by Siddharth Singh Bhaisora

Published On July 2, 2023

Wright Balanced Multifactor Portfolio is one of 3 factor investing focused portfolios. The Portfolio is managed by Sonam Srivastava , launched in 2019 to provide our investors access to factor based investing. It is available directly on Wright Research and on Smallcase, where it is one of the longest running & most popular factor investing focused portfolios.

This page will provide you with an in-depth understanding of the Wright Balanced Multifactor portfolio , how it is formed, the investing approach, key metrics to look at when using factor investing, past performance of the portfolio & its constituents and how you can get started. We also answer the most frequently asked questions about the Wright Balanced Multi Factor portfolio. We cover the following topics:

Return performance (in % terms) of the Balanced Multifactor Portfolio against its benchmark, Multicap Index is -

Over a 3 year horizon, ₹1 Lac invested would have become -

Here are the key performance metrics of the Balanced Portfolio against its benchmark, the Multicap Index -

Factor investing is an investment technique where securities are chosen based on specific attributes that have been identified as key drivers of returns. To put it in simple terms, consider an investor who chooses stocks that are undervalued; in this case, they are investing based on 'value' as a factor.

Factor investing is an approach that targets securities with distinct attributes such as value, quality, momentum, etc. These traits, known as factors, are enduring and well-studied features that help investors decipher variations in anticipated returns. Professional investors have used factors as a means to strive for better performance for a long time, and with the advent of Exchange Traded Funds (ETFs), Robo advisory, Quantitative strategies these factor strategies are now accessible to all investors. To learn more about factor based investing check out our article here .

Factor investing is a method that employs pre-set parameters, known as factors, to anticipate the performance of various assets such as stocks, bonds, or funds. These factors are categorized into two broad types - investment style factors and macroeconomic factors.

Factor-based asset allocation investing is a strategy that seeks to improve portfolio performance by investing in assets based on certain characteristics or "factors". These factors have historically been associated with higher returns. The goal is to construct a portfolio that aligns with these factors, aiming to drive positive returns.

Macroeconomic factors are broad events or conditions that significantly impact an economy, with repercussions across various asset classes. These factors can be fiscal, natural, or geopolitical and may affect a particular region, a nation, or the global economy at large. Some examples of macroeconomic factors include unemployment rates, inflation, interest rates, and GDP.

Style factors provide a quantitative method for identifying outperforming strategies within asset classes. The five main style factors - size, value, quality, momentum, and risk volatility - influence investors' security evaluations.

Size: Research indicates that "small-cap" companies often yield higher returns than "large-cap" ones, despite the added volatility and instability.

Value: This factor centers on undervalued companies, which typically outperform overvalued ones. Investors use metrics such as the price-to-book value ratio, price-to-earnings ratio, and dividends to find stocks trading below their intrinsic value.

Quality: Companies with high-quality earnings, indicative of strong financial health, fall under this factor. These companies usually have low debt, steady earnings, consistent growth, and effective capital use.

Momentum: This factor relates to the price trend of a stock. It suggests that stocks doing well recently will likely continue their positive performance.

Risk Volatility: This strategy aspires to build a low-volatility portfolio, aiming to reduce risk rather than maximize returns. It involves investing in historically less volatile stocks for fewer portfolio fluctuations, benefitting risk-averse investors.

Read more about the different types of investing factors .

Investing based on factors carries its unique set of risks. Opting for a smart beta approach may prove more expensive than going with traditional index funds. The growing fascination with factor-based investing has caused a spike in the asset prices of those with appealing factors, which could potentially limit future returns.

Placing excessive importance on certain factors might cause investors to neglect the importance of maintaining a diversified portfolio. Given that stocks may stop fulfilling particular factors over time, a smart beta fund may necessitate more frequent portfolio adjustments. This might involve selling a stock to replace it with another that aligns with the targeted factor. Even though the goal of factor-based investing is to decrease risk by zeroing in on specific factors, this approach can backfire if the portfolio becomes too dependent on certain smart betas. This can lead to increased risks, such as having too much exposure to smaller company stocks or reducing the total number of stocks in the portfolio.

Factor-based investing, an active investment style where investors consistently check whether stocks are in line with selected factors and adjust accordingly, can increase risk levels, particularly if the selected factors are geared towards high returns.

Timing these factors correctly can be challenging for individual investors. But that doesn't mean that factor based investing strategies don't deserve consideration within your portfolio. Just as most investors diversify across asset classes, long-term investors might also want to think about investing in professionally managed funds that concentrate on single factors or multiple factor strategies. Check out our article to understand the Nuances of Factor Investing: A Balancing Act of Risks and Rewards .

Factor investing, a strategy targeting specific characteristics like value, size, profitability, momentum, and low volatility, has proven to be an effective approach for portfolio diversification and enhancing returns. It focuses on traits that have consistently outperformed the broader market. Here's a glance at some key factor investing methods:

Quality Factor Investing: Targeting companies with high margins, low leverage, stable earnings, consistent growth, and strong management teams. High-quality companies can be more expensive to invest in and their future performance isn't guaranteed.

Momentum Factor Investing: This strategy capitalizes on the market's tendency to underreact to positive news and overreact to negative news. It considers securities that have recently performed well but may incur high transaction costs due to its high turnover nature.

Value Factor Investing: This focuses on cheaper or 'value' companies, which tend to outperform growth companies over the long term. It's a strategy that is more suitable for long-term investors due to periods of underperformance.

Small Cap Factor Investing: This method prioritizes small cap stocks, which tend to outperform large cap stocks over long periods. It's vital to control for quality when investing in small cap stocks to avoid failures or bankruptcies.

Multi-Factor Investing: A diversified approach that combines different factors for increased returns or diversification. This may use funds designed to capture these multifactor premiums.

While all these strategies can potentially yield higher returns, they also come with inherent risks. Therefore, a balanced, well-researched investment approach is always recommended. Click here to read more about the performance & analysis of factor based investing strategies over longer periods of time.

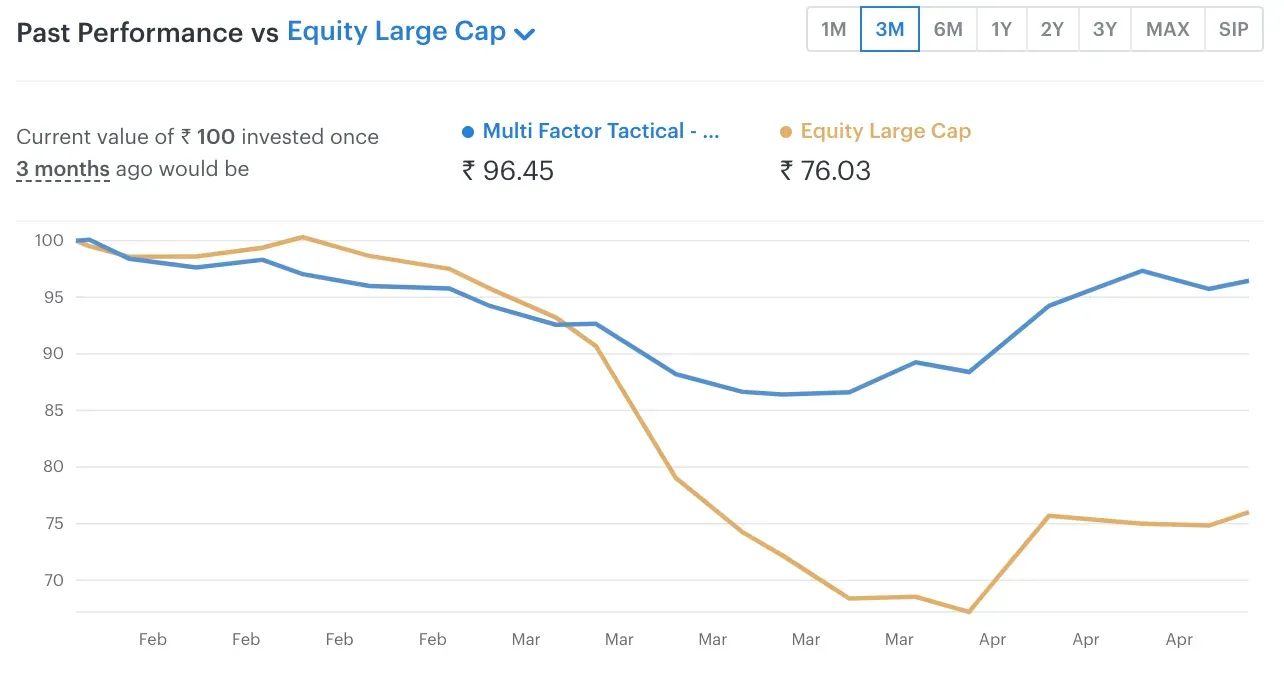

The Wright Balanced Multifactor strategy has shown remarkable resilience and strength in its recent performance. Over the last month, the Balanced portfolio has delivered a return of 4.7%, demonstrating a steady upward trend. This pattern of growth extends to the three-month period as well, where the Balanced portfolio provided an impressive 11.9% return.

The balanced strategy's longer-term performance is also noteworthy. Over a six-month horizon, despite fluctuating market conditions, it managed to deliver a return of 3.6%, and over a one-year horizon, it gave a strong return of 11.5%. Year-to-date, the Balanced portfolio has achieved a return of 6.1%, showcasing its potential to provide steady returns even in volatile market conditions. Since inception, the strategy has performed exceptionally well, with a compound annual growth rate (CAGR) of 28.4%, which is commendable.

Here's the performance of the Balanced Multifactor portfolio across different periods -Overall, the Balanced strategy has proven to be a robust and consistent performer, demonstrating its ability to provide stable returns across varying market conditions. The recent performance data suggests that the strategy has been adept at mitigating risk while capturing growth opportunities, which is the hallmark of a well-constructed balanced portfolio.

When the markets crashed in March 2020 led by coronavirus fears, our portfolios stood out based on the principles of dynamic asset allocation. While the markets suffered a drawdown of ~30% the portfolio only dropped ~5%

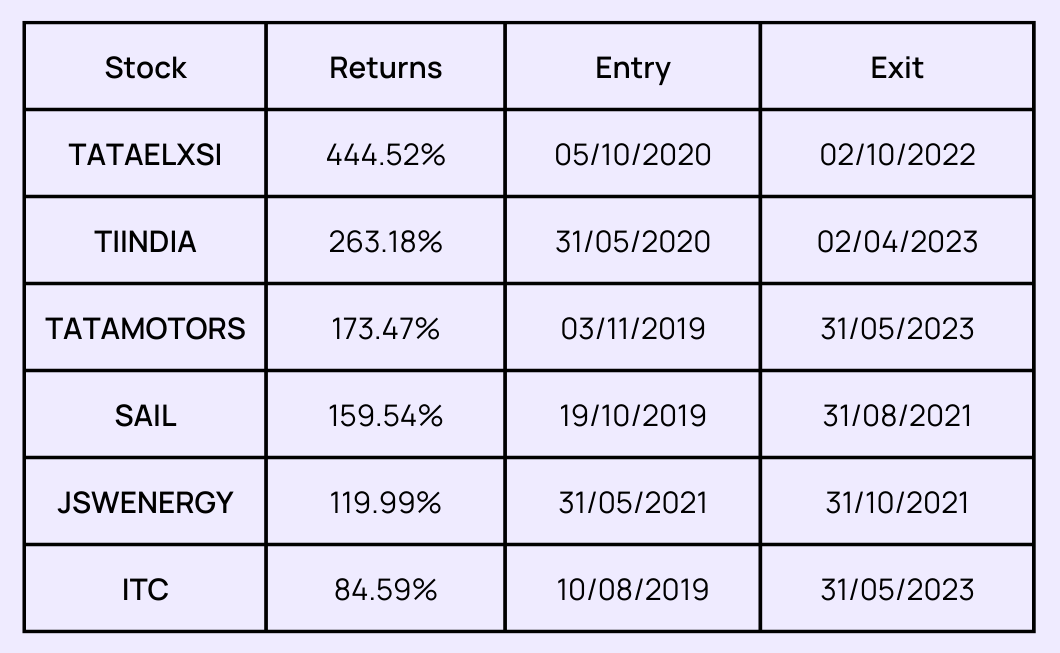

Here's a glimpse into the top performing companies from which we have exited with significant profits that were once a part of the Wright Balanced Multifactor Portfolio :

TATAELXSI: Tata Elxsi is a leading provider of design and technology services across various industries, including automotive, broadcast, and communications. With a solid reputation for innovation, TATAELXSI is a key player in driving digital transformation. Between 5th October 2020 and 2nd October 2022, this stock held in the Wright Balanced Multifactor Portfolio portfolio achieved an impressive return of 444.52%.

TIINDIA: Tube Investments of India is a diversified engineering conglomerate in India, with expertise in segments like cycles, metal forming, and tubes. Known for its strong operational performance and commitment to quality, TIINDIA presents a robust investment opportunity. The Wright Balanced Multifactor portfolio saw a substantial 263.18% return during its holding period from 31st May 2020 to 2nd April 2023.

TATAMOTORS: Tata motors is a renowned automotive manufacturer with a diverse portfolio, spanning from cars to heavy vehicles. Despite the industry's cyclical nature and intense competition, TATAMOTORS stands strong due to its wide global footprint and innovation-driven approach. From 3rd November 2019 to 31st May 2023, the stock offered an impressive return of 173.47% in our Balanced Multifactor portfolio.

SAIL: Steel Authority of India Limited is one of the largest steel-making companies in India. Even though the steel industry faces volatility due to fluctuating commodity prices, SAIL has managed to perform commendably, primarily due to its expansive production capacity. It was a part of the Balanced Multifactor portfolio from 19th October 2019 to 31st August 2021, during which it provided a healthy return of 159.54%.

JSWENERGY: JSW Energy is a key player in the Indian power sector, involved in electricity generation, transmission, and distribution. Despite the sector's regulatory uncertainties and heavy capital requirements, JSWENERGY has thrived due to its diversified power sources and robust operational performance. In the period between 31st May 2021 and 31st October 2021, it generated a commendable return of 119.99% for the Wright Balanced Multifactor portfolio.

ITC: ITC Limited is a multi-business conglomerate with operations in fast-moving consumer goods (FMCG), hotels, paperboards, and packaging. Despite the challenges posed by the FMCG sector's intense competition and regulatory changes, ITC has maintained a strong footing due to its diverse business portfolio and strong brands. The stock has delivered an 84.59% return in the Wright Balanced Multifactor portfolio, held from 10th August 2019 to 31st May 2023.

The regimes are predicted using a model that looks at short term and long term price patterns and economic data. We chase the equity market trend when the market is favourable and try to control the risk when it is not. To learn more, you can read this article All you need to know about the Multi Factor portfolio .

The Wright Balanced Multifactor portfolio is a more balanced and medium risk portfolio compared to the Wright Growth Multifactor portfolio , which is a more risky and aggressive version, and the Wright Conservative Multifactor portfolio , which is a less risky and conservative version. The constituents of the portfolios will vary with Balanced portfolio taking a neutral risk and balanced approach.

For detailed insight and information about the Balanced Multi Factor portfolio, read our article on Complete guide to Factor Investing & Wright Growth Multifactor Portfolio. If you want to learn more about the Conservative Multi Factor portfolio, read our detailed article on Complete guide to Factor Investing & Wright Conservative Multifactor Portfolio.

All NSE-listed stocks meeting minimum criteria in daily traded volume and company market capitalization. This translates to nearly 90% of the total market cap trading in India.

While we trade bonds & commodities through ETFs, the choice of stocks in the portfolio comes from equity factor models or the popular name smart-beta. The individual equity buckets chase factors like:

Momentum or trend following

Value or choosing the undervalued stocks

Growth or choosing high growth stocks

Quality or choosing the stocks with good earning quality

Our AI & Quantitative models analyzes the stock universe based on several key factors such as intrinsic value, quality, earnings growth, momentum, and low volatility. Employing sophisticated statistical concepts to fine-tune stock selection and optimise performance, 20-25 high-quality stocks are selected aiming for growth while minimising risk exposure. The balanced multifactor portfolio uses the following criteria:

Strategic factor selection: Our team selects a variety of factors, like value and momentum, to create a well-rounded portfolio.

Tactical allocation: We adjust the allocation of resources based on current market conditions.

Risk management: We diversify across asset classes and use low-volatility strategies to reduce risk.

Multi-asset ETFs: We use ETFs to diversify across markets and minimize exposure to specific risks.

Cutting-edge techniques: We use advanced methods like machine learning to create a dynamic investment approach.

Stocks ranking high on these metrics are selected, the portfolio weights and allocation are also adjusted to add more diversification and reduce portfolio risk. Stocks exit the portfolio in two scenarios, other stronger stocks emerge, or if existing stocks fail one of more criteria for retention in the portfolio

Our proprietary AI & quantitative models assign optimal weights based on a sophisticated multi factor stock selection model. Adopting a weight scoring approach, stocks are weighted according to the rank assigned by the AI & Quantitative models. This rank is reviewed & analysed in depth by our Investment Team & the Investment Advisor approves the stocks into the portfolio.

Our approach ensures multiple checks and balances to craft an optimal portfolio that has high growth potential while minimising risk exposures, demonstrating optimal performance across different market cycles.

Wright Balanced Multifactor portfolio is carefully curated to optimize potential returns while minimizing risk. Thanks to our strong focus on quantitative analysis, we employ AI models, the expertise of our investment manager, and advanced statistical analysis to refine our stock selection process and balance risk-reward allocation. We utilize various tools to address risk in a comprehensive manner, which include:

Wright Balanced Multifactor portfolio is assessed weekly by the Investment Advisor and Investment Team. This practice ensures that the portfolio's stocks align with our AI and quantitative models, while also keeping an eye on significant market aspects such as volatility, momentum, and other factors, as well as unexpected news or macroeconomic shifts. This ensures the portfolio’s performance is optimized.

In cases of adverse market conditions or negative developments specific to a stock, regular portfolio reviews allow the Investment Advisor and Investment Team to act quickly, thereby reducing risk exposure to such unfavorable events. Rebalances in such exceptional scenarios are immediately implemented to shield our subscribers from a negative fallout.

Rebalancing plays an important role in portfolio management to ensure the risk of the portfolio doesn’t increase drastically since risky investments can out-compound conservative ones in the long run. You can also potentially take advantage of selling high and buying low opportunities.

Rebalance is an update to a portfolio to get best returns. It helps align your portfolio with the portfolio’s investment objective and the asset allocation that was decided by the investment advisor.

Wright Balanced Multi Factor portfolio is reviewed weekly by the Investment Advisor & the Investment Team. Any changes are communicated to our investors immediately before markets open.

Historically, the majority of portfolio rebalances have happened on a monthly basis, however this can vary depending on market conditions. Our monthly rebalancing approach ensures a well-balanced, up-to-date investment mix with low turnover, which reduces unnecessary transaction costs providing higher return potential.

Portfolio review is different from rebalancing a portfolio.

The Wright Balanced Multi Factor portfolio is reviewed weekly by the Investment Advisor & the Investment Team. This is to ensure stocks allocated to the portfolio are aligned with the AI & quantitative models, and the team monitors significant market factors such as volatility, momentum & others along with sudden news announcements, macro economy level changes do not impact the performance of the portfolio.

Frequent portfolio reviews provide significant inputs into the monthly rebalancing strategy. This way the Wright Balanced Multi Factor portfolio remains a well-balanced, up-to-date investment mix with low portfolio churn.

In situations, where there are adverse market conditions or negative stock-specific developments, frequent portfolio reviews enable the Investment Advisor & the Investment Team to react quickly, limiting risk exposure to such negative events. Rebalances in such rare scenarios are sent out immediately to protect our subscribers from a negative fallout.

No. Any additions or deletions of stocks in the Wright Balanced Multi Factor portfolio are decided by the Investment advisor. Frequent portfolio reviews and monthly rebalancing strategy means stocks that needed to be replaced will already have been decided, advised and executed. Any stock that is retained in the portfolio means the stock has potential to grow.

For example, let’s say a stock in the Wright Balanced Multi Factor portfolio is performing well and is up 50%+. It continues to be in the portfolio, this means as a subscriber it should be bought per the constituent weight assigned in the portfolio, along with the other stocks in the portfolio. Please note 50% isn’t an absolute benchmark, and has only been used for illustrative purposes.

Subscription fees for the Wright Balanced Multifactor portfolio are as follows:

MRP | Discounted Price | |

3 Month | ₹3,000 | ₹2,000 |

6 Month | ₹5,400 | ₹3,600 |

There are a few costs involved over and above the portfolio subscription fees. These costs can vary but can be anywhere from 0.5% to 1% on average for investors. Let’s go through the main ones:

This depends on the broker you use, from full service brokers such as HDFC Securities, Axis Securities, ICICI Direct to low cost discount brokers such as Zerodha, Upstox, Angel Broking.

If you do not use a broker, then brokerage account opening costs will also be incurred when you start investing. This is a one time cost, and not a recurring charge. However, depending on your broker you may have yearly maintenance fees, please check with your broker for such details.

When you start investing in Smallcase, an investor has to pay a fee of Rs 100 when starting the first Smallcase. There are no other charges associated with account opening or maintenance. Please check Smallcase for updated information.

There are no additional charges incurred on Wright Research. The only charges are the brokerage costs, STT, DP charges etc.

STT or Securities Transaction Tax is the tax you pay to the government for buying or selling stocks listed on the stock exchange. For equity transactions, the buyer & seller both pay 0.1% of the share value as STT.

Depository Participant (DP) charges are levied by the depository i.e. Central Depository Services (India) Limited (CDSL) or National Securities Depository Ltd. (NSDL) and the Depository Participant, DP. These charges can vary depending on your DP. For instance, for Zerodha DP charges are applied when shares are sold from the demat account. Zerodha DP charges are Rs. 13.50 +18% GST applicable per day and per stock, irrespective of quantity sold. So selling 100 shares of Tata Motors on any given day would levy DP charges of Rs. 13.50 + 18% GST and selling 1000 shares of Reliance would also levy DP charges of Rs. 13.50 + 18% GST.

Wright Balanced Multi Factor Portfolio typically holds stocks for less than 1 year, but a few top-performers can also be held for greater than 1 year. Therefore, gains will be taxed between Short Term Capital Gains (STCG) & Long Term Capital Gains (LTCG).

STCG is charged at 15% + cess + surcharge of portfolio gains. LTCG is applicable on portfolio gains in excess of Rs. 1 Lakh and are charged at 10% + cess + surcharge of portfolio gains.

Let’s take an example in simple terms. If the Wright Balanced Multi Factor Portfolio provides short term returns of 25%. Then the short term tax impact is 15% of 25% i.e. 3.75%, giving an after tax short term return of 21.25%.

Similar calculations would be applicable for long term returns, after adjusting for the Rs. 1 Lakh LTCG exemption. The combined portfolio returns is simply the total gain minus the tax paid for both STCG & LTCG. This number divided by the total invested amount is the net return.

Wright Research has a manual mode enabling you to invest in the stocks directly without using the smallcase interface. The process is as follows:

Visit the Wright Balanced Multifactor portfolio page . Click on “Get Started”

If the user is not logged it, the page will prompt you to login/signup. Post sign up enter your basic details, complete your basic risk profiling

All trades by default run through the smallcase interface. To do this manually, click on the Profile icon and select “Switch to Manual Based” mode

Click on “Subscribe Now” to proceed with subscription

Read through the Investment Advisor agreement and enter OTP details to accept the agreement

Select the payment plan that you are comfortable with and make the payment

Once you have subscribed, you will have access to the portfolio, its constituents and sector allocation

Here's a video guide to the manual subscription process

The process of investing in the Wright Balanced Multifactor Smallcase is as follows:

Open a Brokerage Account: Smallcase is partnered with several leading brokers. You'll need to open a demat and trading account with one of these brokers such as Zerodha, Upstox, ICICI Direct, etc.

Visit the Smallcase Platform: Once your brokerage account is set up connect it to your smallcase account by visiting the Smallcase platform.

Select the Smallcase: In this case, you're interested in the Wright Balanced Multifactor Smallcase . You will be able to search for this specific Smallcase on the platform.

Review and Purchase: Review the Smallcase to understand what it contains and if it aligns with your investment goals. If you decide to go ahead, you can buy Wright Balanced Multifactor Smallcase directly on Smallcase.

Monitor and Manage Your Investment: After purchasing, you can monitor the performance of your Smallcase on the platform. You can also choose to rebalance the Smallcase as per the suggestions provided by the investment advisor you have subscribed to or add/remove individual stocks as per your preference.

Yes, simply visit the Wright Balanced Multifactor portfolio page and click on “Get Started”. The process is as follows:

Visit the Wright Balanced Multifactor portfolio page . Click on “Get Started”

If the user is not logged it, the page will prompt you to login/signup. Post sign up enter your basic details, complete your basic risk profiling

All trades by default run through the smallcase interface. Click on “Subscribe Now” to open the Smallcase gateway flow

Choose the broker that you have registered with. If you haven’t registered with a broker, then you will need to setup a demat account with a broker to invest in Smallcase or in the Equity markets in general

After logging in with your broker, you enter your basic contact information

Complete your risk profile on the smallcase interface

Provide KYC details such as Pan Card to complete your registration and select the payment plan that you are comfortable with

Proceed to sign the Investment Adviser Agreement and make the subscription payment

Once you have subscribed, you will have access to the portfolio and its constituents. You will see the recommended orders when you click “Invest Now” - you can choose the investment amount and also customize the orders

Upon confirmation, orders will be placed in your brokerage account.

Once the orders are placed, you will be able to see the portfolio in the second fold of the page

Here’s a video giving you a walkthrough of investing in a smallcase directly from Wright Research

Investing in a portfolio through either a lumpsum investment or a systematic investment plan (SIP) depends on various factors. Here are some things to consider while deciding:

Market Conditions: When markets are low or at fair valuation, a lumpsum investment can be a good choice as it allows you to lock in low prices. If markets are at a high, then SIPs can help average out costs over time.

Risk Tolerance: If you are uncomfortable with the idea of investing a large sum of money at once, an SIP can help reduce the anxiety associated with market volatility by allowing you to invest smaller amounts over a period of time.

Cash Availability: If you have a large sum of money readily available, and you are confident about your investment decision based on your research, lumpsum investment might be a good option. On the other hand, if you have a regular income and wish to invest a fixed amount every month, an SIP could be more suitable.

Investment Horizon: For long-term goals, SIPs are often recommended as they take advantage of market fluctuations over time, a concept known as rupee cost averaging. Lumpsum investments can also be beneficial for long term goals, especially when entered at a time of lower market valuations.

Discipline: SIPs enforce a disciplined approach to investing, ensuring regular investments regardless of market conditions. This can be useful if you find it difficult to save and invest regularly.

Yes, there is a minimum investment amount when you invest in the Smallcase portfolio. However, the amount is not fixed and can vary based on when you're investing.

The minimum investment amount is determined by the sum of the minimum investment amounts of each individual stock in the Smallcase portfolio. The minimum investment amount for a stock is the price of one share. Therefore, the minimum investment for the portfolio is the sum of the price of one share of each stock in the Smallcase.

Remember to check the minimum investment amount of the Smallcase you're interested in before investing. The same minimum investment criteria for the Smallcase, is applicable when investing directly on Wright Research as well.

There's no specified maximum investment amount when investing in the Balanced Multifactor portfolio directly or on Smallcase. You can invest as much as you wish, depending on your investment goals, risk tolerance, and financial condition.

Additionally, no matter the amount, it's essential to consider diversification and not put all your investment into one portfolio or even one type of asset. Different investments carry different levels of risk, and diversifying your portfolio can help manage that risk.

Always remember to do your due diligence or consult with a financial advisor before making investment decisions.

You will be notified via email, whatsapp push notifications or in-app notification depending on what permissions were provided when you subscribed to the portfolio directly on our website or on smallcase.

These rebalances are not applied automatically. Once notified, you should ideally update your portfolio per the recommended rebalance at the earliest. If you miss or skip a rebalance, your portfolio will vary from the original portfolio that has been designed by the Investment Manager.

There is no time limit on rebalancing your portfolio even if you miss or skip it. You can always update your portfolio to the latest rebalance. However, skipping a rebalance or multiple rebalances will lead to deviations in returns. Upon updating in such scenarios you could incur additional expenses or losses since the market dynamics may changed from when the rebalances were published.

No, there is no refund.

Investing in the stock market involves inherent risks and rewards, and there's no guarantee of profits or protection from losses. As such, you cannot get a refund for your subscription fees or for your investments in Smallcase or on Wright Research directly, or in any stock market investment for that matter, just because the value has gone down.

Equity strategies are risky. Such portfolio strategies will see drawdowns depending on market conditions. Investments in the stock market should be considered for the long term, as short-term market fluctuations are normal and expected. The value of your investment can go up and down over time, and it's possible to experience losses. If you cannot tolerate such drawdowns, do not invest in this portfolio.

It's essential to carefully consider your investment decisions and your risk tolerance before investing. If you're uncertain about your investment decisions, consider seeking advice from a financial advisor or investing professional. Always remember to only invest money that you can afford to lose without significantly affecting your lifestyle.

Yes, Wright Research has AUM based investing strategies. The underlying portfolio will remain the same, but the fees will be deducted based on the AUM portfolio’s specific pricing. To learn more about larger investment appetites or to invest in AUM based investing strategies, you can reach out to us at info@wrightresearch.in .

If you are looking to invest above Rs. 50 Lakhs per the portfolio management route, then please visit our portfolio management services for more information.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios