by Sonam Srivastava

Published On May 1, 2022

Even with the recent volatility in the Indian market, the stocks that have stayed resilient are the ones that come from the sectors favoured by government policies focused on making India self-reliant, future-ready and innovative.

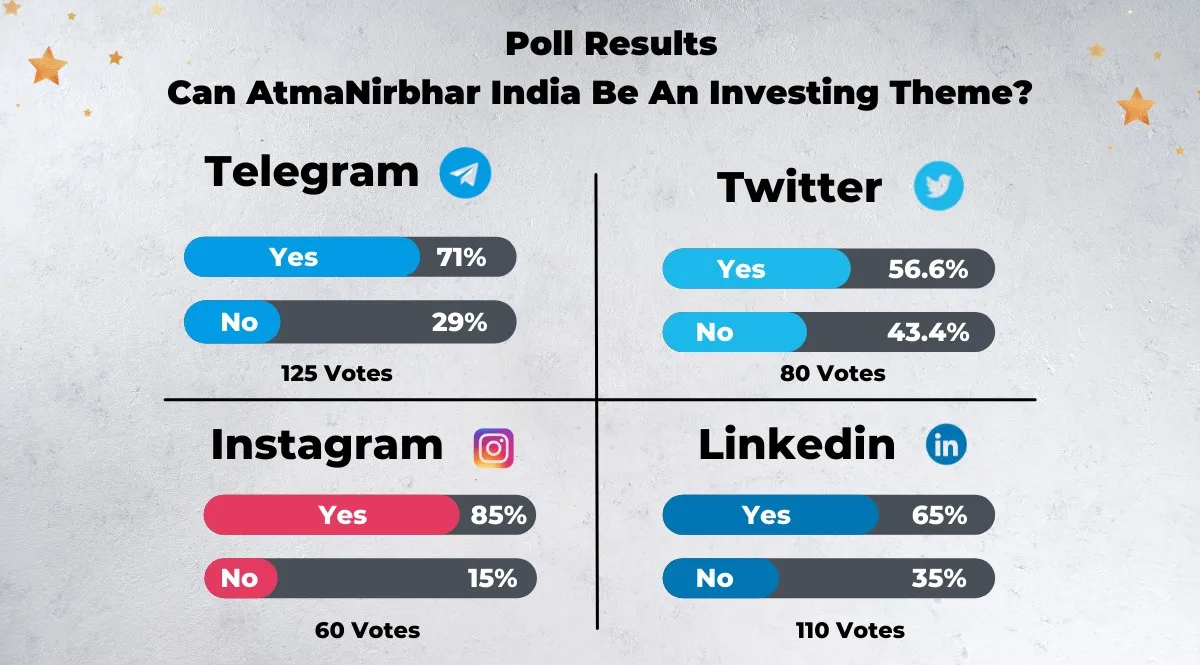

Last week we asked you can Atmanirbhar 🇮🇳 India be an investing theme? And the answer was a resounding YES.

The term ‘Atma-Nirbhar’ has evolved from a buzzword to a solid profitable strategy. It has become essential to evaluate the impact of policy reforms and drill down into their impact on the markets.

The 'Atmanirbhar Bharat' or Make in India initiative has transformed from a vision into a game-changing strategy, presenting lucrative opportunities for investors. This mission aims to boost domestic manufacturing, promote innovation, and generate employment across strategic sectors. As India strives for self-sufficiency, certain themes have emerged as potential beneficiaries of this policy. The focus is on new economic sectors, renewables, and areas where India can become a crucial manufacturing hub.

There are 3 government policies that we think are important to spot winners in the current stock market

Profit Linked Incentives and,

China plus One

Let’s dig a little deeper into each of these themes and determine which sectors will stand out in light of these policies.

The central government has started targeted efforts to address reforms and regulations to boost Indian manufacturing and infrastructure and incentivize and ease the functioning of specific key sectors in the economy. In addition, the government has underlined inclusive development, productivity enhancement, energy transition, and climate action as the four pillars of development that will drive the nation’s growth trajectory to new levels.

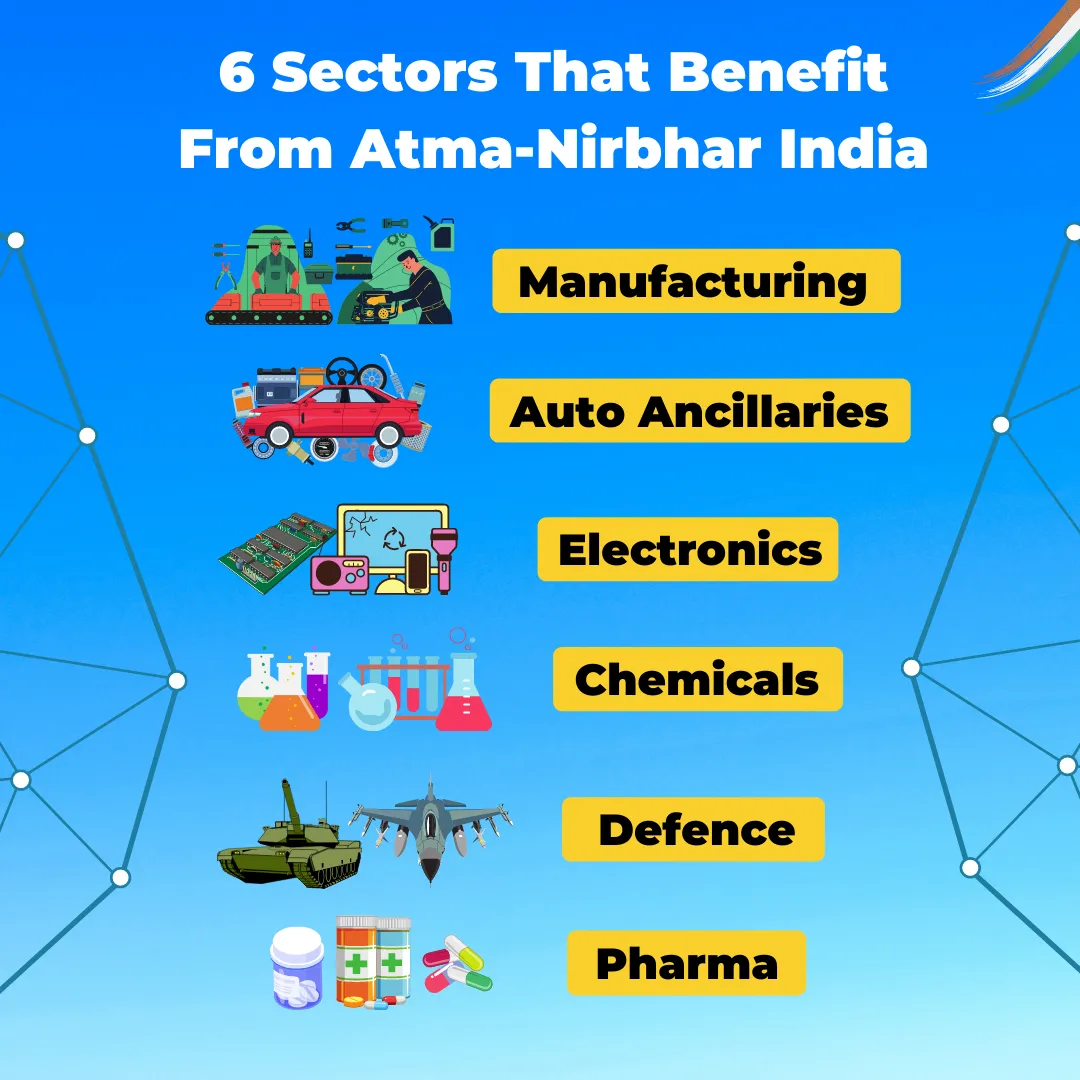

With this scheme, we can expect reforms in infrastructure and real estate development to boost domestic manufacturing in critical areas like semiconductors, electronic goods, auto components, defence, and white goods. Specialty Chemicals and Metals will also be favoured, and the energy transition and climate action push will select the renewable energy and electric mobility ecosystem. The Indian Pharmaceutical sector will see favourable growth through this initiative. The digitization of various industries, including fintech and e-commerce, and the development of the India stack that favours MSMEs and startups will also be a gainer.

Much of the domestic manufacturing sector faces a lack of a level playing field vis-à-vis competing nations. Indian manufacturers on account of lack of adequate infrastructure, domestic supply chain, and logistics; high cost of finance; inadequate availability of quality power; limited design capabilities and focus on R&D by the industry; and inadequacies in skill development.

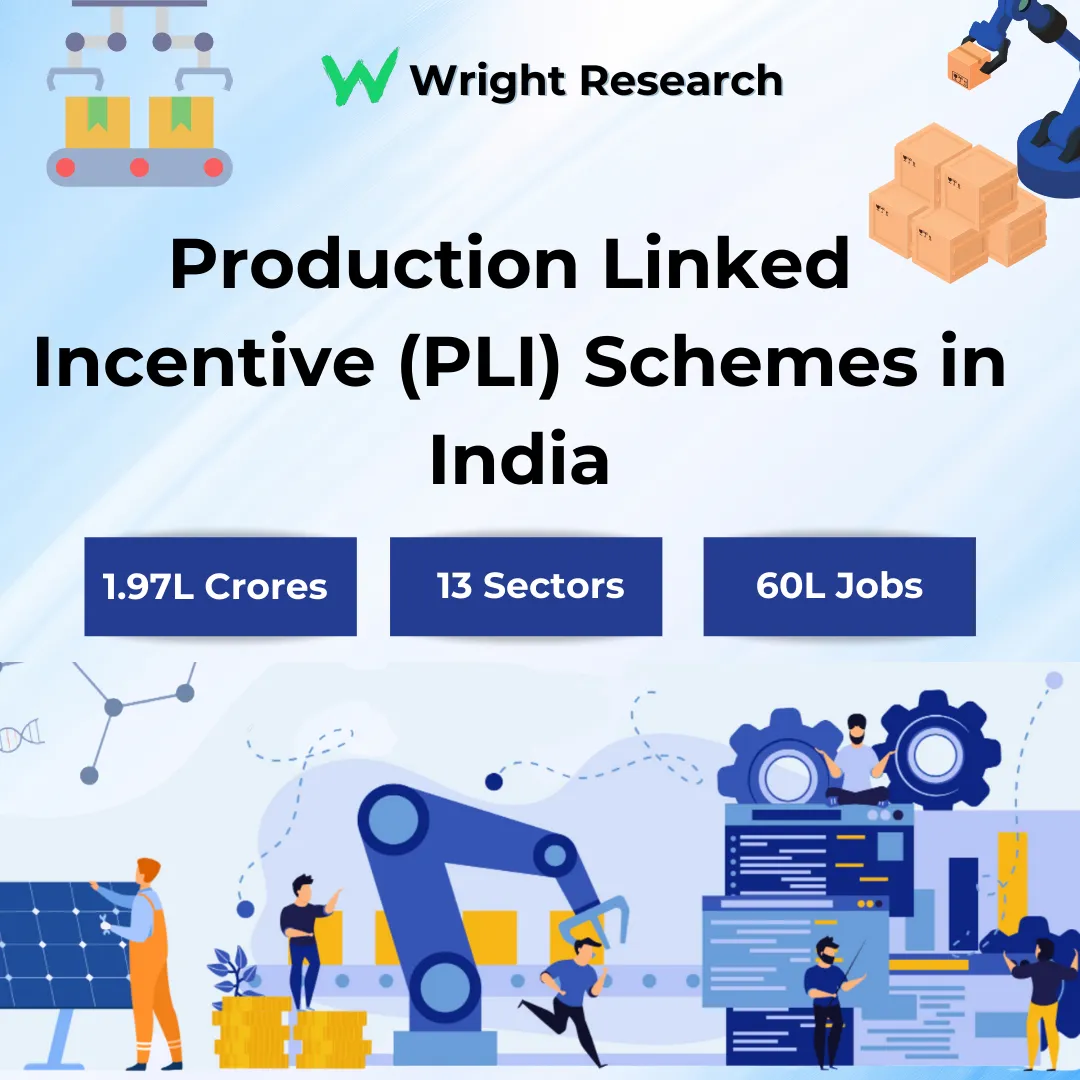

With the PLI scheme, the GOI intends to extend an incentive of 4% to 6% on incremental sales (over a base year) of goods manufactured in India and covered under target segments, to eligible companies, for five (5) years.

There would be a direct correlation between stocks selected for PLI incentive and the profitability growth because of the incentives.

China has been the fastest growing nation over the last decade and is the hub of global manufacturing. Still, recently, due to higher labour costs, stringent environment, compliance costs, and other challenges, the share of Chinese manufacturing is shrinking. Various nations like India, Vietnam, Thailand, Bangladesh, and Malaysia compete for a piece of the pie. While the Indian sectors that can be an alternative to China are already booming, the Indian government is also incentivizing these sectors to speed up India’s market share as an alternative to China. The corporate tax cut, PLI, made in India is part of this broader strategy. The government is even putting anti-dumping duty and import licensing schemes to boost domestic manufacturing.

Next let's look at sectors that will benefit directly from the Atmanirbhar Bharat theme.

The Digital India initiative aims to transform India into a digitally empowered society and knowledge economy, targeting a 20% contribution to GDP from the digital economy by FY '25, with a projected $1 trillion digital GDP by 2025-26. This ambitious vision is already bearing fruit across various sectors.

Digital India is a government initiative and a transformative movement towards a digitally empowered future, promising growth, connectivity, and innovation for all citizens.

For a deeper understanding of the opportunities and potential growth, you can read more in our article, Why we are bullish on India .

India's commitment to renewable energy and sustainability aligns with global climate goals, driving substantial growth in the renewable energy sector. The government's focus on transitioning to cleaner energy sources aims to catalyze various industries, fostering an eco-friendly and sustainable economy.

India's robust renewable energy targets and sustainability initiatives are paving the way for a greener future. These efforts not only align with global climate goals but also promise economic growth, job creation, and a sustainable environment.

Given the robust investment landscape in renewable energy, many investors are looking towards green energy stocks to capitalize on this growth. For insights into the top investment opportunities in this sector, you can read our article on the Top Green Energy Stock .

Improving access to financial services is crucial for achieving inclusive growth in India. The government's promotion of financial inclusion and fintech innovation aims to reach underserved populations, driving significant opportunities across various sectors. India is one of the fastest-growing fintech markets globally, with the industry projected to grow from $50 billion in 2021 to an estimated $150 billion by 2025.

India's commitment to financial inclusion and fintech innovation is driving a transformative impact on its economy. By fostering growth across banking, fintech, insurance, and microfinance, the country is paving the way for inclusive and sustainable economic development.

Self-reliance in defense production is crucial for national security. The Indian government is promoting the indigenization of defense manufacturing and investing in aerospace technologies to enhance the country's defense capabilities and drive technological advancements. In the Union Budget 2023-24, capital allocations for modernization and infrastructure development of the Defense Services increased to INR 1,62,600 crore, representing a rise of 6.7% over FY 2022-23. The overall defense budget saw a 13% increase to INR 5.94 lakh crore. The Aerospace and Defense (A&D) market in India is estimated to reach around $70 billion by 2030, driven by improving infrastructure and government initiatives.

With the government's emphasis on self-reliance in defense production and the growth of the aerospace sector, investment opportunities in these areas are becoming increasingly attractive. For those interested in investing in the defense and aerospace industries, you may want to explore Best Defence Stocks to Buy in India Today for insights into potential investment options.

The Ministry of Defence aims to achieve a turnover of INR 1.75 lakh crore in aerospace and defense manufacturing by 2025, including exports worth INR 35,000 crore. By focusing on self-reliance in defense production and advancing aerospace technologies, India is set to enhance its defense capabilities and establish itself as a significant player in the global defense and space industries.

Defense and aerospace investments not only strengthen national security but also drive technological advancements and economic growth, positioning India as a leader in these critical sectors.

India's ambition to become a global hub for electronics manufacturing underscores its commitment to reducing reliance on imports and bolstering domestic production. Government initiatives, particularly under the Production Linked Incentive (PLI) scheme, are driving significant growth in key sectors.

The government's push for local manufacturing, especially under the PLI scheme, incentivizes companies to produce mobile phones, laptops, and other consumer electronics domestically. Electronic exports have become the 6th largest export commodity group as of March 2023. With rising per capita disposable income and private consumption, India has emerged as one of the largest markets for electronic products in the world.

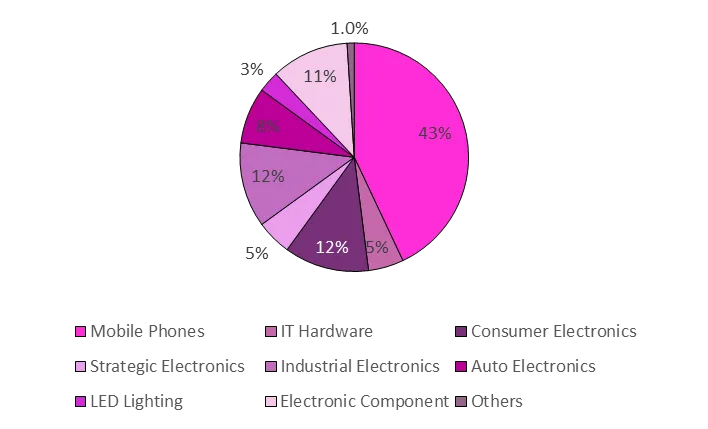

Domestic production of electronics is valued at $101 billion in FY23. Segmentation based on FY22 data includes:

To position India as a global hub for Electronics Systems Design and Manufacturing (ESDM), several schemes have been launched:

India's commitment to electronics and consumer goods manufacturing is not only reducing dependency on imports but also fostering job creation, technological advancement, and economic growth. This strategic focus positions India as a significant player in the global electronics and consumer goods market.

India's automotive sector , especially in the context of electric vehicles (EVs), is poised for significant growth under the Atmanirbhar Bharat initiative. The Indian electric vehicle market is projected to grow from $23.38 billion in 2024 to $117.78 billion by 2032, at a CAGR of 22.4% over the forecast period, according to Fortune Business Insights. This substantial growth underscores the rapidly increasing adoption of electric vehicles in the country and the expanding market opportunities. Read more in our detailedarticle on Indian Electric Vehicle Sector Booming: EVs Tipping Point.

EV Adoption Goals for 2030

India's drive towards electric vehicles presents a massive investment opportunity of over USD 200 billion over the next 8-10 years. Key areas of investment include:

India's ambition to become a global hub for electric vehicle manufacturing aligns with its broader goals of achieving sustainability and reducing carbon emissions. The government’s target to significantly increase the share of EV sales by 2030 reflects its commitment to fostering a greener, more self-reliant automotive industry.

India's automotive sector, particularly the electric vehicle market, is set for transformative growth. With strong government support, substantial investment opportunities, and ambitious adoption targets, India is well on its way to becoming a leader in the global EV market.

To capitalize on these emerging trends, consider exploring our curated Smallcase, Wright New India Manufacturing , is designed to help you invest in companies benefiting from these strategic initiatives.

The 'Atmanirbhar Bharat' initiative has transcended its initial vision, evolving into a robust and profitable strategy that promises to reshape India's economic landscape. By focusing on self-reliance across strategic sectors such as digital infrastructure, green energy, financial inclusion, defense, aerospace, electronics manufacturing, and the burgeoning electric vehicle market, India is positioning itself as a global powerhouse. Each of these themes offers substantial investment opportunities, driven by government policies, technological advancements, and increasing domestic capabilities. As India continues to embrace self-sufficiency and innovation, investors stand to benefit from the country's dynamic growth trajectory. The ongoing transformation under the 'Atmanirbhar Bharat' mission not only promotes sustainable economic development but also reinforces India's role as a pivotal player on the global stage.To capitalize on these emerging trends, consider exploring our curated Smallcase, Wright New India Manufacturing is designed to help you invest in companies benefiting from these strategic initiatives.

We are launching a new portfolio to invest in the Atmanirbhar theme! In the chosen sectors and industries based on the announcements in the Atmanirbhar initiatives, we invest tactically based on announcements, projections and trends.

We are bullish on the India Growth Story. We have been doing this for you for over 4 years, with 25,000+ investors and Rs. 650cr+ AUA (Assets Under Advisory). Our New India portfolio has been doing well. Here's the return performance (in % terms) of the New India Portfolio against its benchmark, Smallcap Index is -

Over a 3 year horizon, ₹1 Lac invested would have become -

Here are the key performance metrics of the New India Portfolio against its benchmark, the Smallcap Index -

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart