by Sonam Srivastava

Published On July 29, 2023

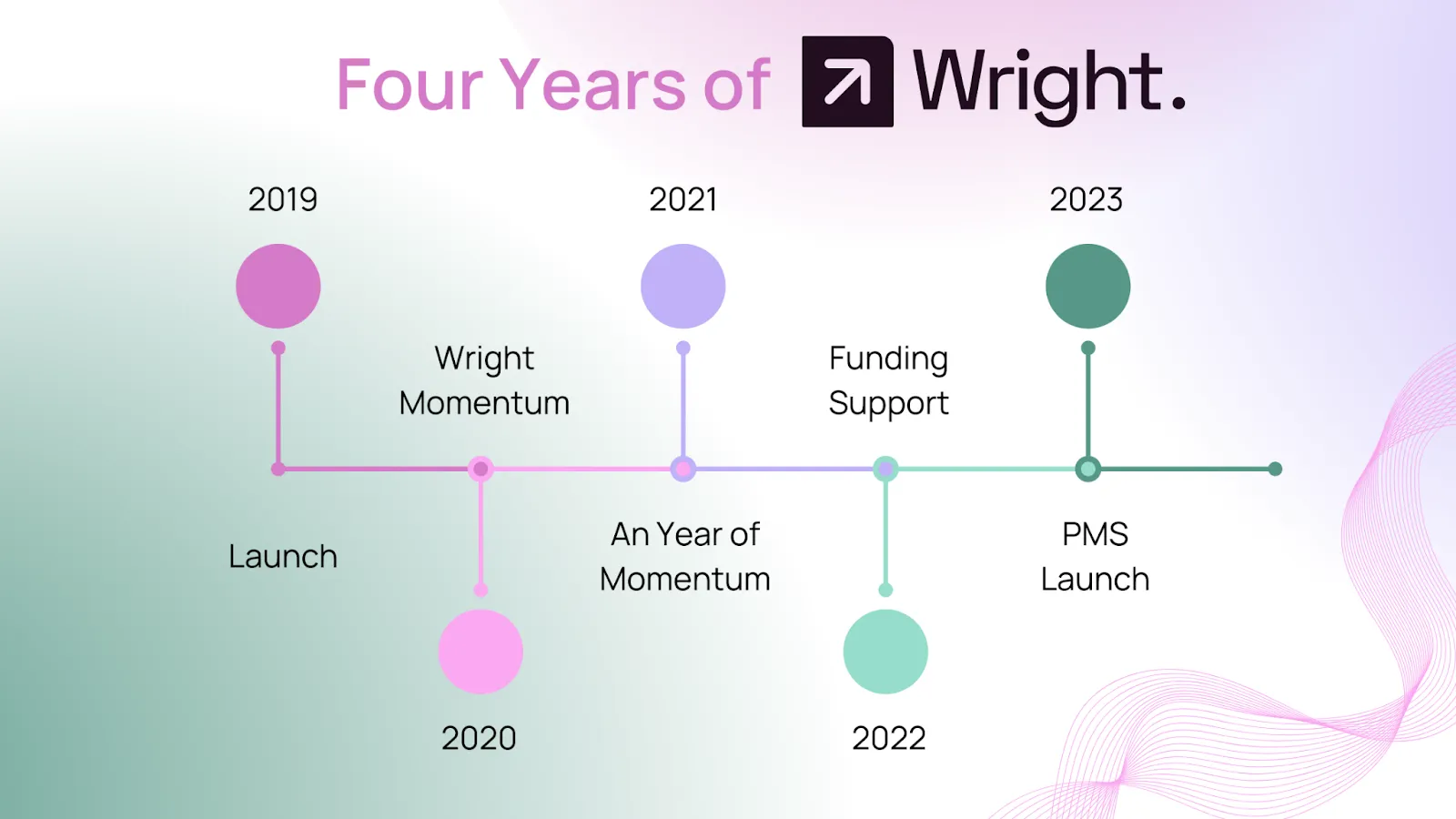

Exactly 4 years ago, on the 25th of July, I took up this mammoth task of turning my deep-seated passion for finance into a viable business. Starting from scratch seemed daunting, but when you are driven by profound, unfiltered passion, even the impossible becomes your playground.

It all started with doing what you love, and my love was for finance, quants, algorithms, and how they could turn the world of investing on its head. I started my journey by conducting in-depth research on Factor Investing , Momentum Investing , Smallcaps and various other fascinating concepts, using these to build my own portfolio in April 2019.

The portfolio's success made me confident, and I launched it on 25th of July on social media, naively thinking that this would change everything. But life had different plans. Just six months after starting, the pandemic hit us. However, the turmoil couldn't stop us. Our strategy held strong during the market crash in 2020, drawing attention from our clients, and when the momentum swung back, and the surge of retail investors happened, we were well positioned to capitalize on it.

There have been many days where I've spent 20 hours working on our strategies and growing our business, dealing with complex regulations, the marketing aspects of the business, building relationships, going on business development meetings, and more. It's been an uphill journey, but when you work on something you love, it feels less like work and more like a part of your life.

Fast forward to 4 years later, we’ve come a long way from nothing to working with a stellar team of professionals and serving a client base of over 10,000+ active, 25,000+ lifetime and an active community of 50,000+. Our community has grown exponentially, and our assets under advisory have risen to an impressive 300 crores+. We have launched multiple new equity smallcases , introduced new investment avenues such as mutual fund baskets , and tailored them for all risk profiles. Along the way we have built a kickass team of 12 rockstars.

Our recognition as a top 50 AI Game Changer startup by NASCOM and the securing of pre-seed funding from BSC and a whopping 1 Million dollars in seed funding from Orios Venture Partners bear testament to our potential. Moreover, our Equity portfolios on smallcase have consistently topped the charts, making them a favourite amongst investors.

Our balanced portfolio has returned 30.2% since its inception, clearly surpassing the multi-cap benchmark of 18.5%. Over the last month alone, it posted a robust return of 9.2%. Similarly, our small cap portfolio has delivered a whopping 43.5% return since its inception. The last month saw an impressive gain of 9.4%, leaving the multi-caps behind. And let's not forget our Momentum portfolio . This has been our shooting star. It's returned a staggering 42.8% since inception, trouncing the Multicap's 18.5%. The last month saw an impressive gain of 7.7%, leaving the Multicap's 4.9% far behind.

Our latest offering, Alpha Prime portfolio , has already made waves as the most wishlisted, watched, and the most invested portfolio on smallcase, returning nearly 22%+ in less than one month. Use discount code ALPHA25 to avail a 25% discount on the subscription fees - Only valid till 31st July, so get going!

We’ve always strived to stay ahead of the curve, and we’ll continue to do so, ensuring the best for our valued customers. I am absolutely thrilled to welcome you on an exciting journey in our chapter and for investment management. This week we announced the launch of the Wright Research Portfolio Management Service (PMS). Built on the bedrock of transparency, accessibility, and innovation, Wright PMS is designed to offer a fresh and cutting-edge investment experience to our clients.

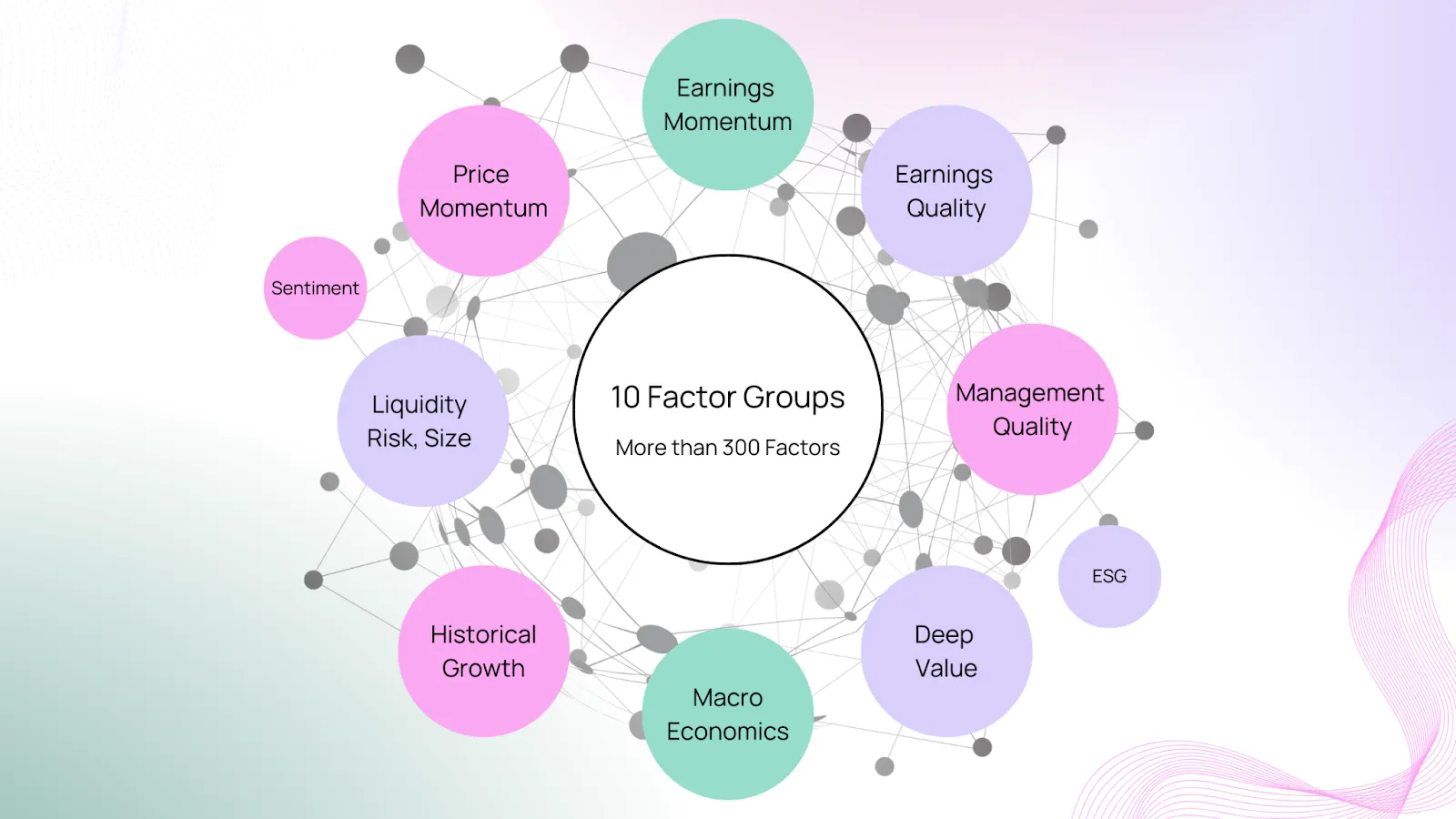

At its core, Wright PMS is built on the principles of factor investing, momentum investing, artificial intelligence, risk modeling, understanding market regimes, and efficient execution. We believe that any stock can be dissected into numerous factors such as momentum, value, growth, quality, and more. Our goal is to understand these factors, harness their advantages, and anticipate their behaviour in any given market regime.

Our vision is to democratize access to quantitative investing. We aimed to make scientific, data-driven methods accessible to every investor. As we evolved over the past four years, we realized the enormous potential of blending financial expertise with AI-driven, data-oriented techniques. The result of this evolution is the Wright Portfolio Management Service , a revolutionary product built on advanced mathematical models and the latest AI techniques. Our data-driven approach is objective, eliminating human biases and offering a systematic strategy. This strategy allows for quick analysis, and automated risk management, making investment outcomes more consistent, reliable, and predictable.

Wright PMS is a highly tactical portfolio management service which churns on a monthly basis. It provides you access to 20-30 stocks from a diverse universe, ensuring no sector or stock has more than 20% and 10% allocation, respectively. Our universe comprises the top 500 stocks on BSE, to which we will tactically allocate. We do not favor any sector, industry, or market cap.

Unfortunately, we do not have live performance to display since we have just launched our service. However, we are confident in presenting our back-tested results. These results come from four years of consistent, advisory strategies, and showcase an attractive expected return over 10 years at a lower risk and drawdown.

In favorable markets, we will do a lot of momentum investing and pick high performing stocks. However, as market risk increases, we will shift to safer investments, including gold, bonds, or cash equivalents. Our strategic risk management ensures that even during tough times, our strategy outperforms the market, providing a balance between capturing the upside during good times and managing risk during downturns.

We have launched 2 portfolios for you to consider - the Wright Factor Fund and the Wright Factor Fund - Hedged . The Wright Factor Fund builds on the principals of Momentum and strong risk management by diversification to other factors to deliver the strong potential of returns. Wright Factor Fund Hedged, doubles down on risk mitigation by including options to hedge against the market drawdown.

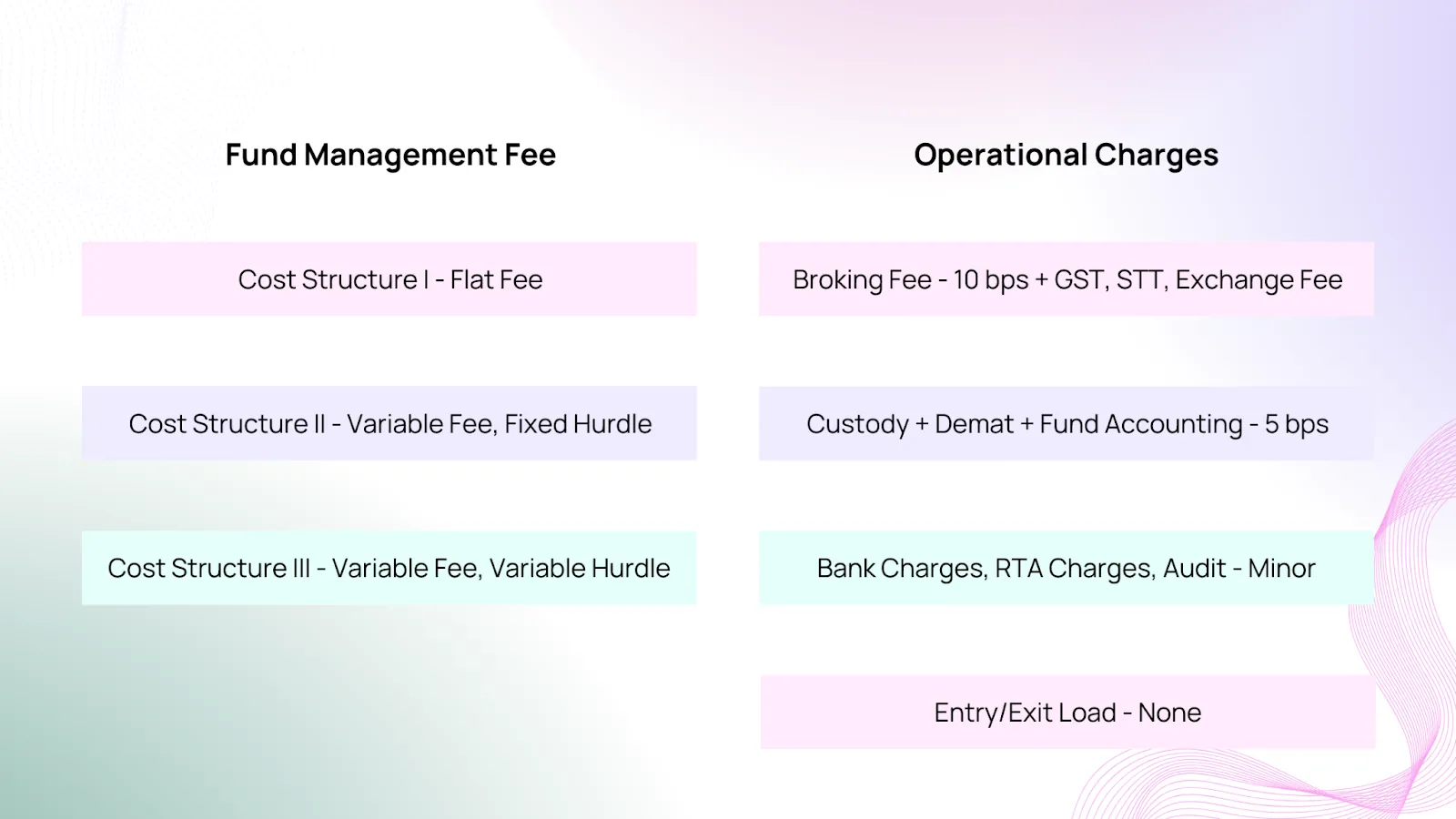

At Wright Research, we firmly believe that each investor is unique and deserves a pricing model that mirrors their investment strategy and goals. With this in mind, we have devised a flexible and dynamic pricing structure for our Wright PMS product. This pricing structure is centered around three key models that cater to various investment preferences and risk appetites. Recognizing that every investor is unique, we have developed a flexible pricing structure -

Our fixed fee model is designed for investors who prefer a stable and predictable fee structure. Under this model, we charge a fixed percentage on Assets Under Management (AUM), irrespective of the performance of the portfolio. The beauty of this model lies in its simplicity and transparency, offering a flat fee that is one of the lowest in the competition. This approach ensures that investors always know what to expect in terms of costs, eliminating any unwelcome surprises.

The variable fee model is our answer to profit-sharing. Ideal for investors who prefer to align their interests with ours, this model includes a fee charged over a specific hurdle rate. The hurdle rate is a pre-defined benchmark that the portfolio needs to achieve before we receive our fee. This model ensures that we are remunerated for performance, motivating us to strive for better returns for your portfolio.

This model is the most exciting of the lot, favored by investors who seek skin in the game from their portfolio managers. In this structure, we charge a fee only if we outperform the agreed-upon benchmark, the BSE 500 TRI. Simply put, if you don't make money, neither do we. This model is a testament to our confidence in our strategies and commitment to delivering superior returns. It ensures complete alignment of interests, where our earnings are directly linked to the success of your portfolio.

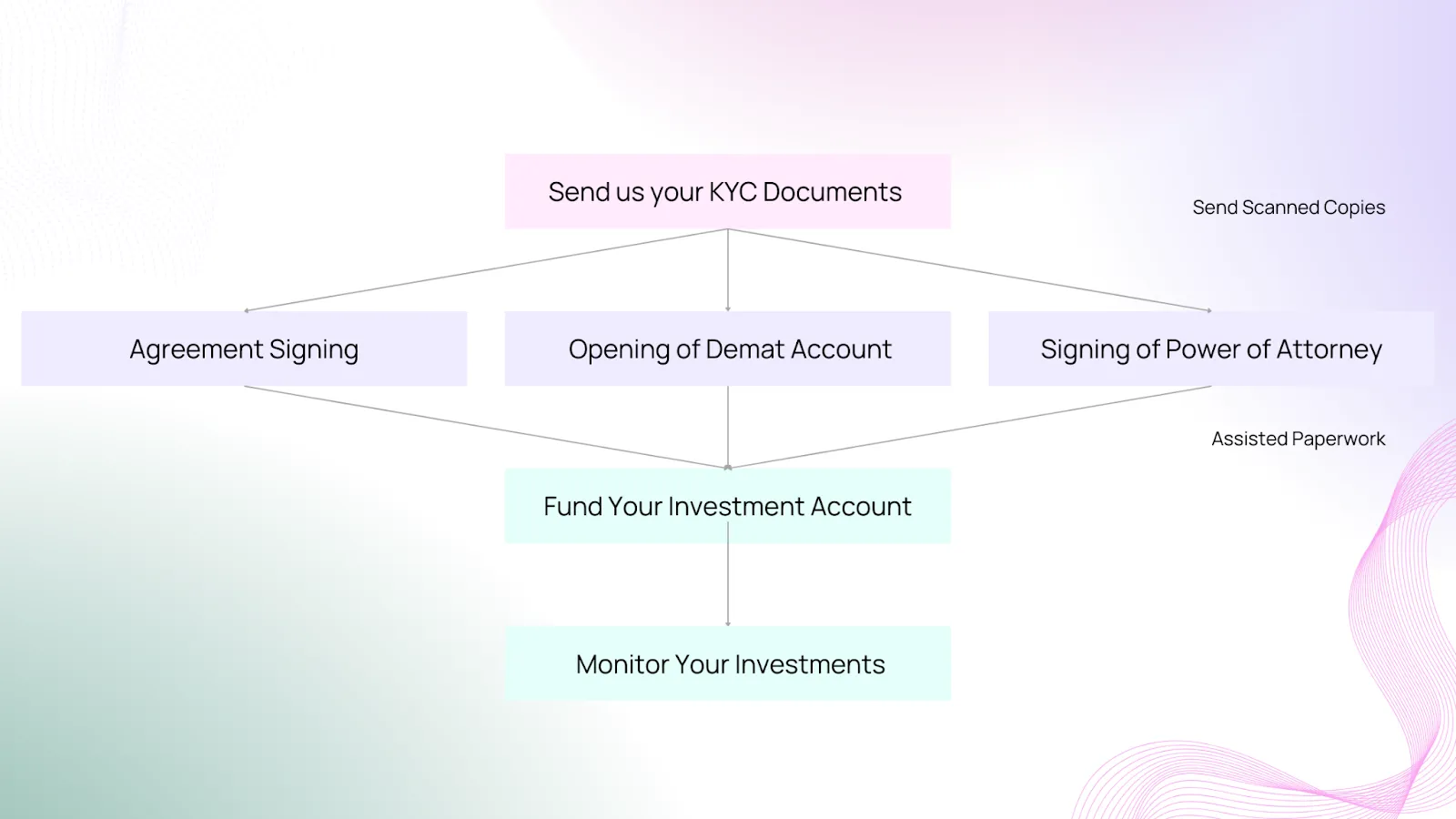

To begin your investment journey with Wright PMS, simply set up a call with us -

Selecting one of the 2 PMS portfolios on our website

Click on “Get Started”

Enter you details on the form

Wait for up to 6 hours for our team to contact you

We'll answer all your queries and guide you through the KYC (Know Your Customer) process. Once the KYC documents are verified, we'll send you an agreement, a Demat form, and a power of attorney to sign. After this, you're ready to transfer funds, and we can start investing on your behalf. We'll also provide a login to track trades and generate live reporting of your portfolio.

We invite you to review our past advisory work and speak to our trusted clients. Over the past four years, we've consistently outperformed benchmarks while effectively managing risk during downturns. All of this has helped us garner the trust of over 25,000+ investors and with assets under advisory of Rs.300+ cr. This success stems from our unwavering focus on data-driven, factor-focused strategies and our commitment to continuous research and the latest AI technologies. We are excited about the potential of Wright PMS to reshape the investment landscape in India.

However, like any investment solution, PMS carries its own set of risks. It is crucial to evaluate if it fits into your risk profile before allocating funds to it. If you have any queries or wish to discuss further, please do reach out to us.

The journey in the last four years has been incredible. However, we believe that we are just getting started. We are excited about the future and look forward to welcoming you aboard on this exciting journey.

Also, join us next Sunday for a live AMA session with me and Rakesh Rathod from smallcase as we celebrate our anniversary together, answer your questions, and discuss the future of Wright Research. Be sure to click the bell icon to be notified of the live session! See you there!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios