US Elections are the one of most important events for the markets. There is a lot of fear in the market on the ongoing trend in the equity markets getting broken after elections. Investors are looking at how they can adjust their allocations to best prepare for this event. In this short blog we look at how US elections have historically impacted stock returns and if there is a significant anomaly which can be traded.

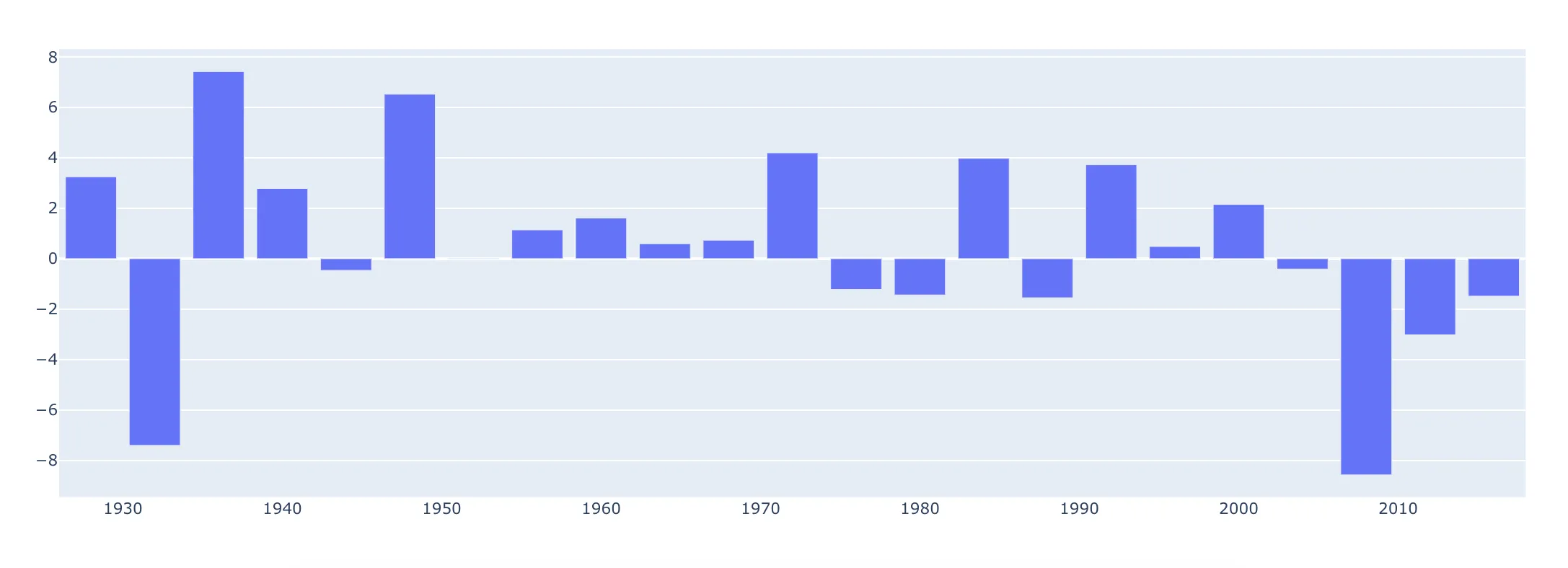

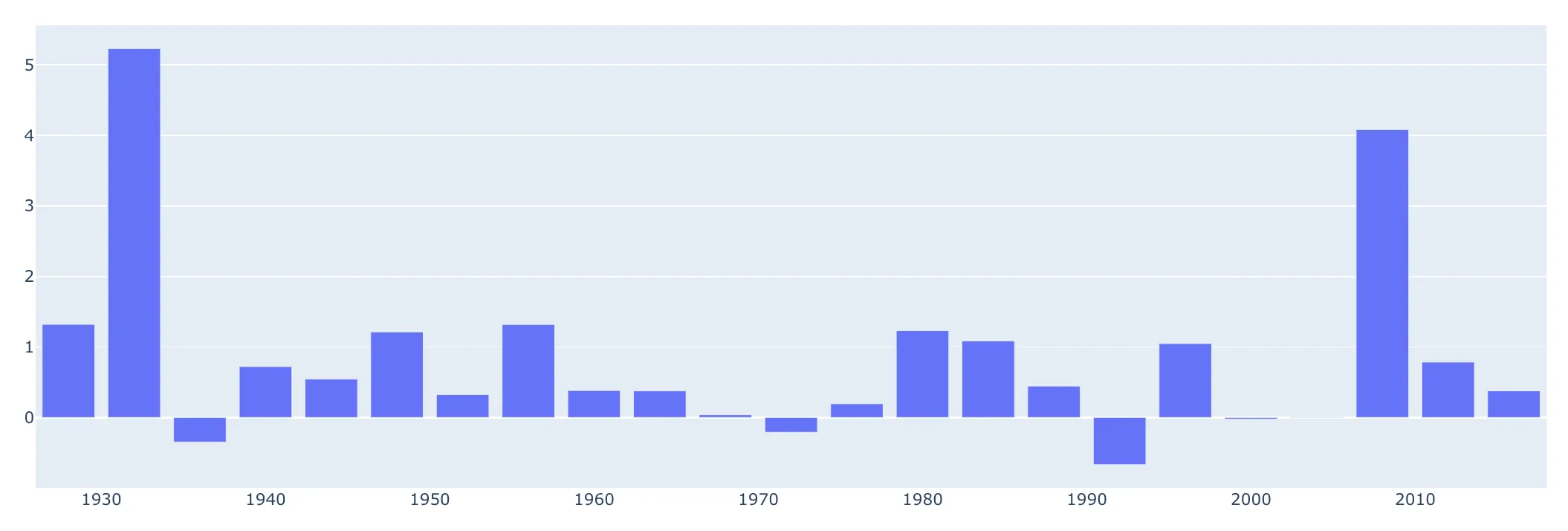

US Election are held every four year on the first Tuesday after the first Monday in November. This year US Elections will be held on 3rd November 2020. Let’s look at the S&P 500 returns one month prior to the US Election for the last 23 election years.

Let’s simply look at the returns of the S&P 500 a month prior to the election day, it is positive for 13 out of 23 elections, which is not a significant number.

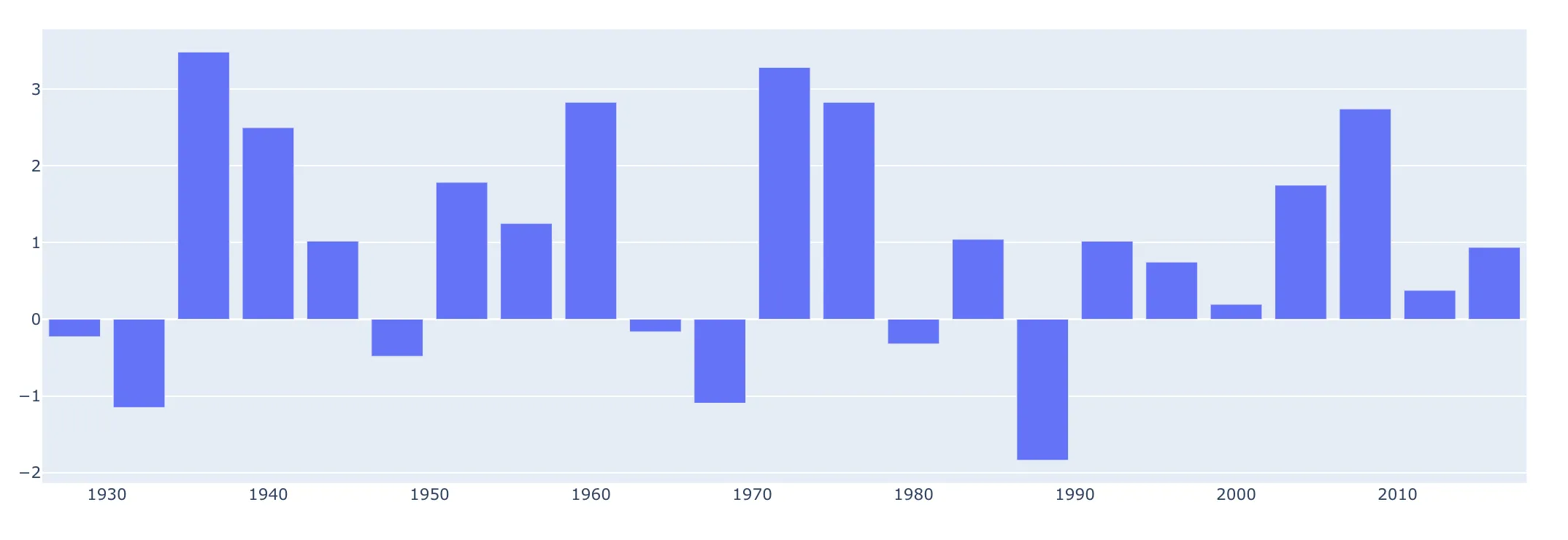

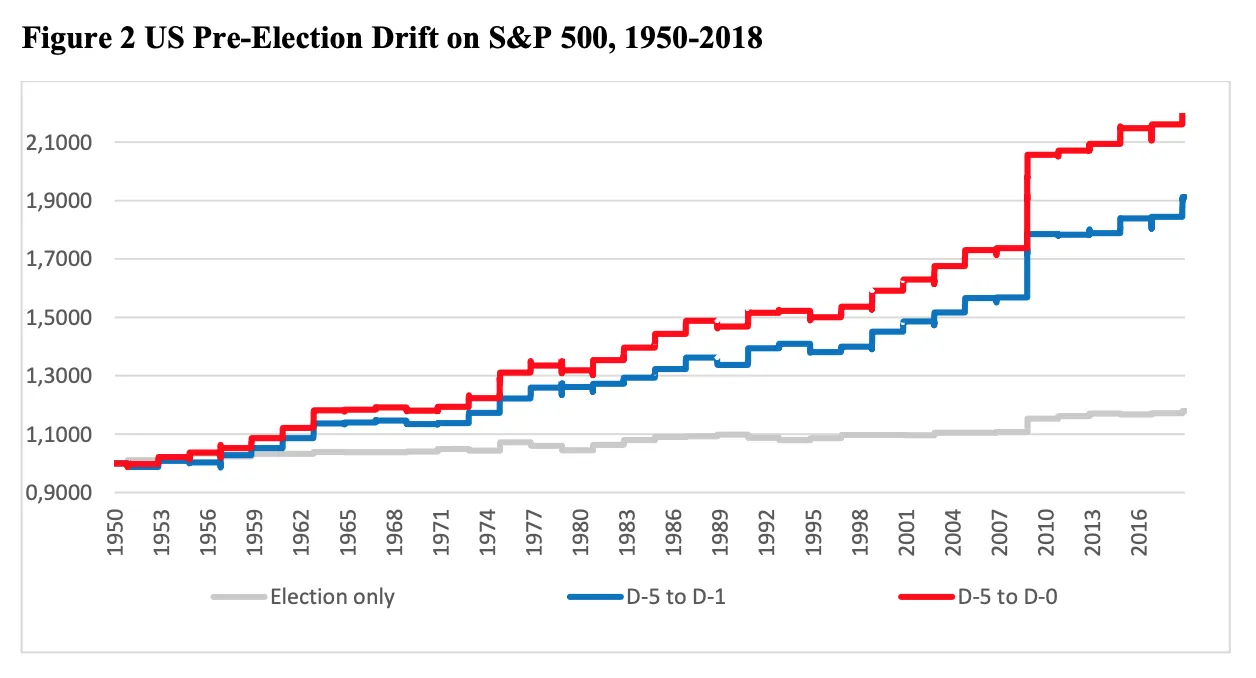

Let’s look at the returns one week prior. This seems significant with 17 out of the previous 23 election days showing positive one week pre election drift.

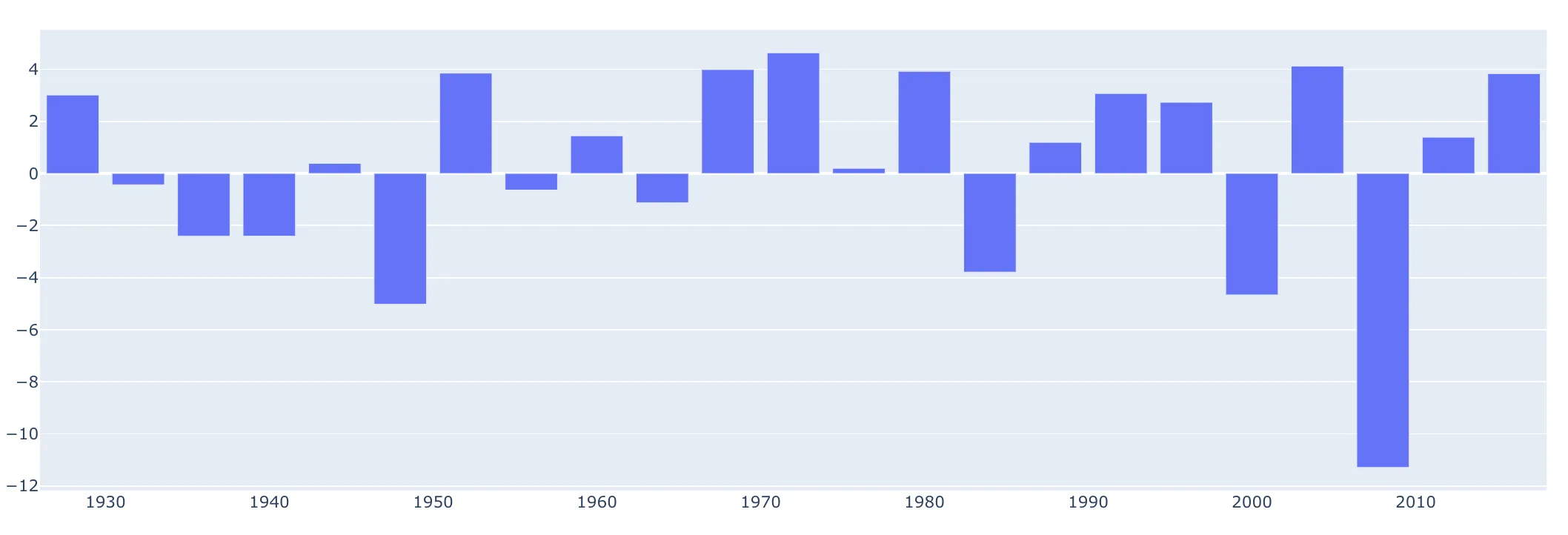

Looking at the returns one month after the election day, this is again not significant.

Looking at the returns one week after the election day, this is again not significant.

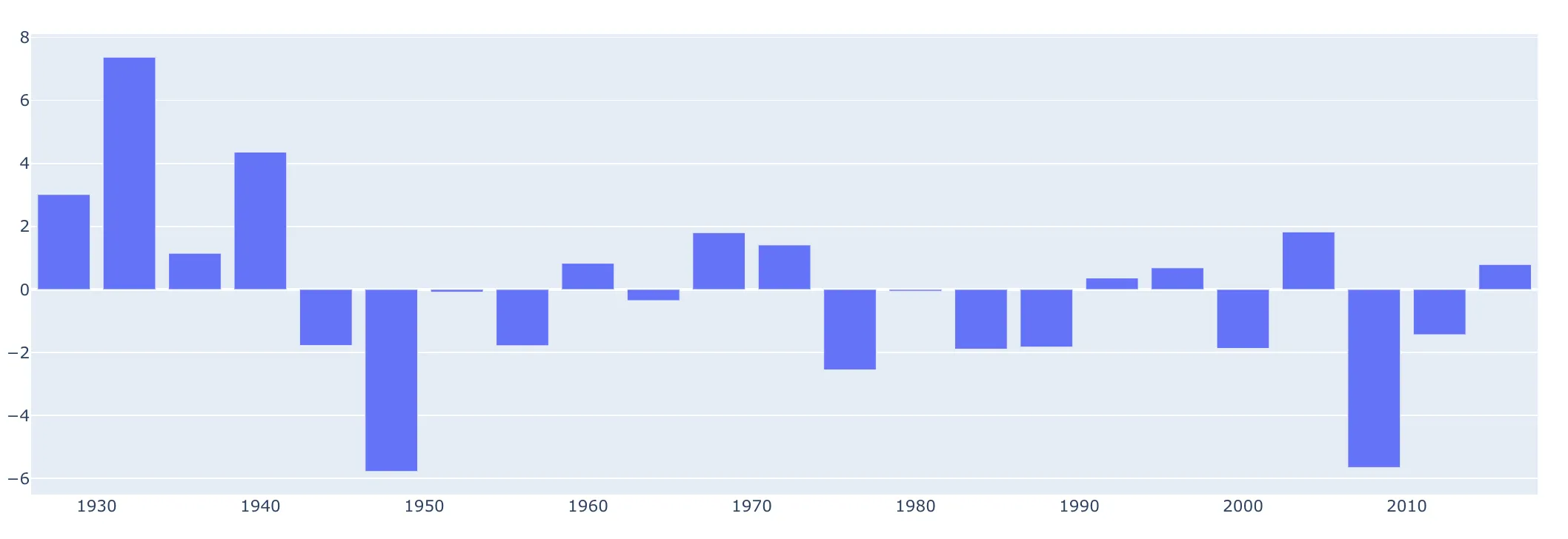

Let’s took at the returns on the election day now. Based on our numbers this is significantly positive!

The one week pre earning drift seems like a good tradable strategy. It is indeed by tested by Quantpedia in their article on pre-earning drift, and it seems like a infrequent but profitable strategy.

As per our analysis, the election day also seems like a positive day, even though there might be a lot of intraday volatility.

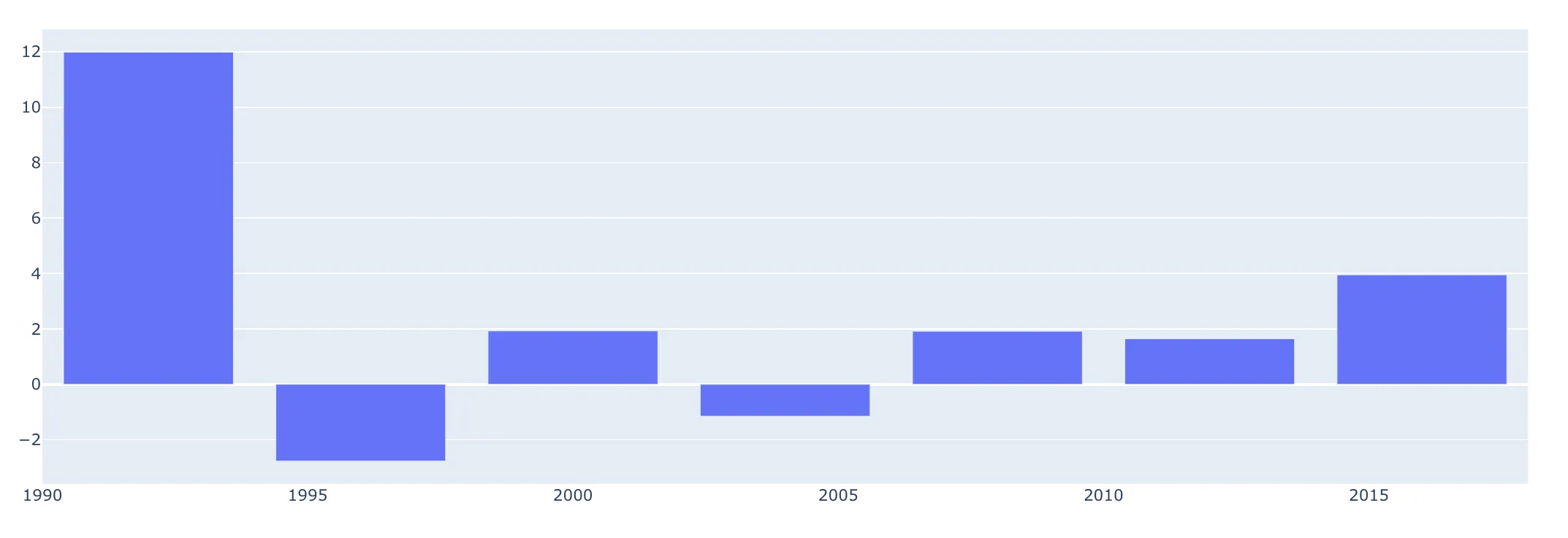

As we conclude, lets quickly look at the Indian Nifty returns in the one week before the election day. Nifty seems to give a positive drift on 5 out of 7 pre election weeks!

We demonstrated a very infrequent but significant trading on a positive drift in the index returns in the one week run up to US elections & on the election day. The next one month is the testing ground for this strategy.

As for the elections results, lets leave it to the two candidates and the American people and sit with the hope that this does not significantly change the trend for our equity allocations!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

“I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product.”

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart