by Sonam Srivastava

Published On Sept. 3, 2023

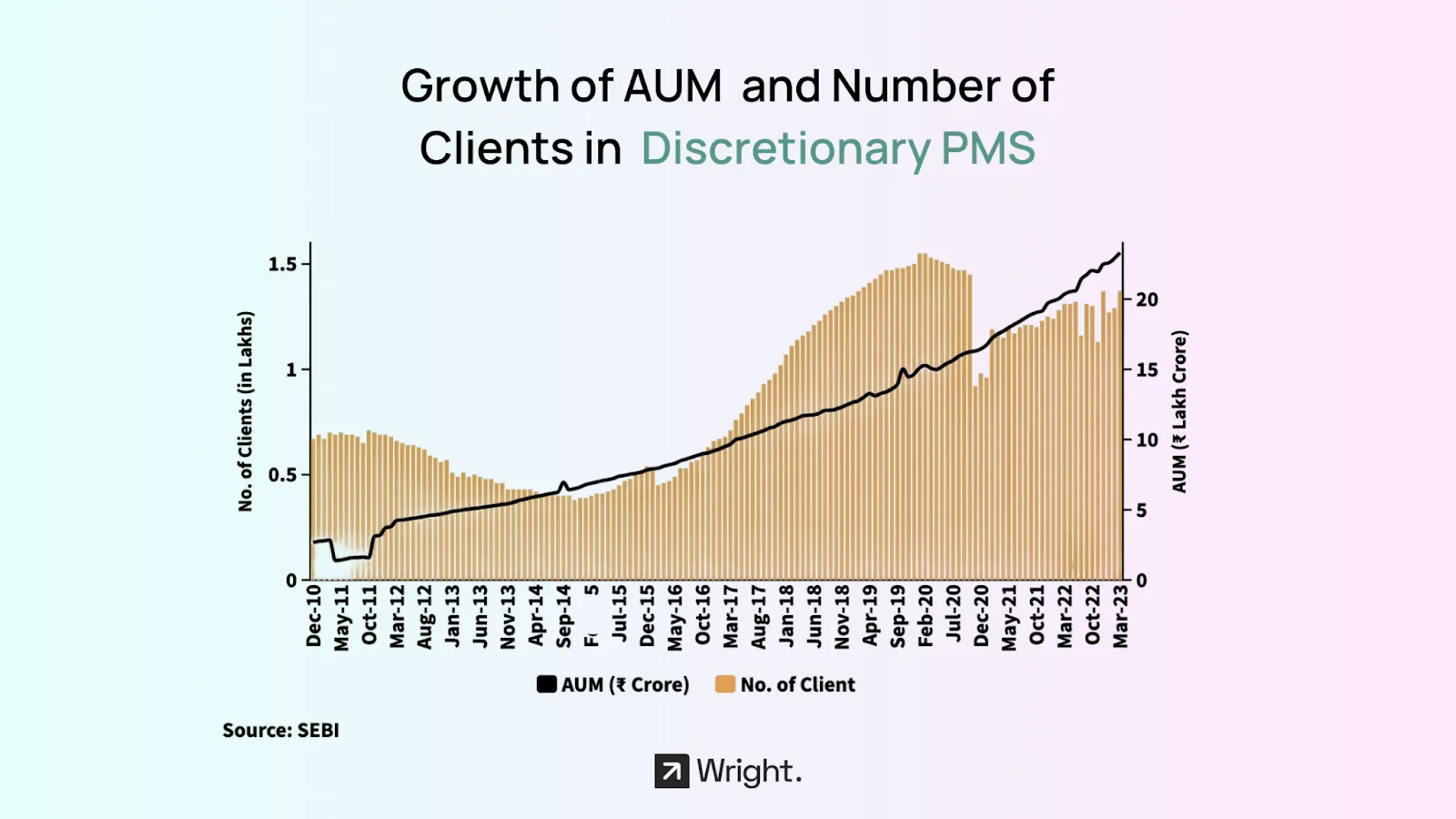

Investing in the stock market can often feel like navigating a labyrinth, especially for those who are new to the world of finance or even for seasoned investors overwhelmed by the sheer number of investment options available. From individual stocks and bonds to mutual funds, ETFs, and more, the choices are endless. Amidst this complexity, Portfolio Management Services (PMS) have emerged as a tailored solution for investors seeking specialized investment strategies. These services offer the benefit of personalized portfolio management, where a dedicated team of experts actively manages your investments, aiming for higher returns while mitigating risks.

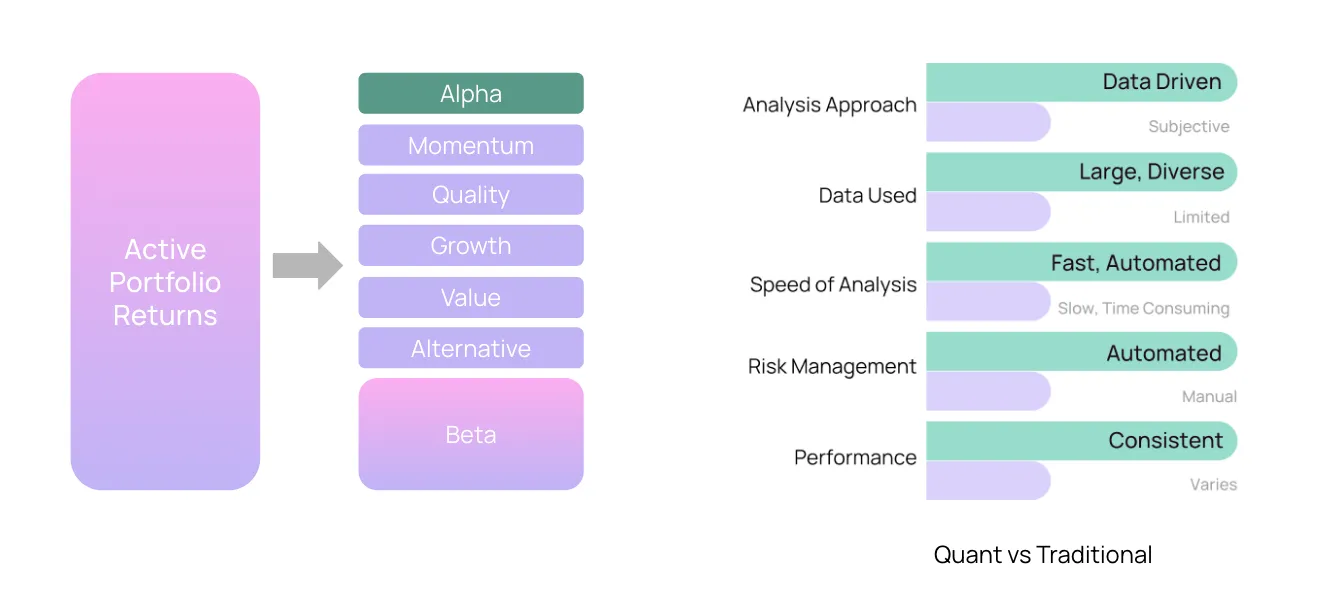

In the Indian financial landscape, the Wright Factor Fund PMS stands out as a unique quantitative (quant) PMS. Unlike traditional investment methods that often rely on subjective judgment, this service employs factor investing, a scientific, evidence-based approach that has been proven to generate superior returns over time. Factor investing is not just another buzzword in the finance industry; it's a method rooted in extensive academic research and real-world performance. It offers a structured, systematic way to invest in the stock market, reducing the reliance on luck and timing.

In this comprehensive guide, we will demystify factor investing and delve into the unique advantages offered by the Wright Factor Fund PMS. Whether you're a novice investor looking to understand the basics or a seasoned veteran seeking to optimize your portfolio, this guide aims to provide valuable insights into the world of factor investing and how the Wright Factor Fund can serve as a cornerstone in your investment strategy.

The Wright Factor Fund PMS is one of the few quant-based PMS offerings in India. It employs a disciplined, quantitative multi-factor investment process, leveraging the power of data analytics and computational algorithms. This unique positioning allows it to offer a cutting-edge investment solution that is both robust and well-diversified.

The primary objective of the Wright Factor Fund is to provide long-term capital appreciation by strategically investing in a portfolio of Indian equities. The fund aims to consistently outperform its benchmark through a disciplined, factor-based approach, focusing on market anomalies and meticulously chosen investment opportunities.

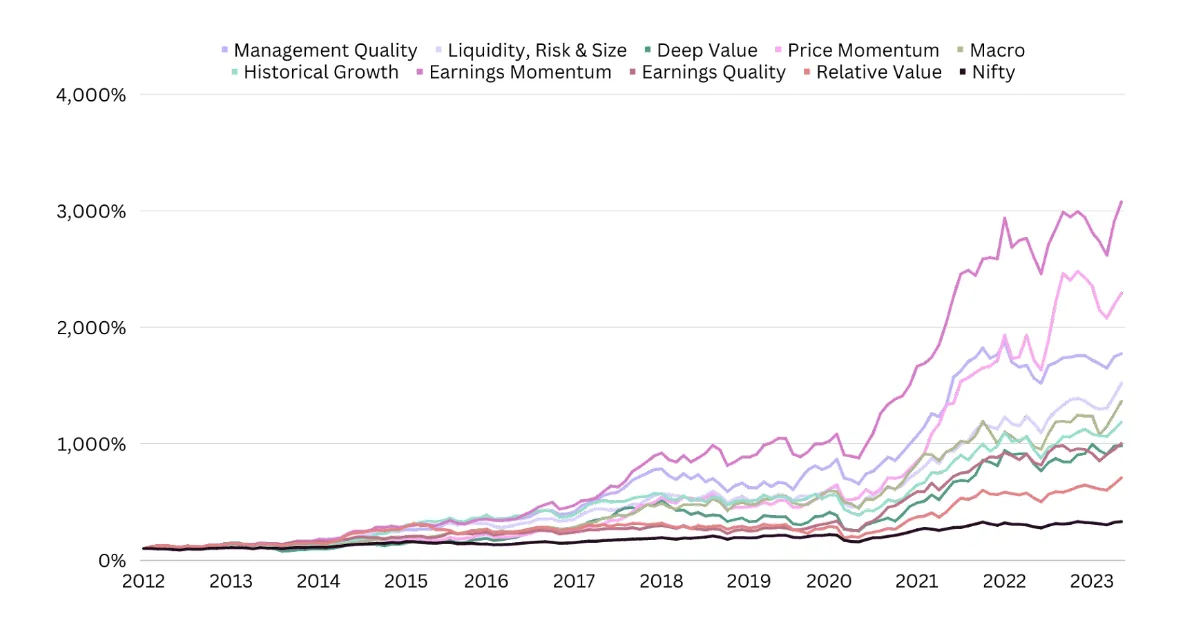

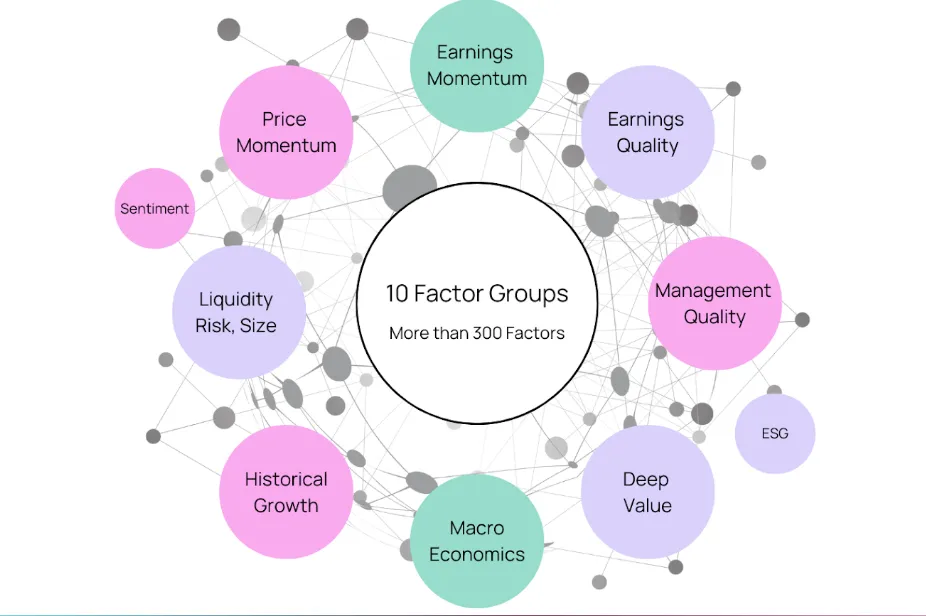

The Wright Factor Fund employs a disciplined, quantitative multi-factor investment process. This approach leverages the power of 10 factor groups like value, momentum, growth, and quality. These factors are carefully selected for their proven contribution to portfolio returns over time. The investment team uses an academically backed, data-driven approach to identify securities with attractive characteristics.

The investment approach is dynamic, adjusting allocations among equity factors, bonds, and gold based on market conditions and expected returns. This agile asset allocation strategy enables the fund to capitalize on opportunities across different market conditions, reducing risk and enhancing potential returns.

While Wright Factor Fund has only completed one month since going live and has around 10 crores deployed, Wright Research has a history of consistent outperformance, delivering robust returns in various market conditions as can be seen in our Momentum and Balanced portfolios. These strategies have been running as a model portfolio for four years, showcasing its ability to navigate different market cycles successfully.

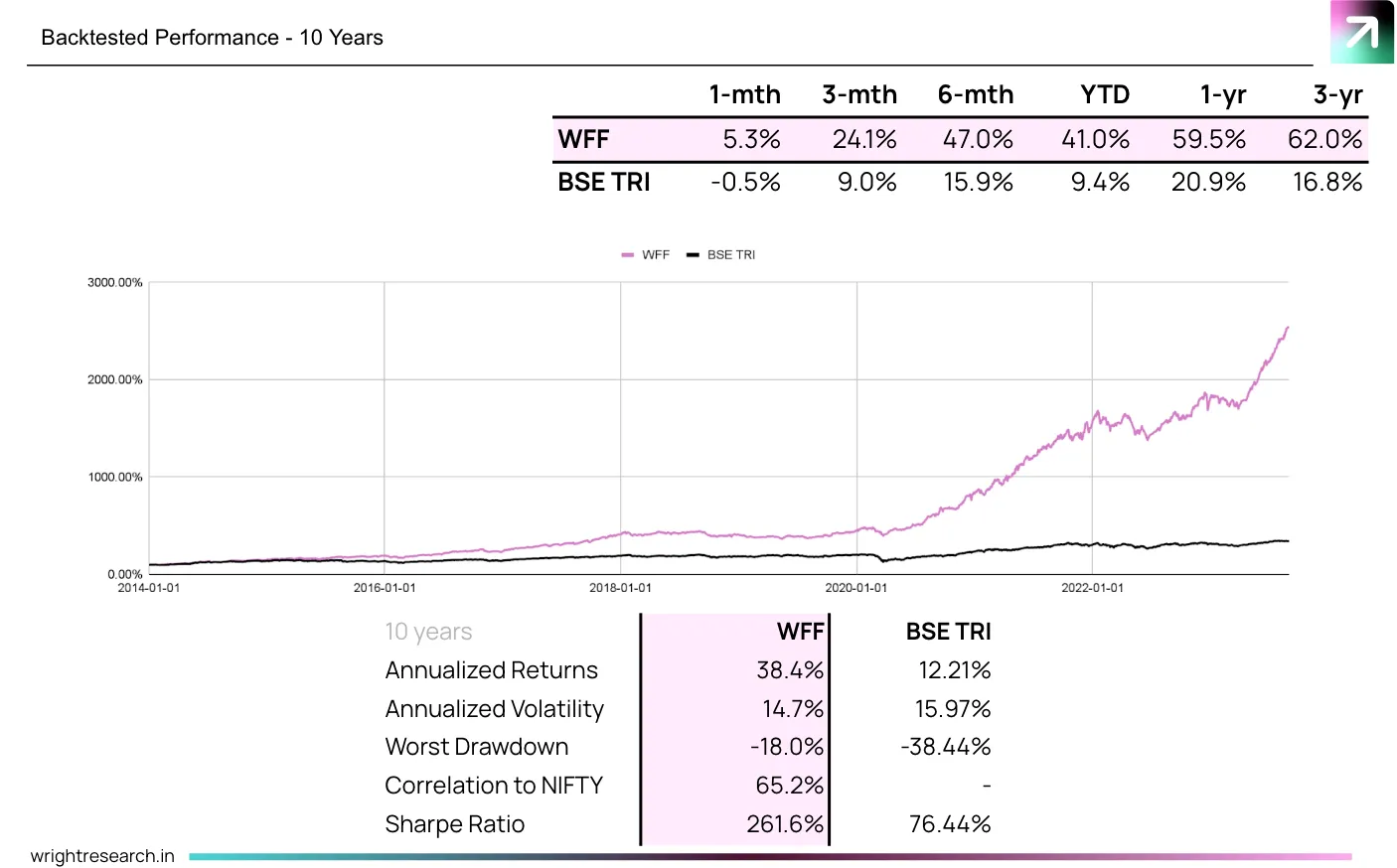

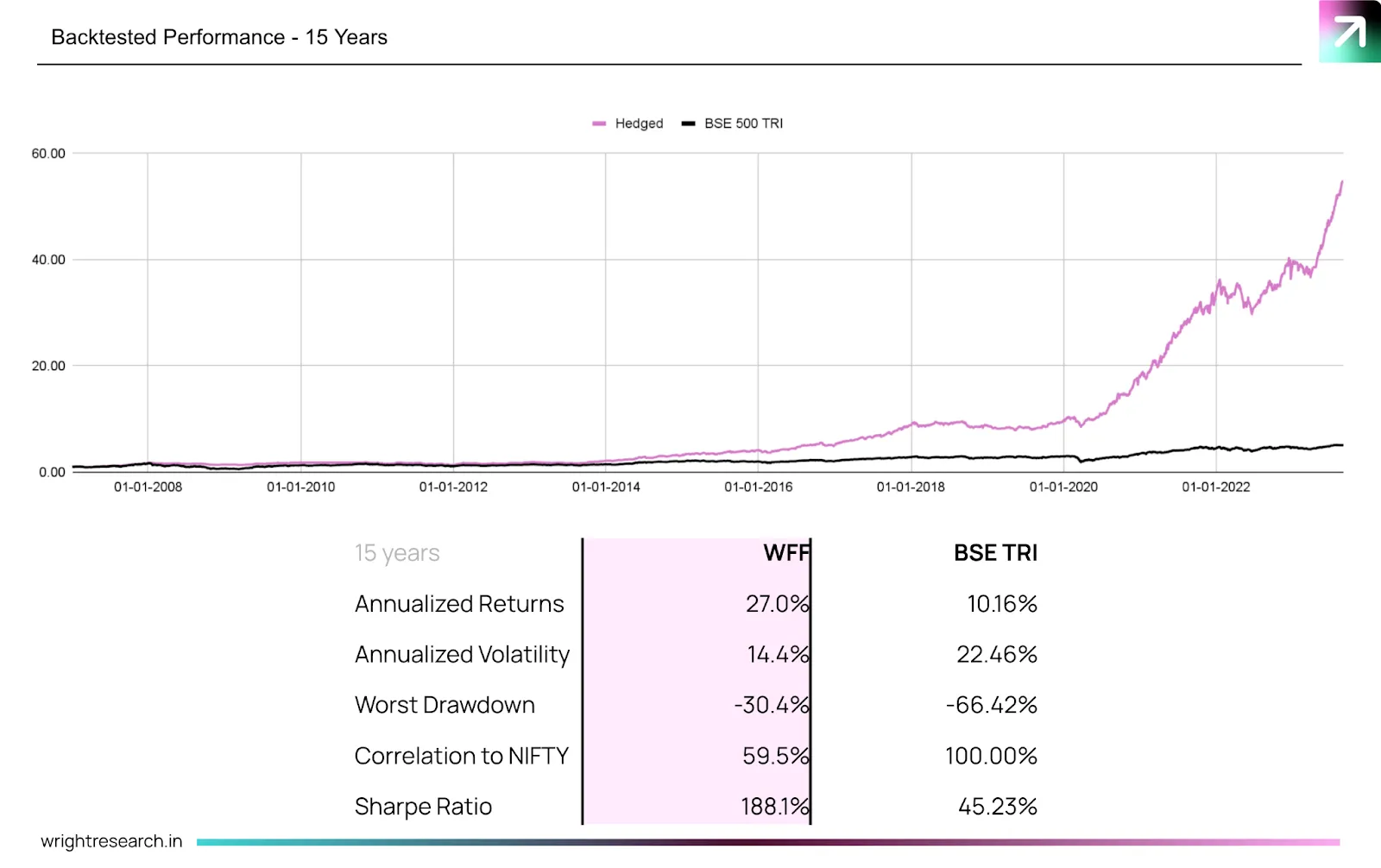

We have backtested the system rigorously over the last 10 years and results are quite attractive. The 10 year CAGR before any cost adjustment is 38% plus. The wide horizon, focus on risk management and strong risk management explains these numbers.

What is really attractive is that the risk is also lower than the benchmark and the drawdowns are also much lower.

While the emphasis is on creating a robust growth trajectory, risk management is given equal importance. The portfolio is structured to be well-diversified across sectors, limiting sector-specific risks and ensuring balance. This dual focus on growth and risk management makes it a compelling choice for investors.

Despite being highly tactical our models have controls for turnover built in to reduce the number of trades and the churn in the portfolios remains relatively low.

The fund offers a transparent fee structure with no entry or exit load. Investors can choose between a flat fee of 1% or a performance-based fee, providing flexibility based on individual preferences.

With a minimum investment requirement of 50 Lac as per SEBI guidelines. The Wright Factor Fund is geared towards serious investors who are looking for a specialised, high-return investment avenue.

Factor investing has become increasingly popular among both institutional and individual investors for several compelling reasons:

Factor investing is rooted in extensive academic research and empirical evidence. It's not based on gut feelings or market timing but on proven factors that have historically provided higher returns. This scientific, evidence-based method offers a more reliable and consistent approach to investing.

One of the key advantages of factor investing is its ability to systematically exploit market inefficiencies. Traditional market theories assume that markets are perfectly efficient, but in reality, they are not. Factor investing capitalizes on these inefficiencies by focusing on specific factors that are undervalued or poised for growth.

Factor investing allows for a more nuanced approach to risk management. By diversifying across multiple factors, investors can reduce the impact of any single factor underperforming, thereby lowering the overall risk of the portfolio. This is particularly beneficial during market downturns or volatile periods.

Factor investing provides the flexibility to tailor your investment strategy according to your risk tolerance, investment goals, and market outlook. Whether you're a conservative investor focusing on low-volatility factors or an aggressive investor seeking high returns through momentum factors, there's a factor strategy for you.

Compared to actively managed funds, factor-based portfolios often come with lower fees and expenses. This is because they rely on systematic rules for buying and selling, reducing the need for constant oversight by fund managers. Lower costs mean higher net returns for investors.

Factor investing is highly transparent. Investors can easily understand the rationale behind the portfolio construction and the factors that are being targeted. This level of transparency is often missing in traditional active management, where the investment process can be opaque.

The world of investing is dynamic, and factor investing allows for adaptability. Factors can be combined, weighted, and adjusted according to changing market conditions, making it a versatile investment strategy suitable for various economic cycles.

Wright Research’s track record speaks volumes about its effectiveness as an investment manager. With a history of consistent outperformance, it has proven its mettle in various market conditions. Below are some key points that highlight its past performance and success stories:

While Wright Factor Fund has only completed one month since going live and has around 10 crores deployed, Wright Research has a history of consistent outperformance, delivering robust returns in various market conditions as can be seen in our Momentum and Balanced portfolios. These strategies have been running as a model portfolio for four years, showcasing its ability to navigate different market cycles successfully.

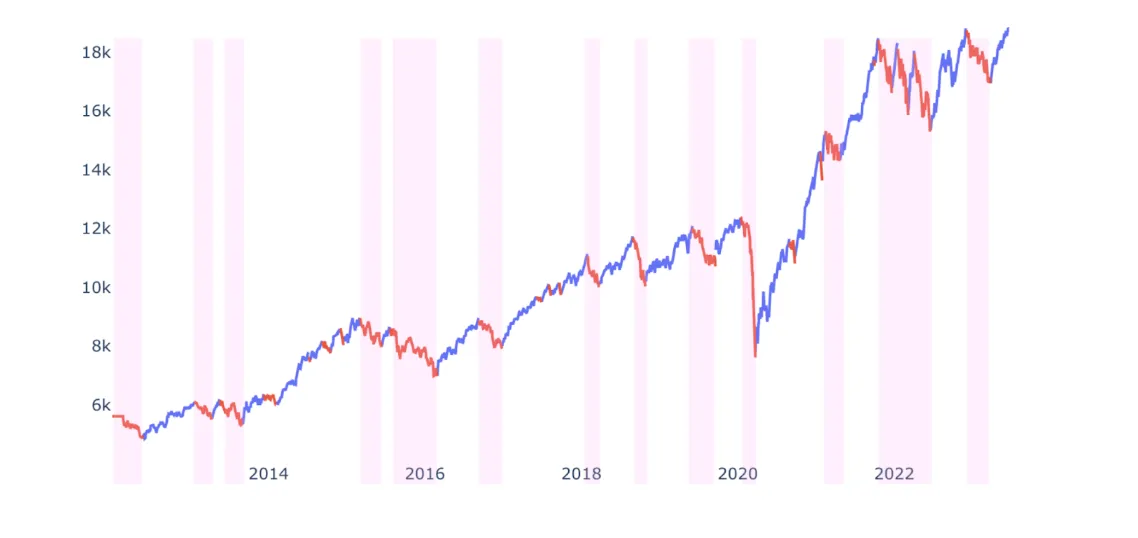

The fifteen year backtest is shown below:

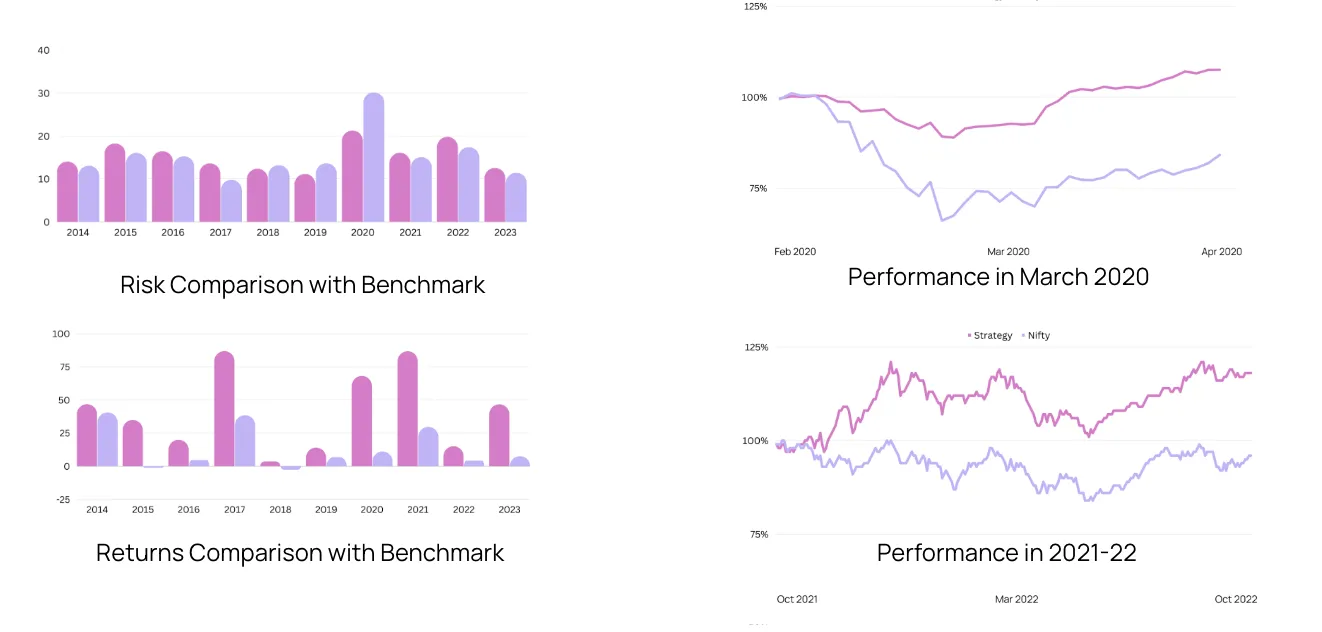

The Wright Factor Fund as per the backtest has strong outperformance over the index in 1 year, 2 year, 3 year and 5 year rolling periods. What is to note is that while the one year returns can be choppy, the 3 and 5 year windows consistently give a strong return - which is why investors should have a longer horizon exposure while investing.

The backbone of the strategy is the strong risk management along with focus on momentum. The risk of the strategy remains lower than the benchmark in most years and in the 2 scenarios shown - 2020 Covid crash and 2022 volatility the strategy gives much stronger performance compared to the index due to the focus on diversification, asset allocation and systematic deallocation.

The secret sauce behind this strategy is the strong momentum based factor that outperform during trending bull markets coupled with strong risk management in volatile times. The combination of these two factors makes this a highly robust strategy.

In one month of launch of the Wright PMS, we have been able to add more than 75 clients in the onboarding pipeline and have already gone live with around 20 clients which speaks volumes about client’s trust on our strategies.

Creating a successful investment portfolio is both an art and a science. The Wright Factor Fund has mastered this by employing a disciplined, quantitative multi-factor investment process. Below are the key steps involved in constructing the portfolio:

The first step in the portfolio construction process is the selection of factors. The fund leverages the power of 10 factor groups, including value, momentum, growth, and quality. These factors are chosen based on their proven contribution to portfolio returns over time. The investment team uses an academically backed, data-driven approach to identify securities with attractive characteristics based on these factors.

The team employs sophisticated artificial intelligence based algorithms and data analytics tools to sift through vast amounts of macroeconomic and market data to identify and forecast the regime in the markets. The risk in the strategy is varied based on the market regimes.

Before any security is added to the portfolio, it undergoes a rigorous risk assessment. This involves evaluating the stock's volatility, correlation with other assets in the portfolio, and its impact on the overall risk profile. The goal is to ensure that each addition aligns with the fund's risk management strategy.

After the data analysis and risk assessment, the portfolio is constructed. The aim is to create a well-diversified portfolio that is balanced across sectors, thereby limiting sector-specific risks. The fund also ensures that the portfolio is diversified across large-cap, mid-cap, and small-cap stocks, providing a good mix of stability and growth potential.

The portfolio is not static; it undergoes monthly rebalancing to fine-tune its composition based on evolving market conditions and investment outlook. Additional adjustments may be made on a weekly basis in response to significant market events. This ensures that the portfolio remains optimized for both growth and risk management.

The fund employs a dynamic asset allocation strategy, adjusting the portfolio's exposure to different asset classes like equities, bonds, and gold based on market conditions and expected returns. This adds another layer of diversification and risk management, making the portfolio resilient to various market scenarios.

Once the portfolio is live, its performance is continuously monitored. The fund uses various metrics and key performance indicators to assess how well the portfolio is doing and whether it is meeting its investment objectives.

By following this meticulous process, the Wright Factor Fund ensures that its portfolio is not only robust but also agile, capable of adapting to market changes while staying true to its investment objectives. This comprehensive approach to portfolio construction sets it apart as a specialized, high-return investment avenue

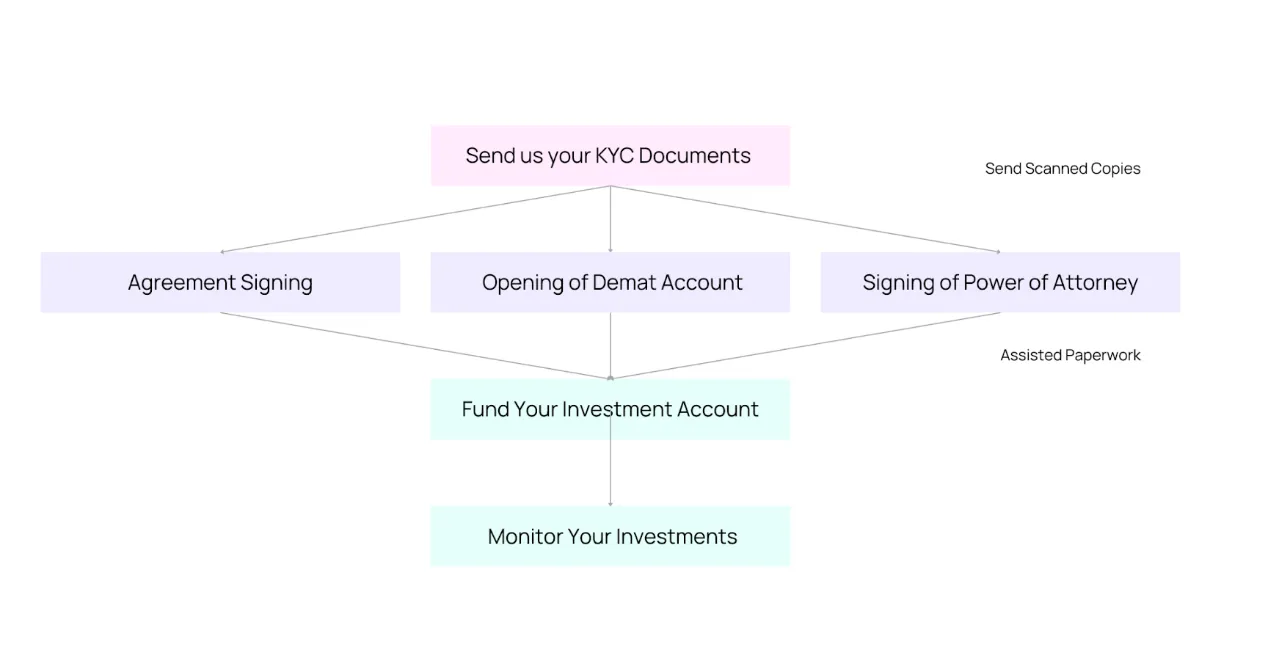

Investing in the Wright Factor Fund Portfolio is a straightforward process, but it's essential to follow certain steps to ensure that you're making an informed decision. Here's a step-by-step guide on how to start your investment journey with the Wright Factor Fund:

If you are interested in the PMS, please click on the get started button on the PMS page and you will receive an email with a calendar link to book a call with us and if you provide us your phone number we will call you back.

We will organise a call with the portfolio management team to clear up any doubts or queries.

Once you're satisfied with your research and consultation, the next step is to complete all the necessary documentation. As a first step we take a scan copy of your KYC documents digitally and then our team sends you filled forms for PMS Agreement, Demat Account and Power of Attorney for you to sign.

The Wright Factor Fund has a minimum investment requirement of 50 Lac. Once your documentation is complete, you can go ahead and make the initial investment. This can usually be done through a wire transfer, cheque, or other payment methods as specified by the fund.

The Wright Factor Fund offers two fee structures: a flat fee of 1% or a performance-based fee. Choose the one that best suits your investment philosophy.

After your investment is made, you'll receive regular updates on the portfolio's performance. Most funds offer online platforms where you can monitor your investment, view transaction history, and read quarterly or annual reports.

The fund undergoes monthly rebalancing and may make additional adjustments based on significant market events. As an investor, it's good to be aware of these changes, as they can impact your investment's performance.

While the Wright Factor Fund aims for long-term capital appreciation, it's essential to have an exit strategy. Knowing when and how to exit your investment can be as crucial as the initial investment itself. The fund has a transparent exit policy with no exit load, making it easier for investors to withdraw their investment when needed.

By following these steps, you can start your investment journey with the Wright Factor Fund Portfolio in a structured and informed manner. This ensures that you're not only making a sound financial decision but also optimizing your potential for high returns while effectively managing risk.

Factor investing offers a scientific, evidence-based approach to investment, and the Wright Factor Fund is a prime example of this strategy done right. With its disciplined multi-factor investment process, dynamic asset allocation, and strong track record, it presents a compelling investment opportunity.

Investing in the Wright Factor Fund could be the key to unlocking superior returns while effectively managing risk. So, consult your financial advisor today and take the first step towards a more secure financial future.

*Disclaimer: Investment in equities is subject to market risks. Please read all related documents carefully before investing.*

Want to learn more about PMS? Here are some interesting articles related to Portfolio Management Services in India:

What is the Minimum Investment Ticket Size for Portfolio Management Services (PMS)?

Complete Guide to Factor Investing & the Wright Factor Fund PMS

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios

on your first subscription