by Siddharth Singh Bhaisora

Published On June 22, 2025

Recent escalations between Israel and Iran have intensified, with fresh attacks causing civilian casualties and prompting fears of broader regional instability. Iran, currently resisting ceasefire mediation, insists on retaliation amid ongoing Israeli attacks. Currently, the conflict's direct economic impact on India is limited. However, authorities remain vigilant due to potential volatility in global crude oil prices, capital flows, currency fluctuations, and increased shipping costs.

India’s economy, heavily reliant on imported crude oil, faces unique vulnerabilities. In the financial year 2025, India imported 85% of its oil, costing approximately $137 billion - about 15% of its total import bill. Such reliance exposes India to significant economic shocks whenever global oil prices spike. Let’s look at the potential for an energy crisis globally, why oil prices matter to India and 3 potential outcomes of the Israel-Iran conflict!

Benchmark Brent crude oil prices surged by 7%, briefly exceeding $74 a barrel, following intense Israeli airstrikes on Iranian targets, prompting retaliatory missile launches by Iran against Israeli positions. However, prices slightly retreated as neither side immediately escalated attacks on the most sensitive energy infrastructure and due to emerging reports of potential ceasefire mediation.

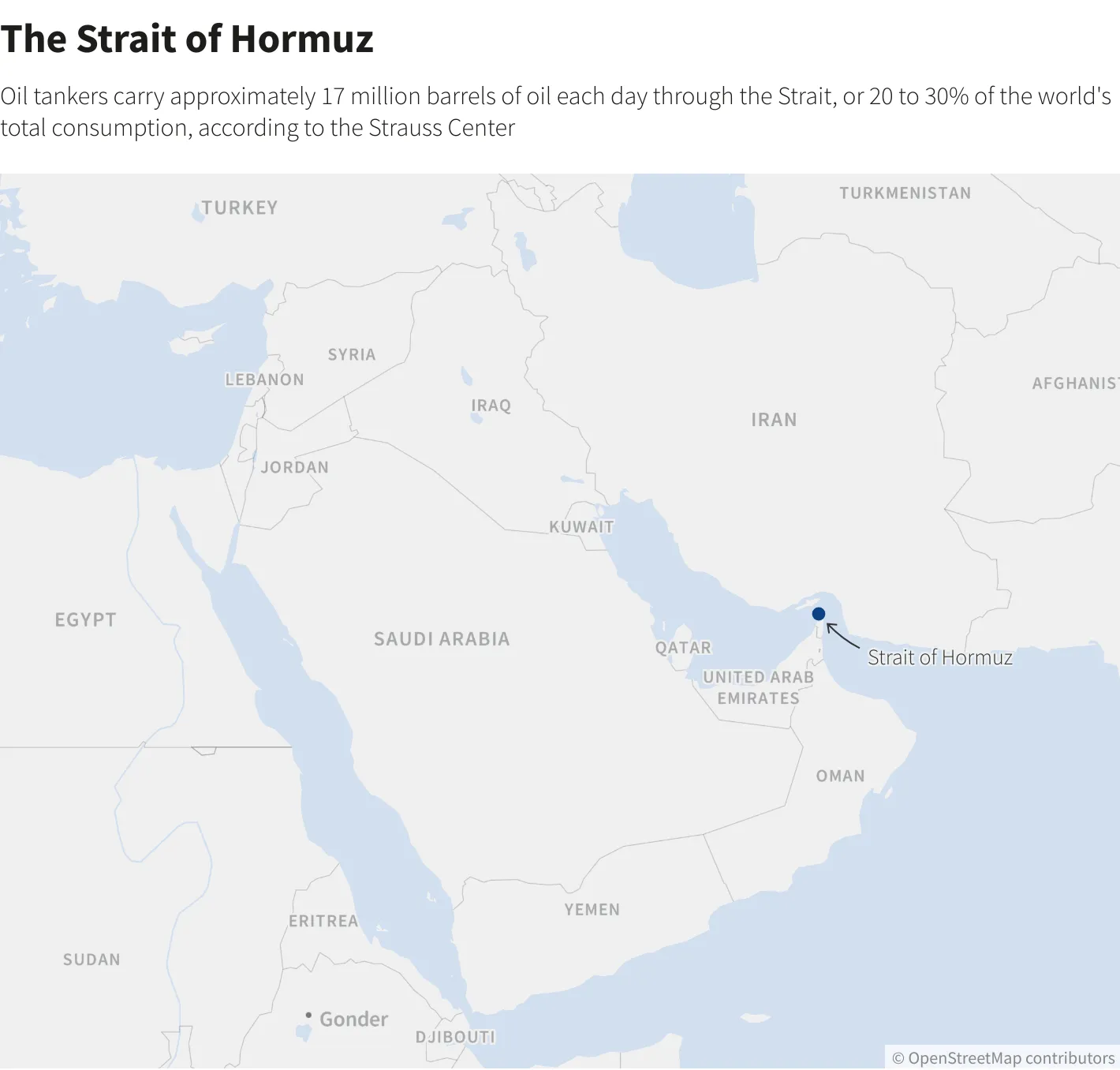

Investor anxiety centers significantly around the Strait of Hormuz, a crucial global maritime route between Iran and Oman, handling 18-19 million barrels per day - nearly 20% of global crude and fuel consumption - and 85 million tons of LNG annually from Qatar and the UAE. Any disruptions could severely elevate energy prices, possibly beyond $100 per barrel, drastically impacting global markets.

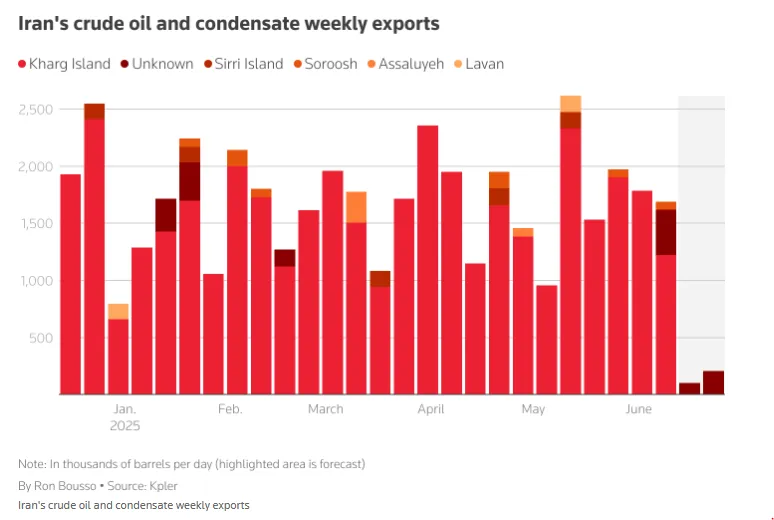

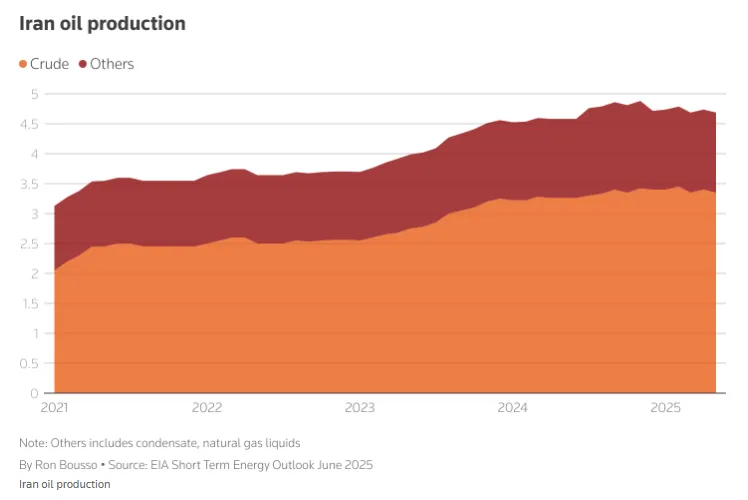

Iranian oil exports have drastically declined, nearly ceasing entirely in recent days. According to analytics firm Kpler, Iranian crude and condensate exports plunged to approximately 102,000 barrels per day (bpd), significantly below the 2025 weekly average of 1.7 million bpd. Satellite data indicated a complete halt in tanker movements from Kharg Island, responsible for over 90% of Iranian oil exports. However, Iran still retains about 27.5 million barrels stored offshore, providing short-term relief.

Israel’s targeted strikes inflicted notable disruptions, particularly at Iran's massive South Pars gas field, partially suspending gas production. South Pars accounts for 80% of Iran’s gas output, producing 610 million cubic meters per day and approximately 700,000 bpd of condensate, vital for petrochemical production. Damage assessments remain unclear, yet significant operational disruptions could severely impact Iran's energy sector.

Additional Israeli airstrikes hit the Shahr refinery and fuel depots near Tehran, further affecting domestic energy supply. The full extent of these impacts awaits further clarification.

Israeli energy operations also suffered substantially. Two major offshore natural gas fields—Leviathan, operated by Chevron, and Energean's Karish field—were shut down, reducing national gas supplies by nearly two-thirds. Israel must now increasingly rely on coal and fuel oil to sustain its energy needs.

The disruptions significantly curtailed gas exports to Egypt and Jordan, where Israeli supplies constitute 15-20% of Egyptian gas consumption. The interruption prompted operational halts in Egypt’s fertilizer industry.

Moreover, a critical strike at the ORL oil refinery in Haifa severely damaged infrastructure essential for steam and electricity generation, prompting a full shutdown of operations.

In this scenario, diplomatic efforts rapidly diffuse immediate tensions. Potential military or retaliatory acts remain limited, symbolic, and avoid significant infrastructural or civilian harm. Diplomatic dialogues resume, possibly reigniting broader regional security discussions and talks regarding Iran’s nuclear ambitions.

Oil Prices: Short-lived spikes; quick normalization to pre-crisis levels.

Inflation: Minimal, enabling continued adherence to existing central bank policies.

Supply Chains: Brief, minor disruptions without lasting effect.

Investment Climate: Quick recovery in investor confidence, rebound in risk assets, and reversal of safe-haven asset flows.

Here, tensions persist without direct large-scale conflict but intensify proxy conflicts across Syria, Iraq, Yemen, and Lebanon (via groups like Hezbollah). Limited but persistent confrontations, targeted strikes, and cyber-attacks continue without escalating to full-scale war.

Oil Prices: Elevated and volatile, driven by sustained geopolitical uncertainty.

Inflation: Persistent upward pressure, complicating central bank policy and increasing global economic challenges.

Supply Chains: Increased logistical costs, heightened shipping insurance premiums, and moderate disruptions.

Investment Climate: Increased risk aversion, volatility in equities, higher demand for safe-haven assets like gold and USD, and reduced foreign investment.

This dire scenario involves direct and extensive military conflict potentially drawing in additional regional and global players, severely disrupting global energy flows through key chokepoints like the Strait of Hormuz.

Oil Prices: Significant surge, prolonged high prices dependent on conflict duration.

Inflation: Severe, widespread inflationary pressures leading to global economic distress.

Supply Chains: Severe disruptions and paralysis of global trade, widespread shortages, and halted manufacturing processes.

Investment Climate: Extreme volatility, sharp market declines, systemic financial instability, and potential global recession or depression.

Should the conflict escalate into a wider regional war involving actors like the Houthis, India faces severe economic repercussions primarily through energy price shocks. India imports approximately 85% of its oil needs. A significant rise in crude prices, potentially reaching $200–$300 per barrel if critical routes like the Strait of Hormuz are disrupted, could significantly strain India's economy. Each $10 per barrel increase in crude oil prices could reduce India’s GDP growth by 0.3 percentage points and raise inflation by 0.4 points, complicating fiscal management and dampening consumer demand.

Households: Fuel, transportation, groceries, and even EMIs become costlier, reducing disposable income and purchasing power.

Businesses: Increased costs of transport and raw materials eat into profits, forcing companies either to raise prices or accept lower margins, potentially slowing growth and hiring.

Currency Pressure: A rise in oil prices increases the need for dollars to buy crude oil, weakening the rupee and amplifying the cost of all imports.

The conflict could substantially disrupt India's trade routes, especially through the Strait of Hormuz and Red Sea, crucial for India's exports to Europe and the US. Freight costs and marine insurance premiums are likely to increase by 15–20%, impacting export competitiveness and causing logistical delays.

India’s exports, notably pharmaceuticals, textiles, and diamonds, could suffer significantly, especially with key Middle Eastern and North African markets. Previous conflicts have already demonstrated risks to Indian textile margins and diamond supply chains.

Major Indian corporations, including TCS, Wipro, Infosys, Sun Pharma, Adani Group, SBI, and Larsen & Toubro, possess substantial operations in Israel. Sustained conflict could disrupt these operations, prompting companies to activate contingency plans, potentially relocating operations back to India or elsewhere. Indian businesses across various sectors could face heightened financial stress.

Airlines could experience escalating operational costs due to rising aviation turbine fuel prices, potentially leading to increased fares and suppressed demand. Firms like IndiGo already allocate about a 1/3rd of their revenue to fuel.

FMCG and Retail: Transportation expenses can squeeze margins. Companies such as Hindustan Unilever, Nestlé, and ITC may either raise consumer prices or see reduced profitability.

Automobile: Higher fuel prices reduce consumer demand for traditional vehicles. Companies like Maruti Suzuki and Tata Motors face potential slowdowns as buyers postpone purchases or opt for more economical vehicles. Potentially providing a competitive edge to electric vehicle manufacturers.

Paint Manufacturers (Asian Paints, Berger, Kansai Nerolac) heavily reliant on crude-based raw materials would face increased costs, pressuring profit margins and retail pricing strategies.

Chemical and Petrochemical Companies including Pidilite, SRF, Aarti Industries, and Deepak Nitrite would incur higher input costs from elevated prices of crude derivatives.

Paint and Chemicals: Companies like Asian Paints and Berger Paints rely heavily on petroleum-derived inputs. Rising crude prices directly inflate production costs, pressuring margins.

Fertilizer Industry would face rising production costs from increased LNG and crude prices, impacting government subsidy burdens.

FMCG and Retail: Transportation expenses can squeeze margins. Companies such as Hindustan Unilever, Nestlé, and ITC may either raise consumer prices or see reduced profitability.

Oil Refiners & Oil Marketing Companies: Companies like Reliance Industries, BPCL, HPCL and IOCL could benefit from wider refining margins during periods of volatile crude prices. It could be a potential loss if they face limited pass-through of increasing costs to consumers.

Defence Stocks: Increased global geopolitical tension often leads to higher defence spending, benefiting firms such as Bharat Electronics (BEL), HAL, and Bharat Dynamics (BDL).

Gold and Financial Services: Rising global uncertainty typically boosts safe-haven assets. Gold and gold loan companies like Titan and Muthoot Finance might experience increased investor interest.

For informed investing and financial planning, consider watching these crucial indicators:

Brent Price Thresholds: Brent crude surpassing $80 per barrel could signal increased inflationary risks, prompting Foreign Institutional Investors (FIIs) to reallocate funds away from Indian equities.

USD/INR Exchange Rate: A weakening rupee increases import costs, adding to inflation pressures and potentially impacting your purchasing power and investment returns. RBI’s potential dollar sales to stabilize the currency could also impact bond yields and liquidity. A weak rupee increases import costs dramatically - and impacts your ability to purchase things

RBI’s Monetary Policy: Higher oil prices could force RBI to delay rate cuts or maintain higher interest rates longer, impacting EMIs, credit growth, and economic expansion.

Gold: Geopolitical uncertainty lifted 24k gold prices above ₹1 lakh/10 g and silver to record levels .

Domestic central bank and inflation data: June 27–29 bring global economic data (e.g., US durable goods, UK inflation) and local indicators like Q1 FY26 GDP and industrial output. These will guide RBI rate expectations amid geopolitical risks

While India currently faces minimal immediate risk from the Israel-Iran conflict, sustained escalation poses severe threats through elevated energy prices, disrupted supply chains, and corporate operational stress. Indian policymakers and businesses must closely monitor developments and prepare robust risk mitigation strategies.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart