India's financial markets witnessed a historic transformation in 2025, marked by an unprecedented decline in trading volumes at Zerodha the country's largest discount broker and a dramatic fall in futures and options (F&O) activity nationwide. This downturn represents the most significant regulatory-driven market correction in India's modern trading history, fundamentally reshaping how retail investors engage with derivatives trading.

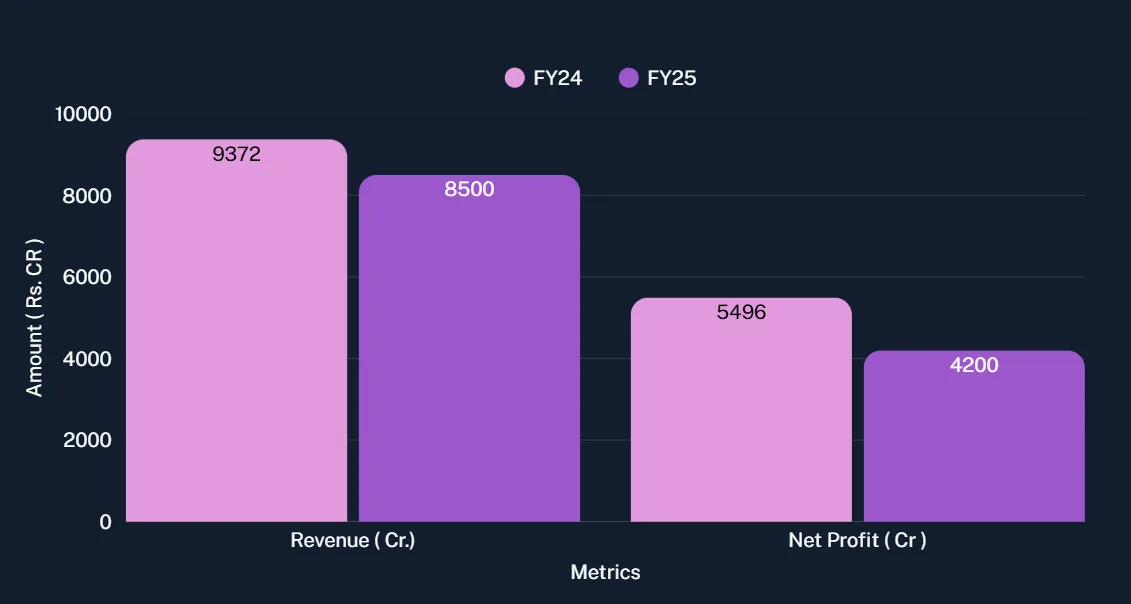

Zerodha's financial performance in FY25 marked the first decline in the company's 15-year history. The Bengaluru-based brokerage reported a 15% drop in revenue to Rs 8,500 crore from Rs 9,372 crore in FY24, while net profit plummeted 23.6% to Rs 4,200 crore from Rs 5,496 crore. Even more alarming was the 40% year-on-year decline in brokerage revenue during Q2 FY2025, signaling the severity of the impact.

Source : Moneycontrol , ET

The decline wasn't limited to financial metrics. Zerodha lost approximately 550,000 active clients between January and August 2025, with its client base dropping from 7.95 million in February to 7.26 million by August. This represented a market share erosion from 22% in early 2023 to just 16% by 2025, highlighting how regulatory changes disproportionately affected the discount broker's business model.

Metric | Zerodha FY24 | Zerodha FY25 | Change | Broader Industry Trend |

Brokerage Revenue | ₹7,000 cr | ₹4,200 cr | -40% | 15-20% drop for rivals |

Active Clients (Jan-Aug 2025) | 7.8 million | 7.26 million | -550,000 | Groww lost 600,000 |

Net Profit (FY25 est.) | ₹5,500 cr | ₹4,200 cr | -15% | Industry profits down |

Facing this existential challenge, Zerodha CEO Nithin Kamath announced potential strategic pivots. The company is considering ending its zero-brokerage model for equity delivery trades, a revolutionary offering that had disrupted traditional broking in India. Kamath warned that if regulatory headwinds continue, charging for delivery trades might become inevitable.

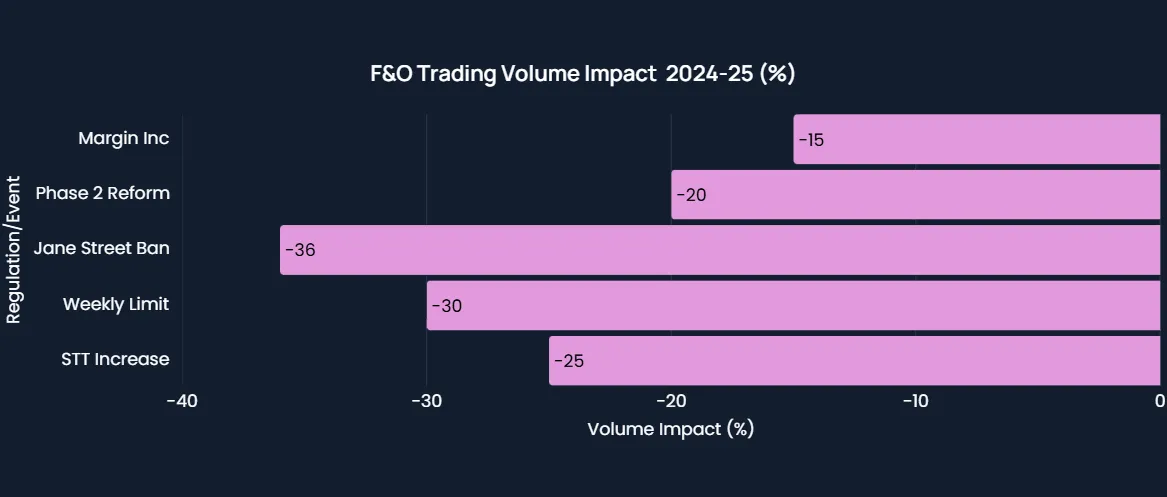

The Securities and Exchange Board of India (SEBI) launched a comprehensive regulatory offensive throughout 2024 and 2025, targeting what it perceived as excessive speculation in the derivatives market. The regulatory changes came in waves, each dealing a significant blow to trading volumes.

Source : Zerodha , Reuters , Moneyisle , Inc 42

Securities Transaction Tax (STT) Increase: In July 2024, the government increased STT on F&O trades by approximately 60%. The tax on futures sell turnover rose from Rs 625 to Rs 1,000 per crore, while options sell turnover saw STT jump from Rs 3,125 to Rs 5,000 per crore.

Weekly Options Limitations: SEBI reduced weekly options expiries to only Nifty and Sensex contracts, eliminating the daily expiry cycle that had become extremely popular among retail traders.

Position Limits and Margin Requirements: The regulator increased lot sizes from Rs 5-10 lakh to Rs 15-20 lakh and implemented stricter margin requirements for expiry day trading.

Enhanced Risk Disclosure: Brokers were mandated to display historical data showing that 91% of retail F&O traders lose money, with median losses reaching significant amounts.

The SEBI report for FY2025 revealed staggering statistics about retail participation in F&O trading. Individual traders suffered cumulative losses of Rs 1.06 trillion in FY2025 alone, with 91% of all retail F&O traders ending the year in losses. These numbers validated SEBI's concerns about treating F&O trading as speculation rather than investment.

The impact on trading volumes was immediate and severe:

Options Contracts: Monthly options contracts traded fell from 397 million in October 2024 to just 68 million by February 2025 .

Premium Turnover: Peak monthly premium declined from Rs 250 billion in June 2024 to Rs 151 billion by February 2025 .

Retail Participation: Premium turnover among retail investors declined by 20% comparing January-February 2025 with the April-October 2024 average .

The F&O volume decline has broader economic implications:

Lower F&O volumes directly impact government STT collections, potentially reducing fiscal revenues by up to 50% in FY2025-26.

SEBI Chairperson Madhabi Puri Buch highlighted concerns that household savings were being diverted toward speculation rather than productive investments. The regulatory intervention aims to redirect capital toward more constructive economic activities.

The measures raise questions about balancing financial inclusion with investor protection. While making derivatives accessible democratized trading, the high loss rates suggested many participants lacked adequate understanding of risks involved.

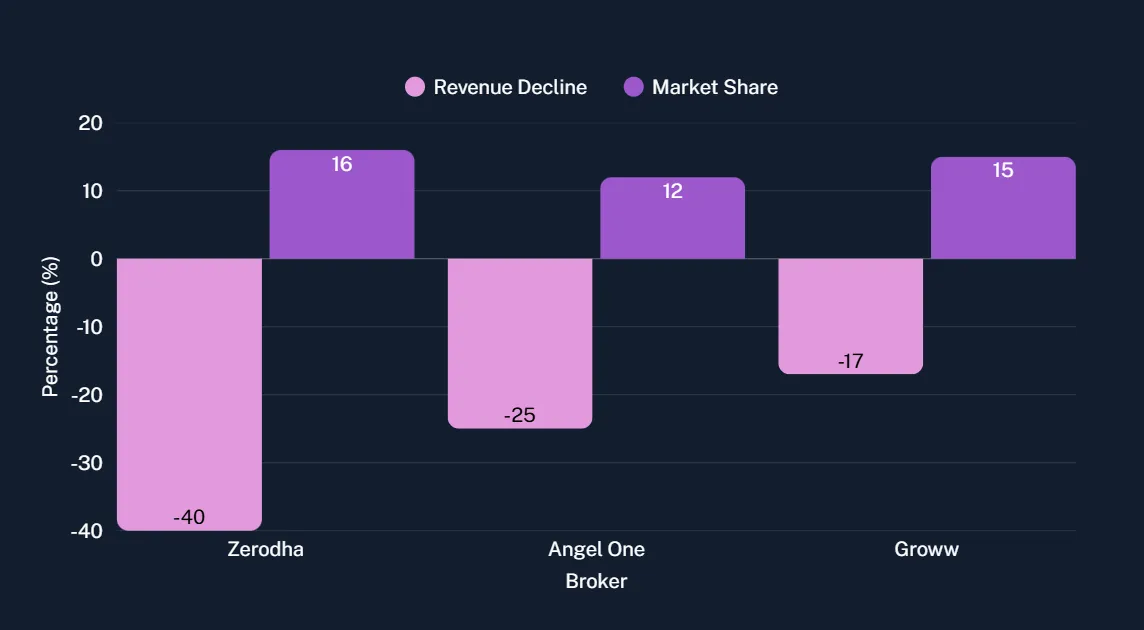

The decline wasn't isolated to Zerodha. The entire discount brokerage ecosystem felt the regulatory pressure, though to varying degrees.

Source : Inc42

Angel One experienced a 25% decline in revenue, while Groww saw a more modest 17% drop. However, all major discount brokers lost active clients during 2025. Groww, despite being the largest broker by active clients, lost 600,000 users between January and August 2025, while Angel One shed 450,000 active clients.

Interestingly, traditional bank-backed brokers like HDFC Securities, ICICI Securities, and Kotak Securities managed to grow their active user base during this period. This suggests that more conservative, advisory-focused business models proved more resilient during the regulatory crackdown.

Before the 2025 decline, India had established itself as the global leader in derivatives trading. The National Stock Exchange (NSE) became the world's largest derivatives exchange by contract volume, with Indian exchanges accounting for over 84% of all equity options traded globally in Q1 2024.

The monthly F&O turnover had reached a record Rs 8,740 lakh crore ($1.1 trillion) in March 2024, representing a massive jump from Rs 217 lakh crore in March 2019. However, this dominance came at a cost the Futures Industry Association (FIA) reported that global exchange-traded derivatives volume fell 42.5% in Q1 2025, largely due to India's regulatory crackdown.

Adding to the regulatory pressure was SEBI's ban on Jane Street, a major U.S. high-frequency trading firm, in July 2025. The ban resulted in an immediate 36% decline in index options premium turnover, demonstrating how dependent Indian markets had become on algorithmic trading. This event highlighted the role of foreign firms in India's derivatives boom and raised questions about market structure.

To compensate for declining F&O revenues, Zerodha is focusing on:

Margin Trading Facility (MTF): The loan book grew to Rs 5,000 crore

Investment Services: Diversification into advisory and portfolio-based services

Technology Products: Expanding API and fintech infrastructure offerings

The regulatory changes have fundamentally altered India's market structure. The new rules include:

SEBI introduced a more sophisticated method of calculating open interest using delta-based metrics rather than simple notional values. This provides a more accurate picture of actual market exposure and risk.

The new MWPL calculation ties position limits to free float and actual trading volumes, making it the lower of 15% of free float or 65 times average daily delivery value. This ensures derivatives exposure aligns better with underlying cash market liquidity.

New regulations require:

Five-day cooling-off periods for new F&O traders

Mandatory derivatives suitability tests

Income and net worth verification (minimum Rs 5 lakh annual income or Rs 25 lakh net worth)

As 2025 progresses, several trends are emerging . SEBI continues monitoring data through June 2025 before implementing additional measures. The regulator is taking a measured approach, analyzing the impact of existing changes before introducing new restrictions.

Brokers are innovating beyond traditional transaction-based models:

Advisory services and wealth management

Technology infrastructure and APIs

Margin lending and credit products

Mutual fund distribution and SIPs

The regulatory intervention may ultimately lead to a more mature, stable derivatives market with better-informed participants and more appropriate risk management.

The 2025 volume decline at Zerodha and across India's F&O market represents a watershed moment in the country's financial evolution. While painful for brokers and active traders, the regulatory intervention addresses legitimate concerns about speculation, investor protection, and market stability.

The transformation from a high-volume, speculation-driven market to a more regulated, investor-focused ecosystem may ultimately strengthen India's position as a global financial center. However, the transition period requires careful navigation by brokers, regulators, and investors alike.

For Zerodha and its peers, survival depends on successful business model adaptation. The era of zero-cost trading subsidized by F&O speculation may be ending, but new opportunities in wealth management, advisory services, and financial technology are emerging.

The story of 2025's volume decline is ultimately about growing pains—the necessary adjustments required as India's financial markets mature from a frontier market focused on speculation to a sophisticated ecosystem emphasizing long-term wealth creation and investor protection. Whether this transformation succeeds will determine the future of Indian capital markets and the millions of retail investors who depend on them.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart