by Naman Agarwal

Published On Sept. 15, 2025

Options trading has revolutionized the Indian financial markets, offering investors sophisticated tools to hedge risks, generate income, and speculate on market movements. At the heart of every options transaction lies a fundamental concept that determines success or failure: the option premium. Understanding what option premium is and how it works becomes crucial for anyone looking to navigate the complexities of derivatives trading in India's dynamic markets.

The option premium represents the price paid by buyers to option sellers for the rights conveyed by the contract. Unlike stocks where you pay the full price to own shares, options require only the premium payment to control a much larger position. This leverage makes options attractive, but the premium's behavior can be puzzling for newcomers. Factors ranging from market volatility to time decay constantly influence premium values, creating opportunities and challenges for traders across NSE and BSE platforms.

For Indian traders dealing with Nifty options, Bank Nifty derivatives, or individual stock options, mastering premium dynamics becomes essential. This comprehensive guide explores every aspect of option premiums, from basic definitions to advanced pricing factors, ensuring you develop the knowledge needed to make informed trading decisions in India's vibrant options market.

An option premium is the market price paid by the buyer to the seller for acquiring the rights granted by an options contract. This premium serves as compensation to the option writer for accepting the obligations associated with the contract while providing the buyer with valuable rights without corresponding obligations. The premium represents the only upfront cost for option buyers and the immediate income for option sellers.

In practical terms, when you purchase a call option on Reliance Industries with a strike price of ₹2,400, you pay a premium that might be ₹120 per share. Since each options contract typically covers 1,000 shares in Indian markets, your total premium outlay would be ₹1,20,000. This payment grants you the right to buy Reliance shares at ₹2,400 until the option expires, regardless of how high the market price rises.

The premium structure creates asymmetric risk profiles that make options unique financial instruments. Option buyers face limited risk equal to the premium paid but enjoy unlimited profit potential in favorable market movements. Conversely, option sellers receive the premium income immediately but accept potentially unlimited losses if markets move against their positions. This fundamental asymmetry explains why premium pricing must accurately reflect the risks and opportunities inherent in each contract.

Option premiums fluctuate constantly during market hours, responding to changes in underlying asset prices, market volatility, time remaining until expiration, and various other factors. Unlike the fixed premium paid at purchase, the market value of your option position changes continuously, creating opportunities for profit or loss before expiration. Understanding this dynamic nature becomes crucial for timing entries and exits effectively.

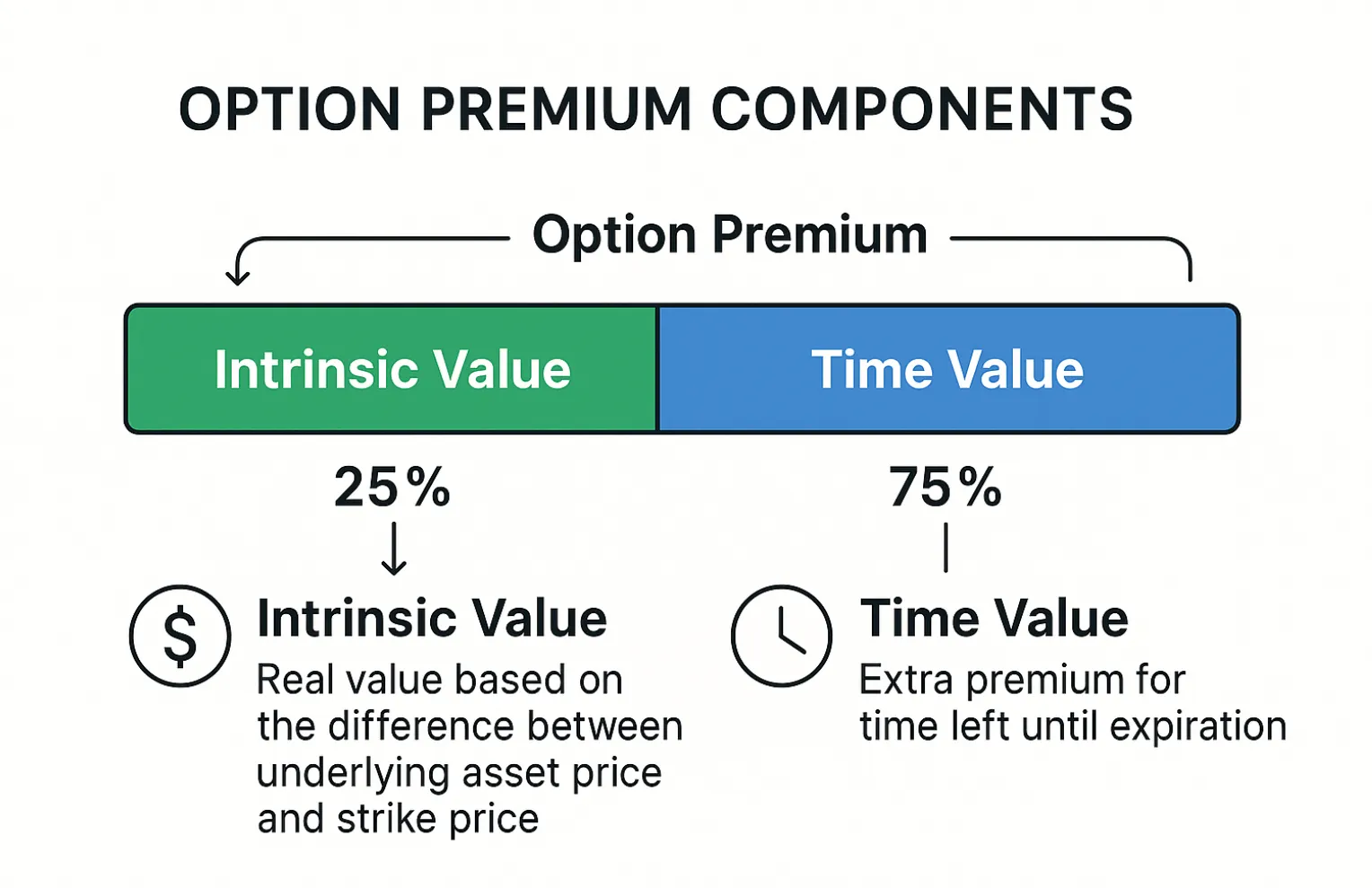

Every option premium consists of two fundamental components: intrinsic value and time value. This breakdown helps traders understand what they're paying for and how different market conditions affect premium values. The relationship between these components determines whether options appear expensive or cheap relative to their theoretical worth.

Intrinsic Value represents the immediate exercise value of an option contract. For call options, intrinsic value equals the difference between the current stock price and the strike price, provided the stock price exceeds the strike price. If Tata Consultancy Services trades at ₹3,800 and you hold a ₹3,600 call option, the intrinsic value equals ₹200. This component reflects the guaranteed profit available if you exercised the option immediately.

Put options calculate intrinsic value differently, using the excess of strike price over current market price. A Bank Nifty put option with a ₹45,000 strike price has ₹500 intrinsic value when Bank Nifty trades at ₹44,500. Options trading below their intrinsic value create arbitrage opportunities, though such situations rarely persist in efficient markets due to professional arbitrageurs.

Time Value encompasses everything beyond intrinsic value in the premium. This component reflects the option's potential to gain additional intrinsic value before expiration. Even out-of-the-money options possess time value because price movements could bring them into profitable territory. The time value compensates sellers for the uncertainty they face regarding future price movements.

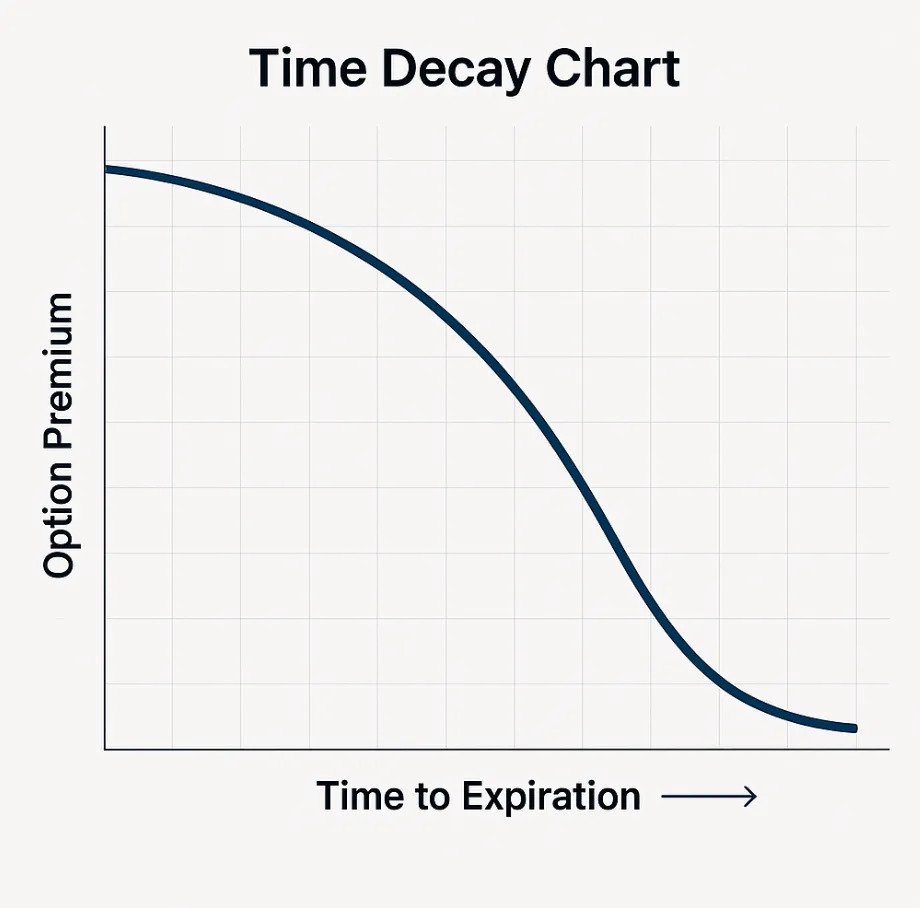

Time value diminishes predictably as expiration approaches, following a pattern called time decay. Options lose approximately one-third of their time value during the first half of their life and two-thirds during the second half. This acceleration means that options lose value more rapidly as expiration nears, making timing crucial for both buyers and sellers.

The balance between intrinsic and time value varies significantly across different options. At-the-money options possess maximum time value because they have the highest probability of finishing in-the-money with favorable movements. Deep in-the-money options consist primarily of intrinsic value with minimal time premium, while far out-of-the-money options contain only time value.

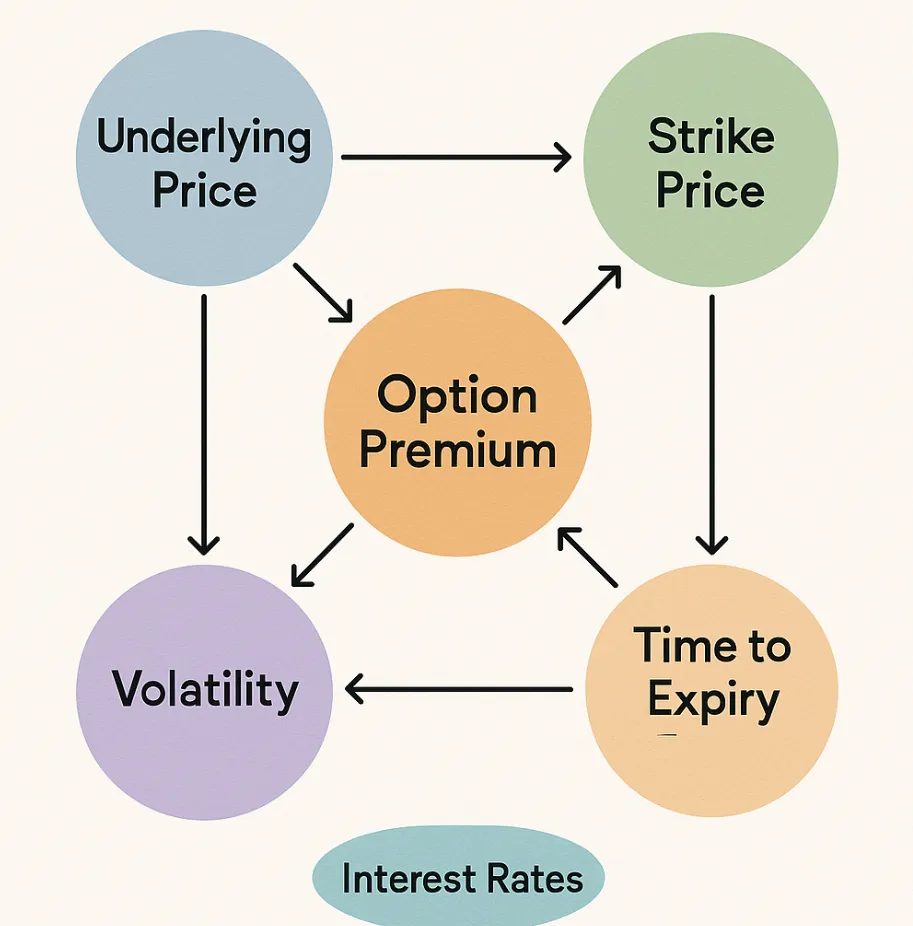

Option premiums aren't fixed values but dynamic prices shaped by multiple market and contract-related forces working simultaneously. Understanding these factors enables traders to anticipate premium movements and identify trading opportunities before they become obvious to the broader market. Each factor influences premiums differently depending on market conditions and option characteristics.

The complexity of premium pricing arises from the interconnected nature of these factors. A change in underlying price affects intrinsic value directly but also influences implied volatility and time value indirectly. Similarly, approaching expiration accelerates time decay while potentially increasing volatility as market participants adjust positions. Successful options trading requires understanding how these factors interact rather than viewing them in isolation.

Market participants must grasp these pricing dynamics before buying or selling options because premiums can move against positions even when directional views prove correct. A trader might correctly predict that Infosys will rise but still lose money on call options if volatility collapses or time decay exceeds price appreciation. Conversely, understanding premium mechanics helps identify situations where options appear mispriced relative to their theoretical values.

Professional traders spend considerable time analyzing these factors using sophisticated models and real-time data. However, retail traders can develop intuitive understanding by observing how premiums respond to different market scenarios. This knowledge becomes particularly valuable during earnings seasons, policy announcements, and other events that significantly impact option pricing factors simultaneously.

Premium fluctuations result from the continuous interplay of multiple dynamic factors, each responding to changing market conditions throughout the trading day. Unlike stocks that primarily move based on company-specific news and market sentiment, option premiums incorporate expectations about future volatility, time decay, and probability assessments of various price outcomes.

Time Decay represents the most predictable source of premium fluctuation, working against option buyers consistently. This decay accelerates as expiration approaches, following mathematical patterns that traders can model precisely. Weekly options experience rapid time decay, losing substantial value each day during their final week. Monthly options decay more gradually initially but accelerate significantly during their last two weeks.

Volatility Changes create some of the most dramatic premium movements, often exceeding those caused by underlying price changes. When market participants anticipate increased uncertainty such as before earnings announcements or policy decisions implied volatility rises sharply, inflating premiums across all strike prices. Conversely, volatility collapses after events pass, causing premiums to decline even if underlying prices remain stable.

Underlying Price Movements affect premiums through multiple channels simultaneously. Direct effects include changes in intrinsic value for in-the-money options and shifts in moneyness for all options. Indirect effects involve volatility adjustments as market participants reassess future price uncertainty based on current movements. Large price gaps often trigger volatility spikes that amplify premium changes beyond what intrinsic value changes alone would suggest.

Interest Rate Fluctuations influence premiums subtly but meaningfully, particularly for longer-term options. Rising rates increase call option values while decreasing put option values, reflecting the cost of carrying underlying positions. In India's dynamic interest rate environment, these effects become more pronounced during monetary policy cycles and economic transitions.

The interaction between these factors creates complex premium behaviors that can surprise inexperienced traders. Understanding these dynamics helps explain why options sometimes gain value when underlying prices move against them or lose value despite favorable price movements.

Option premiums serve as the foundation for all options trading strategies, determining profit potential, risk exposure, and strategic viability. Every trading decision ultimately revolves around whether premiums offer favorable risk-reward relationships given market expectations and probability assessments. Mastering premium analysis separates successful options traders from those who struggle with consistent profitability.

Risk Management benefits enormously from premium understanding because the premium paid represents the maximum loss for option buyers. This defined risk characteristic makes options attractive for hedging existing positions or speculating with limited downside exposure. Traders can size positions appropriately by calculating maximum loss scenarios based on premium costs rather than estimating potential losses from unlimited risk strategies.

Strategy Selection depends heavily on premium levels relative to expected market movements. Expensive premiums favor selling strategies that profit from time decay and volatility contraction, while cheap premiums support buying strategies that benefit from large price movements or volatility expansion. Successful traders adjust their approach based on current premium levels rather than maintaining fixed preferences.

Timing Decisions become more precise when traders understand premium components and their sensitivity to various factors. Buying options before volatility events and selling them afterward captures premium expansion and contraction cycles. Similarly, understanding time decay patterns helps optimize entry and exit timing to maximize time value capture or minimize time value loss.

Profit Optimization requires balancing premium costs against profit potential across different strike prices and expiration dates. Higher premium options offer greater profit potential but require larger favorable movements to achieve profitability. Lower premium options provide better percentage returns on smaller movements but limit absolute profit potential. This trade-off analysis guides strike price selection and position sizing decisions.

Professional traders develop systematic approaches to premium analysis, using mathematical models and probability assessments to identify mispriced options consistently. While retail traders may not access the same sophisticated tools, understanding basic premium principles enables better decision-making and improved trading outcomes in Indian options markets.

Option premium pricing follows mathematical models that incorporate multiple variables to estimate fair values under different market scenarios. The most widely used model, Black-Scholes, provides theoretical prices that serve as benchmarks for market trading, though actual premiums may deviate based on supply and demand dynamics.

Current Stock Price forms the primary input for premium calculations, directly affecting intrinsic values and influencing probability assessments for various outcomes. As stock prices rise, call option premiums increase while put option premiums decrease, reflecting changing exercise probabilities. The relationship isn't linear because volatility and other factors adjust simultaneously with price changes.

Strike Price Selection determines the option's moneyness and significantly influences premium levels. At-the-money options command highest premiums due to maximum time value, while deep in-the-money options consist primarily of intrinsic value with minimal time premium. Out-of-the-money options contain only time value, making them sensitive to volatility and time decay changes.

Time Until Expiration affects premiums through time value calculations that consider the probability of favorable price movements during the remaining period. Longer-term options cost more because additional time increases chances for profitable outcomes. However, the relationship isn't proportional—doubling time doesn't double premiums because time value follows square root relationships in most pricing models.

Implied Volatility represents market participants' collective assessment of future price uncertainty and often deviates significantly from historical volatility. High implied volatility inflates premiums across all strikes because greater price swings increase profit probabilities for option buyers. Volatility trading becomes profitable when traders accurately predict volatility changes independent of directional movements.

Interest Rates influence premium calculations through present value adjustments and carrying cost considerations. Higher rates increase call option values because they reduce the present value of strike prices paid upon exercise. Put option values decrease with rising rates because early exercise becomes less attractive when money has higher alternative returns.

Dividend Expectations affect option premiums because stock prices typically decline by dividend amounts on ex-dividend dates. Expected dividends reduce call option premiums and increase put option premiums, particularly for options approaching ex-dividend dates. Indian markets see pronounced dividend effects during dividend-heavy seasons.

Option premiums represent far more than simple transaction costs—they embody the collective wisdom of market participants regarding future price probabilities, volatility expectations, and time value relationships. For Indian traders navigating NSE and BSE options markets, understanding premium dynamics provides the foundation for successful trading across all strategies and market conditions.

The interplay between intrinsic value and time value creates opportunities for traders who understand these relationships and can anticipate their changes. Whether pursuing income generation through option writing, hedging existing positions, or speculating on directional movements, premium analysis guides every decision from strategy selection to position sizing and timing.

Success in options trading ultimately depends on developing intuitive understanding of how premiums respond to changing market conditions. This knowledge enables traders to identify mispriced opportunities, optimize entry and exit timing, and manage risk effectively. As Indian options markets continue growing in sophistication and participation, mastering premium concepts becomes increasingly valuable for achieving consistent profitability.

The mathematical precision of option pricing models provides frameworks for analysis, but real-world trading success requires understanding the human psychology and market dynamics that cause actual premiums to deviate from theoretical values. This combination of quantitative knowledge and market intuition separates consistently profitable options traders from those who struggle with the complexities of premium behavior.

No, option premiums are not refundable once paid. The premium represents the cost of purchasing rights granted by the option contract and becomes the seller's income immediately upon transaction completion. If you buy an option and it expires worthless, you lose the entire premium paid. However, you can sell your option before expiration to recover some value if the option still has market value remaining.

Option premiums cannot be exactly zero in liquid markets because they always contain some time value until expiration, even for deeply out-of-the-money options. However, premiums can approach very small values, trading at ₹0.05 or ₹0.10 for options with extremely low exercise probabilities. At expiration, out-of-the-money options become worthless, but until that moment, some minimal premium typically exists reflecting tiny possibilities of profitable movements.

The option seller (writer) receives the premium paid by the option buyer. When you purchase a call or put option, your premium payment goes directly to whoever sold that option contract. This immediate income represents the primary benefit for option sellers, who accept the obligations associated with the contract in exchange for receiving the premium upfront. The premium becomes the seller's profit if the option expires worthless.

Option premiums determine the cost of entering positions, maximum loss potential for buyers, and income generation for sellers. Understanding premium behavior enables traders to identify profitable opportunities, manage risk effectively, and optimize timing decisions. Premium analysis helps distinguish between expensive and cheap options relative to expected market movements, guiding strategy selection and position sizing. Without premium understanding, traders cannot evaluate whether options offer favorable risk-reward relationships.

Yes, time significantly affects option premiums through time decay, which reduces option values as expiration approaches. Time value decreases predictably, with options losing approximately one-third of their time value during the first half of their life and two-thirds during the second half. This acceleration means options lose value more rapidly near expiration, making timing crucial for both buyers and sellers. Time decay works against option buyers but favors option sellers who profit from this predictable value erosion.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart