by Siddhart Agarwal

Published On Dec. 1, 2021

These days, momentum investing is all the rage. However, this rage is not irrational as a momentum approach is designed to profit from the bull market and, we have witnessed a dream bull run phase.

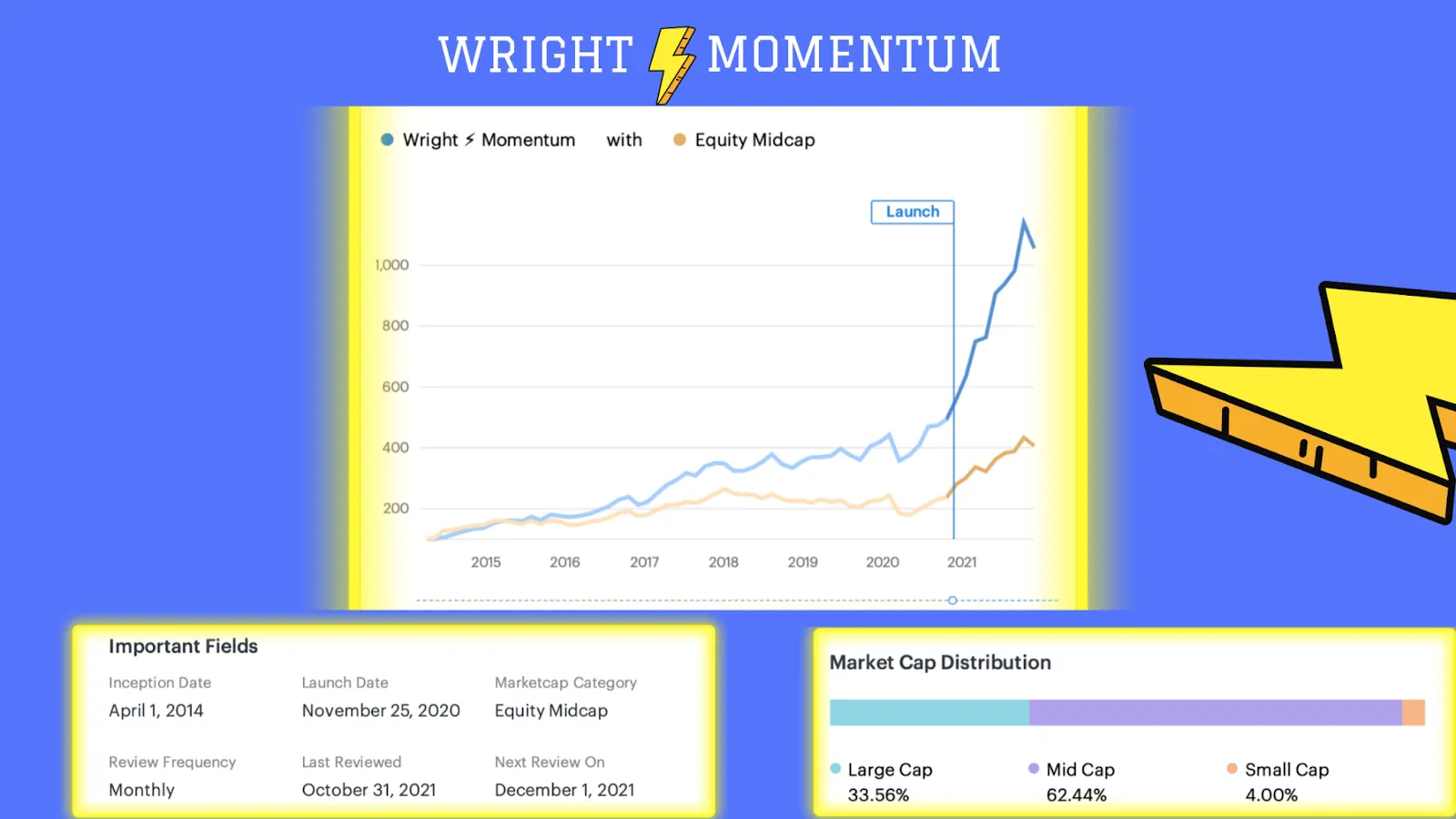

Wright ⚡️ momentum is our flagship smallcase that was curated with the ideology to generate superior returns by investing in trending stocks. It was launched on 25th November 2020, and its yearly performance has been spectacular. It has outperformed the equity midcap and its and has a 1Y CAGR of 108.54%

A momentum trader sails on a wave then hop on the next wave before the previous one tumbles down.

Momentum finds a basis in behavioral finance, attributing it to distinct cognitive biases in irrational investors like herding behavior, confirmation bias, initial under reaction, and delayed overreaction. Such attributes, when intertwined with prevailing market conditions, make momentum an intriguing strategy to comprehend.

Wright's momentum strategy is sector agnostic and dynamic. We invest in cyclical sectors when the markets are in a growth phase and defensives when markets are consolidating.

In essence, this is a multi-stock portfolio of 20-25 stocks selected from the top 300 universes. The rebalancing of the portfolio is usually done every month to keep the turnover low.

The inherent notion that a bull investor operates with is high optimism. However, the market is like the ocean with high and low tides. When the IRCTC dilemma was at its peak, the fall in its share price sparked a lot of panics. The same could be acknowledged when the issue with the Adani group of companies regarding its structure was published.

These are real-time cases that defined our momentum strategy and instilled a level of confidence among our existing investors. The same was possible due to our methodology that encompasses a robust risk management policy.

We try to size our positions such that no single stock gets more than 10% allocation. We put a limit on the sector and industry allocations as well to promote diversification. The position sizing is done using the mean-variance optimization methodology.

5.1 Momentum exhibits elevated churn

Momentum trading can feel like a lot of buying and selling to investors who are used to investing in stocks using classic bottom-up basic methods. In

years with increased volatility, such as 2020, this activity may rise. However, even in regular times, momentum strategies will replace between 10% and 20% of their portfolio each month, depending on how they are built.

5.1 Momentum is not always about being right

Momentum Investing does not follow the typical way of picking specific stocks after thorough investigation. It's a stock selection approach that uses quantitative price and volume criteria to choose an equities group. And as many as half of the stocks in the portfolio don't perform well.

At the portfolio level, momentum investing is supposed to produce decent returns by not losing too much on those who do lose.

However, for some people, the prospect of purchasing a portfolio of stocks just to see half of them go in the opposite way than expected might be pretty unsettling.

5.3 Momentum is not about picking blue-chip stocks

Momentum investing is unconcerned about blue-chip or pedigree companies. It only adds stocks that meet a set of defined objectives/ criteria. And, in retrospect, several of these stocks and companies might appear to be unappealing.

5.4 Opinion about Momentum is intertwined with the performance of the market

Momentum will fluctuate over time. At that point, obituaries will be written about this foolish way of investing, along with a lot of "I told you so" statements. When this happens, it'll be difficult to stay invested.

5.5 Fact check - momentum might underperform

Momentum techniques will occasionally underperform, especially in the short run. Every equity strategy, like any other, underperforms for varying periods. They'd be termed "Holy Grail" strategies if they didn't, and we're not aware of any.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart