Last week was a big week for the markets. First, the US inflation numbers came lower than expected after months of struggle to contain inflation. A lot of action happened in the US tech markets with Elon Musk’s shenanigans at Twitter and a big crash in the crypto market due to the FTX meltdown.

Let’s unwrap the market with some charts and some high-quality memes!

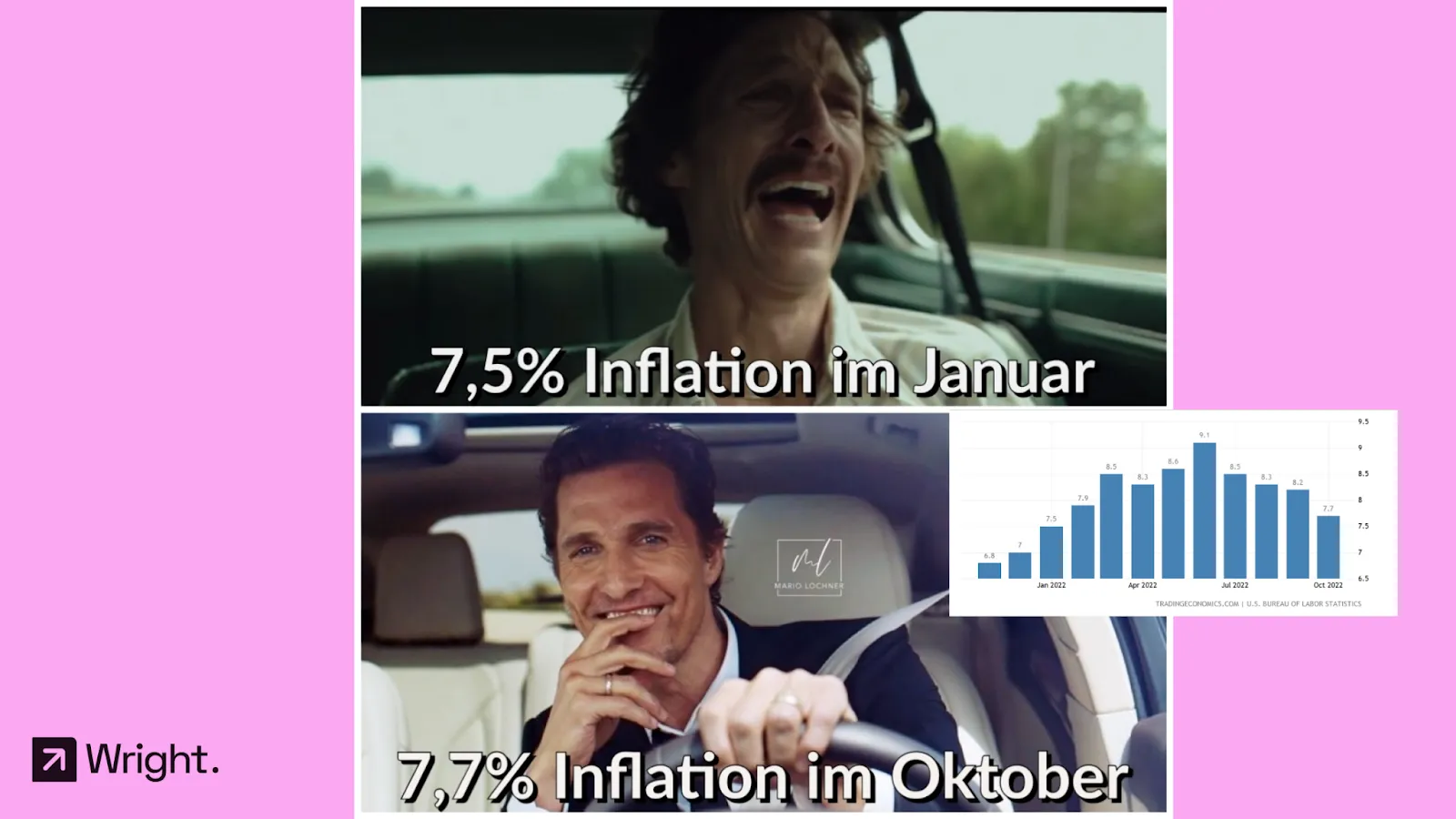

While the US inflation eased more than expected but stayed far above the US FED target of 2%, inflation is excellent news in the current environment where central banks have been struggling to contain inflation.

The reaction of the markets to the inflation numbers was one to watch, though! The moment the inflation came lower than expected - all the risk assets, Equities, Gold, and Currencies vs the Dollar rallied sharply.

Elon Musk opened the Twitter Blue tick for anyone who could pay 8$/month to the platform, and many hilarious and dangerous consequences followed. Several accounts started impersonating famous people and big brands with the blue tick mark, which needed clarification. Twitter eventually had to stop the 8$ for the blue tick program immediately.

The platform was full of memes about this. Still, the most alarming ones were billions being wiped out of large companies like Lockheed Martin and Eli Lilly because impersonator accounts tweeted something random.

As one of the largest crypto exchanges FTX, files for bankruptcy, the entire $16 billion fortune of former FTX co-founder Sam Bankman-Fried has been wiped out in one of history's greatest destructions of wealth.

A subsidiary of FTX, Almeda research, had been holding a lot of tokens of FTX’s crypto FTT and as the prices of the token collapsed, there was a bank run of customer withdrawals.

Binance CEO Zhao stepped in to rescue FTX, agreeing on Tuesday to buy the company but then announcing on Wednesday that he was stepping away from the deal. As a result, there have been relaunched regulatory investigations in the US, FTX.

Our portfolios have struggled over the last month. First, because of the sharp crash in Tata Elxsi, one of our most significant holdings for more than two years, last week, after the Tech sector revived suddenly after the US Inflation release, the portfolios did not follow suit due to low-tech holdings.

But investing is a long-term game. We are not frazzled. We’ll watch how the markets unfold, and we expect a long-term outperformance of our factor-driven methodology.

The significant events to watch for in the next week will be:

First, the US midterm election results will give us a clearer stance on their policies relating to the markets.

More than 1,000 companies are scheduled to release their earnings on Monday as the results season ends.

India’s consumer price inflation data for October is due on Monday, and that will be on the investors’ radar, especially after the sharp rise in September.

Strong buying by foreign investors has backed the gains registered by domestic equities this month, and we will have to watch those trends.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart