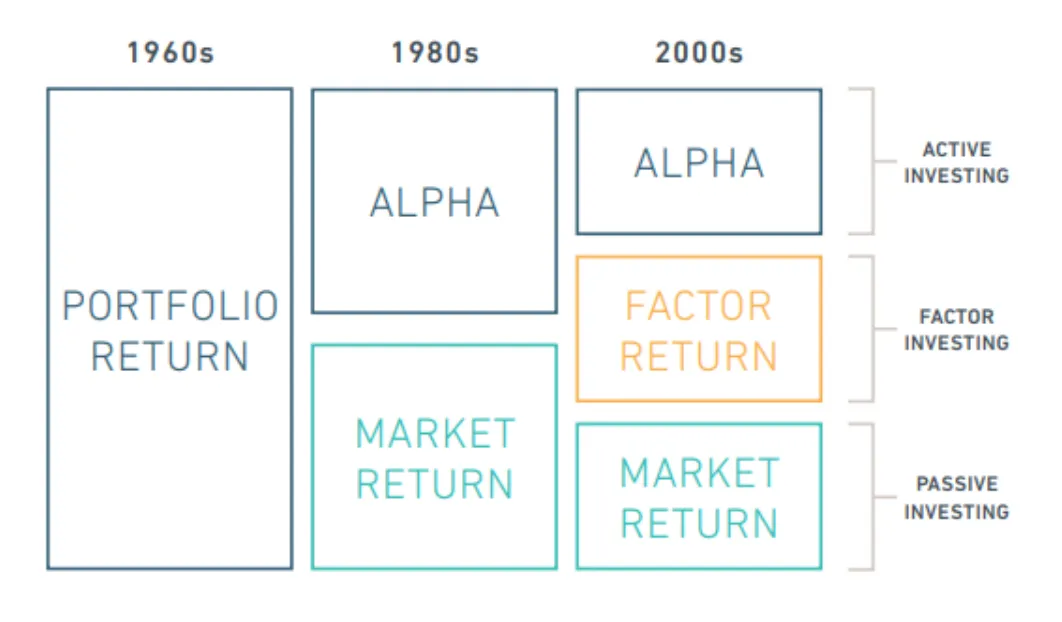

The rise of Smart Beta strategies signifies a paradigm shift in investing. These strategies believe that the returns of any strategy can be decomposed into three components - market returns, smart beta components, and manager returns or active returns.

MSCI Barra, a renowned provider of factor indices, categorizes global equity factors into 8 groups and 16 factors, offering a robust framework for investment decisions. Now, with the advent ofSmart Betastrategies, any strategies returns are widely believed to be broken down into —market component, smart beta components, manager returns (or active returns)

MSCI Barra, the leading provider of factor indices categorises global equity factor in 8 groups and 16 factors

Many quantitative portfolio managers device strategies that follow one or more of these factor models

For a quant, the most fascinating aspect of these models is the maths! If we can identify and capture all the relevant factor exposures, these factors can fully describe a securities risk and returns!

where Q is the factor covariance matrix and w is the weight of the factors.

Quantitative factor strategies simplify the investing process by reducing the vast universe of stocks to a handful of factors that most influence the market. By focusing on these significant factors, quants are able to build models that align with economic theories, predict market behavior more accurately, and devise strategies that optimize returns.

If you dive into the mathematical aspect of these models, you find that factor exposures and their covariance can fully encapsulate a security's risk and returns. This simplification forms the backbone of many quantitative factor strategies, allowing quants to model the market with greater efficiency and precision.

The power of factor models in investment strategy design cannot be overstated. By focusing on the fundamental drivers of returns, factor investing provides a systematic, rules-based approach to outperform traditional market cap-weighted indices. The evolution of factor models and strategies presents exciting opportunities for investors looking to harness the power of these factors for portfolio construction and risk management. With continued advancements in technology and data.

What are some commonly used linear factor models?

The most common linear factor models include:

How do multi-factor models enhance portfolio diversification?

Multi-factor models consider multiple factors that have low correlation to each other. By combining such factors in a portfolio, multi-factor models enhance diversification and reduce concentration risk.

What are equity factor models, and how do they contribute to portfolio management?

Equity factor models focus on factors specific to equity markets, such as value, size, momentum, and quality. These models help identify factors that drive equity returns and allow for factor-based portfolio construction and risk management.

How are factors selected and weighed in factor-based portfolio construction?

Factor selection is primarily based on their historical ability to explain asset returns. Factors are weighed according to the investor's risk tolerance, return expectations, and investment horizon. Diversification is also a critical consideration in a multi-factor portfolio to balance out the performance of different factors under varying market conditions. These factor weights can be adjusted over time in response to market changes or shifts in the investor's risk/return profile.

What are the benefits of factor investing in portfolio management?

Benefits of factor investing include enhanced risk-adjusted returns, diversification beyond traditional asset classes, increased transparency, potential for persistent returns, and flexibility for customization based on investor preferences.

What challenges should be considered when implementing factor investing?

Challenges of factor investing include factor volatility and cyclicality, potential data mining and model overfitting, factor crowding, implementation costs, and the need for skilled manager selection. It's important to carefully assess and manage these challenges when implementing factor investing strategies.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart