by Siddharth Singh Bhaisora

Published On July 11, 2023

Many investors choose to engage in factor investing as it aims to curb risk by enhancing portfolio diversity. At the heart of successful long-term investment strategies is diversification. Factors contribute to portfolio diversity as they cover a broad array of scenarios, performing well at various stages of the economic cycle. This means even when one factor underperforms, another is likely to thrive.

Historically, factors encapsulate traits driving robust and consistent returns. This, coupled with the ability for investors to single out preferred traits, gives factor or smart beta strategies the potential to deliver above-average returns. This makes factor investing an appealing complement to traditional index funds for some investors, helping to counterbalance market exposure and enhance portfolio resilience during volatile periods.

However, factor investing comes with its share of challenges. Adopting a smart beta strategy may prove costlier than investing in traditional index funds. The rising popularity of factor investing has led to a surge in the price of assets with attractive factors, potentially diminishing future returns.

An overemphasis on specific factors can lead investors to overlook the necessity of a balanced portfolio. Since stocks may cease to satisfy certain factors over time, a smart beta fund might require more frequent rebalancing. This could mean selling a stock to replace it with another that fits the desired factor. Even though factor investing aims to reduce risk by focusing on specific factors, this strategy can backfire if the portfolio leans too heavily towards certain smart betas. This can expose the investor to greater risks, such as overconcentration in small company stocks or reducing the overall number of stocks in the portfolio.

Factor investing, being an active investment approach where investors are continuously monitoring stocks' compliance with chosen factors and making adjustments as necessary, can elevate risk levels, especially if the chosen factors lean towards high returns. The classic investment adage, "high reward comes with high risk", holds true in this scenario.

To create an investment portfolio that fits your objectives and risk tolerance, it's vital to understand the factors influencing equity returns. However, it's important to keep in mind that no single factor consistently delivers superior returns - factor returns demonstrate a cyclical pattern.

Just as returns from different asset classes can fluctuate over time, returns from individual factors can also exhibit similar cyclical behaviors. It's crucial for investors to grasp that specific factors might underperform for prolonged periods. This risk isn't unique to factor-based investing but emphasizes the need for a disciplined, long-term approach when evaluating factor-based investment strategies. Previous research indicates that certain factors have generated above-average returns over the long run. Still, these same factors can also face periods of underperformance. To harness potential long-term premiums, investors must remain steadfast during these periods of subpar factor performance.

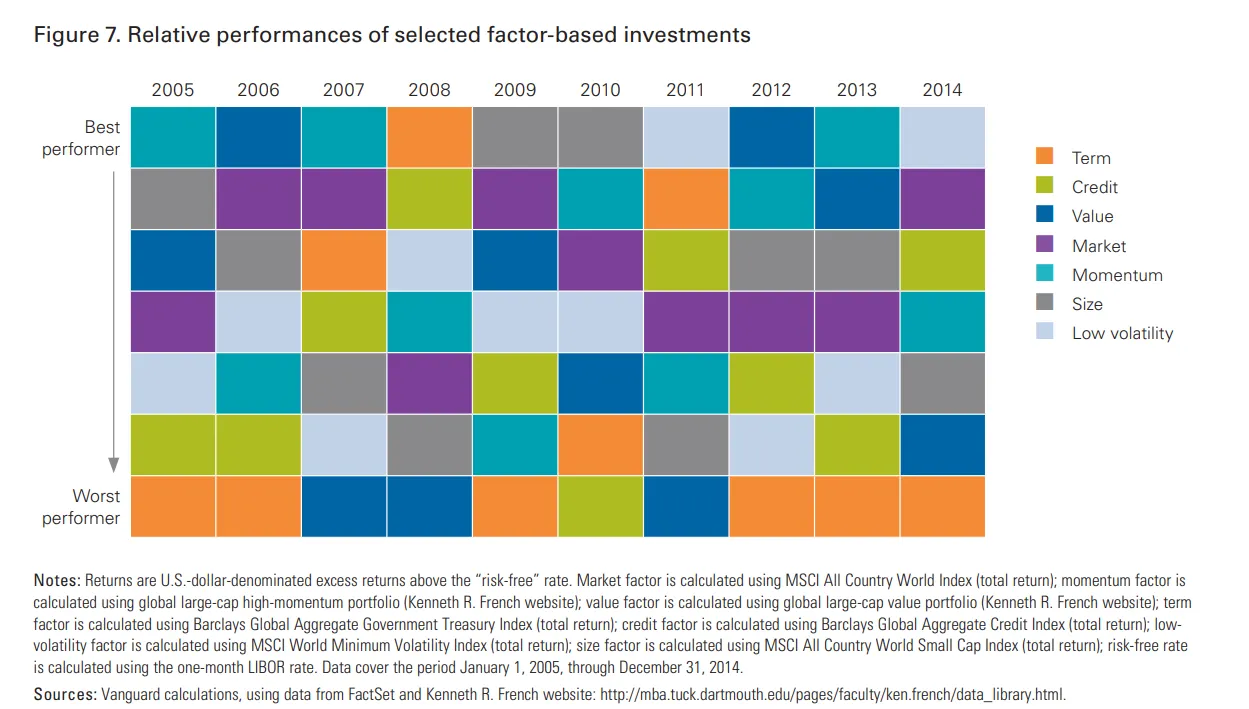

Figure 7(source Vanguard) depicts the relative performance of the 7 sample factors, highlighting their cyclical nature. No single factor consistently outperforms the others over the ten-year period analyzed by Vanguard. All factors have experienced periods of robust and lackluster performance at different times. This further underscores the need for a long-term outlook when navigating the factor-based investing landscape.

For example, small-cap stocks may lag behind their large-cap counterparts over extended periods. Rapid changes in market direction, such as those seen in the wake of the 2008-2009 financial crisis, can negatively impact momentum strategies. Additionally, high-quality value stocks may underperform growth stocks during the early stages of an economic cycle. Therefore, understanding the cyclicality of factors is essential for successful factor investing.

When it comes to performance, transparency, cost, diversification, and the elimination of human bias, factor based investing stands out as a superior investment strategy compared to traditional investing.

Traditional methods of building a portfolio of stocks rely on fund managers conducting fundamental research to assess the performance of specific companies against competitors, management quality, and future sector or company prospects. On the other hand, factor investing is a rules-based strategy that systematically selects stocks based on certain attributes. For instance, a momentum factor investing strategy may rank all stocks in its universe based on momentum scores, assign weights to them based on these scores, and construct a portfolio.

In traditional investing, the causes behind poor returns or performance can often remain elusive. However, with factor-based funds, the reasons for fund performance become much clearer.

Factor investing involves codifying rules and identifying suitable investment opportunities. Thus, fund managers don't need to devote significant effort to portfolio management, resulting in lower costs compared to traditional active investment strategies.

Concentration risk can be a significant issue when the market is down. This risk occurs when you put all your eggs in one basket - investing solely based on market capitalization or specific sectors. Factor investing helps by offering a diversified portfolio, particularly with multi-factor investing strategies.

Traditional investing is often influenced by human bias, leading to suboptimal decisions. There might be tendencies to invest in underperforming stocks or overlook stocks that are actually performing well. Emotional responses to market fluctuations can also distort decision-making.

While some may argue that investing via mutual funds can mitigate this bias due to clear fund manager strategies and goals, the potential for bias still exists. Factor investing addresses this problem by eliminating human bias and qualifying stocks based on logical, data-driven rules. Interested in reading about whether factor investing can provide higher returns?

Like all investment strategies, factor-based asset allocation comes with its own set of benefits and drawbacks.

Reduced vulnerability to volatility

Systematic approach to investments

Alignment of investment objectives to outcomes of the portfolio

Emotional detachment from investments

Increased diversification of the investment portfolio

Lack of understanding or understating the risks associated with factor based investing

Potential of concentration risk due to overemphasis on specific factors

Risk of data mining or selecting factors that show good backtest results leading to selection bias

Complexity of the investment strategy

Factor investing can complement other investment strategies that an investor has. It eliminates the negative consequences of emotional decision-making, enabling investors to base their decisions on data driven insights instead of intuition. Factor investing should allow investors to diversify their portfolios more effectively, potentially yield above average returns compared to the market, and efficiently manage risk.

Timing these factors correctly can be challenging for individual investors. But that doesn't mean that factor based investing strategies don't deserve consideration within your portfolio. Just as most investors diversify across asset classes, long-term investors might also want to think about investing in professionally managed funds that concentrate on single factors or multiple factor strategies.

Read the next article in the series, Can Factor Investing provide higher returns?

Check out the Wright's Balanced Multifactor portfolio to see for yourself if factor investing is worth it.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios