by Siddharth Singh Bhaisora

Published On July 10, 2023

Have you watched one of the movies where the plot is tense, and there’s a tricky problem at hand, and suddenly someone applies data and pattern detection techniques and finds a solution?

Factor Investing applies the same logic for long-term investing. Factor investing uses data and algorithms to find distinguishable patterns in the market that can help us consistently outperform the market at low risk.

Factors are indicators that can help describe stock returns. When you try to get into the details of the factors influencing market returns, you’ll find that they are very intuitive to understand.

Factor investing is a method that employs pre-set parameters, known as factors, to anticipate the performance of various assets such as stocks, bonds, or funds. These factors are categorized into two broad types - investment style factors and macroeconomic factors.

Factor-based asset allocation investing is a strategy that seeks to improve portfolio performance by investing in assets based on certain characteristics or "factors". These factors have historically been associated with higher returns. The goal is to construct a portfolio that aligns with these factors, aiming to drive positive returns.

Macroeconomic factors are broad events or conditions that significantly impact an economy, with repercussions across various asset classes. These factors can be fiscal, natural, or geopolitical and may affect a particular region, a nation, or the global economy at large. Some examples of macroeconomic factors include unemployment rates, inflation, interest rates, and GDP. These are distinct from microeconomic factors which are more focused on individual securities and include aspects like credit risk, liquidity, and stock price volatility.

Style factors are more nuanced and are a quantitative way to describe strategies for outperformance. Style factors aim to account for returns and risks within specific asset classes. The five primary style factors - size, value, quality, momentum, and risk volatility - are considered by investors when evaluating various securities. Each of these style factors would have proponents among quantitative investors and all types of investors.

Size: Research has shown that smaller companies, often called "small-cap" companies, tend to produce higher returns than larger companies, or "large-cap" companies. This does not come without risk, however, as smaller companies can be more volatile and less stable than their larger counterparts. Despite this, the potential for high returns makes small-cap companies an attractive option for many investors.

Value: This factor is based on the principle that undervalued companies outperform overvalued ones. Value investors seek stocks that are trading for less than their intrinsic value, determined by metrics such as the price-to-book value ratio, price-to-earnings ratio, and dividends. Essentially, value investing is about finding and buying stocks that are "on sale".

Quality: This factor focuses on companies with high-quality earnings, signifying strong financial health. Such companies often have low debt, stable earnings, and consistent growth. They're also typically efficient with their use of capital. Quality investing is about finding companies with solid financial foundations that are likely to be profitable in the long term.

Momentum: This factor is based on the trend of a stock's price. It posits that stocks that have been performing well recently are likely to continue doing so in the near future. Momentum investing involves buying stocks on an upward trend and selling them when they appear to have peaked.

Risk Volatility: This strategy aims to create a portfolio that has the lowest possible volatility. The goal is not necessarily to enhance returns but to decrease risk. By investing in stocks that have historically demonstrated lower volatility, the portfolio is expected to experience smaller fluctuations, which can be beneficial for risk-averse investors. High volatility stocks, which have historically had lower realized returns, are often excluded from such portfolios.

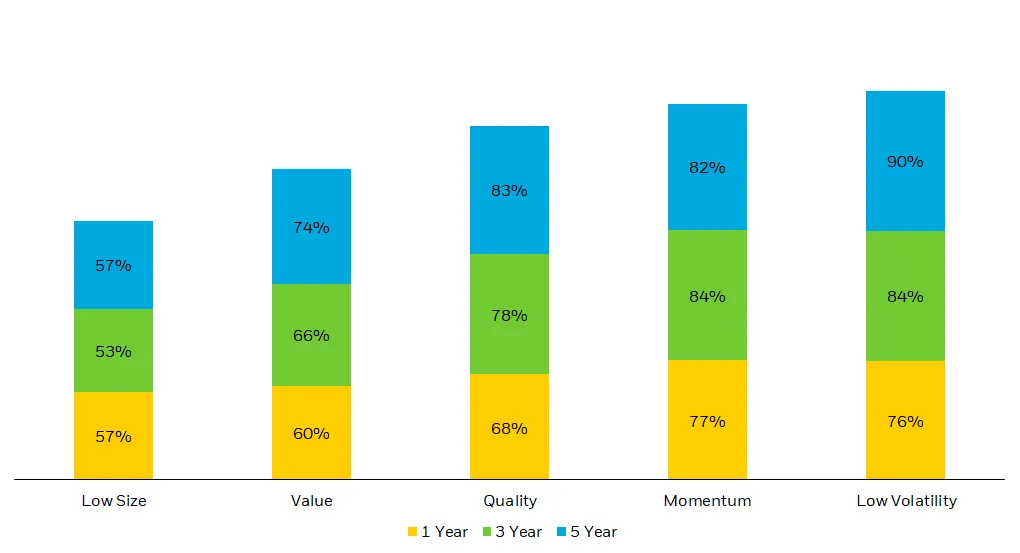

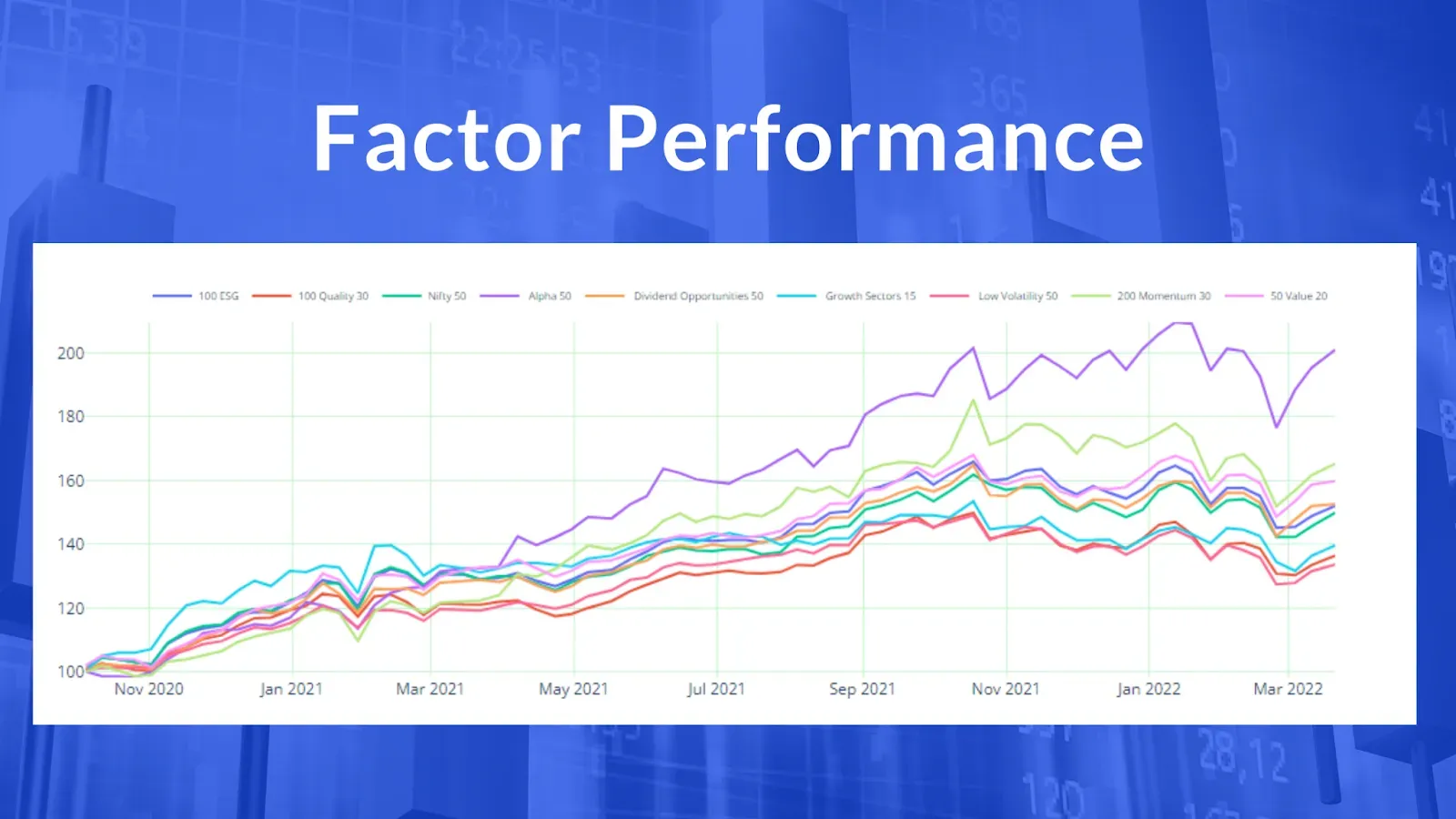

The effectiveness of these factors can depend on the holding period. Longer holding periods often increase the probability of success, as market fluctuations tend to even out over time. And factor investing strategies can be a gamechanger for long-term performance. While the Nifty 50 Index has given around 10% CAGR since 2010, most factor strategies have a much higher return.

As with any investment strategy, it's crucial to carefully consider one's individual financial situation, risk tolerance, and investment goals.

It's important to note that these factors aren't guarantees of success; they simply provide a structured approach to portfolio construction based on historical data. Additionally, while these factors can improve the potential for positive returns, they also carry their own risks and should be used as part of a well-diversified investment strategy.

Factors allow investors to find stock themes that fit their risk appetite and enable them to invest in a unique opportunity. Investors can get exposure to multiple factors, thus increasing their diversification and consistency or returns. Tactical allocation to Factors, while challenging, can be highly lucrative.

Factors being data-driven can focus on a broad universe. They capture all significant fundamental anomalies in the market and behavioral biases. They allow the investors to get greater diversification, thus lowering their drawdowns.

Factors can be served in a passive or an active basket. As these baskets are data and technology-driven, they have low expense ratios.

Factor returns can be cyclical , and any factor will not work all the time. On the other hand, a single factor can have extended periods of underperformance like the value factor had in the last couple of years when Momentum outperformed.

So, it is always a good idea to trust an investment advisor that guides you with a tactical allocation to factors. Factor maths is also quite complex, so investors should generally trust practiced researchers in the field.

The NSE has published factor Indices since 2017, and there are some ETFs available for the same as well. In addition, Robo-advisors like Wright Research also publish curated factor or smart beta strategies, which are very popular on smallcase. Explore market indices & factors here

Talking about the relative performance of Factors in India, Momentum or Trend Following has always been an influential factor for Indian investors because India has gone through strong growth markets.

Quality is also a factor that works well in India, along with Size or betting on smaller stocks.

In times of volatility, Value or Low Volatility factors outperform the market.

Read about the risks and rewards associated with factor investing .

Visit Wright's Balanced Multifactor portfolio.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios