by Sonam Srivastava

Published On Sept. 10, 2022

India has started efforts to address reforms and regulations to boost manufacturing and infrastructure and incentivize and ease the functioning of critical sectors. For over a decade, India’s service sector has contributed more than 50% of the GDP. However, in 2021-22, manufacturing constituted only 17.4% of our GDP. Therefore, the government is incentivizing the development of the new-age manufacturing industries through its policies.

Stocks benefiting from these critical policies have a long way to go. In this post, we will drill down into the sectors and industries covered under these schemes, which will be crucial to spot these winners.

The government has underlined inclusive development, productivity enhancement, energy transition, and climate action as the four pillars of development that will drive the nation’s growth trajectory to new levels.

We think three government policies are essential to spot winners in the current stock market.

Make in India or Atmanirbhar-Bharat

Profit Linked Incentives and,

China Plus One

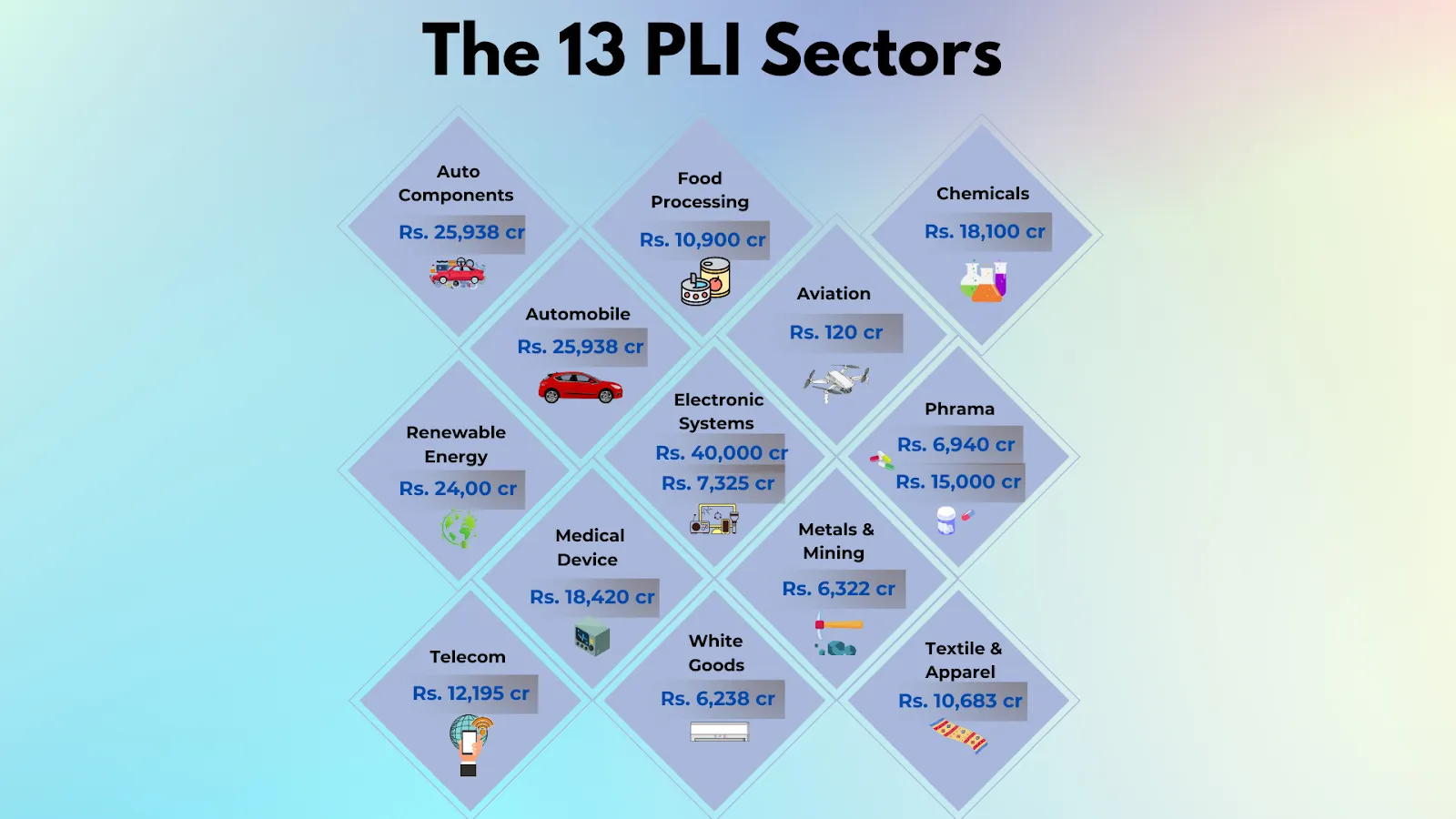

The PLI scheme for the automobile sector proposes financial incentives of up to Rs 26000 crore to boost domestic manufacturing of advanced automotive technology products and attract investments in the automotive manufacturing value chain. Several Auto companies, as well as Ancillaries, will be beneficiaries of this scheme.

Under the scheme, the government seeks to boost local manufacturing of advanced chemistry cells to bring down the prices of batteries in the country, reducing the cost of electric vehicles. The scheme was designed to be technology-agnostic. The beneficiary firm was free to choose suitably advanced technology, machinery, raw materials, and other intermediate goods for setting up a cell manufacturing facility.

A scheme outlay of 10,900 crores is allocated to this sector. The sub-industries covered are - ready-to-eat, marine products, fruits and vegetables, and mozzarella cheese.

The Indian Government has identified medical devices as a priority sector for the flagship 'Make in India' program and is committed to strengthening the manufacturing ecosystem. As a result, Rs 18140 crore worth of benefits are allocated to this sector.

The Indian pharmaceutical industry is the 3rd largest in the world by volume and value at $41. In addition, the country contributes 3.5% of total drugs and medicines exported globally to over 200+ countries.

Schemes are launched to ensure greater resilience to external shocks, enforce greater drug security and boost the capacity for domestic production of critical bulk drugs and high-value products.

High-Efficiency Solar PV Modules for Enhancing India’s Manufacturing Capabilities and Enhancing Exports are included in the Production Linked Incentive scheme. The government has set aside 24000 crores for this sector.

Core telecom equipment, 4G/5G systems, Enterprise Systems, Internet of Things, etc. are various themes covered under the incentives for the telecom sector. The scheme layout here is 12195 crore.

The government approved the Production-Linked Incentive (PLI) Scheme in Textiles Products for Enhancing India’s Manufacturing Capabilities and Exports. This includes the manufactured fabrics and technical textiles segments.

The Production Linked Incentive Scheme for White Goods (PLIWG) proposes a financial incentive to boost domestic manufacturing and attract significant investments in the White Goods manufacturing value chain. Its prime objectives include removing sectoral disabilities, creating economies of scale, enhancing exports, and creating a robust component ecosystem and employment generation.

Interested in investing in these innovative sectors? Have a look at Wright's New India portfolio:

Wright 🇮🇳 New India smallcase by Wright Research

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart