In December 2025, the dollar–rupee rate briefly pushed past the psychologically charged ₹90 mark. For anyone holding dollars, it feels like a win; for someone planning a foreign trip or sending a child abroad, it feels like a tax. But purely in macro terms, this level tells us more about long-running structural trends than about an imminent blow-up.

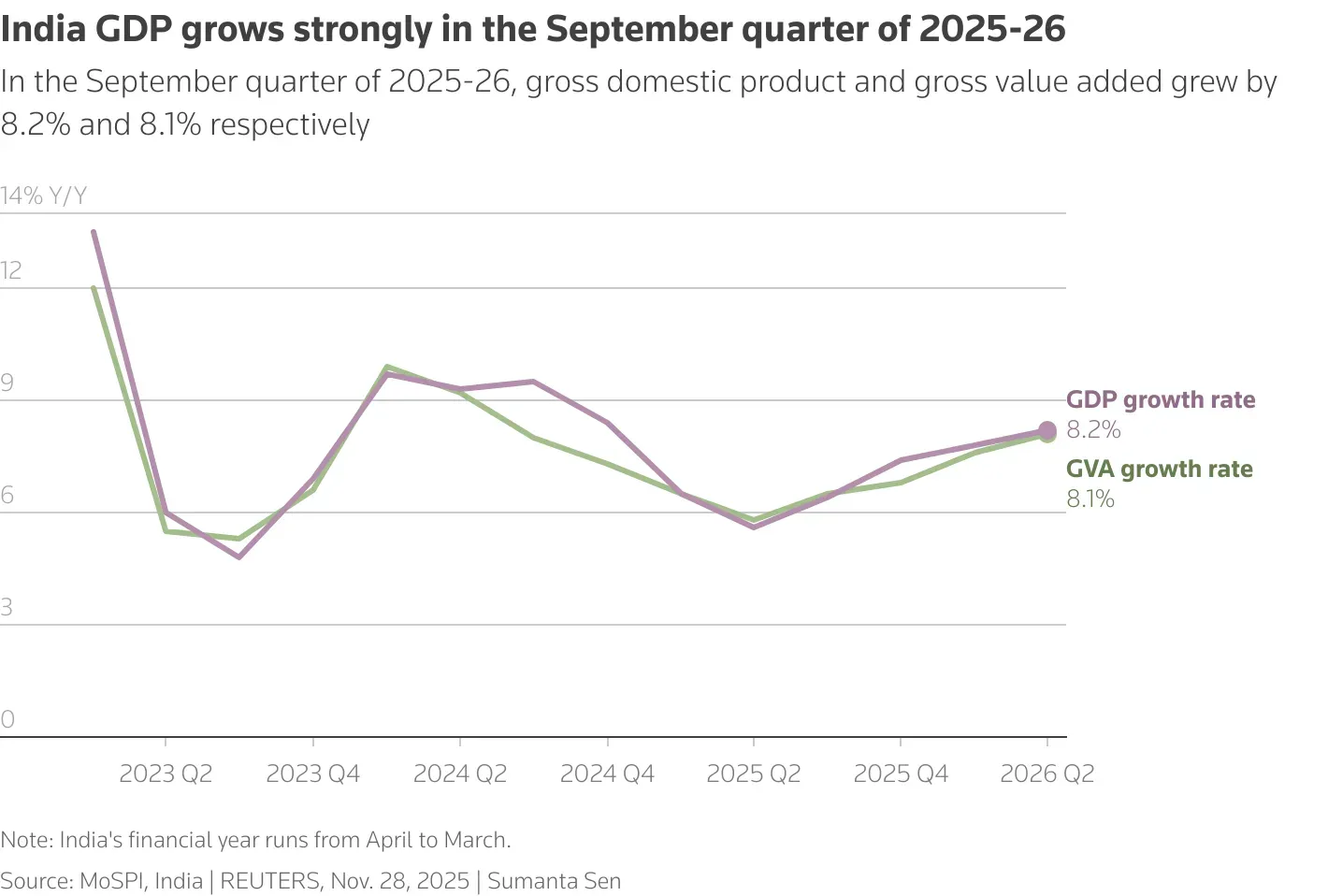

The broader backdrop is actually one of strong growth with manageable external stress. Real GDP grew 8.2% in the September quarter for FY26 , one of the fastest rates among major economies.

The current account deficit (CAD) narrowed sharply to about 0.7% of GDP in FY24, roughly USD 23 billion, before widening again more recently as domestic demand and imports picked up. Foreign exchange reserves remain substantial, around USD 686–688 billion, placing India among the world’s top reserve holders.

The 90-plus rupee not as a verdict on India’s economic health, but as the price that balances the global supply and demand for rupees.

This is not what a classic currency crisis looks like.

So, let’s look at it in detail today.

To see why the rupee is where it is, you have to understand India’s balance-of-payments “diary”.

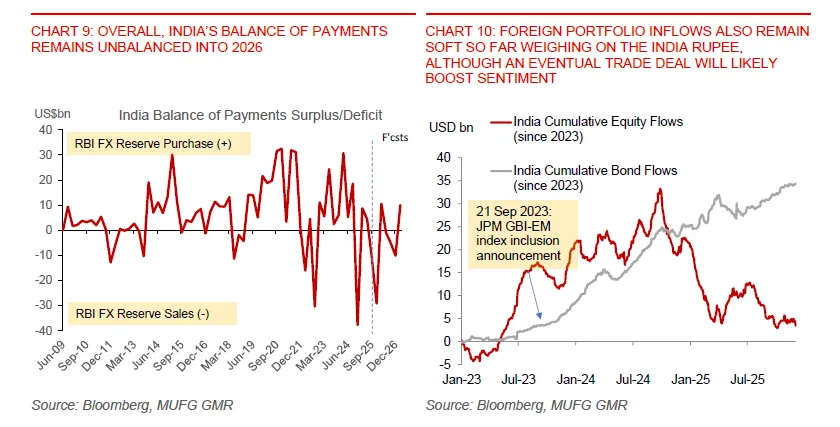

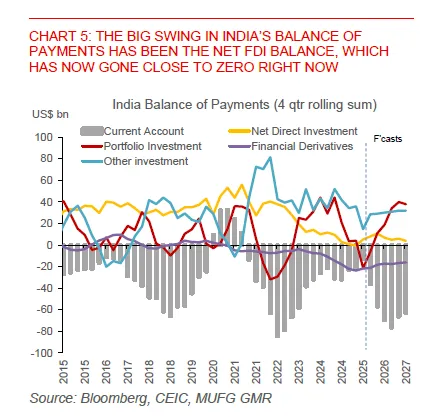

Over recent years, that diary shows a clear pattern: the current account has slipped back into deficit, net direct investment has faded from strong positives to near zero, and the overall balance of payments oscillates around modest deficits or small surpluses, with the RBI’s reserve sales or purchases smoothing the edges. In value terms, research expects India’s current account deficit to widen to about 64 billion US dollars in FY2026/27, roughly 1.5% of GDP, after sitting at just 0.7% of GDP in FY2024/25 and 1.3% in FY2025/26.

The run-rate of the trade deficit is projected to average just under 30 billion dollars through 2026, which is an improvement on the recent 30–40 billion dollar monthly gaps, but still wider than in 2025. When you plot these flows cumulatively, what jumps out is how often the line sits modestly below zero. That is what it means to have an unbalanced balance of payments: not a sudden collapse, but a persistent tendency for more money to leak out than come in unless the central bank leans against it.

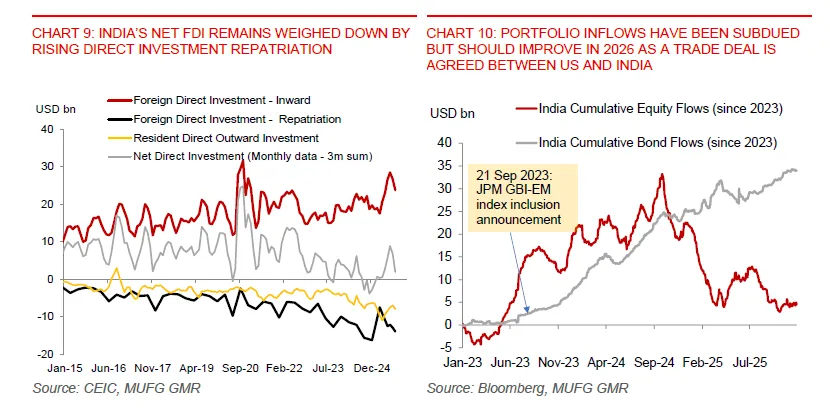

The net FDI balance – which used to contribute around 40 billion dollars annualised a few years ago – has slipped to essentially zero on a four-quarter rolling basis. On the same chart, the current account is moving deeper into deficit at the same time. That combination – a wider current account deficit and a thinner cushion from direct investment – is exactly why India’s external accounts look “unbalanced” into 2026 and why there could be a modestly weaker rupee.

On the current-account side, the mechanics are straightforward but the numbers are big. Whenever India imports oil, electronics, machinery or gold, someone has to sell rupees to buy foreign currency. When it exports software, pharmaceuticals and other goods and services, foreigners have to buy rupees to pay. Over time, the debit side has been winning: the current account, which was only a 0.7% of GDP deficit in FY2024/25, is forecast to widen to 1.3% in FY2025/26 and 1.5% in FY2026/27. That may not sound huge, but in an economy of India’s size that is tens of billions of dollars of net outflows each year, all of which have to be matched by capital inflows or by a weaker currency.

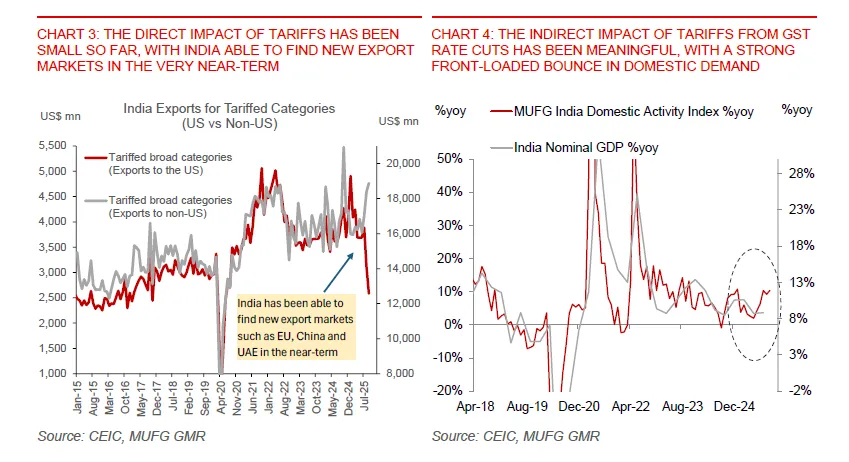

The trade balance into gold and non-oil/non-gold segments shows a sharp deterioration driven by a surge in gold imports and robust domestic demand after GST cuts.

At the same time, the domestic activity index which closely shadows nominal GDP growth, shows a powerful front-loaded bounce in activity from mid-2024 into late 2025 after GST rates were lowered and brackets simplified. In simple terms, tax cuts and strong growth have put more spending power in people’s hands, and a meaningful chunk of that extra spending has gone into goods that rely on imports, directly widening the trade deficit.

Tariffs complicate the picture. The direct hit from US tariffs on India’s exports has been limited so far because Indian firms have found alternative markets such as the EU, China and the UAE. Export But this workaround cannot fully offset the drag if elevated tariffs remain in place for long.

Even if tariffs are cut from 50% to 25% in early 2026 as part of a trade deal, which is better than today but still worse than for many of India’s competitors, exports will still soften and the current account deficit will widen. Without such a deal, the risks tilt towards an even weaker rupee and potentially more rate cuts.

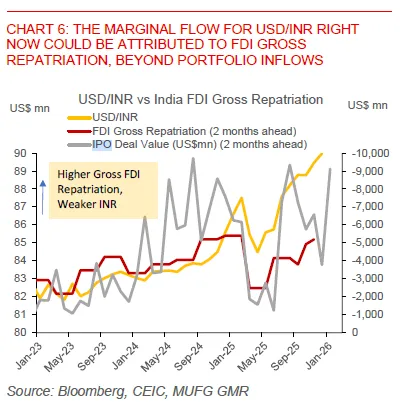

Historically, the balance of payment gap has been bridged by the capital account – the flows of money into Indian assets. The net foreign direct investment, which used to run at roughly 40 billion dollars annualised a few years ago, has faded to almost zero as of 2025. The reason is not just slower inward investment, but a sharp rise in FDI repatriation. Gross repatriation has climbed steadily, and when you offset it against new inflows and Indian firms’ own investments abroad, the net number shrinks dramatically.

As repatriation rises and IPOs give foreign investors opportunities to exit, the rupee weakens with a lag of a couple of months. The “marginal flow” driving USD/INR at the moment may be more about FDI profit-taking than about shifts in foreign portfolio flows. Whether this drying up of net capital is structural or cyclical remains an open question, but India’s balance of payments remains under modest pressure even after assuming a trade deal and some improvement in portfolio inflows.

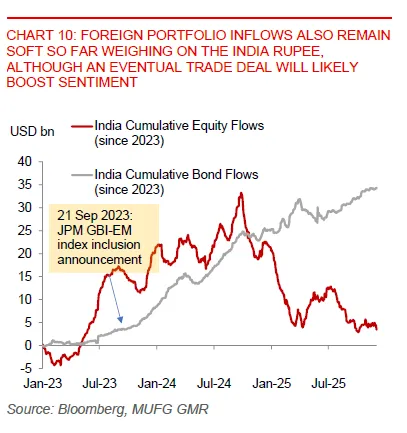

Portfolio flows themselves are a mixed bag. Cumulative equity and bond flow charts from early 2023 show that bond flows have improved, especially after the announcement in September 2023 that Indian government bonds would be added to the JP Morgan GBI-EM index, but equity flows remain choppy and often subdued.

Once you marry the current-account and capital-account numbers, the rupee’s drift weaker looks like simple arithmetic.

On the one side, you have a current account expected to run a deficit of about 1.5% of GDP, or 64 billion dollars, in FY2026/27, with a trade deficit averaging just under 30 billion dollars a month in 2026. On the other side, you have a capital account where net FDI has fallen from around 40 billion dollars annualised to roughly zero, portfolio flows are improving but still not spectacular, and residents themselves are sending more money abroad. India’s balance-of-payments surplus/deficit will oscillate around mild deficits into 2026 unless the RBI steps in with its reserves.

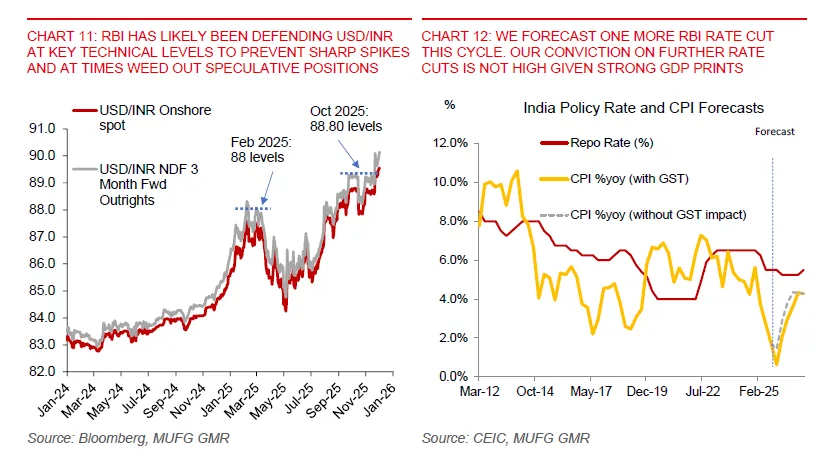

That is where the central bank’s FX operations come in. RBI likely sold more than 25 billion dollars in FX reserves between October and December to resist rupee weakness, and that its net short forward position reached about 64 billion dollars by October 2025. The charts show a clear pattern of negative reserve changes and rising net short forward positions at times when USD/INR approached or broke through key levels, such as 88 and then 88.80 earlier in 2025. The message is that the RBI has been actively leaning against sharp rupee moves, but the research also stresses that the fundamentals “ultimately imply some pressure for INR to weaken” and that the central bank is likely to “eventually allow USD/INR to break above 90” as part of an orderly adjustment.

Interestingly, market pricing does not signal panic about the rupee. The implied-volatility charts show one-month, three-month and twelve-month USD/INR option vols in a relatively tight range and described as “reasonably contained”. Risk-reversal measures, which capture whether markets are paying up for protection against extreme rupee weakness or strength, sit in a narrow band and do not point to expectations of a sharp slide.

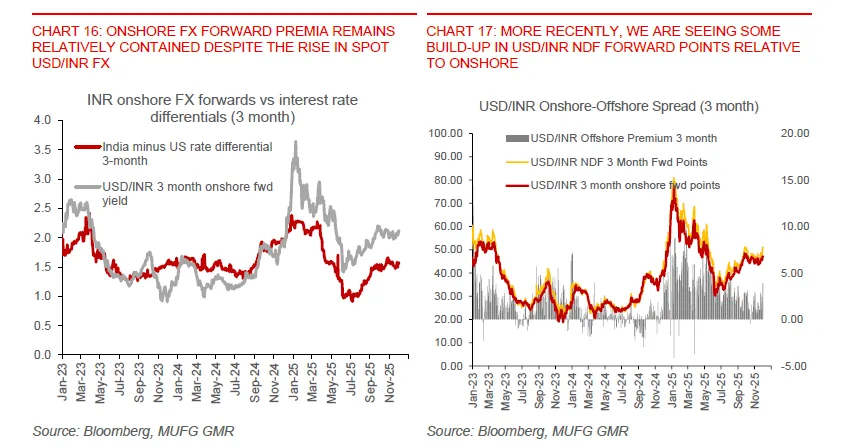

The December 2025 RBI meeting adds another layer to the story. The central bank delivered a 25-basis-point rate cut, taking the repo rate from 5.50% to 5.25%, and signalled that this probably marks the end of the easing cycle. At the same time, it announced sizeable liquidity injections: about 1 trillion rupees of open-market purchases of government bonds and a three-year FX buy/sell swap of 5 billion dollars, which together aim to inject around 1.4 trillion rupees into the system.

These measures matter for the currency because they tweak both the return on rupee assets and their perceived risk. FX forward implied yields dropped after the meeting as the commitment to liquidity eased earlier tensions in funding markets. Government bond yields fell modestly in the two-, five- and ten-year tenors, with a slight steepening of the curve.

At the same time, FX intervention had previously tightened conditions, pulling liquidity down from high surplus levels, before the RBI partially reversed that squeeze. The result is a finely balanced stance: policy is loose enough to support growth and credit, but not so loose as to fuel a disorderly rush out of rupee assets.

Crucially, the RBI is not trying to defend a particular USD/INR number. The December note is explicit that officials focused on managing FX volatility and “did not push back against INR weakness” in their communication. The reserve sales and forward-book moves are attempts to smooth “sharp spikes” and “weed out speculative positions”, not as a pledge to hold the line at, say, 88 or 90 forever. That approach is consistent with the FX option market’s relatively calm pricing.

Looking ahead, the base case is one of continued rupee softness, but against a backdrop of strong growth and manageable inflation rather than crisis-style stress.

In FX terms, the USD/INR could end 2025 around 89.50, before drifting to 91.00 by the end of FY2026/27 under the central scenario where US–India tariffs are cut from 50% to 25% by early 2026.

The risk scenario, explicitly spelled out in the RBI-focused note, is that if no trade deal is struck and tariffs stay at 50%, weaker exports and shakier investor sentiment could push USD/INR towards 92.

Even then, this is framed as an extension of the current adjustment rather than a sudden crash. The structural anchors – decent growth, contained inflation, improving bond-market access and a credible central bank – remain in place.

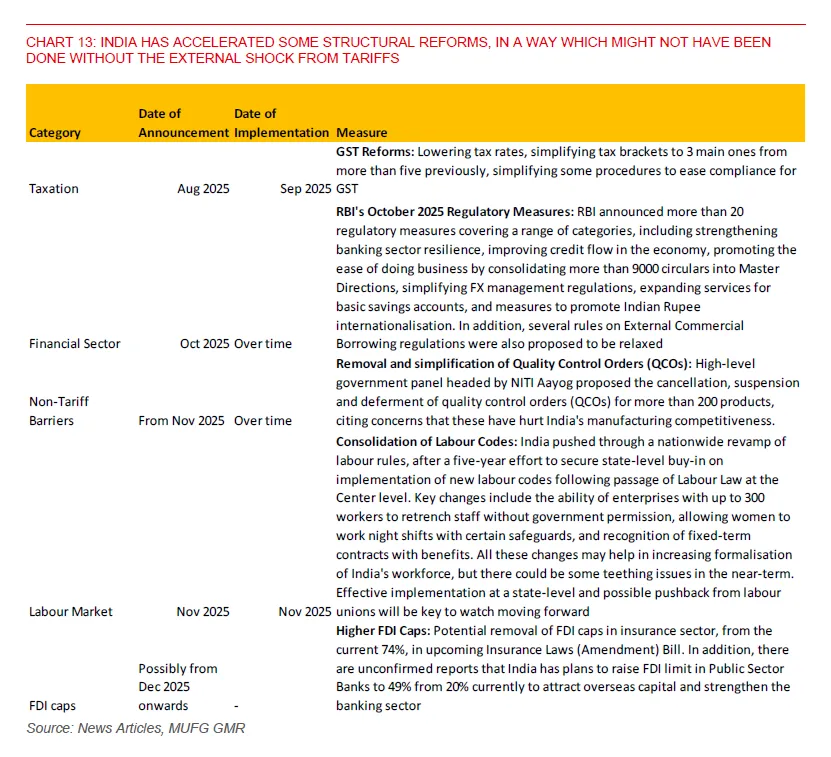

Finally, there is the reform story. A of structural measures that have been accelerated in the wake of the external tariff shock.

GST has been simplified, with tax brackets consolidated into three main slabs and procedures eased to improve compliance. The RBI’s October 2025 regulatory package consolidated more than 9,000 circulars into clearer Master Directions, simplified FX management rules and included steps to promote rupee internationalisation and expand basic banking services. A high-level panel has recommended cancelling, suspending or deferring quality-control orders for more than 200 products that were seen as hampering manufacturing competitiveness. Labour codes have been consolidated nationwide, with more flexible retrenchment rules and recognition of fixed-term contracts, while plans are afoot to lift foreign-ownership caps in insurance and raise FDI limits in public-sector banks.

Put together, these reforms point to an economy that is using this period of FX and trade tension to tackle long-standing bottlenecks. In the near term, the price of that adjustment is a somewhat weaker rupee, especially given the widened current account deficit and softer net FDI. India enters this phase with growth running above 7%, inflation temporarily very low, FX valuations already cheap on a real-effective basis and a reform agenda that could lift productivity and attract new capital over time.

For an investor or saver, the takeaway is less about whether USD/INR is at 89, 90 or 91 on any given day and more about the underlying trajectory: a currency adjusting in line with fundamentals, under active but measured central-bank management, in an economy that still looks fundamentally resilient.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart