The markets have been volatile since October but things have become worse since the war in Ukraine started. While the geopolitical tension itself should not impact the markets too much (as witnessed by analyzing the history of the impact of wars on market returns) with the Ukraine-Russia war Indian market has been seeing broader risks due to supply chain disruption.

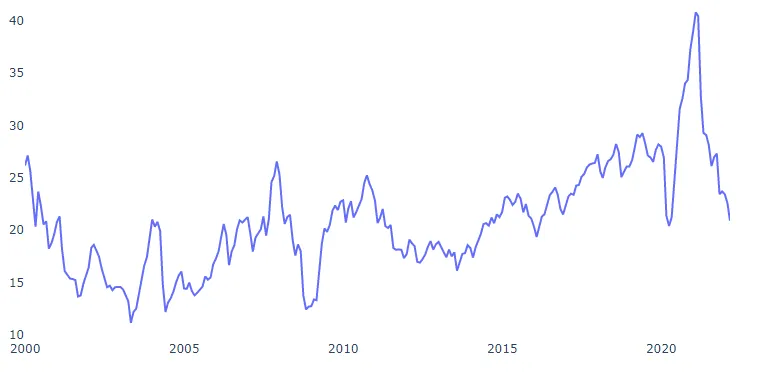

Having said that, we could see the markets jump back up at a rapid pace once this conflict de-escalates. As seen in the chart below, the Nifty PE is at historically undervalued levels and has a huge scope to grow once the conflict is over.

While the trade and corporate sectors might not see a direct hit, the global inflation in crude and commodity prices will be a worry for India. The banking sector seems to be robust in light of the crisis.

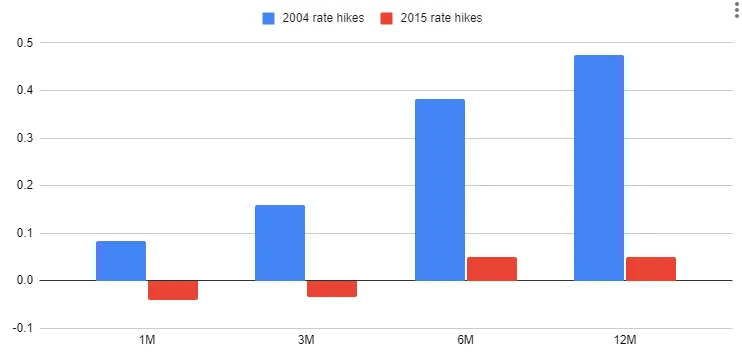

The prospects of rate hikes have been spooking the market even before the war. With crude prices rising the US inflation is not going to come down, which is why we can expect the hikes to come soon. Even though the FED might delay the hikes a little bit due to the conflict.

The Indian economy is inherently strong with good growth numbers and controlled deficits. We expect the hikes to have a moderate impact and the post-hike trajectory to be positive.

All sectors and industries have struggled in the last 6 months and so have our portfolios. In light of the volatility, we have deallocated away from equities in most of our portfolios, and in multi-factor portfolios, we have added gold as well.

While we will be on the lookout for further deallocation if volatility escalates, we believe that in the long term the markets will be strong. This is the time to hold on to the conviction for the long term and not be bogged down by short-term noise.

In our portfolios Banking, Metals, and Energy allocations have increased recently and you’d see that we have shifted to large caps.

Here are our general recommendations:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart