The Indian economy has seen some green shoots in recent months as it gradually restarts activity following the lockdown. The earning season for corporate India has been strong, and a good cohort of IPOs is coming. Moreover, because of the favorable monsoon, government stimulus, and the Atma Nirbhar initiative, agricultural growth is likely to increase progressively domestic demand, reviving the economy.

With Diwali approaching, now is the time for investors to assess their investment portfolio and add some luster to it with some exciting investing themes.

Due to Diwali, this week will be a truncated trading week, with the market moving into this festival season in a profit-taking attitude with the inherent mood of booking profits.

The things to look out for include:

It’s the rainy season of earnings.

Earning season so far remained mixed where most of the companies beat expectations on the revenue front, but one clear trend is emerging is margin pressure due to rising input cost. Nevertheless, some spectacular numbers came this week, like SAIL posting 10X growth in EBIDTA, IndusInd Bank publishing a 72% profit jump, TVS beating estimates with a 27% growth in profit.

Global Outlook

The outcome of the US Fed meeting on November 3rd will be the most crucial cue globally, as it will be essential to watch how the Fed reacts in the face of rising prices and a slowing GDP momentum. Another source of concern for the business is the increase in Covid cases around the world.

Let’s address the elephant in the room.

Following a raging rise, the latest downturn in equities markets has cornered bulls. Investor caution has been fueled by weak global cues, mixed company earnings, and FII selling. In addition, investors may have booked profits to invest in the primary markets due to a half-dozen IPOs coming out roughly at the same time.

Is this the time to back off or to surge ahead? As per our research, the long-term view remains favorable. In our multi-factor portfolios, we rely on a regime shift model that forecasts the risk in the market and has historically been correct more than 80% of the time. Moreover, our model estimates that the markets are still in a positive phase.

Rebalance your portfolio

For Diwali, much as we clean our homes and get rid of old, worn-out items, you must review your investment portfolio and realign it with your financial objectives. So we are sending out updates to the portfolios today and hoping to revitalize the sparkle in the performance.

No investment amount is small.

Many people believe they need a considerable sum of money to begin investing, which is one of the primary reasons they back out from doing so. Unfortunately, this isn't the best way to put your money to work. Due to compounding, these tiny investments grow into a significant corpus over time. Compounding is the process by which the returns you earn additional profits for you.

You can invest as small as 2000 Rs with our Tactical ETFs portfolio.

The best time to invest is now.

Diwali is the time to start new things! There’s an old Chinese proverb that goes: “The best time to plant a tree was twenty years ago. The second best time is now.”

This pearl of wisdom has a lot of application in the investment world. You may watch your fortune develop right in front of your eyes if you start investing early. Then, when the time comes, you'll be able to enjoy the rewards of your labor. You don’t have to travel back in time and start investing now to achieve significant returns. Instead, it suggests that now is the optimum time to begin investing. Long-term profits are better if you start investing early.

Invest in ideas with Wright Research

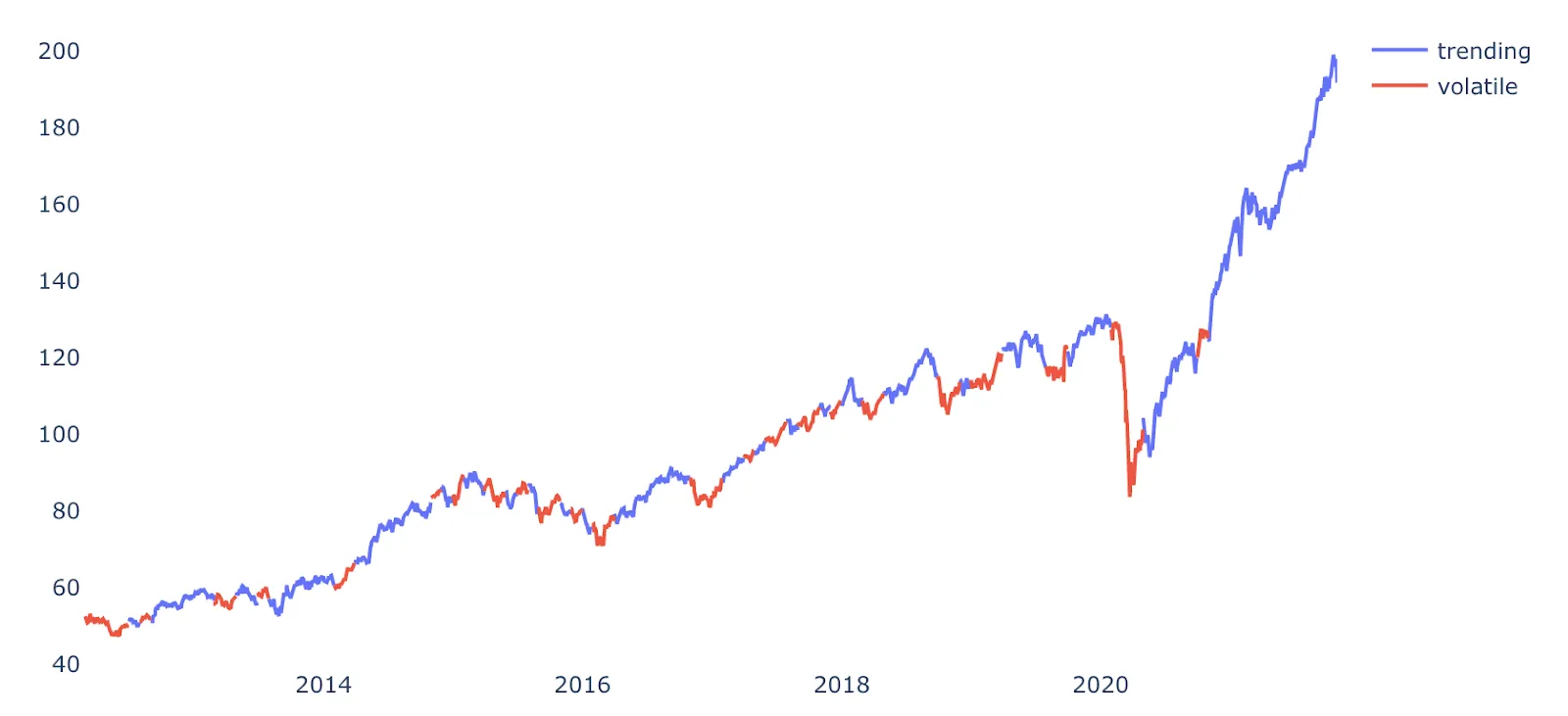

A variety of causes influences markets. The market cycle's intrinsic function is volatility. These swings have a significant impact on the performance of your investments. The Balanced MFT combats market volatility by dynamically assigning innovative beta components and asset classes dependent on market conditions. Aside from stocks, the smallcase also includes bonds, gold, and international exchange-traded funds (ETFs), which are dynamically weighted higher when markets are tumultuous.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart