The recent announcement by former US President Donald Trump to impose a 25% tariff on Indian imports, coupled with unspecified penalties, marks a critical juncture in USA & India’s trade relations. The 25% tariffs will inevitably exert downward pressure on India's economic growth. The fallout was immediately visible in India's financial markets: the NSE Nifty 50 Index opened down nearly 0.9%, while the rupee slid 0.3% in early trading following Trump's announcement. But the market recovered thereafter on Thursday, ending the day slightly higher.

In today’s video we evaluate implications of these tariffs, economic impacts, sectoral vulnerabilities, geopolitical dynamics, and the broader strategic ramifications.

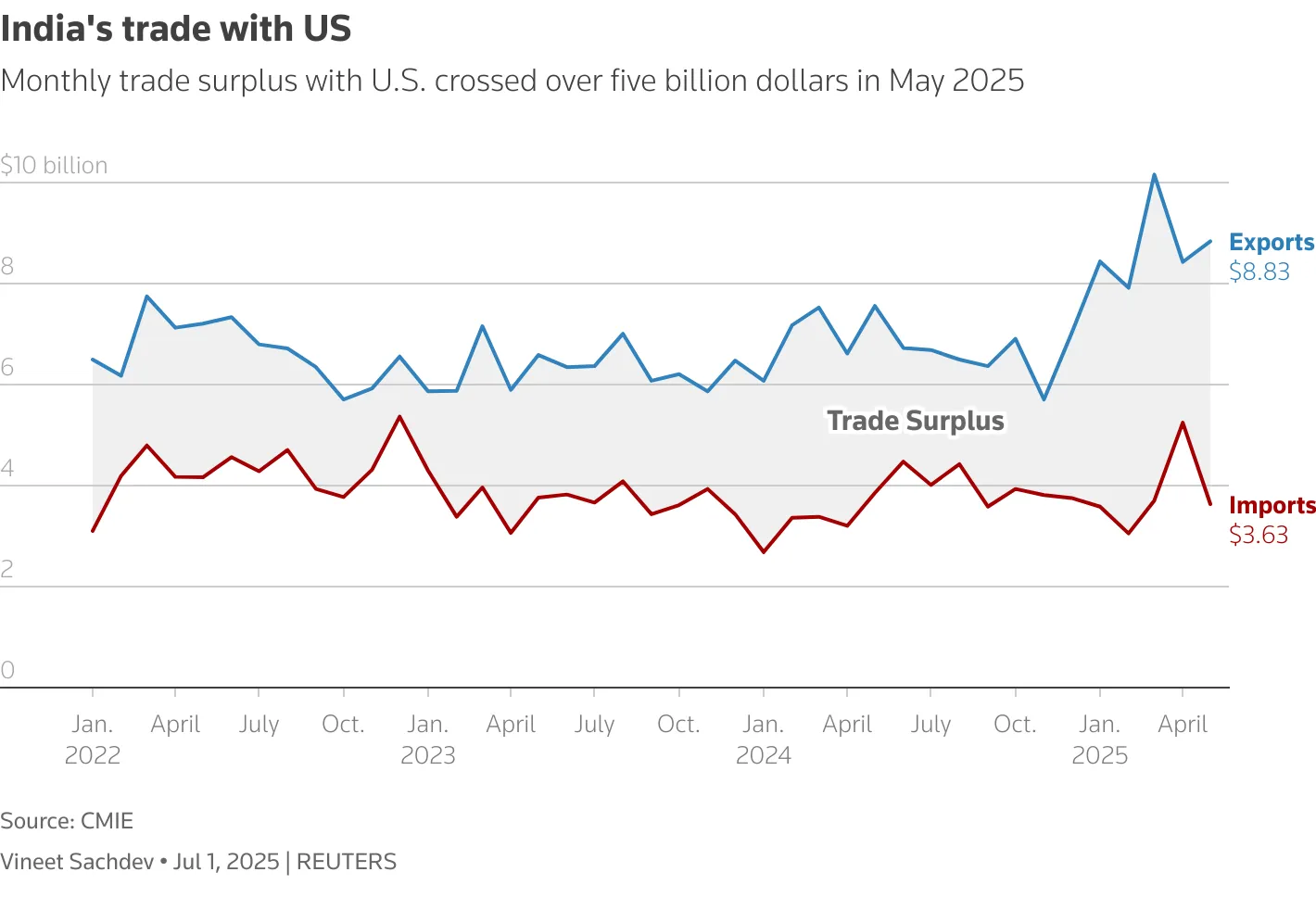

India’s monthly trade surplus with the United States surged significantly in May 2025, crossing the $5 billion mark. Exports from India reached $8.83 billion, while imports from the USA fell to $3.63 billion, widening the surplus. The trend indicates India's growing export strength and a notable reduction in imports, highlighting increasing dependence of the USA on Indian products.

President Trump sharply criticized India, labeling its economy "dead" and accusing it of maintaining "strenuous and obnoxious" non-monetary trade barriers and high tariffs. Trump emphasized that despite India being a strategic partner, trade volumes remain limited because of these factors.

Trump’s latest move revives his longstanding label for India: the "Tariff King." He claims India imposes some of the highest tariffs globally, coupled with significant non-monetary barriers limiting US goods. Yet, behind these rhetorical volleys lies a more complex truth. While India's average applied tariff indeed stood at 15.9% in 2024, significantly higher than America's 3.4%, the United States itself maintains stringent trade barriers, particularly on agricultural goods.

Another sticking point is India's extensive network of over 700 Quality Control Orders, aimed at limiting low quality imports and bolstering domestic manufacturing as part of the “self reliant India” push, contributing to the India & US trade deal delay. The US views these as significant non-tariff barriers that complicate market access and inflate costs for American exporters. While the effectiveness of these non-tariff barriers is up for debate as they can be unnecessarily restrictive.

Import caps: India restricts market access through quantitative import limits on agricultural goods like pulses and beans. Additionally, in 2023, India introduced new import licensing requirements for laptops and tablets, impacting major US companies such as Apple and Dell. Implementation of these restrictions has been extended until December 31, 2025, aimed at boosting domestic manufacturing.

Technical Barriers: India has imposed stringent, mandatory quality control standards across a wide range of products, including chemicals, medical devices, electronics, food, batteries, and textiles. These standards, governed by Indian certification authorities, often differ from international norms, making compliance challenging for US exporters.

Dairy Products: Indian regulations require certification verifying that dairy products are not derived from animals fed meat or animal based feeds, a rule that reflects local religious sensitivities. However, this significantly hampers US dairy exports to India, a critical global dairy market.

Internet and Data Localisation: India’s IT regulations create hurdles for American digital service providers, imposing personal criminal liability on employees, impractical compliance timelines, and an increasing number of politically motivated content takedown requests since 2021. Additionally, proposed data privacy laws mandate disclosure of personal data to Indian authorities, restricting cross border data transfers.

Customs Procedures: US exporters frequently face difficulties with Indian customs authorities rejecting declared transaction values, leading to investigations and disputes, especially involving the import of technology and computer equipment.

Banking and Insurance Restrictions: The US has also criticized investment restrictions in India's banking and insurance sectors. Ownership in state run banks is capped at 20%, despite their dominance (60% market share and 67% of branches), while foreign banks face opaque limits on expansion. Additionally, state run insurers operate under preferential conditions with explicit government backing.

Specifically, Trump's administration expressed frustration over India's significant procurement of military equipment and energy resources from Russia during the Ukraine conflict, branding these actions as detrimental to global peace efforts.

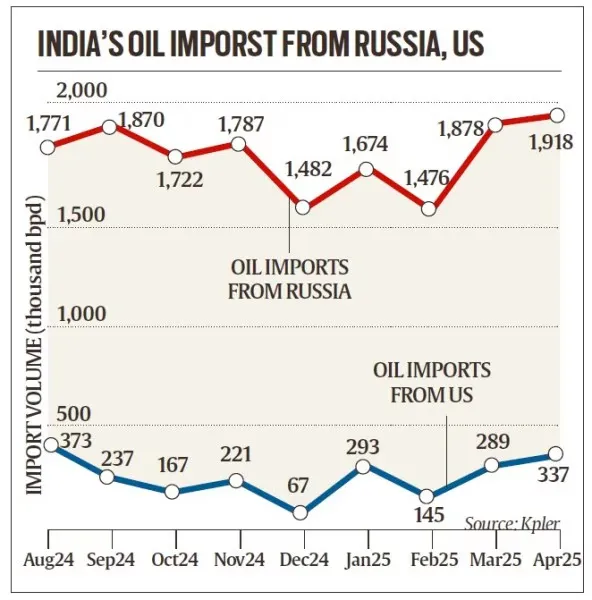

The addition of penalties is tied explicitly to India’s trade and defense relationship with Russia. India’s historical defense dependence on Russia and its pragmatic energy procurement policy, aimed at safeguarding domestic energy security, positions India unfavorably amidst US led international pressure against Russia due to the ongoing Ukraine conflict.

India’s strategic autonomy and its refusal to completely align with Western geopolitical interests against Russia is thus economically penalized, indicating a pronounced shift toward coercive economic diplomacy by the US administration. This development could inadvertently push India closer to alternative strategic alliances, including deeper integration with Russia, BRICS nations, or the Middle East.

According to Bloomberg, around 10% of India's total exports could suffer between July and September if tariffs exceed 25%. India and the US share a deep bilateral trade partnership of $190 billion, with expected to reach $500 billion in the next few years. Some experts suspect Trump wants to negotiate these major deals personally.

Domestically, the tariffs have triggered substantial political debate and criticism of India’s diplomatic strategy vis-à-vis the US. Opposition parties have characterized these developments as a severe diplomatic setback, implying failure in proactive engagement with critical international stakeholders.

India's Ministry of Commerce and Industry indicated that it was actively studying the implications of Trump's tariff announcement, reaffirming the government's commitment to protecting national interests. India's steadfast position highlights the importance it places on safeguarding the welfare of its farmers, entrepreneurs, and MSMEs, suggesting minimal flexibility on sensitive sectors like agriculture and dairy during negotiations. Any compromise on these fronts would pose significant domestic political risks, potentially impacting voter sentiment.

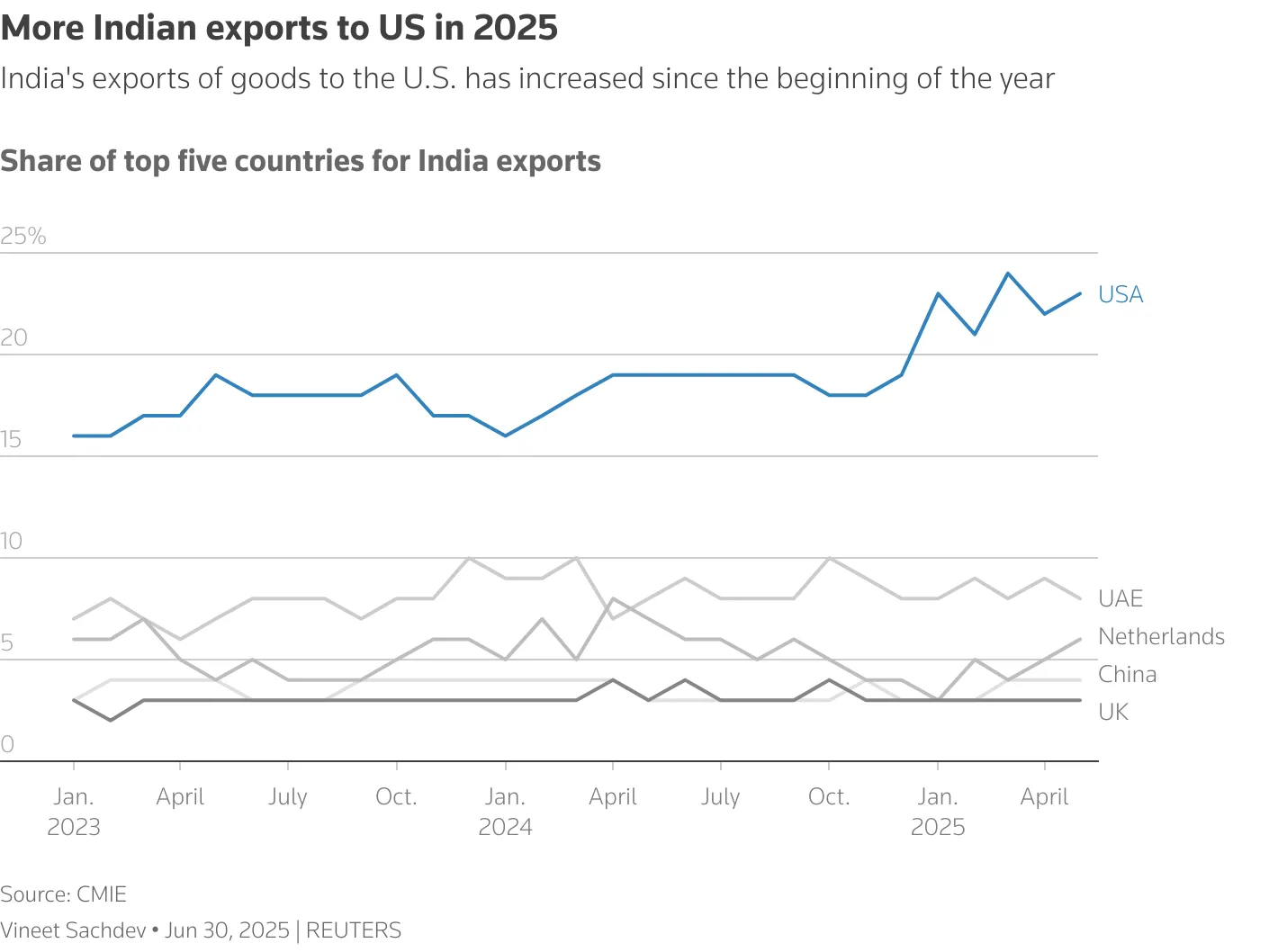

In 2025, the United States solidified its position as India’s top export destination, markedly increasing its share since the start of the year. The US now accounts for nearly 20% of India's total exports, far surpassing other major partners such as UAE, Netherlands, China, and the UK, whose shares remain relatively stable and significantly lower.

According to projections by economists at ICRA and Nomura, India’s GDP could experience a reduction between 0.2% and 0.5%. Given India's GDP growth forecast was already moderated from 6.5% to 6.2%, these tariffs represent a substantial additional economic headwind.

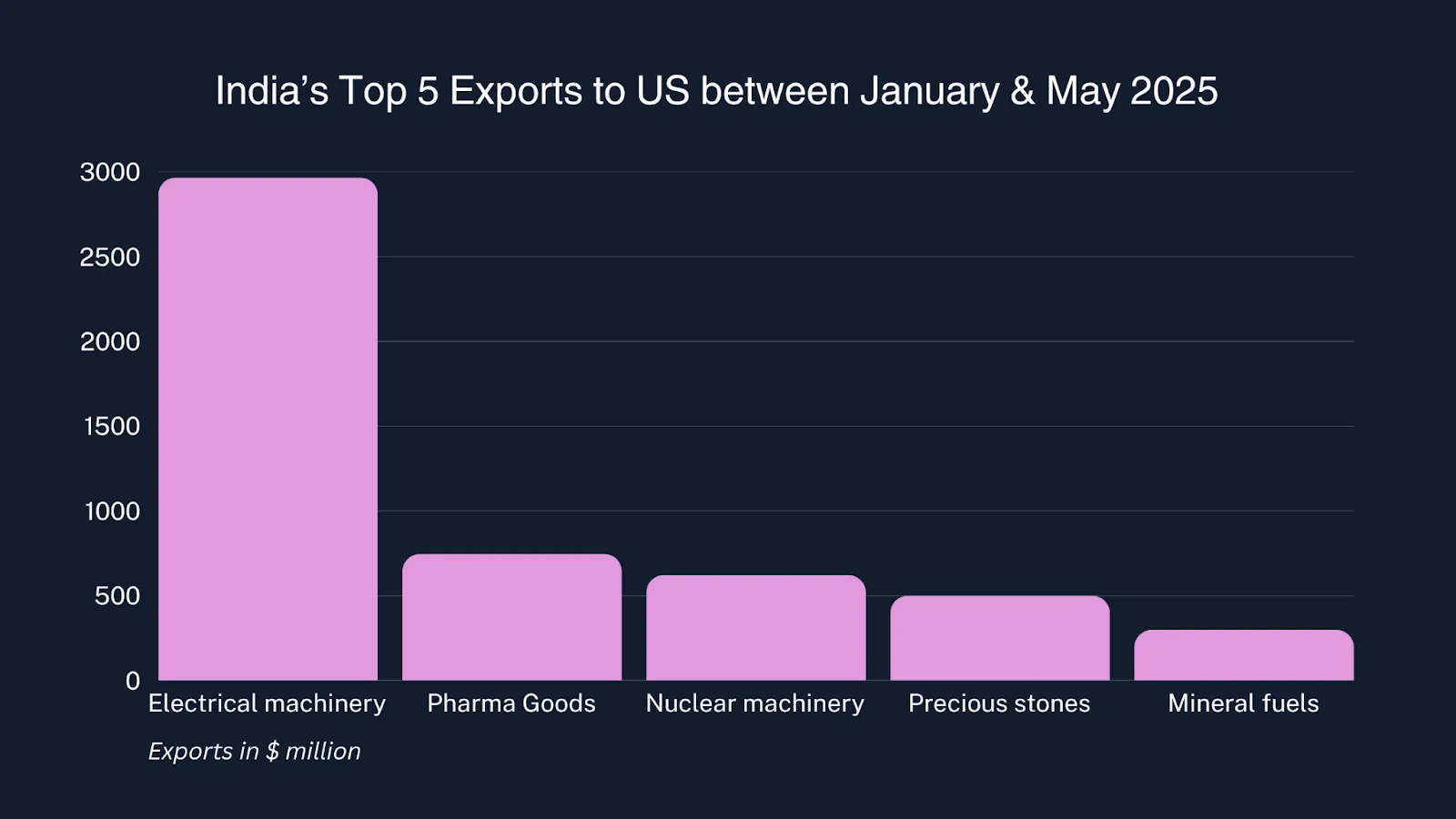

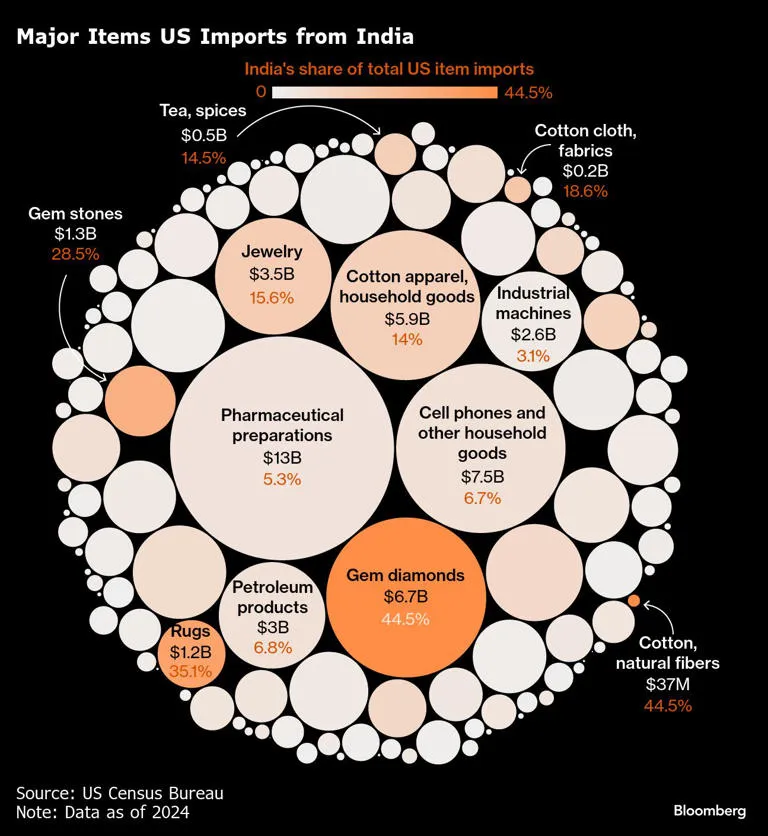

The sectors most vulnerable to tariff impacts are labor intensive export industries such as textiles, jewelry, automobile parts, pharmaceuticals, and processed foods. India’s exports to the US totaled approximately $87.4 billion in 2024, making America India’s largest export market. Hence, this tariff could significantly impact margins, competitiveness, and employment within these sectors.

Agriculture remains the central point of contention underpinning USA & India trade negotiations. The US government is particularly eager for expanded access to India's vast agricultural market to reduce its $45 billion trade deficit. India’s steadfast position to protect its agricultural sector, which employs millions of small scale farmers and serves as a backbone for rural economic stability, conflicts directly with US demands for greater market access. India's tariff protections, primarily aimed at securing domestic food security and livelihoods, remain non-negotiable despite intense US pressure. Key points include:

US demands for greater exports of maize, soya bean, cotton, and corn.

India's resistance to tariff reductions on politically and economically sensitive products like dairy, rice, and wheat, crucial for rural economic stability.

Concerns that concessions could undermine India's Minimum Support Price (MSP) framework and public procurement system, essential for safeguarding farmer incomes.

Conversely, while criticizing India’s tariff regime, the US maintains extremely high bound tariff ceilings on agricultural products such as tobacco, dairy, fruits, and vegetables, sometimes exceeding 200%. This underscores the inherent protectionism present within the US agricultural policy, revealing a critical double standard that undermines its tariff criticism against India.

The textile, apparel and gems & jewelry sectors, although not a dominant exporter to the US and with a modest share of the global textile market, remains vulnerable to sentiment driven selling pressures. They are crucial for employment generation domestically and will bear the brunt of tariffs. Higher tariffs will inflate prices for American consumers, thereby reducing demand and causing Indian exporters to either cut margins or lose market share. Companies such as Welspun India, KPR Mill, and Vardhman Textiles could face near term headwinds due to perceived risks. Considering the narrow profit margins, any absorption of tariff costs could substantially impair the viability of SMEs operating within these sectors.

Though not directly hit by the 25% tariff, India's IT services industry faces indirect pressures. Economic slowdown in the US, coupled with rising costs due to tariffs on other sectors, may prompt American companies to cut discretionary tech spending. This could pressure major IT exporters like Infosys, HCL Technologies, Tech Mahindra, and LTIMindtree, especially those heavily exposed to US retail and manufacturing clients.

Pharmaceuticals currently remain insulated from the immediate 25% tariff under the reciprocal tariff framework announced in April 2025. However, concerns remain about future policy moves. The ongoing Section 232 investigation into pharma imports is a lingering concern. While Trump previously indicated tariffs could eventually hit 200% to incentivize US based production, industry experts argue such tariffs are improbable as Indian pharma accounts for approximately 45% of US generic medications. Companies like Cipla and Piramal Pharma, which have significant US manufacturing footprints, appear well positioned to manage potential disruptions. Sun Pharma, in particular, suggested that any tariffs imposed would likely be passed on to US customers.

Steel and aluminium products are excluded from the newly announced reciprocal duties since they already fall under existing Section 232 tariffs. However, broader trade sentiment and global pricing pressures could create volatility in stocks such as Hindalco Industries, Tata Steel, and JSW Steel.

The energy sector appears largely shielded, thanks to exemptions provided for petroleum and electricity products. Major listed entities such as ONGC and Oil India are expected to remain largely unaffected. However, unlisted firms or refiners involved in complex trade activities like Nayara Energy could face friction, particularly in dealings involving Russian oil imports and resale to European markets.

While automobile components and electronics are largely exempt from the new tariffs under Section 232, Indian auto component manufacturers remain vulnerable to potential demand downturns in the US.

Increased tariffs will raise production costs for American manufacturers sourcing from India and export focused firms such as Samvardhana Motherson International, Bharat Forge, and Bosch. This potentially could lead to supply chain reconfiguration away from India towards competing Asian economies like Vietnam or China, negatively impacting India's position as an emerging manufacturing hub.

India had hoped for preferential treatment compared to regional peers after initiating early trade talks with Washington in February. Yet, the newly announced tariffs place India at a disadvantage as they are higher than the 20% applied to Vietnam, 19% to Indonesia, and 15% to Japan and South Korea.

Country | Tariff |

Indonesia | 19% |

Vietnam | 20% |

India | 25% |

Malaysia | 25% |

Mexico | 30% |

Bangladesh | 35% |

Thailand | 36% |

Myanmar | 40% |

Laos | 40% |

A critical factor exacerbating India’s vulnerability lies in the comparative easing of US tariffs against China (reduced from 145% to 30%) and Vietnam (reduced from 46% to 20%). India’s attractiveness as an alternative manufacturing hub to China diminishes substantially under these circumstances, potentially redirecting investment and trade flows away from India towards these countries. Thus, these tariffs are strategically detrimental, undermining India's position in global value chains.

From a macroeconomic perspective, prolonged tariff regimes could prompt RBI to adopt a more accommodative monetary policy stance to cushion growth. Deeper rate cuts may be considered to offset the contractionary effects of reduced exports. Concurrently, the government may consider fiscal measures, such as export incentives, subsidies, or enhanced domestic spending, to mitigate negative economic impacts.

Despite tariff setbacks, both India and the US maintain substantial strategic interests, with bilateral trade targets ambitiously set at $500 billion. Diplomatic engagement through ongoing negotiations remains pivotal. A comprehensive trade deal, although challenging, remains mutually beneficial. The forthcoming US delegation's visit signifies continued engagement opportunities, where India can negotiate reductions in tariffs, targeting rates closer to 15 to 20% as a realistic, albeit less than optimal, outcome.

India’s negotiating strategy must balance economic pragmatism with geopolitical realism, clearly articulating its strategic autonomy and economic imperatives while exploring viable compromises that protect core domestic interests.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart