by Siddharth Singh Bhaisora

Published On June 1, 2025

US has a $36 trillion ticking debt bomb. And it's ticking louder than ever. The IMF has even sent a warning. Today we will analyse what the US debt crisis means for us as investors. We will look at –

1. What exactly is this debt bomb?

2. Why is it hitting a critical point now?

3. And why is the whole world seemingly paying such close attention?

As of 2025, the United States faces a staggering national debt burden, soaring past $34 trillion and climbing steadily. While political debates often point fingers at opposing parties or isolated spending bills, the truth is more systemic—and much more alarming. Four brutal, interconnected truths reveal how the U.S. has entered a dangerous cycle of unsustainable borrowing and spending. Let’s break them down.

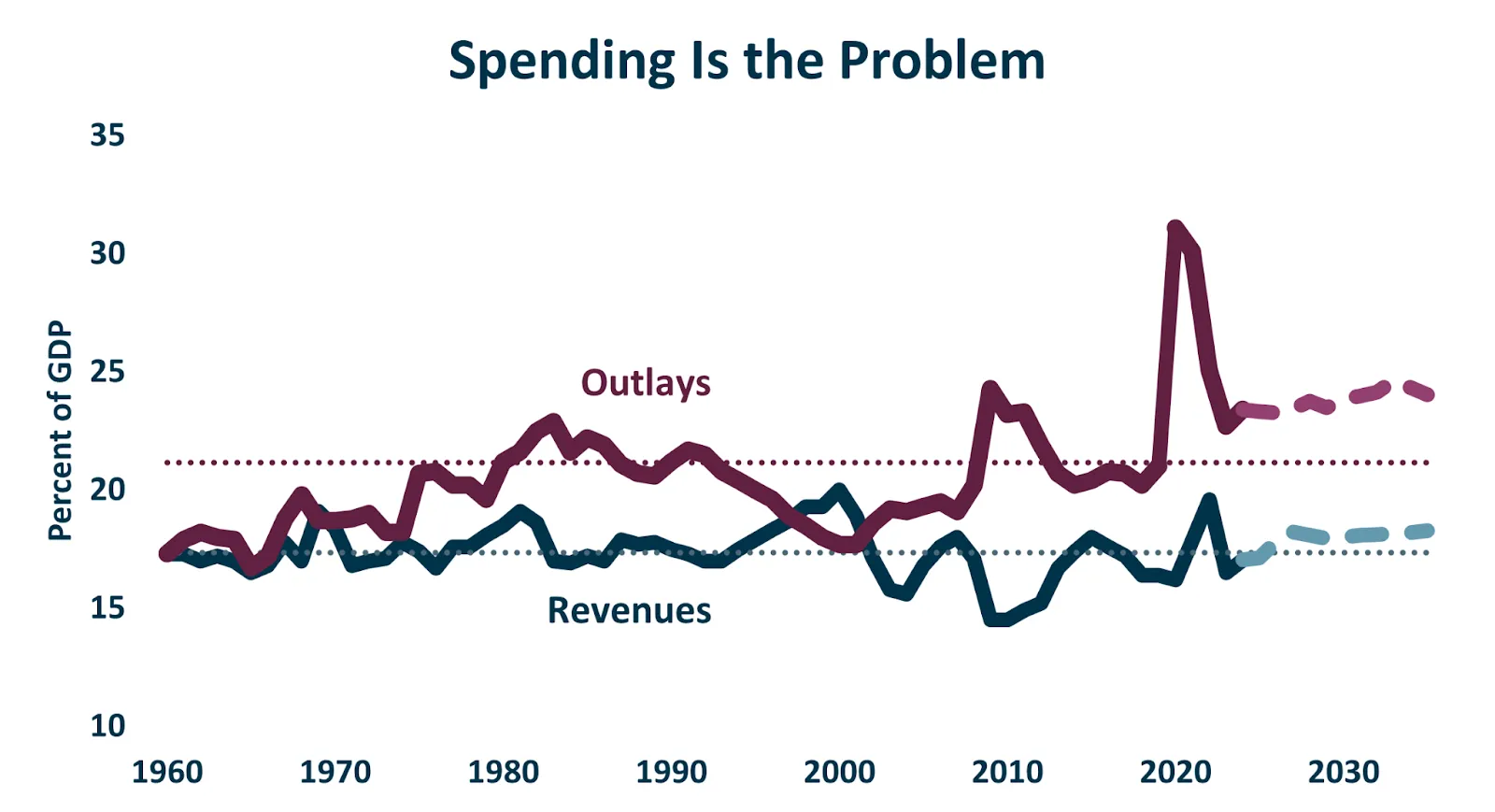

Regardless of economic conditions—whether the nation is enjoying a boom or grappling with a recession—the U.S. government has operated at a deficit virtually every year for decades. In simple terms, America consistently spends more than it earns.

Imagine someone with a modest paycheck who insists on a luxury lifestyle, financing it all on credit cards and loans. That’s the U.S. federal budget in a nutshell.

So, where does all this money go?

A massive portion of federal spending—nearly 70%—is locked into mandatory expenditures like:

Defense: Around $800 billion annually, more than the next ten countries combined.

Social Security & Medicare: Costs ballooning due to an aging population.

Interest payments: A growing obligation (more on this later).

Layered on top of these are trillions spent on COVID-19 relief, infrastructure bills, military aid, and other discretionary programs. The result is a government that bleeds red ink—year after year—regardless of whether revenues are strong or weak.

High spending would be sustainable—if matched by high revenues. But that hasn’t been the case.

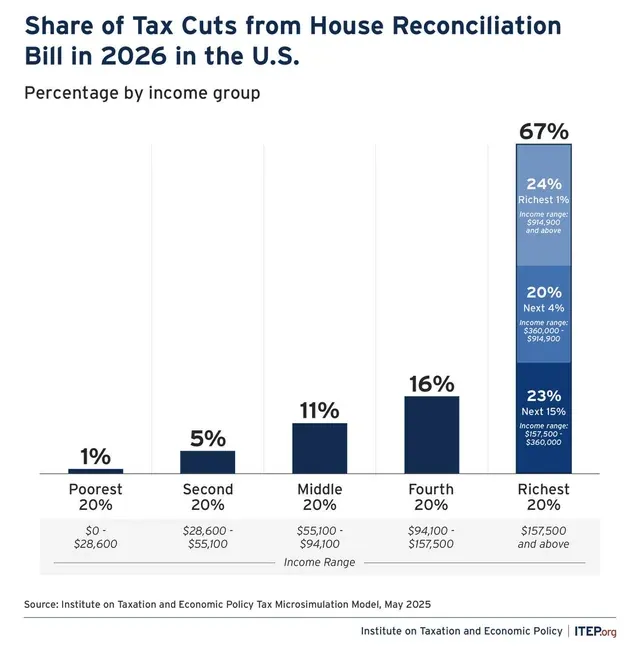

Over the decades, federal tax policy has favored the wealthy, with disproportionate tax cuts flowing to the top earners. In fact, the richest 20% of Americans benefit from about 65% of all federal tax cuts. These tax breaks may boost private wealth, but they do little to replenish public coffers.

Meanwhile, corporate tax rates have declined, and tax loopholes remain wide open, contributing to a structural revenue shortfall.

So, we end up with a government that:

Spends like a big economy.

Collects revenue like a smaller one.

Borrows the difference.

And that difference keeps getting larger.

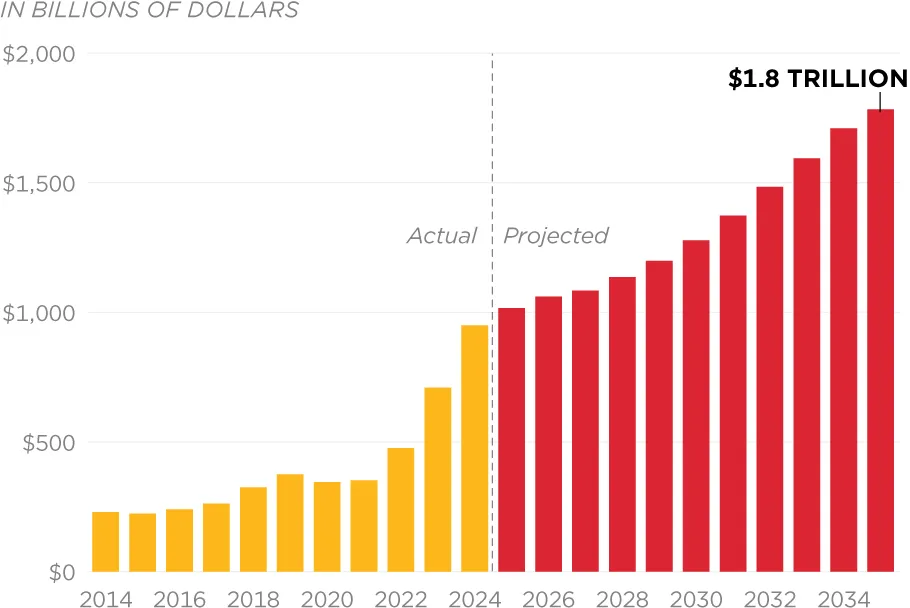

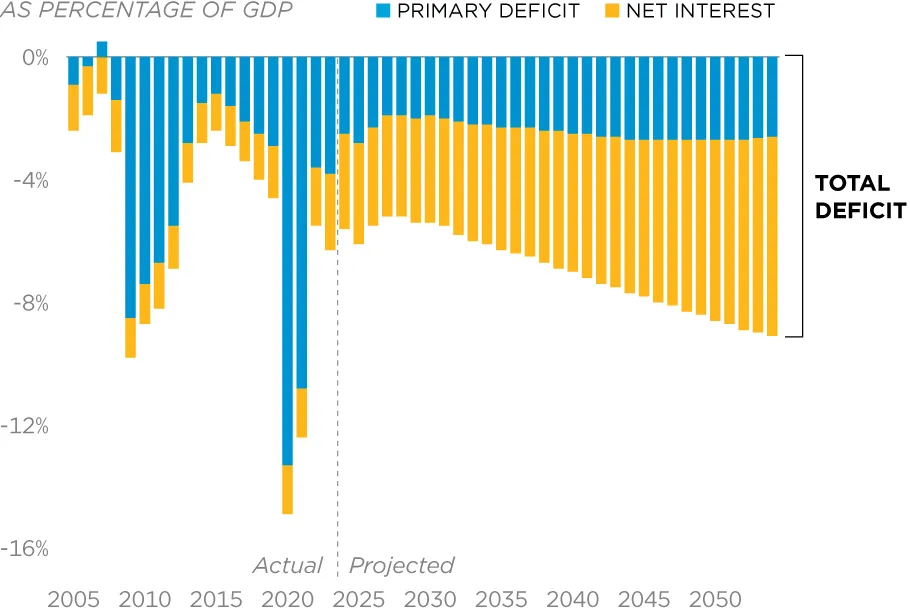

Borrowing has consequences—chief among them, interest payments. In 2024, the U.S. spent nearly $1 trillion annually just on interest—more than the GDP of 174 countries.

Worse, this isn’t a one-time spike. It’s a self-reinforcing cycle:

Deficits lead to borrowing → borrowing increases the debt → debt increases interest payments → interest payments deepen the deficit → repeat.

This is the dreaded debt spiral, and it’s becoming harder to escape. Projections suggest that interest payments could consume 6.5% of U.S. GDP annually if current trends continue.

Adding to the danger is the U.S. hitting its debt ceiling repeatedly—over 70 times since the 1960s. Each time, Congress has simply raised the limit. That might avoid short-term default, but it sidesteps the deeper issue: unchecked borrowing.

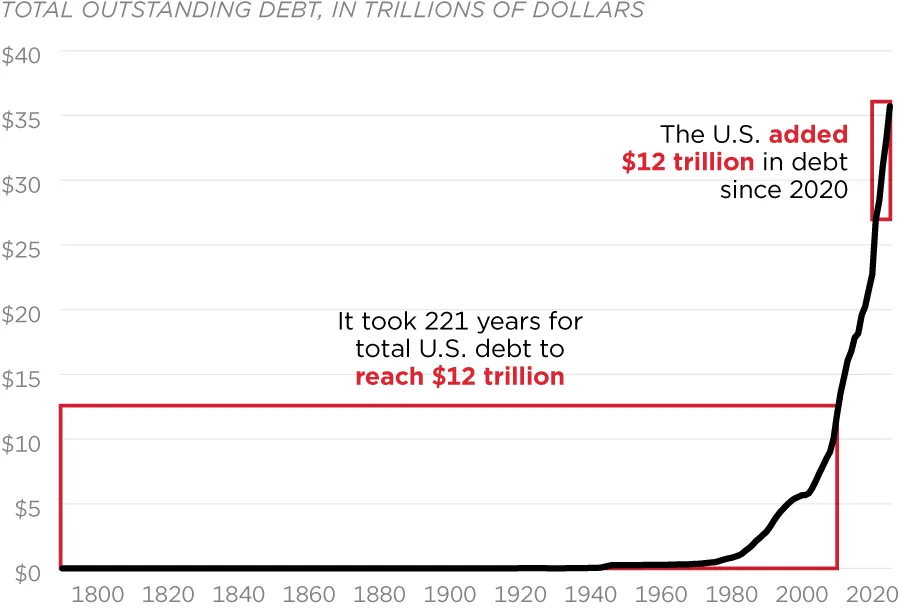

From 2020 to 2024, the national debt ballooned by $12 trillion—a number that took over two centuries to reach the first time.

So is there really a limit? Or is the ceiling just an illusion?

One reason the U.S. could sustain high borrowing in the past was that investors around the world eagerly bought U.S. Treasury bonds—considered ultra-safe. But that’s starting to change.

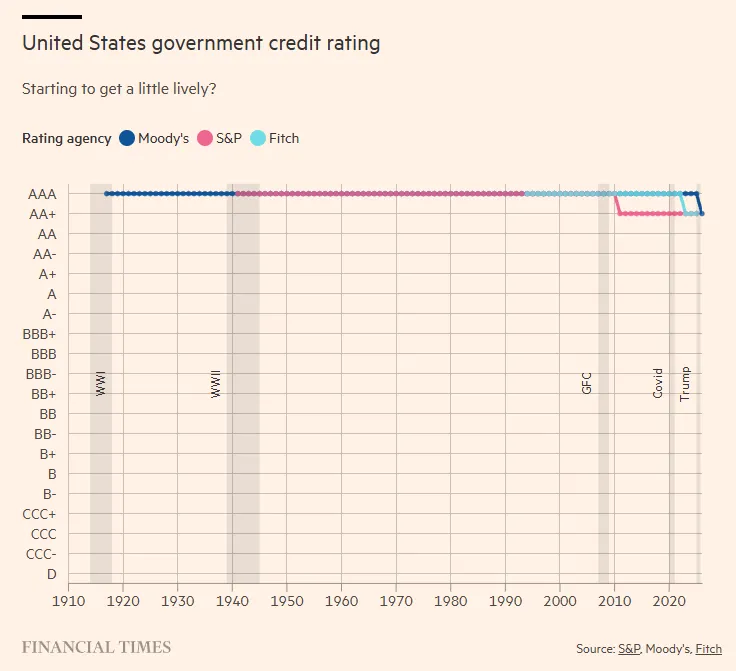

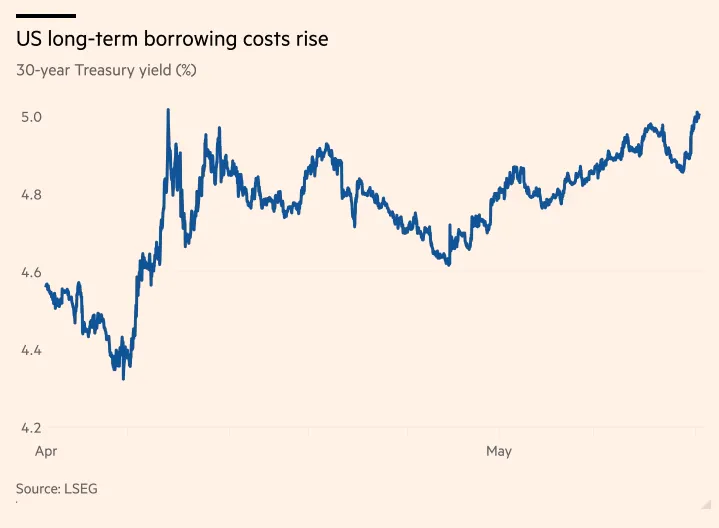

In recent years, credit rating agencies have downgraded U.S. government bonds, citing political instability, unsustainable fiscal policies, and governance risks. This has spooked investors, leading to lower demand for U.S. debt. Why does this matter? When demand falls, the government must offer higher interest rates to attract buyers. This raises the cost of borrowing, feeding right back into the interest problem.

March’s data also revealed a notable reshuffling among the top foreign holders of U.S. debt. For the first time in recent memory, the United Kingdom overtook China to become the second-largest non-U.S. holder of Treasuries, with $779 billion in holdings. However, the UK figure is widely interpreted by analysts as reflecting custodial accounts—largely used by global hedge funds rather than institutional buyers—similar to those in the Cayman Islands and Bahamas.

As of May, China’s US government debt holdings were down from $1.3 trillion to $759 billion. This continues a multiyear downtrend that began in 2018, reflecting both geopolitical tensions and efforts by Beijing to diversify its foreign reserves. China's Treasury stockpile is now just above its December 2023 low of $759 billion, which was the smallest since February 2009.

Japan has maintained its top spot, with holdings rising modestly to $1.13 trillion in March, up from $1.126 trillion in February. However as of May it is down to $1.06 trillion from it’s peak of $1.84 trillion sometime back.

These two countries were once the largest foreign holders of U.S. debt. Their retreat signals declining confidence in America's long-term fiscal stability. Factors like the U.S.–China trade war and rising geopolitical tensions have only accelerated this pullback.

Foreign demand, especially from large, stable institutions, helps keep borrowing costs down for the U.S. government. When that demand diminishes, the consequences are clear:

Higher Interest Rates: To attract new buyers in a weaker demand environment, the U.S. must offer higher yields on Treasury bonds. That directly increases the cost of borrowing.

Worsening Deficits: Higher interest payments mean the government must allocate more of its budget to service debt rather than fund programs, infrastructure, or economic investment.

Reduced Flexibility in Crises: Without strong foreign demand, the U.S. has less fiscal room to maneuver in future emergencies—be it pandemics, wars, or financial shocks.

In short, as reliable foreign buyers like China and Japan pull back, the U.S. faces a future where it may need to borrow more, pay more to do it, and rely increasingly on domestic investors or the Federal Reserve to fill the gap. That’s a risky proposition for a country already entangled in a complex and growing debt spiral.

As the U.S. Congress considers a sweeping new tax cut bill, the global financial community is sounding alarms. The legislation proposes to make previous tax cuts permanent, dramatically increase military spending, and slash funding for healthcare and welfare programs. But beyond the domestic political implications, this bill could have dire global consequences—with India among the countries most exposed to the fallout.

At the heart of the controversy is the bill’s projected cost: between $3.3 trillion and $5.2 trillion added to the U.S. national debt over the next decade. To put that in perspective, it’s roughly equivalent to the combined GDP of India and Germany—just tacked onto America’s already-massive debt load.

This additional borrowing could push annual U.S. budget deficits past $3 trillion and interest payments up to $1.8 trillion per year, nearly double current levels. That would mean the U.S. government would spend more on interest than on national defense, Social Security, or any single public program.

Far from stabilizing the fiscal situation, this bill is seen by many economists as pouring gasoline on a raging fire. It risks accelerating a debt spiral, where rising interest costs force even more borrowing, which in turn drives interest rates even higher—trapping the government in a cycle that becomes harder and harder to break.

And all of this mix of existing deficits, rising rates, falling bond demand, and potential policy changes is why credit agencies are acting now and why these serious fears of a major economic event persist.

At first glance, a U.S. debt crisis may seem like a distant problem. But in a deeply interconnected global economy, what happens in Washington can trigger financial tremors across Mumbai, Delhi, and beyond.

In times of crisis, global investors usually follow a predictable pattern: they pull out of riskier markets—including emerging economies like India—and flock to "safe haven" assets such as U.S. Treasury bonds, ironically the very asset class at the center of the crisis.

This behavior is called a "flight to safety," and it can hit Indian markets hard. Case in point: during the 2011 U.S. credit rating downgrade, Indian equities plunged nearly 10% over three months, not because of India’s fundamentals, but due to global panic and capital outflows.

With the new tax cut bill potentially adding fuel to existing debt concerns, a similar or even more severe scenario could unfold. Indian investors, especially retail participants, could be blindsided by sharp corrections, even if domestic economic indicators remain strong.

The U.S. dollar remains the backbone of global trade, accounting for over 70% of transactions worldwide. So, when the U.S. economy stumbles, the dollar can behave erratically—sometimes strengthening despite the crisis, as demand for safe assets surges.

For the Indian rupee, this spells trouble. If foreign investors start selling Indian assets and converting rupees to dollars, it places downward pressure on the currency. A weaker rupee makes imports more expensive, fans inflation, and complicates policymaking for the Reserve Bank of India (RBI).

Moreover, India holds over $237 billion in U.S. Treasury securities as part of its foreign exchange reserves. If the value of those bonds drops due to falling confidence or higher yields, it could reduce the RBI’s capacity to defend the rupee during periods of extreme volatility.

As U.S. interest rates rise—either through policy hikes or increased bond yields—borrowing costs climb worldwide. That’s because U.S. Treasuries serve as the global benchmark for risk-free lending.

For Indian households and businesses, this could mean:

More expensive mortgages

Higher EMIs on personal and education loans

Costlier capital for entrepreneurs and corporations

In a country where the middle class heavily relies on affordable credit, this trend can stunt homeownership, business investment, and consumer spending.

India is already grappling with sticky inflation, particularly in healthcare. Recent data suggests medical inflation is rising at 14% annually, while middle-class wage growth is effectively flat—hovering around 0.04%.

If a global debt crisis triggers supply chain disruptions, import inflation, or a weak rupee, this pressure could worsen. For the average Indian, that means less purchasing power, higher living costs, and greater financial stress, even if their salary remains the same.

The U.S. debt crisis isn’t a future problem—it’s already here. US faces a lethal combination of:

Excessive and inflexible spending,

A tax code skewed against revenue generation,

An accelerating interest burden,

And a global loss of confidence in U.S. debt.

Together, these four brutal truths are driving the U.S. into a debt spiral that could soon be impossible to reverse without serious economic or political upheaval. Fixing the problem will require political courage, bipartisan reforms, and a willingness to sacrifice short-term political gains for long-term fiscal health. Because if these trends continue unchecked, the world's largest economy may find itself out of road—and out of options.

Now, as before, they can simply push the proverbial can down the road by simply increasing the debt limit. However, at some point the US will have to face the brunt of its reckless spending.

And in a world where major economies are wrestling with debt levels we've never seen before, we are potentially seeing more volatility, more uncertainty, and maybe bigger societal shifts. How does that change how you think about your own financial future? Your planning, your strategy? It's definitely something worth giving some serious thought to as you navigate the years ahead.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart